In times of economic uncertainty, access to credit can become limited, leaving businesses with little room to maneuver financially. Tight credit markets—often caused by rising interest rates, inflationary pressures, or stricter lending policies—can significantly strain a company’s cash flow.

For business leaders, managing working capital effectively is no longer just a financial best practice; it’s a strategic necessity. The ability to maintain liquidity and meet short-term obligations without relying heavily on external financing determines how well a company can weather such economic pressures.

Working capital, in essence, represents the balance between a company’s current assets and current liabilities. The working capital ratio, a key liquidity indicator, helps measure this balance. A healthy ratio is typically between 1.50 and 1.75 for every $1 of current liabilities, indicating that a business has sufficient resources to cover its short-term debts.

Conversely, a ratio below 1.0 signals potential liquidity problems, while a ratio above 2.0 suggests that the company might be holding too much idle cash—capital that could otherwise be reinvested for growth or innovation. Understanding and maintaining this balance is crucial, especially when external funding becomes harder to secure.

For many companies, the challenge lies not just in sustaining positive cash flow but also in optimizing it. Efficient working capital management involves synchronizing cash inflows and outflows, fine-tuning inventory levels, and managing receivables and payables strategically.

During periods of tight credit, even small inefficiencies—like delayed payments or excess stock—can ripple through the entire business, affecting profitability and growth potential. Therefore, adopting data-driven forecasting and proactive liquidity management becomes a cornerstone of financial resilience.

