The Government of Karnataka on April 26, 2021 has issued the Karnataka Tax on Professions, Trades, Callings and Employment Removal of Difficulties Order, 2021 to further amend the Karnataka Tax on Professions, Trades, Callings and Employment (Removal of Difficulties) Order, 1976.

All you need to know about this act is in this article. So, let’s get started!

This article covers the following:

- What is the Karnataka tax on professions, trades, callings, and employment act 1976?

- All you need to know about the act.

- Returns, notices, and payments of tax.

- Filling of statements, returns, and payments through banks.

- Appeals

- How can Deskera assist you?

What is Karnataka Tax on Professions, Trades, Callings, and Employment?

Firstly, the act extends to the whole of the State of Karnataka, and it shall be deemed to have come into force on the first day of April 1976. Profession tax is levied under the Karnataka Tax on Professions, Trades, Callings and Employments Act, 1976.

This tax shall be paid by every person exercising any profession or calling or is engaged in any trade or holds any appointment, public or private, as specified in the Schedule to the Act.

All You Need to Know About the Act

Grant of Certificate of Registration

An application for a certificate of registration under subsection (1) of section 5 shall be made in Form-1. An employer having places of work within the jurisdiction of different assessing authorities shall apply for registration separately to each such authority in respect of his place of work within the jurisdiction of that authority.

Provided that in respect of an industrial undertaking whose project is approved either by the State High-Level clearance Committee or State Level Window Committee, or District Level Single Window Committee, a combined application form in Form 1-A may be submitted

Provided further that any assessment having more than one place of work coming within the jurisdiction of different assessing authorities may make a single application in respect of all such places to the assessing authority having jurisdiction over his principal place of work.

On receipt of an application for a certificate of registration, the assessing authority shall grant to the applicant a certificate of registration in Form-3 if it is satisfied that the application is in order and the applicant has furnished the necessary particulars.

Suppose the assessing authority finds that the application is not in order or that all the particulars necessary for the issue of the certificate of registration have not been furnished. In that case, it shall direct the applicant to file a revised application or furnish such additional information as it may consider necessary.

After considering the revised application or the additional information, the assessing authority shall grant a registration certificate in Form-3.

Grant of Certificate of Enrolment

An application for a certificate of enrolment under subsection 2 of Section 5 shall be made in Form-2. A person having more than one place of work in the State of Karnataka, whether within the jurisdiction of the assessing authority or outside such jurisdiction, shall be granted only one certificate of enrolment.

Provided that in respect of an industrial undertaking whose project is approved either by the state High-Level clearance Committee, State Level Single Window clearance Committee, or District Level Single Window Committee, a combined application form in Form 1-A may be submitted.

Where the person has more than one place of work within the State of Karnataka, he shall make a single application in respect of all such places, name in such application one of such places as the principal place of work for these rules, and submit such application to the assessing authority in whose jurisdiction the said principal place of work is situated.

Upon receipt of an application in Form-2, the assessing authority may call upon the person to furnish such additional information or evidence as necessary for determining the amount of tax payable by him according to the Schedule to the Act.

After considering the application and such additional information or evidence as may be furnished, the assessing authority shall grant an enrolment certificate in Form-4 where the person has more than one place of work in the State as many copies of the certificate shall be issued to him as there are places of work, in addition to the principal place of work.

Amendment of Certificate of Registration

Where the holder of a certificate of registration granted under Rule 3 desires the certificate to be amended, he shall submit an application for this purpose to the assessing authority setting out the specific matters in respect of which he desires such amendment and reasons; therefore, together with the certificate of registration, and such authority may, if satisfied with the reasons given, make such amendments as it thinks necessary in the certificate of registration.

Amendment of Certificate of Enrolment

The certificate of enrolment granted under Rule 4 shall remain valid so long as it is not canceled under the sub-rule of Rule-7. An application for a revised certificate of enrolment shall be made in Form-2.

