The Minimum Wages Code 2022 is a revolution that has been initiated by the Central Government to amend and consolidate important forum laws relating to the minimum wages, payment of wages, bonuses, equal pay, and related matters.

The purpose of a legal minimum wages code is to bring together the various laws in one place. Currently in India, we have nearly 44+ laws covering labor and employment with their own rules that define the procedural aspects.

To streamline these laws, the central government has mainly grouped these laws under 4 codes, namely:

- The Code on Wages, 2019 – covers laws relating to wages and bonuses

- The Industrial Relations Code, 2020 – covers laws relating to trade unions, conditions of employment in industrial establishments or businesses, investigation, and resolution of industrial disputes

- The Code on Social Security, 2020 – covers social security legislation to extend social security to all employees and workers in the organized, unorganized, and other sectors

- The Code on Occupational Safety, Health, and Working Conditions, 2020 – includes laws governing the safety, health, and working conditions of people employed in a business

This article provides a overview of the minimum wage code and what it means for shops and establishments in Tamil Nadu.

Table of Contents

- About the Minimum Wages Code

- Highlights of the Minimum Wages Code Applicable to Shops and Establishments in Tamil Nadu

- Applicability of the Minimum Wages Code under the Shops and Establishments Act in Tamil Nadu

- Provisions under Section 2 (Y) of the Minimum Wages Code

- Legal Provisions of the Minimum Wages Code under the Shops and Establishments Act in Tamil Nadu

- Important Components of the Minimum Wages Code

- Appointment of the Inspector

- Violations and Penalties

- Data, Returns, and Communication

- Shops and Establishments of Tamil Nadu and the Minimum Wages Code

- Other Compliances

- Conclusion

- Key Takeaways

About the Minimum Wages Code

The Minimum Wages Code has been initiated to reform the concept of salaries, bonuses, and related matters with consistency and accountability. The Minimum Wages Code is compiled in 9 chapters with 69 sections simplifying the laws mentioned below relating to wages, bonuses, and related matters, namely:

- The Minimum Wages Act, of 1948 sets/revises minimum wages for scheduled jobs

- The Payment of Wages Act, 1936 applies to employees whose income threshold does not exceed Rs. 24,000 per month

- The Payment of Bonus Act, 1965 applies to establishments employing 20 or more employees on any given day in an accounting year for their employees whose salaries do not exceed Rs. 21,000 per month

- The Equal Remuneration Act, of 1976 prohibits discrimination based on gender in pay, hiring, transfer, and promotion

Highlights of the Minimum Wages Code Applicable to Shops and Establishments in Tamil Nadu

- The minimum wages code is extended to all jobs and it benefits many workers in disorganized departments who were not included in the scope of normal work under the Minimum Wages Act

- The minimum wages code introduces the concept of a minimum wages system established by the central government

- States and UTs must set a minimum wage above the set limit. This simplifies the methodology for establishing the minimum wage, mainly through geographical locations and talent

- The minimum wages code ensures timely rewards, bonus payments, and other employee benefits

- The minimum wages code will apply to all employees and rebuild the definition of minimum wages

- The minimum wages code promoted integrated maintenance of management, payment thresholds, and advertising overviews

- The minimum wages code ensures equal pay and work opportunities in the labor market for both men and women

- It has also brought about modifications in the inspection mechanism wherein the deadline has been increased to 3 years to claim uniform rights such as minimum wage, bonus, and equal pay

Applicability of the Minimum Wages Code under the Shops and Establishments Act in Tamil Nadu

The minimum wage law applies throughout India. The national government announces the effective date of the law in the official bulletin. The Minimum Wage Act applies to all organizations and it recognizes basic wages, benefits, and other allowances such as overtime, housing, lighting, water, health, and other services.

In addition to the aforementioned remuneration, if this is equal to half (50%) of the total amount of remuneration (salary + other benefits) paid in the form of remuneration (excluding bonuses, severance pay, severance indemnity, and goodwill allowance) it is considered a difference within the added wage.

All benefits in kind that do not exceed 15% of the total salary to be paid are considered part of the salary.

Provisions under Section 2 (Y) of the Minimum Wages Code

Minimum Wages means each remuneration, whether by wages, allowances, or another way, that includes:

- Basic Pay

- DA – Dearness Allowance

- Other Allowances

But does not include:

- Any bonus which is payable after a current period that is not part of the remuneration must be paid within the framework of the conditions of employment

- The value of house control or the supply of light, water, medical visitors, or other amenities or an excluded service of the calculation of wages by a general or special order of the government concerned

- Contributions paid by the employer to the pension or service providers and the interest suspended on them

- Transport allowance or the value of a travel permit

- Amount paid to the employee to avoid special expenses associated with the type of job

- Preparation of the rental of houses

- Remuneration must be paid in the context of a sentence or a comparison between the parties or a court or a court

- Any overtime assignment

- Commission payable to the employee

- Gratuity to be paid by the employer after the termination of employment

- Any reduction compensation or another retirement provision or ex-Gratia payment paid to the employee to terminate employment

Legal Provisions of the Minimum Wages Code under the Shops and Establishments Act in Tamil Nadu

In India, workers are largely covered by the current law of the minimum wages code. It applies to the expected employment and eliminates the concept of scheduled employment by providing full coverage by bringing the workforce of non-unionized sectors within the scope of the minimum wage to ensure economic fairness.

According to the minimum wages code, the central government under the shops and establishments in Tamil Nadu sets the minimum wages.

Individual states and union territories (UTs) must ensure that their respective minimum wages do not drop below the threshold. In cases where existing minimum wages are higher than the mandatory minimum wage, these higher wages will be maintained.

The minimum wage range depends on the location and skills of the worker. Employers and businesses are obliged to pay their staff no less than the prescribed minimum wage.

The salary range is determined based on temporary work or piecework and for the payment, the salary period is calculated based on the hour, day, or month.

Important Components of the Minimum Wages Code

The minimum wages Code specifies the procedural requirements for setting and reviewing the minimum wage, determining working hours for a normal working day, the minimum wage for piecework, calculating wages for employees who work less than normal working hours, or work for two or more jobs classes, pay for overtime, etc.

Payment of Minimum Wages

The minimum wages code applies to all employees and has removed the threshold provided for in the Wage Payment Act, which applies to employees earning wages below Rs. 24,000 per month.

Employers are responsible for:

- Minimum Wages structure

- Timely payment of the salary, i.e. by the 7th of the following month

- For employees of contractors, wages must be paid to the contractor in good time before the 7th day, so that the contractor pays it to the employees on time

- Make full and final payments within 2 business days to the employee who is either laid off, terminated, or become unemployed due to the closure

The minimum wages Code allows the employer to set the wage period by the day, week, fortnight, or month and to pay the wages according to the time limits prescribed therein.

The employer has the authority to make deductions from wages for certain aspects, i.e. imposing permissible fines, breach of duty, causing damage or loss, for services such as applicable lump-sum deductions, collection of advances, loans paid, etc.

The total amount of deductions for services during a pay period from an employee's salary cannot exceed 50% of that salary. If it is exceeded, it can be recovered in the prescribed manner. The employer is responsible for legal transfers.

Bonus Payment

Bonus payment rules apply to companies with at least 20 employees on any day of that accounting year. The competent government communicates the salary threshold of the employees who are entitled to the payment of the bonus. The Bonus Pay Act applies to employees earning less than Rs.21,000 per month.

The annual bonus payable shall be between a minimum of 8.33% and a maximum of 20% of the salary earned by the employee or Rs. 100/- whichever is greater. The amounts to be paid as bonuses must be paid by the employer within 8 months of the end of the financial year.

An employee who is fired from the service for the following reasons will be disqualified from receiving the bonus:

- Fraud

- Incendiary or violent behavior on the premises of the institution

- Theft, embezzlement, or sabotage of assets belonging to the establishment

- Conviction of sexual harassment

Equal Remuneration

The concept of equal pay for equal work is enshrined in our constitution to prevent gender discrimination. The minimum wages Code prohibits discrimination between employees based on gender, pay by the same employer, and for the same or similar job.

Advisory Council, Central and state governments will have their respective advisory councils to decide:

- Fixing or reviewing minimum wages and other related matters

- Provision of employment opportunities for women

- Any other matter related to this Code

Payment of Dues and Claims

The Minimum Wages Code requires employers to pay all wages, allowances, bonuses, and other applicable charges, if any, to their employees promptly and on time.

In cases where the employee's death or whereabouts are unknown before the payment of such contributions, the employer shall pay the contributions to such employee's agent

If no nomination is made or if the dues cannot be paid to the nominee for any reason, the employer shall deposit the amount of the dues with the designated body in the prescribed manner. The designated authority pays the contributions to the dependents of the deceased in the prescribed manner.

Claims

The disputed claims will be reinstated by the designated authorities.

The application must be presented to this Authority within three years from the date on which the claim arose, or through:

- The employee concerned; or

- A registered trade union of which the employee is a member; or

- The inspector cum supervisor

The Authority in charge will examine the application and, in deciding, may request compensation for damages up to ten times the request made in addition to the request, depending on the circumstances in which such request arises. The Authority is in charge of ruling on appeals within 3 months.

If the employer does not pay the amount of the accident/compensation established, the Authority will issue proof of recovery to the District Collector or to the District Magistrate in which the exercise is located. The credit/compensation will be recovered as land arrears and remitted to the Authority for payment to the employee concerned.

Appointment of the Inspector

The inspector-facilitator will be appointed by the relevant government to inspect factories, records, and records and can advise employers and employees, employees on compliance. The government may conduct web-based inspections that require electronic information and designate inspectors from other jurisdictions to conduct such inspections.

Violations and Penalties

If the employer pays less than the amount owed to an employee, he will be punished with a fine of up to Rs.50,000; Repeating this offense within 5 years will result in imprisonment of up to 3 months or a fine of up to Rs.100.000 or both.

Employers who violate other provisions of the Code will be fined up to Rs. 20,000 or imprisonment of up to 1 month or a fine of up to Rs. 40,000 or both. The employer will be fined up to Rs. 10,000 for failure to maintain or improper records maintenance.

Data, Returns, and Communication

The employer of the establishment to which the Code applies must keep the records containing:

- Employee data

- Muster roll

- Wages and other details

Each employer must have a notice on the bulletin board in a prominent place within the premises, containing:

- Summary of the Minimum Wages Code

- Employee salary rate and category

- Pay period

- Day or date and hour of salary payment

- Name and address of the responsible inspector and the moderator

All employers must issue pay slips to employees in the prescribed form and manner

These provisions do not apply to employers who employ no more than 5 workers employed for agricultural or domestic purposes relating solely to the domestic or family affairs of the employer and do not cover matters relating to an establishment, industry, trade, business, manufacture, or profession.

Shops and Establishments of Tamil Nadu and the Minimum Wages Code

The State Government of Tamil Nadu has published the draft Salary Rules (Tamil Nadu) Code 2022 in its notice dated April 11, 2022.

According to the draft regulation, the minimum wage rate is set “on each day basis”, considering the following criteria, namely:

- The typical worker's family, which includes a spouse and two children in addition to the worker; an equivalent of three adult consumption units

- A net intake of 2700 calories per day per serving

- 10% of expenses for food and clothing for rent

- Fuel, electricity, and other expenses are 20% of the minimum wage

Other Compliances

- The normal working day includes 8 hours of work and one or more breaks, which in total cannot exceed one hour

- An employee's working day must be divided in such a way that, including breaks, it does not exceed 12 hours per day

- Each employer issues payslips to employees electronically or otherwise on Form V

- If the workers are employees of a contractor in an establishment, the company must pay the contractor the amount due to him before the salary payment date, so that the salary paid to employees will be positive

- The annual declaration is submitted electronically by each employer of an establishment that is not covered by the Occupational Health and Safety Code, in Form VII

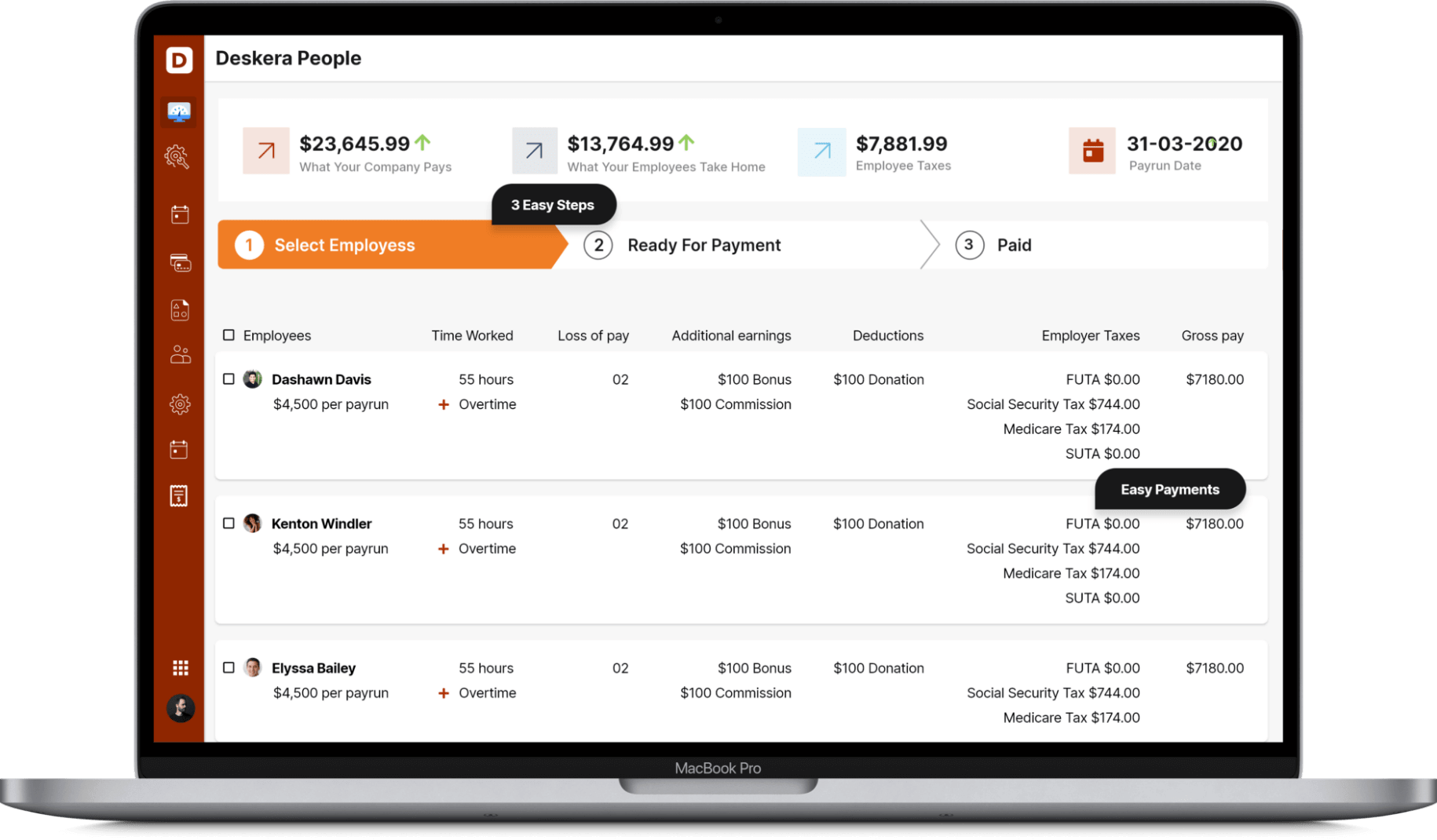

How Can Deskera Assist You?

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. Features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning and uploading expenses, and creating new leave types make your work simple.

Conclusion

The Minimum Wages Code is an extraordinary move by the government to supplement and simplify the four existing laws. The expectation is that there will be more standardization, responsibility, and transparency in the system. The Minimum Wages Code gives everyone sufficient time to complete all tasks and supports compliance strategies that are accepted and understood by both employers and employees.

Key Takeaways

- The minimum wage code is exquisite in many ways. It is a collection of the essential elements of all the existing fundamental laws. Unlike the Minimum Wage Act, this law applies to everyone at all levels, including employees, managers, and executives

- The new minimum wages code brings reporting to a single authority and appoints a review body

- The Minimum Wages Code outlines the employer's responsibilities and clearly defines minimum wages, inclusions, and exceptions. The National or Central Authorities sets the minimum wages for local workers

- The Minimum Wages Code provides for equal pay and opportunities for service and employment for all genders

- The new provisions of the Minimum wages code under shops and establishments act in Tamil Nadu will facilitate rapid case resolution and ensure that law-abiding employers do not face unnecessary problems

Related Articles