Charges that you incur while working for a customer or an employer are referred to as reimbursable expenditures. They are the expenses related to finishing a project or assignment. You will submit the expenses to your employer or customer for reimbursement—often with copies of the receipts—instead of paying for those expenditures out of your own pocket.

If you want to operate your business efficiently and save money, keeping track of your reimbursable expenditures is essential. Let's go through exactly what constitutes reimbursable charges as well as some typical reimbursable expenses you need to be aware of.

Table of Content

- What Are Reimbursable Expenses?

- Advantages of Tracking & Managing Employee Expenses

- Rules Regarding What Expenses Should Be Considered Reimbursable

- How to Record Reimbursable Payments in a Software (A General Overview)?

- Types of Reimbursable Expenses

- Difference between Reimbursement and Disbursement

- Example of Reimbursable expense

- Importance of Having a Reimbursed Expense Policy

- Are Reimbursable Expenses Taxable?

- Final Thoughts

- How Deskera Can help You?

- Key Takeaways

What Are Reimbursable Expenses?

Employees or suppliers who incurred business-related or billable expenditures are paid back by the firm through reimbursable expenses. Employees typically use their own money or a credit card to pay for their vacation or office supply purchases. After filing cost claims, the employers reimburse the workers. Travel costs and care costs are regarded as allowable expenses for reimbursement.

A company's employees have almost universal access to reimbursable expenditures. The majority of the time, nevertheless, the business can only refund expenditures that are specifically included in the reimbursement policy.

According on the policies established by your employer, the examples of costs in the table above may or may not be reimbursable. Additionally, there are other costs that businesses may reimburse that may qualify as deductible expenses under IRAS regulations.

Before enabling workers to repay, such expenditures should be specified in the corporate policy.

As a business owner, you should constantly keep a record of all the costs that your company may incur, including those that are not necessarily reimbursable. You can simply manage these costs and adjust your budget by keeping track of them. Let's look at a few benefits of tracking employee-related spending.

Let’s see what are the advantages of tracking and managing employee expenses.

Advantages of Tracking & Managing Employee Expenses

· Take full advantage of tax deductions. Companies can be sure they can take all the deductions allowed and have the necessary degree of reporting for the IRS by keeping the right documentation for the right amount of time and making sure all deductions are genuine.

· Improve forecasting and budgeting accuracy. The operational budget of the average corporation includes a sizeable amount of T&E costs. A CFO's ability to appropriately budget and foresee the future may be hampered if these costs are not properly recorded and handled.

· Manage expenditures. It's challenging to successfully manage cash flow when you don't know how much employees are spending when they're working on the road (or at home). You will have more control over these costs and greater knowledge of who is spending what thanks to increased monitoring in this area, which will make it simpler to stop employees from abusing the system.

· Minimize business expense fraud. Overstating company costs, providing false documents, and other abuses are examples of occupational fraud that may be prevented by having effective rules, controls, and monitoring.

Rules Regarding What Expenses Should Be Considered Reimbursable

The cost must first be clearly of a business nature. It must be a purchase necessary for the employee to perform their work duties, or one that is connected to the employee's services to their employer.

This is a rather broad term and may include anything from an additional display for their work computer to an overnight hotel stay during a business trip. To find out the precise legal meaning, check your local laws as they may differ somewhat from place to place.

Secondly, they must have documentation of the payment, such as a receipt, invoice, or other proof of purchase. Depending on the nation, different information must be included on the record for it to be legally acceptable, but at the absolute least, it must contain the total cost (including tax), the date and location of the purchase, and a description of the product or service received.

Last but not least, all reimbursable payments must be promptly reported to the appropriate department. The employee must return to the employer within the same time limit any extra money they may have from the first refund.

If a cost meets these criteria, it may very possibly qualify for a tax deduction.

How to Record Reimbursable Payments in a Software (A General Overview)?

It's critical to keep track of every reimbursable cost, regardless of its nature. You will then have a record in case your client requests one. Additionally, you may be confident that you don't miss out on any money.

Using accounting software is the simplest approach to recording chargeable charges. The appropriate accounting programme will:

· Track your spending automatically, even those that are reimbursed, without you having to do anything.

· enables you to quickly submit a snapshot of a receipt taken with your phone to the cloud.

· enables you to categorise any costs as billable so that you don't neglect to collect payments from clients.

· Because you'll have a thorough record of all business spending, tax time will be a snap for you.

All you have to do is verify the correctness of these costs, making sure they are categorised correctly and, if reimbursable, allocated to the appropriate customer. From there, you may add a markup and attach a receipt (if applicable).

