Have you ever wondered how businesses predict how much revenue they will generate months—or even years—into the future? The answer lies in revenue projections. These projections help organizations estimate future income based on data, trends, and informed assumptions, enabling leaders to plan with greater confidence rather than relying on guesswork.

Revenue projections are more than just financial numbers on a spreadsheet. They serve as a strategic compass, guiding decisions around budgeting, hiring, pricing, and expansion. When calculated correctly, revenue projections help businesses anticipate cash flow needs, prepare for market fluctuations, and align short-term actions with long-term goals and know exactly how much you can spend on essential expenses like professional indemnity cover and still make a profit.

However, calculating revenue projections is not a one-size-fits-all exercise. It requires a clear understanding of historical performance, revenue drivers, market conditions, and realistic growth assumptions. Without a structured approach, projections can quickly become overly optimistic or disconnected from business realities—leading to missed targets and poor decision-making.

This is where technology plays a critical role. Deskera ERP helps businesses simplify revenue projections by centralizing financial, sales, and operational data in one platform. With real-time reporting, automated financial insights, and accurate data visibility, Deskera enables finance teams to build reliable revenue projections and continuously refine them as business conditions evolve.

What Are Revenue Projections?

Revenue projections are estimates of how much money a business expects to generate over a specific period—such as monthly, quarterly, or annually. At a basic level, they answer a critical question: How much revenue is the company likely to earn in the future? For example, a business may create a revenue projection to estimate next month’s income by analyzing recent sales, expenses, and customer demand patterns.

At their core, revenue projections are built using a combination of historical sales data, market trends, industry conditions, and internal insights from sales and leadership teams. They are widely used for budgeting and forecasting purposes, helping businesses set financial targets, plan expenses, and align operational strategies with expected income. For sales-driven organizations, revenue projections often focus specifically on projected sales revenue from products or services.

Revenue projections also play a vital role in long-term business planning. By assessing current performance alongside potential growth opportunities, they provide clarity on future income streams and help form the foundation for budgets and investment decisions. Accurate projections enable businesses to allocate resources efficiently, determine when to hire additional staff, invest in new technology, or expand into new markets.

To remain effective, revenue projections must account for external changes such as evolving customer preferences, economic conditions, and competitive pressures. Since markets are constantly shifting, businesses should review and update their revenue projections regularly to reflect new data and emerging risks. While the terms revenue projection and revenue forecast are often used interchangeably, projections are generally more aspirational and goal-oriented, whereas forecasts tend to be more conservative and data-driven—focused on what is realistically achievable.

Why Revenue Projections Matter for Business Success

Accurate revenue projections are not merely financial estimates—they are a cornerstone of effective business management. When revenue expectations are well-defined and data-driven, organizations can plan confidently, allocate resources wisely, and pursue growth with clarity. Conversely, inaccurate or overly optimistic projections can trigger budget overruns, cash flow constraints, and strategic missteps that affect the entire organization.

Strategic Planning and Decision-Making

Revenue projections guide high-impact decisions such as hiring, capital investments, product launches, and market expansion. Reliable projections allow leadership teams to evaluate growth opportunities realistically and choose strategies that align with expected revenue outcomes, reducing uncertainty and risk.

Smarter Budgeting and Resource Allocation

Well-structured revenue projections help businesses set realistic sales targets and allocate budgets effectively across departments. By understanding expected income, organizations can prioritize spending, control costs, and ensure that resources are directed toward initiatives with the highest return.

Improved Cash Flow Management

Revenue projections provide visibility into future cash inflows, enabling businesses to plan for operational expenses, debt obligations, and working capital needs. This proactive approach helps prevent liquidity shortfalls and ensures financial stability during both growth phases and market downturns.

Performance Tracking and Accountability

Comparing actual revenue against projected figures allows businesses to measure performance objectively. This ongoing evaluation helps identify gaps early, refine sales strategies, and make timely adjustments to stay aligned with business goals.

Stronger Investor Confidence and Funding Readiness

Investors and lenders rely heavily on revenue projections to assess a company’s growth potential and financial health. Clear, credible projections signal disciplined planning and increase confidence in the business’s ability to deliver sustainable returns.

