The Assam State Tax on Professions, Trades, Callings and Employment Act, 1947 (“Assam PT Act”) is enacted with the object of levying tax on professions, trades, callings, and employments in its State.

In today’s guide, you will learn all chapters associated with Assam Professions, Trades, Callings and Employments Taxation Act, 1947 and also about form VIII refund voucher as PT act. Let’s take a look at what we’ll cover ahead:

CHAPTER I LIABILITY TO AND CHARGES OF TAX

CHAPTER V DEMAND, PAYMENT AND RECOVERY

CHAPTER VII OFFENCES AND PENALTIES

Let’s Start!

Preliminary

1. Short title, extent and commencement.-

(1) This Act may be called the Assam Professions, Trades, Callings and Employments Taxation Act, 1947.

(2) It extends to the whole of Assam.

(3) It shall come into force on such date as the State Government may, by notification in the Official Gazette, appoint.

Definitions

In this Act unless there is anything repugnant in the subject or context,—

(a) "assessing authority" in a particular area means the Senior Superintendent of Taxes and Superintendent of Taxes referred to in section 6 exercising jurisdiction in that area and includes any other officer referred to in that Section and specifically authorized by the State Government in that behalf;

Amendments : ( 1 ) The clause (a) was substituted w.e.f. 1-4-1992 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June, 1992.

(2) The clause (a), so substituted, was further amended w.e.f. 1-4- 1993 by Assam Act No. VIII of 1993 by inserting words "Senior Superintendent of Taxes and".

(b) "Deputy Commissioner of Taxes (Appeals) means a person appointed to be a Deputy Commissioner of Taxes (Appeals) under sub-section (2) of section 6;

Amendments : Clause (b) of section 2 has been amended w.e.f. 1-4-1993 by Assam Act No. VIII of 1993 published in the Assam Gazette of 7th May, 1993. By this amendment the words "Assistant Commissioner of Taxes (Appeals)" has been replaced by words "Deputy commissioner of Taxes (Appeals)".

(c) "employee" means a person employed on salary or wages, and includes-

(i) a Government servant receiving pay from the revenue of the Central Government or any State Government or the Railway Fund;

(ii) a person in the service of a body, whether incorporated or not, which is owned or controlled by the Central Government or any State Government, where the body operates in any part of the State, even though its headquarters may be outside the State;

(iii) a person engaged in any employment of an employer, not covered by items (i) and (ii) above;

(d) "employer" in relation to an employee earning any salary or wages on regular basis under him, means the person or the officer who is responsible for disbursement of such salary or wages, and includes the head of the office or any establishment as well as the manager or agent of the employer;

(e) "prescribed" means prescribed by rules made under this Act; (f) ' 'person'' includes a company, firm, a Hindu undivided family, a corporation, a corporate body, a society, a club or other association of persons;

Amendments : The existing clause (f) is to be substituted by the following clause by Assam Act No. XV of 2001, published in the Assam Gazette, Extraordinary of 19-10-2001, with effect from such date as the State Government may notify.

"person" means any person who is engaged in any profession, trade, callings or employment in Assam and includes a company, a firm, a Hindu undivided family, a corporation, a corporate body, a society, a club or other association of persons so engaged but does not include any person who earns wages on a casual basis;

Explanation I: - The expression ' 'person who earns wages on casual basis" shall mean a person who earns wages on being employed for a period not exceeding one hundred eighty days in a year;

Explanation II: Every branch of a company, a firm, a corporation, a corporate body, a society, a club or other association of persons shall be deemed to be a separate person.

Amendment: In the principal Act, in section 2, in clause (f) for the word “Explanation”, the word and figure “Explanation I” has been substituted and after the first Explanation a new Explanation II has been inserted vide notification no. LGL.55/2005/30 Dated 7th February, 2009 published in the Assam Gazette Extraordinary no.41 Dated 7th February, 2009

(g) "salary" or "wages" includes pay, dearness allowance and all other remunerations received by any person on regular basis, whether payable in cash or in kind, and also includes perquisites and profits in lieu of salary, as defined in section 17 of the Income Tax Act, 1961; Amendments : The clause (g) has been substituted w.e.f. 1-4-1992 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June, 1992.

(h) "State" means State of Assam;

(i) deleted.

Amendments : The clause (i) was deleted w.e.f. 1-4-1992 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June, 1992.