Types of Reimbursable Expenses

Employees may generally request the following categories of main reimbursements:

1. Travel and mileage rate reimbursements

Travel expenditures incurred by workers while on a business trip are reimbursed. Typically, the firm covers all costs associated with the vacation, including lodging, meals, and transportation. In contrast, mileage refers to costs associated with employee-driven business journeys inside the city. If the employee drives a personal car, mileage reimbursements would cover petrol refill expenses, parking fines, and meals. The worker should record the distance driven for the business journey on the car's odometer. Keep in mind that the company's template determines how the mileage rate is calculated.

It's possible that the employee's expenses for meals and entertainment during the work trip won't be reimbursed.

2. Business expense reimbursements

The majority of business expense reimbursements are given when an employee pays for supplies, memberships, services, or other necessities for the operation of the firm. The money the firm spends on marketing initiatives like commercials and content production would be an illustration of business expenditure. Employee membership costs to digital tools and marketing platforms should also be covered via reimbursement.

3. Medical reimbursements

Healthcare for employees should be a top concern for businesses, and any costs incurred that are covered by an employee's healthcare plan will be repaid by the business. Treatments and health insurance premiums are eligible costs for reimbursement. Depending on your health or medical insurance coverage, some expenses associated with your health may not be reimbursed.

Difference between Reimbursement and Disbursement

The methods of disbursement and reimbursement are distinct. The business disburses funds to a third-party provider of products and services. This can take the shape of cheques, money orders, electronic financial transfers, and more.

On the other hand, reimbursements involve compensating any costs made by a team member in order to complete work that is linked to the organization's business. Reimbursement is, in essence, a payout or repayment of the initial disbursement.

Employees use their own funds to pay for reimbursable office expenditures, and the business reimburses them afterwards.

Example of Reimbursable expense

Here are some examples of reimbursable expenses:

Marketing Expenses

You must make marketing efforts round-the-clock if you want to extend your services to the ideal clients. You might spend more money to gratify the customer by running both online and offline advertisements. Therefore, the expenditures associated with these advertising charges are included in the expenses that were reimbursed.

Additionally, you would need to spend extra money on PPC adverts and other web portals if you wanted to grow your business online. Additionally, it's possible that the marketing on social media platforms raised the cost.

Medical Expenses

The HRA (Health Reimbursement Arrangement) plan offers protection to employees of all businesses. Therefore, anytime an employee needs medical attention or sustains an injury while working on-site, he or she may submit a claim for reimbursement of expenditures. Benefits from these medical costs only apply while you are an employee of the firm.

While deducting these costs, you can also avoid paying other taxes. To safeguard your employees against health and medical crises, you must establish a health expenditure reimbursement strategy.

Travel Expenses

It is an additional kind of reimbursement charge for paying for personnel who are out in the field. If you own a company, your staff would be going from place to place advertising your services. These workers' travel expenditures would be paid if they needed to buy any office supplies from a third party.

Additionally, if an employee takes part in a training session outside of their region, they are eligible to claim these reimbursable costs. Many businesses have a policy to only reimburse travel costs associated with customer purchases. The business cannot afterwards claim other services that are unrelated to the business.

Utility Cost

The reimbursement policy safeguards firm personnel when they go to other locations. These utility expenditures may be claimed in connection with the employee's lodging and other utility bills. Additionally, the cost of utilities includes mobile allowances such as internet fees and cell recharges.

Water and power expenditures will be reimbursable for the employee travelling outside of the state. For instance, if a member of your team works from home, typical reimbursable expenditures like internet, energy, and laptops would be reimbursed to their reimbursable account.

Hotel Expenses

When employees are executing their duties away from the office, the company's policy often includes a full-time lunch and overnight accommodations. It will be challenging to get food and lodging if you are providing customer service in the ruler region.

In these situations, you should search for a nearby hotel where you may spend the night. These lodging costs are seen as connected to a business. Employees will only receive limited advantages in situations when the organisation has pre-defined restrictions for the reimbursement programme.

Rented Office Charge

Even though the majority of businesses now allow employees to work from home, many still insist on office space. Therefore, those workers who must work from a temporary location should be paid for their expenditures. Additionally, the cost of office supplies including pens, paperweights, books, and registers is subtracted from operating expenditures.

Additionally, all information must be provided in order to trace the purchase made for office usage. When working remotely, employees hire the office to operate certain on-field equipment. You may also lease a home to keep the supplies and equipment needed by the jobbers.

Importance of Having a Reimbursed Expense Policy

The employer's worry and uncertainty will be lessened by creating a reimbursement policy. This is due to the fact that workers can request repayment at any time, and if you don't have a plan, both parties will be disappointed.

