Planning to start your business in the United States?

Then, you must apply for an Employer Identification Number or EIN!

Acquiring an Employer Identification Number, or EIN is the very first step in forming a business in the United States. It helps to identify your business.

Let’s understand in this way— When an individual is born in the United States, they are given a unique Social Security number. This number is used to distinguish one individual from another and to make it easier for government agencies to identify them.

In a similar manner, Employer Identification Number or EIN are granted to U.S. businesses for identification.

This comprehensive guide will clear all your doubts associated with Employment Identification numbers or EINs. Let’s check what we’ll cover ahead:

- What’s an Employer Identification Number or EIN?

- Understanding Employer Identification Numbers

- Significance of Employer Identification Number (EIN)

- Working of Employer Identification Number (EIN)

- Eligibility of Employer Identification Number (EIN)

- Documents Required for Employer Identification Number (EIN)

- Need of Employer Identification Number (EIN)

- 3 Important Steps to Apply for Employer Identification Number (EIN)

- Advantages of Employer Identification Number (EIN)

- What is the purpose of having an Employer Identification Number (EIN) for your business?

- Frequently Asked Questions (FAQs) Associated with Employer Identification Number (EIN)

- How Deskera Can Assist You?

Let’s Dive in!

What’s an Employer Identification Number or EIN?

EINs are unique nine-digit numbers issued by the Internal Revenue Service (IRS) that are used to identify businesses for tax purposes. The number is nine digits long and is formatted as XX-XXXXXXX.

Moreover, EINs are used in the same way that Social Security numbers are used for people. It generally helps to make it easier to identify and distinguish oneself from other businesses for tax and other reasons.

The majority of businesses are needed to obtain an EIN, which is usually available on the IRS website. Businesses can apply for EINs directly with the IRS and receive them almost immediately.

EIN is used by—sole proprietors, employers, corporations, government agencies, trusts, partnerships, Non-profit organizations, estates, some individuals, and other business entities.

EINs are employed by the IRS for business identification and tax reporting, according to IRS Publication 15 (Circular E), Employer Tax Guide. Remember that it's not meant to be used for anything else.

Note: A Federal Employer Identification Number (FEIN) or a Federal Tax Identification Number (TIN) is another name for an Employer Identification Number.

Example:

Suppose John decides to form a limited liability corporation to build a specialist grocery store (LLC). John was needed to file for an EIN with the IRS after registering his company with his state.

Further, John did so by registering to the IRS official website and filling out his personal or financial information. Then, John was issued an EIN shortly after the IRS verified his details.

This provided the IRS with a record of John’s operation as well as a way to identify the company for tax reasons.

Understanding Employer Identification Numbers

Employer identification numbers (EINs) are issued in the same way that Social Security numbers (SSNs) are in the United States, as earlier mentioned.

The former (EIN) helps to identify businesses whereas the latter (SSN) helps to Identify individuals in the country.

The issued EINs by the IRS include information about the status in which the company is registered. The IRS uses EINs to identify taxpayers who need to file multiple business tax returns.

If you have workers, manage a firm or a partnership, file multiple tax returns, or withhold taxes on income other than salaries, you'll need to have an EIN.

Moreover, an EIN is required before a business may begin operations. This could be performed via phone, online, fax, or mail. A range of businesses or Government agencies can apply for and receive EINs, including:

Sole proprietorships

EINs are essential for sole proprietors with employees. Note that you don't need an Employer Identification Number if your company is a sole proprietorship with no workers (and doesn't file any pension plan tax filings or excise).

Limited liability companies (LLCs)

An EIN is required for a single-member LLC that has workers.

If your company is a single-member LLC with no employees, you do not need to acquire an Employer ID Number (or liabilities or excise tax).

However, registering a bank account is still a smart option (and often required) if you want to hire employees later while maintaining your business's anonymity.

S corporations

If you have an S company tax structure, you must obtain an EIN for tax purposes.

Moreover, if you have a C corporation, your firm is considered separate, and you must obtain an EIN for tax purposes.

Partnerships or Multi Member LLC

If your business is a partnership or a multi-member LLC, you'll need an EIN because the LLC will need to file a partnership return and give K-1s to its members.