Business Valuation and Long-Term Growth

Revenue projections offer insight into future earning potential, which directly influences business valuation. Accurate projections support long-term planning, strengthen stakeholder trust, and position the company for scalable and sustainable growth.

For sales leaders and executives alike, missed or inaccurate revenue projections can erode internal trust, stall growth initiatives, and damage investor relationships. Consistent, realistic forecasting ensures alignment across teams and supports informed decision-making at every level of the organization.

Key Components Required to Calculate Revenue Projections

Accurate revenue projections depend on more than intuition or high-level assumptions. They require a structured evaluation of internal data, external influences, and clearly defined business drivers. By focusing on the right components, businesses can create projections that are realistic, defensible, and aligned with strategic goals.

Historical Revenue Data

Past sales performance provides a critical baseline for projecting future revenue. Analyzing historical trends helps identify growth patterns, seasonality, and recurring revenue cycles that can inform more reliable estimates.

Sales Pipeline and Conversion Rates

A clear view of the sales pipeline—including lead volume, deal size, and conversion rates—helps estimate how much potential revenue is likely to close within a given period. This is especially important for sales-driven and B2B organizations.

Pricing Strategy and Product Mix

Revenue projections should reflect current pricing models, discounts, and the mix of products or services offered. Changes in pricing or shifts toward higher- or lower-margin offerings can significantly impact projected revenue.

Market Trends and External Factors

Industry conditions, economic indicators, customer demand, and competitive dynamics all influence revenue potential. Factoring in these external variables ensures projections remain realistic and responsive to market changes.

Key Assumptions and Growth Drivers

Every revenue projection is built on assumptions—such as expected growth rates, customer acquisition, or expansion plans. Clearly documenting these assumptions improves transparency and makes it easier to adjust projections as conditions evolve.

Timeframe and Projection Period

Defining whether projections are monthly, quarterly, or annual is essential for accuracy. Short-term projections tend to be more precise, while long-term projections require broader assumptions and scenario planning.

By combining these components into a structured framework, businesses can move beyond guesswork and build revenue projections that support confident planning, informed decision-making, and sustainable growth.

Common Methods to Calculate Revenue Projections

Choosing the right method to calculate revenue projections is essential for building forecasts that support sound business decisions. A data-driven approach reduces uncertainty and helps organizations avoid assumptions that can derail growth plans. While no single method fits every business, the following are some of the most widely used and effective revenue projection models.

Historical Forecasting Method

This method is based on the assumption that past performance is a strong indicator of future results. Businesses analyze historical revenue data and apply an expected growth rate to project future revenue. While this approach is straightforward and useful for stable markets, its accuracy may decline during periods of rapid change, economic shifts, or major business transformations.

Sales Cycle Length Forecasting

Sales cycle forecasting focuses on how long it typically takes to convert a lead into a paying customer. By understanding the average sales cycle duration and deal values, businesses can estimate when revenue is likely to be realized. This method is particularly effective for B2B companies and organizations with well-defined sales processes.

Test Market Analysis

Test market analysis is commonly used by startups or businesses launching new products or services. Instead of committing to a full-scale launch, companies introduce the offering to a smaller segment of the market and measure performance. The insights gained help estimate broader revenue potential while minimizing financial risk.

Multivariable Analysis

This advanced method incorporates multiple internal and external variables to generate more nuanced revenue projections. Factors such as marketing spend, seasonality, economic conditions, inflation, interest rates, and supply-and-demand dynamics are analyzed together. While more complex, multivariable analysis often delivers higher accuracy when supported by robust data and analytics tools.

Each of these methods relies heavily on the quality and availability of data. By selecting the most appropriate approach—or combining multiple methods—businesses can improve projection accuracy and make more informed, growth-oriented decisions.

Step-by-Step Guide: How to Calculate Revenue Projections

Calculating revenue projections requires a structured, data-backed approach that balances historical performance with forward-looking assumptions. While the exact process may vary by business model, following a clear set of steps helps ensure your projections are realistic, actionable, and aligned with strategic goals.

Step 1: Define the Projection Period and Revenue Streams

Start by determining the timeframe for your projection—monthly, quarterly, or annually. Next, clearly identify all revenue streams, such as product sales, services, subscriptions, or recurring contracts. Defining scope upfront ensures consistency and accuracy throughout the calculation process.

