Why does the “cheapest” option so often turn out to be the most expensive one? The answer lies in what businesses fail to see at first glance. While purchase price grabs attention, it rarely tells the full story. Hidden costs—implementation, maintenance, downtime, upgrades, and even lost productivity—quietly accumulate over time, reshaping the true value of an investment.

This is where Total Cost of Ownership (TCO) comes in. TCO looks beyond upfront expenses to capture the complete cost of owning, operating, and maintaining an asset or system throughout its lifecycle. Whether you’re evaluating software, machinery, or long-term service contracts, understanding TCO helps decision-makers avoid budget surprises and make financially sound choices grounded in long-term impact rather than short-term savings.

In today’s competitive and tech-driven business environment, TCO has become a critical metric for strategic planning. Organizations are under constant pressure to scale efficiently, control operational costs, and justify investments with measurable outcomes. A clear TCO analysis enables leaders to compare alternatives accurately, assess risk, and align investments with business growth and profitability goals.

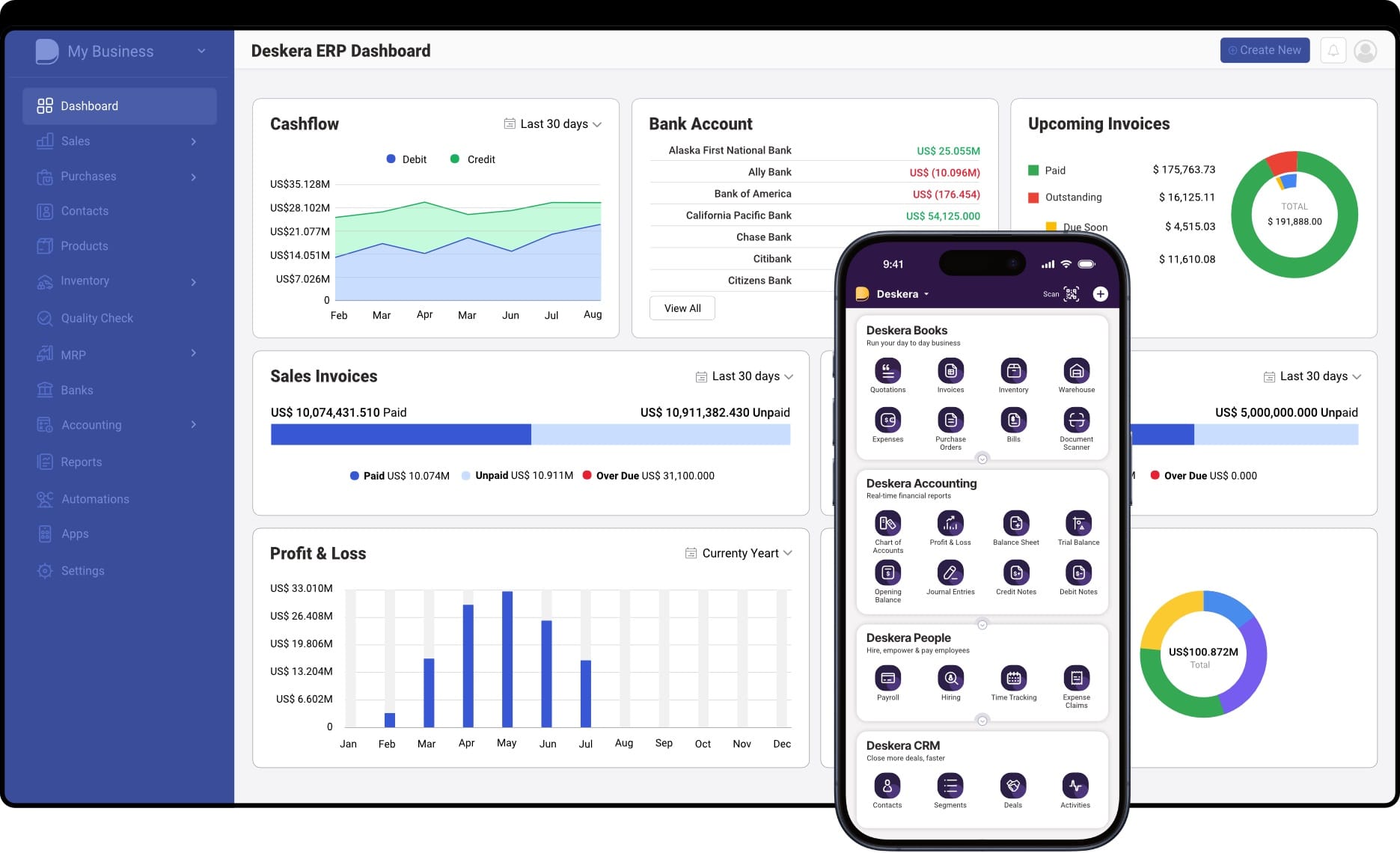

This is where modern ERP solutions like Deskera ERP play a vital role. Deskera helps businesses lower their total cost of ownership by consolidating accounting, inventory, manufacturing, and CRM into a single, integrated platform. With built-in automation, real-time reporting, and scalable features, Deskera reduces manual effort, minimizes errors, and eliminates the hidden costs that often inflate long-term expenses.

What Is Total Cost of Ownership (TCO)?

Total Cost of Ownership (TCO) is a comprehensive financial assessment that goes far beyond an asset’s initial purchase price. It captures all direct and indirect costs associated with owning, operating, maintaining, and eventually disposing of an asset or service over its entire lifecycle. In simple terms, TCO helps businesses understand what something really costs—not just what they pay upfront.

At its core, TCO can be summarized using this formula:

TCO = Acquisition Costs + Operating Costs + Maintenance & Incidental Costs − Residual Value at End of Life

This approach ensures that both visible and hidden expenses are considered, giving decision-makers a far more accurate picture of long-term financial impact.

For physical assets such as machinery, vehicles, or office furnishings, TCO includes the purchase price, financing or interest costs, transportation and installation fees, and ongoing expenses like fuel, insurance, repairs, and routine maintenance.

Over time, these assets may also have resale or scrap value, which offsets part of the total cost. Importantly, assets often become more expensive to maintain as they age—something TCO analysis explicitly accounts for.

When it comes to business applications and software, such as ERP systems or cloud-based SaaS platforms, TCO extends well beyond subscription fees. It includes implementation and setup costs, customization, data migration, system integrations, user training, support contracts, and add-on expenses like storage or professional services.

For on-premises software, infrastructure investments and IT staffing also play a role. Typically, software TCO is assessed over three to five years, while larger capital assets may require a five- to ten-year horizon to capture their full economic impact.

