Have you ever wondered how global giants like Apple or Tesla manage to maintain such tight control over every step of their production and delivery processes? The secret lies in a powerful business strategy known as vertical integration. By controlling multiple stages of their supply chain—from raw materials to distribution—companies can enhance efficiency, reduce costs, and ensure consistent product quality. In today’s fast-paced and competitive business world, vertical integration has become more than just a growth strategy—it’s a way to build resilience and long-term sustainability.

At its core, vertical integration allows businesses to consolidate operations across different parts of the supply chain. Instead of relying heavily on external vendors or distributors, companies bring these processes in-house or acquire firms that handle them. This direct control helps minimize supply chain disruptions, improve profit margins, and strengthen market dominance. It’s a strategy that transforms dependence into independence—empowering organizations to respond faster to market changes and customer needs.

However, while vertical integration promises numerous advantages, it also comes with challenges. High capital investment, complex operations, and potential regulatory concerns can make implementation demanding. Businesses must carefully assess whether vertical integration aligns with their capabilities and long-term goals. When done right, it not only boosts operational efficiency but also creates a significant competitive edge that competitors find hard to replicate.

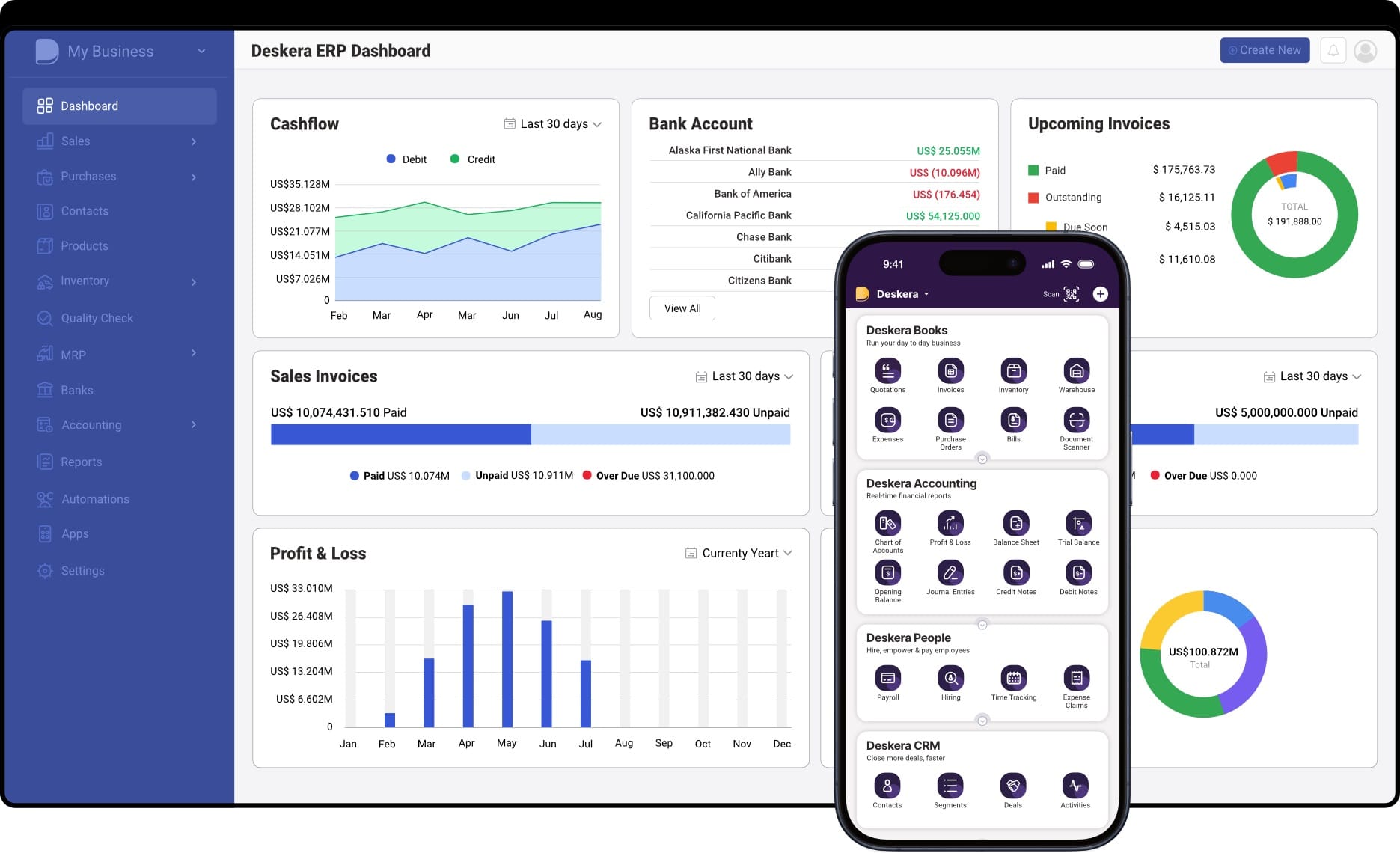

This is where Deskera ERP becomes a strategic enabler. Deskera ERP helps businesses achieve seamless integration across procurement, manufacturing, inventory, sales, and accounting—all from a single platform. With powerful features like demand forecasting, production planning, and financial automation, it ensures complete visibility and control over the supply chain. Deskera’s AI-powered assistant, David, further enhances decision-making by providing real-time insights and recommendations, helping companies execute their vertical integration strategy with precision and agility.

What is Vertical Integration?

Vertical integration is a business strategy in which a company takes control of multiple stages of its supply chain — from sourcing raw materials to manufacturing, distribution, and even final sales to customers. Instead of relying on third-party suppliers, manufacturers, or retailers, businesses bring these operations in-house or acquire other firms involved in those stages. This allows them to have greater control over production quality, costs, and delivery timelines, creating a more streamlined and efficient workflow.

In simpler terms, vertical integration means extending ownership up or down the supply chain. For instance, a clothing manufacturer may acquire a fabric supplier (known as backward integration) to reduce material costs and ensure consistent quality, or it may open its own retail outlets (forward integration) to sell directly to consumers. Some companies even pursue both directions, gaining end-to-end control of their operations.

