When you are selling goods in large quantities, you are utilizing the inventory and not wasting it. However, low sales reflect wastage of goods, inventory turning obsolete, or damaged in the warehouse. Therefore, it is essential to keep a note of all the inventory movement and its relationship to sales.

An ideal way to do this is to track the Day Sales Inventory (DSI) as a business metric.

In this all-in-one article, you will learn everything about Days Sales in Inventory- From what Days Sales in Inventory is, what it means for your company, to how to calculate it.

"Make inventory a common enemy for your company" - Dave Waters

Here's what we shall cover in this post:

- What is Days Sales in Inventory?

- Why is DSI Important for Your Company?

- How to Calculate Day Sales Inventory (DSI)?

- What is Average Inventory and How to Calculate it?

- Comparing DSI Ratio with Other Financial Ratios

- Conclusion

- Things to Remember in DSI

What is Days Sales in Inventory?

Days Sales in Inventory (DSI) aka, Average Age of Inventory, demonstrates the time needed for an organization to turn its stock into deals.

Organizations that take fewer days to sell the inventory show that the organization is more proficient at selling its stock. The DSI figure also helps in determining the overall performance of the company. DSI trends can be indicators of whether a company is improving its sales or falling behind.

Decreasing Day Sales in Inventory (DSI) numbers generally mean the company is moving in the right direction.

Days Sales in Inventory Ratio

Days sales in inventory (DSI) is a financial ratio that measures how many days it takes a company to sell its inventory. It is also referred to as the inventory turnover period or days inventory outstanding.

The ratio is calculated by dividing the average inventory by the cost of goods sold and then multiplying the result by the number of days in the period being measured.

Why is DSI Important for Your Company?

If you are a company that sells goods more than services, DSI makes a significant marker for you and your investors. DSI reflects the liquidity of your business. So, your investors who always want to know whether or not your company is performing well can easily refer to the DSI report.

Secondly, when the maintenance cost, rent, security cost, and other expenses of holding inventory are not managed efficiently, it directly impacts your profit margin. Hence, DSI value helps you to study the movement of the goods in the supply chain. It helps in the expense planning of storage and maintenance costs of your holding inventory.

Another way in which Day Sales Inventory helps a company is by providing indicators to restock at the right time.

Now that you have understood what DSI holds for you, we have listed a few things to remember before you learn how to calculate DSI.

How to Calculate Day Sales Inventory (DSI)?

The ratio indicates the efficiency of a company in managing and selling its inventory. It is important for a company to maintain an appropriate level of inventory to meet customer demand and avoid stockouts, while not holding too much inventory that ties up cash and leads to obsolescence or waste.

Here's a step-by-step guide on how to calculate Days Sales in Inventory Ratio:

Step 1: Determine the average inventory level for the period

The first step in calculating DSI ratio is to determine the average inventory level during the period for which you want to calculate the ratio. This is typically done by taking the sum of the beginning and ending inventory levels and dividing by two.

Average Inventory = (Beginning Inventory + Ending Inventory) / 2

Step 2: Calculate the Cost of Goods Sold (COGS)

The next step is to determine the Cost of Goods Sold (COGS) during the period. COGS is the total cost of all goods that were sold during the period, and it includes the cost of raw materials, labor, and other expenses associated with the production and sale of the goods.

COGS = Beginning Inventory + Purchases - Ending Inventory

Step 3: Calculate the Days Sales in Inventory Ratio

Once you have the average inventory level and the COGS for the period, you can calculate the DSI ratio. The formula for DSI ratio is:

DSI Ratio = (Average Inventory / COGS) x Number of Days in the Period

For example, if the average inventory level is $100,000, and the COGS is $500,000 for a period of 365 days, the DSI ratio would be:

DSI Ratio = ($100,000 / $500,000) x 365 DSI Ratio = 73 days

This means that it takes the company approximately 73 days to turn its inventory into sales.

Step 4: Analyze the results

Once you have calculated the DSI ratio, it's important to analyze the results and compare them to industry averages or the company's historical performance. A high DSI ratio may indicate that the company is holding too much inventory or that sales are slowing down, while a low DSI ratio may indicate that the company is not stocking enough inventory to meet demand.

What is Average Inventory and How to Calculate it?

Average inventory is the mean value of a company’s inventory over a specific period of time.

The average inventory values can be used as a point for comparison when considering the overall sales volume, allowing a business to track inventory losses that may have occurred due to damaged goods, theft, and so on. It also accounts for any perishable inventory that has expired. Average inventory is also used in calculating Inventory Turnover Ratio.

