Why do businesses struggle to control expenses even when they have detailed budgets in place? The answer lies not in the lack of planning, but in the absence of real-time visibility, integrated data, and structured controls. Traditional expense planning methods—often driven by spreadsheets and disconnected systems—fail to keep pace with today’s dynamic business environments, where costs shift rapidly and decisions must be made with speed and precision.

Expense planning has evolved from a routine budgeting exercise into a strategic financial discipline. Organizations now need to anticipate spending patterns, align expenses with business goals, and respond proactively to cost fluctuations. Without accurate data and timely insights, expense plans quickly become outdated, leading to budget overruns, cash flow strain, and missed growth opportunities.

This is where ERP systems play a transformative role. By centralizing financial data and integrating expense planning with accounting, procurement, payroll, and operations, ERP systems enable organizations to move from reactive cost tracking to proactive expense management. Real-time monitoring, automated controls, and data-driven forecasting empower finance teams to plan expenses with greater accuracy and confidence.

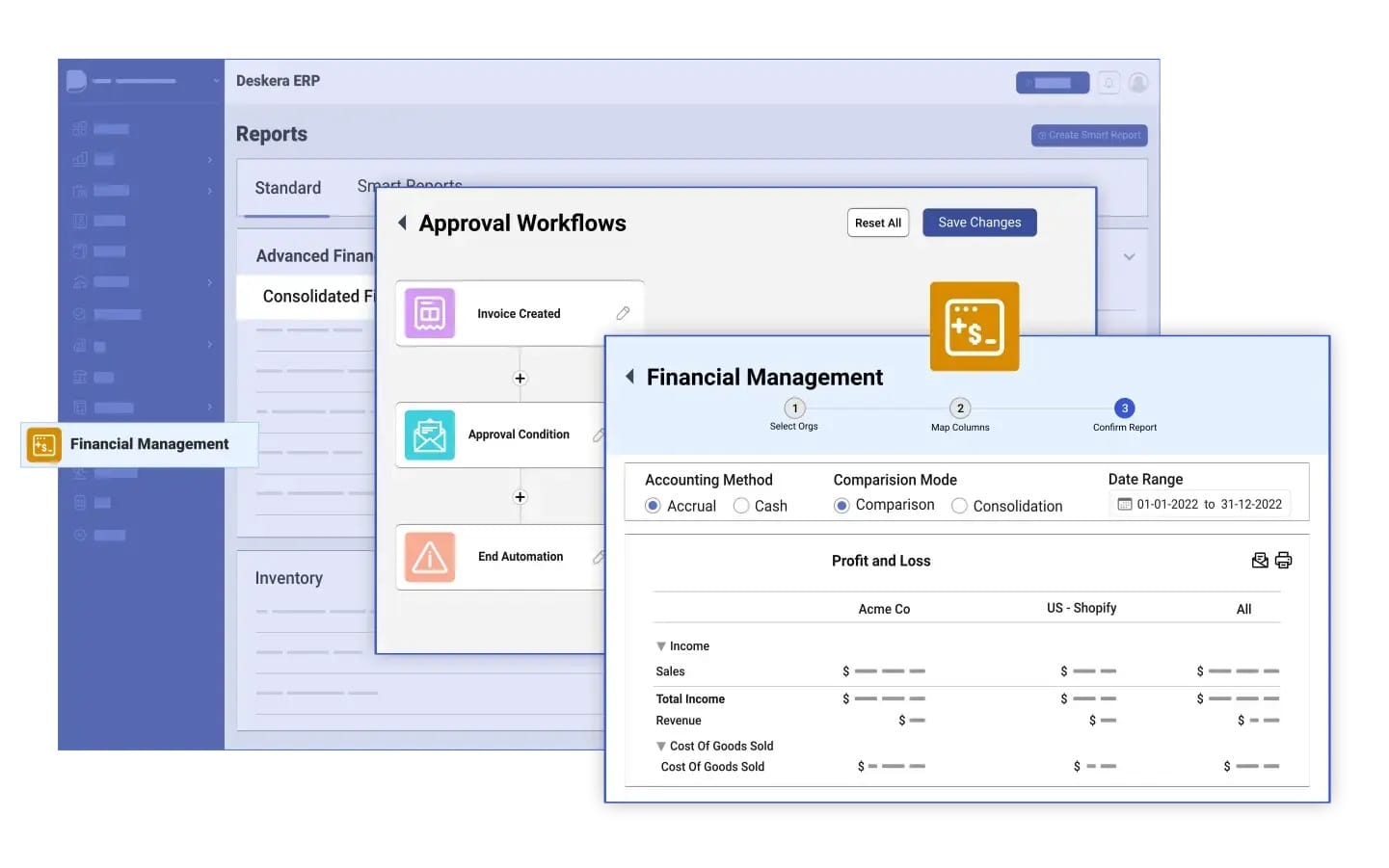

Modern ERP platforms like Deskera ERP are designed to support this strategic shift. Deskera ERP offers centralized financial management, real-time expense tracking, automated approvals, and insightful dashboards that enhance visibility across departments. By simplifying expense planning and strengthening financial control, Deskera ERP helps businesses make informed decisions, maintain budget discipline, and scale sustainably.

What Is Expense Planning for Businesses?

Expense planning for businesses is the process of forecasting, organizing, and controlling company spending to ensure that costs align with financial goals, operational needs, and available resources. It involves estimating future expenses, allocating budgets across departments or projects, and setting clear guidelines to manage how and when money is spent.

At a strategic level, expense planning helps businesses maintain profitability and cash flow stability. By anticipating costs such as payroll, procurement, marketing, utilities, and operational overheads, organizations can avoid unexpected overruns and make informed decisions about investments, hiring, and expansion.

Effective expense planning is not a one-time budgeting activity—it is a continuous process. Businesses regularly track actual expenses against planned budgets, analyze variances, and adjust spending plans based on changing market conditions or business priorities. This ongoing monitoring ensures financial discipline and improves accountability across teams.

Modern businesses increasingly rely on ERP systems to support expense planning. ERP platforms centralize financial data, automate expense tracking, and provide real-time insights, enabling organizations to plan expenses more accurately, enforce controls, and respond quickly to cost fluctuations.

Importance of Expense Planning for Businesses

Expense planning plays a critical role in helping businesses maintain financial stability while supporting long-term growth.

By proactively anticipating costs and aligning spending with strategic objectives, organizations can avoid budget overruns, improve resource utilization, and make more informed financial decisions.

Effective expense planning also strengthens financial discipline across departments, ensuring that every expense contributes measurable business value.

Improves Budget Control and Cost Management

Expense planning enables businesses to set realistic budgets and monitor spending against predefined limits. By identifying potential cost overruns early, organizations can take corrective action before expenses spiral out of control, leading to more disciplined and predictable financial management.

Enhances Cash Flow Visibility and Stability

By forecasting expenses in advance, businesses gain better visibility into future cash outflows. This helps ensure that sufficient liquidity is available to meet operational needs, reduce reliance on short-term borrowing, and maintain healthy cash flow throughout the financial cycle.

Supports Strategic Decision-Making

Well-structured expense planning provides leaders with accurate financial insights needed to evaluate trade-offs, prioritize investments, and align spending with business goals. Decisions around expansion, hiring, or cost optimization become more data-driven and less reactive.

Increases Accountability Across Departments

Expense planning assigns clear spending limits and responsibilities to departments and teams. This promotes accountability, encourages responsible spending behavior, and fosters closer collaboration between finance teams and operational leaders.

Reduces Financial Risk and Uncertainty

By anticipating expenses and preparing for different cost scenarios, businesses can better manage financial risks. Expense planning helps organizations respond quickly to market changes, economic fluctuations, or unexpected costs without disrupting overall financial performance.

Common Challenges in Traditional Expense Planning

Traditional expense planning methods were designed for simpler operating environments. As businesses scale and expenses become more complex, these approaches struggle to deliver the accuracy, control, and agility that modern finance teams require. Reliance on manual processes, disconnected systems, and static budgets often results in poor visibility, delayed decisions, and increased financial risk.

Lack of Real-Time Visibility Into Spending

Traditional expense planning typically relies on monthly or quarterly reports, which provide only a retrospective view of spending. By the time finance teams identify budget overruns or abnormal expenses, the impact has already occurred. This delayed visibility prevents proactive cost management and limits the ability to respond quickly to changing business conditions.

Overreliance on Spreadsheets and Manual Workflows

Spreadsheets remain a common tool for expense planning, but they introduce significant inefficiencies. Manual data entry increases the risk of errors, inconsistencies, and duplicated records. Version control issues further complicate collaboration, making it difficult for teams to work with accurate, up-to-date expense data.

Disconnected and Siloed Financial Data

In traditional setups, expense data is often spread across multiple systems—such as accounting software, procurement tools, and departmental records. This fragmentation prevents organizations from establishing a single source of truth, resulting in incomplete expense analysis and limited cross-departmental financial visibility.

Inaccurate and Static Expense Forecasts

Traditional expense planning frequently depends on historical spending trends without factoring in current market dynamics, operational changes, or strategic initiatives. Static budgets quickly become outdated, leading to unrealistic forecasts that fail to support informed decision-making or effective cost control.

Inefficient Approval Processes and Weak Policy Enforcement

Manual approval workflows slow down expense processing and create bottlenecks. At the same time, inconsistent policy enforcement increases the risk of unauthorized or non-compliant spending. Without automated controls and audit trails, maintaining financial discipline and regulatory compliance becomes increasingly challenging.

Limited Scalability as the Business Grows

As organizations expand, traditional expense planning methods struggle to scale. Increasing transaction volumes, new cost centers, and geographically dispersed teams add complexity that manual systems cannot efficiently manage, resulting in higher administrative overhead and reduced financial control.

What Makes ERP Systems Strategic for Expense Planning

ERP systems elevate expense planning from a routine budgeting task to a strategic financial function. By integrating financial data, processes, and controls into a single platform, ERP systems provide the structure and intelligence businesses need to plan, monitor, and optimize expenses with greater accuracy and confidence.

Centralized Financial Data and a Single Source of Truth

ERP systems consolidate expense-related data from accounting, procurement, payroll, and operations into one unified system. This eliminates data silos and ensures that finance teams and business leaders work with consistent, reliable information when planning and reviewing expenses.

Real-Time Expense Tracking and Budget Visibility

With ERP systems, businesses can monitor actual expenses against planned budgets in real time. This continuous visibility enables early identification of cost overruns, supports timely corrective actions, and helps maintain tighter budget control across departments.

Integrated Workflows Across Business Functions

ERP platforms connect expense planning with related processes such as purchasing, vendor management, payroll, and project management. This integration ensures that expense plans reflect operational realities and that spending decisions are aligned with broader business activities.

Automated Controls and Approval Hierarchies

ERP systems enforce predefined expense policies through automated approval workflows and spending limits. These built-in controls reduce manual intervention, prevent unauthorized expenses, and strengthen financial governance without slowing down business operations.

Data-Driven Forecasting and Scenario Planning

By leveraging historical data and real-time inputs, ERP systems support more accurate expense forecasting. Businesses can model different scenarios, assess the financial impact of strategic decisions, and adjust expense plans proactively in response to changing conditions.

Scalability and Consistency as the Business Grows

ERP systems are designed to scale with organizational growth. As transaction volumes increase and new departments or locations are added, ERP platforms maintain consistent expense planning processes, ensuring control and visibility without adding administrative complexity.

Key ERP Features That Enable Effective Expense Planning

ERP systems provide a comprehensive set of features that help businesses plan, monitor, and control expenses more effectively. By combining automation, real-time insights, and integrated financial data, these features enable organizations to move beyond static budgets and adopt a more proactive, strategic approach to expense planning.

Real-Time Budget Monitoring and Variance Analysis

ERP systems allow finance teams to track actual expenses against approved budgets in real time. Built-in variance analysis highlights deviations as they occur, enabling early intervention, tighter budget control, and more informed financial decision-making.

Automated Expense Categorization and Cost Allocation

With predefined expense categories and allocation rules, ERP platforms automatically classify expenses across departments, projects, or cost centers. This reduces manual effort, improves accuracy, and ensures expenses are consistently aligned with financial reporting structures.

Policy-Based Controls and Approval Workflows

ERP systems enforce expense policies through automated approval hierarchies and spending limits. This ensures that expenses comply with internal guidelines, reduces the risk of unauthorized spending, and accelerates approval cycles without compromising governance.

Forecasting and Scenario Planning Capabilities

By leveraging historical data and current spending trends, ERP systems support more accurate expense forecasting. Scenario planning tools help businesses evaluate the financial impact of different cost assumptions, growth plans, or market changes before committing resources.

Integrated Reporting and Financial Dashboards

ERP platforms provide centralized dashboards and customizable reports that offer clear visibility into expense patterns and budget performance. These insights help finance leaders identify cost-saving opportunities, track trends, and communicate financial performance effectively to stakeholders.

Cross-Functional Integration for Holistic Expense Planning

ERP systems integrate expense planning with procurement, payroll, inventory, and project management modules. This holistic view ensures that expense plans reflect operational realities and that financial decisions are aligned across the organization.

Strategic Benefits of Using ERP Systems for Expense Planning

ERP systems deliver far more than operational efficiency in expense planning—they create measurable strategic value for the business. By combining real-time financial visibility, integrated processes, and data-driven insights, ERP platforms help organizations strengthen financial discipline, improve decision-making, and align spending with long-term business objectives.

Stronger Financial Control and Cost Optimization

ERP systems provide continuous visibility into expenses across departments and cost centers. This enables businesses to identify inefficiencies, control overspending early, and optimize costs without compromising operational performance.

Improved Accuracy in Expense Forecasting and Planning

With access to historical data and real-time spending trends, ERP systems support more accurate and realistic expense forecasts. This reduces reliance on assumptions and helps finance teams plan expenses that reflect actual business conditions.

Better Alignment Between Spending and Business Strategy

ERP-driven expense planning ensures that budgets are directly linked to strategic priorities. Organizations can allocate resources more effectively, evaluate trade-offs, and ensure that spending decisions support growth, innovation, and profitability goals.

Enhanced Decision-Making Through Real-Time Insights

ERP dashboards and analytics provide leaders with timely, actionable insights into expense performance. This allows faster adjustments, more confident financial decisions, and improved responsiveness to market or operational changes.

Increased Accountability and Governance

By enforcing standardized policies and approval workflows, ERP systems promote accountability across teams. Clear audit trails and controlled access strengthen governance, reduce financial risk, and support compliance requirements.

Scalability and Long-Term Financial Resilience

As businesses grow, ERP systems scale seamlessly to handle increased transaction volumes and complexity. This ensures consistent expense planning practices, sustained financial control, and greater resilience in dynamic business environments.

How ERP Systems Support Long-Term Financial Planning

ERP systems provide the financial foundation businesses need to plan years ahead, not just quarters. Rather than focusing on immediate cost control, ERP platforms support long-term financial planning by structuring data, timelines, and assumptions in a way that enables consistency, continuity, and foresight across planning cycles.

Establishing a Consistent Financial Planning Framework

ERP systems standardize chart of accounts, cost centers, and planning structures across the organization. This consistency allows businesses to build long-term financial plans on a stable framework, ensuring that projections remain comparable and reliable over multiple planning periods.

Leveraging Historical Data for Trend-Based Planning

Long-term planning depends on understanding patterns over time. ERP systems retain detailed financial history, enabling organizations to analyze multi-year expense trends, recurring cost drivers, and seasonality. These insights form the basis for realistic long-range financial assumptions.

Supporting Multi-Period and Rolling Planning Cycles

ERP platforms allow businesses to plan across multiple fiscal periods simultaneously. Finance teams can create rolling plans that extend beyond the current year, update assumptions regularly, and maintain continuity between short-term budgets and long-term financial goals.

Linking Operational Plans to Financial Projections

ERP systems connect financial planning with operational inputs such as workforce plans, procurement schedules, and production forecasts. This linkage ensures that long-term financial plans reflect actual business capacity and operational direction rather than isolated financial estimates.

Enabling Assumption Management and Scenario Comparisons

Long-term financial planning requires managing changing assumptions. ERP systems allow finance teams to document assumptions, compare scenarios, and evaluate the long-term financial impact of strategic decisions—such as expansion, cost restructuring, or technology investments.

Maintaining Planning Discipline Over Time

By embedding planning processes within a centralized system, ERP platforms ensure that long-term financial planning remains structured and repeatable. This discipline reduces reliance on ad hoc models and supports sustained financial clarity as the business evolves.

Future Trends in ERP-Driven Expense Planning

As businesses move toward more agile and data-centric financial management, ERP-driven expense planning continues to evolve. Emerging technologies and changing business expectations are reshaping how organizations plan, monitor, and optimize expenses—shifting the focus from retrospective analysis to forward-looking, intelligent financial control.

AI-Driven Expense Forecasting and Predictive Insights

ERP systems are increasingly embedding artificial intelligence and machine learning to analyze historical spending patterns and predict future expenses. These capabilities enable more accurate forecasts, early identification of cost anomalies, and proactive expense adjustments before issues arise.

Real-Time, Continuous Expense Planning Models

Traditional annual budgeting cycles are giving way to continuous planning approaches. Modern ERP platforms support real-time expense updates and rolling forecasts, allowing businesses to adapt expense plans dynamically as market conditions, demand, or operational priorities change.

Greater Automation in Expense Controls and Approvals

Future ERP systems will further automate expense governance through intelligent approval workflows and policy enforcement. Automated controls will reduce manual intervention, speed up approvals, and ensure consistent compliance with spending policies across the organization.

Advanced Analytics and Self-Service Financial Insights

ERP-driven analytics are becoming more intuitive and accessible. Finance leaders and department heads will increasingly rely on self-service dashboards and visual analytics to explore expense data, identify trends, and make informed decisions without heavy reliance on finance teams.

Deeper Integration Across Business Ecosystems

ERP platforms are expanding beyond internal systems to integrate with external tools such as procurement platforms, banking systems, and expense management applications. This broader ecosystem integration will provide end-to-end visibility into expenses and improve planning accuracy.

Increased Focus on Financial Agility and Resilience

As uncertainty becomes the norm, ERP-driven expense planning will prioritize agility. Future ERP systems will help businesses quickly model scenarios, reallocate budgets, and maintain financial resilience in response to economic shifts, regulatory changes, or unexpected disruptions.

How Deskera ERP Supports Strategic Expense Planning

Deskera ERP is designed to help businesses move beyond basic expense tracking and adopt a more strategic, controlled approach to expense planning. By centralizing financial data and automating key finance processes, Deskera enables organizations to plan, monitor, and manage expenses with greater accuracy and visibility.

Centralized Expense and Budget Management

Deskera ERP brings expense data, budgets, and financial records into a single platform. This centralized view allows finance teams to plan expenses more effectively, monitor spending across departments, and ensure alignment with approved budgets.

Real-Time Expense Tracking and Financial Visibility

With real-time updates, Deskera ERP enables businesses to track actual expenses as they occur. This immediate visibility helps identify variances early, supports timely corrective actions, and strengthens overall budget control.

Automated Approval Workflows and Policy Controls

Deskera ERP supports structured approval workflows that help enforce internal expense policies. Automated approvals reduce manual delays, improve compliance, and ensure that expenses are reviewed and authorized consistently.

Integrated Accounting and Financial Reporting

Expense planning in Deskera ERP is closely integrated with accounting and financial reporting. This integration ensures that planned and actual expenses are accurately reflected in financial statements, improving reporting accuracy and audit readiness.

Insightful Dashboards and Standardized Reports

Deskera ERP provides dashboards and built-in financial reports that offer clear insights into expense trends and budget performance. These insights help finance leaders evaluate spending patterns, optimize costs, and make data-driven decisions.

Scalable Platform for Growing Businesses

As businesses expand, Deskera ERP scales to support increasing transaction volumes, additional departments, and more complex expense structures—ensuring consistent expense planning and financial control over time.

Key Takeaways

- Expense planning enables organizations to forecast, allocate, and control spending, ensuring financial stability and aligning expenses with strategic goals.

- Effective expense planning improves budget control, enhances cash flow visibility, supports strategic decision-making, increases accountability, and reduces financial risks.

- Manual processes, fragmented data, delayed insights, and weak policy enforcement make traditional expense planning inefficient and prone to errors.

- ERP systems transform expense planning into a strategic function by centralizing data, providing real-time visibility, integrating workflows, and enforcing controls.

- Features like real-time budget monitoring, automated expense categorization, policy-based approvals, scenario planning, and integrated reporting make ERP-driven expense planning accurate and actionable.

- ERP systems strengthen financial control, improve forecasting, align spending with strategy, enhance decision-making, increase accountability, and support scalability.

- ERP platforms provide structured planning frameworks, historical trend analysis, multi-period planning, operational alignment, scenario modeling, and disciplined processes for sustainable long-term financial planning.

- AI-driven forecasting, real-time planning, automation, advanced analytics, ecosystem integration, and financial agility are shaping the future of ERP-enabled expense management.

- Deskera ERP centralizes budgets and expenses, provides real-time tracking, automates approvals, integrates accounting, delivers actionable dashboards, and scales with business growth.

Related Articles