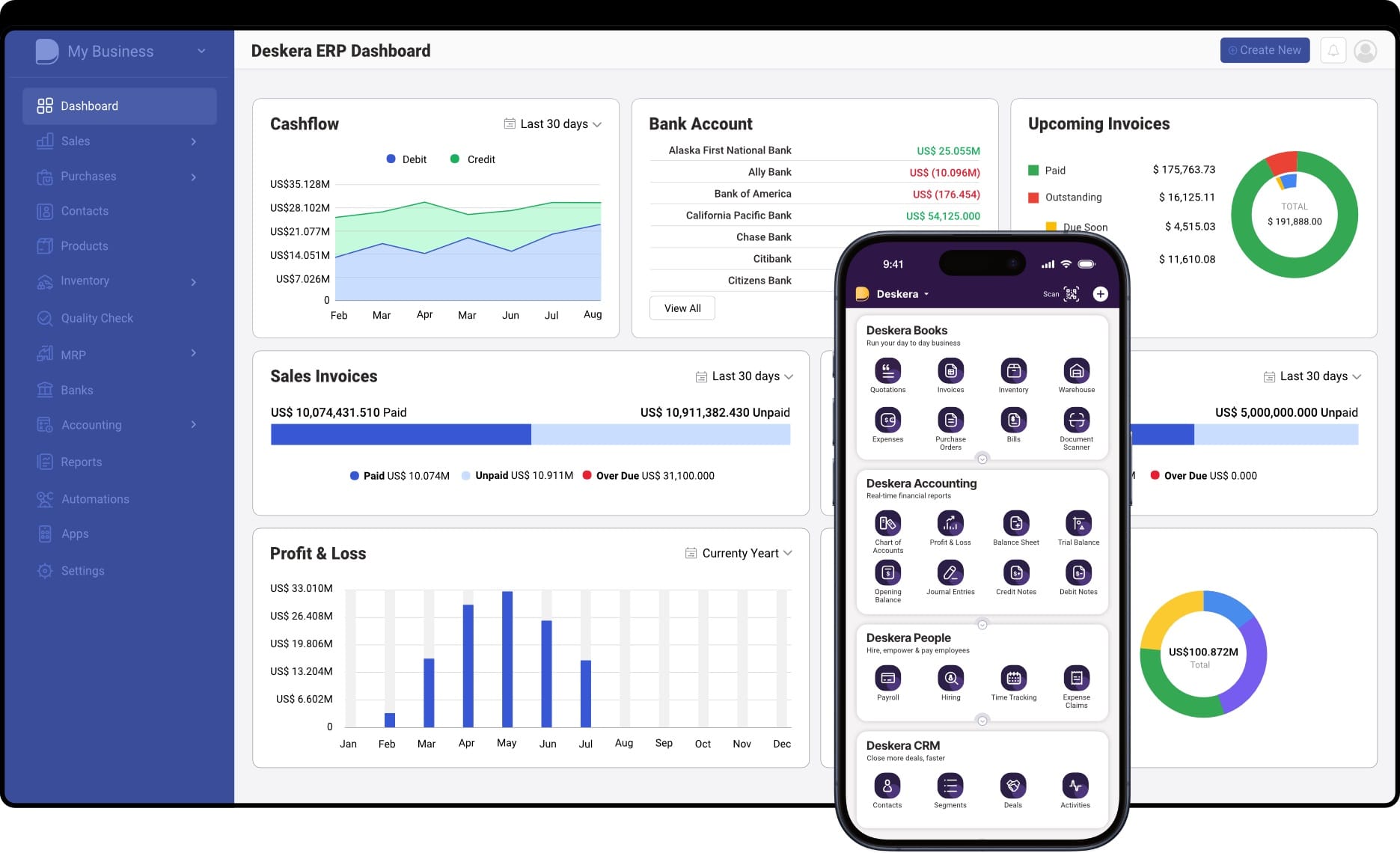

This is where modern technology solutions, such as Deskera ERP, make a meaningful impact. Deskera ERP provides real-time visibility into your company’s financial health, automates cash flow tracking, and streamlines inventory and receivables management.

With AI-driven insights and built-in forecasting tools, businesses can make informed decisions, reduce working capital inefficiencies, and adapt quickly to market fluctuations. In a world where credit availability is uncertain, leveraging a comprehensive ERP system like Deskera helps businesses stay agile, optimize resources, and sustain long-term growth.

What Are Tight Credit Markets?

A tight credit market occurs when banks and financial institutions reduce their lending activities due to increased caution or limited liquidity. Lenders impose stricter eligibility criteria, demand stronger collateral, and often approve smaller loan amounts.

As a result, even financially sound companies may struggle to secure funds for working capital, inventory purchases, or expansion. Borrowing also becomes more expensive, as higher interest rates and shorter repayment terms further constrain cash flow and profitability.

Key Causes of Tight Credit Conditions

Several economic and regulatory factors can trigger tighter credit environments:

- Rising Interest Rates: Central banks increase rates to combat inflation, making loans costlier.

- Economic Uncertainty: Recessions, market volatility, or geopolitical instability reduce lenders’ willingness to take risks.

- Regulatory Pressure: Stricter capital and reserve requirements limit banks’ lending capacity.

- Liquidity Shortages: Lower investor confidence and reduced cash flow in the financial system restrict lending flexibility.

Each of these factors contributes to reduced credit access, forcing businesses to rely more on internal cash reserves.

Recognizing Tight Credit Conditions

Businesses can identify tightening credit markets through observable changes in lending behavior and financial indicators, such as:

- Higher loan rejection rates or delayed approvals.

- Increased collateral or documentation requirements.

- Rising interest rates on existing or new loans.

- Shorter repayment periods and reduced credit lines.

Recognizing these early signs allows businesses to take proactive measures to strengthen liquidity and working capital management.

Why Tight Credit Markets Matter

Restricted access to financing affects more than just a company’s borrowing ability—it impacts operations, investment, and long-term competitiveness. Limited liquidity can delay supplier payments, disrupt production, and constrain business growth.

Small and medium-sized enterprises (SMEs) are often hit hardest, as they depend heavily on short-term credit for operational flexibility. To withstand such conditions, businesses must focus on optimizing internal cash flow, improving receivables and payables management, and leveraging tools like ERP systems for real-time financial visibility and control.

How Tight Credit Markets Impact Businesses

When credit conditions tighten, businesses across industries feel the pressure almost immediately. Limited access to financing, higher borrowing costs, and stricter lending requirements disrupt normal operations and force companies to rethink how they manage cash flow.

For many organizations—especially SMEs—these challenges can impact everything from day-to-day liquidity to long-term growth planning. Understanding the specific ways tight credit markets affect businesses is essential for building financial resilience.