CHAPTER I LIABILITY TO AND CHARGES OF TAX

3. Liability to Tax.- As from the first day of April, 1947 and subject to the provisions of this Act, every person, who carries on a trade either by himself or by an agent or representative, or who follows a profession or calling, or who is an employment, either wholly or in part within the State shall be liable to pay for each financial year a tax in respect of such profession, trade, call in or employment and in addition to pay any tax, rate or fee which he is liable to pay under any other enactment for the time being in force:

Provided that for the purposes of this section a person on leave shall be deemed to be a person in employment:

Provided further that notwithstanding anything contained in this section the provisions of this Act shall not apply to a member of the Armed forces of India and to a Co-operative Society registered or deemed to have been registered under the Assam Co-operative Societies Act, 1947:

Provided also that the State Government, if considers it necessary in the public interest so to do, may by notification in the Official Gazette, subject to such conditions and restrictions as it may impose, exempt any person who carries on a trade either by himself or by an agent or representative, or who follows a profession or calling, or who is in employment, either wholly or in part within the State, fully or partially from payment of tax under this Act and the State Government may also grant, such exemption retrospectively. The State Government may withdraw any such exemption at any time, as it may think fit and proper.

Amendments : Second proviso was inserted w.e.f. 1-4-1992 by Assam Act No XI of 1992 , published in the Assam Gazette of 6th June,1992.

Amendment: Third proviso has been inserted w.e.f. 8- 06-2005 by Assam Act No. XVII of 2005, published in the Assam Gazette vide Notification No.LGL.55/2005/7 Dtd. the 30th April, 2005

3A. Restriction to renewal of licence, permit and registration: - Notwithstanding anything contained in any other law for the time being in force, where a person liable to pay tax under this Act is required to obtain licence, permit or registration form time to time from other authorities, no such authorities shall either register any such person or assign or renew any licence or permit or registration unless payment of tax under this Act has been made by the person concerned

Amendments:- A new section 3A has been inserted w.e.f. 8- 06- 2005 by Assam Act No. XVII of 2005, published in the Assam Gazette vide Notification No.LGL.55/2005/7 Dtd. the 30th April, 2005

4. Rates of Tax.- The tax under section 3 shall be payable by every person specified in that section and falling under one or the other of the classes mentioned in the second column of the Schedule annexed to this Act at the rate mentioned against the class of such persons in the third column of the Schedule :

Provided that entry 21 in the Schedule shall apply only to such classes of persons as may be specified by the State Government b notification from time to time:

Provided further that the State Government may, by notification in the Official Gazette, add to, delete, amend or otherwise modify the said Schedule and also may vary the rates of tax of the entries specified in the Schedule and thereupon the said Schedule shall be deemed to have been amended accordingly.

Amendments: Section 4 has been substituted w.e.f 1-4-92 by Assam Act No. XI 0f 1992, published in the Assam Gazette of 6th June, 1992. Amendment:- Second proviso has been inserted w.e.f. 8- 06-2005 by Assam Act No. XVII of 2005, published in the Assam Gazette vide Notification No.LGL.55/2005/7 Dtd. the 30th April, 2005

5. Employer’s liability to deduct and pay tax on behalf of employees. - The tax payable under this Ac by any person earning a salary or wage shall be deducted by his employer from the salary or wage payable to such person before such salary or wage is paid to him, and such employer shall, irrespective of whether such deduction has been made or not when salary or wage is paid to such persons, be liable to pay the tax on behalf of all such persons:

Provided that if the employer is an officer of the Government, the State Government may, notwithstanding anything contained in this Act, prescribed by rules the manner in which the employer shall discharge the said liability :

Provided further that where any person earning a salary or wage is also covered by one or more entries other than entry 1 in the Schedule or is simultaneously engaged in employment of more than one employer, and such person furnishes to his employer or employers a certificate in the prescribed from declaring, inter alia, that he shall obtain a certificate of enrolment under sub section (2) of Section 5A and pay the tax himself then the employer or employers of such person shall not deduct the tax from the salary or wage payable to such person and such employer or employers, as the case may be, shall not be liable to pay tax on behalf of such person.(see: Rule10(16)/Form IIB,IIC)

Amendments: Section 5 has been substituted w.e.f 1-4-9 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June, 1992.

5A. Registration and enrolment. - (1) Every employer (not being an officer of the Government) liable to pay tax under Section 5 shall obtain a certificate of registration from the assessing authority in the prescribed manner. (See: Rule 10/Form1, 1A)

(2) Every person liable to pay tax under this Act (other than a person earning salary or wages, in respect of whom the tax is payable by his employer), shall obtain a certificate of enrolment from the assessing authority in the prescribed manner. (See: Rule 10(4) from II, IIA)

(3) Notwithstanding anything contained in this section and section 5, where a person is a citizen of India and is in employment of any diplomatic or consular office or trade commissioner of any foreign country situated in any part of Assam such person, if liable to pay tax, hall obtain a certificate of enrolment as provided in sub section (2) and pay the tax himself.

