How do successful businesses make confident decisions about growth, budgets, and investments—often months in advance? The answer lies in revenue forecasting. By estimating future income based on historical data, market trends, and business assumptions, revenue forecasting helps organizations move from guesswork to informed planning. It provides leaders with a forward-looking view of financial performance, enabling them to prepare for opportunities as well as uncertainties.

At its core, revenue forecasting is more than a financial exercise—it is a strategic capability. Accurate forecasts support smarter budgeting, realistic goal-setting, and better resource allocation across departments. In an environment shaped by fluctuating demand, pricing pressures, and economic shifts, businesses that forecast revenue effectively are better positioned to stay resilient and competitive.

However, forecasting revenue is not without its challenges. Incomplete data, changing market conditions, and siloed teams can quickly reduce accuracy. This is why many organizations are moving away from manual spreadsheets and toward integrated, data-driven approaches that combine financial, sales, and operational insights into a single, reliable forecast.

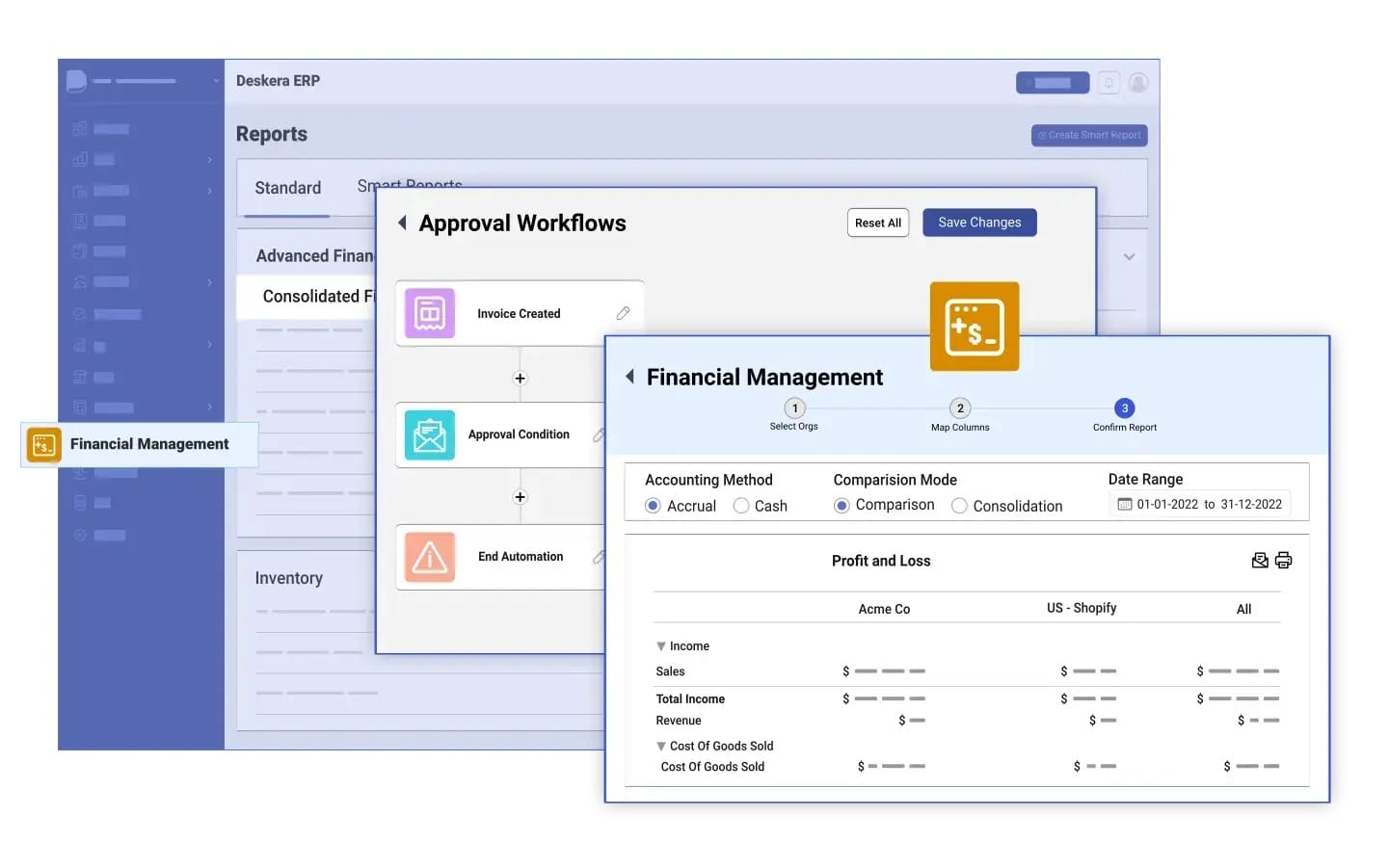

Modern ERP platforms like Deskera ERP play a critical role in this transformation. Deskera ERP centralizes accounting, sales, and operational data, giving businesses real-time visibility into revenue drivers. With automated reporting, financial dashboards, and integrated data flows, Deskera helps improve forecast accuracy while reducing manual effort. As a result, finance teams can focus less on data reconciliation and more on strategic decision-making.

What Is Revenue Forecasting?

Revenue forecasting is the process of estimating how much income a business expects to generate from selling its products or services over a defined period—typically monthly, quarterly, or annually. These forecasts are built using historical revenue data, current business performance, market conditions, and external economic factors. Rather than relying on assumptions alone, revenue forecasting enables organizations to make educated, data-backed predictions about future gross sales.

Unlike narrow sales targets or marketing metrics, a revenue forecast evaluates the business as a whole. It considers multiple dimensions such as pricing strategies, production capacity, staffing levels, competitive dynamics, and broader economic trends. Because revenue is the starting point for financial planning, it forms one of the most critical assumptions when building budgets, profit forecasts, and cash flow projections.