Reduced Access to Working Capital

One of the most immediate impacts of tight credit markets is the difficulty in securing short-term financing. Businesses that rely on lines of credit or short-term loans to manage payroll, inventory purchases, or operating expenses may suddenly find these options limited or unavailable.

This reduced access to working capital can lead to delayed supplier payments, production slowdowns, and cash flow gaps that disrupt normal business operations.

Higher Borrowing Costs

When lenders tighten credit, they often increase interest rates to compensate for perceived risk. As a result, any new loans or refinancing arrangements become more expensive, directly impacting profitability.

For many companies, higher borrowing costs force a reevaluation of investment plans, expansion projects, and even essential operational spending.

Shortened Credit Terms from Suppliers

Tight credit conditions don’t just affect banks—suppliers also become more cautious. Vendors may shorten payment terms, reduce credit limits, or require upfront payments to protect themselves from financial exposure.

This puts additional pressure on businesses already dealing with cash flow constraints, often triggering a cycle of delayed payments and weaker supplier relationships.

Decreased Customer Spending

Economic uncertainty and restricted credit availability often lead to reduced consumer and business spending. Customers may cut back on purchases, delay orders, or negotiate longer payment cycles, all of which reduce incoming cash flow.

This drop in demand can affect revenue predictability and make inventory planning more difficult.

Slower Growth and Investment

With limited credit and higher borrowing costs, businesses tend to delay or cancel growth initiatives such as market expansion, hiring, or capital investments.

This slowdown can impact overall competitiveness and make it harder for companies to seize new opportunities—even when the market eventually stabilizes.

Greater Pressure on Internal Cash Flow

In tight credit markets, businesses must rely heavily on their internal cash resources. This increases the need for efficient receivables collection, optimized inventory levels, and strong expense control.

Companies without robust cash flow management systems risk liquidity shortages that can escalate into operational disruptions or financial distress.

Benefits of Working Capital Optimization

Optimizing working capital delivers far-reaching advantages that strengthen a company’s financial health, operational efficiency, and long-term resilience.

When businesses manage cash flow, inventory, receivables, and payables strategically, they unlock more liquidity, reduce reliance on external financing, and position themselves for sustainable growth.

Below are the key benefits of effective working capital optimization.

Improved Liquidity and Cash Flow Stability

Efficient working capital management ensures that a business always has enough cash to meet short-term obligations. By accelerating receivables, optimizing inventory, and managing payables thoughtfully, companies maintain steady cash flow—even when credit conditions tighten.

This stability reduces the risk of liquidity crises and helps businesses operate smoothly during economic fluctuations.

Reduced Dependence on External Financing

When businesses free up internal cash, they rely less on bank loans, credit lines, or high-interest financing. Lower debt levels mean reduced interest expenses and better profitability.

This is especially critical during tight credit markets, where borrowing becomes more expensive and harder to obtain.

Enhanced Operational Efficiency

Optimizing working capital often goes hand in hand with streamlining processes—such as invoicing, procurement, and inventory management. These improvements reduce delays, eliminate waste, and increase productivity across departments.

Stronger internal workflows directly contribute to better cash utilization and operational reliability.

Higher Profitability and Return on Investment (ROI)

When cash tied up in excess inventory or unpaid invoices is released, businesses can reinvest those funds into high-return activities—such as marketing, technology upgrades, or capacity expansion.

This boosts overall profitability and ensures that capital works harder for the organization.

Stronger Supplier and Customer Relationships

With better control over cash flow, businesses can pay suppliers on time, negotiate favorable terms, and maintain trust-based partnerships.

Similarly, improved receivables processes enhance customer experience through clear payment terms and smoother transactions.

Increased Financial Agility

Working capital optimization provides the flexibility needed to respond quickly to market opportunities or challenges. Whether expanding product lines, entering new markets, or navigating economic downturns, companies with strong working capital positions can make strategic decisions without financial strain.

This agility becomes a competitive advantage in fast-changing business environments.

Improved Risk Management

Efficient working capital practices help businesses anticipate cash shortages, identify credit risks, and prevent disruptions caused by delayed payments or excess stock.

With better forecasting and tighter control, organizations can avoid operational bottlenecks and reduce exposure to financial risk.

