Employment for accountants, auditors, and CPAs, is expected to grow six percent by 2028, which is about the same rate for all occupations. The growth of these careers is largely attributed to economic growth. But do you know why you need an accountant for your business? Here is why.

Accounting plays a vital role in running a business because it helps you track income and expenditures, ensure statutory compliance, and provide investors, management, and government with quantitative financial information to make business decisions. And an accountant or a CPA helps you do that. However, there is a confusion between the two. To clear this confusion we have this article ready for you. So, let's get started!

In this article, we will explore the following:

- Who is a CPA?

- Who is an accountant?

- What is the difference between an accountant and a CPA?

- How can Deskera assist you?

Who is a CPA?

A certified public accountant (CPA) is a designation provided to licensed accounting professionals. The Board of Accountancy provides the CPA license for each state. The American Institute of Certified Public Accountants (AICPA) provides resources on obtaining the permit. The CPA designation helps enforce professional standards in the accounting industry. Other countries have certifications equivalent to the CPA designation, notably, the chartered accountant (CA) designation.

Who is an Accountant?

The term accountant refers to a professional who performs accounting functions such as account analysis, auditing, or financial statement analysis. Accountants work with accounting firms or internal account departments with large companies. They may also set up their individual practices. After meeting state-specific educational and testing requirements, national professional associations certify these professionals.

Accountants Vs. CPAs

- A certified public accountant (CPA) is a professional accountant who has met state qualifications and has acquired an additional level of credibility and expertise. A US CPA is equivalent to an Indian CA.

- To be licensed as a CPA, an accountant must pass the Uniform Certified Public Accountant Examination and meet other educational and work criteria necessary to become a CPA. As opposed to accountants, only CPAs can perform mandatory audits for publicly traded U.S. companies.

- CPAs are responsible for the preparation of tax returns for businesses and individuals, signing tax returns, and representing taxpayers before the IRS for audits and other matters, in addition to preparing and reviewing financial statements. The American Institute of Certified Public Accountants (AICPA) is the national professional association for CPAs.

- The significant difference between a regular accountant and a CPA is that only CPAs can write audited financial statements, such as a balance sheet or an income statement. The one thing a CPA can do is issue an opinion on audited, reviewed, or compiled financial statements.

- A CPA license is required to provide attest services. Accountants do the routine work, and they can complete tax returns, while CPAs are responsible for analyzing the work, representing you at a tax audit, and help you make more high-level business and tax decisions.

- Companies that sell their shares on the stock market have to provide audited statements so investors can judge the worth of the stock. Smaller companies that don't sell shares may get along fine with an accountant who is not a CPA.

- CPAs have to pass rigorous testing and strict requirements for licensing in the state in which they intend to practice. CPA candidates must complete required hours of institute coursework, including specific hours in accounting, auditing, taxation, and business core classes.

- CPAs are considered some of the business world’s most trusted advisers, according to a survey conducted by the AICPA.

- Many businesses that are required to have a financial statement audit will find that only a CPA can perform these services and issue the necessary reports.

- In addition, CPAs are considered the ones with a legal duty and power to act on behalf of and in the best interest of their clients. Non-CPA accountants are not considered to be fiduciaries to their clients.

- Accountants without a CPA certification may prepare a proper tax return, but a CPA provides distinct advantages to clients that non-CPAs cannot offer.

- Many CPAs are more knowledgeable in tax codes because of the rigorous CPA licensing examination and continuing education requirements. Another critical factor is that CPAs are eligible to represent clients before the IRS, while a non-CPA accountant is not.

- CPAs are also expected to follow a strict code of ethics and meet the high standards of the profession, as having the license is not the only requirement to be a CPA.

- The cost and expenses in pursuing CPA are higher when compared to pursuing accountancy courses/certifications.

- Accounting is a processor work of keeping financial accounts. An accountant is a person whose job is to keep financial accounts.

- A Certified Public Accountant (CPA) is an accountant who has met state licensing requirements.