On receipt of such application, the assessing authority may call upon the applicant to furnish such additional information in evidence as may be necessary for determining the amount of tax payable by him according to the Schedule to the Act and after so, determining the amount of tax payable by the applicant, the assessing authority shall make necessary amendments, in the certificate of enrolment under his dated signature indicating the year from which the tax at the revised rate shall be payable.

Cancellation of Certificate

The certificate of registration granted under Rule 3 may be canceled by the assessing authority after it has satisfied itself that the employer to whom such a certificate was granted has ceased to be an employer.

The certificate of enrolment granted under Rule 4 may be canceled by the assessing authority after it is satisfied that the enrolled person is dead or his liability to pay tax has ceased.

Exhibition of the Certificate

The holder of the certificate of registration or the certificate of enrolment, as the case, maybe, shall display conspicuously at his places of work the certificate of registration or the certificate of enrolment or a copy thereof.

Issue of Duplicate Copy of Certificate

Suppose a certificate of registration or a certificate of enrolment granted under these rules is lost, destroyed, defaced, or becomes illegible. In that case, the holder of the certificate may apply along with a court-free stamp of rupee one to the assessing authority for the grant of a duplicate copy of such certificate.

The said authority shall, after such verification as may be necessary, issue to the holder of the certificate a copy of the original certificate, after stamping thereon the words “duplicate copy.”

Returns, Notices, and Payment of Tax

Commissioner to Give a Public Notice

The commissioner shall, in the month of April every year, give a publication in the newspapers directing all persons liable to pay tax under the Act to get themselves registered or enrolled as the case may be (unless they are already registered or enrolled) and to furnish returns and pay the tax according to the provisions of the Act and these rules.

Returns and Assessment

The return under sub-section 1 of Section 6 shall be furnished in Form-5. (2) Before an order of assessment is made under clause (c) of sub-section (2) or under sub-section (3) of Section 7, the assess shall be afforded a reasonable opportunity of showing cause against such assessment, and for this purpose, he shall be served with a notice in Form-12.

Payment of Tax in Advance

The statement under subsection 1 of Section 6-A shall be in Form 5-A and shall be sent in duplication to the assessing authority within the time specified in Section 6-A.

Notice under Sections 5(6), 6(3), and 7(2)(a) or (3)

The notice under sub-section (6) of Section 5, under sub-section (3) of Section 6, or under clause (a) of sub-section (2) or sub-section (3) of Section 7 shall be issued by the assessing authority in Form-6.

Notice under Section 5(5) and 12

The notice under sub-section (5) of Section 5 or under Section 12 shall be issued by the assessing authority in Form-7.

Notice of Demand Under Section 7(4)

The Notice of demand under sub-section (4) of Section 7 and other demands, including any penalty or interest imposed under the Act, shall be issued by the assessing authority in Form-8.

Payment of Tax by Employers

An employer shall make payment of tax and interest and penalty (if any) by deposit of the requisite amount in the treasury by Challan in Form-9 in quadruplicate.

The copies marked ‘Original’ and ‘Duplicate’ shall be returned to the employer duly receipted, of which the copy marked ‘Duplicate’ shall be submitted by the employer other than an officer referred to in Rule 16 to the assessing authority along with the return prescribed by Rule 16 to the assessing authority along with the return prescribed by Rule 11.

An officer referred to in Rule 16 shall forward such receipted copies of challans marked ‘Duplicate’ to the assessing authority along with the statement prescribed in the said Rule.

Deduction of Tax Amount from the Salary or Wages of Employees

The drawing and disbursing officer in the case of non-gazetted Government servants and the treasury officer or the pay and accounts officer, as the case may be, in the case of gazetted Government servants, shall be responsible for the deduction of the due amount of tax from the pay bill of the employees.

