If you are a small business owner, seeking to get a clarity on write-offs, this post is for you!

As of 2020, the federal tax write-off for charitable donations is $300. This write-off is available for taxpayers who do not itemize their taxes and take the standard deduction. The limit for tax write-off for charitable donations is 60% of the taxpayer's adjusted gross income. For those who do itemize their taxes, the limit is up to 100% of the taxpayer's adjusted gross income.

Tax write-offs are deductions from taxable income that can reduce the amount of taxes a business has to pay. They can be used to offset some of the costs associated with running a business, such as expenses for equipment, supplies, and labor.

Additionally, individuals can use tax write-offs to reduce the amount of taxes they owe by deducting qualifying expenses from their taxable income. Common tax write-offs for individuals include charitable donations, mortgage interest, and state and local taxes.

Businesses can take advantage of a variety of deductions, such as advertising and marketing costs, business travel expenses, and employee benefits. Knowing which deductions you qualify for and how to maximize them can help reduce your tax burden.

Let’s get a detailed understanding of the write-offs through this article. Here is what we shall learn:

- What is Tax Write-Off?

- Benefits of Tax Write-Offs

- Types of Tax Write-Offs

- Tax Write-Off Examples

- Common Tax Write-Offs for Individuals

- Common Tax Write-Offs for Businesses

- How Do Tax Write-Offs Work?

- Eligibility Requirements for Write-off

- What Small Business Expenses Can Be Deducted?

- Why are Tax Write-Offs Important?

- Tips for Claiming Tax Write-Offs

- Concluding Thoughts

- Disclaimer

- How can Deskera Help You?

- Key Takeaways

- Related Articles

What is Tax Write-Off?

A tax write-off is a deduction from taxable income that can reduce the amount of taxes owed. It allows individuals and businesses to reduce the amount of income that is subject to taxation.

Tax write-offs are an important part of tax planning, as they can be used to reduce the amount of taxes owed or to increase the amount of money that can be saved. There are many different types of tax write-offs available.

It is important to understand the rules and regulations associated with each type so that they can be used to maximize the benefit.

Benefits of Tax Write-Offs

We have learned about the concept of a tax write-off. Let’s look at the various benefit it offers.

- Lower Overall Tax Liability: One of the most obvious benefits of taking tax write-offs is that it can reduce your overall tax liability. By taking deductions and credits, you can reduce the amount of taxes you owe, which can help you save money.

- Increase Your Refund: If you have deductions and credits that are greater than your tax liability, you can increase the amount you receive in your tax refund. This can be especially beneficial if you’re expecting to receive a refund, as you can use the extra money to pay bills or to save for the future.

- Minimize Your Taxable Income: By taking deductions, you can reduce your taxable income, which can help you minimize your taxes. This can be especially beneficial for those who are in a higher tax bracket, as it could result in a significant reduction in their overall tax bill.

- Get Credits: Tax credits are another great way to reduce your tax liability. Tax credits are reductions in the amount of taxes you owe and can be used to offset taxes due.

- Support Charities: Many people use tax write-offs to support charities. By donating to a charity, you can deduct the amount of your donation from your taxes, which can help you support a cause that you believe in while reducing your tax bill.

Types of Tax Write-Offs

Accounting write-offs are commonly used by businesses to account for asset losses caused by a variety of conditions. As a result, write-offs on the balance sheet normally comprise a debit to an expense account and a credit to the accompanying asset account. Each write-off circumstance is unique, although expenses are typically recorded on the income statement after deducting any previously reported revenues.

The accounting entries required for a write-off are detailed in generally accepted accounting standards (GAAP). The direct write-off method and the allowance method are the two most common business accounting methods for write-offs. The entries will normally differ based on the situation. Unpaid bank loans, unpaid receivables, and losses on held goods are three of the most prevalent scenarios for business write-offs.

There are various types of tax write-offs, as depicted in the following table:

Tax Write-Off Examples

Here is a quick look at the tax-write-off examples:

- Home Office Deduction: If you work from home, you may be able to deduct certain expenses related to using a portion of your home for business purposes, such as a home office or part of a room for business use.