Companies can achieve vertical integration through mergers, acquisitions, or by developing new in-house capabilities. While it often involves high capital investment and increased organizational complexity, the rewards can be significant—ranging from reduced dependency on external partners to improved margins and greater market stability.

Ultimately, vertical integration empowers businesses to strengthen supply chain visibility, enhance quality assurance, and increase resilience against disruptions. When implemented strategically, it can transform a company’s operating model from one of dependence to one of dominance, ensuring sustained competitive advantage in an increasingly volatile global market.

Vertical Integration vs Horizontal Integration

When companies aim to grow, they generally adopt one of two strategies: vertical integration or horizontal integration. Both approaches expand a business’s reach, but they differ in focus, objectives, and execution. Understanding the distinction between them is key to selecting the right growth strategy for long-term success.

Vertical Integration

Vertical integration involves expanding a company’s control along the supply chain. This means owning or managing multiple stages of production, from raw materials to manufacturing, distribution, and retail.

Key Points:

- Direction: Can be backward (acquiring suppliers) or forward (acquiring distributors or retailers).

- Objective: Streamline operations, reduce costs, improve quality, and gain more control over the supply chain.

- Example: Tesla producing its own batteries (backward integration) and selling directly through Tesla stores (forward integration).

Horizontal Integration

Horizontal integration, on the other hand, focuses on expanding at the same level of the value chain. Companies grow by acquiring or merging with competitors or similar businesses in their industry.

Key Points:

- Direction: Expansion occurs across the same production or service stage rather than up or down the supply chain.

- Objective: Increase market share, reduce competition, and achieve economies of scale.

- Example: Facebook acquiring Instagram or WhatsApp to strengthen its position in the social media market.

Key Differences

Both strategies have their merits and challenges, and companies often combine them to achieve balanced growth and operational efficiency.

Why Do Companies Vertically Integrate?

Companies choose to vertically integrate for several strategic reasons—ranging from improving cost efficiency to ensuring greater control over supply chains and customer experience. The decision often depends on market conditions, competitive pressures, and the company’s long-term growth objectives.

Here are the primary drivers that motivate businesses to pursue vertical integration:

1. To Reduce Costs

One of the most common reasons for vertical integration is cost reduction. By bringing production, distribution, or retail operations in-house, companies can eliminate supplier markups, distributor fees, and other third-party expenses.