Ultimately, the goal of calculating TCO is to move past surface-level pricing and evaluate long-term value. By understanding the full lifecycle cost, businesses can make smarter purchasing decisions, compare alternatives more effectively (such as buying vs. leasing or on-premises vs. cloud), and ensure that investments truly align with operational needs and financial goals.

Key Components of Total Cost of Ownership

Understanding Total Cost of Ownership (TCO) requires breaking it down into the individual cost elements that accumulate over an asset’s entire lifecycle.

These components include both direct and indirect costs, many of which are often overlooked during initial purchase decisions.

By evaluating each cost category separately, businesses gain a clearer, more realistic view of what owning and operating an asset or system truly entails.

Acquisition Costs

Acquisition costs represent the upfront expenses required to obtain an asset or service. This typically includes the purchase price, licensing fees, financing or interest charges, and any taxes or duties involved.

For physical assets, acquisition may also involve transportation and delivery costs, while for software, it may include initial subscription or license fees.

Implementation and Setup Costs

These costs arise when putting the asset into operation. For equipment, this can include installation, configuration, and testing.

In the case of software or ERP systems, implementation costs often involve customization, data migration, system integrations, and deployment efforts required to make the solution fully functional.

Operating Costs

Operating costs are the recurring expenses associated with day-to-day usage. For physical assets, this includes fuel, electricity, consumables, and insurance.

For software, operating costs may involve recurring subscription fees, cloud usage charges, bandwidth costs, or additional fees based on consumption or user count.

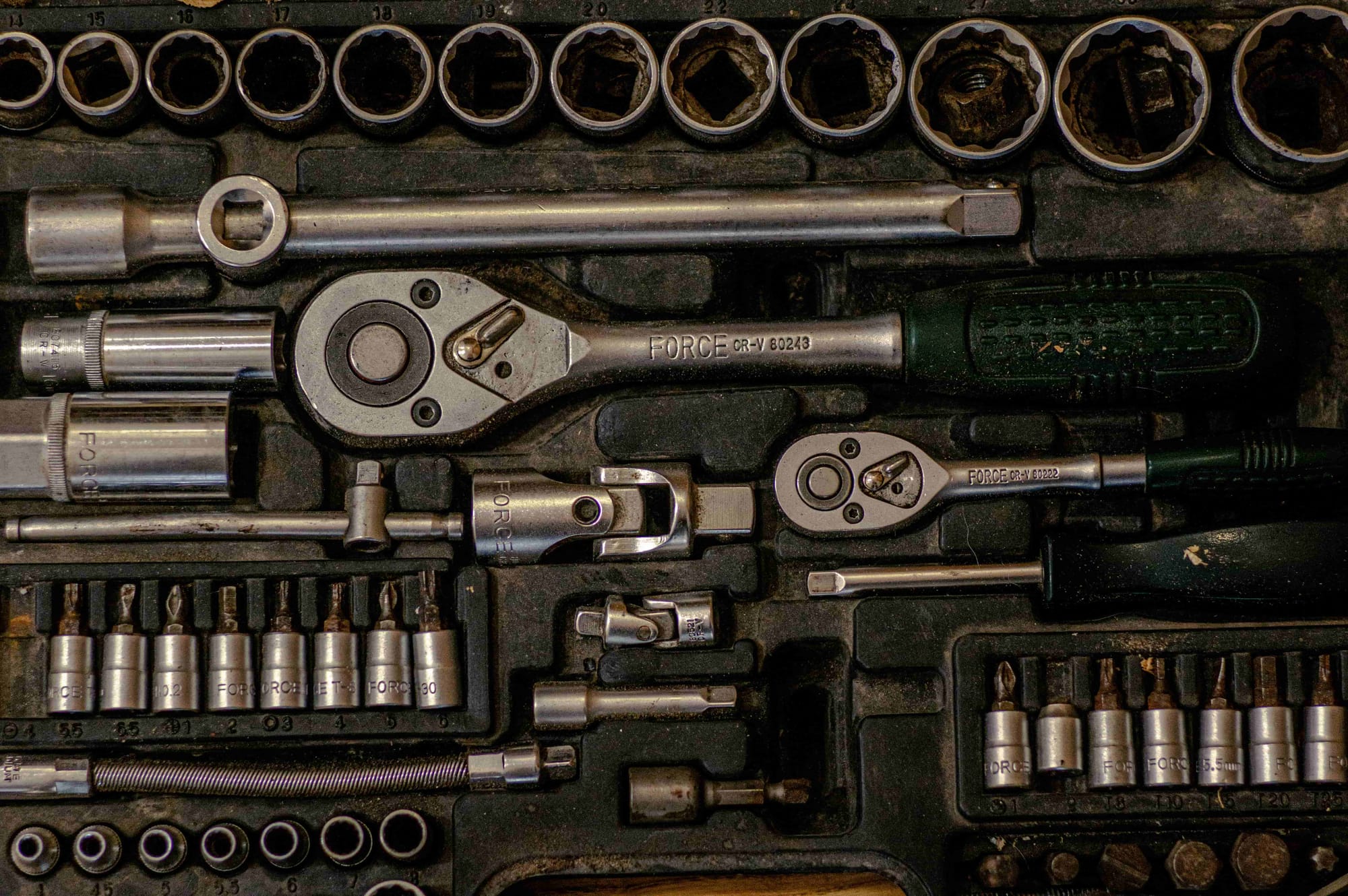

Maintenance and Support Costs

Maintenance costs cover the expenses required to keep the asset running efficiently over time. This includes routine servicing, repairs, spare parts, software updates, patches, and technical support. As assets age or systems scale, these costs often increase and can significantly impact overall TCO.

Training and Productivity Costs

Training costs account for the time and resources spent enabling employees to use the asset effectively. This may include formal training programs, onboarding sessions, documentation, or lost productivity during learning periods. Complex systems can also lead to inefficiencies if user adoption is slow or workflows are poorly designed.

Downtime and Risk-Related Costs

Downtime can be one of the most underestimated components of TCO. System failures, equipment breakdowns, or software outages can result in lost revenue, delayed operations, and reputational damage. Risk-related costs may also include compliance penalties, security breaches, or data loss.

Scalability and Upgrade Costs

As business needs evolve, assets often require upgrades or expansion. These costs include hardware replacements, software upgrades, additional licenses, or increased infrastructure capacity. Solutions that are difficult to scale can drive up long-term costs and limit operational flexibility.

End-of-Life and Disposal Costs

At the end of an asset’s useful life, businesses may incur disposal, decommissioning, or data removal costs. For physical assets, this could involve recycling or resale, while for software, it may include migration costs to a new system. Any residual or resale value should be deducted from the total cost, as it helps offset overall ownership expenses.