Formula for calculating Average Inventory:

Average Inventory = (Current Inventory + Previous Inventory) / Time-Period

What is COGS?

Cost of Goods Sold (COGS) also known as cost of sales refers to the expenses of manufacturing the products sold by an organization. It includes the expense of the raw materials and labor costs. It excludes any indirect expenses, such as sales for cost and distribution cost. Head over to our article on Cost of Goods to Sold to learn more about it.

Number of days

When calculating a DSI you can either take, 365 days for a year and 90 days for a quarter. Sometimes, companies also consider 360 days for calculation.

While the numerator reflects the value of the stock, the denominator shows the everyday cost spent by the organization for the manufacturing of goods. The net factor tells the number of days taken by an organization to clear its inventory.

Note: A business should be calculating and tracking DSI and observe the trend over time. A decreasing DSI means you are headed in the right direction.

What is a good Days Sales in Inventory Ratio?

The optimal DSI ratio varies by industry and depends on a company's operations. A good DSI ratio should be in line with industry averages or benchmarks. If a company has a higher DSI ratio than its peers, it may indicate that it is struggling to sell its inventory, which could lead to losses.

How to Interpret Days Sales in Inventory Ratio?

A high DSI ratio indicates that a company is holding onto inventory for a long time before selling it. This may be due to several reasons, including low demand for the product, inefficient inventory management, or inadequate marketing efforts. This can result in higher carrying costs, which may reduce profits.

On the other hand, a low DSI ratio indicates that a company is selling its inventory quickly. This may be due to strong demand for the product, effective marketing, or efficient inventory management. However, a very low DSI ratio may indicate a risk of stockouts or shortages, which could impact sales negatively.

It's important to keep in mind that DSI ratio is just one metric used to evaluate a company's financial health. It should be used in conjunction with other financial ratios to get a more comprehensive understanding of a company's performance.

Relationship between Days Sales in Inventory Ratio and Cash Flow

Here are some points to consider when examining the relationship between DSI ratio and cash flow:

- A higher DSI ratio means a longer time to convert inventory into sales, which can negatively impact cash flow. This is because inventory ties up cash that could otherwise be used for other business expenses or investments. A longer DSI ratio can also increase the risk of inventory becoming obsolete or unsellable.

- On the other hand, a lower DSI ratio can improve cash flow as inventory is converted into sales more quickly. This allows the business to replenish its inventory with new products or invest in other areas of the business. However, having too low of a DSI ratio can lead to stock shortages and missed sales opportunities.

- In general, businesses want to maintain a balance between DSI ratio and cash flow. This means finding the optimal level of inventory that allows for quick turnover while still having enough inventory to meet customer demand.

- One way to improve DSI ratio and cash flow is to implement inventory management systems that optimize the supply chain and reduce the risk of overstocking or stockouts. This can involve using forecasting tools to anticipate demand, setting up just-in-time delivery systems, or implementing automated inventory tracking.

Another strategy to improve cash flow is to negotiate better payment terms with suppliers or customers. For example, businesses can negotiate longer payment terms with suppliers, which can provide more time to sell inventory before needing to pay for it. Alternatively, businesses can offer incentives for customers to pay their invoices more quickly.

Comparing DSI Ratio with Other Financial Ratios

Inventory Turnover Ratio

Inventory Turnover Ratio (ITR) is a ratio that measures the number of times a company's inventory is sold and replaced over a certain period of time. It is calculated by dividing the cost of goods sold (COGS) by the average inventory for the period.

Unlike DSI, ITR is an activity ratio and measures how effectively a company is managing its inventory. A high ITR indicates that a company is selling its inventory quickly and efficiently, while a low ITR suggests the opposite. DSI and ITR are related, and a higher ITR usually results in a lower DSI.

Gross Profit Margin

Gross Profit Margin (GPM) is a ratio that measures a company's profitability after deducting the cost of goods sold (COGS). It is calculated by dividing the gross profit by revenue.

Since DSI and ITR are both related to the cost of goods sold, the GPM can be a useful indicator of a company's profitability. If a company has a high GPM and a low DSI, it suggests that the company is efficient at both inventory management and generating profits.

Current Ratio

The Current Ratio is a liquidity ratio that measures a company's ability to pay its current liabilities using its current assets. It is calculated by dividing current assets by current liabilities.

While not specifically related to inventory management, it is worth noting that the amount of inventory a company holds can impact its current ratio. If a company has too much inventory, it may struggle to pay its short-term liabilities.

Debt to Equity Ratio

The Debt to Equity Ratio is a leverage ratio that measures a company's reliance on debt to finance its operations. It is calculated by dividing total liabilities by total equity.