- The accountant cannot provide attestation services.

- You are required to have a CPA license to provide attestation services.

- No License is required to be an accountant.

- The license is required to be a CPA.

- The accountant has no standing with the IRS (Internal Revenue Services)

- CPAs can represent a taxpayer before the IRS (Internal Revenue Services)

- Accountants cannot sign tax returns or represent clients during tax Audits before IRS.

- CPAs can sign tax returns and also represent clients during tax audits before the IRS.

- The governing body for CPAs is the American institute of certified public accountants.

- Accountants have low costs compared to CPAs.

- The CPAs have a comparatively higher cost.

- The salary of an accountant is comparatively lower than CPAs.

- The salary of CPAs is higher when compared to an accountant.

- All accountants are not CPAs.

- All CPAs are accountants.

- The opinion of a CPA is final and holds more weight than that of an accountant.

- CPA is certified to carry out audits, whereas an accountant cannot.

- CPA represents a business while dealing with IRS, whereas an accountant is called up only when he has prepared an individual’s tax returns.

- CPAs are accountants of the highest degree who not just prepare tax returns of individuals but also act as financial strategists and manage the finances of individuals and businesses. They also help diversify businesses while performing the basic duty of preparing financial statements and auditing companies. CPAs can analyze information to help businesses make the right financial decision. This means they can help a business increase its profitability.

- CPAs are accountants of the highest degree who not just prepare tax returns of individuals but also act as financial strategists and manage the finances of individuals and businesses. They also help in diversifying businesses while performing the basic duty of preparing financial statements and auditing companies. CPAs have the expertise to analyze information to help businesses make the right financial decisions. This means they can help a business increase its profitability.

- Regular accounts typically work in an office environment full-time and may need to work weekends and nights. CPAs work in an office too, but may also work from home and might travel if they need to perform a business audit or testify as an expert witness for a client in court.

- CPAs hold significant responsibility to provide exceptional professional services.

- Every action a CPA takes should serve the public interest.

- CPAs must live by the ethical standard and only do what is right by the standard.

- CPAs must remain objective and uninvolved with conflicts of interest.

- CPAs must perform their abilities to the best of their ability and seek continuing education, guidance, and evaluations to do so.

To conclude, A CPA is better qualified than an accountant to perform accounting duties and is recognized by the government as someone who is credible and an expert in the field. Individuals who have received a CPA designation are trained in generally accepted accounting principles and best practices (including online tools). Typically, they are also much better paid.

A Certified Public Accountant is allowed to perform certain duties that regular accountants are not permitted to do, such as preparing an audited financial statement or acting as a taxpayer or company representative in discussion with IRS Revenue Officers or Counsel. An accountant without the CPA designation cannot do any of these things.

The length of time it takes to become a CPA will depend on the personal situation of the candidate, their level of education, the state they live in, and the state’s qualifications. The difference between state requirements for obtaining the CPA designation can be considerable; for instance, some states only require one year of work experience while others require two.