(4) Every employer or person required to obtain a certificate of registration or enrolment shall, within the 30th day of June,1992, or if he was not engaged in any profession, trade, calling or employment on that date, within ninety days of his becoming liable to pay tax, or, in respect of any person referred to in sub section (2) or sub section (3) within ninety days of his becoming liable to pay tax at a rate higher or lower than one mentioned in his certificate of enrolment, or a revised certificate of enrolment, as the case may be, to the assessing authority, shall ,after making such enquiry, as may be necessary, within thirty days of the receipt of the application, grant him such certificate, if the application is in order. The application, if is not in order, shall be rejected:

Provided that the State Government may, for good and sufficient reason, in any case or class of cases, extend the time for making an application under this sub section.

(5) The assessing authority shall mention in every certificate of registration or enrolment the amount of tax payable by the holder according to the Schedule, and the date by which it shall be paid, and such certificate shall serve as a notice of demand for the purposes of section 11.

(6) Where an employer or a person liable for registration or enrolment willfully fails to apply for such certificate within the required time as provided for in sub section (4), the assessing authority may, after giving him a reasonable opportunity of being heard, impose upon him a penalty not exceeding rupees twenty for each day of delay in case of an employer and not exceeding rupees five for each day of delay in the case of others.

(7) Where an employer or a person liable for registration or enrolment has deliberately given false information in any application submitted under this section, the assessing authority may, after giving him a reasonable opportunity of being heard, impose upon him a penalty not exceeding rupees one thousand.

Amendments: Section 5A has been substituted w.e.f 1-4-92 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June, 1992.

CHAPTER II

6. Taxing authorities.-

(1) There shall be the following classes of the tax authorities for the purposes of this Act, namely :-

(a) Commissioner of Taxes

(b) Additional Commissioner of Taxes,

(c) Joint Commissioner of Taxes,

(d) Deputy Commissioner of Taxes (Appeals),

(e) Deputy Commissioner of Taxes,

(f) Senior Superintendent of Taxes,

(g) Superintendent of Taxes,

(h) All Assam Investigation Officer,

(i) Inspector of Taxes.

(2) The State Government may appoint one Commissioner of Taxes and as many as Additional Commissioner of Taxes, Joint Commissioner of Taxes, Deputy Commissioner of Taxes, (Appeals), Deputy Commissioner of Taxes, Senior Superintendent of Taxes, Superintendent of Taxes, All Assam Investigation Officers and Inspector of Taxes as it thinks fit.

(3) The Commissioner of Taxes shall perform his functions in respect of the whole of the State of Assam and the Additional Commissioner of Taxes, Joint Commissioner of Taxes, Deputy Commissioner of Taxes, (Appeals),Deputy Commissioner of Taxes, Senior Superintendent of Taxes, Superintendent of Taxes, All Assam Investigation Officers and Inspector of Taxes shall perform their functions in respect of such areas or of such persons or classes of persons or of such incomes or classes of income or of such cases or classes of cases as the Commissioner of Taxes may by notification in the official Gazette direct.

Amendments. - Section 6 has been substituted w.e.f. 1-4-1993 by Assam Act No. VIII of 1993, published in the Assam Gazette of 7th May, 1993

CHAPTER III

7. RETURNS.- (1) Every employer registered under this Act shall furnish to the assessing authority a return in such form, for such periods and by such dates as may be prescribed, showing therein the salaries and wages paid by him and the amount of tax deducted by him in respect thereof. (See: Rule 12/Form III)

(2) Every return shall be accompanied by a treasury challan in proof of payment of full amount of tax due according to the return, and a return without such proof of payment shall not be deemed to have been duly filed.

(3) Where an employer, without reasonable clause, fails to file such return within the prescribed time, the assessing authority may, after giving him a reasonable opportunity of being heard, impose upon him a penalty not exceeding rupees five for each day of delay

Amendments.- Section 7 has been substituted w.e.f 1-4-92 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June, 1992.

8. Assessment of employers.- (1) if the assessing authority is satisfied that the return filed by any employer is correct and complete, it shall accept the return.

(2) (a) If the assessing authority is not satisfied that the return filed is correct and complete, it shall serve upon the employer a notice requiring him, on a date and at the hour and place specified in the notice, to attend in person or through an authorised representative and to produce or cause to be produced accounts and papers in support for the return.