The deduction shall be made every month, and the payor wages of such an employee for the month of February shall not be permitted to be drawn unless the tax due for the period March to February or part thereof or from the month in which the employee has attracted liability to pay the tax to February, as the case may be, has been fully deducted and a statement showing such deduction has been enclosed with the pay bill.

The drawing and disbursing officer or the treasury officer, as the case may be, shall furnish to the assessing authority not later than the 30th of April a statement relating to the payment of salary made to the Government servants along with a certificate that the tax payable in respect of the employees for whom they drew or passed pay bill during the year immediately preceding has been deducted in accordance with the provisions of the Schedule to the Act.

Such statement shall show the name of the employee, the details of salary drawn, the amount of tax deducted therefrom, and the period to which the tax relates.

Notwithstanding the provisions contained in Rule 15 and sub-rule (1), the liability of an employee to pay tax shall not cease until the due amount of tax in respect of his has been fully paid to the Government account, and without prejudice to the aforesaid provisions, the said amount may be recovered from him if the employer or the assessing authority is satisfied that the amount has not been deducted from his salary or wages.

Rounded Off of Tax

The amount of tax, including tax payable in advance, penalty, or any other amount payable and the amount of refund due under the Act shall be rounded off to the nearest rupee and for this purpose, where such amount contains a part of a rupee consisting of a paise, then, if such part is fifty paise or more it shall be increased to one rupee, and if such part is less than fifty paise, it shall be ignored.

Collecting Agents to Maintain an Account of Collection of Tax

Every Collecting Agent shall maintain proper accounts of the tax and other amounts collected by him under the Act. He shall also maintain a register in Form-22 in which he shall enter the tax and other amounts as and when collected.

Employer to Keep Account of Deduction of Tax from Salary of the Employees

Every employer liable to pay tax shall maintain a register in which shall be entered the amount of salary and wages paid to each of the persons in his employment and the said register shall contain a column in which shall be shown the amount deducted from the salary and wages of the employee on account of the tax.

Payment of Tax 1 filling of Returns by Enrolled Persons 2 and Deduction of Tax in the Case of Certain Enrolled Persons

A person enrolled under subsection (2) of Section 5 and liable to pay tax shall make payment of tax within the period specified in sub-section (2) of Section 10 by paying the requisite amount into the treasury by challan in Form-9 in quadruplicate.

The copies marked ‘Original’ and ‘Duplicate’ shall be returned to the person duly receipted, of which the copy marked ‘Duplicate’ shall be submitted by him to the assessing authority as proof of payment of tax.

Provided that the payment of tax may also be made in cash to the assessing authority or where the amount does not exceed rupees five hundred, to the Commercial Tax Inspector attached to the jurisdictional assessing authority. The receipts for such payments shall be issued in Form-23.

Where payment of tax, interest, and penalty (if any) is required to be made to a Collecting Agent appointed under Section 15, such payment shall be made within such time as may be notified by means of a paying-in-slip duly filled in Form-10 in duplicate.

The Collecting Agent shall credit to the treasury by challan in Form-9 in quadruplicate on or before the 10th of each month the amount of tax, interest, and penalty collected by him during the preceding month under sub-rule (2) and forward the receipted copy of the challan marked ‘Duplicate’ to such authority as may be specified by the Commissioner along with a statement of collection in Form-14 signed and verified by him.

Every enrolled person liable to pay tax shall furnish to the assessing authority within the time limit as specified in sub-section (2) of Section 10, a return in Form 4-A.

Filling of Statements, Returns, and Payments Through Banks

Procedure to file statements, returns, and payments through Banks

The tax payable and any other amount due under Section 3,4,5,6,6-A and any other provision of the Act read with Rules 11, 11-A, 15, 19, and any other Rule may be paid into the State Bank of India or its associate Bank or any other Bank approved by the Reserve bank of India and specified by the Government, in Form 9-A along with prescribed statements and returns and subject to the stipulations specified under the relevant provisions of the Act and the Rules.