By considering each of these components, organizations can calculate TCO more accurately and make investment decisions based on long-term value rather than short-term cost savings.

How to Calculate Total Cost of Ownership

Calculating Total Cost of Ownership (TCO) is about understanding the complete financial impact of an asset or service over a defined period—not just its upfront price.

A structured TCO calculation helps businesses uncover hidden costs, compare alternatives fairly, and make long-term, value-driven decisions. While the exact components may vary by asset type, the process follows a clear and logical framework.

Step 1: Define the Timeframe for Analysis

The first step is deciding the period over which TCO will be calculated. This depends on the nature of the asset and its expected useful life. For technology investments like ERP or SaaS platforms, a three- to five-year timeframe is common.

For capital-intensive assets such as machinery or vehicles, five to ten years may be more appropriate. Choosing the right timeframe ensures costs are neither underestimated nor overstretched.

Step 2: Identify Acquisition Costs

Next, list all upfront costs required to acquire the asset or service. This includes the purchase price, licensing or subscription fees, financing or interest charges, taxes, transportation, and installation. For software, acquisition costs may also include initial setup or onboarding fees.

Step 3: Estimate Operating Costs

Operating costs cover the recurring expenses needed to use the asset on a day-to-day basis. These may include fuel, electricity, insurance, cloud usage fees, bandwidth charges, or subscription renewals. Accurately estimating these ongoing costs is critical, as they often make up a large portion of TCO over time.

Step 4: Account for Maintenance and Support Costs

Maintenance and support costs include routine servicing, repairs, upgrades, technical support, and software updates. For physical assets, maintenance expenses typically increase as the asset ages. For software, support contracts, patches, and version upgrades should be factored in throughout the analysis period.

Step 5: Include Training and Productivity Costs

Training costs capture the time and resources required to help users adopt and use the asset effectively. This may involve formal training sessions, documentation, onboarding time, or temporary productivity losses during the learning phase—especially relevant for complex systems like ERP software.

Step 6: Factor in Downtime and Risk Costs

Downtime-related costs arise from system failures, breakdowns, or service disruptions that impact operations. These can translate into lost revenue, delayed deliveries, or customer dissatisfaction. Risk-related costs—such as compliance penalties, security incidents, or data loss—should also be considered where applicable.

Step 7: Add Scalability and Upgrade Costs

As business needs evolve, additional investments may be required to scale or upgrade the asset. This can include purchasing additional licenses, expanding infrastructure, upgrading hardware, or investing in enhanced features. Assets that are difficult to scale often result in higher long-term costs.

Step 8: Subtract Residual or End-of-Life Value

Finally, deduct any value that can be recovered at the end of the asset’s lifecycle. For physical assets, this may be resale or scrap value. For software, it could include avoided costs due to smooth migration or contract flexibility. Subtracting this amount helps arrive at a more accurate net TCO.

By systematically adding all relevant costs and subtracting end-of-life value, businesses can calculate TCO with confidence. This holistic approach enables more accurate comparisons between alternatives and supports smarter, long-term investment decisions.

Total Cost of Ownership vs Total Cost of Acquisition (TCA)

When evaluating business investments, Total Cost of Ownership (TCO) and Total Cost of Acquisition (TCA) are often used interchangeably—but they measure very different things.

Understanding the distinction between the two is essential for making informed, long-term purchasing decisions.

What Is Total Cost of Acquisition (TCA)?

Total Cost of Acquisition focuses exclusively on the costs incurred to acquire an asset or service. It captures expenses from the point of evaluation up to the moment the asset is ready for use. TCA is useful for understanding initial budget requirements but stops short of evaluating long-term impact.

Typical TCA components include purchase price, licensing or subscription fees, taxes, shipping, installation, setup, and initial onboarding or implementation costs.

What Is Total Cost of Ownership (TCO)?

Total Cost of Ownership goes beyond acquisition and examines the entire lifecycle cost of an asset. It includes all costs from purchase through operation, maintenance, upgrades, downtime, and eventual disposal or replacement—minus any residual value at the end of life.

TCO provides a comprehensive view of what an asset truly costs over time, making it far more valuable for strategic planning and long-term investment decisions.

Key Differences Between TCO and TCA

The primary difference lies in scope and timeframe. TCA looks at short-term, upfront expenses, while TCO evaluates long-term, ongoing costs. TCA answers the question, “How much will it cost to get this?” whereas TCO answers, “How much will this cost us over its useful life?”

Because TCA excludes operational and indirect costs, it can make lower-priced options appear more attractive—even if they result in higher expenses over time.

When to Use TCA vs TCO

TCA is most useful during early-stage budgeting or procurement planning, where understanding initial cash outlay is critical. However, relying on TCA alone can lead to poor investment choices.

TCO should be used when comparing alternatives, evaluating technology or capital investments, and planning for long-term financial sustainability. In most cases, businesses benefit from using TCA as a starting point and TCO as the final decision-making metric.

Why TCO Provides a More Accurate Cost Picture

By accounting for hidden and recurring expenses, TCO helps organizations avoid budget overruns, reduce risk, and select options that deliver the best value over time. While TCA shows what you pay today, TCO reveals what you’ll pay overall—making it the smarter metric for strategic decision-making.

TCO in Different Business Contexts

Total Cost of Ownership (TCO) is not a one-size-fits-all metric. Its importance and composition vary depending on the type of investment, industry, and operational environment. By applying TCO analysis across different business contexts, organizations can make smarter decisions that balance cost, performance, and long-term value.