(b) The assessing authority shall, on examination of the accounts and papers, by an order in writing, assess the amount of tax payable by the employer. (See: Rule 13/Form VIIA)

(c) If the employer fails to comply with the terms of the notice, or if in the opinion of the assessing authority the accounts and papers are incorrect or incomplete or unreliable such authority shall, after such inquiry as it may deem fit or otherwise, by an order in writing assess the tax to the best of its judgement.

(3) The amount of tax due from any employer shall be assessed separately for each year during which he is liable to pay tax :

Provided that the assessing authority may, subject to such conditions as may be prescribed and for reasons to be recorded in writing, assess the tax due from any employer during any part of a year:

Provided further that where a registered employer fails to furnish a return for any part of a year, the assessing authority may, if it thinks fit, assess the tax due from such employer separately for different parts of such year.

(4) If an employer fails to get him self registered or being registered fails to filer any return, the assessing authority, shall, after giving the employer a reasonable opportunity of being heard and after holding such inquiry as it may deem fit or otherwise, pass an order assessing the amount of tax due to the best of its judgement.

(5) The amount of tax, so assessed, shall be paid within fifteen days of receipt of the notice of demand from the assessing authority.

Amendments: Section 8 has been substituted w.e.f 1-4-92 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June, 1992.

8A. Assessment of Escaped Tax.- If for nay reason any person has not been assessed or has been under- assessed for any financial year the assessing authority may, notwithstanding anything contained in sub-section (2) of section 7, at any time within five years of the end of that year, serve on the person liable to pay the tax, a notice containing all or any of the requirement, which may be included in he notice under sub-section (2) of section 7 and may proceed to assess or reassess him under the provisions of this Act shall, so far as may be, apply accordingly as if the notice were a notice issued under that subsection:

Provided that the tax shall be charged at the rate at which it would have been charged if the person would not escaped assessment or full assessment, as the case may be.

Amendment: In the principal Act, in section 8A, for the words, “three years” the words “five years” has been substituted vide notification no. LGL.55/2005/30 Dated 7th February, 2009 published in the Assam Gazette Extraordinary no.41 Dated 7th February, 2009.

8B. Rectification of mistakes.- (1) The authority which made an assessment or passed an order on appeal or revision in respect thereof, may of his own motion, and shall if an application is filed in this behalf, within three years from the date of such assessment or order rectify any mistake apparent from the record of the case:

Provided that no such rectification having adverse effect upon an assessee shall be made unless the assessee has been given a reasonable opportunity of being heard.

(2) Where any such rectification has the effect of reducing the assessment, the assessing authority shall order any refund which may be due to such person.

(3) Where any such rectification has the effect of enhancing the assessment or reducing the refund, the assessing authority shall serve on the person a notice of demand in the prescribed form specifying the sum payable, and such notice of demand shall be deemed to be issued under section 11 and the provisions of this Act shall apply accordingly.

9. Deleted with effect from 1.4.1992 by Assam Act No. XI of 1992.

9A. Deleted with effect from 1.4.1992 by Assam Act No. XI of 1992.

9B. Deleted with effect from 1.4.1992 by Assam Act No. XI of 1992.

CHAPTER IV APPEALS

10. Appeals.- (1) Any person aggrieved by a order passed under this Act by an assessing authority not bein an order passed under this section, may appeal to the Deputy Commissioner of taxes (Appeals), against such order within thirty days from the date of service of such order in the manner prescribed : (See Rule 19 to 23,35,35A,36)

Provided that no appeal against an order of an assessment or penalty shall be entertained by Deputy Commissioner of Taxes (Appeals) unless he is satisfied that the amount of tax assessed or penalty imposed, if not otherwise directed by him, has been paid:

Provided further that the deputy Commissioner of Taxes (Appeals), before whom the appeal is filed, may admit it after expiration of thirty days, if he is satisfied that for reasons beyond the control of the appellant or any other sufficient cause it could not be filed within the specified time.

(2) The Deputy Commissioner of Taxes (Appeals) shall fix a day and place for hearing the appeal, and may from time to time adjourn the hearing and make such further inquiry as he thinks fit.

(3) In disposing of the appeal under sub-section (1) against an order of assessment or penalty, the Deputy Commissioner of taxes (Appeals) may,

(a) confirm, reduce, enhance or annul the assessment;

(b) set-aside the order of assessment and direct a fresh assessment after such inquiry as may be ordered; or

(c) confirm, reduce or annul the order of penalty.

Amendments. - Section 10 has been amended w.e.f 1-4-93 by Assam Act No. VII of 1993, published in the Assam Gazette of 7th May, 1993. By this amendment the words “Assistant Commissioner of taxes (Appeals)” have been replaced by the words “Deputy Commissioner of Taxes (Appeals)”.