Non-profit organizations (NPOs)

If your company is a nonprofit, you must have an Employer Identification Number (EIN) for tax reporting purposes.

Estates and Trusts

EINs are assigned to various sorts of trusts and estates in a variety of situations.

The IRS is independent of the size of the company. It indicates that one-person firms are just as eligible for an EIN as giant corporations.

Significance of Employer Identification Number (EIN)

Following we have discussed some crucial points that explain the significance of Employer Identification Number (EIN). Let’s learn:

- Businesses that specialize in the trading, production, sale, and export of goods and services require it.

- It also aids in the identifying of assets for the purposes of the Income Tax (IT) Act.

- It also helps revenue agencies differentiate between companies with identical names.

- Intrastate and interstate transactions can be expedited because all information is in one place.

Working of Employer Identification Number (EIN)

The EIN is a nine-digit number with the following format: XX-XXXXXXX. Every EIN follows the same format and procedure, regardless of the size or type of business.

This structure is used to assign EINs to LLCs, partnerships, organizations, and businesses, among other entities.

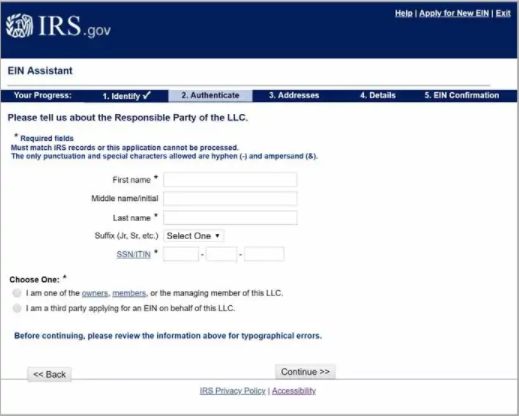

Every day, the IRS enables you to register for one EIN per "responsible party."

Here, the responsible party is referred to as the person who eventually controls and runs the business, or who has overall significant control over the organization, is the responsible party. The accountable party must be a person, not an entity unless the petitioner is a government agency.

Sole proprietors are not needed to acquire an EIN and could instead conduct business using their Social Security number.

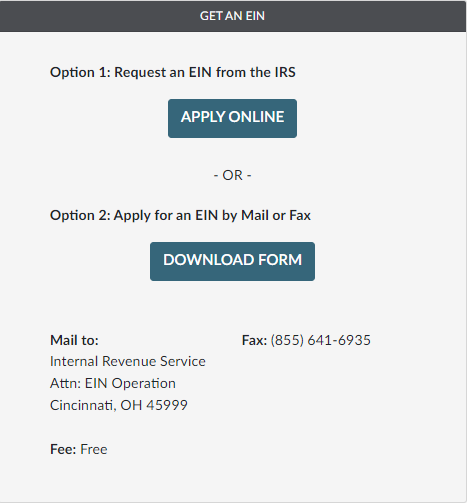

Getting on to the IRS website and applying for an EIN electronically is the most efficient way to get one. Registering for an EIN is completely free of charge.

Remember that you can also get an EIN via mail, phone, or fax. The EIN is used by the US government to track down taxpayers who must file various company tax forms.

In general, businesses without an EIN are unable to open bank accounts. Employers use their unique identity to file taxes and pay their employees. As a result, it is critical for a new business owner to file for an EIN as soon as possible.

Assume John requires a business fund to pay his suppliers and deposit his store's earnings. John will be unable to get a business account if he did not obtain an EIN when he originally started his company.

John will also need his EIN when it comes time to file his taxes at the end of the year. If John’s store becomes busy and he has to recruit more staff, he'll need an EIN to pay them.

Eligibility of Employer Identification Number (EIN)

An EIN can only be obtained by a firm that is based in the United States and has its own taxpayer identification number.

From LLC companies, sole proprietorships, government entities, partnerships, non-profits, and other sorts of organizations—anyone can register for and obtain an EIN.

There are no size restrictions or limitations when it comes to staff. A sole proprietorship with merely the operator as an employee, as well as a multinational organization or a charity, can all obtain one.