Greater Investor and Lender Confidence

A company that consistently demonstrates strong working capital management is seen as financially disciplined and stable. This boosts investor confidence and strengthens credibility with lenders, resulting in easier access to financing when needed and potentially better borrowing terms.

Core Principles of Effective Working Capital Management

Effective working capital management is the foundation of financial stability—especially in environments where credit is limited and cash flow is under pressure.

It ensures that a business can meet its short-term obligations, operate smoothly, and continue investing in growth.

The core principles revolve around maintaining balance, optimizing cash flow cycles, and ensuring liquidity at all times.

Below are the essential pillars that guide strong working capital management.

Balancing Liquidity and Profitability

A key principle is finding the right balance between holding enough cash to stay liquid and investing resources to drive profitability. Too little liquidity may result in cash shortages, while too much idle cash reduces returns.

Businesses must assess their working capital ratio, cash reserves, and operational needs to ensure funds are deployed effectively without compromising financial security.

Optimizing the Cash Conversion Cycle

The cash conversion cycle (CCC) measures how quickly a company can turn inventory and receivables into cash. A shorter CCC improves liquidity and reduces the need for external financing.

This involves minimizing the time inventory is held, accelerating customer payments, and managing payables strategically to maintain healthy cash flow.

Strengthening Receivables Management

Timely collection of receivables is crucial for sustaining cash flow. Clear credit policies, automated invoicing, and proactive follow-ups help reduce delays and minimize bad debt.

By prioritizing efficient receivables management, businesses can maintain steady inflows and reduce the risk of liquidity gaps.

Controlling Inventory Levels

Inventory can tie up a significant amount of working capital if not managed carefully. Overstocks increase holding costs, while understocking leads to missed sales opportunities.

Effective inventory management—supported by forecasting tools, demand planning, and lean practices—helps businesses maintain optimal stock levels and improve cash efficiency.

Managing Payables Strategically

Extending payables responsibly allows businesses to retain cash longer without damaging supplier relationships. Negotiating favorable terms, consolidating purchases, and maintaining transparent communication are essential components of payables management.

The goal is to maximize the payment window without compromising trust or supply reliability.

Leveraging Technology and Real-Time Insights

Modern working capital management relies heavily on data accuracy and real-time visibility. ERP systems and automation tools provide insights into cash flow trends, inventory movement, and payment cycles.

With better forecasting and centralized financial data, businesses can make informed decisions, identify risks early, and adapt quickly to market changes.

Smart Strategies for Managing Working Capital in Tight Credit Conditions

When credit becomes harder to access, businesses must depend more heavily on efficient internal cash management. Tight credit conditions heighten the importance of optimizing receivables, payables, inventory, and cash forecasting.

The following strategies help companies maintain liquidity, strengthen financial resilience, and continue operating smoothly—even when external financing is limited.

Strengthen Cash Flow Forecasting

Accurate and dynamic cash flow forecasting becomes essential in restricted credit environments. Businesses should use rolling forecasts, scenario planning, and real-time cash visibility to anticipate liquidity gaps.

By understanding upcoming inflows and outflows, leaders can make proactive decisions—such as adjusting spending, renegotiating terms, or accelerating collections—to maintain financial stability.

Optimize Inventory Management

Excess inventory ties up valuable working capital, while insufficient stock can lead to missed sales. Tight credit markets require smarter inventory practices such as demand-driven planning, JIT (Just-in-Time), and regular stock audits.

Using digital tools and forecasting software enables businesses to maintain lean, efficient inventory levels and free up cash for critical operations.

Improve Receivables Collection

Timely customer payments are crucial when financing options are limited. Businesses should strengthen credit policies, use automated invoicing, and implement follow-up reminders to reduce delays.

Offering early payment discounts or enabling multiple digital payment methods can further accelerate collections and improve cash flow reliability.

Extend Payables Strategically

Managing payables with intention helps businesses retain cash without harming supplier relationships. This may include negotiating longer payment terms, consolidating purchases, or arranging flexible payment schedules.

Transparent communication with suppliers ensures trust while giving companies more breathing room in tight cash periods.

Control Operational Expenses

Tight credit markets require disciplined cost management. Companies should review discretionary spending, reduce inefficiencies, and implement lean operational practices.

