With the onset of COVID-19, everything has turned topsy-turvy, especially the food industry including restaurants. With shutdowns and restrictions all over, revenue opportunities have been cut off to a great extent.

This is where Restaurant Revitalization Fund (RRF) steps in! It is a new grant program that strives to provide financial relief to businesses and individuals across the country. Read on to know more about RRF!

What is the Restaurant Revitalization fund?

It is a grant program for restaurants that aims at easing the financial burden owing to the Covid-19 pandemic. The RRF was established under the American Rescue Plan Act and it became public law on March 11, 2021. This was established with the aim to provide financial relief to businesses and individuals across the country. $28.6 billion has been put aside to provide restaurants with funding that would make up the pandemic-related revenue loss i.e., up to $10 million per business, and no more than $5 million per physical location.

What is the Eligibility for RRF?

There are a lot of parameters that decide the eligibility criteria for RRF. Let’s take a look:

- Restaurants

- Food trucks and/or food carts

- Food stands and/or kiosks

- Caterers

- Bars

- Lounges

- Taverns and/or bistros

- Snack bars

- Bakeries

- Breweries and/or microbreweries

- Wineries

- Distilleries

- Tasting and/or taprooms

- Inns

Organization types that are eligible:

- C Corporations

- S Corporations

- Partnerships

- Limited Liability Companies (LLCs)

- Sole traders or proprietors

- Self-employed individuals

- Independent contractors

- Tribal businesses

- Certain B Corporations can be eligible depending on their taxation

There are some other eligibility criteria that include:

Revenue-In order to be eligible to receive RRF, an applicant should be at least 33 percent of gross receipts in 2019 from sales from a physical location. In most cases, it is only required to attest it, but in certain cases, it is required to provide documentation in order to prove it.

Revenue Loss-Businesses should have experienced revenue loss in order to be eligible for this program.

Recipients of other COVID-19 financial relief: Applicants who have received PPP and EIDL and are eligible for RRF, while recipients of SVOG (Shuttered Venues Operators Grant) are not eligible.

Locations: Applicants should have less than 21 locations in order to be eligible

Ineligible businesses include:

- Non-profits companies

- Publicly traded companies

- The companies that are permanently closed

- Those businesses who have done filing of Chapter 7 bankruptcy

- Businesses that have a pending application for, or have received a SVOG

- Those who do their RRF calculation and are only eligible for $1,000 or less in grant funding

The covered period for RRF

The grant funding needs to be spent on eligible expenses that occurred between February 15, 2020, and March 11, 2023. However, if you don’t use all the funds by the March 11th deadline, you will have to return unused money. In cases where the business permanently shuts down before March 11th, then the last day of operation will also be the last day of the covered period.

Eligible expenses for RRF

Let’s take a look at some of the eligible expenses for RRF:

- Operating expenses that occur in daily businesses operations

- Payroll costs

- Paid leave costs for employees

- Group healthcare costs

- Life and disability benefit costs

- Mortgage payments

- Utility payments

- Payment on debt incurred from the business

- Maintenance expenses required to maintain a physical location

- Outdoor seating and service construction

- Cost of PPE and cleaning supplies

- Other business supplies

- Food and beverage expenses

- Certain supplier costs

To apply for RRF, you can either apply online or call at (844) 279-8898.

How to calculate your RRF grant amount?

If you want to apply, you need to calculate the RRF grant amount you are requesting. Here’s a look at the steps involved in it:

Step 1: Firstly, you need to find out the gross receipts number that you reported on your 2019 tax return.

Step 2: Then, the next step is to find out the gross receipts number that you reported on your 2020 tax return. However, this number should not include any funds from PPP, EIDL, or any SBA loans

Step 3: Then you need to subtract the 2020 gross receipts number from the 2019 gross receipts number in order to get your revenue Loss:

2019 Gross Receipts – 2020 Gross Receipts = Revenue Loss

Step 4: if you want to get your RRF Grant Request number, you will have to subtract any funding received from PPP from your Revenue Loss number:

Revenue Loss – PPP Funding Amount = RRF Grant Request

Step 5: In case the RRF Grant Request number is greater than $5 million per location, then you need to reduce the number to $5 million per location.

Then you will get the amount that you are requesting on your RRF application!

When can you expect the RRF grant money?

Remember that from May 3, 2021, applications will start getting received from all applicants. That is why it is imperative to register as early as possible. However, the timing of approvals and grant awards will be prioritized on the basis of businesses that need the most help.

In the first 21 days, funding will be provided to the businesses that are at least 51 percent owned by females, veterans, or socially and economically disadvantaged people.