Revenue forecasting can be approached from both top-down and bottom-up perspectives. A top-down approach starts with strategic goals, market size, and historical performance, then cascades revenue expectations across business units. In contrast, a bottom-up approach aggregates revenue estimates from individual departments—such as sales initiatives, marketing campaigns, or new product launches—to shape the overall forecast. In practice, many organizations use a combination of both to improve accuracy.

At its core, revenue forecasting is a quantitative analysis that supports a wide range of business decisions. It helps leaders determine how much to invest in marketing, when to hire new talent, how to allocate resources, and how aggressively to pursue growth opportunities. While achieving perfect accuracy is challenging, a well-structured revenue forecast provides clarity, reduces uncertainty, and enables smarter, more confident business decisions.

Revenue Forecasting vs. Revenue Projections vs. Sales Forecasts

Although often used interchangeably, revenue forecasting, revenue projections, and sales forecasts serve different purposes in financial and strategic planning. Each focuses on a distinct aspect of future performance and is used by different stakeholders across the organization. Understanding these differences helps businesses apply the right approach for planning, budgeting, and decision-making.

Revenue Forecasting

- Estimates future revenue based on historical data, current performance, and market conditions

- Uses quantitative analysis and data-driven models

- Focuses on realistic and achievable outcomes

- Forms the foundation for budgets, cash flow forecasts, and financial planning

- Regularly updated to reflect changing business and economic conditions

Revenue Projections

- Represents aspirational or goal-based revenue expectations

- Often aligned with long-term growth targets or strategic visions

- May assume ideal market conditions or successful execution of initiatives

- Commonly used for investor presentations, fundraising, and strategic planning

- Less focused on short-term accuracy compared to revenue forecasts

Sales Forecasts

- Predicts future sales volumes or deal closures within a specific period

- Typically owned by sales teams and revenue operations

- Based on pipeline data, conversion rates, and sales activities

- Focuses on units sold, deal value, or customer acquisition rather than total revenue impact

- Feeds into revenue forecasting but does not account for broader financial or operational factors

Key Components of an Effective Revenue Forecast

An effective revenue forecast is built on more than historical numbers alone. It combines internal performance data, external market insights, and well-defined assumptions to create a realistic view of future revenue. The following components work together to improve forecast accuracy and support confident, data-driven decision-making.