Step 2: Analyze Historical Sales Data

Review past sales data across multiple periods to establish a baseline. Look for trends, growth rates, seasonality, and fluctuations in demand. Historical performance often provides the most reliable foundation for estimating future revenue, especially in stable markets.

Step 3: Estimate Future Sales Volume

Estimate how much you expect to sell during the projection period. This requires an understanding of your market, customer demand, sales capacity, and expected growth. For example, if you sold 60,000 units last year and anticipate 25% growth, your projected sales volume would be 75,000 units.

Step 4: Calculate Projected Income

Once sales volume is estimated, calculate projected income by multiplying expected sales by the price of each product or service:

Projected Income = Estimated Sales × Price per Unit

This step translates sales assumptions into revenue figures and forms the basis of your overall projection.

Step 5: Estimate Projected Expenses

Next, calculate all costs associated with generating that income. This includes production or service delivery costs, employee salaries, marketing expenses, rent, utilities, technology, and other operational overheads. Add these together to arrive at total projected expenses.

Step 6: Apply the Revenue Projection Formula

With projected income and expenses in hand, calculate projected revenue using the standard formula:

Projected Revenue = Projected Income – Projected Expenses

This figure represents the revenue your business expects to retain after covering costs and is critical for profitability analysis and planning.

Step 7: Factor in Key Drivers and External Influences

Adjust your projections based on anticipated changes such as new marketing campaigns, product launches, pricing adjustments, customer churn, or market conditions. For subscription-based businesses, consider metrics like Monthly Recurring Revenue (MRR), customer acquisition, and churn rates for greater accuracy.

Step 8: Build, Review, and Refine the Forecast

Use spreadsheets or financial tools to model different scenarios—optimistic, pessimistic, and most likely. Revenue projections are not static; regularly compare them against actual performance and refine assumptions as new data becomes available.

By following this step-by-step approach, businesses can move beyond rough estimates and develop revenue projections that support informed decision-making, effective budgeting, and long-term financial stability.

Common Mistakes to Avoid When Calculating Revenue Projections

Even with the right data and tools, revenue projections can fall short if key pitfalls are overlooked. Avoiding these common mistakes helps ensure your projections remain realistic, credible, and useful for decision-making.

Relying on Overly Optimistic Assumptions

One of the most frequent errors is assuming aggressive growth without sufficient evidence. Overestimating sales growth, customer acquisition, or market demand can lead to inflated projections that are difficult to achieve and may result in poor strategic decisions.

Ignoring Historical Data and Trends

Failing to analyze past performance removes a critical reference point. Historical sales data often reveal seasonality, recurring patterns, and realistic growth rates that should inform future projections.

Overlooking Expenses and Cost Increases

Many projections focus heavily on revenue while underestimating costs. Ignoring rising operational expenses, inflation, or scaling costs can distort projected revenue and create unrealistic profitability expectations.

Not Accounting for Market Volatility

Market conditions, economic shifts, and competitive pressures can significantly impact revenue. Projections that ignore external risks or assume stable conditions may quickly become outdated.

Using Incomplete or Poor-Quality Data

Revenue projections are only as reliable as the data behind them. Inaccurate, outdated, or fragmented data can undermine forecast accuracy and reduce confidence in financial planning.

Failing to Update Projections Regularly

Revenue projections should evolve with the business. Treating them as one-time exercises rather than living documents can lead to misalignment between actual performance and strategic plans.

Confusing Revenue Projections with Revenue Forecasts

While often used interchangeably, projections are typically more aspirational, whereas forecasts are more conservative and data-driven. Blurring this distinction can create unrealistic expectations among stakeholders.

By avoiding these common mistakes, businesses can build revenue projections that are grounded in reality, adaptable to change, and better suited to support long-term growth and financial stability.

Metrics Used to Calculate Revenue Projections

Accurate revenue projections rely on tracking the right metrics and understanding how both internal performance and external market forces influence future income.

While historical sales data provides a baseline, forward-looking metrics help businesses assess revenue stability, growth potential, and customer behavior. Below are the key metrics commonly used to calculate and refine revenue projections, along with their formulas wherever applicable.