10A. Revision.- (1) The Commissioner may call for and examine the record of any proceeding under the Act, and if he considers that any order passed therein by any officer other than himself, is erroneous is so far as it is prejudicial to the interest of revenue, he may, after giving the assessee an opportunity of being heard and after making or causing to be made such inquiry as he deems necessary, pass such orders thereon as the circumstances of the case justify including an order enhancing or modifying the assessment, or cancelling the assessment and directing a fresh assessment.

(2) In the case of any order other than an order to which Sub-section (1) applies, passed under this Act by any officer other than himself, the Commissioner may of his own motion, and in the case of an order passed under section 10, also, subject to such rules as may be prescribed, on a petition by an assessee for revision, call for the record of any proceeding under this Act in which any such order has been passed and may make such inquiry or cause such inquiry to be made, and subject to the provisions of this Act, may pass such order thereon not being an order prejudicial to the assessee, as he thinks fit: (See Rule 20 to 23A, 35,35A,36)

Provided that the Commissioner may dispense with the inquiry required to be made under this subsection, if he, for reasons to be recorded, considers such inquiry to be necessary.

(3) In case of a petition for revision under sub-section (2) by an assessee, the petition shall be made within ninety days from the date on which the order in question was communicated to him or the date on which he otherwise comes to know of it, whichever is earlier :

Provided that the Commissioner before whom the petition is filed may admit it after expiration of the period of ninety days if he is satisfied that for reasons beyond the control of the petitioner or for any other sufficient cause, it could not be filed within time.

CHAPTER V DEMAND, PAYMENT AND RECOVERY

11. Notice of demand.- Where any tax or penalty or interest is payable in consequence of any order passed under or in pursuance of this Act, the assessing authority shall serve on the person concerned a notice of demand in the prescribed from specifying the amount so payable. (See Rule 24/Form VIIB) Amendments: In Section 11 , the words “or interest” have been inserted w.e.f. 1-4-92 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June 1992.

12. Payment of dues. – ( 1) The amount of tax due from enrolled persons for each year as specified in their certificate of enrolment shall be paid :

(a) in respect of a person

Before the 30th day of who stands enrolled before September of that year. the commencement of a year and is enrolled on or before 31 st day of August of a year;

Before the 30th day of September of that year.

(b) in respect of a person

Within one month of the is enrolled after the 31st date of enrolment.

(2) In other cases the amount of tax due shall be paid in accordance with the provisions of sub-section (5) of section 5A or, as the case may be, sub-section (2) of section 7 or subsection (5) of section 8.

(3) The tax payable under this Act shall be paid in the prescribed manner. (See Rule 25 to 30/ Form VII C & VIID)

(4) All other dues shall be payable in the prescribed manner by such date as me be specified in the notice of demand and where no such date is specified, it shall be paid within 15 days from the date of service of the notice of demand.

Amendments. Section 12 has been substituted w.e.f. 1-4—92 by Assam Act No. XI Of 1992, published in the Assam Gazette of 6th June, 1992.

12A. Consequences of failure to deduct or to pay tax.-

(1) If an employer (not being an officer of the Government) fails to pay the tax as required by or under this Act, he shall, without prejudice to any other consequences and liabilities, which may incur, be deemed to be as assessee in default in respect of such tax.

(2) Without prejudice to the provisions of sub-section (1), an employer referred to in that sub-section shall be liable to pay a simple interest at two percentum of the amount of tax due for each month or part thereof for the period for which the tax remained unpaid.

(3) If any person fails to pay the tax as required by or under this Act, he shall be liable to pay a simple interest at the rate and in the manner laid down in sub-section (2) above.

Amendments: (1) Section 12A has been inserted w.e.f. 1-4-1992 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June,1992.

(2) In Section 12A, in sub-section (3) for the words, “an enrolled”, occur between the words ‘If’ and ‘person’, the word “any” has been substituted w.e.f. 1-6-1999 by Assam Act No. XII of 1999.

12B. Penalty for non-payment of tax.- if any person or an employer fails without reasonable cause, to make payment of any amount of tax within the time or date specified in the notice of demand, the assessing authority may, after giving him a reasonable opportunity of being heard, impose upon him a penalty of minimum fifty percentum subject to a maximum of two hundred percentum of the amount of tax due.

Amendments: (1) Section 12B has been inserted w.e.f. 1-4-1992 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June, 1992.