Historical Revenue Data and Trends

Past revenue performance provides the foundation for forecasting. Analyzing historical data helps identify growth patterns, seasonality, and recurring fluctuations that can influence future revenue expectations.

Market and Economic Conditions

External factors such as industry trends, economic cycles, inflation, and competitive pressures play a significant role in shaping revenue outcomes. Incorporating these variables ensures forecasts reflect real-world conditions.

Pricing Strategy and Demand Patterns

Revenue forecasts must account for pricing models, discounts, and expected changes in demand. Even small adjustments in pricing or volume can significantly impact projected revenue.

Sales Pipeline and Conversion Rates

Evaluating the current sales pipeline, deal stages, and historical conversion rates helps estimate near-term revenue more accurately. This component is especially critical for short-term and quarterly forecasts.

Customer Behavior, Retention, and Churn

Understanding customer acquisition, renewal rates, and churn trends provides insights into recurring and predictable revenue streams, particularly for subscription-based or repeat-purchase businesses.

Business Capacity and Operational Constraints

Production capacity, workforce availability, and supply chain limitations can cap revenue potential. Effective forecasts align revenue expectations with what the business can realistically deliver.

Assumptions and Growth Drivers

Clearly defined assumptions—such as new product launches, market expansion, or increased marketing spend—help explain forecast logic and make projections easier to review, validate, and adjust over time.

Types of Revenue Forecasting

Revenue forecasting can take different forms depending on the time horizon, data inputs, and business objectives. Organizations often use multiple forecasting types together to balance short-term operational needs with long-term strategic planning.

Below are the most common types of revenue forecasting based on methodology and scope.

Short-Term Revenue Forecasting

Short-term revenue forecasts focus on immediate or near-term periods, such as monthly or quarterly cycles. They rely heavily on current sales pipeline data, conversion rates, and active customer demand to predict upcoming revenue.

Long-Term Revenue Forecasting

Long-term revenue forecasting looks beyond the immediate future, often covering multiple years. This approach takes a broader market-based view and incorporates growth strategies, expansion plans, economic trends, and industry outlooks.

Top-Down Revenue Forecasting

Top-down forecasting begins with high-level assumptions such as market size, revenue targets, or growth rates. These assumptions are then distributed across regions, product lines, or business units to arrive at detailed revenue estimates.

Bottom-Up Revenue Forecasting

Bottom-up forecasting builds revenue estimates from the ground up by aggregating inputs from individual teams, products, or departments. This method reflects operational realities and is often considered more accurate for short-term planning.

Operational Revenue Forecasting

Operational forecasts focus on near-term revenue streams tied directly to execution. They are commonly used by sales, marketing, and operations teams to plan activities, manage capacity, and track performance against targets.

Financial Revenue Forecasting

Financial revenue forecasting takes a holistic view of the business by integrating revenue estimates with costs, expenses, and investments. These forecasts are essential for budgeting, profit planning, and cash flow analysis.

Deterministic Revenue Forecasting

Deterministic forecasting produces a single expected revenue outcome based on fixed assumptions. While simple to understand, this approach may not fully capture uncertainty or variability in market conditions.

Probabilistic Revenue Forecasting

Probabilistic forecasting models a range of possible revenue outcomes along with their likelihood. By accounting for uncertainty, this approach supports scenario planning and more resilient decision-making.

Common Revenue Forecasting Methods and Models

Revenue forecasting methods differ in complexity, data requirements, and use cases. Broadly, they fall into quantitative and qualitative approaches. Quantitative methods rely on historical data and statistical modeling, while qualitative methods depend on expert judgment and market insights. The most accurate forecasts typically combine multiple models to balance data precision with real-world context.

Quantitative Revenue Forecasting Methods and Models

Quantitative models use measurable data to extrapolate future revenue and are best suited for businesses with sufficient historical performance data.

Straight-Line (Trend) Forecasting

This method assumes revenue will grow at a consistent historical rate. It is easy to apply and useful as a starting point, but it oversimplifies reality by ignoring seasonality, market volatility, and operational constraints.

Moving Average Method

The moving average method forecasts revenue by averaging revenue figures from a defined historical period. It smooths short-term fluctuations and is useful for identifying near-term trends.

Weighted Moving Average

A refined version of the moving average, this method assigns greater weight to more recent data points. It works well for short-term forecasts in stable, non-seasonal businesses.

Exponential Smoothing

Exponential smoothing places progressively higher weight on recent revenue data while still considering older data. It is more responsive to recent changes but may lose accuracy in highly volatile environments.

Linear Regression Models

Linear regression analyzes the relationship between revenue and one or more independent variables such as time, pricing, marketing spend, or sales activity.

- Simple linear regression uses one variable to predict revenue.

- Multiple linear regression incorporates several revenue drivers simultaneously. These models help quantify revenue drivers but depend heavily on data quality and may not capture nonlinear effects.

Time Series Forecasting

Time series models decompose historical revenue into trend, seasonality, and noise. Common techniques include moving averages, exponential smoothing, and ARIMA. These models are effective for businesses with recurring revenue patterns and sufficient historical data.

ARIMA (Auto Regressive Integrated Moving Average)

ARIMA is an advanced time-series model used to forecast long-term trends. It is more complex but offers higher accuracy when historical patterns are consistent.

Holt-Winters Seasonal Method

The Holt-Winters method extends exponential smoothing by explicitly modeling trend and seasonality. It is particularly effective for businesses with strong seasonal revenue cycles.

Qualitative Revenue Forecasting Methods

Qualitative forecasting relies on expert insight and unstructured data. These methods are valuable when historical data is limited or when forecasting new markets or products.

Executive Opinion

Forecasts are based on the experience and judgment of senior leaders or founders. While subjective, this method can be useful in early-stage or rapidly changing markets.

Sales Force and Channel Partner Input

Sales teams and channel partners provide bottom-up estimates based on pipeline visibility and customer interactions. This approach adds operational realism to forecasts.

Market Research

Customer surveys, interviews, and focus groups help estimate demand, purchasing intent, and willingness to pay—especially useful in B2B or niche markets.

Delphi Technique

A structured method where a panel of experts anonymously provides forecasts over multiple rounds. Responses are refined iteratively to reach a consensus view.

External Expert Analysis

Industry analysts, consultants, and trade associations provide macro-level insights into market trends, competition, and economic conditions.

No single revenue forecasting model is sufficient on its own. Quantitative models provide consistency and objectivity, while qualitative methods capture strategic insight and market nuance. By combining multiple approaches, businesses can create more resilient and realistic revenue forecasts that support confident planning and decision-making.

Benefits of Revenue Forecasting

Revenue forecasting is more than a financial exercise—it is a strategic tool that helps businesses plan with confidence, allocate resources effectively, and respond proactively to change. When done well, it creates alignment across teams and provides leadership with the clarity needed to make informed decisions.

Enables Budgeting with Realistic Precision

Accurate revenue forecasts form the foundation of effective budgeting. By estimating future income based on data and assumptions, finance teams can align spending on R&D, marketing, hiring, and operations with expected revenue. This prevents both over-investment that leads to budget shortfalls and under-investment that limits growth opportunities.

Optimizes Operational Management Across Teams

Revenue forecasts guide day-to-day and medium-term operational decisions across departments. Sales teams use forecasts for territory planning, quota setting, and capacity management.

Marketing relies on them to plan campaign budgets and funnel targets. Product, HR, and operations teams use revenue expectations to prioritize roadmaps, workforce planning, and capacity decisions, ensuring resources are used where they create the most value.

Supports Strategic and Long-Term Decision-Making

Reliable revenue forecasting gives executives the confidence to pursue major strategic initiatives. Whether raising capital, evaluating mergers and acquisitions, entering new markets, or launching new products, forecasts quantify potential returns and risks. Strong forecasts also strengthen credibility with investors, lenders, and board members.

Improves Cash Flow Planning and Financial Stability

By anticipating future revenue streams, businesses can better plan for upcoming expenses and manage cash flow proactively. This reduces the risk of liquidity shortages, helps meet financial obligations on time, and ensures the organization is prepared to seize growth opportunities when they arise.