For instance, when a manufacturer starts producing its own components instead of purchasing them externally, it captures the profits that would have gone to suppliers. Moreover, it reduces the administrative costs involved in managing external contracts, negotiations, and logistics. Over time, this translates to improved margins and stronger pricing power.

2. To Better Manage Inputs

Another major advantage of vertical integration is enhanced control over inputs. Companies gain direct oversight of critical materials, processes, and technologies, allowing them to maintain consistent quality standards.

During periods of global supply chain disruptions or raw material shortages, vertically integrated firms have a competitive edge—they can prioritize their own production needs and adjust schedules without relying on third-party suppliers. This stability helps ensure uninterrupted production and protects against volatility in pricing or supply availability.

3. To Increase Efficiency

Vertical integration streamlines operations by removing layers of coordination between multiple partners. When procurement, manufacturing, and distribution operate under one system, companies can align production schedules, inventory levels, and logistics seamlessly.

This integrated structure reduces lead times, minimizes stockouts or overproduction, and allows for real-time decision-making. In essence, vertical integration helps organizations balance operational efficiency with cost control, improving overall productivity and profitability.

4. To Improve Customer Experience

Finally, vertical integration helps companies build stronger relationships with customers by giving them direct control over sales and service channels. By integrating downstream operations such as retail stores or e-commerce platforms, businesses can interact directly with end users, understand their needs, and deliver consistent brand experiences.

This approach not only improves service quality but also provides valuable feedback that can inform future product development and innovation. A closer connection to the customer also allows for better price management and faster adaptation to market trends.

In short, vertical integration enables companies to create a more resilient, efficient, and customer-focused supply chain. While the strategy demands significant investment and operational discipline, the long-term gains in control, cost savings, and brand strength often make it a compelling choice for forward-thinking organizations.

How Does Vertical Integration Work?

Vertical integration works by allowing a company to take control of multiple stages of its supply chain, from sourcing raw materials to manufacturing, distribution, and sales.

The process begins with identifying critical areas of the supply chain that the company wants to control—these could be a particular raw material, a manufacturing process, or a distribution channel. By focusing on these key points, businesses can streamline operations, improve efficiency, and reduce reliance on external vendors.

Once the target areas are identified, companies can achieve vertical integration through two main approaches:

- Acquisition or Merger: Purchasing existing suppliers, distributors, or retail partners to bring them under the company’s control.

- Internal Development: Building in-house capabilities, such as establishing new production lines, warehouses, or logistics teams, and hiring experts to manage these operations.

After acquiring or developing these operations, the company integrates them into its existing workflows. This step involves aligning processes, IT systems, and operational practices to ensure smooth coordination across all stages of production and distribution. Businesses may also adopt supply chain management software to monitor and optimize the newly integrated operations in real time.

The final step is coordination and adjustment. Vertical integration gives companies the ability to manage inventory, synchronize supply with demand, adjust production schedules, and respond quickly to market changes.

For example, companies like Apple and Netflix control both production and distribution—Apple designs and manufactures its hardware while Netflix produces and distributes its own content. By controlling more stages of their supply chain, these companies reduce costs, maintain high quality, and improve overall efficiency.

Types of Vertical Integration

Vertical integration allows companies to expand their control across different stages of the supply chain. Depending on the direction and extent of this expansion, vertical integration can be classified into several types. Each type has unique strategies, benefits, and challenges that businesses must consider to maximize efficiency and profitability.

1. Backward Integration

Backward integration involves expanding upstream in the supply chain, taking control of processes or resources that supply the company’s current operations. By doing so, companies reduce dependency on external suppliers and gain greater control over costs, quality, and availability of critical inputs.

How It Works:

- Companies identify suppliers or raw material sources critical to their production process.

- They may acquire these suppliers, enter into joint ventures, or develop in-house production capabilities.

- This integration often requires significant investment but offers long-term stability and competitive advantage.

Benefits:

- Lower production costs by eliminating supplier markups.

- Greater control over product quality and consistency.

- Protection against supply chain disruptions or material shortages.

Example: McDonald’s has adopted backward integration by owning farms and food production facilities that supply ingredients for its restaurants. This allows it to maintain high quality standards and consistent supply while controlling costs. Similarly, a furniture retailer might acquire a wood supplier to secure its raw material supply.

2. Forward Integration

Forward integration occurs when a company expands downstream in the supply chain to gain control over distribution, retail, or direct sales to consumers. It brings the company closer to its customers, improving profit margins, customer experience, and brand control.