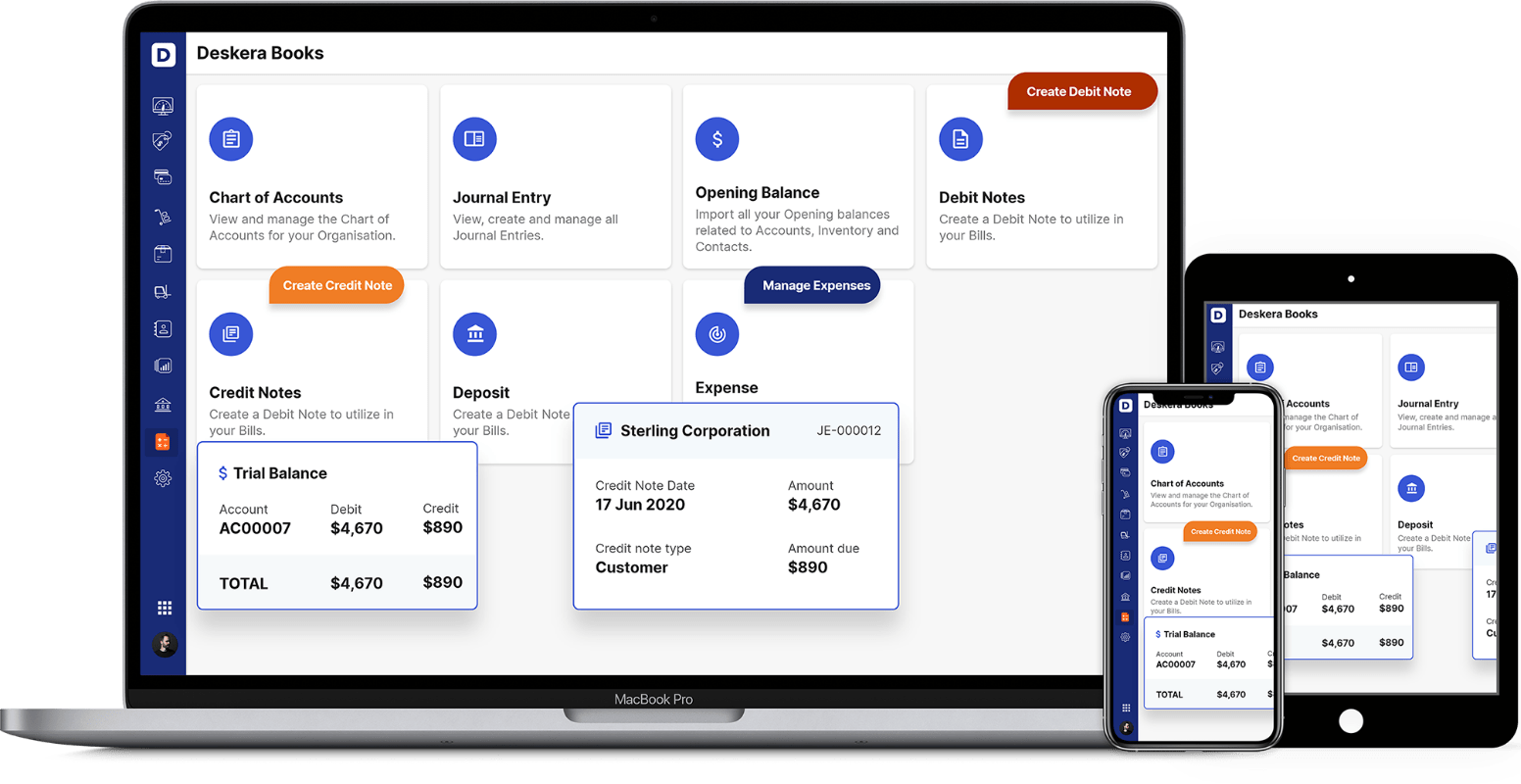

How Can Deskera Assist You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Through Deskera Books, your accounting would be handled by it, with all that you would need to do is update your invoices, your account receivables and accounts payable, and the operating expenses incurred as well as operating income earned on the software. In fact, you can even delete or edit the existing debit notes and credit notes, as is applicable.

The platform works exceptionally well for small businesses that need to figure out a lot of things when they are setting out. This delightful software allows them to keep up with the client’s expectations by assisting them in overseeing a timely delivery.

With the well-thought and well-designed templates, you can now anticipate your work to become simpler. These templates can be used for transactions like invoices, quotations, orders, bills, and payment receipts.

If yours is a drop shipping business, you can easily track your orders and create new dropship orders for your suppliers based on the customer orders.

Watch this video for a quick Deskera demo:

Deskera People is another platform that enables you to expedite and simplify the processes. Through automated processes like hiring, payroll, leave, attendance, expenses, and more, you can now unburden yourself and focus on the major business activities. It also assists with driving growth for your business by integrated Accounting, CRM & HR Software.

Related Articles: