Every legitimate company keeps a balance sheet in its transaction records. It is one of the fundamentals of running a business. This balance sheet contains columns on credit and debit. A company is believed to flourish when the sheet shows a proper balance between the two. Here, give more weightage to the debit portion.

A debit in finance and accounting terms refers to a significant decrease in liabilities or a consecutive increase in a company’s assets. It is a powerful accounting tool, which is generally balanced by credits in finances. These two forces work like Newton’s Third Law of Motion, i.e., ‘every action has an equal and opposite reaction,’

When it comes to bookkeeping, around 33% of small businesses hire bookkeepers. Their general task is to keep a log of all the debits and credit transactions of their company.

There is a continuous interplay between credits and debits in a company when they are either attributed to the assets section of the transactions or the liabilities section; for example, if a company seeks to get a loan for a product purchase, it will debit its fixed assets and create a credit liabilities account on the purchase.

A popular abbreviation for debit is ‘dr,’ which is popular in the accounting world.

For the sake of convenience, this article is divided into the following sections:

- How are Debits Balanced by Credits?

- Working Mechanism of Debit

- Debit Notes: Trustable Debit Records

- Debit Cards and Credit Cards

- Common Mistakes to Avoid When Dealing with Debits

- Conclusion

- How Can Deskera Assist You?

- Key Takeaways

How are Debits Balanced by Credits?

Picking up on the part where we mentioned striking a balance between credits and debits, here is how credit works in an opposite directional reaction to credits.

The father of accounting, Luca Pacioli developed a double-entry accounting method, something companies use in the modern-day. Bookkeeping includes the use of this double-entry method to maintain the company’s balance sheet. Pacioli said that it is incorrigible to end a working day at the office without thoroughly reviewing the credits and debits of that day and entering them into the balance sheet.

We can decipher the double-entry accounting method as “Assets Equals Liabilities Plus Shareholder’s Equity.” Here are some thumb rules to remember this:

- An increase in the value of assets is a debit to the account

- A decrease in the value of assets is considered as a credit to the account

- An increase in the liabilities of the company and shareholder’s equity is considered as credit for the account

- A decrease in the liabilities of the company and shareholder’s equity is considered as a debit for the account

Here’s an example.

A company has a client who has assigned a task that the former has successfully completed. The company raises an invoice for the client to be paid. The company nails this invoice amount as a debit in the account receivables section. At the same time, it credits this in the company revenue system. The company’s bookkeeper takes care of this credit and debit procedure in the balance sheet following the double-entry accounting system.

In this way, every transaction the company loses or gains is maintained in the balance sheet by the bookkeeper.

After understanding the interplay between the two terms, it is essential to look into more terms related to debit.

Difference Between Debits and Credits

Debits and credits are fundamental concepts in accounting that are used to record financial transactions. Understanding the difference between the two is crucial to maintaining accurate financial records.

- Use: Debits and credits are used to record all financial transactions in accounting. They are the basis of the double-entry accounting system, which requires every transaction to have a debit and a credit entry.

- Placement: Debits are recorded on the left side of an account, while credits are recorded on the right side of an account. This is known as the normal balance of an account.

- Increase and decrease: In most accounts, a debit represents an increase in the account balance, while a credit represents a decrease in the account balance. However, in certain accounts, such as liability and equity accounts, the opposite is true.

- Assets, liabilities, and equity: In general, debits increase asset accounts and decrease liability and equity accounts. Credits increase liability and equity accounts and decrease asset accounts.

- Income and expense: In income and expense accounts, debits represent an increase in expenses and a decrease in income, while credits represent an increase in income and a decrease in expenses.

Working Mechanism of Debit

To understand the concept around debit, absolute clarity on a few terms related to it is essential:

Standard Journal Entry

A standard journal entry is also called the general ledger. Every company follows this method to maintain a balance in their transactions of the day. This means that a general ledger or a standard journal entry is used to keep a record and strike a balance between the credit and debit transactions on the company journal.

You can successfully achieve this by subtracting the total number of credits by the total number of debit.

A simple way to do this is to note down all the credits on one column of the page in the journal, and the other column should contain all the debits. Once you have noted down all the transactions of the day and deciphered whether they get a place in the credit column or the debit, the calculations on both ends should match, and a subtraction of the two columns should amount to zero.

Only then are you rest assured that you have balanced the books.