How It Works:

- The company may open retail outlets, create e-commerce platforms, or acquire distribution networks.

- This integration often involves a significant investment in logistics, sales infrastructure, and customer service capabilities.

- It allows businesses to control pricing, branding, and product availability more effectively.

Benefits:

- Higher profit margins by capturing downstream profits.

- Direct access to customer feedback and data for improving products.

- Stronger brand presence and control over customer experience.

Example: Nike has implemented forward integration by opening its own retail stores and online platforms to sell products directly to consumers, bypassing intermediaries. Disney’s Disney+ is another case, delivering content straight to viewers instead of relying solely on cable providers.

3. Balanced Integration

Balanced integration combines both backward and forward strategies, enabling companies to control the supply chain from raw materials to final sales. This approach is most feasible for companies positioned mid-chain that have the capacity to manage both upstream and downstream operations.

How It Works:

- Companies acquire or develop upstream suppliers and downstream distribution or retail channels simultaneously.

- Requires careful coordination of multiple operations to maintain efficiency and quality across the entire value chain.

- Often involves high capital investment and managerial complexity.

Benefits:

- Full control over production, distribution, and quality.

- Optimized operational efficiency by aligning upstream and downstream processes.

- Stronger market position and competitive edge due to reduced dependency on third parties.

Example: Apple designs its own semiconductors and other components (backward integration) while also operating its retail stores and online platforms (forward integration). Tesla also demonstrates balanced integration, producing its own batteries and vehicles while managing direct-to-consumer sales and charging infrastructure.

4. Disintermediation (Optional/Strategic Type)

Disintermediation is a strategic variation of vertical integration where a company removes intermediaries in the supply chain to sell directly to end customers. This approach reduces costs and increases control over the entire customer journey.

How It Works:

- Companies bypass distributors, dealers, or retailers.

- Typically combined with balanced or forward integration strategies to ensure full control over production and delivery.

Benefits:

- Reduced costs by eliminating middlemen.

- Direct interaction with customers provides insights for product improvements.

- Enhanced control over pricing, branding, and customer experience.

Example: Tesla sells vehicles directly to consumers without relying on dealerships. Dell historically sold computers directly online, allowing it to manage inventory, pricing, and customer relationships more effectively.

By understanding these types, companies can choose the vertical integration strategy that best fits their industry, supply chain position, and long-term objectives. Whether upstream, downstream, or both, vertical integration can provide a powerful competitive advantage when implemented thoughtfully.

Degrees of Vertical Integration

Vertical integration is not always an “all-or-nothing” strategy. Companies can choose different degrees of integration depending on their resources, risk tolerance, and strategic goals. By understanding these degrees, businesses can decide how much of the supply chain they want to control while balancing cost, flexibility, and operational complexity.

1. Full Vertical Integration

Full vertical integration represents the most comprehensive level of control. A company may aim to acquire or build all the assets, capabilities, and resources necessary to control one stage of the supply chain or, in some cases, manage every step from raw materials to customer delivery.

Key Points:

- Involves significant investment and operational oversight.

- Provides complete control over quality, costs, production schedules, and distribution.

- Reduces dependency on third parties, minimizing supply chain disruptions.

Example: Apple demonstrates full vertical integration by designing its own chips, manufacturing certain components, and selling products directly through its stores and online platforms. Tesla is another example, controlling vehicle production, battery manufacturing, and direct-to-consumer sales.

2. Quasi Vertical Integration

Quasi vertical integration offers many benefits of full integration but with less risk and lower upfront costs. Companies can secure partial control over upstream or downstream activities without owning all assets.

Key Approaches:

- Acquiring minority stakes in suppliers or distributors.

- Forming joint ventures or strategic alliances.

- Licensing technology, acquiring specific assets, or franchising.

Benefits:

- Lower capital requirements compared to full integration.

- Flexibility to scale operations or adapt to changing market conditions.

- Partial control over supply chain operations, improving efficiency and reliability.

Example: A clothing brand may form a joint venture with a fabric supplier to ensure consistent quality, rather than acquiring the supplier outright.

3. Long-Term Contracts

Some companies prefer long-term agreements to gain more control over suppliers or distributors without ownership. These contracts can increase predictability in costs, supply, and delivery schedules.