Every payment made under the Karnataka Tax on Professions, Trades, Callings and Employments Act, 1976 or under the relevant rules into the State Bank of India or its associate Bank or any other Bank approved by the Reserve Bank of India and specified by the Government, shall be through a Challan in Form 9-A and the Challan may be obtained from the office of the Assessing Authority or the Bank.

Challan in Form9-A shall be filled up in quadruplicate and the copy marked “original” shall be returned to the dealer duly receipted as proof of payment. The copy marked as “duplicate” shall be sent to the Assessing Authority, and such copy marked as “triplicate” shall be sent to the Treasury by the Bank and the copy marked “quadruplicate” shall be retained by the bank.

Appeals

Appeal to the Joint Commissioner

Every appeal under Section 16 to the Joint Commissioner shall be in Form-18 and shall be verified in the manner specified therein. The appeal may be sent to the appellate authority by registered post or may be presented to the authority or to such other officer as the appellate authority may appoint on this behalf, by the appellant or by his authorized agent or a legal practitioner or an accountant or sales tax practitioner duly authorized by the appellant in writing.

Appeal to Appellate Tribunal

An appeal under Section 17 to the Tribunal shall be in Form19 and shall be verified in the manner specified therein. 22. Appeal to the High Court. An appeal to the High Court under sub-section (4) of Section 18 shall be in Form-20 and shall be verified in the manner specified therein.

Revision petition to the High Court

Every petition under sub-section (1) of Section 18-A to the High Court shall be in Form-20-A and shall be verified in the manner specified therein. The petition shall be accompanied by a certified copy of the order of the Appellate Tribunal.

Every application for review under subsection (7) of Section 18-A to the High Court shall be in Form-20-B and shall be verified in the manner specified therein.

Miscellaneous

Action for default by an enrolled person. (1) If it comes to the notice of the assessing authority that a person enrolled under subsection (2) of Section 5 has failed to pay the amount of tax due from him, in the manner laid down in Rule 19, he shall serve on that person a notice in Form-13 requiring him on a date specified in the notice, to attend in person or through an authorized representative for showing cause regarding non-payment of tax.

After giving such a person a reasonable opportunity of being heard and after holding such inquiry as may be deemed fit, or otherwise, if the assessing authority is satisfied that the tax is payable but has not been paid, that authority shall serve a notice of demand in Form-16 on that person or his representative to pay the amount within fifteen days of the receipt of the notice.

Suppose a person liable to pay tax has willfully failed to get himself enrolled, then without prejudice to the action that may be taken against him under sub-section (5) of Section 5.

In that case, the assessing authority shall after giving that person a reasonable opportunity of being heard and after such inquiry, as may be deemed fit, or otherwise, assess the tax due to the best of its judgment and serve on him a notice of demand in Form17 to pay the tax within fifteen days of the receipt of the notice.

Notice of hearing in such case shall be issued by the assessing authority in Form-11. The notice under sub-section (6) of Section 5 in respect of persons liable for enrolment shall also be in Form-11.

Notice Under Section 8 of 9

Notice under Section 8 or 9 shall be issued in Form-14. 25.

Treasury Officer to forward quadruplicate copies of Challans to the Government Computer Centre

The receipted copies of challans in Form-9 marked ‘Quadruplicate’ in respect of each month shall be forwarded by the officer-in-charge of the Treasury to the Government Computer Centre, Bangalore, within the 15th of the succeeding month.

Shifting the Place of Work

Suppose the holder of a certificate of registration or a certificate of enrolment in one area shifts his place of work to another area. In that case, he shall within fifteen days of such shifting, give notice thereof to the assessing authority from whose office the certificate was issued, and shall, at the same time, send a copy of such notice to the assessing authority exercising jurisdiction over the area to which the place of work is being or has been shifted.