The eligibility conditions for acquiring an EIN are listed below:

- Your business is a partnership or corporation

- Your company or business must have employees

- Business files excise taxes

- Your business withholds taxes for nonwage income paid to a nonresidents

Documents Required for Employer Identification Number (EIN)

Following we have discussed documents required for the Employer identification number (EIN). Let’s check the list:

- Proof of address

- PAN Card of the proprietor

- Proof of identity

- Address proof for the business that you have applied for

- References

- Passport-sized photos of the proprietor

Need of Employer Identification Number (EIN)

The most common reason for obtaining an Employer Identification Number is to file taxes. To pay and file payroll taxes for their employees, each firm with staff members must obtain an EIN.

Additionally, in order to file a business income tax return, multi-member LLCs, partnerships, and corporations must have an employer identification number.

Furthermore, single-member LLCs and sole proprietorships with no workers are taxed as exceptions that do not require an EIN.

If you fall into one of these groups, you can file your taxes with your Social Security number rather than an EIN.

An EIN is also required for some types of organizational formations. Regardless of whether or not you have employees, if your company fits into one of the following categories, you'll need to apply for an EIN:

- Businesses that pay excise, alcohol, tobacco, or firearm taxes

- Nonprofit organizations

- Estates

- Trusts, except certain grantor-owned revocable trusts, IRAs, and Exempt Organization Business Income Tax Returns

- Farmers' cooperatives

- Real estate mortgage investment conduits.

- Plan administrators

- Businesses with a Keogh plan

Note:

While the IRS does not require you to acquire an EIN, U.S.-based businesses can. Moreover, getting one has a slew of advantages.

By registering for business credit, opening a company bank account, and engaging with suppliers without revealing your personal Social Security number, you may simply segregate your business and personal finances.

Are you prepared to implement a payroll system? For small enterprises in the United States, try Deskera People's online payroll software. Because it's all in the cloud, you won't have to do any updates. We assure accurate computations and will even take care of your tax deposits and filing. The software is available for free trial. Start your Free Trial Now!

3 Steps to Obtaining an Employer Identification Number (EIN)

When you start your business or firm— the very first thing you need to do is— to apply for EIN. However, you can also register for EIN for the purpose of submitting a business loan application or preparation for tax seasons.

Moreover, you need to be aware of companies that charge you to register for an EIN on your account because the IRS provides EIN at no cost at all.

Following we have discussed three steps that will help you to understand how you can apply for an Employer Identification Number (EIN). Let’s discuss:

Step 1: Check your Eligibility for EIN

In order to register for an employer identification number, you must meet two prerequisites. These are the two requirements:

- The United States or one of its territories must be your major business location.

- When applying, you must have a valid taxpayer identification number, such as a Social Security number.

Furthermore, your primary revenue operation and your major physical location are often used to determine your principal business.

Although, it's not necessary to complete the eligibility standards only because you supply services outside of the United States. Nonetheless, you can register for an EIN if your major business activities are in the United States.

Moreover, it is not mandatory that the individual submitting the application have to be the owner of the company. The individual can be a firm partner or officer.

Furthermore, any "responsible party" overseeing the business finances, as defined by the IRS, is allowed to apply. A responsible party must complete Form SS-4 and complete the third-party designee section before another person, such as a secretary or assistant, can apply.

Step 2: Obtain Relevant Documents

Consider looking over the PDF version of Form SS-4: Employer Identification Number Application. It will assist you to obtain all necessary and relevant information on hand. It includes the accountable party's name, Social Security number, and address.

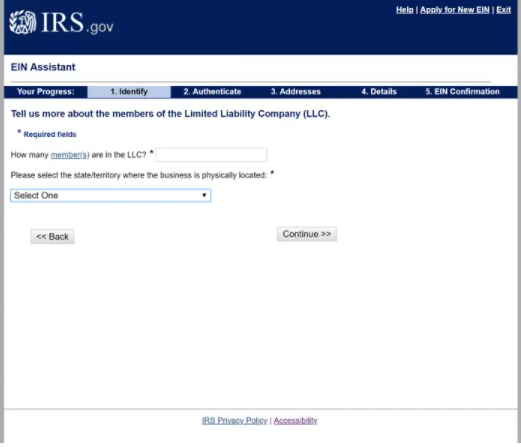

Moreover, you have to know the type of firm that you are operating. In case, your business comes under the cooperation category— then you have to include the country or state where it was established.