Key Points:

- Provides stability and reduces uncertainty in the supply chain.

- Can be a cost-effective alternative to ownership or full integration.

- Often combined with other degrees of integration to optimize control.

Example: A food manufacturer may enter a multi-year contract with farmers to secure a steady supply of raw ingredients at a fixed price.

4. Spot Contracts

At the opposite end of the spectrum from full integration are spot contracts, which involve purchasing supplies or services as needed. These one-off transactions provide minimal control but require little investment.

Key Points:

- Offers maximum flexibility for companies that do not want to commit to ownership or long-term agreements.

- Higher risk of supply disruption or price fluctuations.

- Best suited for companies with low-volume, variable, or easily sourced inputs.

Example: A small electronics manufacturer purchasing specific components from a distributor for each production cycle without establishing long-term agreements.

By understanding these degrees of vertical integration, companies can tailor their strategy to balance control, cost, and operational risk, rather than committing blindly to full integration.

Benefits of Vertical Integration

Vertical integration allows companies to gain control, efficiency, and competitive advantage by managing multiple stages of the supply chain, from raw materials to final sales. Beyond cost savings, this strategy provides numerous operational, strategic, and market benefits.

1. Greater Control Over the Supply Chain

Vertical integration gives companies end-to-end control over production, distribution, and sales. This ensures that operational processes, quality standards, and timelines are consistently maintained. It also reduces dependency on external suppliers or distributors, allowing companies to manage risks and respond proactively to supply chain disruptions.

Example: Tesla controls battery production, vehicle assembly, and direct-to-consumer sales, ensuring consistent quality and reliability.

2. Lower Operational Costs

By internalizing supply chain operations, companies can achieve economies of scale and reduce expenses. Eliminating supplier markups, intermediary fees, and redundant logistics lowers variable and fixed costs. Lean production, streamlined operations, and just-in-time inventory systems further contribute to cost savings.

Example: McDonald’s backward integration into agricultural supply reduces costs while ensuring consistent quality of ingredients.

3. Increased Efficiency and Coordination

Vertical integration enables better alignment between production, inventory, and distribution. Companies can streamline workflows, shorten lead times, and eliminate delays caused by third-party dependencies. Efficient coordination also helps prevent bottlenecks and allows for better planning across multiple stages.

Example: Apple synchronizes component production with assembly and retail distribution, optimizing inventory and minimizing delays.

4. Improved Quality Control

Ownership of multiple supply chain stages allows companies to enforce strict quality standards throughout production and distribution. This leads to higher customer satisfaction, fewer defects, and stronger brand reputation.

Example: Nike manages manufacturing and retail operations, ensuring consistent quality across products and customer touchpoints.

5. Better Market Responsiveness and Customer Feedback

Direct involvement in sales and distribution allows companies to respond quickly to changing market demands. Companies can launch products faster, adjust production schedules, and use customer data to improve products and services.

Example: Netflix produces and distributes original content directly via its platform, responding in real-time to viewer preferences.

6. Increased Profit Margins and Market Power

Capturing value at multiple stages of the supply chain helps companies increase profitability and reduce exposure to price fluctuations. Greater control over inputs and outputs enhances negotiating power and market positioning.

Example: Apple controls both production and retail, maintaining premium pricing while capturing more profit per product.

7. Reduced Supply Chain Disruptions

Vertical integration mitigates risks from external disruptions, such as supplier delays, transportation issues, or global crises. Companies with integrated operations have better visibility into the supply chain, allowing them to anticipate and manage challenges more effectively.

Example: A vertically integrated automotive company can prioritize its own production needs during raw material shortages without relying on third-party suppliers.

8. Faster Time to Market

Integrated operations reduce delays between production, assembly, and distribution, allowing companies to launch products more quickly. This is especially critical in industries where speed and innovation are competitive advantages.

Example: Apple can introduce new iPhone models faster because it controls component production, assembly, and retail distribution.

9. Enhanced Innovation and R&D Capabilities

Companies controlling multiple stages of production can experiment with new materials, processes, and designs more effectively. Integration facilitates collaboration across departments, enabling faster innovation cycles and better product development.

Example: Tesla develops batteries, software, and vehicles in-house, allowing rapid experimentation and innovation across its products.

10. Stronger Brand Loyalty and Customer Experience

Forward integration, such as owning retail stores or e-commerce platforms, improves customer engagement and satisfaction. Companies can provide a seamless brand experience, collect direct feedback, and offer superior service.

