As we know the purpose of various acts, laws, and rules in place is to make businesses easy to function. The Contract Labour Regulation & Abolition Act of 1970 is one such act that mentions several rules you must take note of as a business owner.

In this article, we will learn a little about the Contract Labor Act of 1970 and discuss the register of fines to be maintained by the contractors.

This article covers the following:

- What is the Contract Labour Regulation & Abolition Act 1970?

- Contract Labour Regulation & Abolition Act 1970

- Registration of certain establishment

- Effect of non-registration

- Prohibition of employment of contract labour

- Maintenance of register of fines

What is The Contract Labour Regulation & Abolition Act 1970?

It applies to every establishment where every contractor who employs 20 or more workers is employed or was employed in the preceding 12 months. It does not apply to establishments in which work of casual nature is performed.

Work performed in an establishment should not be deemed to be intermittent if it was performed for more than one hundred and twenty days in the preceding twelve months.

Every principal employer shall apply to the registering officer for the registration of the establishment in Form I and pay applicable fees. The principal employer shall nominate a representative who shall be present at the time of disbursement of wages, and the amounts paid to the contract labor shall be certified by the representative.

As per the Contract Labor (Regulation & Abolition) Karnataka Rules, 1974, the authorized representative of the principal employer shall record under his signature a certificate at the end of the entries in the register of wages or register of wages cum muster roll.

The employer shall maintain a register of contractors in Form XXI. The principal employer shall send a return in Form XXV to the Registering Officer by 15th February.

A return shall be submitted, intimating the actual dates of commencement or completion of work to the inspector within 15 days of completion of each contract work under each contractor.

This was the gist of the act; now, let’s take a deep dive into the act.

Contract Labour Regulation & Abolition Act 1970

The Contract Labour (Regulation and Abolition) Act of 1970 extends to the whole of India. It shall come into force when the Central Government, by notification in the Official Gazette, appoints and different dates may be appointed for different provisions of this Act.

The Act applies to every establishment in which twenty or more workmen, art employed, or were employed on any day of the preceding twelve months as contract labor. to every contractor who employs or who employed on any day of the preceding twelve months twenty or more workmen.

Provided that the appropriate Government may, after giving not less than two months' notice of its intention so to do, by notification in the Official Gazette, apply the provisions of this Act to any establishment or contractor employing the such number of workmen less than twenty as may be specified in the notification.

It shall not apply to establishments in which work only of an intermittent or casual nature is performed. In case the question arises whether work performed in an establishment is of an intermittent or casual nature, the appropriate Government shall decide that question after consultation with the Central Board or, as the case may be, a State Board, and its decision shall be final.

For this sub-section, work performed in an establishment shall not be deemed to be intermittent. If it was performed for more than one hundred and twenty days in the preceding twelve months, or if it is seasonal and is performed for more than sixty days in a year.

Object and purpose of the Act-Application to pending construction works do not amount to unreasonable restriction on the right under Act 19. The whole statute is constitutional and valid.

Where the dispute relates to service conditions of the workers engaged in the factory canteen maintained by the company, and there is no question of the abolition of contract labor, the dispute can be referred to the Industrial Tribunal for adjudication of Indian Explosives. The appropriate Government may, by an order notified in the Official Gazette:

Appoint such persons, being Gazetted Officers of Government, as it thinks fit to be registering officers for this Chapter. Define the limits within which a registering officer shall exercise the powers conferred on him by or under this Act.

Registration of Certain Establishment

Every principal employer of an establishment to which this Act applies shall, within such period as the appropriate Government may, by notification in the Official Gazette, fix in this behalf concerning establishments generally or concerning any class of them, make an application to the registering office: in the prescribed manner for registration of the establishment.

Provided that the registering officer may entertain any such application for registration after the expiry of the period fixed on this behalf if the registering officer is satisfied that the applicant was prevented by sufficient cause from making the application in time.

Suppose the application for registration is complete in all respects. In that case, the registering officer shall register the establishment and issue to the principal employer of the establishment a certificate of registration containing such particulars as may be prescribed.

Revocation of Registration in Certain Cases

If the registering officer is satisfied, either on a reference made to him on this behalf or otherwise, that the registration of any establishment has been obtained by misrepresentation or suppression of any material fact.

Or that for any other reason the registration has become useless or ineffective and, therefore requires to be revoked, the registering officer may, after giving an opportunity to the principal employer of the establishment be heard and with the previous approval of the appropriate Government, revoke the registration.