Provides a Benchmark for Performance Tracking

Revenue forecasts act as a reference point for measuring actual performance. Comparing forecasted revenue with actual results helps teams quickly identify variances, understand their causes, and take corrective action before small gaps escalate into larger financial issues.

Enables Smarter Resource Allocation

Forecasting helps businesses allocate capital, time, and talent more effectively. By identifying which products, markets, or customer segments are likely to generate the highest returns, organizations can focus investments on areas with the greatest growth potential while minimizing waste.

Strengthens Sales and Marketing Alignment

With clear revenue targets, sales and marketing teams can set realistic goals, prioritize high-value opportunities, and align campaigns with broader business objectives. This alignment improves pipeline visibility and increases the likelihood of meeting revenue goals.

Reduces Risk and Uncertainty

While no forecast is perfect, revenue forecasting reduces uncertainty by replacing assumptions with structured analysis. Scenario modeling and regular forecast updates help businesses prepare for market volatility and make more resilient decisions.

Builds Organizational Confidence and Agility

Ultimately, revenue forecasting empowers businesses to move forward with clarity. When leaders and teams understand where the business is headed financially, they can act faster, adapt to change, and pursue growth with greater confidence.

Challenges and Limitations of Revenue Forecasting

While revenue forecasting is essential for effective planning and decision-making, it is not without challenges. Internal constraints, external uncertainties, and methodological limitations can all impact forecast accuracy. Understanding these challenges helps businesses set realistic expectations and improve their forecasting approach over time.

Data Quality and Availability Issues

Revenue forecasts are only as reliable as the data behind them. Incomplete, outdated, or inconsistent data—often spread across disconnected systems—can lead to inaccurate assumptions and flawed projections.

Market Volatility and Economic Uncertainty

Changes in economic conditions, customer demand, regulatory environments, or competitive dynamics can quickly invalidate even well-built forecasts. Sudden disruptions make long-term predictions especially challenging.

Overreliance on Historical Performance

While historical data provides a strong foundation, past trends do not always predict future outcomes. Shifts in customer behavior, pricing models, or business strategy can reduce the relevance of historical patterns.

Assumption Bias and Human Judgment Errors

Forecasts often rely on assumptions about growth rates, conversion ratios, or market conditions. Optimism bias, pressure to meet targets, or executive influence can result in overly aggressive or conservative forecasts.

Siloed Teams and Lack of Cross-Functional Alignment

When sales, finance, marketing, and operations teams work in isolation, forecasts may reflect conflicting assumptions. This misalignment reduces accuracy and limits the usefulness of the forecast across the organization.

Manual Processes and Spreadsheet Dependency

Manual forecasting using spreadsheets increases the risk of errors, version control issues, and delayed updates. These limitations make it difficult to respond quickly to changing conditions.

Difficulty Accounting for External Factors

External influences such as competitor actions, supply chain disruptions, or regulatory changes are hard to quantify but can significantly impact revenue. Many forecasting models struggle to incorporate these variables effectively.

Limited Scenario Planning

Single-point forecasts fail to capture uncertainty. Without scenario-based or probabilistic modeling, businesses may be unprepared for downside risks or upside opportunities.

Forecast Accuracy Diminishes Over Time

The further a forecast extends into the future, the less accurate it tends to become. Long-term forecasts are inherently more speculative and should be treated as directional rather than precise.

Balancing Complexity and Usability

Advanced forecasting models can improve accuracy but may be difficult to understand, maintain, or explain to stakeholders. Striking the right balance between sophistication and usability remains a key challenge.

Mistakes to Avoid in Revenue Forecasting

Even well-intentioned revenue forecasts can fall short when common pitfalls are overlooked. Forecast accuracy depends heavily on data quality, awareness of internal and external drivers, and disciplined processes. Avoiding the following mistakes can significantly improve the reliability and usefulness of your revenue forecasts.

Assuming the Past Will Automatically Repeat

Relying too heavily on historical trends or straight-line growth assumes stable conditions. This approach often ignores changes in competition, customer behavior, economic conditions, or internal capacity, leading to overly optimistic or misleading forecasts.