Monthly Recurring Revenue (MRR)

Monthly Recurring Revenue (MRR) represents the predictable revenue a business generates each month from subscription-based customers. It is a foundational metric for SaaS and subscription businesses, offering visibility into stable, recurring income.

Formula: MRR = Number of Active Customers × Average Revenue Per User (ARPU)

Tracking MRR trends over time helps businesses forecast future revenue, evaluate pricing changes, and plan for scalable growth.

Average Revenue Per User (ARPU)

Average Revenue Per User (ARPU) measures the average revenue generated per customer during a specific period. It helps estimate future revenue based on customer acquisition and spending behavior.

Formula: ARPU = Total Revenue ÷ Total Number of Customers

Changes in ARPU often reflect the impact of upselling, cross-selling, or pricing strategy adjustments.

Revenue Churn Rate

Revenue churn measures the percentage of revenue lost from existing customers over a given period. It is critical for understanding revenue stability and predicting future income erosion.

Formula: Revenue Churn Rate = (Revenue Lost During Period ÷ Total Revenue at Start of Period) × 100

A high churn rate can significantly reduce projected revenue, even when new customer acquisition is strong.

Net Dollar Retention (NDR)

Net Dollar Retention (NDR) shows how much revenue is retained from existing customers after accounting for expansions, upgrades, downgrades, and churn. It provides insight into the long-term value of the customer base.

Formula: NDR = ((Starting Revenue + Expansion Revenue − Churned Revenue) ÷ Starting Revenue) × 100

An NDR above 100% indicates that revenue growth from existing customers exceeds losses.

Sales Growth Rate

Sales growth rate measures how revenue changes over time and helps apply realistic growth assumptions in revenue projections.

Formula: Sales Growth Rate = ((Current Period Revenue − Previous Period Revenue) ÷ Previous Period Revenue) × 100

This metric is especially useful when using historical trend-based forecasting methods.

Customer Churn Rate

Customer churn rate measures the percentage of customers who stop doing business with a company during a specific period. It directly impacts projected revenue and customer lifetime value.

Formula: Customer Churn Rate = (Customers Lost During Period ÷ Customers at Start of Period) × 100

Lower churn rates generally lead to more stable and predictable revenue projections.

Market and Demand Adjustment Factors

While not expressed through a single formula, market demand indicators—such as industry growth rates, competitive intensity, and customer behavior trends—are often applied as adjustment factors to revenue projections. These inputs help refine assumptions and ensure projections reflect real-world conditions.

By combining these metrics and formulas with qualitative insights and regularly updating assumptions, businesses can build revenue projections that are accurate, transparent, and aligned with strategic goals.

Best Practices for Creating Accurate Revenue Projections

Creating accurate revenue projections goes beyond choosing a forecasting model—it requires discipline, collaboration, and continuous refinement. By following proven best practices, businesses can improve forecast reliability, reduce uncertainty, and make more confident strategic decisions.

Establish a Consistent Forecasting Cadence

Set a regular schedule for creating and updating revenue projections, whether weekly, monthly, or quarterly. A consistent cadence enables better trend analysis, improves comparability over time, and embeds forecasting into routine business operations rather than treating it as a one-off task.

Combine Multiple Forecasting Methods

Relying on a single forecasting approach can create blind spots. Combining methods—such as top-down forecasting (starting with market size) and bottom-up forecasting (building from individual sales, products, or customers)—provides a more balanced and realistic view of future revenue.

Involve Cross-Functional Teams

Revenue projections should not be owned by finance alone. Involving sales, marketing, product, customer success, and operations teams brings diverse insights into customer behavior, pipeline health, campaign performance, and delivery capacity. This collaboration improves accuracy and strengthens accountability across the organization.

Document Assumptions and Rationale

Clearly document all assumptions used in revenue projections, including growth rates, pricing changes, conversion rates, churn expectations, and market conditions. Transparent documentation makes it easier to validate projections, explain variances, and adjust forecasts as conditions evolve.

Create Multiple Forecast Scenarios

Develop best-case, worst-case, and most-likely scenarios to account for uncertainty. Scenario planning helps businesses prepare for different outcomes, assess risk exposure, and make informed decisions even when market conditions change unexpectedly.

Regularly Review and Refine Projections

Compare actual results against projected figures on a regular basis. Analyzing variances helps identify gaps in assumptions, uncover emerging trends, and improve the accuracy of future projections through continuous learning.

Invest in High-Quality Data

Revenue projections are only as accurate as the data behind them. Invest in reliable data collection systems, ensure data consistency across teams, and focus on metrics that directly impact revenue performance. Regular data audits can further enhance forecast credibility.

Leverage Technology and Automation

Modern forecasting tools and ERP systems can automate data aggregation, apply advanced analytics, and generate real-time insights. Leveraging technology reduces manual errors, saves time, and enables faster, more accurate revenue projections.

Account for Seasonality and Business Cycles

Identify seasonal patterns and cyclical trends in historical revenue data and incorporate them into projections. Accounting for predictable fluctuations prevents overreaction to short-term changes and supports more stable planning.

Monitor Leading Indicators

Track leading indicators—such as sales pipeline activity, website traffic, customer inquiries, and market signals—that often signal future revenue changes. Monitoring these early indicators allows businesses to adjust projections proactively rather than reacting after performance shifts occur.

By applying these best practices consistently, organizations can transform revenue projections into a powerful tool for strategic planning, financial stability, and sustainable growth.

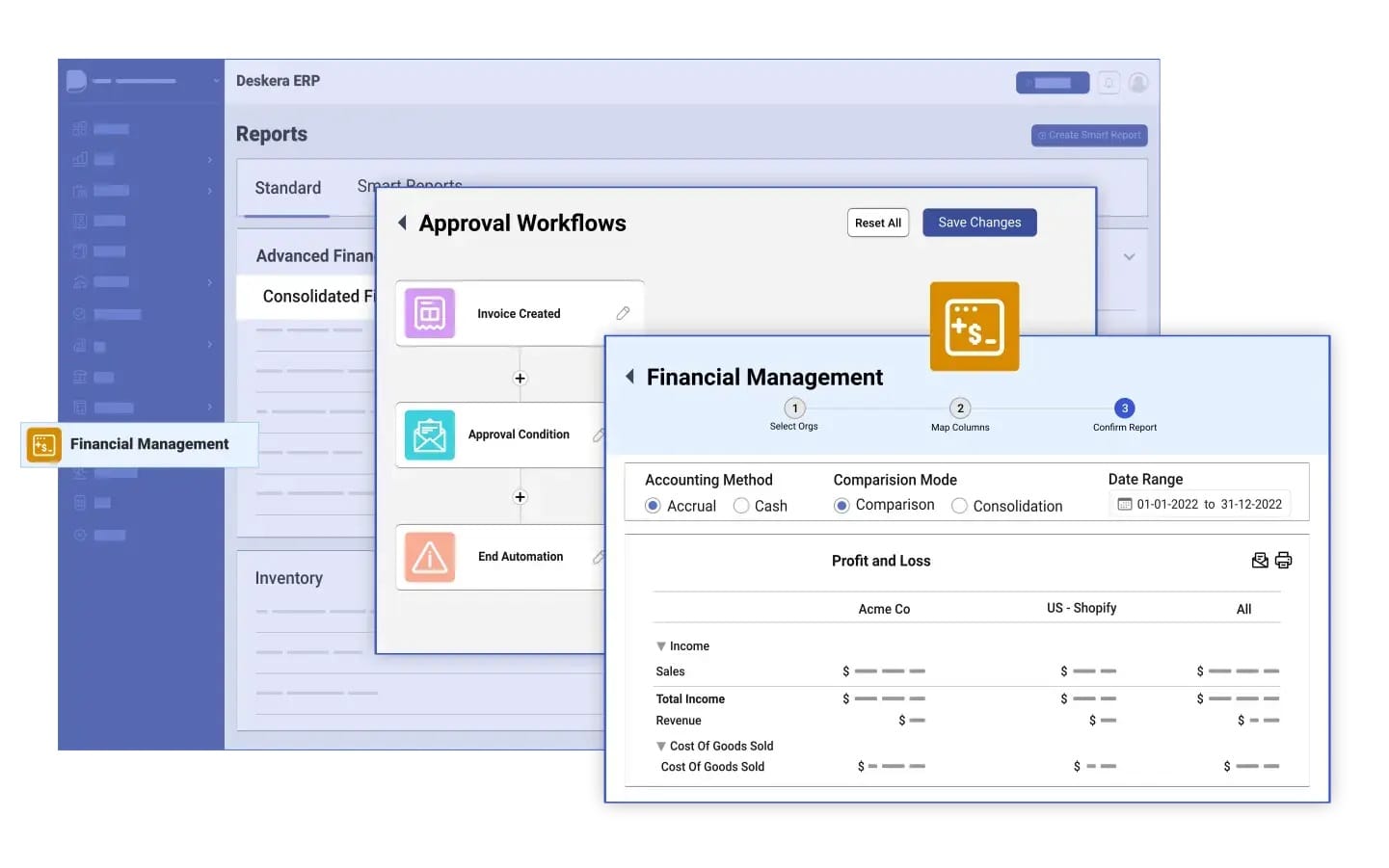

How Deskera ERP Simplifies Revenue Projections

Accurate revenue projections depend on timely data, clear visibility, and consistent assumptions—areas where manual spreadsheets often fall short. Deskera ERP simplifies the revenue projection process by centralizing financial, sales, and operational data into a single platform, enabling businesses to build reliable, data-driven projections with less effort and greater confidence.

Centralized Financial and Sales Data

Deskera ERP brings together accounting, sales, invoicing, and customer data in one unified system. This centralized view eliminates data silos, ensures consistency across departments, and provides a single source of truth for calculating revenue projections.

Real-Time Revenue Visibility

With real-time dashboards and financial reports, Deskera ERP allows businesses to monitor revenue performance as it happens. Up-to-date insights help finance teams adjust projections quickly in response to changes in sales activity, customer demand, or market conditions.

Automated Invoicing and Revenue Tracking

Deskera automates invoicing and revenue recognition, reducing manual errors and ensuring accurate tracking of income. This automation makes it easier to calculate projected income based on actual billing data and recurring revenue patterns.

Support for Recurring and Subscription Revenue

For businesses with recurring revenue models, Deskera ERP helps track recurring invoices, customer payments, and renewal cycles. This visibility supports more accurate forecasting of Monthly Recurring Revenue (MRR) and long-term revenue stability.

Integrated Expense and Cost Tracking

Revenue projections are only meaningful when expenses are accounted for. Deskera ERP tracks operational costs, payroll, and overheads alongside revenue, enabling businesses to calculate projected revenue more accurately using income and expense data.

Customizable Financial Reports and Forecasting Insights

Deskera ERP offers customizable financial reports that help businesses analyze historical trends, growth rates, and performance metrics. These insights support informed assumptions and improve the accuracy of future revenue projections.

By automating data collection and providing real-time financial visibility, Deskera ERP enables businesses to move beyond static spreadsheets and build revenue projections that are accurate, adaptable, and aligned with strategic goals.

Key Takeaways

- Revenue projections estimate a company’s future income over a defined period, serving as a foundation for budgeting, goal-setting, and long-term financial planning.

- Accurate revenue projections enable smarter strategic decisions, improve cash flow management, strengthen investor confidence, and support sustainable business growth.

- Reliable projections depend on historical data, sales pipeline insights, pricing strategy, market conditions, and clearly defined assumptions.

- Using data-driven methods—such as historical forecasting, sales cycle analysis, test market analysis, and multivariable models—helps businesses choose the most suitable approach for their context.

- A structured process that includes estimating sales, calculating projected income and expenses, and refining assumptions ensures projections are realistic and actionable.

- Avoiding overly optimistic assumptions, ignoring costs or market volatility, and failing to update projections regularly is critical to maintaining forecast accuracy.

- Key metrics such as MRR, ARPU, revenue churn, net dollar retention, and sales growth rate provide quantitative insights that strengthen projection reliability.

- Consistent forecasting, cross-functional collaboration, scenario planning, quality data, and regular performance reviews significantly improve projection accuracy.

- Deskera ERP streamlines revenue projections by centralizing data, automating revenue and expense tracking, and providing real-time financial visibility for better forecasting decisions.

Related Articles