A school employed Suma, a teacher, for a year in 2021 on a contract basis in a regular employee's place who had gone on leave.

Will Suma be eligible for gratuity?

As per the new gratuity rules (2020) contract employees working for a fixed term of one year or employees working in seasonal business establishments should be treated as regular employees and are entitled to gratuity. Non-compliance is punishable with imprisonment, with a fine, or both.

Statutory compliance is challenging but crucial for an establishment. As per the Payment of Gratuity (Central)Rules, 1972, an employer must submit a series of forms, the first among them is the Form Notice of Opening.

Form notice of opening is essential for an organisation to establish itself legally. It contains the number of its employees, nature of business, the name and address of the establishment, and its submission is within thirty days from the enforcement of the rule applicable to the concern.

This blog speaks of the purpose of Form Notice of Opening and contains:

- What is a Form notice of opening?

- Controlling Authority for Form Notice of opening submission

- When should a Business Enterprise submit the form notice of opening

- Form Notice of Opening of Establishment

- To Whom does the submission of Form notice of opening apply

- Purpose of Form notice of Opening

- Contents of Form Notice of Opening

- Name and address of the Establishment

- Name and designation of the Employer

- Number of persons employed

- Maximum number of persons employed on any day during the preceding twelve months with the date

- Number of employees covered by the Act

- Nature of industry

- Whether seasonal

- Date of opening

- Details of Head Office/Branches

- Name and address of the head office and number of employees

- Names and addresses of other branches in India

- Declaration

- When Should a Business Enterprise submit the Form Notice of Opening?

- Form notice of the opening

- Form notice of change

- Form notice of closure

- The criteria to display the form notice of opening

- Conclusion

- Key Takeaways

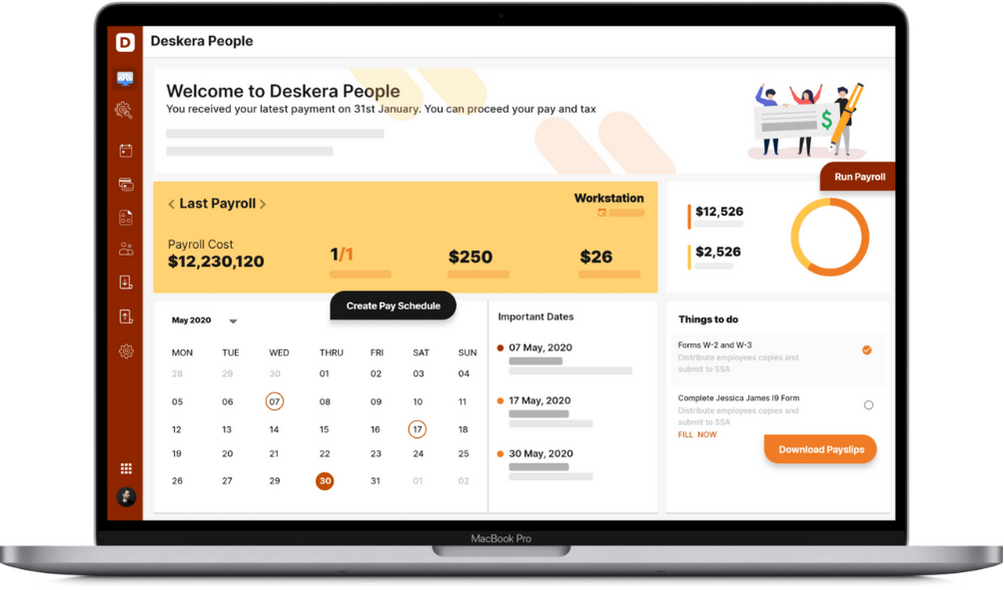

- Human Resource Software from Deskera

What is a Form Notice of Opening?

By the enforcement of the Payment of Gratuity (Central) Rules, 1972 on September 16, 1972, an establishment needs to send a Form Notice of opening to the Central Government or the authority specified by the Central Government under sub-section (7) of section 7.

Form notice of opening is the establishment's information of its existence and an appeal for its legal recognition by the Central Authority.

In compliance with the Act, business establishments must submit Form notice A or the form notice of opening to the controlling authority within the specified period, within thirty days of its application to the business.

Controlling Authority for Form Notice of Opening Submission

The Government appoints one of its officers as the controlling authority. The Central Government intimates their decision by a notification. The appointed officer shall then be responsible for the administration of the Payment of Gratuity Act, 1972, in the area allotted to him. The Central Government may appoint many controlling authorities and designate them to different areas.

When Should a Business Enterprise submit the Form Notice of Opening?

Business Establishment must submit the Form notice to the controlling authority in the following scenario:

Form Notice of Opening of Establishment

With thirty days of rule application, the employer must submit Form A or form notice of the opening of their establishment to the controlling authority.

To Whom does the Submission of Form Notice of Opening Apply

The Payment of Gratuity (Central) Rules, 1972 apply to the whole of India except the State of Jammu and Kashmir and apply to:

- Every factory, mine, oilfield, plantation, port, and the railway company

- Every shop or establishment which has ten or more persons are employees or were employed, on any day of the preceding twelve months

- Such other establishments or class of establishments, in which ten or more employees are or were employed, on any day of the preceding twelve months, as the Central Government may, by notification, specify on this behalf

- A shop or establishment to which this Act has become applicable continues to be governed by this Act, notwithstanding that the number of persons employed therein at any time after it has become so applicable falls below ten

- It shall come into force on such date as the Central Government may, by notification, appoint

Purpose of Form Notice of Opening

Rule 3 (1) 0f the Payment of Gratuity (Central) Rules, 1972 -1, necessitates the employer of a business organisation to submit a Form Notice of Opening to the Controlling Authority. The submission of Form Notice of Opening within thirty days of the applicability of rules to the establishment. The Form notice of opening enables an organisation to establish itself legally. The employer must fill up all relevant information about the nature of the business, the number of employees, and the name and address of the establishment in the Form notice of opening.

Contents of Form Notice of Opening

The form notice of opening must have all the relevant details of the company as follows:

Name and Address of the Company

State the unique name of the business establishment in the Form notice of opening. If the business establishment changes its name or location, the controlling authority of the new locality needs to be informed. The form notice of change or form B is appropriate for this purpose.

Name and Designation of the Employer

The second detail to be filled in, in the form notice of opening, is the name and designation of the employer. Input the name clearly as stated in the photo identification documents. Also, state the employer designation in the form notice of opening.

Number of Persons Employed

The employer submits the form notice is opening in compliance with the Payment of Gratuity Act, 1972. That is why it should state the precise number of employees.

Maximum Number of Persons Employed on any day During the Preceding Twelve Months with Date

In addition to their regular employees, a business entity hires freelancers, interns, and contract workers to do specific jobs.

In the preceding twelve months, if they have hired such personnel and accepted their services in return for remuneration, the maximum number of employees and the date of employment should be input on the form notice of opening.

Number of Employees covered by the Payment of Gratuity Act

The Payment of Gratuity Act covers those employees who have served the organisation for five years and more. State the precise number in the form notice of opening.

Nature of Industry

The primary aim of Business entities is to carry out the manufacture and sale of products or provision of services.

The term nature of business refers to the purpose and reason for the organisation to exist within an industry or market sector.

Nature of Business refers to :

- The type of services the company renders the products it manufactures and sells or both

- The market sector or the industry in which the business operates

- Distinctive characteristics of the business if any

- The mission and purpose of the business enterprise

An easier way to find the nature of your business is to categorise nature into diverse classes like:

- By the product they deal in or the services they offer

- The set up of the business organisation

- The structure of the business organisation

- The type of business

Determine the nature of your business by following the above guidelines and add them to form notice of opening under this head.

Also, if there is a change in the above, intimate the information to the controlling authority by sending them the duly filled form notice B clearly stating a change like a business.

It is Seasonal

Some businesses like those dealing with school supplies, raincoats, and umbrellas or tourism are seasonal, while others carry on their business throughout the year. The form notice must include this information.

Date of Opening

Form notice must have the following information concerning dates of opening:

- Date of opening of business

- Date of the commencement of business

Details of Head Office and Branches

The form notice must contain the relevant information of its head or authorised offices and branches of the business establishment in India. It should hold information about:

(a) Name and address of the head office and the number of employees

(b) Names and addresses of other branches in India

Declaration

After stating all the necessary details precisely in the form notice of opening, the employer must present a declaration concerning the authenticity of the particulars input in the form notice of opening.

Draft as follows:

I verify that the information furnished above is true to the best of my knowledge and belief.

The employer must then sign the form notice of opening.

The Criteria to Display the Notice of Opening

Under the Payment of Gratuity Act, 1972 (1) employers must display the form notice of opening as follows:

- The employer must display the form notice of opening where it is visible to employees, preferably at the entrance or exit

- Write the form notice in English and a language understood and legible to most of the employees

- The employer must also display the authorised officer’s name who will receive the notices on his behalf

- The employer will change the notice when he incorporates the changes on the form notice of opening

- The employer will also change the notice and display a fresh one in its place if the notice on display is illegible

Conclusion

In compliance with the payment of gratuity act, 1972(1) all business establishments with ten or more employees at a given time must submit the form notice with all relevant businesses, employers and employees. This blog details each aspect of the form notice to help the human resources (HR) department efficiently handle its preparation, submission, and display.

How can Deskera Help You?

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- In compliance with the gratuity Act, the employer of a business establish having more than ten employers on one or during a fixed period must submit Form A or form notice to the controlling authority in the area

- The form should be submitted within thirty days of rule applicability to the business

- The form must contain all relevant details concerning the business, the employer, and the employee

- The employer must display the form notice at a prominent place where all can see in two languages— English and the local language or any other language that is legible to the majority of the employees

- The employer adds the name of the office to whom the employees must submit receipts on the form before displaying it

You can manually handle the payroll processing and management, but it takes much time, involves complex calculations, and may also be inaccurate. Introduce Deskera to your business today. Digitise and automate hiring, payroll, leave, attendance, expense, gratuity payments, submission of forms, and other HR processes. Deskera offers you the powerful HRMS tool to streamline all payroll tasks paving the way for the HR and business owners to concentrate only on more crucial areas of business.

Related Articles