(2) In Section 12B, the words “an enrolled”, occur between the words ‘If’ and ‘person’, the word ‘any’ has been substituted and for the words “a registered”, occur between the words ‘or’ and ‘employer’, the word “an” has been substituted w.e.f 1-6-1999 by Assam Act No. XII of 1999.

Amendment:- In Section 12B, for the word “fifty”, the word “hundred” has been substituted w.e.f. 8- 06-2005 by Assam Act No. XVII of 2005, published in the Assam Gazette vide Notification No.LGL.55/2005/7 Dtd. the 30th April, 2005.

Amendment: In the principal Act, in section 12B, for the words, “not exceeding hundred percentum”, appearing between the words, “impose upon him a penalty” and “of the amount tax due”, the words “of minimum fifty percentum subject to a maximum of two hundred percentum” has been substituted vide notification no. LGL.55/2005/30 Dated 7th February, 2009 published in the Assam Gazette Extraordinary no.41 Dated 7th February, 2009.

13. Mode of recovery.- All arrears of tax, penalty, interest and fees due under this Act from any person shall be recoverable as an arrear of land revenue and the assessing authority shall proceed to realise the arrear as such from such person.

Amendments: Section 13 has been substituted w.e.f. 1-4-1992 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June,1992.

13A. Special mode of recovery.- Notwithstanding anything to the contrary contained in any law or in any contract, the assessing authority may, at any time or from time to time, by notice in writing, a copy of which shall be forwarded to the assessee at his last address known to the assessing authority, require –

(i) any person from whom any amount of money is due or may become due to an assessee on whom notice of demand has been served under this Act, or

(ii) any person who holds or may subsequently hold money for or on account of such assessee,

to pay the assessing authority, either forthwith upon the money becoming due or being held or at or within the time specified in the notice ( but not before the money becomes due or is held as aforesaid), so much of the money as is sufficient to pay the amount due by the assessee in respect of the arrear of tax, penalty and interest under this Act, or the whole of the money when it is equal to or less than that amount.

CHAPTER VI REFUNDS

14. Refund.- The assessing authority shall refund to a person the amount of tax, interest and fees (if any) paid by such person in excess of the amount due from him. The refund may be made either by cash payment or, at the option of such person, by deduction of such excess from the amount of tax penalty, interest and fee due from him: (See: Rule 312 to 32B/Form VIII & IX)

Provided that such excess shall first be applied towards the recovery of any amount due in respect of which a notice under section 8 has been served and thereafter the balance, if any, shall be refunded.

Amendments: Section 14 has been substituted w.e.f. 1-4-1992 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June,1992.

Form VIII Refund Voucher

CHAPTER VII OFFENCES AND PENALTIES

15. Failure to make returns, etc.- Whoever –

(1) fails, without reasonable cause, to submit in due time any return as required by or under the provisions of this Act or submits false return; or

(2) fails or neglects, without reasonable cause, to comply with any requirement made of, or any obligation laid on, him under the provisions of this Act; or

(3) fraudulently evades payment of any tax due under this Act or conceals his liability to such tax, shall, on conviction before a Magistrate and in addition to any tax or penalty or both that may be due from him, be punishable with imprisonment which may extend to six months or with fine not exceeding five hundred rupees or with both.

15A. Offence by companies.-

(1) Where an offence under this Act has been committed by a company, every person who at the time when the offence was committed was in charge of, and was responsible to, the company for the conduct of the business of the company as well as the company, shall be deemed to be guilty of the offence and shall be liable to be proceeded against and punished accordingly :

Provided that nothing contained in this sub-section shall render any such person liable to any punishment, if he proves that the offence was committed without his knowledge or that he had exercised due diligence to prevent the commission of such offence.

(2) Notwithstanding anything contained in this sub-section (1), where any offence under this Act has been committed by a company and it is proved that the offence has been committed with the consent or connivance of, or is attributable to any neglect on the part, any director, manager, secretary or other officer, such director, manager, secretary or other officer shall be deemed to be guilty of that offence and shall be liable to be proceeded against and punished accordingly.

Amendments: Section 15A has been inserted w.e.f. 1-4-1992 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June, 1992.

15B. Composition of offence.-

(1) Subject to such conditions, as may be prescribed, the assessing authority may either before or after institution of a criminal proceeding under this Act, accept from the person who has committed or is reasonably suspected of having committed an offence under this Act or the rules made thereunder, by way of composition of such offence.

(a) where the offence consists of the failure to pay or evasion of any tax recoverable under this Act in addition to the tax, so recoverable, a sum of money not exceeding one thousand rupees or double the amount of tax recoverable, if any, whichever is greater; and

(b) in any other case a sum of money not exceeding one thousand rupees in addition to the tax recoverable.

(2) On payment of such sum, no further proceeding shall be taken against the person concerned in respect of the same offence.

Amendment: Section 15B has been inserted w.e.f. 1-4-1992 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June, 1992.

CHAPTER VIII MISCELLANEOUS

16. Power to compel attendance, etc.-

(1) The assessing authority may by a written notice require any person to attend before him and give evidence or produce documents, as the case may be, for the purpose of determining the liability of himself or of any other person to taxation under this Act.

(2) Such person shall on such requisition be legally bound to attend and give evidence or produce documents, if in his power and possession, as the case may be, at the place and time specified in such notice, and whoever is required to produce a document may either attend and produce it or cause it to be produced.

16A. Accounts.-

(1) If the assessing authority is satisfied that the books of accounts and other documents maintained by an employer in the normal course of his business are not adequate for verification of the return filed by the employer under this Act, it shall be lawful for the assessing authority to direct the employer to maintain the books of accounts or other documents in such manner as he may, in writing, direct and thereupon the employer shall maintain such books of accounts or other documents accordingly.

(2) Where an employer fails to maintain the books of accounts or other documents as directed under sub-section (1), the assessing authority may, after giving him an opportunity of being heard, impose upon him a penalty not exceeding rupees five for each day of delay.

Amendments. Section 16A has been inserted w.e.f. 1-4-1992 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June, 1992.

16B. Production and inspection of accounts and documents and search of premises.- Any authority referred to in section 6 of this Act may inspect and search any premises where any profession, trade, calling or employment liable to taxation under this Act is carried on or is suspected to be carried on and may cause production and examination of books, registers, accounts or documents relating thereto, and may seize such books, registers, accounts or documents as may be necessary :

Provided that if such authority removes from such premises any book, register, account or document, it shall give to the person in charge of the place, a receipt describing the book, register, accounts or document so removed by it and retain the same only for so long as may be necessary for the purposes of examination thereof or for prosecution.

Amendments: section 16B has been inserted w.e.f. 1-4-1992 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June, 1992.

17. Information to be furnished by employer.- The assessing authority may demand from the employer the name and complete address of all or any of the persons in relation to whom he is the employer and such employer shall thereupon furnish the assessing authority with the names and addresses so demanded.

Amendments.- Section 17 has been substituted w.e.f. 1-4-1992 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June, 1992.

17A. Prosecution, suits or other proceedings.- No suit shall be brought in any civil court to set aside or modify any assessment made or order passed under the provisions of this Act, and no prosecution, suit or other proceedings shall lie against any officer of the Government for anything in goods faith done or intended to be done under this Act or the rules made thereunder.

17B. Power to transfer proceedings.- The Commissioner of Taxes may, after giving the parties concerned an opportunity of being heard, wherever it is possible to do so, and after recording his reasons for doing so, by order in writing, transfer any proceedings or class of proceedings under this Act, from himself to any other officer, and he may likewise transfer any such proceedings (including a proceeding pending with any officer or already transferred under this section) from any officer to any other officer or to himself :

Provided that nothing in this section shall be deemed to require any such opportunity to be given where the transfer is from any officer to any other officer and the offices of both are situated in the same city, locality or place.

Amendments: Section 17B has been substituted w.e.f. 1-4-1992 by Assam Act No. XI of 1992, published in the Assam Gazette of 6th June,1992.

18. Place of assessment.- Any person liable to pay tax under this Act shall ordinarily be assessed by the assessing authority of the area in which he carries on trade, or follows a profession or calling or is in employment. (See : Rule 34)

19. Power to make rules.- The State Government may, subject to the condition of previous publication, make rules for carrying out the provisions of this Act : Provided that it shall not be necessary to make previous publication as aforesaid, of any rules required to be made on the first occasion in order to give effect to the provisions of the Assam Professions, Trades, Callings and Employments Taxation (Amendment) Act,1992.

Amendments : In Section 19, the proviso has been inserted w.e.f. 1-4- 1992 by Assam Act No. XI of 1992, published in the Assam Gazette of 6 th June, 1992