Example: Disney+ combines content production and direct streaming to provide a consistent, high-quality user experience.

11. Better Management of Input Costs

By controlling raw material production or supplier relationships, vertically integrated companies reduce dependency on market pricing fluctuations. This can stabilize costs and improve profitability over time.

Example: Furniture manufacturers acquiring timber suppliers reduce material cost volatility and maintain stable production budgets.

12. Strategic Competitive Advantage

Vertical integration can create barriers to entry for competitors by controlling critical supply chain assets. Competitors without similar integration may struggle to match quality, speed, or pricing, giving integrated companies a sustainable market edge.

Example: Apple’s control over semiconductors and retail stores creates competitive barriers that are difficult for rivals to replicate.

Drawbacks of Vertical Integration

While vertical integration offers significant benefits, it also comes with a set of challenges that companies must carefully consider. These drawbacks often stem from the high costs, complexity, and reduced flexibility associated with managing multiple stages of the supply chain internally.

1. High Initial Capital Requirements

One of the most significant drawbacks of vertical integration is the substantial upfront investment needed. Acquiring suppliers, distributors, or retail operations—or building new facilities—can be extremely costly. Additionally, companies may need to invest in new equipment, technology, and workforce training to successfully integrate these operations.

Example: A manufacturing company looking to acquire a raw material supplier may face millions in acquisition costs and subsequent upgrades to align with its operations.

2. Reduced Flexibility

Vertical integration often locks a company into specific processes, technologies, and markets, making it harder to pivot or respond to changing market conditions. Unlike companies that rely on external suppliers or distributors, vertically integrated firms may struggle to adjust quickly when demand shifts or new opportunities arise.

Example: A clothing brand that owns its fabric mills may find it difficult to quickly switch to a more cost-effective supplier if fashion trends or raw material costs change.

3. Increased Managerial Complexity

Managing multiple stages of the supply chain adds operational and managerial complexity. Companies need expertise in areas outside their core competency, which can lead to inefficiencies if not handled effectively. Oversight, coordination, and integration across diverse operations require significant management skills and resources.

Example: ExxonMobil’s consideration of operating convenience stores alongside gas stations highlighted the challenge of managing a new type of business requiring expertise beyond its core oil operations.

4. Risk of Inefficiency

If any part of a vertically integrated operation is poorly managed, it can negatively impact the entire supply chain. The interconnected nature of integrated operations means inefficiencies in one stage can cascade and affect production, distribution, and customer satisfaction.

Example: A company producing its own components may experience delays or quality issues that halt assembly lines, whereas outsourcing could have mitigated the disruption.

5. Potential Distraction from Core Business

Expanding operations into multiple supply chain stages can divert focus from a company’s primary objectives. Firms risk losing sight of their core competencies, which can lead to weaker performance in areas where they previously excelled.

Example: A tech company venturing into raw material production may find its R&D and innovation efforts diluted.

6. Regulatory and Legal Risks

Highly integrated companies can attract antitrust scrutiny and legal challenges, especially if their market power grows significantly. Regulatory authorities may impose restrictions to prevent monopolistic practices, affecting operations and expansion strategies.

Example: Large tech companies or automakers integrating vertically have faced regulatory scrutiny in multiple jurisdictions to ensure fair competition.

7. Long-Term Commitment and Slow ROI

Vertical integration is a long-term strategy that often requires years before returns are realized. Setting up or acquiring operations, training employees, and integrating processes take time, which can delay profitability.

Example: Establishing a backward integration into raw material production may take years to fully stabilize and generate expected cost savings.

8. Reduced Market Agility

By controlling their own supply chain, companies may become less agile in responding to new technologies, suppliers, or market trends. In fast-moving industries, this can put vertically integrated firms at a disadvantage compared to more flexible competitors.

Example: A manufacturer with its own distribution network may struggle to adopt new e-commerce platforms quickly compared to a company that relies on third-party logistics.

9. Customer Dissatisfaction Risk

In some cases, forward integration into retail or direct sales can alienate existing customers or partners. Small retailers or distributors may feel bypassed or disadvantaged, which can impact brand reputation and long-term partnerships.

Example: Tesla’s direct-to-consumer sales model initially faced resistance in states where traditional dealerships dominated car sales.