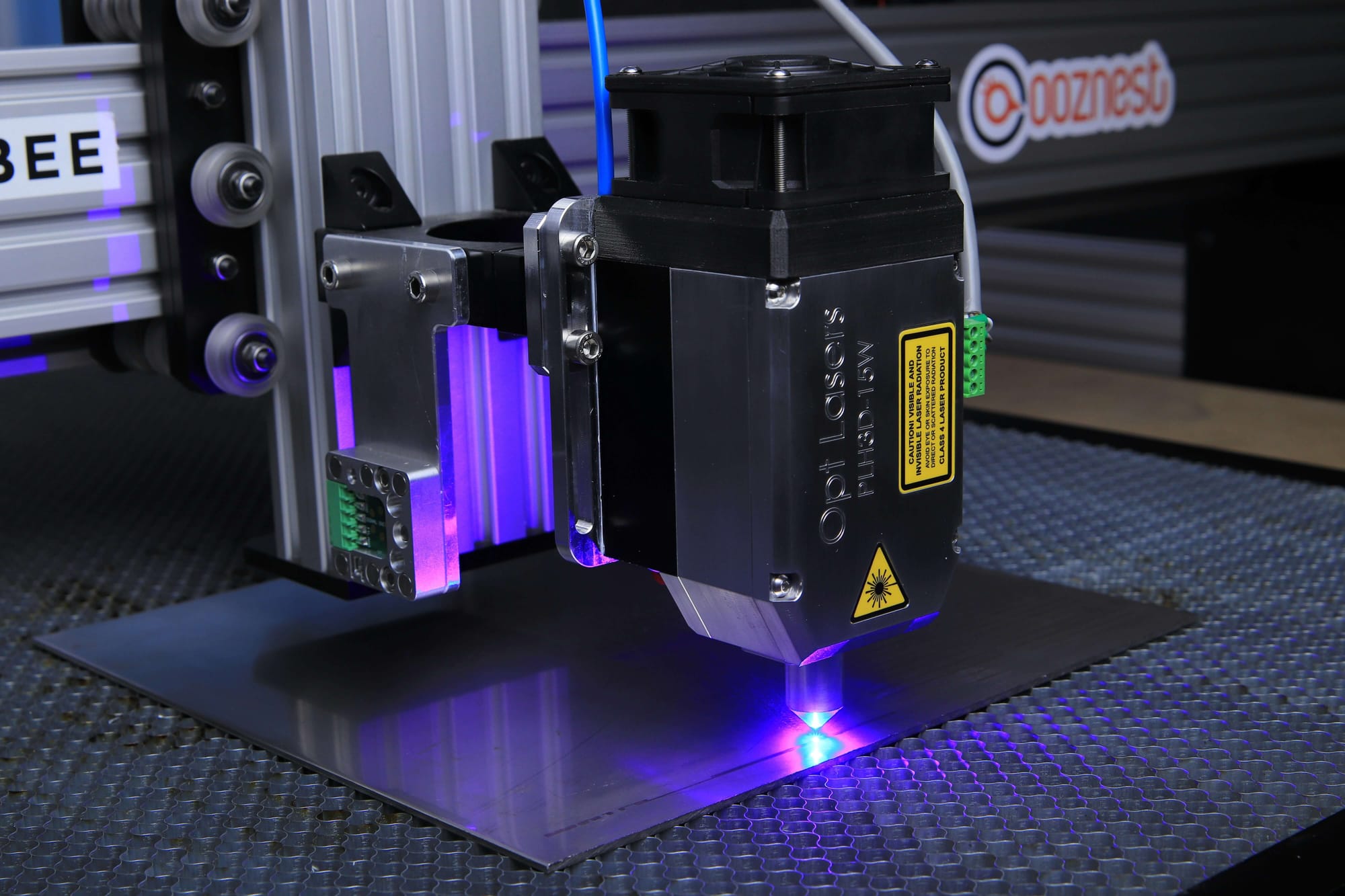

TCO in IT and Technology Investments

In IT environments, TCO extends far beyond the purchase of hardware or software licenses. It includes infrastructure costs, implementation, integration, cybersecurity measures, ongoing maintenance, upgrades, energy consumption, and IT staffing.

Downtime, system reliability, and user productivity also play a significant role. TCO analysis helps businesses compare on-premises, cloud, and hybrid solutions more accurately.

TCO in ERP and Business Software

For ERP and enterprise applications, TCO includes implementation costs, customization, data migration, user training, support contracts, and scalability expenses.

Cloud-based ERP solutions often reduce infrastructure and maintenance costs, while integrated platforms lower expenses related to system integrations and fragmented workflows. Evaluating ERP TCO over three to five years provides a realistic picture of long-term value.