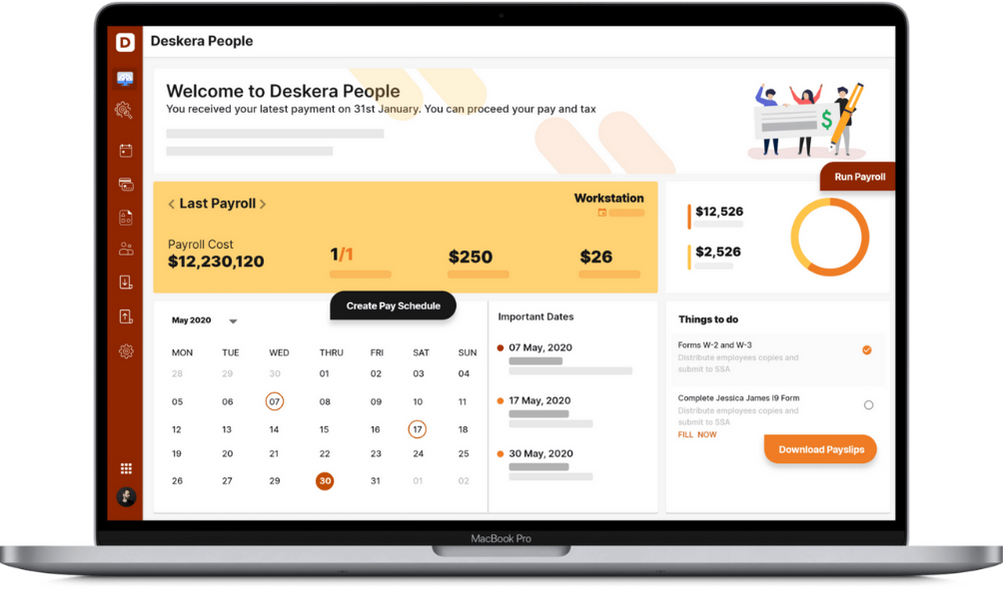

How Deskera Can Assist You?

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. Easily generate pay slips for your employees and simplify your payroll management with Deskera People. It also digitizes and automates HR processes including hiring, expenses, payroll, leave, attendance, and more.

Final Takeaways

We've arrived at the last section of this guide. Let's have a look at some of the most important points to remember:

- The Assam State Tax on Professions, Trades, Callings and Employment Act, 1947 (“Assam PT Act”) is enacted with the object of levying tax on professions, trades, callings, and employments in its State.

- 1. Short title, extent and commencement.-

- (1) This Act may be called the Assam Professions, Trades, Callings and Employments Taxation Act, 1947.

- (2) It extends to the whole of Assam.

- (3) It shall come into force on such date as the State Government may, by notification in the Official Gazette, appoint.

- (a) "assessing authority" in a particular area means the Senior Superintendent of Taxes and Superintendent of Taxes referred to in section 6 exercising jurisdiction in that area and includes any other officer referred to in that Section and specifically authorised by the State Government in that behalf

- "employer" in relation to an employee earning any salary or wages on regular basis under him, means the person or the officer who is responsible for disbursement of such salary or wages, and includes the head of the office or any establishment as well as the manager or agent of the employer Where an employer or a person liable for registration or enrolment willfully fails to apply for such certificate within the required time as provided for in sub section (4), the assessing authority may, after giving him a reasonable opportunity of being heard, impose upon him a penalty not exceeding rupees twenty for each day of delay in case of an employer and not exceeding rupees five for each day of delay in the case of others.

- If the assessing authority is not satisfied that the return filed is correct and complete, it shall serve upon the employer a notice requiring him, on a date and at the hour and place specified in the notice, to attend in person or through an authorised representative and to produce or cause to be produced accounts and papers in support for the return.

- If an employer fails to get him self registered or being registered fails to filer any return, the assessing authority, shall, after giving the employer a reasonable opportunity of being heard and after holding such inquiry as it may deem fit or otherwise, pass an order assessing the amount of tax due to the best of its judgement.

- Refund.- The assessing authority shall refund to a person the amount of tax, interest and fees (if any) paid by such person in excess of the amount due from him. The refund may be made either by cash payment or, at the option of such person, by deduction of such excess from the amount of tax penalty, interest and fee due from him: (See: Rule 312 to 32B/Form VIII & IX)

- Provided that such excess shall first be applied towards the recovery of any amount due in respect of which a notice under section 8 has been served and thereafter the balance, if any, shall be refunded.

- Notwithstanding anything contained in this sub-section (1), where any offence under this Act has been committed by a company and it is proved that the offence has been committed with the consent or connivance of, or is attributable to any neglect on the part, any director, manager, secretary or other officer, such director, manager, secretary or other officer shall be deemed to be guilty of that offence and shall be liable to be proceeded against and punished accordingly.The State Government may, subject to the condition of previous publication, make rules for carrying out the provisions of this Act

- Provided that it shall not be necessary to make previous publication as aforesaid, of any rules required to be made on the first occasion in order to give effect to the provisions of the Assam Professions, Trades, Callings and Employments Taxation (Amendment) Act,1992.

Related Articles