Dedicated funding for smallest and underserved businesses

The total amount of the RRF fund is $28.6 billion. From this money, a certain amount has been set aside and dedicated to the smallest businesses and those in underserved communities.

- $5 billion is kept aside for RRF applicants with 2019 gross receipts of less than $500,000.

- For applicants with 2019 gross receipts between $500,001 – $1,500,000, $4 billion is set aside.

- For applicants with 2019 gross receipts of less than $50,000, $500 million is set aside.

Who manages the Restaurant Revitalization Fund?

The Restaurant Revitalization Fund is managed by the Small Business Association (SBA) which was founded in 1953. It is an independent agency of the federal government that provides resources and support to entrepreneurs and small businesses in various forms from field offices to partnerships.

What can Restaurant Operators do with the Funds?

There can be many ways that funds can be used for business-related expenses such as payroll costs, utility payments, maintenance expenses, operating expenses, food and beverage expenses including raw materials, supplies, and even construction of outdoor seating spaces.

Business debt including rent, mortgage installments, or other loans is also covered. However, some things like expansion costs and prepayment of rent or debt are ineligible.

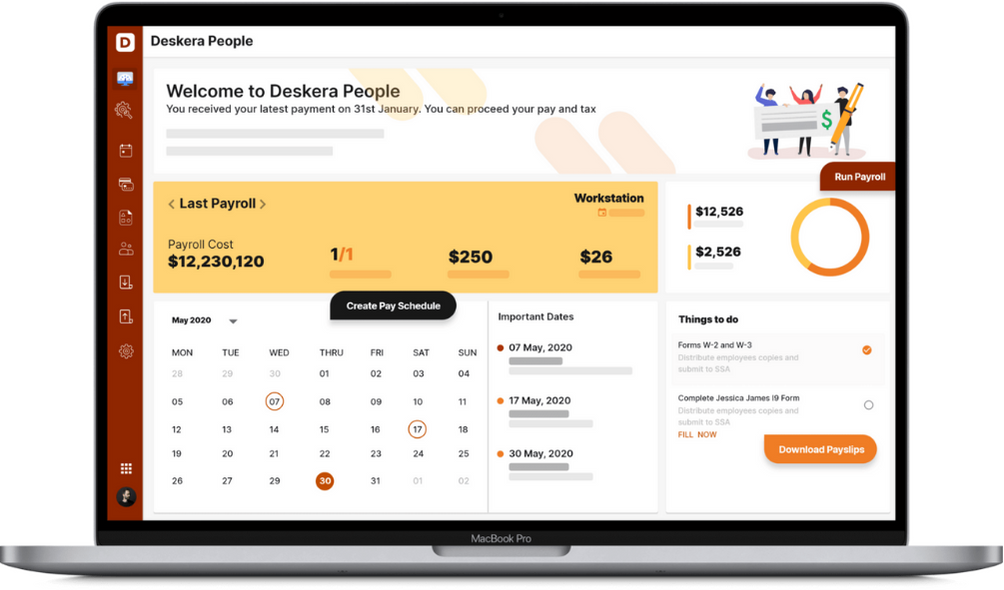

How can Deskera Help You?

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Restaurant Revitalization Fund is a grant program for restaurants that aims at easing the financial burden owing to the Covid-19 pandemic

- The RRF was established under the American Rescue Plan Act and it became public law on March 11, 2021

- Some eligibility criteria need to be met if you want to receive RRF

- Ineligible businesses include non-profits companies, publicly traded companies, the companies that are permanently closed, businesses who have filed for Chapter 7 bankruptcy, those that have a pending application for, or have received a Shuttered Venues Operators Grant (SVOG), those who do their RRF calculation and are only eligible for $1,000 or less in grant funding

- The grant funding needs to be spent on eligible expenses that occurred between February 15, 2020, and March 11, 2023

- Eligible expenses include operating expenses, payroll costs, paid leave costs for employees, group healthcare costs, life and disability benefit costs, mortgage payments, utility payments, payment on debt incurred from the business, maintenance expenses, costs related to outdoor seating and service construction, cost of PPE and cleaning supplies, other business supplies, food and beverage expenses, certain supplier costs, etc.

- There are various steps that need to be followed to calculate RRF

- The total amount of the RRF fund is $28.6 billion. From this money, a certain amount has been set aside and dedicated to the smallest businesses and those in underserved communities

- The Restaurant Revitalization Fund is managed by the Small Business Association (SBA) which was founded in 1953

- There can be many ways that funds can be used for business-related expenses such as payroll costs, utility payments, maintenance expenses, operating expenses, food and beverage expenses including raw materials, supplies, and even construction of outdoor seating spaces

Related Articles