In addition, if your LLC has more than one member, make sure you have a count of members.

You'll also need the following information to finish the application:

- When did you start or buy your company?

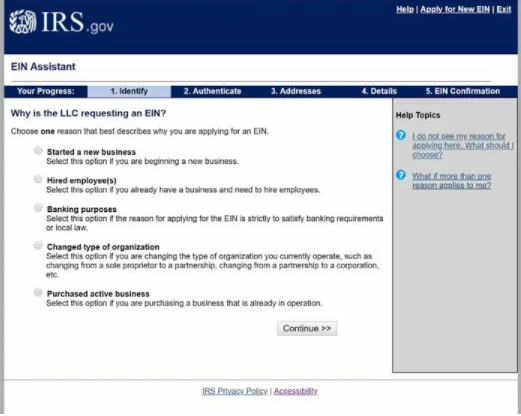

- The main objective or reason for submitting an application (e.g., banking purposes, launching a business, hiring employees, etc.).

- Include a description of your major product or service, as well as your main industry.

- In your company, first date salaries were or will be paid.

- This is the month in which your fiscal or accounting year comes to a conclusion (typically December if you are a calendar-year taxpayer).

- The greatest number and type of employees you expect to hire in the future year.

- If you provide your employees $4,000 or less in compensation in a calendar year, you can choose to prepare an annual employer tax return rather than a quarterly employment tax return. (For this component of the application, contact your accountant.)

Remember that before beginning the online application process, check and complete out Form SS-4 to ensure you have all of the material you'll need.

Step 3: Register for an EIN through Fax, Mail, or Online Method

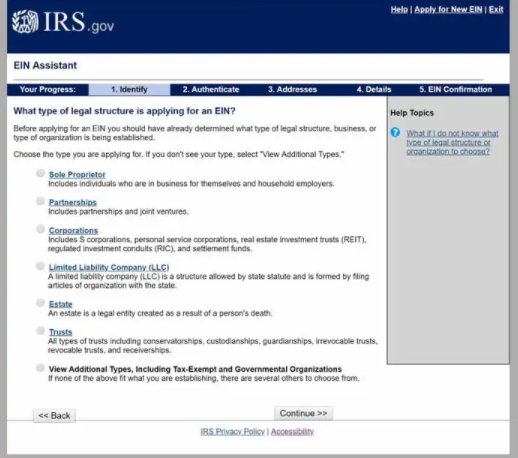

The IRS offers several options for obtaining an EIN. Your application can be submitted via:

- Online Method

- Fax

Candidates who are currently outside the United States and want to immigrate to the United States for business can also register by phone. The online application is the simplest and fastest approach for all candidates based in the United States.

Furthermore, the IRS's online EIN assistance walks you through the application process stepwise. The application form is open from 7 a.m. to 10 p.m. EST Monday through Friday.

The advisor will guide you through the registration process and offer you connections to further information and resources.

For security concerns, you'll be automatically logged out of the service after 15 minutes, and each responsible party can only register for one EIN each business day.

If you use the IRS's online application, you can obtain your EIN immediately after submitting your application digitally. The processing time for fax applications is four business days. It takes four weeks to receive an application by mail.

If you want to apply for an EIN via fax or mail, you'll need to send in a finished Form SS-4.

International EIN Applicants

In case you are not a citizen of the U.S.A and also don't have a Social Security number, you can still get an EIN number. Simply print and complete IRS Form SS-4. Section 7b can be left blank.

- Call the IRS at 267-941-1099 (NOT a toll-free number) Monday to Friday between 7:00 a.m. and 10:00 p.m.

- Eastern Standard Time to register your application. You can also fax your application for an EIN to 304-707-9471.

