Any business's cornerstone is its workforce. Every company has a duty to protect its employees, especially when they become ill or hurt while carrying out their tasks.

The Workmen Compensation Act of 1923 was created to offer compensation to workers who perished or were wounded accidentally while at work.

The Workmen's Compensation Act of 1923 mandates that businesses pay benefits to employees who sustain accidents on the job that leave them disabled or dead.

On July 1st, 1924, the Workman's Compensation Act, which is applicable throughout India, came into force. Employees who are protected by the Employees State Insurance Act of 1948, however, are not subject to the Workmen's Compensation Act of 1923.

Let's take a look at the table of content that we'll covered in this comprehensive guide:

- Workmen’s Compensation Act 1923: Definition

- Understanding Workmen’s Compensation Act, 1923 in Detail

- Workmen’s Compensation Policy Scope

- Workmen's Compensation Act, 1923 Objective

- Features of Workmen's Compensation Act 1923

- What is the Need of Workmen’s Compensation Act, 1923?

- Significance of Workmen’s Compensation Act, 1923

- The Workmen's Compensation Policy's Extent of Coverage

- Conditions Under Which the Employer is not Required to Provide Compensation

- What Does a Workmen's Compensation Policy Not Cover?

- Amount Payable Under the Workmen’s Compensation Act

- When Do Employers Release Compensation?

- Workmen’s Compensation Calculation

- A Guide for Employers on How to Find the Best Workmen's Compensation Policy Online

- Procedures for Filing Claims Under Insurance Coverage for Workers' Compensation

- Documentation for Workmen's Compensation Policy

- Application of the Workmen's Compensation Act of 1923

- Workmen’s Compensation Rules Have Changed in 2020

- Conclusion

- Frequently Asked Questions (FAQs) Associated with Workmen’s Compensation Act, 1923

- How Deskera Can Assist You?

Let's get started!

Workmen’s Compensation Act 1923: Definition

The Workmen's Compensation Act of 1923 is an Indian law that offers benefits to employees in the event that they sustain physical harm or pass away while performing their job-related duties.

It also applies to specific hazardous jobs and all factories and establishments with ten or more employees. All employees, including those who work part-time, temporarily, or casually, are subject to it.

The Act mandates the payment of compensation in cases of harm, incapacity, or death brought on by an accident or work-related illness.

In case of death, the Act provides for the payment of a lump sum as well as a monthly pension to the survivors. The type of disease or injury, the degree of disability or demise, and the worker's earnings all affect how much compensation is awarded.

The Act also provides for medical and other benefits such as the reimbursement of medical expenses, the provision of artificial limbs, and the payment of a gratuity. It also provides for the establishment of a fund to provide insurance benefits for disabled workers.

The Act also provides for the formation of tribunals to adjudicate disputes between employers and employees. The tribunals are empowered to make awards for compensation in case of injury, disability, or death.

Furthermore, the Act is administered by the Ministry of Labour and Employment. It is enforced by the Central and State Labour Commissioners.

Understanding Workmen’s Compensation Act, 1923 in Detail

The Workmen's Compensation Act, 1923 was passed to offer benefits to employees or their dependents in the event of death, disfigurement, or injury as a result of an accident occurring while they were on the job. This Act applies to all factories, plantations, mines and to any workplace where 10 or more persons are employed.

This act has two main points. In the first place, it paves the way for employees and their dependents to get money from employers in the event that an accident leaves an employee dead or disabled. Second, it mandates that employers pay workers' compensation benefits in the event that an employee acquires a disease or condition that is connected to their line of work.

The Act stipulates that in the event of a worker's death, serious injury, or disabling accident, the company shall give benefits to the employee or his dependents. The compensation is calculated on the basis of the wages earned by the worker in the preceding 12 months, or on the basis of the wages earned by a similar worker in the same establishment, whichever is higher.

- The Act also provides for medical aid to be provided to the injured worker and his dependents, as well as other benefits in case of disablement or death due to an accident.

- The Act also provides for the establishment of a tribunal for the adjudication of claims for compensation and for the determination of disputes between the employer and the worker.

- The Act also lays down certain safety measures that the employer must take to ensure the safety of the workers. These include the provision of adequate lighting, ventilation, protective clothing, etc.

Workers' compensation benefits are available to employees who sustain workplace injuries. The age of the employee, the kind of damage, and average monthly salary or wages are a few elements that affect the amount of compensation.

However, the minimum and maximum payouts are established in cases of demise or permanent handicap. In the event of a tragic working accident, the company must provide compensation for the employee's dependents.

To create and manage worker social security programs, the Ministry of Labour and Employment in India has formed a division known as the Social Security Division. The Workmen's Compensation Act is defended by the division as well. However, commissioners nominated by the several state governments are in charge of monitoring this statute.

Workmen’s Compensation Policy Scope

The scope of workmen’s compensation policy is varied and broad and covers a wide range of benefits for employees who sustain an injury or contract a disease in the course of their employment.

In general, the insurance covers medical costs, lost wages reimbursement, and other benefits. In the event of death, the policy may also provide for a lump sum payment to the deceased’s family.

In addition, the policy may provide for rehabilitation expenses, and certain other miscellaneous benefits such as funeral costs and legal expenses. The scope of the policy depends on the particular employer, state, and type of injury or illness.

The following front-line employees are protected under workers' compensation in India:

- Personnel employed by the establishments listed in Schedule II of the Act, including factories, mines, docks, building sites, and specific businesses.

- Employees who were hired internationally in accordance with Schedule II of the Act.

- It applies to any job involving work linked with vehicles, members of an aircraft crew, captains, helpers, drivers, or mechanics.

- Not employed permanently railroad personnel that work in administrative, district, or subdivisional offices.

Armed services members are not eligible for Workmen's Compensation coverage since they are covered by the Employee State Insurance (ESI) Act.

According to the 2017 amendment to the Act, employers are required to advise employees of their rights to receive compensation. This can be done in a language that the employee can comprehend, on paper, or online.

Workmen's Compensation Act, 1923 Objective

A law passed by the Indian Parliament in 1923 called the Workmen's Compensation Act establishes the provision of compensation to employees for injuries sustained while working. All factories, mines, oil fields, plantations, railroads, retail stores, and other establishments must comply with the Act.

In the event of injury or death brought on by employment, the Act offers some sort of social protection to employees and stipulates quick resolution of disputes.

The main objective of the Workmen's Compensation Act is to provide compensation to employees, or their dependents, in case of injury, illness, or death caused due to employment, and to provide a system of speedy settlement of disputes.

Moreover, the Act ensures the payment of compensation to workers in case of occupational accidents, illness, or death, and helps them to get back to work with minimum disruption.

By encouraging employers to give their employees a secure and safe working environment, the Act also aims to improve workplace occupational safety. Furthermore, it also encourages employers to take care of their employees by providing medical facilities and other benefits.

The Act also seeks to provide a uniform system of compensation across India, by setting up a Central Government and State Government-appointed tribunal to hear claims and disputes. The Act also seeks to ensure that employers take responsibility for the safety.

Features of Workmen's Compensation Act 1923

In accordance with Section 3 of the Employee Compensation Act, if an employee suffers a personal injury as a result of an accident that:

- is brought on by employment (that is, while working), and;

- arises while working, or while on the job, and;

- The victim of the injury either dies or becomes disabled.

If the aforementioned three conditions are satisfied, employers are obligated by the Workmen's Compensation Act of 1923 to pay compensation.

The Workmen's Compensation Act of 1923 mandates that employers provide benefits to workers who become permanently or temporarily disabled due to job accidents.

The worker may have a temporary or permanent disability. A permanent handicap permanently reduces an employee's ability to generate money, unlike a temporary ailment, which merely inhibits their ability to do so while they are disabled. Whether temporarily or permanently injured, a worker is unable to carry out any of the responsibilities he did before the accident.

Under the Employee Compensation Act, benefits are also offered to employees who contract an occupational sickness. An occupational ailment is a condition that only affects a specific type of profession.

The table below, which is organized in columns, lists certain occupational ailments that are covered by the Workmen's Compensation Act of 1923.

The Workmen's Compensation Act of 1923 contains a detailed list of occupational ailments in Schedule 3.

What is the Need of Workmen’s Compensation Act, 1923?

A workmen's insurance coverage has advantages for both employers and employees. Let's look at the three main justifications for any employer buying workers' compensation insurance.

#Reason 1:

The first argument is that any fees or expenses incurred once an employer is covered by such a policy will be paid for by the insurance partner.

#Reason 2:

In the event of a work-related illness, injury, or death, employees or their families may get considerable compensation. The insurance provider that provides workmen's compensation insurance coverage is responsible for this legal obligation for an employer.

#Reason 3:

In accordance with the Workmen's Compensation Act of 1923, legal criteria are governed. It becomes necessary to purchase workmen's compensation insurance in order to comply with the standards and guidelines indicated above and to fulfill legal duties.

Significance of Workmen’s Compensation Act, 1923

Workmen’s compensation insurance is an important type of insurance policy designed to protect employers from the financial liability of workplace injuries and occupational illnesses.

In most jurisdictions, employers are legally required to carry this type of insurance in order to cover the costs of medical treatment, lost wages, and other related expenses that may be incurred by employees due to an injury or illness.

Workers' compensation insurance provides employers with financial protection from the costs of treating and rehabilitating injured workers, as well as covering any legal fees associated with defending against a worker’s compensation claim. It also ensures that the employer’s financial resources are not depleted by the costs associated with a workplace injury or illness.

Workers' compensation insurance is especially important for employers who employ a large number of employees, as the costs associated with a workplace injury or illness can be significant.

Employers can be held liable for the costs of medical treatment, lost wages, and other related expenses, even if the injury or illness was not caused by negligence on the part of the employer.

Having workmen’s compensation insurance in place is critical for employers as it helps to protect them from the financial risks associated with workplace injuries and illnesses. It also provides employees with the financial resources.

The Workmen's Compensation Policy's Extent of Coverage

The extent of coverage will ultimately depend on the insurance provider you choose. Some would only provide bare-bones coverage, while others might go above and beyond.

The majority of workmen's compensation insurance policies in India typically include the following elements:

- Any harm, whether bodily or otherwise, sustained as a result of a workplace accident illness or disease aggravated by workplace circumstances.

- illness, injury, or disease aggravated by work; temporary death or disablement; a whole or partial disablement that is permanent; any and all incurred costs and fees of counsel.

Conditions Under Which the Employer is not Required to Provide Compensation

According to the Workmen's Compensation Act of 1923, an employer is not compelled to make up for personal injuries a worker has as a result of an accident that happens while the worker is on the employment. When it comes to paying compensation, a worker is exempt if—

(a) in respect of any injury which does not result in the total or partial disablement of the workman for a period exceeding 3* [three] days;

(b) in respect of any 4*[injury, not resulting in death, caused by] an accident which is directly attributable to—

(i) the workman having been at the time thereof under the influence of drink or drugs, or

(ii) the wilful disobedience of the workman to an order expressly given, or to a rule expressly framed, for the purpose of securing the safety of workmen, or

(iii) the willful removal or disregard by the workman of any safety guard or other devices which he knew to have been provided for the purpose of securing the safety of workmen.

What Does a Workmen's Compensation Policy Not Cover?

In a number of situations and circumstances, workmen's compensation insurance won't protect your business and its employees.

- any and all responsibilities a contract entails.

- accidents or injuries resulting from drug or alcohol abuse.

- injuries resulting from wars, insurrections or invasion.

- Contractor staff are not covered unless they are declared or insured.

- the first 3 days of disability when it lasts for fewer than 28 days.

- any harm, as long as it doesn't render you partially incapacitated for more than three days.

- Any damage or impairment brought on by a worker who disregarded safety regulations or guidelines.

Amount Payable Under the Workmen’s Compensation Act

The Workmen's Compensation Act of 1923 bases the amount of compensation payable on the circumstances surrounding the accident and the type of injury the worker received.

Generally, compensation is paid in the form of medical expenses, loss of wages, and disability benefits. Depending on the extent of the injury and the length of the worker's employment, different amounts of compensation are offered.

In some cases, compensation may also be paid for death benefits or funeral expenses.

The salaries that a company must give to front-line employees are as follows:

- The company shall pay the greater of $120,000 or 50% of the employee's monthly wage in the event of death.

- total and ongoing disability whichever is greater: $140,000 or 60% of the monthly salary multiplied by the pertinent component.

- A percentage of the earnings potential that was lost due to the disability is used to determine compensation in cases of permanent partial disability. The Schedule I, Part II of the Act makes mention of certain injuries.

- For temporary disability, 25% of the employee's monthly compensation is provided.

For the benefit of their employees, eligible businesses must maintain full workmen's compensation coverage. There are certain documentation requirements for this policy, and there is a systematic procedure for submitting claims. For a large, dispersed staff, managing this process can be challenging.

When Do Employers Release Compensation?

According to Section 3 of the Workmen's Compensation Act, a company must pay its employees in the following situations:

- if a worker has one of the occupational diseases listed under Schedule III, Parts A, B, or C. A work-related accident injury must have caused the condition.

- a work-related illness or accident that renders a worker wholly or partially handicapped.

- death caused by a risk at work to an employee.

Workmen’s Compensation Calculation

To determine compensation in conformity with the legislation, the formulas in Section 4 of the Workmen's Compensation Act are used:

- If an accident results in death, pay the appropriate factor 50% of the dead employee's monthly wage, or Rs. 1,20,000, whichever is higher.

- An amount equal to 60% of the injured worker's monthly wage in the relevant factor, or Rs. 1,20,000, whichever is greater, is granted if an accident leads in a permanent total disability.

Note: According to the newly released government guidelines, Rs. 15,000 is considered to be a wage for the purposes of calculating compensation under the Workmen's Compensation Act of 1923. The applicable provision in this matter is found in Section IV of this Act.

A Guide for Employers on How to Find the Best Workmen's Compensation Policy Online

It might be difficult to buy insurance, especially for your employees. Why? since there are many insurance companies offering a variety of products.

There are many insurance requirements. A policy developed for one organization might not be effective for another. Keep in mind that the necessity of this insurance is a result of the laws that must be followed and supported by the relevant authorities and governments.

So how do you find the finest one for your business? Some of these things are important for you to remember. Check them out:

Coverage: The maximum amount of protection for your company and employees should be provided by your workmen's insurance coverage.

Sum insured: Your insurance partner ought to provide you the freedom to increase the sum insured in light of the dangers to your staff and your company.

Optional covers: It's possible that not all risks and obligations are covered by a typical workmen's compensation insurance policy. Look around the insurance industry for one that does. Understanding your company's needs and determining whether or not you actually require any add-ons should come first.

Claims: Take your insurance partner's claim settlement ratio into account. It should be covered by any form of insurance, so look for one that makes the process straightforward and provides excellent claims help around-the-clock.

Extras: Find an insurance partner that provides extra benefits like employee and employer self-service apps, discounted rates, special offers, a no-claims bonus (if applicable), and other advantages.

Every business wants to cut costs and risk. A cheap premium does not always mean higher benefits, even though the ideal policy has maximum coverage, a smooth claims process, and a low premium.

Spend some time comparing various insurance packages. To find out more about the coverage they have to offer, contact insurance agents.

Procedures for Filing Claims Under Insurance Coverage for Workers' Compensation

This is how a workmen's compensation coverage claim is typically handled.

- The employer is informed of any employee fatalities or accidents.

- Any accidents or occurrences that take place on the property must be reported to the site inspector.

- Gather all necessary data and paperwork in accordance with the provider's requirements.

- The insurance provider should receive the assembled documentation.

- The provider tells the stakeholders as to whether it accepts or rejects the claim based on the information and documents obtained.

Documentation for Workmen's Compensation Policy

The typical documentation needed to support claims filed under a workmen's compensation insurance policy is shown in the following examples.

Application of the Workmen's Compensation Act of 1923

This law applies to the entire country of India, excluding Jammu and Kashmir. The 1948 Employees State Insurance Act does not apply to any locations covered by this Act.

Workmen’s Compensation Rules Have Changed in 2020

It is wonderful news for the workers that the central government has changed the processes for assessing the employees' compensation under the Workmen's Compensation Act of 1923.

The statement from the Ministry of Labour and Employment, which was sent on January 3, 2020, states that the number of wages previously considered for determining compensation has increased to Rs. 15,000 instead of Rs. 8,000.

The Employee's Compensation Act has been the official name of the 1923 Workmen's Compensation Act since 2010. Workers who lose their lives in a workplace accident or become wholly or partially disabled are entitled to compensation. Employees who qualify for ESI compensation do not fall under the scope of the Employee's Compensation Act of 1923 because the employer is the one who must cover the cost.

Conclusion

The Workmen’s Compensation Act 1923 was an important piece of legislation in India’s history, as it provided workers with some form of protection against workplace accidents and injuries. The Act also made employers liable for any medical costs and compensation to the injured worker, or to the family of the deceased worker.

The Workmen’s Compensation Act was amended several times over the years, and today it is widely accepted as an important law that provides vital protection to workers.

Additionally, the Act has the potential to reduce the amount of litigation in the workplace and help employers and workers to resolve disputes more quickly.

Frequently Asked Questions (FAQs) Associated with Workmen’s Compensation Act, 1923

Following, we've discussed some frequently asked questions (FAQs) associated with workmen's compensation act, 1923. Let's learn:

Que 1: Is India's law requiring workers' compensation strictly followed?

Answer: In India, any company with more than 20 employees must have workmen's compensation insurance. Employers are required to offer insurance benefits to their workers and employees under the terms of the Employees' State Insurance Act of 1948.

To comply with the rules established in the Workmen's Compensation Insurance Act of 1923 and the Fatal Accidents Act of 1855, even companies with fewer than 20 employees must enroll in an insurance plan.

Que 2: What sort of coverage is offered by Workmen's Compensation?

Answer: A workmen's compensation insurance policy covers the following:

- temporary death or incapacity

- injuries caused by or exacerbated by the working environment.

- Any bodily injuries incurred while at work as a result of an accident.

- long-term disability

- Other costs, such as attorney fees, were incurred.

Que 3: Who is in charge of handling the benefits under the Workmen's Compensation Act?

Answer: The employer is required to provide all underwriting for the insurance policy. Employers normally have 30 days to provide all benefits specified in the policy if a claim is submitted.

Employees commonly receive individual insurance plans from their employers, who also manage claim processing.

Que 4: What distinctions exist between the Employee Compensation Act and the Workmen's Compensation Act?

Answer: Actually, they are the same. The Workmen's Compensation Act was the law's official name at the moment the government put it into effect. After then, it was changed to Employee Compensation Act.

Que 5: Who is eligible to obtain compensation under the Workmen's Compensation Act of 1923?

Answer: A claim for compensation can be made on behalf of a deceased worker by any of the following parties:

- a minor illegitimate son, an unmarried illegitimate daughter or a daughter (legitimate or illegitimate or adopted) if married and a minor or if widowed and a minor,

- a paternal grandparent if no parent of the workman is alive,

- a minor brother or an unmarried sister or a widowed sister if a minor,

- a parent other than a widowed mother,

- a widowed daughter-in-law,

- a widower,

- a minor child of a pre-deceased son,

- a minor child of a pre-deceased daughter where no parent of the child is alive.

Que 6: Is purchasing a workers' compensation insurance coverage online a smart move?

Answer: It is acceptable to obtain worker's compensation insurance online. In fact, since most platforms let you evaluate all aspects of insurance packages side by side, it would be a terrific place to start. Simply be cautious when selecting an insurance comparison website.

Additionally, if you are only left with a small number of insurance providers, carefully read each policy paperwork before selecting one.

How Deskera Can Assist You?

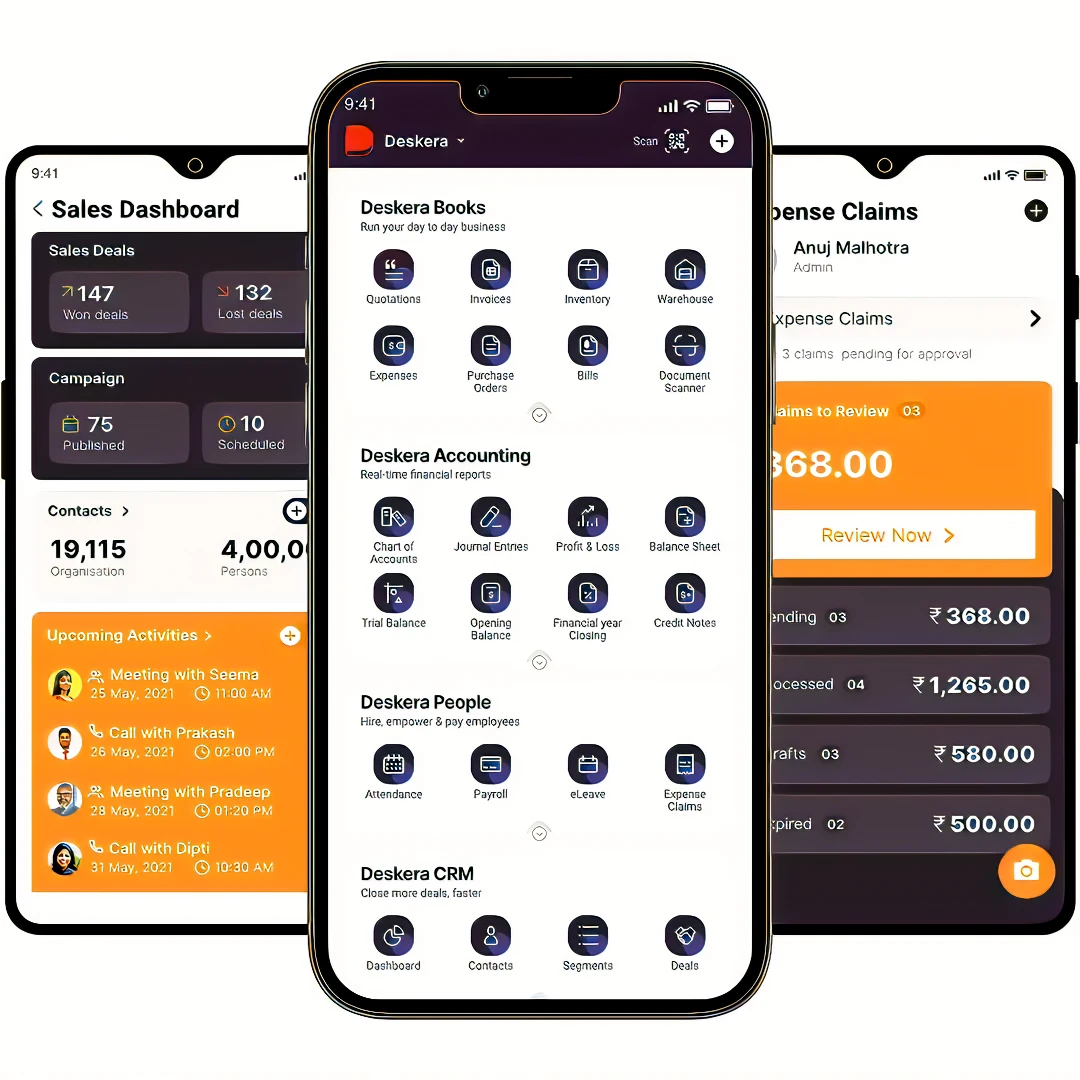

Deskera's integrated financial planning tools allow investors to better plan their investments and track their progress. It can help investors make decisions faster and more accurately.

Deskera Books enables you to manage your accounts and finances more effectively. Maintain sound accounting practices by automating accounting operations such as billing, invoicing, and payment processing.

Deskera CRM is a strong solution that manages your sales and assists you in closing agreements quickly. It not only allows you to do critical duties such as lead generation via email, but it also provides you with a comprehensive view of your sales funnel.

Deskera People is a simple tool for taking control of your human resource management functions. The technology not only speeds up payroll processing but also allows you to manage all other activities such as overtime, benefits, bonuses, training programs, and much more. This is your chance to grow your business, increase earnings, and improve the efficiency of the entire production process.

Final Takeaways

We've arrived at the last section of this guide. Let's have a look at some of the most important points to remember:

- The Workmen's Compensation Act of 1923 is an Indian law that offers benefits to employees in the event that they sustain physical harm or pass away while performing their job-related duties.

- The Act also provides for medical and other benefits such as the reimbursement of medical expenses, the provision of artificial limbs, and the payment of a gratuity. It also provides for the establishment of a fund to provide insurance benefits for disabled workers.

- This act has two main points. In the first place, it paves the way for employees and their dependents to get money from employers in the event that an accident leaves an employee dead or disabled. Second, it mandates that employers pay workers' compensation benefits in the event that an employee acquires a disease or condition that is connected to their line of work.

- The Act stipulates that in the event of a worker's death, serious injury, or disabling accident, the company shall give benefits to the employee or his dependents. The compensation is calculated on the basis of the wages earned by the worker in the preceding 12 months, or on the basis of the wages earned by a similar worker in the same establishment, whichever is higher.

- To create and manage worker social security programs, the Ministry of Labour and Employment in India has formed a division known as the Social Security Division. The Workmen's Compensation Act is defended by the division as well. However, commissioners nominated by the several state governments are in charge of monitoring this statute.

- It's possible that not all risks and obligations are covered by a typical workmen's compensation insurance policy. Look around the insurance industry for one that does. Understanding your company's needs and determining whether or not you actually require any add-ons should come first.

Related Articles