Are you prepared to discover how to set up a small business's direct deposit? You are, of course! Fortunately for you, setting up your direct deposit usually only requires six easy steps. An employee's pay can be placed immediately into their bank account through direct deposit, the most popular method of paying employees, usually within a few days of processing.

You only need the bank account details of your employees, their written consent, and a service to help with the setup of direct deposit. The actions you must do are described below. The following topics were covered:

- What is Direct Deposit?

- Benefits of Direct Deposit

- How does direct deposit work?

- Direct deposit cost

- How to set up direct deposit for employees?

- Disadvantages of Direct Deposit

- Key takeaways

What is Direct Deposit?

Direct deposit, as it relates to work, is the electronic transfer of net pay from a financial institution owned by an employer to a person's personal bank account. This transaction occurs across a network known as the Automated Clearing House (ACH).

The term that banks use to classify various payment kinds is "ACH." By definition, an ACH payment is an electronic, automatic transfer of deposits between banks under the control of the ACH.

This implies that, as an employer, you are sending the necessary sum of money from your business bank account to your employee's bank account. Therefore, direct deposit for your employee means they will get an electronic payment (their paycheck) from your bank account to their bank account on the other end of that transfer.

Instead of utilizing a paper check, direct deposit is a secure and dependable method of sending money electronically to designated bank accounts. To transfer money from one party (usually an employer) to another, this process depends on a reliable and secure electronic network.

Direct deposit payments are not just used for regular income. You might qualify for money deposited directly into your account if:

- You select this method for filing with the IRS because you anticipate receiving a tax refund.

- You expect receiving investment funds or retirement account payouts.

- You receive money from initiatives like Social Security.

Benefits of Direct Deposit

Using direct deposit payroll has many benefits for both the firm and the employee.

Because it is quicker and more secure, direct deposit has surpassed paper paychecks as the preferred method of wage payment. That's not all, though. Direct deposit has several features that are advantageous to both companies and employees.

Why should I pay my staff through direct deposit? You might be questioning yourself as a small business owner with a lengthy to-do list each day. This is a wonderful, important query. Setting up direct deposit has advantages for you and your staff as well as long-term advantages for your company.

The manual processes are replaced

Manually processing compensation can be time-consuming and taxing for personnel. Paper check preparation takes time as well, especially for large businesses. With direct deposit, manual options are replaced with a more hands-off mechanism.

For your employees, setting up direct deposit just requires that they fill out a few simple forms. They will be aware of when and how much money will be deposited into their bank accounts each pay month. They may better organize their own personal money thanks to this predictability, and they also don't have to bother about physically going to the bank to cash a check.

Employee autonomy is promoted by direct deposit

Staff or team members can frequently add bank account information for both checking and savings accounts when they choose direct deposit. Employees can take charge of their financial situation by having money go into savings automatically.

It costs less to prepare and mail.

Printing paper checks, buying postage, and paying for letters all add up over time. With the use of direct deposit services, postage and unnecessary administrative expenditures can be decreased.

Direct deposit lowers payroll costs because there is no need for mailing or printed paper. As a small business owner, managing your finances is crucial because even the smallest issue may have a significant impact on your operation. You have more flexibility and control over your company's money thanks to direct deposit.

First of all, you are aware of the precise time that funds will be deducted from your account each pay month. You don't need to be concerned about a lot of workers randomly collecting their paychecks. You have a system in place with direct deposit that allows you to organize your finances around payment schedules.

Similar to how it's secure, practical, and effective for your staff, it's also true for you. The payments themselves are secure for your company, so you don't need to be concerned about security issues like someone stealing or discovering a misplaced employee paycheck that contains critical information about your company. Direct deposit makes your finances more secure in this manner.

Ecologically sound.

As more businesses encourage green efforts, cutting back on paper usage is a responsible choice.

Employee benefits for direct deposit

One of the reasons that so many companies, both small and large, use direct deposit is that it's fantastic for both the employees and the firm. Here are a few advantages of direct deposit for your staff members.

There was a time when workers were concerned that unfavorable bank hours or bad weather would prevent them from depositing their salary. These concerns, however, are no longer present with direct deposit.

Speed

Money is transferred rapidly, resulting in a short waiting period and quicker access to wages.

Security

The risk of lost or stolen checks is completely avoided because money is electronically transferred to employees' bank and savings accounts.

To make the direct deposit process as secure as possible, NACHA has procedures and regulations in place. Additionally, by using ACH, electronic payments not only pass security checks but also do away with the security hazards that come with paper checks.

Direct deposit reduces the danger that your employees will misplace or have their paper check stolen, which poses a security concern to both of you.

Furthermore, because the payments are made electronically, both you and your employees have a record of the transaction. They can view and access their pay stubs at any time online. Either party may simply cite this record if there is ever a dispute.

In the end, direct deposit gives your employees peace of mind that their paychecks will be sent securely, precisely, and on time.

Convenience

Checks can now be deposited without making trips to the bank or ATM, saving time. In the end, direct deposit relieves a lot of the burdens that come with running a small business.

First off, using direct deposit in place of paper checks will probably result in time and money savings—both of which are valuable. After you set up direct deposit, the cost and time required to handle your payroll are far less than when you cut physical checks, which is expensive and time-consuming.

Additionally, direct deposit makes it incredibly simple to manage your payroll system and makes paying your employees an automatic process that just requires a few button clicks. Your staff will still get paid even if you're not there or your office is closed, and you'll still enjoy the financial stability that comes with that procedure.

You will have simple access to payment and transaction records, just like your employees have, which will undoubtedly be helpful for your financial operations. The same advantages that make it simple, practical, secure, and effective for your staff also apply to you. Additionally, your staff is happy, which is always a good thing for you.

Flexibility

Multiple accounts, including a checking account and a savings account, can each receive payments.

Direct deposit advantages for employers

Employers can benefit from direct deposit just as much as employees can. With the help of electronic payments, firms may be able to:

Due to the security risk posed by lost or stolen cheques with information about business accounts, direct deposit helps keep your finances secure.

Minimize labor

Processing payroll paperwork and mailing or distributing paper paychecks takes less time for HR staff.

Maintain accurate records

Going paperless makes it easier to view transaction history and streamline bookkeeping. Correcting errors or locating lost monies is made simpler by electronic records and access to mobile and internet banking.

Direct deposit advantages for small business owners

All employers profit from direct deposit, but small businesses that could be on a tight budget particularly benefit from it. When companies deliver paychecks, they have little influence over when employees deposit or cash them.

If the employees withdraw money when rent, utilities, or other bills are due, this could result in a cash shortage. Because employers may routinely specify the precise time that their account will be debited, direct deposit minimizes this issue.

They may better manage their funds this way and take care of their people and bills. Direct deposit is the greatest option for you and your employees if you own a small business.

How does direct deposit work?

Direct deposit requests are sent by the employer's bank to the ACH on predetermined days, where they are processed and forwarded to the financial institutions of the employees.

The funds mentioned in the direct deposit requests are then credited to the employees' personal accounts by the banks. An identical amount of money is also deducted from the employer's company account concurrently.

If we delve even deeper into the mechanics of the direct deposit procedure, the processes involved are as follows:

1. As the employer, you must contact your bank to begin the direct deposit process (we'll go into more detail on how to do this later).

2. At regular, predetermined intervals, your bank will collect all direct deposits, bundle them, and send them to the ACH in batches.

3. The ACH will accept the direct deposit orders and forward them to each employee's bank.

4. Those banks will receive the orders and credit your employees' accounts as necessary. Your account is debited by the same amount as is credited to your employees'.

5. According to the National Automated Clearing House Association, this procedure typically takes one to two working days (NACHA).

It's vital to keep in mind that the precise timing of this process can also rely on your bank, the bank of your employee, the payroll software you use, and any bank operating holidays. But don't worry, you may set the payroll schedule and corresponding direct deposit schedule that works best for you with the assistance of your bank or payroll software.

Direct deposit cost

You might be wondering how much direct deposit will cost your company after learning the fundamentals of how it operates. This is a crucial factor to take into account because, as a small business, you need to carefully monitor your finances, specifically where you're spending your money.

The cost of using direct deposit for your business will vary depending on a few distinct variables. Who you utilize for direct deposit, for instance, is one aspect that is in play. If you use a bank, the price will vary depending on which bank you choose.

According to the National Federation of Independent Business, banks often charge a setup fee for direct deposit that ranges from $50 to $149 on average (NFIB). Although the majority of banks do not, some levy ongoing monthly fees for direct deposit. In addition, several banks impose different transaction costs.

Every time your account is impacted by a transaction, which happens every pay period, your bank could impose a transaction fee. When you process payroll, they may also charge you for the deposits made by each employee. Depending on the bank, the size of your company, and your direct deposit agreement, these costs can vary. Once more, the NFIB estimates that each individual deposit will cost between $1.50 and $1.90 in fees.

How to set up direct deposit for employees?

Let's walk through the process of setting up direct deposit for your employees now that we've discussed what it is and how it functions precisely.

1-Choosing a direct deposit payroll provider is step one.

Choosing the provider of your direct deposit services is the first step in setting up direct deposit for employees. In essence, this is the organization that will manage and store all of the data for your company and your employees and will ultimately be the one accepting the money through the above-described direct deposit method.

You typically have two choices for direct deposit companies. You can utilize any company, accounting, or HR software that offers payroll and direct deposit features, the bank that manages your business bank account, or payroll software that supports direct deposit. You can use direct deposit to submit payments electronically using either of these alternatives.

You now have three choices for direct deposit service providers:

• You can continue doing business with the bank that opened your business bank account.

• You can use other company, accounting, or HR software that supports payroll and direct deposit;

• You can work with payroll software that supports direct deposit.

Having stated that, you don't need to second-guess your decision. No matter whatever method you choose, you can transfer payments electronically using direct deposit.

2 -Start the setup process for direct deposit.

Following your selection of a direct deposit service, it ought to provide instructions on how to set up your direct deposit. Keep in mind that setting things up can take a few days or even a week. Set reasonable expectations with your team so that if it's not attainable, employees won't expect direct deposit with their next paycheck.

You can phone your bank and speak with a representative who will walk you through the procedure to set up a direct deposit, or you can utilize your internet portal to complete the transaction electronically. Since every bank has a distinct procedure, it is best to contact your neighborhood branch to learn more.

You must sign the terms of the automated clearing house (ACH) agreement and maybe provide financial documents to demonstrate that you have enough cash on hand to cover regular payrolls now and likely will in the future. You should also talk about how frequently you intend to run payroll at this time.

Thanks to the data you have gave while registering for the service and creating your account, most of the information required to start the direct deposit setting procedure will already be linked into the platform.

However, you must first enter your business bank account information if you're setting up a direct deposit in your payroll software for the first time. The verification process that follows will depend entirely on the program you have selected.

Your payroll service provider will do a direct deposit test and take money out of your account at the conclusion of this phase. You won't be able to continue collecting employee data until you have verified this transaction, which takes some time.

3 -Gather All Required Data from Employees

Have you set up your direct deposit yet? Great! It's time to gather all of your employees' information so that you may pay them via direct deposit.

Even though each provider will have their unique direct deposit form, there are some general guidelines that will never change. It is your responsibility to make sure each of your staff can do the following in a secure and dependable manner:

Key Numbers

The employee's Social Security number, bank account number, and routing number are the three "key numbers" required to set up direct deposit.

The account number tells the provider where to deposit payments, while the routing number and social security number are necessary for digital transfers and give an additional layer of identity verification to ensure the money goes to the right person.

Personal Information

Although the criteria will vary depending on the supplier, generally speaking, this includes the employee's name and address.

Personal data submission reduces any issues with deposit distribution and prevents account confusion.

Content and Authorization

The provider is in charge of outlining the legal foundation and making sure staff members comprehend the contract. Their duties also include verifying that everyone has voluntarily chosen direct deposit.

Your employees may complete all the necessary information and authorize direct deposit straight in the program if your HR system enables employee logins. The employee's whole entry of information will then be automatically linked to your payroll.

As previously stated, we'll presume you've already input this data when creating employee accounts in your system.

4 -Enter Employee Information into Your Payroll System

You need to include it in your payroll now that you've gathered all the required data from your employees. You should not worry about this step if your staff were able to enter the data on their own, as we explained before.

You'll enter the data supplied by your employees into your company's accounting software or another payroll program. You should be able to find instructions for this process in the exact software you use, but in essence, you'll be entering data from the direct deposit authorization form into the system.

You must enter the data into your bank's web system if you are working through your bank. You can accomplish this in one of two ways:

You can first upload a NACHA file. You can export a NACHA file from your accounting program (complete with all necessary data) and upload it using the internet banking service of your bank. The file will be readable by the system at your bank and contain all the data you require to begin using direct deposit.

Manual entry is the secondary strategy. You can set up payroll batches on your bank's online system if you have a small staff or don't have accounting software or software with a NACHA export.

You will enter and save in the system each piece of information provided by your employees on their direct deposit authorization form. You'll be able to direct deposit your payroll to them after this batch has been created.

5 -Create your payroll schedule and direct deposit.

You can begin using direct deposit once you've provided your deposit provider with the necessary employee information and finished the authorization procedure.

You will need to choose a deposit schedule before your direct deposit provider begins the actual check depositing process.

The following factors should be taken into account when choosing your deposit schedule:

Take into account your own budgetary schedule.

Before checks are issued, you must have liquid money in your business account that is easily transferable. Choose a payment schedule that complements your anticipated financial flow as much as possible.

Think about the payment period.

Paychecks are a need for employees, thus it's critical that they arrive on time. The official setup of direct deposit with your provider takes roughly 7 to 10 days, and the money transfer from your business account to your employees takes two business days.

Before determining when to begin direct deposit, you should take account of both your own personal financial plan and the payment time frame.

Always keep your staff and payroll administrators up to date on any payroll-related matters. They ought to be aware of the timetable and deadline for sending and receiving payments.

To give yourself enough time to examine and process payroll, you might set a deadline for employees to turn in their time cards or hours. Even your payroll service provider may have a deadline for receiving all of your information in order to run direct deposit.

To ensure little to no bottlenecks and prompt payouts, make sure to adhere to all time frames.

6 -Manage Your Payroll

If everything is configured properly, every time payroll is performed, employees will automatically get their pay in their bank accounts. However, people who opt out of direct deposit will still need to use a printed paycheck or another payment method to get paid.

What is a NACHA file?

Banks receive the data required for electronic transactions, such as bank account numbers and deposit totals, using NACHA files.

Other uses for electronic payments

Payroll is simply one application of electronic payment. It is used by both employers and employees for: Paying independent contractors;

· Compensating independent contractors

· Paying bills

· Receiving Social Security benefits

· Depositing tax refunds

· Maintaining child support

Disadvantages of Direct Deposit

Although establishing direct deposit has many benefits, there are a few drawbacks to take into account.

Possible overdraft charges- To make sure there are enough money for each payment, the payroll bank account needs to be carefully maintained and kept up to date. Overdraft charges are always the payer's obligation, not the payee's.

Lack of a stop payment option-You cannot halt an electronic transfer once it has begun, unlike real paper checks. Any mistakes must be fixed after the deposit has cleared.

Employees must start over when changing banks – The majority of people find this to be a small annoyance, but each time an employee wishes to move or change their preferred account, a new authorization form is necessary.

Potential hazards to banking security-Although account and routing data must be collected, ACH is a safe method. To prevent unwanted access to account information, it's crucial to handle this data carefully and securely.

How Deskera Can help You?

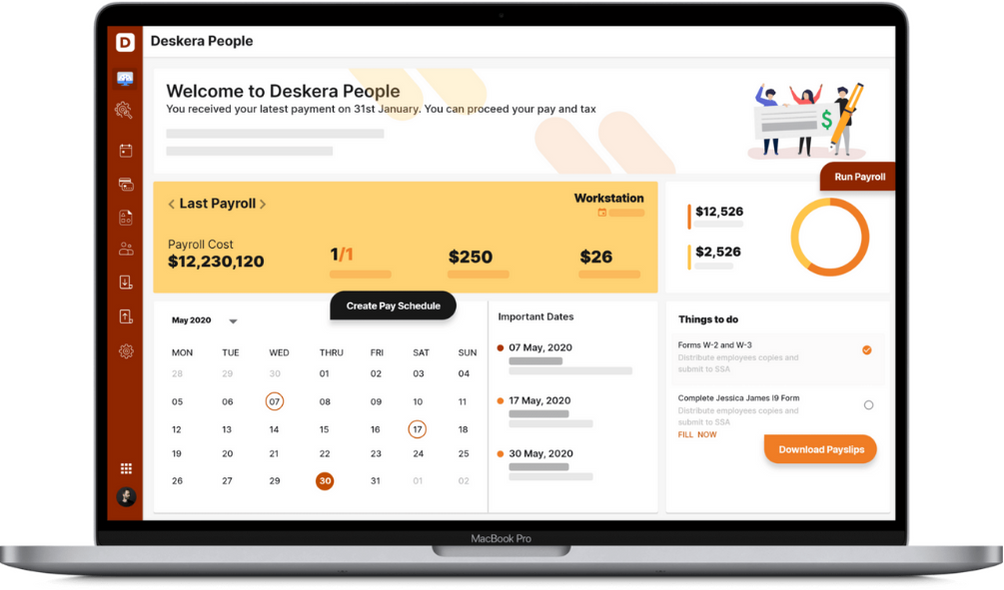

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key takeaways

- One approach to take use of accounting software's advantages and lessen the time and effort required for manual processes is through direct deposit. Follow a specific payroll provider's setup instructions to activate direct deposit. Always keep a thorough set of financial papers on hand to show and record your company's payroll procedures for enhanced security.

- In order to demonstrate their ability to cover the transactions, banks typically need employers to sign the ACH terms and conditions and submit recent financial accounts. Businesses that use a payroll service provider could be required to provide information about their organization as well as, if not already provided, a bank account number.

- The bank, the size of the company, and the terms of their contract all have a role in how much it costs to set up direct deposit. Additionally, certain banks could levy monthly service fees or transaction fees. In contrast, payroll service providers frequently offer direct deposit as a free addition to their standard service offerings.

Related articles