Note: This is not a toll-free number. To save money on the call, we advise using an online calling service.

Before you acquire your EIN, you must anticipate spending up to an hour on the phone. We suggest calling the IRS on an alternate day of the week because Mondays are the crowded day for the IRS.

Advantages of Employer Identification Number (EIN)

The assigned Employer Identification numbers for businesses are unique. Moreover, EINs never expire and also and the same number set is never reassigned to another business if the original employer shuts down his or her business.

Furthermore, the ability to operate is the key benefit of obtaining one. You can't run a business without it, either. You should first obtain an employment identification number before you can proceed.

If you wish to do the following tasks, you'll also need an EIN:

- State tax registration and company tax filing

- Recruiting and compensating employees

- Keeping corporate shields from any kind of thefts

- Acquiring credit, opening bank accounts, and investing extra funds are all things that need to be done.

Another advantage of obtaining EINs is— it provides you the freedom to segregate your business from personal finances. As a result, this offers you the ability to safeguard your personal information from fraudulent activity.

What is the purpose of having an Employer Identification Number (EIN) for your business?

Following we have discussed why is it important for businesses to acquire employer identification numbers (EIN)? Let’s learn:

Generating Business Banking Account

- Monitoring and tracking your expenses will be considerably easier with a corporate bank account.

- You can also boost your business credit and gain access to more loans by doing so.

Hiring Employees

You’ll need an EIN before you hire your employees or staff.

- Employers must have an EIN in terms of creating payroll for an LLC, and the IRS will track payroll taxes for individuals who use the company's EIN.

- Individuals will use the 1040 form issued by the LLC to file their taxes separately.

- You'll need an EIN number to file for your state's employment taxes.

Corporate Shield

EIN offers a shield for corporates:

- An EIN will help you maintain your corporate shield intact if you're a limited liability business (LLC).

- The corporate shield protects businesses from personal liability for their company's responsibilities.

- Maintaining the corporate veil provides credibility and competence by allowing your company to exist independently of its owners.

Safeguard you from Fraudulent Thefts

EIN safeguards businesses or corporations from theft or fraud activities:

- Identity theft can be avoided with the use of an EIN.

- Your SSN (Social Security Number) will be kept more secret.

- When you maintain your business and personal finances apart, it's much less likely that someone will hack into your accounts.

Frequently Asked Questions (FAQs) Associated with Employer Identification Number (EIN)

We've answered some of the most frequently asked questions about employer identification numbers below (EIN). Let's get started:

Que 1: Do I ever have to change or re-apply for Employer Identification Number (EIN)?

Ans: Check the following scenarios where you have to change or re-apply for your employer identification number:

- A bankruptcy case has been filed against you.

- Your company's structure has evolved. If you're a sole proprietor and want to incorporate or add a partner to your business, then you'll need a new EIN.

- You inherit or purchase an existing company and operate it as a sole proprietorship.

Note:

If you're just renamed your company or business or starting a new location for a current company, you won't have to register for an employer identification number.

Que 2: What to do if I misplace or lose my EIN?

Ans: Firstly, there's no need to panic if you lose or misplace your EIN. And no need to enroll for a new one as well. You may seek your business tax ID in a few different ways:

- Find the computer-generated notice that came with your EIN application.

- Your EIN can be located on a tax return you've already submitted.

- Call the IRS Business & Specialty Tax Line within business hours if you can't locate your identification.

- If you used the EIN to open bank accounts, then you'll need to contact your bank to get it back.

- When you register for services, many company service providers, such as merchant service providers, insurance companies, and your tax advisor, will ask for your EIN. You could try contacting one of them to see if they can help.

Que 3: Does Employer Identification Number (EIN) expire?

Ans: EINs are everlasting. They do not terminate, and even if a business is closed, the IRS will not cancel an EIN.

A previously issued EIN will never be issued to another organization by the IRS. All EINs are kept on file in case the IRS has to use them again in the future.

Que 4: Are there any negative effects if I get an EIN but never use it?

Ans: No. If you obtain an EIN but never use it, there are no negative consequences. Even if it appears that you will never use it, having one provides you the chance to enjoy the benefits of carrying one in the future. It's also free and simple to register for one.

