Imagine a situation wherein you are participating in a quiz or giving an exam on financial accounting, and you face a question that asks:

Which of the following invoices are made based on forecasts and assumptions but cannot be used for accounting purposes?"

- A sales invoice

- A proforma invoice

- A tax invoice

Do you know what the right answer is - It is a "proforma invoice". Are you aware of what a proforma invoice is, how to send it and how you should be using it?

A proforma invoice is a pre-sales contract that is sent to the customer before the work is completed. It is a promise of goods and services that have not yet been offered but lists the work to be performed, the quantity, and the price to charge for the product or service. These cannot be used for accounting purposes, and neither is it a payment request. Let us go further and see what a proforma invoice is!

Table of Contents

- What is a Proforma Invoice?

- What is the purpose of the proforma invoice?

- Proforma Invoice Use Case

- Why do companies use proforma invoices?

- Can you pay with Proforma Invoice?

- Is Proforma Invoice legally binding?

- When do you need to send a proforma invoice?

- How is the proforma different from other types of invoices?

- Can you cancel the proforma invoice?

- How to create a proforma invoice?

- What to include in the proforma invoice?

- Proforma Invoices Vs. Sales Invoices

- Conclusion

- Key Takeaways

- Related Articles

What is a Proforma Invoice?

Proforma invoices are preliminary or estimated invoices that are used even before the sale has culminated and are sent to request payment from a required buyer even before the goods/services are delivered. The proforma invoice contains a description of the item, the total amount paid, and other transaction details. This is essentially a "sincere" agreement between you and the buyer, giving the buyer advance knowledge of what to expect.

Proforma applies to invoices that have not yet been finalized, i.e. the proforma invoice does not have the invoice number required for all legal invoices. Unlike invoices, proforma invoices are quotes that outline the goods or services that the seller has agreed to sell.

What is the purpose of the proforma invoice?

A Proforma invoice ensures that the seller and the buyer are on the same platform for the contract, and agree upon the terms and conditions of the sale including the prices of the goods and services. It provides potential customers with an overview of the costs of products and services.

- The purpose of Proforma Invoice is to streamline the process and can be treated as a quote that tells you exactly what you can expect from your customers

- Proforma invoices are sent to buyers to declare the value of goods, or to make them aware of the brand, quality, quantity, and description of goods that the business has dealt in. This ensures a smooth delivery process even at customs, especially in the case of imported goods

- Proforma invoices are best if you don't have all the details you need for a commercial invoice

- Proforma invoices are used by certain customers for the internal purchase approval process and are quite commonly used in imports and commerce

Proforma Invoice Use Case

Suppose XYZ company has a computer firm and the business received an order of 100 laptops to be shipped to ABC company. As soon as XYZ receives the orders, it will start accumulating products according to the demand of the customers and begin the sales process without negotiation or confirmation. Production or procurement will be completed within a month and XYZ company will invoice the buyer.

Looking at the invoice, the buyer is dissatisfied for the following reasons:

- ABC company feels that the prices were never negotiated and they think it is stated too high

- ABC company is not happy with the delivery date and wants to accelerate it

- ABC company requests for a longer payment term after the prices have been lowered, invalidating previous invoices, and issuing new invoices that meet the buyer's requirements

This way of doing business is awkward and inefficient.

On the other hand, as soon as XYZ company got the order from ABC company and before it started working on the order, it sent a proforma invoice to ABC confirming the deal. This invoice includes the price, delivery date, and payment terms for the 100 laptops. The buyer now has room to negotiate with the seller to find terms that can be mutually agreed upon.

Once approved, XYZ company will send a proforma invoice as a sincere document and begin manufacturing or procuring the order of 100 laptops. Once the order accumulation is complete, it can use the final sales invoice using dedicated software or accounting tools and convert the proforma invoice to a sales invoice.

Why do companies use proforma invoices?

Proforma invoice is used:

- To tell buyers what to expect from suppliers and encourage them to negotiate

- To show the supplier's willingness to offer goods and services at the agreed price on the promised date

- Comprises buyer information and his willingness to pay

- Streamlines the Quote to cash process

- To act as an offer for the buyer's internal purchase approval protocol

- To save processing time and cost

- Proforma invoices, on the other hand, are just drafts and are not legal agreements. Proforma invoices are also not payment request documents

Can you pay with Proforma Invoice?

Proforma Invoice allows the customer's accounts payable department to prepay the actual receipt. The invoice avoids misunderstandings about what you are borrowing and how much it is. Once the order is complete, the standard invoice will refer to the proforma invoice number to avoid double payments by the customer.

Is Proforma Invoice legally binding?

The proforma contains a lot, if not all, of the same information that will appear on the final sales invoice, but it does not have the same legal significance and is used for accounting purposes or as a binding contract. In many ways, proforma invoices are more like quotes than final sales invoices.

This is because the customer does not have to pay the amount stated on the proforma invoice, the total amount to be paid is not recorded as the customer's payment or accounts receivable, and the VAT cannot be refunded using the proforma invoice.