Grant of Copies

Suppose any assessee wants to have a certified copy of a document filed by him or of an order concerning him passed by any authority. In that case, he shall make to the authority concerned an application bearing an adhesive Court-fee stamp of the value of twenty-five paise for an ordinary copy or such stamp of the value of rupee one and twenty-five paise for a copy which he desires to be supplied within two days applying for the same.

Upon receipt of the application, the said authority shall inform the applicant of the amount of Court-fee stamps required under the provisions of sub-rule 3 to supply the copy.

After the requisite amount of Court-fee stamp is furnished, the said authority shall cause a certified copy of the document or order to be prepared and granted to the applicant.

Refund of Tax

Where the assessing authority receives an application for a refund of tax under Section 22 he shall, if he is satisfied that a refund is due to the applicant in terms of the provisions of the said Section, record an order showing the amount of refund due and shall issue to the applicant a refund payment order in Form-21.

Offenses and Composition of Offenses

The assessing authority may institute prosecution in respect of an offense specified in Section 23 in a Court, not inferior to that of a Magistrate of the First Class. (2) The assessing authority shall exercise the powers specified in Section 26 in respect of such offense subject to the control and direction of the Joint Commissioner.

Rules of The Karnataka Tax On Professions, Trades, Callings, And Employment Act, 1976

An appeal from any original order passed by the Tax Recovery Officer under this Part, not being an order which is final shall lie to the jurisdictional. Joint Commissioner authorized by the Commissioner on this behalf.

Every appeal under this rule must be made within thirty days from the date of the order appealed against. (3) Pending the decision of any appeal, execution of the certificate may stay if the appellate authority so directs.

Any order passed under this Part may, after notice to all persons interested, be reviewed by the officer who made the order, or by his successor-in-office, on account of any mistake apparent from the record.

Where any person has, under this Part, become surety for the amount due by the defaulter, he may be proceeded against under this Part as if he were the defaulter. 100. Nothing in this Part shall affect any provision of the Act under which the tax is the first charge upon any asset.

Where an order for the sale of immovable property has been made, if the defaulter can satisfy the Tax Recovery Officer that there is a reason to believe that the amount of the certificate may be raised by the mortgage or lease or private sale of such property, or some part thereof, or of any other immovable property of the defaulter.

Tax Recovery Officer may, on the defaulter's request in writing, postpone the sale of the property comprised in the order for sale, on such terms and for such period as he thinks proper, to enable him to raise the amount.

In such a case, the Tax Recovery Officer shall grant a certificate to the defaulter, authorizing him, within a period to be specified therein, and notwithstanding anything contained in this Part, to make the proposed mortgage, lease, or sale.

All monies payable under such mortgage, lease or sale shall be paid, to the Tax Recovery Officer; and (c) a mortgage, lease or sale under this rule shall become absolute after the Tax Recovery Officer confirms it.

Every resale of immovable property, in default of payment of the purchase money within the period allowed for such payment, shall be made after the issue of a fresh proclamation in the manner and for the period hereinbefore provided for the sale.

Where the property sold is a share of undivided immovable property, belonging to the defaulter and a co-sharer, and two or more persons, of whom one is such co-sharer, respectively bid the same sum for such property or for any lot, the bid shall be deemed to be the bid of the co-sharer.

Every Tax Recovery Officer, or others acting under this Part, shall have the powers of a. Civil Court while trying a suit, for the purpose of receiving evidence administering oaths, enforcing the attendance of witnesses, and compelling the production of documents.

An appeal from any original order passed by the Tax Recovery Officer under this Part, not being an order which is final shall lie to the jurisdictional. Joint Commissioner authorized by the Commissioner on this behalf.

Cesses not to be levied in certain cases. Notwithstanding anything in any law for the time being in force, no cess shall be levied on tax on professions, trades, callings, and employments under any such law, and provisions in such law authorizing such levy and collection shall, on and from the date of commencement of this Act, stand repealed. Grants to local authorities for loss of revenue.