Using Limited, Incomplete, or Conflicting Data

Forecasts built on partial or inconsistent data lack credibility. Revenue should be analyzed across dimensions such as product, geography, and sales channel. Failing to account for seasonality or one-time events—such as regulatory changes or unusual demand spikes—can distort projections.

Ignoring or Underweighting External Factors

Overconfidence in internal strategies can cause teams to underestimate risks from external forces like economic downturns, regulatory shifts, disruptive technologies, or competitive pressure. Scenario-based forecasting helps balance optimism with realism.

Failing to Account for Variability and Uncertainty

Revenue forecasts influence hiring, procurement, and expansion decisions. Treating forecasts as fixed numbers rather than ranges can expose the business to risk. Sensitivity analysis and best-, worst-, and most-likely scenarios provide necessary context.

Overcomplicating Forecast Models

Adding too many variables can make models fragile, difficult to maintain, and hard to explain. Highly correlated variables may unintentionally overweight a single factor, while excessive complexity reduces stakeholder trust and usability.

Overfitting Advanced or Machine Learning Models

Overfitted models perform well on historical data but poorly predict the future. This often results from limited datasets or trying to explain every anomaly. Forecasting models should prioritize general patterns over perfect historical accuracy.

Relying Solely on Qualitative Assumptions

While expert judgment adds valuable context, forecasts based only on opinions can introduce bias or over-optimism. Balancing qualitative insights with quantitative data improves objectivity and consistency.

Falling into the “Lack of Data” Trap

Startups and new business lines often lack historical data, making forecasting difficult. Ignoring forecasting altogether is a mistake. Instead, use industry benchmarks, market research, and comparable competitor data to inform estimates.

Oversimplifying Revenue Projections

Overly simplistic models fail to capture the complexity of revenue drivers. Ignoring factors such as marketing effectiveness, pricing changes, customer churn, or competitive positioning can lead to poor resource allocation.

Not Updating Forecasts Regularly

Revenue forecasting is not a one-time exercise. Failing to update forecasts as new data becomes available reduces relevance and accuracy. Regular reviews help businesses adapt to changing market and operational conditions.

Best Practices for Improving Revenue Forecast Accuracy

Improving revenue forecast accuracy requires preparation, process discipline, and the right mix of data, collaboration, and tools. By systematically examining historical performance, current business conditions, and external factors, organizations can build realistic, data-driven forecasts that support better decisions and long-term growth.

Gather Accurate and Complete Financial Data

High-quality data is the foundation of reliable forecasting. Use historical and current financial information such as income statements, balance sheets, and cash flow statements to understand past performance and current financial health. Relying on systems that automatically track transactions and generate financial reports reduces errors and improves consistency.

Choose the Right Forecasting Time Horizon

Define the period your forecast will cover based on its purpose. Annual forecasts are common, supported by quarterly or monthly updates. While long-term forecasts can guide strategy, shorter time horizons tend to be more accurate and actionable.

Combine Quantitative Models with Qualitative Insights

Data-driven models provide structure, but expert judgment adds context. Blend historical trends and statistical models with insights from sales teams, leadership, and market experts to account for changes that data alone may not capture.

Consider Internal Growth Factors

Evaluate internal drivers that influence revenue, including products and services, new launches, geographic expansion, pricing strategies, and marketing initiatives. Capacity constraints such as production, staffing, logistics, and supply chain readiness should also be reflected in the forecast.

Account for External Market and Economic Factors

Incorporate external drivers such as customer demand, seasonality, competition, regulatory changes, and broader economic conditions. Global, national, or local events can significantly affect revenue and should be factored into assumptions.

Identify Constraints and Risk Factors

Assess how sensitive your forecast is to changes in key variables like consumer spending or business investment. Identify risks such as supply shortages, labor constraints, or transportation issues that could limit revenue potential and influence forecast ranges.

Align Sales, Finance, and Operations Teams

Cross-functional alignment ensures consistent assumptions across departments. Regular collaboration improves forecast credibility and ensures the forecast can be effectively used for budgeting, hiring, and operational planning.

Select the Right Tools and Software

Choose tools that support your forecasting needs, from spreadsheets to dedicated financial forecasting or ERP software. The right systems help consolidate data, automate analysis, provide prebuilt forecasting models, and support ongoing updates and monitoring.

Choose Forecasting Methods That Fit Your Business

Select forecasting methods that align with your business model and revenue patterns. Time-series analysis, regression models, and financial modeling techniques each serve different use cases, such as seasonal businesses or predictable growth environments.

Monitor, Compare, and Refine Forecasts Continuously

Revenue forecasts should be actively monitored against actual performance. Use dashboards to track variances, identify deviations early, and revise assumptions as market, competitive, or economic conditions change.

Document Assumptions and Maintain Forecast Discipline

Clearly documenting assumptions, data sources, and methodologies improves transparency and makes forecasts easier to review and refine. Consistent processes and governance help build forecasting maturity over time.

Future Trends in Revenue Forecasting

Revenue forecasting continues to evolve as businesses adopt new technologies, face changing market dynamics, and demand more accurate, real‑time insights. The following trends highlight how forecasting is becoming more strategic, automated, and predictive to support smarter decisions and sustainable growth.

Real‑Time and Continuous Forecasting

Rather than relying on static forecasts updated quarterly or annually, organizations are shifting to continuous forecasting. This approach uses real‑time data to update revenue predictions dynamically, enabling faster responses to market changes, operational shifts, or sales pipeline movements.

Integration of Artificial Intelligence (AI) and Machine Learning (ML)

AI and ML models are transforming revenue forecasting by detecting complex patterns in large datasets that traditional methods might miss. These technologies improve prediction accuracy, automate data processing, and support scenario simulations, helping teams anticipate outcomes under different conditions.

Predictive and Prescriptive Analytics

Beyond predicting future revenue, forecasting tools are increasingly providing prescriptive insights—recommendations on the actions that will most likely improve outcomes. These insights can suggest adjustments to pricing, marketing spend, hiring plans, or product launches based on forecasted scenarios.

Scenario Planning and Probabilistic Forecasting

Businesses are embracing forecasting models that go beyond single‑point estimates. Probabilistic forecasts offer a range of possible outcomes with likelihoods, while scenario planning (best‑case, worst‑case, and most‑likely) helps leaders prepare for uncertainty and make resilient decisions.

Greater Use of External and Alternative Data Sources

Revenue forecasts are no longer built only on internal historical data. Companies are incorporating external data such as economic indicators, consumer sentiment, market trends, social media analytics, and competitive intelligence. Access to broader datasets enhances forecast relevance and allows forecasting to anticipate disruptive shifts.

Automated Data Pipelines and Forecasting Workflows

Automation is streamlining data collection, cleansing, and model execution. Automated forecasting workflows reduce manual errors, increase speed, and free finance teams to focus on analysis and strategy rather than data wrangling.

Cloud‑Based and Integrated Forecasting Platforms

Cloud‑enabled platforms unify sales, finance, marketing, and operational data in one place. This integration eliminates data silos, supports cross‑departmental collaboration, and delivers dashboards that tie revenue forecasts directly to KPIs and business performance metrics.

Enhanced Visualization and Decision Support Tools

Modern forecasting solutions offer intuitive dashboards and visual models that make complex forecasts easier to understand. Visual tools support scenario comparisons, trend analysis, and stakeholder communication, enabling more informed discussions and quicker decisions.

Forecasting Embedded in Business Processes

Forecasting is becoming integrated into regular business cycles—from budgeting and planning to performance reviews and strategic alignment. As forecasting becomes part of core operational routines, it drives accountability and links financial planning with execution.

Focus on Revenue Driver Analysis

Instead of focusing primarily on historical outcomes, future forecasting models will emphasize driver‑based forecasting—modeling how specific factors (pricing, customer churn, marketing ROI, product mix) impact revenue. Understanding drivers improves forecast transparency and helps teams prioritize actions that influence revenue most.

Ethical and Explainable AI in Forecasting

As AI and ML become mainstream in forecasting, organizations are emphasizing interpretability and fairness. Explainable AI ensures that forecast recommendations can be understood, trusted, and audited, reducing risks associated with “black box” models.