A company that holds too much inventory may struggle to generate cash to pay off debt and may end up with a higher debt-to-equity ratio. This can indicate financial distress and reduced shareholder value.

Using DSI Ratio to Make Informed Business Decisions

Assessing Inventory Levels: DSI ratio can be used to assess inventory levels, which can help businesses make informed decisions about production and purchasing.

If DSI ratio is too high, it suggests that the company has excess inventory, and they may need to reduce production or slow down purchases. If DSI ratio is too low, it may suggest that the company is not stocking enough inventory to meet demand.

Identifying Slow-Moving Inventory: The DSI ratio can also help businesses identify slow-moving inventory that may be tying up valuable capital. If a business has a high DSI ratio and slow-moving inventory, it may be time to reduce prices or implement a promotion to move that inventory quickly.

Optimizing Pricing Strategies: Businesses can also use the DSI ratio to optimize their pricing strategies. If a business has a high DSI ratio, it may be time to reduce prices to move inventory more quickly.

Conversely, if a business has a low DSI ratio, they may be able to increase prices and still maintain the appropriate inventory levels.

Improving Cash Flow: By using DSI ratio, businesses can improve their cash flow by reducing excess inventory and freeing up capital. This can be accomplished by reducing production, lowering prices, or implementing promotions to move inventory more quickly.

Identifying Seasonal Trends: DSI ratio can also help businesses identify seasonal trends in their inventory turnover. By comparing DSI ratio across different time periods, businesses can identify which periods have higher inventory turnover and which periods have lower inventory turnover.

This information can help businesses adjust production and purchasing to match demand.

Evaluating Supply Chain Performance: Finally, businesses can use DSI ratio to evaluate the performance of their supply chain.

By tracking the DSI ratio of suppliers, businesses can identify which suppliers are performing well and which are not. This information can be used to renegotiate terms with underperforming suppliers or to switch to a different supplier.

Limitations of Days Sales in Inventory Ratio

It Doesn't Account for Changes in Inventory Composition

The DSI ratio calculates the average number of days it takes for a company to sell its inventory, but it doesn't consider the type of inventory or changes in inventory composition. For example, a company might have a higher DSI ratio because it has a large amount of slow-moving or obsolete inventory. Alternatively, a company might have a lower DSI ratio because it has a high amount of fast-moving inventory. In both cases, the DSI ratio might not accurately reflect the company's inventory management efficiency.

To overcome this limitation, companies can use additional inventory metrics such as inventory turnover, gross margin return on investment, and slow-moving inventory analysis to gain more insight into their inventory composition and efficiency.

It Ignores Seasonal Trends and Industry-Specific Factors

Another limitation of DSI ratio is that it doesn't account for seasonal trends or industry-specific factors. For example, a retail company might experience a surge in sales during the holiday season, which can increase its DSI ratio.

Conversely, a company in the manufacturing industry might experience a decrease in sales during economic downturns, which can decrease its DSI ratio. These factors can skew the DSI ratio and make it difficult to compare companies across different seasons or industries.

To overcome this limitation, companies can use industry-specific benchmarks or adjust their DSI ratio calculations to account for seasonal trends. For example, a company might calculate its DSI ratio on a rolling 12-month basis to account for seasonal fluctuations.

It Doesn't Consider Inventory Holding Costs

The DSI ratio doesn't account for the cost of holding inventory, such as storage, insurance, and obsolescence. A company with a low DSI ratio might be holding too much inventory, which can lead to increased holding costs and reduced profitability.

To overcome this limitation, companies can calculate their inventory carrying costs and use this information to optimize their inventory levels. They can also use inventory management systems that help to reduce holding costs by identifying slow-moving inventory, tracking inventory turnover rates, and providing real-time inventory data.

How Can Deskera Assist You?

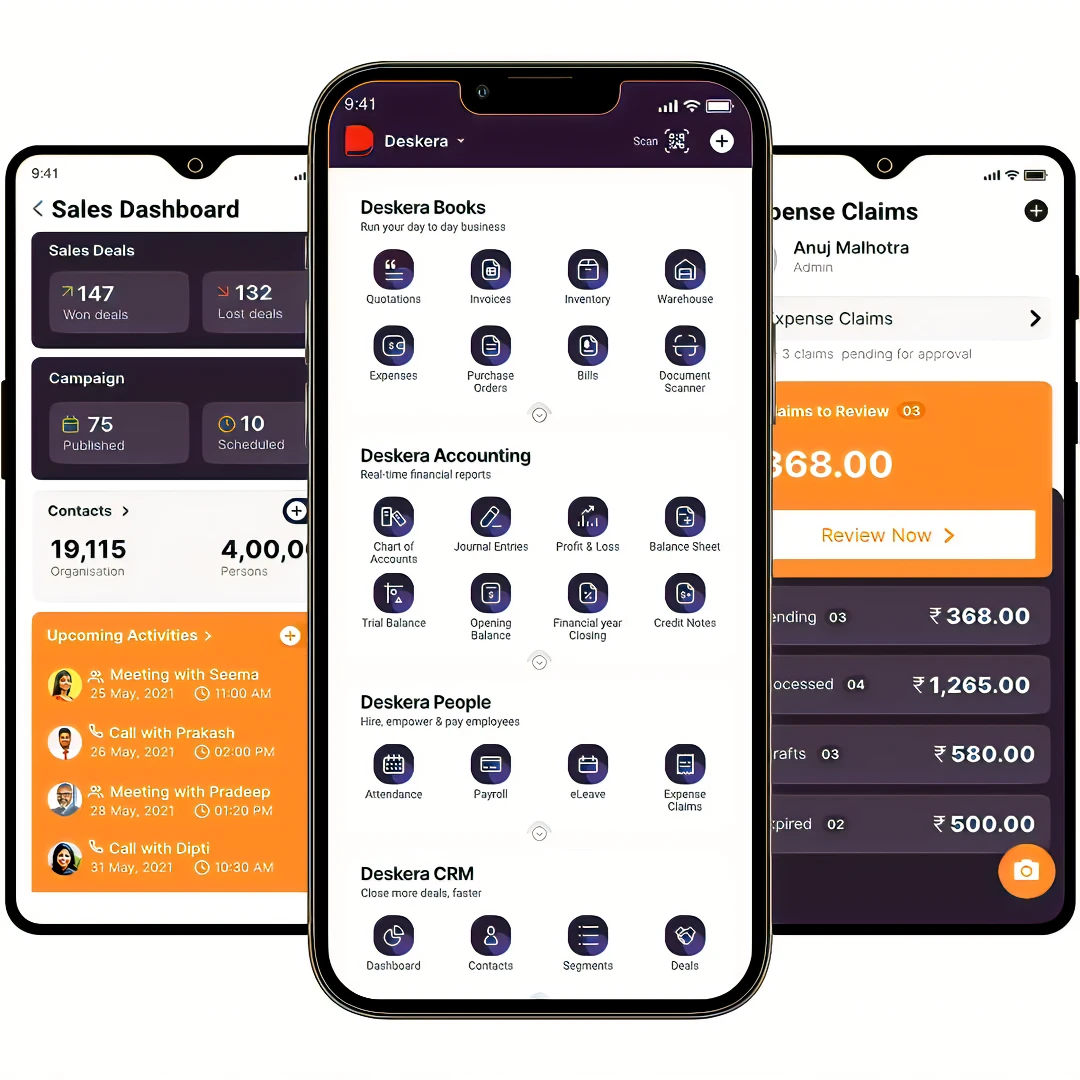

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Deskera Books enables you to manage your accounts and finances more effectively. Maintain sound accounting practices by automating accounting operations such as billing, invoicing, and payment processing.

Deskera CRM is a strong solution that manages your sales and assists you in closing agreements quickly. It not only allows you to do critical duties such as lead generation via email, but it also provides you with a comprehensive view of your sales funnel.

Deskera People is a simple tool for taking control of your human resource management functions. The technology not only speeds up payroll processing but also allows you to manage all other activities such as overtime, benefits, bonuses, training programs, and much more. This is your chance to grow your business, increase earnings, and improve the efficiency of the entire production process.

Conclusion

A recent study suggests that organizations with high inventory turnover ratios and low DSIs help you stay afloat in the market. It enables you to stay ahead of your competitors in the market. Your aim should be to increase the ITR and decrease DSIs over time. Deskera helps you with just that.

With advanced inventory management and inventory control features, Deskera helps you drive DSI down.

We hope this article helped you understand what Day Sales Inventory is, its importance, few things to remember about DSI, and how to calculate it.

Things to Remember in DSI

- DSI differs enormously among companies based on factors such as the business model and the type of product. Every company has a different commodity to offer and practices a business model that aligns with its aims and objectives. So when you make a critical analysis of the DSI value in the market, compare it with the companies in the same sector as you.

- Another point to remember is, organizations in the tech sector, furniture, automobile sector, and many more can bear to clutch their inventories for long. However, those in the business of perishable goods like food items cannot hold inventory for long.

- Every organization should try to find a balance between ideal stock levels and market demand.

Related Articles