Out of the proceeds of the tax and penalties and interest and fees recovered under this Act, there shall be paid annually to such local authorities as were levying immediately before the commencement of this Act a tax on professions, trades, callings, and employments such amounts on the basis of the highest collections made by them in any year during the period of three years immediately preceding the commencement of this Act, as may be determined by the State Government in this behalf.

The State Government may, by notification in the Official Gazette and after previous publication, make rules to carry out the purposes of this Act: Provided that, if the State Government is satisfied that circumstances exist which render it necessary to take immediate action, it may dispense with the previous publication of any rules to be made under this Act.

Without prejudice to the generality of the foregoing power, such rules may provide for the fees payable regarding any applications to be made, the forms to be supplied, the certificates to be granted and appeals and applications for revision to be made under this Act.

Every rule made under this Act shall be laid as soon as may be after it is made, before each House of the State Legislature while it is in session for a total period of thirty days which may be comprised in one session or in two or more successive sessions,

If, before the expiry of the session in which it is so laid or the sessions immediately following, both Houses agree in making any modification in the rule or both Houses agree that the rules should not be made and notify such decision in the Official Gazette, the rule shall from the date of publication of such notification have effect only in such modified form or be or no effect, as the case may be.

So however, any such modification or annulment shall be without prejudice to the validity of anything previously done or omitted to be done under that rule. Power to remove difficulties.

If any difficulty arises in giving effect to the provisions of this Act, the State Government may, by notification, make such provisions, not inconsistent with this Act, as appears to it to be necessary or expedient for removing the difficulty.

Every appeal under this rule must be made within thirty days from the date of the order appealed against. Pending the decision of any appeal, execution of the certificate may have stayed if the appellate authority so directs.

Any order passed under this Part may, after notice to all persons interested, be reviewed by the officer who made the order, or by his successor-in-office, on account of any mistake apparent from the record.

Where any person has, under this Part, become surety for the amount due by the defaulter, he may be proceeded against under this Part as if he were the defaulter. 100. Nothing in this Part shall affect any provision of the Act under which the tax is the first charge upon any asset.

Power to transfer proceedings. The Commissioner may, by order in writing, transfer any proceedings or class of proceedings under any provision of this Act from any officer to any other officer not lower in status than the former.

In this, the word " proceedings" in relation to an assessee whose name is specified in any order issued thereunder means all proceedings under this Act in respect of any year, which may be pending on the date of such order or which may have been completed on or before such date, and also includes all proceedings under this Act which may be commenced after the date of such order in respect of any year in relation to such assessee.

Compounding of offenses. Subject to such conditions as may be prescribed, the assessing authority may, either before or after the institution of prosecution, permit any person charged with the offence to compound the offence on payment of such sum, not exceeding double the amount of tax to which the offense relates, as the assessing authority may determine.

On payment of such sum, as may be determined by the assessing authority under sub-section, no further proceedings shall be taken against the person in respect of the same offense.

Powers to enforce attendance, etc. All authorities under this Act shall, for the purposes of this Act, have the same powers as are vested in a court under the Code of Civil Procedure, 1908 while trying a suit in respect of enforcing the attendance of, and examining any person on oath or affirmation or for compelling the production of any document.

Production and inspection of accounts and documents and search of premises. Any authority under this Act may inspect and search any premises, where any profession, trade, calling, or employees liable to taxation under this Act is carried on or is suspected to be carried on and may require production and examination of books, registers, accounts or documents relating thereto and may seize such books, registers, accounts or documents as may be necessary.

Provided that if the said authority removes from the said premises any book, register, account, or document, it shall give to the person in charge of the place a receipt describing the book, register, account, or document so removed by it and retain the same only for so long as may be necessary for the purposes of examination thereof or for prosecution.

Any person who has paid any tax or penalty or interest or fee in excess of the amount due under this Act may apply to the assessing authority for a refund or adjustment of such amount towards future tax and the amount paid in excess shall be refunded or adjusted accordingly.

Any person or employer who, without sufficient cause, fails to comply with any of the provisions of this Act, or the rules framed thereunder shall, on conviction, be punished with a fine which may extend to five thousand rupees, and when the offense is a continuing one, with fine which may extend to fifty rupees per day of such continuance.

Where an offense under this Act has been committed by a company, every person who at the time the offense was committed was in charge of and was responsible for the company for the conduct of the business of the company as well as the company, shall be deemed to be guilty of the offense and shall be liable to be proceeded against and punished accordingly.

Provided that nothing contained in this sub-section shall render any such person liable to any punishment if he proves that the offense was committed without his knowledge or that he has exercised all due diligence to prevent the commission of such offense.

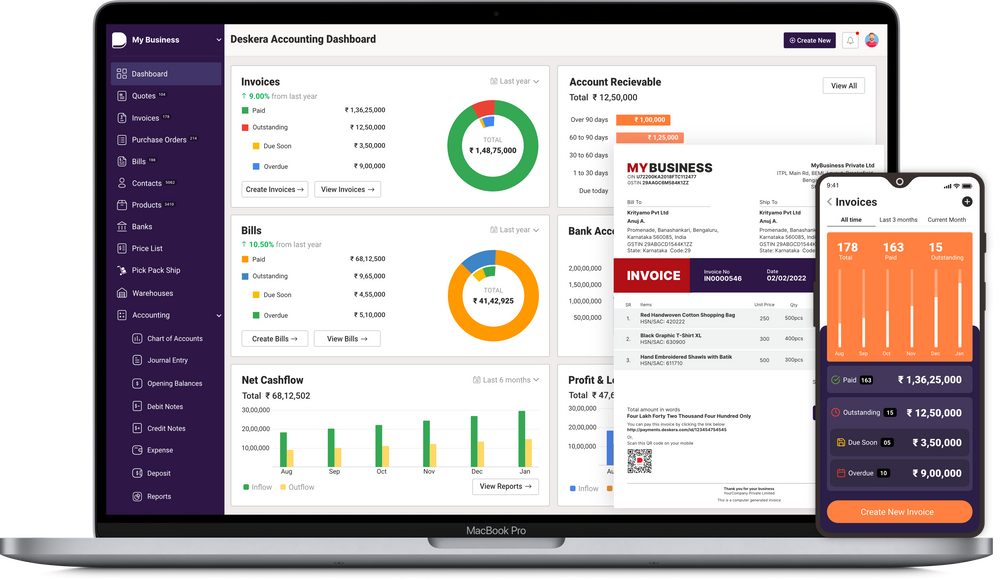

How Can Deskera Assist You?

Want to manage your finances and budgets? Look no further than Deskera. Whether it is invoicing, inventory, CRM, accounting, or HR & payroll, as a business owner, you need to manage thousands of things. This is where Deskera Books can help you.

Key Takeaways

- The act extends to the whole of the State of Karnataka and it shall be deemed to have come into force on the first day of April 1976.

- Profession tax is levied under the Karnataka Tax on Professions, Trades, Callings and Employments Act, 1976.

- An application for a certificate of registration under subsection (1) of section 5 shall be made in Form-1.

- After considering the application and such additional information or evidence as may be furnished, the assessing authority shall grant a certificate of enrolment in Form-4.

- Where the person has more than one place of work in the State, as many copies of the certificate shall be issued to him as there are places of work in addition to the principal place of work.

- The assessing authority may institute prosecution in respect of an offense specified in Section 23 in a Court, not inferior to that of a Magistrate of the First Class.

- Power to transfer proceedings. The Commissioner may, by order in writing, transfer any proceedings or class of proceedings under any provision of this Act from any officer to any other officer not lower in status than the former.

- After the requisite amount of Court-fee stamp is furnished, the said authority shall cause a certified copy of the document or order to be prepared and granted to the applicant.

Related Articles: