Why do some businesses struggle with cash flow even when sales look strong? The answer often lies in how long inventory sits idle before it is sold. Days Inventory Outstanding (DIO) helps uncover this hidden inefficiency by showing the average number of days a company holds inventory before turning it into revenue. It is a deceptively simple metric, yet one that reveals a great deal about operational discipline and financial health.

At its core, Days Inventory Outstanding measures how efficiently a business manages its inventory in relation to its cost of goods sold. A rising DIO can signal excess stock, weak demand forecasting, or slow-moving products, while a declining DIO may indicate leaner operations and faster inventory turnover. For finance and operations teams, DIO acts as a bridge between inventory management and working capital optimization.

Understanding DIO is especially critical in today’s volatile supply chain environment, where holding too much inventory ties up cash and holding too little increases the risk of stockouts. By analyzing DIO alongside other inventory and financial metrics, businesses can strike the right balance between availability, cost control, and liquidity. This makes DIO not just a reporting number, but a strategic performance indicator.

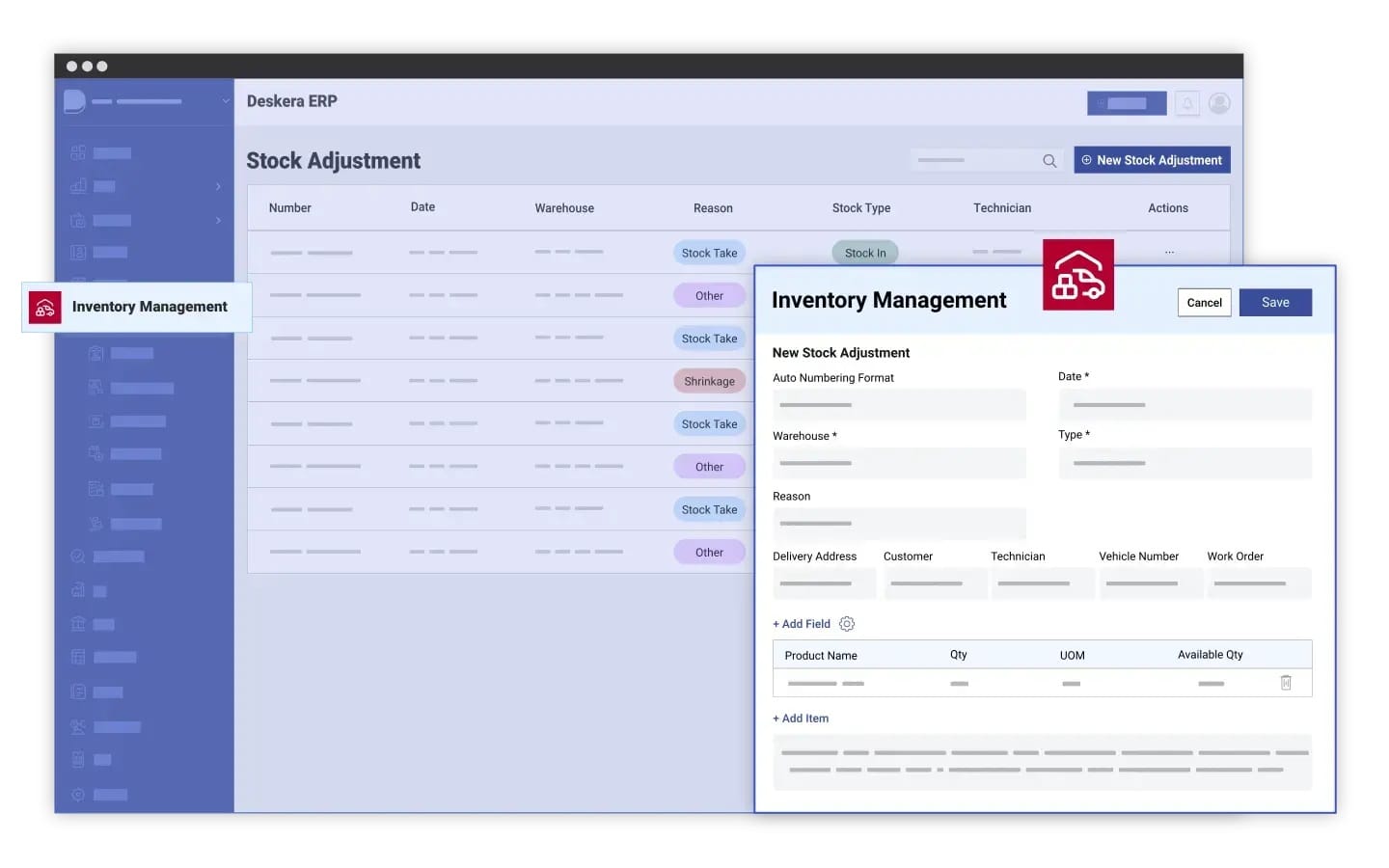

Modern ERP platforms play a key role in making DIO actionable rather than reactive. Deskera ERP provides real-time visibility into inventory levels, cost of goods sold, and financial data, enabling accurate DIO calculations without manual effort. By integrating inventory, accounting, and production data in one system, Deskera ERP helps businesses continuously monitor DIO and take timely, data-driven decisions to improve cash flow and operational efficiency.

What Is Days Inventory Outstanding (DIO)?

Days Inventory Outstanding (DIO) is a key inventory and liquidity metric that measures the average number of days a business takes to sell its inventory. In simple terms, it shows how long inventory sits in storage before it is converted into sales. Because it reflects the average age of inventory, DIO provides a clear view of how efficiently a company manages and moves its stock.

DIO is also commonly referred to as Days Sales of Inventory (DSI), Days in Inventory (DII), inventory days of supply, or the inventory period. While the terminology may vary, the purpose remains the same: to evaluate how quickly inventory is turned into cash. Since inventory ties up working capital, this makes DIO an important indicator of both operational efficiency and financial health.