Effect of Non-Registration

No principal employer of an establishment, to which this Act applies, shall, in the case of an establishment required to be registered under Section 7, but which has not been registered within the time fixed for the purpose under that section.

In the case of an establishment the registration in respect of which has been revoked under Section 8, employ contract labor in the establishment after the expiry of the period referred to in clause A or after the revocation of registration referred to in clause B, as the case may be.

Prohibition of Employment of Contract Labour

Notwithstanding anything contained in this Act, the appropriate Government may, after consultation with the Central Board or, as the case may be, a State Board, prohibit, by notification in the Official Gazette, employment of contract labor in any process, operation, or other work in any establishment.

Before issuing any notification under sub-section 1 in relation to an establishment, the appropriate Government shall have regard to the conditions of work and benefits provided for the contract labor that was established and other relevant factors, such as.

Whether the process, operation, or other work is incidental to or necessary for the industry, trade, business, manufacture, or occupation that is carried on in the establishment.

Whether it is of perennial nature, that is to say, it is so of sufficient duration having regard to the nature of the industry, trade, business, manufacture or occupation carried on in that establishment. Whether it is done ordinarily through regular workmen in that establishment or an establishment similar thereto.

It is sufficient to employ a considerable number of whole-time workmen. If a question arises whether any process or operation or other work is of perennial nature, the decision of the appropriate Government thereon shall be final.

Criteria and Circumstances for Abolition of Contract Labour

The dispute related to the abolition of contract labor in the seeds go down and solvent extraction plants in the appellant's factory engaged in the manufacture of edible oils and their by-products.

The appellant company maintained that in both the departments the work was intermittent and sporadic type and hence contract labor was both efficient and economic.

The union, on behalf of the workmen, challenged this standpoint and furnished charts, etc., to prove the continuous and perennial nature of the work. It also referred to the practice in certain other companies.

Suppose the work for which contract labor is employed is incidental to and closely connected with the main activity of the industry and is of perennial and permanent nature. In that case, the abolition of contract labor should be justified.

It is also open to the Industrial Tribunal to have regard to the practice obtained in other industries in or about the same area. It is clear that the feeding of hoppers in the solvent extraction plant is an activity closely and intimately connected with the main activity of the appellant.

This item of work is incidental to the nature of the industry carried on by the appellant, which must be done almost every day and there should be no difficulty in having regular workmen in the employment of the appellant to do this type of work.

Also in comparison with other factories doing the same work, it follows that the feeding of hoppers is an essential part of the industry carried on by the appellant and that it could very well be done by the departmental workman as is being done by others.

On merits, the direction of the Industrial Tribunal abolishing contract labor regarding loading and unloading cannot be sustained. When it is shown that in similar establishments this type of work is not ordinarily done through regular workmen, but by contract labor that is a circumstance that will operate in favor of the appellant.

No doubt, the Industrial Tribunal referred to Section 10 of the Central Act, but the Tribunal misapplied those provisions when it directed abolition of contract labor regarding loading and unloading operations.

Provincial Govt. has the exclusive jurisdiction regarding the prohibition of employment of contract labor. Industrial Tribunal cannot issue directions to an establishment to abolish contract labor after coming into force of the Act.

Central Government is not required to put on record that they have examined the question of prohibition of contract labor in the establishments after taking into account each fact separately.

Appointment of Licensing Officers

The appropriate Government may, by order, be notified in the Official Gazette. You must appoint such persons, being Gazetted Officers of Government, as it thinks fit to be licensing officers for the purposes of this Chapter and define the limits within which a licensing officer shall exercise the powers conferred on licensing officers by or under this Act.

Licensing of Contractors

With effect from such date as the appropriate Government may, by notification in the Official Gazette, appoint, no contractor to whom this Act applies, shall undertake or execute any work through contract labor except under and in accordance with a license issued on that behalf by the licensing officer.

Subject to the provisions of this Act, a license under subsection one may contain such conditions, including, in particular, conditions as to hours of work, fixation of wages, and other essential amenities in respect of contract labor as the appropriate Government may deem fit to impose in accordance with the rules, if any, made under Section 35 and shall be issued on payment of such fees and on the deposit of such sum, If any, as security for the due performance of the conditions as may be prescribed.

12-Sub-contractors or 'piece wagers' are equally responsible for obtaining a license and implementing the provisions of the Act and the Rules. Execution of work in a government project by piece wagers through workers employed by them either directly or through haters must be in accordance with the license obtained under Section 12.

Where a firm under all agreements undertook the work of holding and storage another company's materials and for that purpose utilized the services of some laborers employed through sirdars, the firm, its partners, and employees could not be prosecuted for not obtaining a license under S. 12 as the firm is an "establishment" within the meaning of Section 2 and not the company's contractor.

Assuming the partners and employees of the firm or any of them were principal employers, they could not be contractors and principal employers in relation to the same establishment. Moreover, each of the sirdars was a contractor within the meaning of the act in relation to the firm, i.e., the establishment.

The concerned workmen having been supplied through the medium of sirdars, neither the firm nor the partners nor the employees could be deemed to be contractors in relation to the said workers. Their liability to take out a license cannot, therefore, arise.

Imposed a liability not to undertake or execute any work through contract labor without a license, a liability which continued until the license was obtained and its requirement was complied with.

It was an act that continued. Undertaking or executing any work through contract labor without a license, therefore, constituted a fresh offense every day on which it continued.

Grant of Licenses

Every application for the grant of a license under sub-section 1 of Section 12 shall be made in the prescribed form and shall contain the particulars regarding the location of the establishment, the nature of the process, operation, or work for which contract labor is to be employed and such other particulars as may be prescribed.

The licensing officer may make such investigation in respect of the application received under sub-section 1 and in making any such investigation the licensing officer shall follow such procedure as may be prescribed.

A license granted under this adapter shall be valid for the period specified therein and may be renewed from time to time for such period, and on payment of such fees and on such conditions as may be prescribed.

Revocation, Suspension, and Amendment of Licenses

If the licensing officer is satisfied, either on a reference made to him on this behalf or otherwise, that a license granted under Section 12 has been obtained by misrepresentation or suppression of any material fact, or.

The holder of a license has, without reasonable cause, failed to comply with the conditions subject to which the license has been granted or has contravened any of the provisions of this Act or the rules made thereunder, then without prejudice to any other penalty to which the holder of the license may be liable under this Act, the licensing officer may after giving the holder of the license an opportunity of showing cause, revoke or suspend the license or forfeit the sum, if any, or any portion thereof deposited as security for the due performance of the conditions subject to which the license has been granted.

Subject to any rules that may be made on this behalf, the licensing officer may vary or amend the license granted under Section 12.

Appeal

Any person aggrieved by an order made under Section 7, Section 8, Section 12, or Section 14 may, within thirty days from the date on which the order is communicated to him, prefer an appeal to an appellate officer who shall be a person nominated in this behalf by the appropriate Government.

Provided that the appellate officer may entertain the appeal after the expiry of the said period of thirty days if he is satisfied that the appellant was prevented by sufficient cause from filing the appeal in time.

The appropriate Government may make rules requiring that in every establishment to which this Act applies, wherein work requiring the employment of contract labour is likely to continue for such period as may be prescribed, and wherein contract labour numbering one hundred or more is ordinarily employed by a contract, one or more canteens shall be provided and maintained by the contractor for the use of such contract labor.

Without prejudice to the generality of the foregoing power, such rules may provide for the date by which the canteens shall be provided by the number of canteens that shall be provided, and the standards in respect of construction, accommodation, furniture, and other equipment of the canteens; and the foodstuffs which may be served therein and the charges which may be made, therefore.

A contractor shall be responsible for payment of wages to each worker employed by him as contract labor, and such wages shall be paid before the expiry of such period as may be prescribed.

Every principal employer shall nominate a representative duly authorized by him to be present at the time of disbursement of wages by the contractor and it shall be the duty of such representative to certify the amounts paid as wages in such manner as may be prescribed.

It shall be the duty of the contractor to ensure the disbursement of wages in the presence of the authorized representative of the principal employer. In case the contractor fails to make payment of wages within the prescribed period or makes a short payment, then the principal employer shall be liable to make payment of wages in full or the unpaid balance due, as the case may be, to the contract labor employed by the contractor and recover the amount so paid from the contractor either by deduction from any amount payable to the contractor any contract as a debt payable by the contractor.

What All You Must Keep an Account of?

Registers of contractors- Every principal employer shall maintain in respect of each registered establishment a register of contractors in Form XII.

Register of persons employed- Every contractor shall maintain in respect of each registered establishment where he employs contract labor a register in Form XIII.

Employment card- Every contractor shall issue an employment card in Form XIV to each worker within three days of the worker's employment. The card shall be maintained up-to-date, and any change in the particulars shall be entered therein.

Service certificate- On termination of employment for any reason whatsoever the contractor shall issue to the workman whose services have been terminated a Service Certificate in Form XV.

Muster Roll, Wages Register, Deduction Register and Overtime Register- Every contractor shall in respect of each work on which he engages contract labour. Maintain a Muster Roll and a Register of Wages in Form XVI and Form XVII respectively. Provided that a combined Register of Wage-cum-Muster Roll in Form XVIII shall be maintained by the contractor where the wage period is a fortnight or less.

Maintain a Register of Deductions for damage or loss, Register of Fines and Register of Advances in Form XX, Form XXI and Form XXII respectively. Maintain a Register of Overtime in Form XXIII recording therein the number of hours of, and wages paid for, overtime work, if any.

Every contractor shall, where the wage period is one week or more, issue wage slips in Form XIX to the workmen at least a day prior to the disbursement of wages. Every contractor shall obtain the signature or thumb impression of the worker concerned against the entries relating to him on the Register of Wages or Muster Roll-cum-Wages Register, as the case may be.

The entries shall be authenticated by the initials of the contractor or his authorized representatives. They shall also be duly certified by the authorized representative of the principal employer in the manner provided in Rule 73.

In respect of establishments that are governed by the Payment of Wages Act, 1936 (4 of 1936) and the rules made thereunder, or Minimum Wages Act, 1948 (11 of 1948) or the rules made thereunder, the following registers and records required to be maintained by a contractor as an employer under those Acts and the Rules made thereunder shall be deemed to be registers and records to be maintained by the contractor under these rules, namely:

(a) Muster Roll

(b) Register of Wages

(c) Register of Deductions

(d) Register of Overtime

(e) Register of Fines

(f) Register of Advances

(g) Wage slip.

Notwithstanding anything contained in these rules, where a combined or alternative form is sought to be used by the contractor to avoid duplication of work for compliance with the provisions of any other Act or the rules framed there under or any other laws or regulations or in cases where mechanized pay rolls are introduced for better administration, alternative suitable form or forms in lieu of any of the forms prescribed under these rules, may be used with the previous approval of the Chief Labour Commissioner (Central).

Every contractor shall display an abstract of the Act and rules in English and Hindi and in the language spoken by the majority of workers in such form as may be approved by the Chief Labour Commissioner (Central).

All registers and other records required to be maintained under the Act and rules shall be maintained complete and up-to-date and, unless otherwise provided for, shall be kept at an office or the nearest convenient building within the precincts of the workplace or at a place within a radius of three kilometers. Such registers shall be maintained legibly in English or Hindi.

All the registers and other records shall be preserved in original for a period of three calendar years from the date of last entry therein. All the registers, records, and notices maintained under the Act or rules shall be produced on demand before the Inspector or any other authority under the Act or any person authorized on that behalf by the Central Government.

Where no deduction or fine has been imposed or no overtime has been worked during any wage period, a 'nil' entry shall be made across the body of the register at the end of the wage period indicating also in precise terms the wage period to which the 'nil' entry relates, in the respective registers maintained in Forms XX, XXI and XXII respectively.

Notices showing the rates of wages, hours of work, wage periods, dates of payment of wages, names and addresses of the Inspectors having jurisdiction, and date of payment of unpaid wages shall be displayed in English and in, Hindi and in the local language understood by the majority of the workers in conspicuous places at the establishment and the work-site by the principal employer or the contractor, as the case may be.

The notices shall be correctly maintained in clean and legible condition. A copy of the notice shall be sent to the Inspector, and whenever any changes occur, the same shall be communicated to him forthwith.

Every principal employer shall, within fifteen days of the commencement or completion of each contract work under each contractor, submit a return to the Inspector, appointed under Section 28 of the Act, intimating the actual dates of the commencement or, as the case may be, completion of such contract work, in Form VI-B.

Every contractor shall send half yearly return in Form XXIV (in duplicate) so as to reach the Licensing Officer concerned not later than 30 days from the close of the half-year.

Half-year for the purpose of this rule means "a period of 6 months commencing from 1st January and 1st July of every year.

Every principal employer of a registered establishment shall send a return annually in Form XXV (in duplicate) so as to reach the Registering Officer concerned not later than the 15th February following the end of the year to which it relates.

The Board, Committee, Chief Labour Commissioner (Central) or the Inspector, or any other authority under the Act shall have the powers to call for any information or statistics in relation to contract labor from any contractor or principal employer at any time by an order in writing. Any person called upon to furnish the information under sub-rule shall be legally bound to do so.

FORM XXI

Register of Fines

How Can Deskera Assist You?

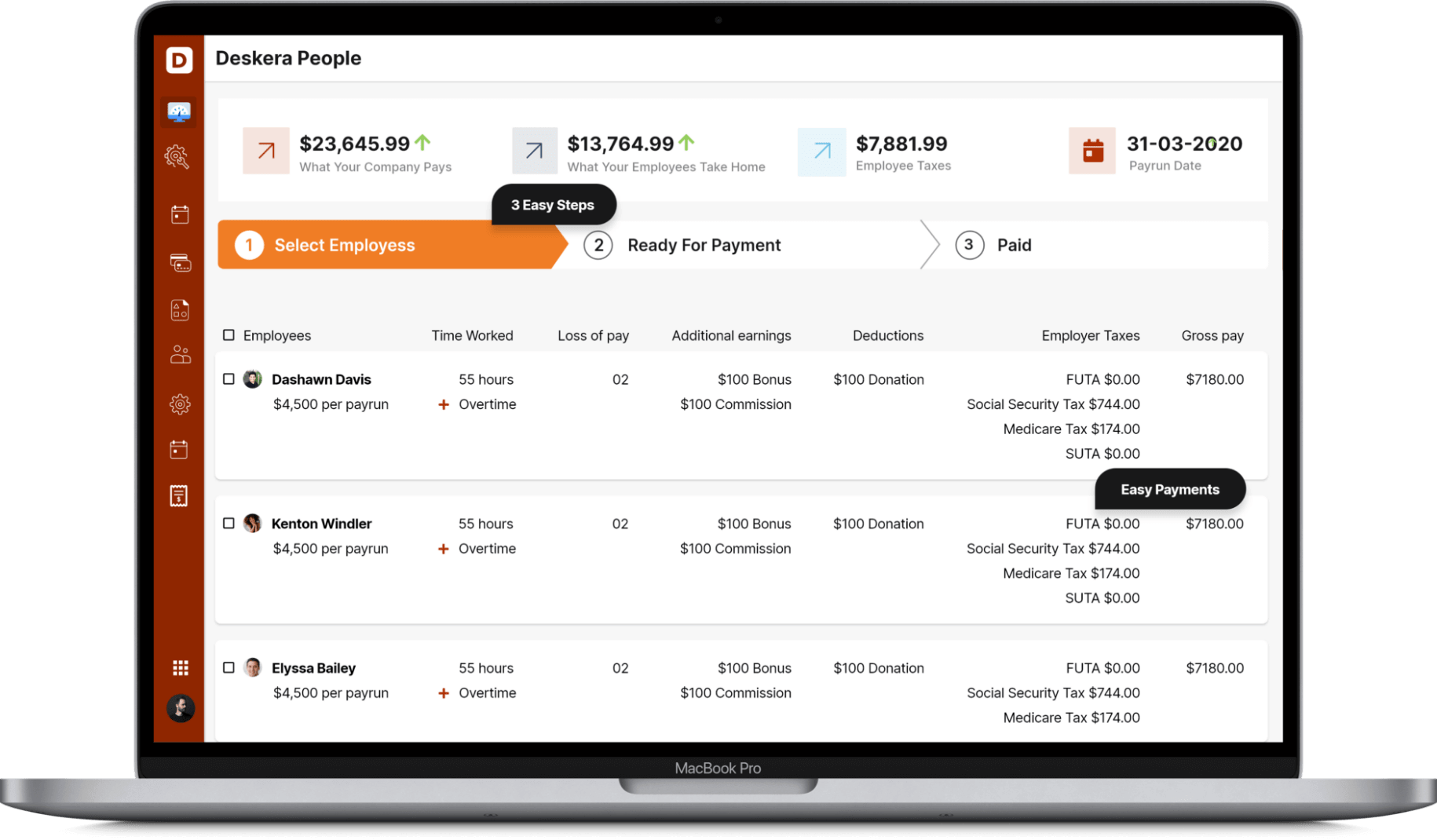

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. Features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning and uploading expenses, and creating new leave types make your work simple.

Key Takeaways

- Contract Labour Regulation Act of 1970 is applicable to every establishment in which every contractor who employs, 20 or more workmen are employed or were employed in the preceding 12 months.

- It shall not apply to establishments in which work only of an intermittent or casual nature is performed.

- Maintain a Register of Deductions for damage or loss, Register of Fines, and Register of Advances in Form XX, Form XXI, and Form XXII, respectively.

- The Central Register Fines Form xxi is given to the principal employer, and another copy is to be retained by the contractor.

Related Articles