The right reimbursable policy will inform workers in advance of the paperwork required to submit a reimbursement claim. If the employee fails to provide proof of costs within a certain period of time, you will also be aware of whether the reimbursement is taxable or not.

Keep in mind that workers' lower income is just for tax purposes. These expenditures should be covered by the business itself, not by the employees. If there is a stated reimbursement policy, it will be simple to determine whether expenditure claims are legitimate.

Are Reimbursable Expenses Taxable?

Reimbursements of expenses are not regarded as taxable income. As a result, when you reimburse workers and independent contractors for company expenditures, they shouldn't be required to pay taxes.

First off, this is not real money. Employers are only being reimbursed for business expenses. Employees then utilise their already-taxed money to cover your company's costs. Taxing someone twice is called double taxation.

It is your responsibility as the employer to ensure that your reimbursable revenue is distinct from your employee's wages. While it may be practical to combine invoices or include reimbursements in payroll, doing so might complicate your taxes when you have to file them. Your accountant won't know which income is repaid, so you shouldn't bank on remembering.

Rather, keep paying employee salary as usual, even if some of your team members are due reimbursements. Next, set up a unique accounts payable account just for team reimbursements.

To keep the cash separate, your accounting department can issue checks to your workers (or deposit them straight from your account). By doing this, the company costs won't be included as income when you file your W-2 or 1099 forms in the spring.

Separate accounts might also help to safeguard your company. You can demonstrate that your reimbursable expenditures are organised and paid out if you are subject to an IRS audit and your salaries are reported appropriately.

Final Thoughts

Many businesses have trouble with the reimbursement procedure for company costs. You, as a business owner, are responsible for handling employee payments on your behalf. You must create a reimbursement strategy in order to reduce your workload. When employees report the reimbursable costs in their income accounts, you won't see any discrepancies either.

However, you may stay on top of company spending and other expense claims with the aid of the appropriate software solutions.

How Deskera Can help You?

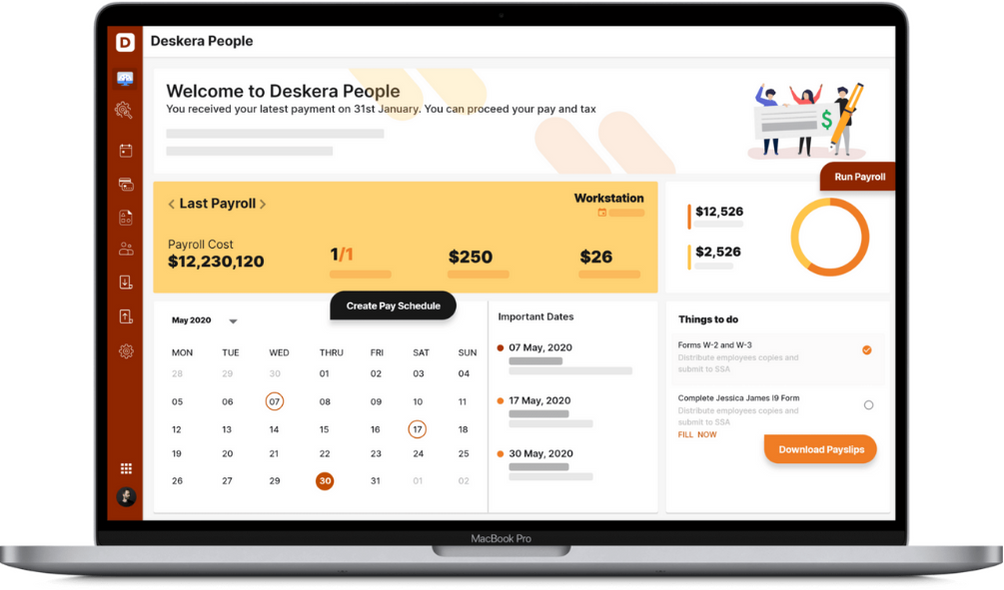

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key Takeaways

· If you want to operate your business efficiently and save money, keeping track of your reimbursable expenditures is essential.

· Employees or suppliers who incurred business-related or billable expenditures are paid back by the firm through reimbursable expenses.

· As a business owner, you should constantly keep a record of all the costs that your company may incur, including those that are not necessarily reimbursable.

· Rules for reimbursement: The cost must first be clearly of a business nature. Secondly, they must have documentation of the payment. Last but not least, all reimbursable payments must be promptly reported to the appropriate department.

· The right reimbursable policy will inform workers in advance of the paperwork required to submit a reimbursement claim.

Related Articles