In summary, vertical integration can increase costs, complexity, and rigidity while requiring long-term commitment and careful management. Companies must weigh these drawbacks against the potential benefits to determine whether vertical integration aligns with their strategic goals.

Is Vertical Integration the Right Choice for Your Business?

Deciding whether vertical integration is the right strategy for your business is not a one-size-fits-all choice. While vertical integration can provide greater control over the supply chain, cost savings, and improved market power, it also comes with high capital requirements, increased complexity, and reduced flexibility. To determine if it makes sense for your company, it’s essential to evaluate both internal capabilities and external market conditions carefully.

1. Conduct a Cost-Benefit Analysis

The first step is to weigh the expected benefits against the costs and risks. Vertical integration often requires significant investment in acquiring suppliers, distributors, or retail operations, or in developing new facilities internally. A detailed financial analysis can help determine whether the integration will generate sufficient returns, reduce supply chain costs, or improve efficiency enough to justify the investment.

Example: A manufacturer considering acquiring a raw material supplier must calculate potential cost savings versus the acquisition and operational costs.

2. Assess Management Capacity

Vertical integration increases organizational complexity, which demands experienced management with a global business perspective. Companies need managers who can oversee multiple stages of the supply chain, integrate operations seamlessly, and maintain quality and efficiency across all units. Without adequate management expertise, vertical integration can lead to operational inefficiencies and strategic misalignment.

Tip: Consider whether your leadership team has the bandwidth to manage additional operations effectively.

3. Analyze Market Conditions

Evaluate whether vertical integration will provide a competitive advantage in your current market. Industries with unreliable suppliers, high market power held by upstream or downstream players, or frequent supply chain disruptions are often ideal candidates for vertical integration. Conversely, in markets with abundant commodity suppliers and stable distribution networks, the benefits of integration may not outweigh the costs.

Example: A tech company facing supply shortages for critical components may benefit from acquiring upstream suppliers to secure resources and reduce production risks.

4. Decide Between Forward or Backward Integration

Companies must consider which part of the supply chain to integrate. Forward integration involves taking control of distribution or retail to reach customers directly, while backward integration focuses on controlling raw materials or component production. In some cases, a company may pursue balanced integration, controlling both upstream and downstream operations for maximum efficiency and oversight.

Example: Nike integrated forward by opening its own retail stores, while Apple integrated backward by designing its own chips.

5. Ensure Strategic Alignment

Vertical integration should align with the company’s long-term vision and objectives. Expanding into additional supply chain stages should complement the business’s core mission rather than distract from it. Misalignment can dilute focus, reduce innovation, and affect overall business performance.

Tip: Define clear integration goals and regularly review them to ensure they support the broader business strategy.

6. Perform a Risk Assessment

Identify potential operational, financial, and regulatory risks associated with vertical integration. Develop strategies to mitigate these risks, such as phased investments, joint ventures, or partial integration approaches, before committing to full-scale vertical integration.

Example: Tesla’s direct-to-consumer sales model required navigating state-specific dealership laws, highlighting the importance of anticipating regulatory challenges.

7. Scale and Feasibility Considerations

Vertical integration tends to work best for larger firms or those with sufficient scale. Attempting to integrate without the resources or market presence can be costly and inefficient. Start small, explore incremental steps, and expand gradually to ensure stability while building control over the supply chain.

Tip: Evaluate whether acquiring existing units or leveraging current infrastructure is more cost-effective than building new operations from scratch.

In short, vertical integration can be highly beneficial but is not suitable for every business. It requires careful evaluation of costs, management capacity, market conditions, strategic alignment, and risk. Companies that approach vertical integration thoughtfully and strategically are more likely to capture its full potential while avoiding pitfalls.

How Can Deskera ERP Help You with Vertical Integration?

Vertical integration can transform your business — but it also introduces complexities in managing operations, coordinating supply chains, and maintaining data visibility across multiple business units. This is where Deskera ERP becomes a game-changer. By unifying your production, procurement, inventory, sales, and finance operations into a single digital ecosystem, Deskera ERP enables seamless control and collaboration across the entire value chain.

1. Unified Supply Chain Visibility

Vertical integration requires complete transparency from raw material sourcing to end-product delivery. Deskera ERP provides a centralized dashboard that tracks every process in real-time — from supplier performance and inventory levels to production progress and customer orders. This ensures all departments operate from a single source of truth, improving coordination between your upstream and downstream operations.