How Deskera ERP Helps Simplify Revenue Forecasting

Revenue forecasting can be complex, involving multiple data sources, assumptions, and analysis methods. Deskera ERP simplifies this process by centralizing data, automating workflows, and providing actionable insights that make forecasts more accurate, timely, and reliable. By integrating financial, sales, and operational data, Deskera ERP enables businesses to build forecasts that reflect real-world conditions and strategic plans.

Centralized Data for Accurate Forecasting

Deskera ERP consolidates financial, sales, inventory, and operational data into a single platform. With a unified source of truth, businesses can avoid data inconsistencies and make more informed forecasting decisions. Historical performance, product trends, and revenue streams are easily accessible, helping teams understand past performance and project future revenue with greater precision.

Real-Time Insights and Dashboards

With Deskera’s real-time dashboards, finance and sales teams can monitor revenue trends and pipeline performance instantly. These insights allow businesses to adjust forecasts dynamically in response to changing market conditions, customer demand, or operational shifts, improving agility and reducing the risk of outdated assumptions.

Automated Forecasting Models

Deskera ERP supports automated forecasting using both quantitative and qualitative data. Whether leveraging trend analysis, weighted moving averages, or driver-based forecasts, the platform simplifies model creation, reduces manual errors, and speeds up the forecasting process. Automation ensures that teams spend more time analyzing results and making strategic decisions rather than gathering data.

Scenario Planning and Predictive Analytics

Deskera allows businesses to create multiple scenarios—best-case, worst-case, and most-likely—so decision-makers can evaluate the impact of different variables on revenue outcomes. Its predictive analytics capabilities help quantify the effect of factors such as pricing changes, new product launches, or market expansion, enabling smarter and more resilient planning.

Cross-Functional Collaboration

Forecasting is not limited to finance teams. Deskera ERP integrates sales, marketing, operations, and finance, facilitating collaboration and alignment across departments. Everyone works from the same data, ensuring assumptions are consistent, forecasts are realistic, and operational plans are synchronized with revenue expectations.

Continuous Monitoring and Updates

Deskera ERP makes it easy to maintain rolling forecasts that are regularly updated with the latest data. This continuous approach ensures forecasts remain relevant, allowing teams to track actual performance against projections, identify variances early, and refine assumptions for future periods.

Key Takeaways

- Revenue forecasting provides data-driven estimates of future revenue based on historical performance and market conditions, whereas revenue projections are aspirational targets, and sales forecasts focus on achievable short-term sales goals.

- Accurate revenue forecasts require historical data, clear assumptions, consideration of internal and external factors, and continuous monitoring to guide financial planning and strategic decision-making.

- Selecting the right type of revenue forecast—short-term vs. long-term, top-down vs. bottom-up, operational vs. financial, or deterministic vs. probabilistic—depends on the company’s goals, data availability, and the level of uncertainty in the market.

- Combining quantitative methods (like straight-line, regression, time-series, and ARIMA) with qualitative insights (expert opinions, customer surveys, and market research) improves forecast accuracy and relevance.

- Revenue forecasting enables smarter budgeting, optimized operations, data-driven strategic decisions, cash flow management, and performance tracking, giving businesses greater clarity and confidence in planning for growth.

- Forecasting is limited by data quality, market volatility, overreliance on historical trends, siloed teams, and model complexity, making it essential to approach forecasts as directional tools rather than exact predictions.

- Accuracy improves by using high-quality data, selecting suitable forecasting methods, incorporating internal and external drivers, aligning cross-functional teams, leveraging automation, and regularly updating forecasts based on performance and market changes.

- Avoid common pitfalls such as relying solely on historical data, ignoring external factors, overcomplicating models, failing to update forecasts, and underestimating variability to ensure forecasts remain realistic and actionable.

- Revenue forecasting is moving toward real-time updates, AI-powered predictions, scenario planning, probabilistic modeling, driver-based analysis, and cloud-based integrated platforms to improve accuracy, agility, and strategic decision-making.

- Deskera ERP centralizes data, automates forecasting models, provides real-time dashboards, supports scenario planning, and fosters cross-functional collaboration, enabling businesses to make faster, smarter, and more accurate revenue predictions.

Related Articles