Que 5: Is it possible to set up a bank account without a Social Security number?

Ans: You may be able to access a business bank account without an EIN under some circumstances.

However, many lenders insist on applicants having a business bank account with a specified quantity of deposits. Although, some banks will let sole owners open a business bank account without an EIN, while others will not.

Que 6: Is it feasible that I could use my Social Security number instead of an EIN?

Ans: In some cases, instead of an EIN, you can use your Social Security number.

However, you should think about the important advantages of an EIN, such as increased protection against fraudulent activity.

Furthermore, an EIN is a unique identifier that separates your individual and company accounts. If you have an EIN, you won't have to disclose your Social Security number to your vendors or clients.

Before getting a Social Security number, foreign people beginning enterprises in the United States can use an EIN to apply for a business credit card or create a business bank account.

Que 7: Is Employer Identification Number (EIN) Required for My Business?

Ans: An employer identification number is required for every business entity that has employees. Also, they need to function as a corporation or a partnership, file particular tax returns, and withhold income tax other than salary.

Que 8: I recently established a limited liability corporation (LLC) (LLC). There are no workers working for the LLC. Is the LLC required to get its own Federal Tax ID number?

Ans: You will not need a unique Federal Tax ID number if you are the sole owner of the LLC without any workers.

Moreover, you'll need to get a second Federal Tax ID number for the LLC if it has employees or if you're not a single owner.

Que 9: My Husband and I are the sole employees, so do we need to have an employer identification number (EIN)?

Ans: If you manage a business together and split the profits and losses, then you're in a partnership.

Furthermore, you will each obtain a Form 1065, Schedule K-1, which is used to calculate your self-employment earnings.

If you operate for your spouse, you should obtain a Form W-2 detailing the taxes deducted, and the owner spouse should be able to withdraw the wages you were paid. Also, note that an EIN is required in both cases of —sole owner or partnership— with an employee.

Que 10: Is a tax ID number required for a small business?

Ans: Only if you run an LLC or sole proprietorship with no workers, your small business will almost certainly require a tax ID number.

Que 11: Is an employer identification number the same as a tax identification number?

Ans: Yes, the employer identification number is the same as a taxpayer identification number (TIN).

Que 12: Is a tax ID number required for a small business?

Ans: If a sole proprietor doesn't have any workers and also does not make any excise or pension plan tax filings. Then, he or she would be the only business person who is not required to obtain the employer identification number.

Furthermore, in this scenario, the taxpayer identification number is the sole proprietor's social security number.

Que 13: What if I forgot the number acquired Online?

Your EIN will be added to IRS records right away. Simply dial (800) 829-4933 and choose EIN from the drop-down menu.

Tell the IRS employee you acquired an EIN on the Internet but can't recall it once you've been linked.

Before releasing the number, the IRS official will ask for the relevant disclosure and sensitive security information.

Que 14: I don't always have all of the information necessary for the application. Why do I have to fill out the application online when I may send it in on paper or by fax with the information I need?

Ans: When the IRS receives a paper or faxed Forms SS-4 with incomplete details, it takes longer to process the application, postponing the issuing of your Employer Identification Number.

If all of the needed information is provided, applicants will receive their EIN significantly faster.

Que 15: My complete address doesn’t fit in the application filing section?

Ans: If your address information does not fill in 35 characters, then please remember to provide the most vital information (i.e., suite numbers, apartment numbers, and so on.)

Moreover, the address you've supplied will then be checked against the USPS database, and you'll be given the option to make any required adjustments.

Que 16: When will I be able to use my EIN to make tax deposits now that I have it?

Ans: Based on the information you submit in your application or if you specify you will have employees, you will be enrolled in the Electronic Federal Tax Payment System—EFTPS—immediately, allowing you to make all of your deposits electronically or by phone.

After a few days, you will get validation of your EFTPS membership, as well as a Personal Identification Number (PIN) and complete guidelines for using EFTPS, in the email.

Furthermore, you'll have to wait till your EFTPS information arrives in the mail before you can make an electronic payment. After you obtain your EFTPS Confirmation Folder, you can begin making EFTPS transactions.