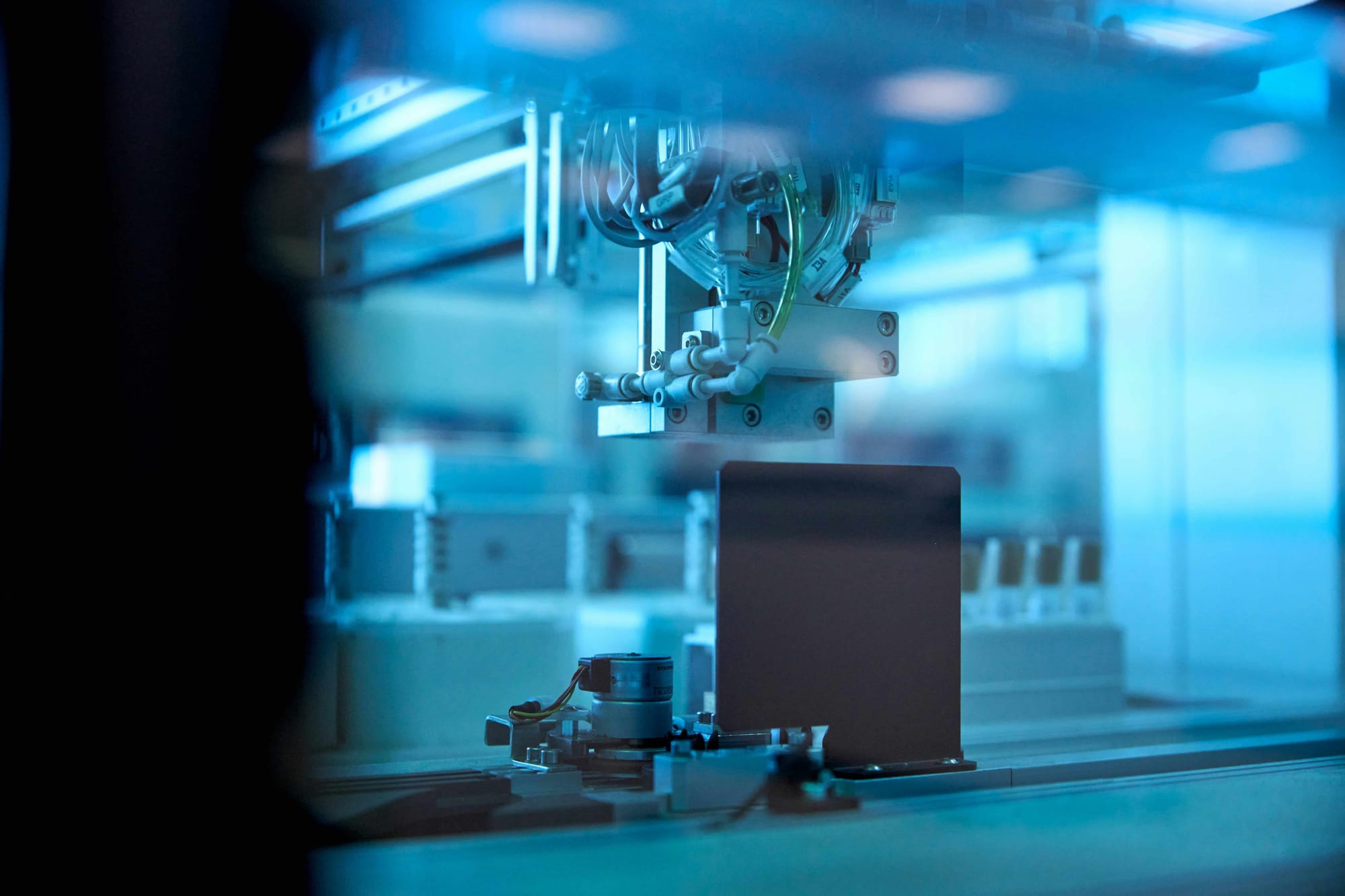

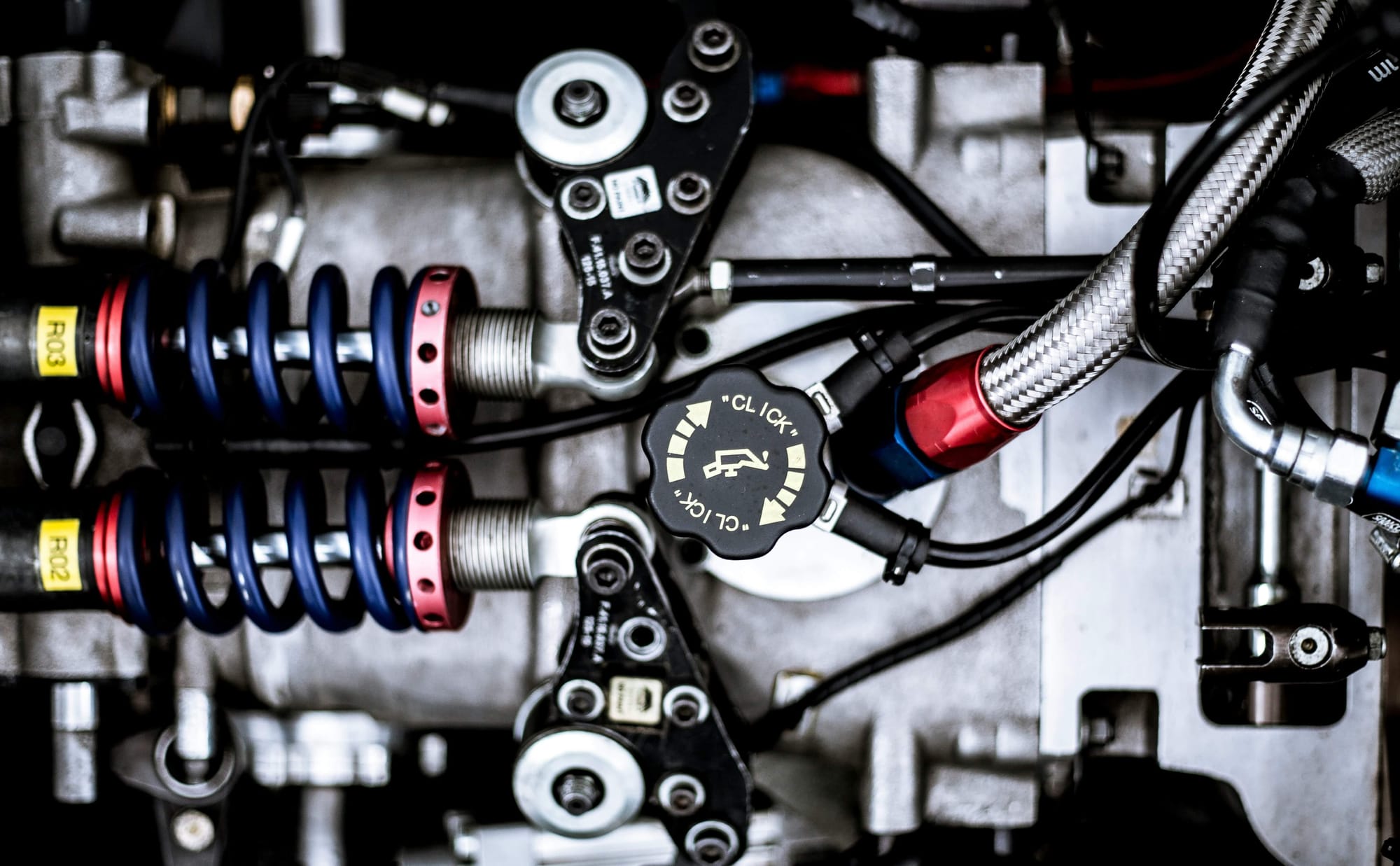

TCO in Manufacturing and Operations

In manufacturing, TCO is commonly used to assess machinery, equipment, and production systems. Beyond the purchase price, it includes installation, energy usage, routine maintenance, spare parts, downtime, safety compliance, and end-of-life disposal. Older equipment may appear cheaper initially but often carries higher maintenance and downtime costs over time.

TCO in Procurement and Vendor Selection

Procurement teams use TCO to evaluate suppliers and vendors more holistically. This includes not only pricing but also delivery reliability, quality, service levels, contract flexibility, and risk exposure. A vendor with higher upfront costs may offer lower TCO through better support, fewer defects, and reduced operational disruptions.

TCO in Logistics and Transportation

For logistics and fleet management, TCO covers vehicle acquisition, financing, fuel, insurance, maintenance, driver training, taxes, and resale value.

It also accounts for indirect costs such as downtime, route inefficiencies, and compliance penalties. Comparing ownership versus leasing using TCO helps businesses choose the most cost-effective model.

TCO in Cloud and Hybrid Environments

In cloud-first or hybrid setups, TCO helps organizations understand trade-offs between flexibility and cost. While cloud solutions reduce upfront infrastructure investments, they may introduce usage-based fees, data egress charges, and connectivity costs. TCO analysis ensures these variable expenses are factored in alongside scalability and performance benefits.

By evaluating TCO within these different business contexts, organizations can move beyond surface-level pricing and make investment decisions that align with operational needs, financial goals, and long-term growth strategies.

Common Mistakes Businesses Make When Analyzing TCO

While Total Cost of Ownership (TCO) is a powerful decision-making tool, it is often miscalculated or misunderstood in practice.

These mistakes can lead to underestimated costs, poor investment choices, and budget overruns. Recognizing the most common pitfalls helps businesses conduct more accurate and reliable TCO analyses.

Focusing Only on Upfront Costs

One of the most common mistakes is treating TCO like a purchase-price comparison. Many businesses prioritize the lowest initial cost and ignore long-term operating, maintenance, and support expenses.