Focusing on high-ROI activities and eliminating waste helps preserve cash and sustain profitability even when funding is limited.

Explore Alternative Financing Options

Even in restricted credit environments, alternative financing sources can bridge short-term gaps. Options include invoice factoring, supply chain financing, dynamic discounting, and digital lending platforms.

These financing tools often offer faster access to cash and more flexible terms compared to traditional bank loans, though businesses must evaluate costs and risks carefully.

Leverage ERP and Automation Tools

Technology plays a significant role in working capital optimization. Modern ERP systems like Deskera ERP provide real-time financial insights, automate receivables and payables processes, and enhance cash flow forecasting.

By centralizing operations and improving visibility, businesses can identify inefficiencies early, streamline decision-making, and maintain agility during credit-tight periods.

Enhance Vendor and Customer Collaboration

Strong communication with suppliers and customers can significantly improve cash flow during tight credit periods. Businesses can collaborate with vendors for flexible delivery schedules, bulk order discounts, or consignment arrangements.

Similarly, engaging customers in advance about payment timelines or offering subscription-based billing can help stabilize predictable inflows.

Adopt Dynamic Pricing Strategies

Adjusting pricing based on demand, seasonality, or customer segments can help maximize revenue and improve liquidity. Dynamic pricing also ensures that businesses do not leave money on the table during high-demand periods while minimizing stock buildup during slow periods.

This strategy directly contributes to healthier working capital by aligning cash inflows with market behavior.

Implement Lean Process Improvements

Lean methodologies help eliminate operational inefficiencies by streamlining workflows, reducing waste, and improving cycle times.

By tightening internal processes—such as reducing production bottlenecks or shortening approval cycles—businesses can reduce costs and accelerate cash flow.

Revisit Procurement Strategies

Strategic procurement is key in tight credit environments. Companies can renegotiate bulk agreements, explore alternative suppliers, or use centralized purchasing to reduce costs.

This helps ensure that money isn’t tied up in over-purchased materials and that procurement decisions are closely aligned with actual demand.

Sell Non-Core or Underutilized Assets

Businesses often hold assets that are either underutilized or no longer essential to core operations. Selling these assets—such as outdated machinery, unused real estate, or excess equipment—can unlock immediate liquidity.

Asset liquidation becomes a powerful tool for improving working capital without needing external financing.

Improve Product or Customer Profitability Analysis

Not all products or customers contribute equally to revenue. Conducting profitability analysis helps identify which segments drain cash and which generate strong margins.

Focusing efforts on high-margin products or reliable customers helps stabilize cash inflows, especially when credit is scarce.

Strengthen Risk Management Practices

Credit tightening is often accompanied by economic uncertainty. Businesses should regularly assess financial risks—such as customer defaults, supplier failures, or market fluctuations—and create contingency plans.

Better risk preparedness prevents sudden disruptions from turning into cash flow crises.

Use Short-Term Internal Restructuring

Restructuring internal workflows—such as freezing non-essential hiring, reviewing incentive structures, or consolidating redundant processes—can create immediate operational savings.

These steps help stabilize finances without compromising long-term strategy.

The Role of Technology in Working Capital Optimization

In today’s volatile economic environment, technology has become a critical enabler of efficient working capital management. With real-time visibility, automated workflows, and data-driven insights, businesses can manage liquidity more proactively and accurately than ever before.

Modern digital tools streamline cash flow processes, reduce manual errors, and provide the intelligence needed to navigate tight credit conditions with confidence.

Below are the key ways technology transforms working capital optimization.

Real-Time Cash Flow Visibility

Digital tools and ERP systems provide a unified view of cash inflows, outflows, and on-hand liquidity. This real-time visibility enables businesses to detect cash shortages early, track financial performance more accurately, and make informed decisions about spending, credit, and investments.

With better data transparency, leaders can identify bottlenecks, reduce uncertainty, and respond swiftly to emerging financial risks.

Automated Receivables and Payables Management

Automation eliminates manual processes that slow down collections or delay payments. Tools such as automated invoicing, reminder systems, and digital payment gateways help accelerate receivables, while rule-based payment scheduling improves control over outflows.

Consistent automation ensures faster cycles, reduced errors, and healthier cash flow despite credit constraints.

