The IRS Forms W-2 and W-4 differ from each other based on who completes the paperwork and who fills them out. Employers withhold taxes from employees' paychecks by completing Form W-4 when an employee begins a new job. Employers file a W-2 at the end of each year to indicate how much was withheld. To determine the total amount withheld and whether employees are eligible for a tax refund, both the IRS and employees will need Form W-2s at year's end.

The purpose of this article is to compare Forms W-2 and W-4 and to explain how they are filled out.

- W-2 vs W-4: What you need to know

- W-2 vs W-4: How to fill in the forms

- Steps for filing a W-2 or W-4

- FAQs

W-2 vs W-4: What You Need to Know

For your convenience, here are the main components of the W-2 and W-4 forms.

Who Fills out These Forms?

Form W-4: Every employee on the company's payroll must fill out a W-4 within the first month of employment.

Form W-2: Every year, employers are required to send the IRS a W-2 form for each employee. Additionally, employers need to provide their employees with their W-2 forms by January 31. The organizations need to be mindful of submitting the W-2 forms for each of its employees who have been paid over $600. This is irrespective of whether or not the company collected any income, medicare tax, or Social Security from them.

Why Should You File These Forms?

Form W-4: The IRS form W-4 informs employees how much income should be withheld from their paychecks. There are lots of factors that determine the amount to be withheld. These could be the employee’s number of dependents, their marital status, and so on.

Form W-2: This document provides information about the employee’s earnings. It includes their tips and bonuses, federal tax, gross pay, also including the Social Security and Medicare taxes. The W-2 would also reflect any additional deductions, for instance, contributions to retirement plans.

When Should You Submit the Forms?

Form W-4: New employees are usually required to submit Form W-4 once they start their new position. The form must be filled out again any time their financial situation changes and they require more or less withholding from each paycheck.

Form W-2: Employers are required to file Form W-2 every year. In order to report withholdings for the previous year, employers must submit a copy of the withholding report to their employees and the IRS by January 31.

W-2 vs W-4: Instructions for filing a W-2 or W-4

W-2 forms are the responsibility of business owners, but you may need to assist employees in filling out their W-4 forms. Please see the instructions below.

Instructions to Fill Form W-4

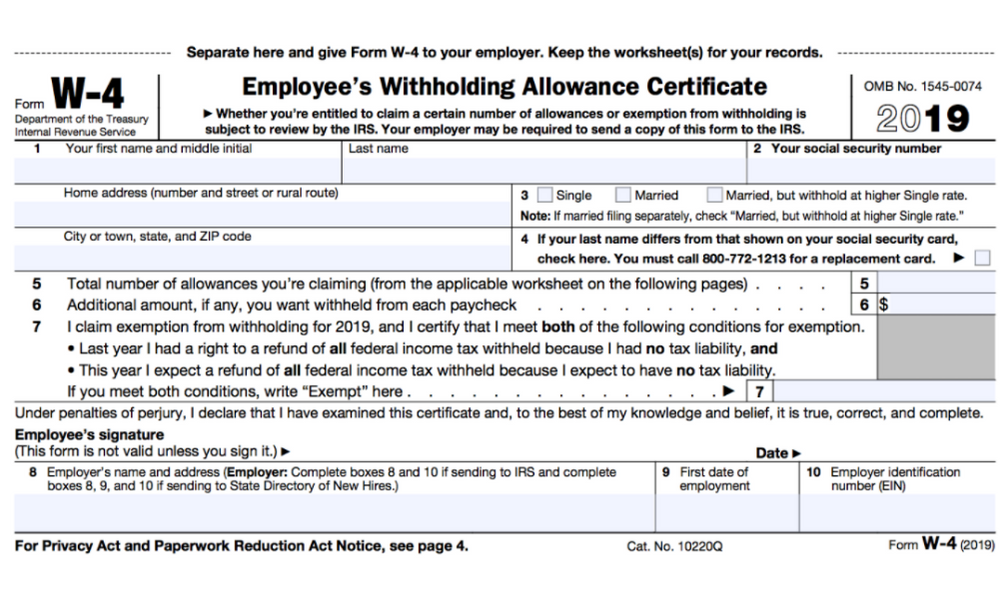

The IRS Form W-4 is also known as Employee’s Withholding Allowance Certificate. This form requires employee information that includes their Social Security number, their home address, and marital status. Fundamentally, it needs the employees’ personal information.

It is important to disclose how many allowances an employee is claiming. If an employee claims a lot of allowances, their tax withholding will be lower. It is possible to claim allowances if you take itemized deductions, have a qualifying child or dependent, or have more than one job.

The W-4 shows the total number of allowances an employee is claiming. It also indicates any additional amounts the employee would like deducted from each paycheck.

Those who work more than one job, whose spouse works, or who earn income from sources outside the scope of withholding may choose to increase their withholdings. Employees could be liable for additional taxes or interest and penalties if they do not adjust their annual tax returns.

If an employee is eligible to claim income tax credits, such as a credit for a child or another dependent, or a deduction, he or she may reduce their withholding. State tax withholding forms are often required for employees in addition to federal tax withholding, and they also need to file state tax returns.

Instructions to Fill Out Form W-2

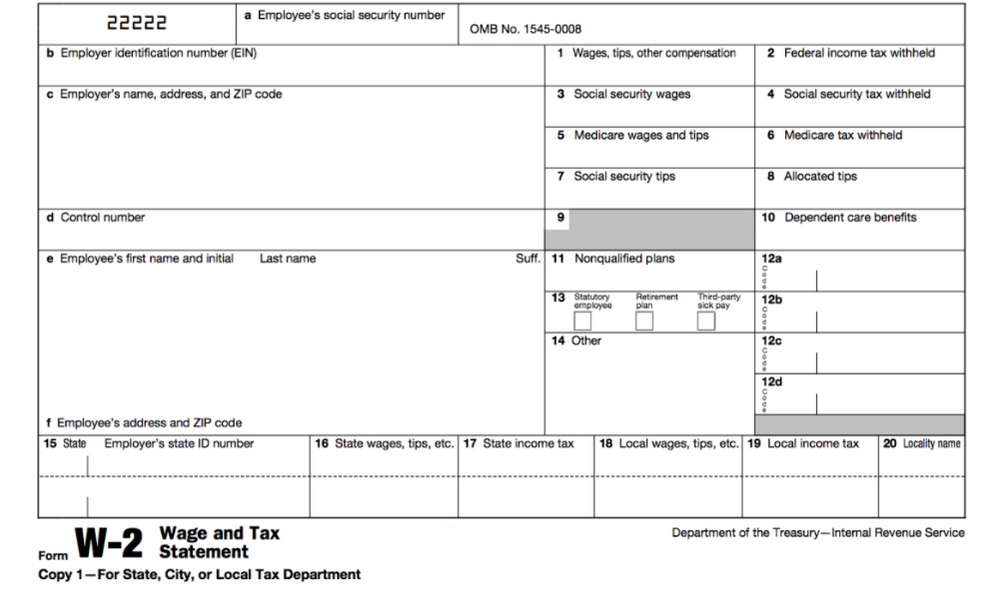

The Form W-2 is also known as the IRD Wage and Tax Statement. It is a document that is to be filed by employers for every employee who receives $600 or more. This is when there have not been any deductions in terms of Medicare or Social Security tax.

This form is also applicable in the cases where the employer did not even deduct income tax from their paycheck if they did not claim an exemption or only claimed one allowance.

Employers must enter their employer identification number (EIN) and Social Security number on the form. Furthermore, the business and employees’ addresses must be provided. Furthermore, the employers must also disclose the following:

- employee's total annual compensation

- including wages and tips

- how much federal income tax

- Social Security tax

- Medicare tax you withheld

The W-2 forms are required by employees to file their annual tax returns. Their tax bill would be reduced by the amount you withheld from their pay as their employer. Withholding amounts are used to determine whether an employee is eligible for a refund or if an additional payment must be made.

Besides stating how much state income tax you withheld from each employee, you would also need to provide your state government with a W-2.

FAQs

- How do Forms W-2 and 1099 differ?