The ideal Days Inventory Outstanding varies significantly by industry. Businesses that deal in perishable or fast-moving goods, such as food retailers, typically have a much lower DIO than industries that sell high-value or durable products, such as automotive or heavy equipment retailers. For this reason, DIO is most meaningful when compared against similar businesses within the same sector rather than across industries.

From a performance perspective, a lower DIO generally indicates faster inventory turnover, stronger sales performance, and better cash flow. A higher DIO, on the other hand, may point to slow-moving stock, excess inventory, or demand forecasting issues. Beyond inventory control, DIO is often analyzed to refine go-to-market strategies, sales and marketing planning, and pricing decisions based on historical demand and customer buying patterns.

Days Inventory Outstanding (DIO) Formula

Days Inventory Outstanding (DIO) measures the average number of days a company takes to sell its inventory. The most commonly used formula for calculating DIO is:

Days Inventory Outstanding (DIO) = (Average Inventory ÷ Cost of Goods Sold) × Number of Days

This formula helps businesses understand how long inventory remains tied up before it is converted into sales, making DIO both a liquidity metric and an indicator of operational efficiency.

How to Calculate Days Inventory Outstanding Step by Step

To calculate DIO accurately, follow these steps:

- Determine the Average Inventory: Average Inventory = (Beginning Inventory + Ending Inventory) ÷ 2. This smooths out fluctuations in inventory levels over the reporting period.

- Identify the Cost of Goods Sold (COGS): COGS represents the direct costs incurred to produce goods sold during the period, including materials, labor, and manufacturing overheads.

- Divide Average Inventory by COGS: This shows the proportion of inventory relative to the cost of goods sold.

- Multiply by the Number of Days in the Period: Businesses typically use 365 days for annual calculations or 90 days for quarterly analysis.

DIO = (Average Inventory ÷ COGS) × 365 Days

Alternative Method to Calculate DIO

DIO can also be calculated using the inventory turnover ratio:

Days Inventory Outstanding (DIO) = 365 Days ÷ Inventory Turnover

This approach highlights the inverse relationship between inventory turnover and DIO. Higher inventory turnover results in a lower DIO, indicating faster inventory movement.