- Vehicle Expenses: You may be able to deduct the cost of operating and maintaining your vehicle for business purposes, such as mileage, maintenance, repairs, registration fees, and insurance.

- Business Travel Expenses: If you travel for business, you may be able to deduct certain expenses related to the trip, such as airfare, hotel costs, meals, and entertainment.

- Business Supplies and Equipment: You can deduct the cost of supplies and equipment used in your business, such as computers, office furniture, software, and other materials.

- Retirement Contributions: You may be able to deduct contributions you make to a qualified retirement plan, such as a 401(k) or IRA.

- Education Expenses: You may be able to deduct tuition, fees, and other educational expenses related to maintaining or improving your skills in your business.

- Charitable Contributions: You may be able to deduct donations you make to a qualified charity.

Common Tax Write-Offs for Individuals

Common tax write-offs for individuals include deductions for include the following:

- charitable donations

- mortgage interest

- medical expenses

- state and local taxes.

Additionally, certain education expenses and unreimbursed employee business expenses may be deducted.

Additionally, there are certain credits available to individuals, including the Earned Income Credit, the Child Tax Credit, and the American Opportunity Credit. It is important for individuals to research and understand the different tax write-offs and credits available to them in order to maximize their deductions and minimize their tax liability.

Common Tax Write-Offs for Businesses

Common tax write-offs for businesses are deductions from taxable income that businesses can use to reduce their tax burdens. These deductions can be used to cover a wide range of expenses, such as the cost of goods sold, wages, rent, office supplies, and even advertising. By taking advantage of these deductions, businesses can save a significant amount of money on their taxes.

Furthermore, the type of deduction a business can claim depends on the type of business it is, so be sure to consult a tax professional to determine which write-offs are available to you. By taking advantage of these common tax write-offs, businesses can reduce their tax liabilities and put more money back into their business.

How Do Tax Write-Offs Work?

Tax write-offs are a great way to reduce your tax liability and get more money back in your pocket. But how do they work? In this section, we'll look at the basics of tax write-offs and explain the steps you need to take to claim them.

Step 1: Understand What is Tax Write-Off

A tax write-off is an expense you can deduct from your taxable income. It means that if you have an expense deductible from your taxable income, you can reduce your tax liability and get a bigger refund. Common tax write-offs include business expenses, medical expenses, charitable donations, and other contributions.

Step 2: Determine Your Eligibility

To be eligible for tax write-offs, you must meet specific criteria. For example, if you are claiming a business expense, you must be able to prove that the expense was necessary for the operation of your business.

If you are claiming a medical expense, you must be able to prove that the expense was related to a medical condition. Understanding the rules and regulations surrounding tax write-offs is crucial before you start claiming them.

Generally, the following criteria must be met:

- The individual must have incurred a financial loss or expense to be eligible for a tax write-off. It could include money spent on business expenses or investments, medical or dental bills, or charitable donations. The expense must have been paid in the tax year in which the deduction is claimed.

- The individual must prove that the expense was necessary and reasonable and that it was not for personal use. For example, if claiming a deduction for business expenses, the individual must be able to prove that the expense was necessary for their business operations.

- The individual must have the necessary supporting documentation to back up the deduction. It could include receipts, invoices, or other documents showing the expense amount and the purpose for which it was incurred.

- The individual must have maintained accurate and organized records of their expenses throughout the year. It includes keeping track of any income received and any expenses incurred.

- The individual must demonstrate that the deduction aligns with the Internal Revenue Service (IRS) guidelines. It means that the deduction must be legitimate, reasonable, and in line with the IRS guidelines for tax deductions.

- The individual must demonstrate that their annual income offsets the deduction. It means that the total amount of deductions must be equal to or less than the total income received.

- The individual must demonstrate that the deduction aligns with their tax filing status. It means that the deduction must be within limits set by the IRS for the individual's filing status.

- The individual must demonstrate that the deduction aligns with the state's tax laws. It means that the individual must abide by the tax laws of their state and any additional restrictions that may be set forth by their state.

Step 3: Gather Supporting Documentation

Once you have determined your eligibility for tax write-offs, you will need to gather the necessary documents to support your claim. Depending on the type of write-off you claim, this may include receipts, invoices, or other proof of the expense. It would be best to keep all of your supporting documentation safe in case you need it for an audit.

- The most common forms of supporting documentation are invoices, canceled checks, credit card statements, and receipts from purchases. These documents must include the date of the transaction, the amount, and the supplier's or vendor's name.

- Any additional information about the transaction should also be kept, such as the type of goods or services purchased, the purpose of the purchase, and the name of the person or business that received the payment.

- For personnel expenses, employers must keep records of each employee's wages and benefits and any travel, entertainment, and auto expenses. This information should include the employee's name, address, Social Security number, and job title, as well as the date, amount, place, and purpose of any business activity.

- For business-related travel expenses, including meals, lodging, and transportation, employers must keep records of the travel's date, location, and purpose. In addition, the cost of any meals, lodging, and transportation must be documented and any other incidental expenses associated with the trip.

- For charitable contributions, employers must keep detailed records of the date, amount, and recipient of any donations. The documentation should also include a description of any goods or services donated and the fair market value of the donation.

- For business use of a vehicle, employers must keep records of the business miles driven, the date of the trip, the purpose of the trip, and the mileage rate used for the deduction. The IRS requires employers to log all business miles driven to substantiate the deduction.

- For business equipment and supplies, employers must keep records of the date and cost of any purchase and the purpose of the purchase. Additionally, employers must keep records of any repairs or upgrades made to the equipment or supplies.

- For business-related entertainment expenses, employers must keep detailed records of the expense's date, place, amount, and purpose. The documentation should also include the names and business relationships of the persons entertained and the type of entertainment.

- Finally, for business-related legal and professional fees, employers must keep records of the date, amount, and purpose of any payment. The documentation should also include the name and address of the individual or business that provided the service.

Step 4: Fill Out the Necessary Forms

To claim your tax write-offs, you must fill out the appropriate forms. You will need to fill out a Schedule C form for business expenses. You will need to fill out a Schedule A form for medical expenses. Depending on the type of write-off you are claiming, there may be additional forms you need to fill out.

- One of the most commonly used forms for tax write-offs is Form 1040. This form reports the taxpayer's income, deductions, credits, and other information such as Social Security number, address, and contact information.

- For deductions related to business expenses, Form 2106 is used. This form is used to document any business expenses deducted from income to reduce the amount of tax owed. The form requires taxpayers to provide information about the type of business, the expenses incurred, and the amount of the deductions.

- Property owners claiming deductions related to their rental properties must fill out Form 4562. This form documents any deductions associated with the rental property, such as depreciation, repairs, and improvements.

- Taxpayers claiming medical expenses deductions must fill out the Form 1040 Schedule. This form is used to document any medical expenses deducted from income to reduce the amount of tax owed. Taxpayers must provide information about the medical expenses, the amount of the deductions, and the date of the expenses.

- For deductions related to child and dependent care expenses, Form 2441 is used. This form is used to document any child and dependent care expenses that were deducted from income to reduce the amount of tax owed. Taxpayers must provide information about the type of care, the expenses incurred, and the amount of deductions.

Step 5: File Your Taxes

Once you have gathered the necessary documents and filled out the forms, it is time to file your taxes. Make sure to include all of your write-offs when filing your taxes. It will reduce your taxable income and increase your refund.

Before claiming any write-offs, understand the rules and regulations and gather the necessary documents to support your claim. Once you have the paperwork required, you can fill out the forms and file your taxes with your write-offs included. These steps can help you get the most out of your tax write-offs.

Eligibility Requirements for Write-off

There are a variety of requirements for a business to qualify for a write-off in the United States. To begin, the business must be an active business operation with a valid Employer Identification Number (EIN) from the Internal Revenue Service (IRS).

Additionally, the business must have the appropriate documents and financial statements to substantiate the write-off. The specific requirements vary depending on the type of write-off a business is seeking. Some of the most common types of write-offs include start-up costs, business expenses, employee wages and benefits, and depreciation of assets.

To qualify for a write-off, businesses generally need to provide evidence that the expense was necessary for business operations, was not reimbursed, and was not a personal expense. Additionally, businesses may need to provide proof that the expense was paid for in the same taxable year in which it was claimed.

What Small Business Expenses Can Be Deducted?

It is critical to understand what expenses you may and cannot claim or write off for your small business. It can help you reduce your income tax liability or possibly enhance your refund. Here are a few of the most important small business tax breaks:

Business Lunches

Most of the time, you can deduct 50% of your food and beverage expenses if they qualify. To be qualified, you must meet certain requirements.

- The cost must be a common and necessary part of doing business.

- The supper must not be an ostentatious affair.

- You or your employee must be present at the lunch or dinner.

- You can also deduct 50% of the expense of providing meals to your staff.

You must preserve all relevant documents, including the amount of each expense.

Promotion and advertising

- You can deduct the expense of advertising and marketing, such as hiring a freelancer to design your company logo

- Printing cost of business cards

- Ad space in internet media must be purchased

- Clients are sent greeting or thank you cards

- Creating and establishing a new website

- Putting together a social media marketing campaign

- Being an event sponsor

Business Use of Your Car

Your business use of your car must be for the convenience of your employer and not for your own personal convenience. Additionally, you must keep detailed records of your driving for business purposes.

This includes the date, purpose of the trip, and the number of miles driven. By properly documenting and tracking your business-related vehicle expenses, you can maximize your deductions and reduce your tax liability.

Why are Tax Write-Offs Important?

Tax write-offs are important because they can help to reduce your taxable income, which can result in a lower tax bill. Tax write-offs are deductions from your taxable income that can lower the amount of income that is taxable by the IRS.

By taking advantage of these deductions, taxpayers can reduce their taxable income and potentially save money on taxes. In addition, tax write-offs can help taxpayers keep more of the money they have earned.

Another reason why tax write-offs are important is that they can help to reduce the amount of taxes that people owe. For example, if a taxpayer has a high amount of deductions, such as a large charitable contribution or a large medical expense, they can reduce their taxable income significantly, which can lower the amount of taxes they owe.

Overall, tax write-offs are important because they help to reduce taxable income, which can ultimately result in lower taxes owed. By taking advantage of deductions, taxpayers can save money and keep more of the money they have earned.

We can summarize the importance of tax write-offs through the following points:

- Tax write-offs can reduce your taxable income, potentially lowering your tax liability and saving you money.

- They can also help you keep more of your hard-earned money by reducing your taxable income and boosting your bottom line.

- Tax write-offs can provide you with a better understanding of your finances and help you plan for the future.

- Write-offs can help you maximize your deductions, leading to a higher return on your taxes.

- Tax write-offs can help you stay organized and in compliance with IRS regulations.

Tips for Claiming Tax Write-Offs

It is always good to know about some tips pertaining to write-offs that can help you save money and maximize your deductions. By understanding which expenses you are eligible to write-off, you can lower your taxable income and potentially get more money back from the IRS.

Additionally, being aware of the rules and regulations surrounding deductions can help you avoid any penalties and fines that may be associated with incorrect filing.

Let’s catch some tips before you claim your write-offs.

- Keep Detailed Records: Make sure to keep all your documents organized and detailed, including receipts, invoices, and other paperwork.

- Know What You Can Claim: Before you begin the process of claiming tax write-offs, you should familiarize yourself with what you can and cannot claim.

- Plan Ahead: Consider planning ahead for your deductions in the upcoming tax year. This can help you make sure you are taking advantage of all available deductions.

- Claim Unreimbursed Expenses: You can claim unreimbursed business expenses as long as they are considered ordinary and necessary for the operation of your business.

- Take Advantage of Tax Breaks: Research available tax breaks that you can take advantage of such as the home office deduction and the self-employment health insurance deduction.

- Take Professional Advice: If you are unsure about any tax deductions, it is a good idea to speak to a professional tax advisor. They can help you make sure you are claiming all the deductions you are entitled to.

Concluding Thoughts

In conclusion, the US tax code allows businesses to take advantage of various tax write-offs that can help them reduce their taxable income. By taking advantage of these write-offs, businesses can reduce their tax liability and keep more of the money they earn.

It is important to consult a tax professional to ensure that you are taking full advantage of the tax write-offs available in the US.

Disclaimer

The information presented in this article is for general informational purposes only and is not intended to be a substitute for professional legal advice. We make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the article or the information, products, services, or related graphics contained in the article for any purpose.

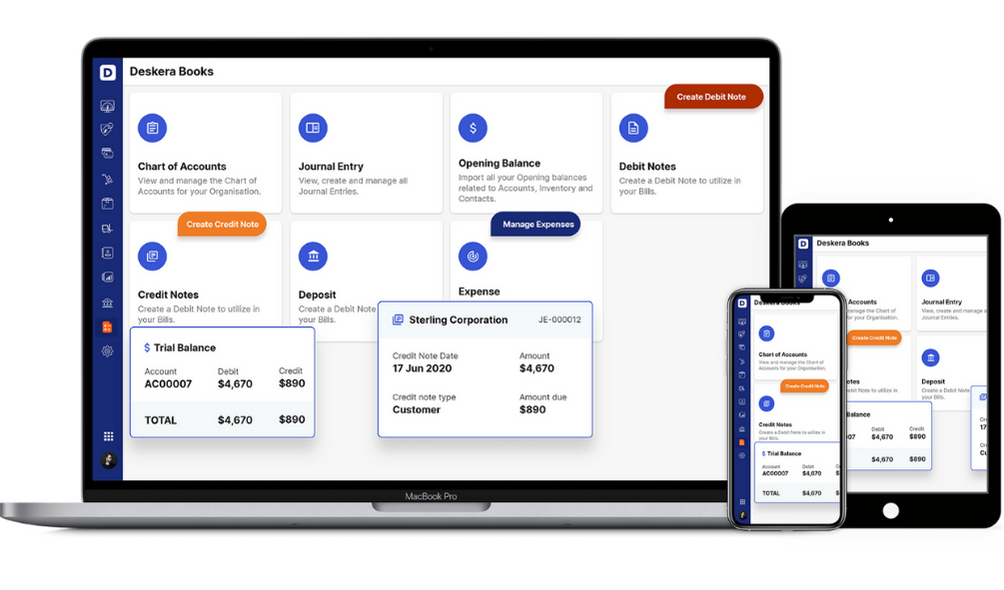

How can Deskera Help You?

Deskera Books is an online bookkeeping software designed for small businesses. It provides an easy-to-use, secure and collaborative platform to keep your business finances organized. With Deskera Books, you can easily track expenses, create invoices, and reconcile accounts.

Deskera Books helps you streamline your accounting processes, so you can focus on growing your business.

Key Takeaways

- Tax write-offs are deductions from taxable income that can reduce the amount of taxes a business has to pay.

- They can be used to offset some of the costs associated with running a business, such as expenses for equipment, supplies, and labor.

- Tax write-offs are an important part of tax planning, as they can be used to reduce the amount of taxes owed or to increase the amount of money that can be saved. There are many different types of tax write-offs available.

- Writing off can be beneficial as it lowers tax liability and increases refund.

- Charitable contributions, home office deductions, retirement savings contributions, and medical expenses are some of the commonly known types of write-offs.

- Mortgage interest, medical expenses, state and local taxes are some examples of write-offs that individuals can utilize.

- Businesses can utilize write-offs against advertising, office supplies, rent, salaries, and COGS.

- For claiming tax write-offs, you must follow the steps required for the process. These include determining eligibility, gathering documents, calculating the amount, filing, and claiming the write-off.

Related Articles