The W-2 forms report full-time employees' compensation and federal tax withheld, while the 1099-MISC forms say what independent contractors are paid. Since contractors are responsible for paying their own taxes, employers do not withhold taxes from their paychecks.

- How many allowances can an employee claim on their W-4?

If there are more claims on allowances, the amount withheld from your paychecks will be less. Therefore, if you are concerned about owing money on your tax return, you should increase your withholding.

- How do I obtain my W-2 Form?

Employers are required to send the employee a copy of their W-2 form before January 31 each year. Employees can obtain a copy of their form through your employer, but they will need to pay the IRS for a copy.

Guidelines for Small Businesses Filing W-2 and W-4 forms

With these tips, you can easily and accurately complete the W-2 and W-4 forms.

- Be proactive and quick

Make sure you fill out these forms well in advance. For W-2s, the IRS can impose late penalties if errors or deadlines are missed. Ideally, businesses must get their employees to fill out their W-4s prior to their first day of employment and enter the appropriate information as soon as possible into your payroll system. In order to meet the January 31 deadline for W-2s, begin working on them as soon as the new year begins.

- Hire an accountant

Despite detailed instructions on the IRS website, both forms can still be difficult to comprehend. For help filling out IRS tax forms, you can consult a business accountant or tax advisor who is familiar with IRS tax forms. Receiving guidance and assistance from them would be helpful in making the process time-efficient and eliminating errors.

- Consider filing electronically

To file the W-2 electronically, the IRS advises you do so. It saves paper and is more convenient. You can stay organized and access the W-4s quickly if you keep them electronically.

- Invest in payroll or HR software

It is perhaps the easiest way to simplify your tax-forms process to use payroll or HR software that includes W-4 and W-2 features. Your employees can fill out their forms on your platform and you can possibly file them.

- Caution is advised

When completing W-2s and helping employees complete W-4s, use extra caution, as you would with all of your business tasks. Making mistakes on these forms can have serious consequences for your company, so spending a bit more time now would save you from unexpected and unwanted circumstances later.

How can Deskera Help You?

Deskera Books is an online accounting, invoicing, and inventory management software which is designed to make your life easy. A one-stop solution, it caters to all your business needs from creating invoices, tracking expenses to viewing all your financial documents whenever you need them.

The platform works exceptionally well for small businesses who need to figure out a lot of things when they are setting out. This delighting software allows them to keep up with the client’s expectations by assisting them in overseeing a timely delivery.

With the well-thought and well-designed templates, you can now anticipate your work to become simpler. These templates can be used for transactions like invoice, quotations, orders, bills and payment receipts.

If yours is a drop shipping business, you can easily track your orders and create new dropship orders for your suppliers based on the customer orders.

Deskera People is another platform that enables you to expedite and simplify the processes. Through its automated processes like hiring, payroll, leave, attendance, expenses, and more, you can now unburden yourself and focus on the major business activities. It also assists with driving growth for your business by integrated Accounting, CRM & HR Software.

Key Takeaways

Here are some of the major points discussed in the article:

- Employers use the W-4, which is also known as an employee's withholding allowance certificate, to determine how much income tax to withhold from an employee's paycheck.

- Every employee on the company's payroll must fill out a W-4 within the first month of employment.

- Every year, employers are required to send the IRS a W-2 form for each employee.

- The IRS forms W-4 tell employees how much income should be withheld from their paychecks.

- Form W-2 provides information about the employee’s earnings. It includes their tips and bonuses, federal tax, gross pay, also including the Social Security and Medicare taxes.

- New employees are usually required to submit Form W-4 once they start their new position.

- Employers are required to file Form W-2 every year. In order to report withholdings for the previous year, employers must submit a copy of the withholding report to their employees and the IRS by January 31.

- The IRS Form W-4 is also known as Employee’s Withholding Allowance Certificate.

- The W-4 form requires employee information that includes their Social Security number, their home address, and marital status.

- The Form W-2 is also known as the IRD Wage and Tax Statement. It is a document that is to be filed by employers for every employee who receives $600 or more.

Related Articles