Days Inventory Outstanding Example

If a company has an average inventory of $27,000 over a year and a cost of goods sold of $243,000, the DIO is calculated as:

DIO = (27,000 ÷ 243,000) × 365 = 40.56 days

This means the company takes approximately 41 days, on average, to sell its inventory.

Why Accuracy Matters in DIO Calculations

Accurate DIO calculations depend on reliable inventory values and correctly calculated COGS. Monitoring average inventory helps eliminate short-term spikes, while precise COGS ensures inventory purchases are not double-counted. Since higher inventory levels tie up cash and reduce free cash flow, businesses are incentivized to minimize DIO without increasing the risk of stockouts.

Key Factors That Influence Days Inventory Outstanding

Days Inventory Outstanding (DIO) is shaped by a combination of operational, market, and planning-related factors. Understanding these drivers helps businesses identify why inventory may be moving slowly or efficiently and where corrective actions are needed.

Demand Forecasting Accuracy

- Accurate demand forecasts align inventory levels with actual customer demand

- Poor forecasting leads to overstocking or slow-moving inventory, increasing DIO

- Demand volatility and inaccurate historical data can distort inventory planning

Sales Performance and Market Demand

- Strong sales velocity reduces the time inventory remains unsold

- Weak demand, changing customer preferences, or ineffective marketing increases DIO

- Product-market fit plays a critical role in maintaining optimal inventory turnover

Inventory Planning and Replenishment Strategy

- Excess safety stock and conservative reorder policies raise DIO

- Lean inventory models and just-in-time practices help lower DIO

- Poor coordination between sales, procurement, and operations increases inventory aging

Supplier Lead Times and Reliability

- Long or inconsistent lead times force businesses to hold higher buffer inventory

- Reliable suppliers with predictable delivery schedules enable lower DIO

- Supply chain disruptions can cause temporary spikes in inventory levels

Production and Manufacturing Cycles

- Longer production cycles increase work-in-progress (WIP) inventory

- Inefficient production scheduling slows inventory movement

- Batch production and inflexible manufacturing processes can elevate DIO

Product Lifecycle and Inventory Mix

- Slow-moving, seasonal, or end-of-life products increase overall DIO

- High SKU complexity makes inventory harder to manage efficiently

- Regular portfolio reviews help reduce aging and obsolete stock

Pricing and Promotion Strategies

- Uncompetitive pricing can slow sales and raise DIO

- Poorly timed promotions may fail to clear excess inventory

- Strategic discounting can help reduce DIO without eroding margins excessively

Inventory Visibility and Technology

- Lack of real-time inventory data leads to delayed decision-making

- Manual tracking increases errors in inventory valuation and aging

- ERP and inventory management systems improve accuracy and DIO control

What Is a Good DIO?

There is no single “good” Days Inventory Outstanding (DIO) that applies to all businesses. An ideal DIO depends heavily on the industry, business model, product type, and demand patterns. In general, a lower DIO is considered favorable because it indicates faster inventory turnover and more efficient use of working capital, but it must always be evaluated in context.

Industry-Specific Benchmarks Matter

DIO varies widely across industries due to differences in product lifecycles and inventory characteristics. For example, businesses dealing in fast-moving or perishable goods typically have a much lower DIO than companies selling high-value, durable, or complex products. As a best practice, businesses should benchmark their DIO against direct competitors or industry averages rather than across unrelated sectors.

Balance Efficiency With Availability

While reducing DIO is often a goal, an extremely low DIO can signal understocking and increase the risk of stockouts, lost sales, and customer dissatisfaction. A good DIO strikes the right balance between minimizing holding costs and ensuring sufficient inventory to meet customer demand consistently.

Consider Seasonality and Demand Cycles

Seasonal businesses may intentionally carry higher inventory levels ahead of peak demand periods, temporarily increasing DIO without indicating poor performance. Similarly, companies anticipating supply disruptions or price increases may stock up in advance, making short-term DIO spikes strategically justified.