T-Accounts

A T-account is an informal connotation of a double-entry account or a simple ledger account. T-accounts are a diagrammatic representation of what a normal ledger account should look like.

In a T-account, it is more about how the page looks rather than the actual conclusions of the credit and debit accounts.

The horizontal straight line on top of the alphabet is where you place the page’s title. It can be transactional information about anything or even about a particular day in the week.

The vertical portion of the alphabet is the dividing line on either side, of which the columns of debit and credit go.

Hence, the alphabet T shows how a company maintains a general ledger.

Dangling Debit

A dangling debit is a moment of ledger dilemma where the credits do not offset the debit portion as observed in standard double-accounting entries. A company reaches the stage of dangling debit on account of the purchase of goodwill, which creates an indent in the credit cycle.

When can you understand your balance sheet has arrived at a dangling debit? It is when your credits cannot be written off against the debits. It occurs when the debit side of the column is complete, but the credit side has a missing component. In this way, you cannot write off the balance.

More often than not, the failure to recognize the presence of a dangling debt in a ledger points to inherent discrepancies your company will have to face. This precisely is the first phase of fraudulent activity circulation that must be put to an end before it gains impetus.

When a company experiences a dangling debit, they register it as negative reserves or deductions against the shareholder’s equity in the company.

It is easy to confuse a dangling debit with a debit balance, but we will get to it in a while.

Using Debits to Record Business Transactions

Here is a step-by-step guide on how to use debits to record business transactions:

- Identify the transaction: The first step is to identify the transaction that needs to be recorded. This could be a sale, purchase, payment, or any other financial transaction that impacts a business's finances.

- Determine the accounts to be debited: Once the transaction has been identified, determine the accounts that need to be debited. This will depend on the type of transaction and the accounts affected. For example, if a business purchases inventory on credit, the accounts to be debited could be inventory and accounts payable.

- Assign the appropriate debit amount: The next step is to assign the appropriate debit amount to each account. This will depend on the value of the transaction and the specific accounts impacted. For example, if the purchase of inventory on credit is worth $1,000, the inventory account would be debited for $1,000.

- Record the transaction: Once the accounts and amounts have been determined, the transaction can be recorded in the appropriate account ledger. This is typically done using accounting software, such as QuickBooks or Xero, but can also be done manually in a paper ledger.

- Check that debits and credits balance: Once the transaction has been recorded, it is important to check that debits and credits balance. This ensures that the accounting equation remains in balance and that the financial records are accurate. If debits and credits do not balance, it may be necessary to review the transaction and make adjustments as necessary.

- Update the financial statements: Once the transaction has been recorded and debits and credits balance, it is important to update the financial statements. This includes the income statement, balance sheet, and cash flow statement, which provide an overview of the business's financial health.

Debit Notes: Trustable Debit Records

Debit notes are records of transactions that are put on the debit side of the column. This proves that B2B transactions with your company are legitimate, and there is no form of fraudulent activities taking place in the transactional records of the company.

A debit note is a form of purchase validation via which the supplier needs to validate the reimbursed amount. This occurs in case a purchaser returns products to the supplier.

Possible errors that can take place in sales, purchases, or any other transaction can be corrected with the correct entry of debit notes through which the company recognizes and validates the transactions.

Debit notes make adjustments in the credit and debit factors of the balance sheet for transactions that have already taken place. For this reason, it is quite distinctive from an invoice.

Margin Debit

Before understanding how debit on margin accounts work, you must understand what buying in margin means. Buying in margin is also called debit balance.

This implies a situation when an investor uses some of their money as well as borrows funds from the brokerage, which s/he then combines to purchase shares of a company. Even though the investor could use their own money, s/he used the funds from a brokerage which s/he now owes to the broker. The funds taken from the broker allow the investor to purchase more shares which s/he could not do so earlier with their own money, due to insufficiency.

The brokerage records this as a debit amount on the investor’s account, which represents the cash cost of the transaction to the investor.

In a margin account, the debit balance is the amount the customer owes the brokerage on the purchase of the much-required securities. Post this successful security purchase by the customer, the debit balance must be put into the customer's margin account to reflect the transaction.

Other terms related to margin debit are long margin positions and short margin positions. Long margin positions reflect debit balances, whereas short margin positions are attributed to credit balances. An interesting fact is that a trader’s margin account has both long and short margin positions. This is where the credit margins can offset the debit ones.

Contra Accounts

The term contra literally means acting in the opposite direction. So, a company usually turns to contra liability accounts to reduce the value of a related account. The sole purpose of its debit is to ensure that the liabilities of the current account are transferred to another.

In this act of adjustment, the book value of an asset or liability is balanced. When companies issue bonds and purchases security, contra liability accounts are used to balance out the liabilities.

It works in opposite reactions to normal accounts. The contra account records a credit when debit is recorded in the normal balance account. There are precisely four (4) types of contra accounts:

- Contra Asset

- Contra Liability

- Contra Revenue

- Contra Equity

The two most popularly used contra accounts are contra assets and contra liabilities. Contra assets include accumulated depreciation and are associated with reducing the balance of an asset since they are recorded with a credit balance.

On the other hand, a contra liability account is recorded with a debit balance, hence ensuring the reduction of liabilities. Usually, the companies that issue bonds deal with contra liability accounts.

In practice, contra assets are far more popular than contra liability. This is because contra assets closely follow the upliftment of a business through a reduction in assets.

Debit Cards and Credit Cards

Although debit and credit cards both let individuals indulge in transactions through cards linked to bank accounts, there is a difference between the two.

Throwing light on some similarities between the two:

- They both look identical

- They both have 16-digit numbers

- They have magnetic strips along with expirations dates

- Both debit and credit cards have EMV chips

So what is the difference? There is one feature under both that starkly distinguishes it from the other.

Debit cards provide a passage for you to spend the money which you have deposited in the bank.

Credit cards let you borrow money from the person who issued the card to withdraw cash or purchase items but only up to a certain limit.

The different types of credit cards include:

- Standard Cards

- Premium Cards

- Reward Cards

- Balance Transfer Cards

- Secured Credit Cards

- Charge Cards

The different types of debit cards include:

- Standard Debit Cards

- Electronic Benefits Transfer( EBT) Cards

- Prepaid Debit Cards

Differences Between Debit and Credit Cards

Debit and credit cards are two common types of payment methods that are widely used around the world. While they may look similar, they have some important differences that can impact your financial life.

Here are some key differences between debit and credit cards:

Interest and fees: Debit cards typically don't charge interest or fees, as they only allow you to spend money you already have in your account. However, some banks may charge overdraft fees if you spend more than you have available in your account.

Credit cards, on the other hand, often charge interest on unpaid balances, as well as fees for late payments, cash advances, or balance transfers.

Rewards and benefits: Credit cards often come with rewards programs, such as cashback or points that can be redeemed for travel, merchandise, or other perks. Debit cards may also offer rewards, but they are usually less generous than credit card rewards.

Additionally, credit cards may provide additional benefits, such as extended warranties, purchase protection, or travel insurance, which are not typically available with debit cards.

Credit score: Using a credit card responsibly can help you build a good credit score, which is important when applying for loans or other financial products. By making on-time payments and keeping your credit utilization low, you can demonstrate to lenders that you are a responsible borrower.

Debit card usage, however, does not impact your credit score as they are not credit instruments.

Fraud protection: Both debit and credit cards offer some level of protection against fraudulent transactions, but credit cards tend to have stronger consumer protections.

Federal law limits your liability for unauthorized credit card charges to $50, and many credit card companies offer zero-liability policies that protect you from unauthorized charges altogether. Debit cards, on the other hand, may offer less protection, and you may have to wait for the funds to be restored to your account while the bank investigates.

How Debits Affect the Accounting Equation

The accounting equation is a fundamental principle of accounting that states that assets must always equal liabilities plus equity. Understanding how debits affect the accounting equation is crucial for businesses and individuals to accurately track their financial transactions.

Here are some key points to consider when examining how debits affect the accounting equation:

- Debits are used to record increases in assets, expenses, and dividends, and decreases in liabilities, equity, and revenue. For example, if a business purchases inventory on credit, this transaction would be recorded as a debit to inventory (an asset) and a credit to accounts payable (a liability).

- Debits and credits must always balance, so for every debit there must be a corresponding credit of equal value. This ensures that the accounting equation remains in balance.

- When a transaction is recorded using a debit, the accounting equation is impacted in the following way: assets increase and liabilities or equity decrease.

- For example, if a business receives cash from a customer, this transaction would be recorded as a debit to cash (an asset) and a credit to accounts receivable (an asset), which increases assets and does not impact liabilities or equity.

- In general, debits increase the left side of the accounting equation (assets) and decrease the right side (liabilities and equity). This is because assets are resources that a business owns, while liabilities and equity represent claims against those assets.

- Debits are a critical tool for businesses and individuals to accurately record and track financial transactions. By ensuring that debits and credits balance, the accounting equation remains in balance and provides a clear picture of a business's financial health.

Common Mistakes to Avoid When Dealing with Debits

These mistakes can lead to inaccuracies in financial records and can have serious consequences for a business's financial health. Here are some common mistakes to avoid when dealing with debits in accounting:

- Misunderstanding the difference between debits and credits: The most common mistake when dealing with debits in accounting is misunderstanding the difference between debits and credits. It's important to remember that debits increase asset accounts and decrease liability and equity accounts, while credits increase liability and equity accounts and decrease asset accounts.

- Failing to balance debits and credits: Another common mistake is failing to balance debits and credits in financial transactions. Every transaction must have an equal value of debits and credits to ensure the accounting equation remains in balance.

- Not recording transactions in a timely manner: Failing to record transactions in a timely manner can lead to inaccuracies in financial records. It's important to record transactions as soon as they occur to ensure that financial records are up-to-date and accurate.

- Not keeping accurate records: Not keeping accurate records of financial transactions can lead to mistakes when dealing with debits in accounting. It's important to keep accurate records of all financial transactions to ensure that the accounting system is working correctly.

- Misclassifying transactions: Misclassifying transactions can lead to errors in financial records. It's important to ensure that transactions are classified correctly and that debits and credits are assigned to the correct accounts.

- Not understanding the impact of debits on financial statements: Failing to understand the impact of debits on financial statements can lead to inaccuracies in financial reporting. It's important to understand how debits impact financial statements, including the income statement, balance sheet, and cash flow statement.

- Using the wrong account: Using the wrong account when recording a transaction can lead to inaccuracies in financial records. It's important to ensure that the correct accounts are used when recording transactions to ensure that the accounting system is accurate.

Future of Debits: Technological Advances and Trends

- Automation: One of the most significant technological advances in accounting is automation. Accounting software now has the ability to automate routine accounting tasks, such as data entry, thereby reducing errors and improving accuracy.

- Blockchain technology: Blockchain technology is another technological advance that is set to transform the accounting industry. With its ability to create an immutable, tamper-proof ledger, blockchain technology can be used to securely record financial transactions.

- Cloud computing: Cloud computing has become increasingly important in the accounting industry, with more businesses adopting cloud-based accounting software. This trend is set to continue as cloud computing offers increased accessibility, flexibility and cost savings.

- Artificial intelligence: Artificial intelligence is another technological trend that is shaping the future of debits in accounting. AI has the potential to automate tasks such as book-keeping, financial statement analysis, and audit compliance.

- Real-time reporting: Real-time reporting is becoming more important in accounting. With advances in technology, businesses can now access real-time data, enabling them to make informed decisions quickly.

- Integration with other systems: Integration with other systems, such as point-of-sale systems and inventory management systems, is set to become more important in the future. Integration will enable businesses to have a more complete and accurate view of their finances.

- Mobile accounting: Mobile accounting is an emerging trend that is set to revolutionize the accounting industry. With more people using smartphones and tablets, accounting software is being developed to work on these devices, enabling businesses to access their financial data on the go.

Conclusion

Thus debit is an umbrella topic under which a wide range of related issues resides. Although there are more terms related to debit, the ones mentioned above are used the most in businesses today.

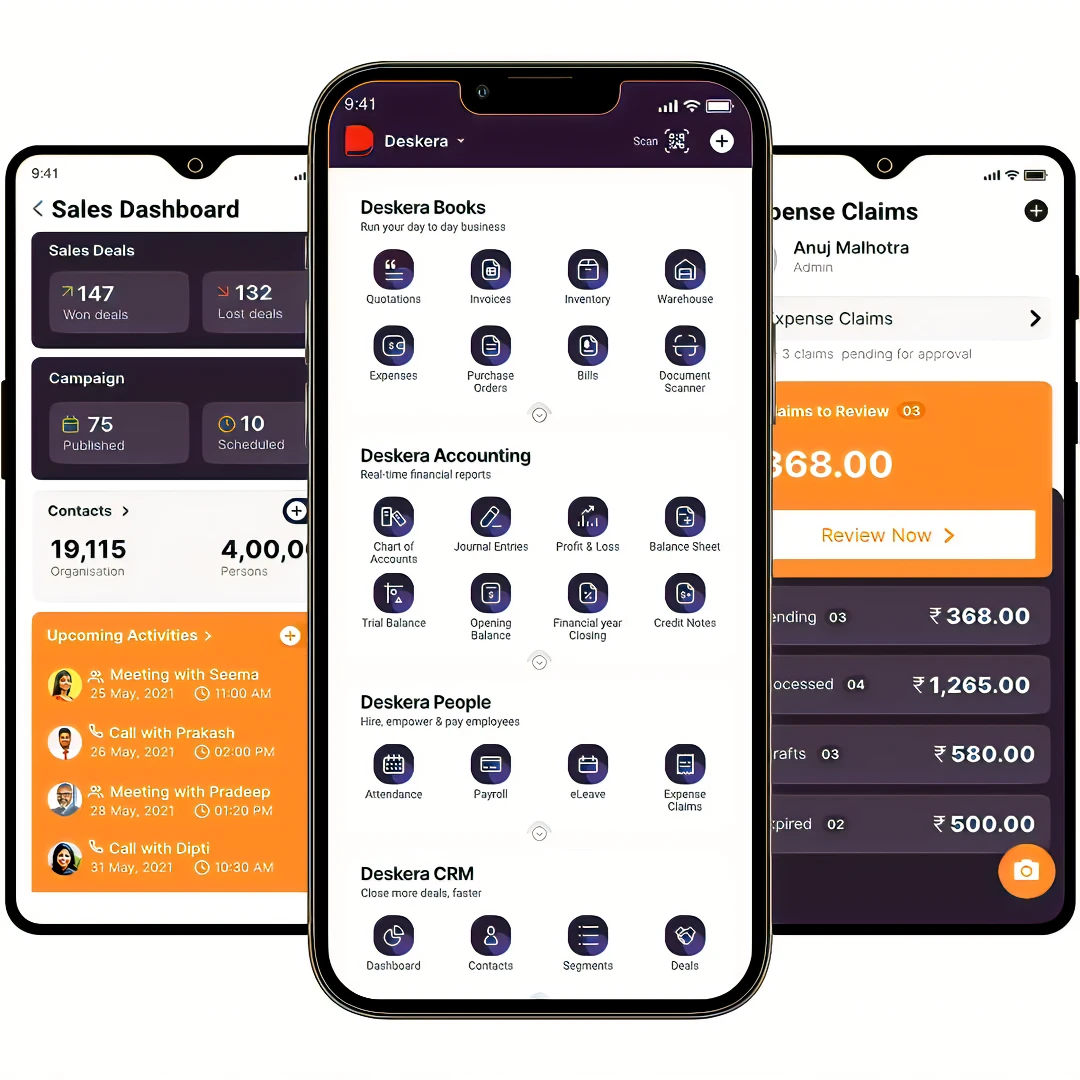

How Can Deskera Assist You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Deskera Books enables you to manage your accounts and finances more effectively. Maintain sound accounting practices by automating accounting operations such as billing, invoicing, and payment processing.

Deskera CRM is a strong solution that manages your sales and assists you in closing agreements quickly. It not only allows you to do critical duties such as lead generation via email, but it also provides you with a comprehensive view of your sales funnel.

Deskera People is a simple tool for taking control of your human resource management functions. The technology not only speeds up payroll processing but also allows you to manage all other activities such as overtime, benefits, bonuses, training programs, and much more. This is your chance to grow your business, increase earnings, and improve the efficiency of the entire production process.

Key Takeaways

- A debit in finance and accounting terms refers to a significant decrease in liabilities or a consecutive increase in a company’s assets

- There is a continuous interplay between credits and debits in a company when they are either attributed to the assets section of the transactions or the liabilities section

- A standard journal entry is also called the general ledger. Every company follows this method to maintain a balance in their transactions of the day

- A T-account is an informal connotation of a double-entry account or a simple ledger account

- A dangling debit is a moment of ledger dilemma where the credits do not offset the debit portion as observed in standard double-accounting entries

- Debit notes are records of transactions that are put on the debit side of the column

- In a margin account, the debit balance is the amount the customer owes the brokerage on the purchase of the much-required securities

Related Articles