Are you aware of what needs to be filled in a Central Register Wages Form XVII? It is more than just the details of wages, dearness allowance, etc.

The form contains all the details of the contractor, and it is crucial to maintain all the details mentioned in the format. It also contains the details of the wages earned, which includes all the calculations related to the Dearness Allowance, Overtime, the net amount that needs to be paid, etc.

All of this information is recorded in a pre-defined wages register format.

Here's what is in store for you in this article regarding the wages register format:

Understanding Contract Labour

Before we deep dive into the wages register format, you need to understand the meaning of a contract laborer.

A person engaged for a certain length of time under terms in which they work on a piece-rate or time-rate basis and is paid on a time-rate basis, subject to deductions from earnings for lapses, breakage, damage, and waste, is referred to as a contract laborer.

However, this does not include any person hired for seasonal or incidental labor. The employer directly engages such a person and supervises and controls them. When someone is hired as contract labor, it is compulsory to fill out the central register wages form XVII and maintain the wages register format.

Contract labor was a form of labor that was highly unorganized in India. The Contract Labor Act came into existence in 1970 to bring about some alignment in the space. Contract laborers were highly exploited, and the Act was introduced as a solution to this problem.

The Act stated that it would be unlawful if an employee engages in contract labor for an employer for more than a year. At present, the Act controls contract labor and every other aspect involved with it.

The Central Register Wages Form XVII

In practice, the working conditions under which contract labor is hired, such as terms and conditions of employment, leave, wages, and so on, are no different from those applicable to regular workers. Regular workers are, in fact, often worse off than contract workers regarding wages, job security, and social security benefits, such as provident fund benefits.

The Contract Labor (Regulation & Abolition) Act, 1970 covers Form XVIII of the Register of Wages. It includes information about the contractor, the establishment, and the employer. Wages are paid on a weekly and fortnightly basis to the workforce. All of the details of these wages are included in the wages register format.

All of the fields on the muster roll show whether or not the employee has met the requirements of their job and the type of attendance that is expected and deemed necessary for the payment of wages. The wages register format consists of different particulars, and all of these must be duly filled by the contractor.

Some of these details include:

- Name and address of the contractor

- Name and address of establishment in/under which contract is carried on

- Nature and location of work

- Name and address of principal employer

- Wage period monthly

The information that should be covered regarding the people who work under the contractor as contract labor is as follows:

- Name of the worker

- The serial number designated to a particular worker

- The designation of the worker or the kind of work carried on by the worker

- Number of days the worker works

- Units of work done

- Piece-rate of wages

These fields have to be duly filled so that the wages due towards the worker's payment are calculated accurately.

For the calculation of the wages, a wage register format is maintained that covers the following particulars:

- The basic wage that needs to be paid

- Dearness allowance

- Overtime that needs to be paid to the worker

- Other cash payments that might be due – The nature of the payments have to be disclosed in the form

- Gross total

- Any deductions applicable and the nature of the deduction

- Net amount to be paid

- The thumb impression or the signature of the worker who receives the payment

- Signature of the representative from the contractor's side

All information is duly filled in the wage register format, and the Government has mandated filling out this form.

How Can Deskera Assist You?

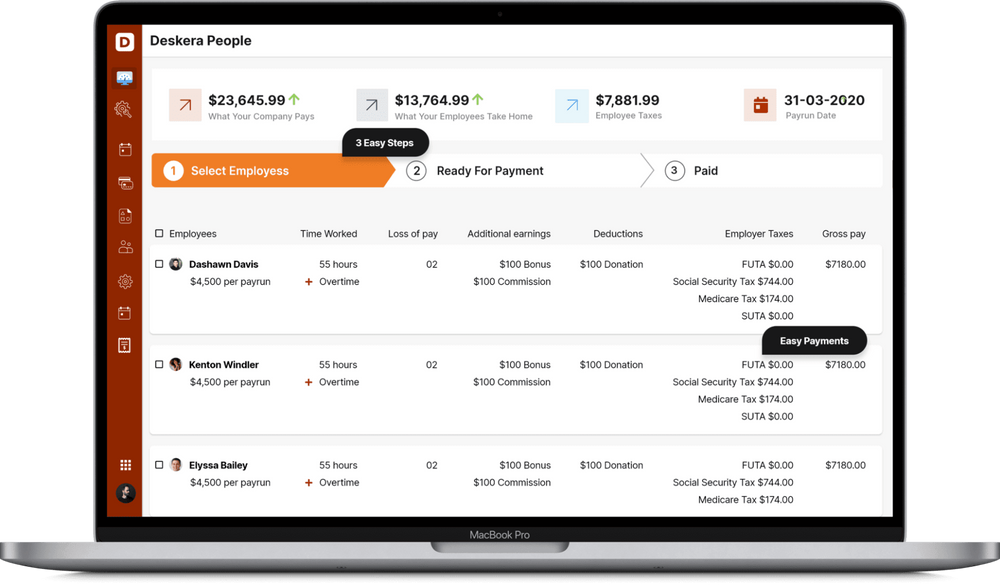

Employees plan vacations around holidays; this may also include taking some extra leaves, so managing their payrolls can be a lot of work. Imagine software that could do that for you. Yes, Deskera can help you with that. Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more. Simplify payroll management and generate payslips in minutes for your employees.

Wrapping up

Contract labor has its own set of complications, but the Government is trying to bring on some system in how contract labor is handled. The Central Register Wages Form XVII is an attempt to bring some consistency and system in the way wages are paid, and contract labor is carried out.

Key Takeaways

- Contract labor is quite unorganized in India, and to bring some system into place, the Contract Labor Act came into existence

- The Central Register Wages Form XVII comes under its purview of it. It is important for all contractors and employers who hire contractual workers to maintain a wage register format and duly fill it.

- Some of the details that need to be filled in the form are:

- Name and address of the contractor

- Name and address of business where the contract is performed/under which contract is performed

- Nature and location of work

- Name and address of major employer

- All the information related to the workers and the wages earned by the workers need to be recorded in the wage register format

Related Articles