EFTPS is a free service provided by the United States Department of Treasury that enables individuals and businesses to make all federal tax payments over the Internet or by phone.

Moreover, you can pay your taxes online or over the around-the-clock through a secured website or an automatic speech response help desk.

Que 17: My company's legal name includes the symbol for a dollar sign ($). Is it true that the IRS accepts symbols as part of a company name?

Ans: A resounding no. Only alpha (A-Z), numeric (0-9), hyphen (-), and ampersand (&) can be used in a business name, according to IRS systems (&).

Furthermore, if your company's legal name includes anything other than those listed above, you'll need to figure out how to input it into the online EIN application.

Que 18: Can I obtain more than one employer identification number?

Ans: Various employer identification numbers are available to business owners who run multiple enterprises.

Because each business that pays taxes as a separate entity has its own EIN, it's not uncommon for some persons to have multiple EINs. The IRS, on the other hand, can only issue one EIN per person per day.

Que 19: Is it possible to cancel an employer identification number?

Ans: No, your EIN won’t get canceled by the IRS even if you don't require it anymore. The employer identification number is permanently associated with a business entity once it is created and registered.

As a result, this registration is never issued to another company, and you can use it again if you reestablish your company with the same structure.

Moreover, the IRS has the authority to terminate your company account if you discover after receiving an EIN that you don't need one.

Que 20: If I have a business outside the USA, then is it possible to apply for an EIN online?

Ans: It is only possible to register through online mode if your agency, office, or business is located in the U.S. territory or the United States.

Furthermore, the business owner, partner, grantor, or officer must have a genuine EIN, TIN, Individual Taxpayer Identification Number, or SSN in order to use the online application.

How Deskera Can Assist You?

As a business, you must be diligent with employee payroll system. Deskera People allows you to conveniently manage payroll, leave, attendance, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Final Takeaways

Finally, you have reached the end section of this detailed guide. We’ve provided some crucial points for your future reference. Let’s learn:

- EINs are unique nine-digit numbers issued by the Internal Revenue Service (IRS) that are used to identify businesses for tax purposes. The number is nine digits long and is formatted as XX-XXXXXXX.

- The majority of businesses are needed to obtain an EIN that is free and usually available the very same day you register on the IRS website.

- EIN is used by—sole proprietors, employers, corporations, government agencies, trusts, partnerships, not-for-profit organizations, descendants' estates, some individuals, and other business entities.

- Employer identification numbers (EINs) are issued in the same way that Social Security numbers (SSNs) are in the United States,

- If you have workers, manage a firm or a partnership, file multiple tax returns, or withhold taxes on income other than salaries, you'll need to have an EIN.

- Every EIN follows the same format and procedure, regardless of the size or type of business. This structure is used to assign EINs to LLCs, partnerships, organizations, and businesses, among other entities.

- You need to be aware of companies that charge you to register for an EIN on your account because the IRS provides EIN at no cost at all.

- A responsible party must complete Form SS-4 and complete out the third-party designee section before another person, such as a secretary or assistant, can apply.

- Consider looking over the PDF version of Form SS-4: Employer Identification Number Application. It will assist you to obtain all necessary and relevant information on hand. It includes the accountable party's name, Social Security number, and address.

- Candidates who are currently outside the United States and want to immigrate to the United States for business can also register by phone. The online application is the simplest and fastest approach for all candidates based in the United States.

- The IRS's online EIN assistance walks you through the application process stepwise. The application form is open from 7 a.m. to 10 p.m. EST Monday through Friday.

- In case, you are not a citizen of the U.S.A and also don't have a Social Security number, you can still get an EIN number. Simply print and complete IRS Form SS-4. Section 7b can be left blank.

- Maintaining the corporate veil provides credibility and competence by allowing your company to exist independently of its owners.

- If you're just renamed your company or business or starting a new location for a current company, you won't have to register for an employer identification number.

- Your EIN won’t get canceled by the IRS even if you don't require it anymore. The employer identification number is permanently associated with a business entity once it is created and registered

Related Articles