2. Streamlined Production and Resource Planning

Managing multiple stages of production becomes more efficient with Deskera’s Material Requirements Planning (MRP) module. It automates production scheduling, resource allocation, and material procurement based on real-time demand forecasts. This eliminates overproduction or understocking — two common challenges in vertically integrated systems.

3. Integrated Financial Management

Vertical integration can make accounting and cost allocation complex, especially when multiple business units operate under one umbrella. Deskera ERP offers integrated financial management tools that automatically capture transactions from procurement, manufacturing, and sales processes, ensuring accurate cost tracking and profit analysis across each stage of the value chain.

4. Enhanced Collaboration and Workflow Automation

Deskera ERP simplifies cross-departmental communication through automated workflows and approval hierarchies. Whether coordinating between suppliers and manufacturing or aligning production with sales orders, the system ensures every stakeholder has access to real-time updates.

5. Scalability and Flexibility for Growth

As your business grows and expands into new stages of the supply chain, Deskera ERP scales effortlessly with you. Its modular design allows you to add new business units, production lines, or warehouses without disrupting existing operations.

6. Data-Driven Decision Making

Deskera’s advanced analytics and reporting tools provide actionable insights across your entire vertically integrated structure. With customizable dashboards and AI-powered recommendations, you can monitor KPIs such as production efficiency, supplier performance, and sales margins to make informed strategic decisions.

7. Mobile Accessibility and AI Assistance (David)

With Deskera’s AI assistant, David, and mobile ERP accessibility, managers and teams can access data, approve processes, and make decisions anytime, anywhere. This ensures continuous oversight of operations, even across geographically dispersed facilities or subsidiaries.

In essence, Deskera ERP empowers businesses to achieve the efficiency, control, and agility needed for successful vertical integration. By connecting every operational layer — from procurement to production to distribution — Deskera ensures that integration enhances performance rather than complicates it.

Key Takeaways

- Vertical integration empowers businesses to control multiple stages of their supply chain—reducing dependency on external partners and improving efficiency, quality, and profitability. With strategic execution, it can transform operational structures and drive sustainable competitive advantage.

- Vertical integration involves acquiring or developing control over upstream (suppliers) or downstream (distributors/retailers) operations. By owning more of their supply chain, companies can better manage costs, quality, and delivery while enhancing customer experience and profitability.

- While vertical integration focuses on gaining control along the supply chain, horizontal integration expands market share by acquiring or merging with competitors in the same industry. The choice between the two depends on a company’s strategic priorities—cost control and supply reliability versus market dominance and scalability.

- Companies pursue vertical integration to reduce costs, secure critical inputs, boost operational efficiency, and improve customer experiences. Each driver aims to strengthen the organization’s value chain, enhance agility, and build resilience against market fluctuations or supply disruptions.

- Vertical integration can be classified into forward, backward, and balanced integration, each serving a unique strategic purpose. Forward integration strengthens customer reach and market control, backward integration enhances supply reliability and cost management, while balanced integration combines both to optimize the entire value chain.

- Vertical integration can take various forms—from full integration (owning all supply chain stages) to quasi integration (joint ventures, alliances, or minority investments) and contract-based partnerships (long-term or spot contracts). The degree of integration should align with the organization’s risk tolerance, capital capacity, and strategic goals.

- The key benefits of vertical integration include greater control over the supply chain, reduced operational costs, improved quality assurance, faster time to market, and enhanced market power. By consolidating production and distribution under one umbrella, companies can boost efficiency, minimize risks, and achieve sustainable long-term profitability.

- Despite its benefits, vertical integration carries challenges like high upfront investment, reduced flexibility, managerial complexity, and potential inefficiencies. Companies must carefully evaluate whether the control and cost advantages outweigh these risks before committing to the strategy.

- Deciding to vertically integrate requires a thorough cost-benefit analysis, assessment of management capacity, and understanding of market conditions and business alignment. It’s most effective for firms with stable demand, capital strength, and a clear strategic vision for end-to-end control.

- Deskera ERP simplifies the complexities of vertical integration through unified supply chain visibility, integrated financial management, automated production planning, and AI-driven insights. By centralizing operations across procurement, manufacturing, inventory, and sales, it helps businesses execute integration efficiently and profitably.

Related Articles