This often results in choosing options that appear affordable initially but become significantly more expensive over time.

Overlooking Hidden and Indirect Costs

Indirect costs such as employee training, productivity loss during onboarding, system downtime, and internal IT effort are frequently excluded from TCO calculations. These hidden costs can quietly add up and materially impact the total financial outcome of an investment.

Using an Unrealistic Timeframe

Selecting a timeframe that is too short—or too long without reliable data—can distort TCO results.

A short horizon may fail to capture maintenance spikes or upgrade cycles, while overly long projections can introduce inaccurate assumptions. The timeframe should align with the asset’s realistic useful life.

Underestimating Maintenance and Support Expenses

Maintenance costs tend to increase over time, especially for aging equipment or heavily customized software. Businesses often assume flat or minimal maintenance expenses, leading to inaccurate long-term cost projections.

Ignoring Scalability and Future Growth

Failing to account for growth-related costs is another frequent mistake. As businesses scale, they may need additional licenses, infrastructure, storage, or upgrades. Solutions that are inexpensive at small scale can become costly or restrictive as requirements evolve.

Excluding Downtime and Risk-Related Costs

Downtime, performance issues, security risks, and compliance penalties are often treated as unlikely or intangible and therefore excluded. In reality, even brief disruptions can lead to revenue loss, customer dissatisfaction, and reputational damage—all of which should be reflected in TCO.

Comparing Solutions Using Different Assumptions

TCO comparisons become unreliable when different options are evaluated using inconsistent assumptions. Variations in timeframes, usage levels, or cost categories can skew results and lead to biased conclusions. A standardized approach is essential for fair comparisons.

Treating TCO as a One-Time Exercise

Many businesses calculate TCO only during the initial purchase decision and never revisit it. However, costs evolve due to changes in usage, pricing, or business needs. TCO should be reviewed periodically to ensure continued alignment with financial and operational goals.

Avoiding these common mistakes allows organizations to use TCO as it was intended—a practical framework for understanding true costs and making smarter, long-term investment decisions.

Benefits of Using TCO for Decision-Making

Total Cost of Ownership (TCO) provides a structured way for leaders to look beyond surface-level pricing and evaluate the true long-term value of an investment.

By accounting for both visible and hidden costs across an asset’s entire lifecycle, TCO enables more informed, objective, and strategically aligned business decisions.

More Accurate Assessment of Total Asset Cost

TCO delivers complete cost visibility by capturing all cost drivers, including acquisition, operation, maintenance, and end-of-life expenses.

While direct costs are easy to identify, TCO also brings hidden and indirect costs—such as utilities, maintenance overhead, data egress fees, or internal labor—into the analysis. This results in a far more realistic understanding of what an asset or service actually costs over time.

Stronger Understanding of Business Value and ROI

By revealing full lifecycle costs, TCO creates greater transparency and supports a clearer evaluation of return on investment (ROI).

Decision-makers can better assess whether a product or service delivers enough business value to justify its total cost, rather than being misled by low upfront pricing.

In technology and IT investments, this encourages efficiency-focused procurement and smarter asset management.

More Informed and Objective Decision-Making

TCO enables procurement and finance teams to compare alternatives based on long-term value, not just short-term affordability.

It incorporates opportunity costs, adoption effort, and operational impact—factors that are often difficult to quantify but critical to decision quality.

This precision helps organizations avoid decisions driven solely by initial price and instead choose options that align with overall business goals.

Improved Budgeting and Forecasting

Because TCO considers costs over multiple years, it supports more accurate financial forecasting and scenario planning. Organizations can anticipate future expenses, plan budgets more effectively, and reduce the risk of unexpected cost overruns. This is especially valuable for large technology or capital investments where costs evolve over time.

Better Strategic Planning and Resource Allocation

A comprehensive TCO analysis strengthens long-term planning by highlighting where resources are being consumed and where inefficiencies exist. It helps businesses extend asset lifecycles, reduce waste, and allocate budgets toward solutions that deliver sustained value. In IT and operations, this leads to more strategic lifecycle management and improved financial performance.

Greater Supplier Accountability and Risk Control

TCO allows businesses to evaluate suppliers based on cost-to-serve and value delivered over time, not just contract pricing. It also helps identify potential future risks such as downtime, compliance issues, or service disruptions, enabling proactive risk mitigation and more resilient vendor relationships.

By using TCO as a decision-making framework, organizations gain clarity, reduce financial risk, and make investments that support long-term growth rather than short-term savings.

TCO Methodologies and Analytical Models

Calculating Total Cost of Ownership effectively requires more than listing costs—it depends on using the right analytical methodologies to uncover hidden expenses, allocate costs accurately, and forecast long-term financial impact.

Different TCO models serve different decision-making needs, from procurement and sourcing to technology and capital investment planning.

Activity-Based Costing (ABC)

Activity-Based Costing allocates indirect costs—such as logistics, quality assurance, inspections, and administrative overhead—to the specific activities or suppliers that generate them.

Instead of spreading overhead evenly, ABC provides a more precise view of where costs truly originate. This method is particularly useful in procurement and supply chain decisions, where indirect costs can significantly influence overall ownership cost.

Should-Cost Modeling

Should-cost modeling estimates what a product or service should reasonably cost based on inputs such as materials, labor, overhead, and profit margins.

By using industry benchmarks and cost components, this model helps businesses assess whether supplier pricing is fair and sustainable.

It is commonly used in vendor negotiations and sourcing strategies to prevent overpaying and improve cost transparency.

Lifecycle Costing (LCC)

Lifecycle Costing evaluates costs across the entire operational lifespan of an asset—from acquisition and implementation to operation, maintenance, and disposal.

LCC is closely aligned with TCO and is especially relevant for capital-intensive assets like machinery, vehicles, and infrastructure. It helps organizations compare alternatives that have different upfront and long-term cost profiles.

Scenario Modeling

Scenario modeling compares multiple sourcing or investment options by simulating different conditions and assumptions.

For example, businesses may evaluate offshore versus local suppliers, buying versus leasing, or on-premises versus cloud deployment.

This approach highlights how changes in labor costs, transportation, risk exposure, or demand volatility can impact total ownership cost under different scenarios.

Predictive Cost Analytics

Predictive cost analytics leverages data, AI, and advanced forecasting techniques to anticipate future cost drivers. This model helps organizations predict factors such as inflation, warranty claims, maintenance spikes, regulatory changes, or supply chain disruptions. By incorporating predictive insights into TCO calculations, businesses can make more resilient decisions and better prepare for uncertainty.

By combining these TCO methodologies and analytical models, organizations gain deeper cost visibility, stronger forecasting capabilities, and a more strategic foundation for long-term investment and sourcing decisions.