Track Trends, Not Just a Single Number

A “good” DIO is often best identified by trend analysis rather than a one-time figure. A stable or gradually improving DIO over time suggests better demand forecasting, inventory planning, and sales execution. Sudden or sustained increases, however, may warrant closer investigation.

Align DIO With Business and Cash Flow Goals

Ultimately, a good DIO is one that supports healthy cash flow, operational efficiency, and service levels. When aligned with metrics such as inventory turnover and the cash conversion cycle, DIO becomes a practical benchmark for evaluating whether inventory investments are working for the business, not just sitting on the balance sheet.

High vs. Low Days Inventory Outstanding: What It Indicates

Days Inventory Outstanding (DIO) is most useful when analyzed in context, using both industry benchmarks and historical trends. The implications of high and low DIO values provide clear signals about inventory efficiency, cash flow health, and sales performance.

What a High Days Inventory Outstanding Indicates

- Inventory is taking longer to convert into sales, signaling slow-moving stock

- Weak product demand, ineffective pricing, or misaligned target customers

- Inefficient inventory planning or over-purchasing

- Cash is tied up in inventory, limiting its use for growth or debt reduction

- Higher storage, handling, and carrying costs

- Increased risk of inventory obsolescence and potential write-downs

- Possible need for heavy discounting to clear excess stock

- Underperformance when compared with industry peers or past periods

What a Low Days Inventory Outstanding Indicates

- Inventory is converted into sales quickly, reflecting strong demand

- Efficient inventory management and faster turnover

- Improved liquidity and stronger free cash flow

- More working capital available for reinvestment or paying down liabilities

- Lower risk of inventory becoming obsolete or unsellable

- Potential risk of stockouts if demand rises unexpectedly

- Reduced buffer to handle supply chain disruptions

Why Industry and Trend Comparisons Matter

- DIO varies significantly by industry and product type

- Comparisons should be made only with similar companies in the same sector

- Tracking DIO trends over time provides deeper insight than a single data point

- A declining DIO signals improving sales velocity and inventory control

- A rising DIO may indicate slowing demand or emerging inventory inefficiencies

Benefits of Measuring Days Inventory Outstanding (DIO)

Measuring Days Inventory Outstanding (DIO) gives businesses a clear, data-backed view of how efficiently inventory is managed and converted into cash. When tracked consistently and analyzed in the right context, DIO becomes a powerful indicator of operational discipline, liquidity, and overall business performance.

Improves Inventory Management Efficiency

DIO helps businesses understand how long inventory is sitting before it is sold. A lower DIO indicates faster inventory turnover and more disciplined inventory planning, reducing the risk of overstocking, obsolescence, and unnecessary carrying costs.

Enhances Cash Flow and Liquidity

Since inventory ties up working capital, minimizing DIO accelerates the conversion of stock into cash. Faster inventory movement improves liquidity, strengthens free cash flow, and gives businesses greater financial flexibility to fund operations or growth initiatives.

Provides Visibility Into Business Productivity

Tracking DIO over time helps identify early signs of declining sales velocity, excess inventory buildup, or demand forecasting issues. It also supports broader financial analysis by feeding into key metrics such as the cash conversion cycle (CCC).

Supports Cash Conversion Cycle (CCC) Analysis

DIO is a critical component of the cash conversion cycle, calculated as:

DIO + DSO – DPO = CCC

By monitoring DIO alongside Days Sales Outstanding (DSO) and Days Payable Outstanding (DPO), businesses gain a holistic view of how efficiently inventory investments are converted into cash.

Strengthens Demand Planning and Purchasing Decisions

A well-managed DIO signals that inventory levels are aligned with actual demand. This enables more accurate procurement planning and allows businesses to reinvest cash from sales into fresh inventory, particularly during inflationary periods when input prices are rising.

Improves Inventory Liquidity Assessment

DIO highlights how liquid a company’s inventory truly is. A shorter DIO means inventory is converted into cash more quickly, while a longer DIO can indicate slow-moving stock and reduced inventory liquidity that may strain working capital.

Enables Smarter Benchmarking Within the Industry

While DIO should never be compared across industries, tracking it against sector peers provides meaningful insight into relative efficiency. A lower DIO than competitors often reflects stronger product-market fit and better inventory control practices.

Increases Investor and Stakeholder Confidence

Investors and analysts often review DIO to assess operational efficiency and capital utilization. A consistently optimized DIO suggests strong inventory discipline, efficient operations, and healthier cash flow, making the business more attractive to external stakeholders.

Supports Strategic Contextual Decision-Making

Measuring DIO helps businesses interpret inventory performance in context. For example, seasonal businesses or companies preparing for supply shortages may temporarily carry higher DIO without signaling inefficiency, allowing leadership to make informed, strategic inventory decisions rather than reactive cuts.

Common Mistakes When Analyzing DIO

While Days Inventory Outstanding (DIO) is a powerful metric, it is often misunderstood or misused. Avoiding these common mistakes ensures that DIO analysis leads to accurate insights and better inventory decisions.

Analyzing DIO in Isolation

- Reviewing DIO without considering related metrics such as inventory turnover or the cash conversion cycle

- Missing the broader working capital and cash flow implications

- Drawing conclusions without understanding the full operational context

Comparing DIO Across Different Industries

- Benchmarking DIO against companies in unrelated sectors

- Ignoring differences in product types, production cycles, and demand patterns

- Using unfair comparisons that lead to misleading performance assessments

Ignoring Seasonality and Demand Cycles

- Treating short-term spikes in DIO as inefficiencies without seasonal context

- Overlooking planned inventory build-ups ahead of peak demand periods

- Misinterpreting strategic stockpiling as poor inventory management

Using Inaccurate or Inconsistent Data

- Relying on outdated inventory valuations or incomplete COGS data

- Mixing reporting periods when calculating average inventory

- Double-counting inventory purchases within COGS, leading to distorted DIO values

Focusing Only on Lowering DIO

- Aggressively reducing inventory without assessing service-level impact

- Increasing the risk of stockouts and lost sales

- Sacrificing customer satisfaction for short-term efficiency gains

Ignoring Trends Over Time

- Evaluating DIO as a one-time number rather than tracking it consistently

- Missing early warning signs of slowing inventory movement

- Overlooking gradual improvements or deteriorations in inventory performance

Overlooking Inventory Composition

- Treating all inventory as equally important

- Failing to separate fast-moving, slow-moving, and obsolete stock

- Masking problem SKUs within an overall acceptable DIO figure

How to Improve Days Inventory Outstanding

Improving Days Inventory Outstanding (DIO) requires a balanced approach that strengthens inventory efficiency without compromising service levels. The goal is not simply to reduce inventory, but to ensure the right inventory is available at the right time while freeing up working capital.

Improve Demand Forecasting Accuracy

- Use historical sales data and demand patterns to create more reliable forecasts

- Incorporate seasonality, promotions, and market trends into planning models

- Align sales, marketing, and operations teams to reduce forecast bias

Optimize Inventory Levels and Safety Stock

- Review safety stock assumptions regularly and adjust based on actual demand variability

- Identify and reduce excess, slow-moving, and obsolete inventory

- Segment inventory by criticality and turnover rates to avoid overstocking

Strengthen Sales and Inventory Alignment

- Improve coordination between sales forecasts and inventory replenishment plans

- Ensure pricing and promotions support timely inventory movement

- Avoid disconnects that cause inventory build-up without corresponding demand

Reduce Supplier Lead Times and Variability

- Work closely with suppliers to improve delivery reliability

- Negotiate shorter lead times or more frequent replenishment cycles

- Diversify suppliers to reduce dependency-related delays

Streamline Production and Replenishment Processes

- Improve production scheduling to reduce work-in-progress inventory

- Adopt lean or just-in-time practices where feasible

- Eliminate bottlenecks that slow inventory movement through operations

Actively Manage Slow-Moving and Obsolete Inventory

- Monitor inventory aging reports regularly

- Use targeted discounts or bundles to clear excess stock

- Discontinue or rationalize underperforming SKUs

Leverage Technology and Real-Time Visibility

- Use ERP and inventory management systems for accurate, real-time inventory tracking

- Automate inventory reporting and DIO calculations to avoid manual errors

- Enable faster, data-driven decisions across finance, procurement, and operations

Monitor DIO Trends and Related Metrics

- Track DIO consistently and compare it with industry benchmarks

- Analyze DIO alongside inventory turnover and the cash conversion cycle

- Use trend analysis to identify issues early and take corrective action

Improve SKU Rationalization and Product Portfolio Management

- Regularly review SKU-level performance instead of relying only on aggregate DIO

- Eliminate or consolidate low-margin, low-velocity, and redundant SKUs

- Focus inventory investment on high-demand, high-profit products

Align Pricing and Discount Strategies With Inventory Objectives

- Use dynamic or tiered pricing to accelerate the sale of aging inventory

- Time promotions based on inventory aging rather than only revenue targets

- Avoid blanket discounts that erode margins without improving turnover

Enhance Sales and Marketing Effectiveness

- Improve demand generation for slow-moving products through targeted campaigns

- Align marketing calendars with inventory availability

- Address exposure gaps that prevent inventory from reaching the right customers

Improve Inventory Accuracy and Cycle Counting

- Conduct regular cycle counts to ensure system inventory matches physical stock

- Reduce shrinkage, miscounts, and write-offs that distort DIO calculations

- Improve confidence in inventory data used for planning and forecasting

Strengthen Cross-Functional Accountability

- Assign clear ownership of DIO across finance, supply chain, and operations

- Set DIO targets at category or product levels rather than only company-wide

- Review DIO in regular performance and S&OP meetings

Use Scenario Planning and What-If Analysis

- Simulate demand surges, supply disruptions, or price changes to assess DIO impact

- Prepare inventory strategies for best-case and worst-case scenarios

- Reduce reactive decision-making during market volatility

Link DIO Improvements to Incentives and KPIs

- Tie inventory turnover and DIO improvements to managerial KPIs

- Encourage behavior that balances sales growth with inventory discipline

- Prevent over-purchasing driven by volume-based incentives

Days Inventory Outstanding vs. Other Inventory Metrics

Days Inventory Outstanding (DIO) does not work in isolation. It is most effective when analyzed alongside other inventory and working capital metrics that together provide a complete picture of operational efficiency, liquidity, and cash flow performance.

Days Inventory Outstanding (DIO) vs. Inventory Turnover

- DIO measures the average number of days inventory is held before being sold

- Inventory turnover measures how many times inventory is sold and replaced during a period

- The two metrics are inversely related:

- Higher inventory turnover results in lower DIO

- Lower inventory turnover leads to higher DIO

- DIO is often easier to interpret for cash flow and working capital analysis, while inventory turnover is useful for operational comparisons

Days Inventory Outstanding (DIO) vs. Days Sales Outstanding (DSO)

- DIO focuses on how long inventory sits before it is sold

- DSO measures how long it takes customers to pay after a sale is made

- DIO highlights inventory efficiency, while DSO reflects credit and receivables management

- Together, they show how quickly goods are sold and how fast cash is collected

Days Inventory Outstanding (DIO) vs. Days Payable Outstanding (DPO)

- DIO tracks how long cash is tied up in inventory

- DPO measures how long a business takes to pay its suppliers

- A higher DPO can partially offset a higher DIO by delaying cash outflows

- Comparing DIO and DPO helps assess whether inventory investments are being financed efficiently

Days Inventory Outstanding (DIO) vs. Cash Conversion Cycle (CCC)

- DIO is a key component of the cash conversion cycle

CCC is calculated as: DIO + DSO – DPO

- While DIO focuses only on inventory movement, CCC shows the full journey of cash through operations

- Improving DIO directly shortens the CCC and strengthens overall liquidity

When to Use DIO Over Other Metrics

- Use DIO when the goal is to understand inventory aging and cash tied up in stock

- DIO is especially useful for identifying slow-moving inventory and excess stock

- It provides clearer insights into liquidity than standalone turnover ratios

Why Combining Inventory Metrics Matters

- No single metric captures inventory performance completely

- DIO explains how long inventory is held, while other metrics explain sales speed and cash timing

- Analyzing DIO alongside turnover, DSO, DPO, and CCC leads to more accurate, actionable decisions

- A combined view prevents over-optimization of one metric at the expense of overall business performance

How Deskera ERP Helps Reduce Days Inventory Outstanding

Reducing Days Inventory Outstanding (DIO) requires accurate data, cross-functional coordination, and timely decision-making. Deskera ERP supports all three by unifying inventory, finance, procurement, and production processes on a single platform, enabling businesses to actively manage and lower DIO.

Real-Time Inventory Visibility

- Provides up-to-date visibility into raw materials, WIP, and finished goods

- Helps identify slow-moving and aging inventory early

- Reduces excess stock caused by outdated or inaccurate inventory data

Accurate Demand Planning and Forecasting

- Uses historical sales and consumption data to support better demand forecasts

- Aligns inventory replenishment with actual demand patterns

- Minimizes overstocking and reduces inventory holding periods

Integrated Procurement and Supplier Management

- Aligns purchasing decisions with inventory levels and demand forecasts

- Helps avoid over-purchasing through automated reorder insights

- Supports better supplier coordination to reduce lead times and buffer stock

Streamlined Production and Inventory Movement

- Improves production planning and scheduling to reduce work-in-progress inventory

- Enables faster movement of inventory from production to sales

- Reduces bottlenecks that increase inventory aging

Automated Inventory Valuation and DIO Tracking

- Calculates inventory values and COGS accurately in real time

- Automates DIO reporting without manual spreadsheets

- Enables consistent monitoring of DIO trends across periods

Inventory Aging and Slow-Moving Stock Analysis

- Provides detailed inventory aging reports at SKU and category levels

- Helps teams take proactive action on excess or obsolete inventory

- Supports timely discounts, transfers, or rationalization decisions

Better Cash Flow and Working Capital Control

- Links inventory data directly with financial reporting

- Shows how inventory levels impact cash flow and liquidity

- Helps leadership make faster, data-driven decisions to optimize working capital

Key Takeaways

- DIO measures the average number of days inventory remains in stock before being sold, offering a clear view of inventory efficiency and liquidity.

- Accurate DIO calculation requires average inventory, cost of goods sold (COGS), and the number of days in the reporting period; it can also be derived from inventory turnover.

- Tracking DIO improves inventory management, enhances cash flow, provides business visibility, and supports data-driven purchasing and operational decisions.

- A “good” DIO depends on industry norms, demand patterns, and business strategy; lower DIO generally indicates efficient inventory turnover but must balance stock availability.

- High DIO signals slow sales, overstocking, or inefficiencies, while low DIO reflects faster turnover and better working capital utilization, though extremely low DIO can risk stockouts.

- DIO is influenced by demand forecasting, sales performance, inventory planning, supplier lead times, production cycles, product lifecycle, pricing, and inventory visibility.

- Mistakes include analyzing DIO in isolation, comparing across industries, ignoring seasonality, using inaccurate data, focusing solely on lowering DIO, and neglecting trends or inventory composition.

- Businesses can reduce DIO by enhancing demand forecasting, optimizing inventory levels, aligning sales and inventory, shortening supplier lead times, streamlining production, managing slow-moving stock, and leveraging ERP technology.

- DIO complements metrics like inventory turnover, DSO, DPO, and the cash conversion cycle, providing a more complete view of inventory efficiency and cash flow performance.

- Deskera ERP provides real-time inventory visibility, accurate forecasting, integrated procurement, streamlined production, automated DIO tracking, slow-moving inventory analysis, and better cash flow management to actively reduce DIO.

Related Articles