Advanced Forecasting and Scenario Planning

Technology empowers businesses to use AI-driven algorithms, predictive analytics, and rolling forecasts to anticipate future liquidity needs. Scenario modeling allows companies to simulate best-case and worst-case situations, helping them prepare for credit tightening, market fluctuations, or unexpected expenses.

Accurate forecasting reduces reliance on external financing by ensuring better preparation and smarter financial planning.

Inventory Optimization Tools

Digital inventory management solutions help businesses maintain optimal stock levels and reduce excess inventory that ties up working capital. Features like demand forecasting, automated reordering, ABC analysis, and real-time tracking reduce stockouts and overstock situations.

By optimizing inventory, businesses free up cash and improve operational efficiency.

AI-Powered Credit and Risk Assessment

Artificial intelligence tools enhance credit decision-making by analyzing customer payment behavior, past transaction history, and external market data. These insights help businesses assess customer creditworthiness more accurately and reduce the risk of bad debt.

This ultimately strengthens receivables management and stabilizes cash flow.

Digital Collaboration Platforms

Integrated digital platforms enhance communication between finance, procurement, sales, and operations teams. When departments share synchronized data, businesses can manage the full working capital cycle more effectively—from forecasting demand to controlling expenses and aligning procurement decisions.

Better internal alignment leads to stronger cash management and reduced operational bottlenecks.

How Deskera ERP Helps Optimize Working Capital

Deskera ERP empowers businesses to boost their working capital position by improving visibility, enhancing control, and automating key financial and operational processes. Here’s how Deskera supports working capital optimization across core areas:

1. Real-Time Cash Flow Visibility

Deskera provides a unified dashboard that tracks payables, receivables, inventory, and cash positions in real time. This helps finance teams make informed decisions, anticipate cash gaps, and plan funding requirements proactively.

2. Faster Accounts Receivable Collection

Automated invoicing, payment reminders, and integrated payment gateways accelerate the cash conversion cycle. Businesses can reduce debtor days and strengthen liquidity through systematic, timely follow-ups.

3. Streamlined Accounts Payable Management

Deskera enables better negotiation of payment terms, prioritization of vendor payments, and avoidance of late fees. AP automation ensures vendors are paid efficiently while allowing businesses to optimize outgoing cash flow.

4. Smarter Inventory Management

With tools for demand forecasting, stock-level alerts, and automated reordering, Deskera prevents excess stock and stockouts. This reduces carrying costs and frees up cash that would otherwise be tied up in underutilized inventory.

5. Integrated Procurement Planning

Deskera helps businesses align procurement cycles with demand forecasts and production requirements. This minimizes over-purchasing, improves vendor management, and ensures that working capital is used strategically.

6. Accurate Financial Forecasting

Advanced reporting tools offer insights into cash flow trends, working capital ratios, and liquidity forecasts. This enables better planning, contingency preparation, and long-term financial stability.

7. Improved Operational Efficiency

By automating manual tasks across finance, procurement, sales, and inventory, Deskera reduces operational delays and errors. Greater efficiency directly contributes to a healthier cash conversion cycle.

Key Takeaways

- A tight credit market means lenders reduce risk exposure (stricter criteria, more collateral, less lending), which raises the cost and difficulty of obtaining external funds.

- When credit tightens, businesses must prioritize internal liquidity — expect reduced lending, higher borrowing costs, and more stringent terms, so proactive cash management becomes essential.

- Optimized working capital improves liquidity, lowers financing costs, boosts profitability and operational efficiency, and strengthens investor and lender confidence.

- Maintain the right balance between liquidity and profitability by optimizing the cash conversion cycle, receivables, payables, and inventory.

- Use a mix of tactics—better forecasting, faster collections, strategic payables, lean inventory, cost control, and alternative financing—to preserve cash and reduce reliance on expensive credit.

- ERP and automation deliver real-time visibility, faster cycles, and predictive forecasting—turning data into actionable steps that shorten the cash conversion cycle and reduce surprises.

- Deskera ERP centralizes finance and operations, automates receivables/payables and inventory management, and provides forecasting and dashboards that make working capital decisions faster and more accurate.

Related Articles