How to Reduce Total Cost of Ownership (TCO)

Once you understand Total Cost of Ownership, the real value comes from actively reducing it. Lowering TCO isn’t about cutting corners or chasing the lowest upfront price—it’s about building smarter habits that keep costs visible, controlled, and aligned with long-term business goals. Small, consistent optimizations often compound into significant savings over time.

Automate Repetitive and Manual Work

Automation is one of the most effective ways to reduce TCO. Manual processes consume time, introduce errors, and require ongoing labor costs.

By automating routine workflows—such as data entry, approvals, reporting, and inventory updates—businesses can reduce operating expenses and improve efficiency.

Regularly reviewing workflows and eliminating steps that no longer add value further drives down long-term costs.

Use Cloud Tools Strategically

Cloud solutions can significantly reduce TCO by eliminating the need for physical hardware, infrastructure maintenance, and energy consumption. However, unmanaged cloud usage can quickly inflate costs.

To keep TCO low, businesses should right-size subscriptions, monitor usage patterns, and avoid paying for excess storage, users, or features that go unused.

Simplify Vendor and Support Management

Managing multiple vendors often leads to overlapping licenses, inconsistent service levels, and hidden support costs.

Consolidating vendors, aligning service-level agreements (SLAs), and standardizing tools reduces administrative overhead and long-term spend.

Fewer vendors also mean easier integrations, simpler training, and lower support complexity.

Prioritize Long-Term Value When Choosing Technology

Low-cost solutions may appear attractive initially but often lead to higher TCO through downtime, poor scalability, and integration challenges.

Investing in reliable, well-supported technology reduces rework, training effort, and system failures over time. A slightly higher upfront cost can result in substantial savings across the asset’s lifecycle.

Track Usage and Eliminate Waste

Unused licenses, underutilized features, and legacy systems quietly increase TCO. Regularly tracking adoption and usage helps identify waste and reclaim unnecessary spend. Planning upgrades or replacements well before renewal dates also prevents rushed decisions that often lead to higher long-term costs.

Standardize and Integrate Systems

Disparate systems increase TCO through integration complexity, duplicate data entry, and fragmented workflows. Standardizing platforms and choosing integrated solutions reduces operational friction, lowers support costs, and improves visibility across the organization.

Reducing TCO is an ongoing process, not a one-time initiative. By focusing on automation, smart cloud usage, vendor consolidation, and long-term value, businesses can turn technology and assets into predictable, cost-efficient investments that support sustainable growth.

Best Practices for Optimizing TCO Calculations

Total Cost of Ownership calculations don’t have to be overly complex—but they do need to be deliberate, consistent, and aligned with how your organization actually uses technology.

Following proven best practices helps uncover hidden expenses, improve accuracy, and turn TCO into a practical decision-making tool rather than a theoretical exercise.

Tailor TCO to Real Usage Patterns

Avoid one-size-fits-all assumptions. TCO should reflect how your teams truly use systems, not how vendors or benchmarks assume they are used.

Adjust cost inputs based on user adoption, transaction volumes, support intensity, and operational dependency to ensure the analysis mirrors reality.

Use AI and Predictive Analytics

Traditional TCO models often capture only visible costs, missing subtle inefficiencies.

AI-driven insights can identify patterns such as idle licenses, underutilized features, or recurring maintenance spikes that are difficult to detect manually.

Predictive analytics also helps forecast future expenses—turning TCO from a static snapshot into a forward-looking planning tool.

Include Sustainability and ESG Factors

Technology choices carry environmental and social costs that are frequently overlooked.

Incorporating energy consumption, carbon emissions, hardware lifespan, and disposal impact into TCO calculations highlights costs that go beyond accounting lines.

Factoring in sustainability not only supports compliance and ESG goals but can also uncover long-term cost savings and enhance brand credibility.

Account for Vendor Lock-In Risks

Low upfront pricing can mask long-term dependency. Proprietary systems, restrictive contracts, or limited integration options can increase future migration, upgrade, or switching costs.

Including vendor lock-in risk in TCO forces decision-makers to weigh flexibility and control against short-term savings—helping preserve negotiating power over the asset’s lifecycle.

Follow a Standardized TCO Framework

Ad hoc or inconsistent TCO estimates often hide real costs and lead to internal debates. A standardized framework ensures acquisition, operational, support, and retirement costs are captured consistently across projects.

This makes comparisons easier, highlights cost outliers, and strengthens the credibility of TCO as a strategic metric rather than a checkbox exercise.

Review and Update TCO Regularly

TCO should not be calculated once and forgotten. Usage patterns, pricing models, and business needs evolve over time. Periodic reviews ensure assumptions remain valid and help organizations course-correct before costs escalate.

By applying these best practices, organizations can optimize TCO calculations, improve cost transparency, and use TCO as a reliable foundation for smarter, long-term investment decisions.

TCO vs ROI: How They Work Together

Total Cost of Ownership (TCO) and Return on Investment (ROI) are often viewed as separate metrics, but they are most powerful when used together.

While TCO focuses on understanding costs, ROI evaluates the value generated from those costs. Combining both provides a balanced, financially sound approach to decision-making.

Understanding the Difference Between TCO and ROI

TCO answers the question, “What will this investment truly cost over time?” It captures all direct and indirect expenses across the asset’s lifecycle, from acquisition and operation to maintenance and disposal.

ROI, on the other hand, answers, “What value or return will we gain from this investment?” It measures benefits such as revenue growth, cost savings, productivity gains, or efficiency improvements relative to the investment made.

Why TCO Should Be Calculated Before ROI

Accurate ROI calculations depend on a clear understanding of costs. If TCO is underestimated, ROI will appear inflated and misleading. Calculating TCO first ensures that all expenses—especially hidden and long-term costs—are included before projecting returns. This sequence leads to more realistic and defensible ROI estimates.

How TCO Improves the Quality of ROI Analysis

By providing a complete cost baseline, TCO allows ROI calculations to focus on net value, not assumptions. It helps decision-makers distinguish between options that deliver genuine long-term benefits and those that simply shift costs to later periods. As a result, ROI becomes a more reliable indicator of business impact.

Using TCO and ROI Together for Smarter Decisions

When used together, TCO and ROI enable organizations to compare investments on both cost efficiency and value creation. An option with a higher upfront cost may have a better ROI if its TCO is lower over time or if it generates greater strategic benefits. Conversely, a low-TCO option with minimal returns may not justify the investment.

Applying TCO and ROI in Strategic Planning

In strategic planning, TCO helps control costs and reduce financial risk, while ROI highlights growth and performance potential. Together, they support informed trade-offs, better prioritization of initiatives, and investments that align with both financial discipline and long-term business objectives.

In short, TCO provides the cost foundation, and ROI measures the reward. Used together, they offer a complete framework for evaluating investments based on both what they cost and what they deliver.

When Should Businesses Perform a TCO Analysis?

Total Cost of Ownership (TCO) analysis is most valuable when businesses are making decisions that will impact costs over an extended period. Rather than being a one-time exercise, TCO should be applied at key moments where long-term financial clarity and risk reduction matter most.

Before Making Major Purchases or Investments

TCO analysis should be conducted before purchasing high-value assets such as equipment, software, or infrastructure. This helps decision-makers understand long-term operating and maintenance costs upfront and avoid choosing options that appear affordable initially but become expensive over time.

During Vendor or Supplier Comparisons

When evaluating multiple vendors or solution providers, TCO enables fair, apples-to-apples comparisons. Instead of focusing only on pricing, businesses can assess total lifecycle costs, service quality, scalability, and risk—leading to more informed vendor selection.

When Implementing or Replacing Technology

TCO is especially critical when adopting new technology or replacing legacy systems. It helps organizations compare on-premises versus cloud models, assess migration and training costs, and understand the long-term impact of integration, support, and scalability requirements.

During Budgeting and Long-Term Financial Planning

Incorporating TCO into budgeting processes improves multi-year forecasting and resource allocation. It allows finance and leadership teams to anticipate future expenses, reduce unexpected cost spikes, and align investments with strategic priorities.

When Scaling Operations or Expanding the Business

As businesses grow, costs related to licenses, infrastructure, staffing, and support often increase. Performing a TCO analysis before scaling ensures systems and assets can grow cost-effectively without creating financial or operational bottlenecks.

When Evaluating Buy vs. Lease or Outsource Decisions

TCO analysis is essential when deciding whether to buy, lease, or outsource assets and services. It helps compare capital expenditure versus operational expenditure models and determine which option delivers better long-term value.

Periodically for Existing Assets and Systems

TCO should also be revisited periodically for assets already in use. Changes in pricing, usage patterns, or business needs can alter cost dynamics. Regular reviews help identify optimization opportunities, justify upgrades, or signal when replacement is more cost-effective.

By performing TCO analysis at these key decision points, businesses gain clearer cost visibility, reduce financial risk, and make investments that support sustainable, long-term success.

How Deskera ERP Helps Reduce Total Cost of Ownership (TCO)

Reducing Total Cost of Ownership (TCO) isn’t just about lowering upfront expenses—it’s about streamlining operations, eliminating hidden costs, and improving efficiency across the business. Deskera ERP, as a modern cloud-based enterprise resource planning solution, helps businesses reduce their TCO in multiple ways by centralizing processes, automating workflows, and lowering ongoing operational costs.

Lowers Upfront and Infrastructure Costs

Deskera ERP’s cloud-based subscription model eliminates the need for large investments in on-premises hardware, servers, and IT maintenance infrastructure. Instead of capital expenditures on equipment and system administration, businesses pay a predictable, pay-as-you-go subscription—making it easier to manage cash flow and reduce initial TCO.

Reduces IT Maintenance and Support Overhead

With Deskera, software updates, patches, backups, and security maintenance are handled by the provider. This shifts the burden of system upkeep away from internal IT teams, reducing ongoing maintenance costs and the need for dedicated IT staff. Regular automatic updates also ensure the system stays current without costly upgrade projects.

Streamlines Processes Through Automation

Deskera ERP integrates a wide range of business functions—including finance, inventory, CRM, sales, and HR—into a single platform. This automation of routine tasks (e.g., billing, invoicing, inventory tracking) minimizes manual work, reduces errors, and boosts productivity. Fewer manual processes mean lower operating costs and faster workflows, which translate into tangible TCO savings.

Improves Visibility and Decision-Making

Real-time consolidated data and advanced reporting tools help leaders make informed decisions quickly, reducing inefficiencies that drive up costs. With accurate visibility into inventory, expenses, and operations, companies can optimize resource allocation and avoid waste.

Scales with Business Growth

A scalable ERP solution like Deskera allows businesses to add modules or users only as needed, preventing over-investment in unused features. This adaptability ensures that TCO grows in line with actual business requirements rather than fixed, inflexible licenses.

Enhances Collaboration and Reduces Redundancy

By centralizing data from across departments, Deskera eliminates the need for multiple standalone systems and redundant data entry. This reduces software licensing costs and decreases the time employees spend reconciling information between siloed systems.

Enables Better Financial Control and Planning

Deskera’s financial management and budgeting features help teams track expenses, enforce policies, and forecast future costs more accurately. Better expense control reduces surprises and improves planning, further lowering the risk of hidden long-term costs.

By combining cloud efficiency, automation, real-time insights, and scalable growth, Deskera ERP helps organizations significantly reduce the total cost of ownership while improving operational performance and long-term value.

Key Takeaways

- Total Cost of Ownership (TCO) reveals the true cost of an asset by accounting for all direct, indirect, and long-term expenses—not just the upfront price.

- Breaking TCO into components such as acquisition, operations, maintenance, training, risk, and end-of-life costs helps businesses uncover expenses that are often overlooked.

- Calculating TCO requires defining the right timeframe, identifying all cost categories, and subtracting residual value to arrive at a realistic lifecycle cost.

- Unlike Total Cost of Acquisition (TCA), which focuses only on upfront spending, TCO provides a complete picture of long-term financial impact and value.

- Applying TCO across different contexts—such as IT, ERP, manufacturing, procurement, logistics, and cloud environments—enables more accurate, situation-specific decision-making.

- Common TCO mistakes, including ignoring hidden costs, using unrealistic timeframes, and overlooking scalability, can significantly distort investment decisions.

- Using TCO for decision-making improves cost visibility, strengthens ROI analysis, enhances budgeting accuracy, and supports long-term strategic planning.

- TCO methodologies like activity-based costing, lifecycle costing, scenario modeling, and predictive analytics help organizations analyze costs more precisely and proactively.

- Reducing TCO depends on smarter operational habits such as automation, cloud optimization, vendor consolidation, usage tracking, and long-term technology planning.

- Optimizing TCO calculations requires standardized frameworks, AI-driven insights, sustainability considerations, and an awareness of vendor lock-in risks.

- TCO and ROI work best together, with TCO establishing the true cost baseline and ROI measuring the value generated from that investment.

- Businesses should perform TCO analysis before major purchases, during vendor comparisons, when scaling operations, and periodically for existing systems.

- Deskera ERP helps reduce TCO by consolidating systems, automating workflows, lowering infrastructure and maintenance costs, and scaling efficiently with business growth.

Related Articles