When do you need to send a proforma invoice?

The most important thing to remember is that the proforma is usually sent when the customer or client promises to buy from you, but the final details have not yet been confirmed, so a formal invoice cannot be sent. If the customer agrees, we will deliver the item and issue a formal invoice.

How is the proforma different from other types of invoices?

Proforma invoices can differ from other kinds of invoices on the following grounds:

1. Sales Invoice

A sales invoice is a formal payment request sent at the same time or immediately after. Goods and services are provided. This is not only a payment request, but also a tax document, and if it contains VAT, it can be called a tax invoice.

2. Commercial Invoices

Commercial invoices are used for international shipping to customers and customs authorities about what is being shipped, who is buying and selling, dates and conditions of sale, quantity, and weight of goods, and more. Commercial invoices are used to calculate the monetary value of the goods traded and the taxes that may apply to the shipment.

3. Credit

If the item is damaged, or if there is a typographical error or other error, the credit will provide the details of a partial or full refund of the original invoice, or the credit used for future purchases. The purpose of the Proforma Invoice is to show the cost of a product or service that helps customers decide whether to continue their purchase.

4. Proforma Invoices, Taxes, and VAT Proforma

Invoices do not establish transaction tax timing. Tax points, also known as "delivery dates," are the dates on which sales are made for VAT purposes.

Suppose XYZ company deals in computers and is a supplier of computer products and materials. Each computer is different and should be checked at the shop before checking the exact dimensions. When a deal is verbally or mutually confirmed, XYZ company can send a proforma invoice to the customer who inquired about a particular item. The company can list all the details of the proposed sale to the consumer.

At this point, the tax date has not yet arrived, so both, the buyer and XYZ company cannot use the date on the form for tax records. The customer confirms that they want to continue and submits the payment. Then XYZ will issue the final sales invoice. The date on this invoice is the taxable date and will be used for VAT filing.

Can you cancel the proforma invoice?

Proforma invoices are not legal documents or official invoices used for accounting and do not need to be canceled. As with the quote, if the sale is not complete, there is no need for you to edit or cancel the quoted invoice. This means that even after the customer has sent a proforma invoice, they change their mind and cannot make a purchase.

For this reason, it's a good idea to track every aspect of your deposits and withdrawals so that you can understand how canceled orders affect your cash flow. You simply need to keep track of your company's spending, as well as an overview of your daily spending.

How to create a proforma invoice?

You can create a proforma invoice using the same method you used to create a regular invoice. For the best support, you can get software that includes several templates for creating a proforma invoice or accounting billing programs that come with an in-built proforma invoice template. Alternatively, you can have your style of proforma invoice in an application.

What to include in the proforma invoice?

The main purpose of the Proforma Invoice is to show the customer what the proposed transaction covers. Therefore, it must contain almost the same information as the actual sales invoice. You can include the following parameters in the proforma invoice

- Unique invoice number

- Company name, address, and contact details

- Customer's name and address

- Issuance date and due date

- Product description

- The period for the validity of the quoted prices

- Links to all applicable terms and conditions

- Payment terms (it is worth giving instructions on how to pay, regardless of whether the customer pays in the proforma phase)

- VAT (Proforma invoices are not tax invoices, but must include an estimated VAT amount)

Proforma Invoices Vs. Sales Invoices

The key difference between proforma invoices and sales invoices is not the appearance, but the intent of the transmission. Here is a comparison of Proforma Invoice and Sales Invoice –

- A proforma invoice is a document similar to a regular invoice, providing agents with information about the details of the products being delivered. Invoices, on the other hand, refer to commercial goods that are delivered to the buyer and contain details of the product or service offered by the seller

- Proforma Invoice is a type of offer that includes a seller's commitment to delivering goods at a specified price and date. Conversely, an invoice is a type of invoice that indicates the amount to be paid to the buyer

- Proforma invoices are quotation invoices that are used to make sales, and invoices are used to confirm sales

- Proforma Invoice is provided by the seller at the request of the buyer before ordering. It is different from the invoice issued by the seller to the buyer to request payment for the delivered goods

- Proforma invoices are dummy invoices and are used to generate revenue, so there are no entries in the financial transaction books. Therefore, it is the actual invoice and, unlike the invoice in which the financial transaction occurs, serves as the basis for posting to both books

- The basic goal of Proforma Invoice is to allow buyers to decide whether to place an order. Invoices, in contrast, are issued by the seller for payment from the buyer

Conclusion

Companies looking for ways to grow rapidly and improve their billing process should consider using Proforma Invoices. Proforma invoices are a type of preliminary summary of the transaction before confirming the sale. The main objective of sending the proforma invoice to the buyer is to streamline the quote-to-cash process and allow the buyer to review the terms and conditions before the transaction is closed.

There are several free proforma invoice issuing software available on the wen, using which you can create quotes, budgets, and proforma invoices to send to your buyers and customers. It ensures collaboration between both parties, simplifying and clarifying the terms and conditions of the sale, and informing the consumer what exactly the deal offers him.

How can Deskera Help You?

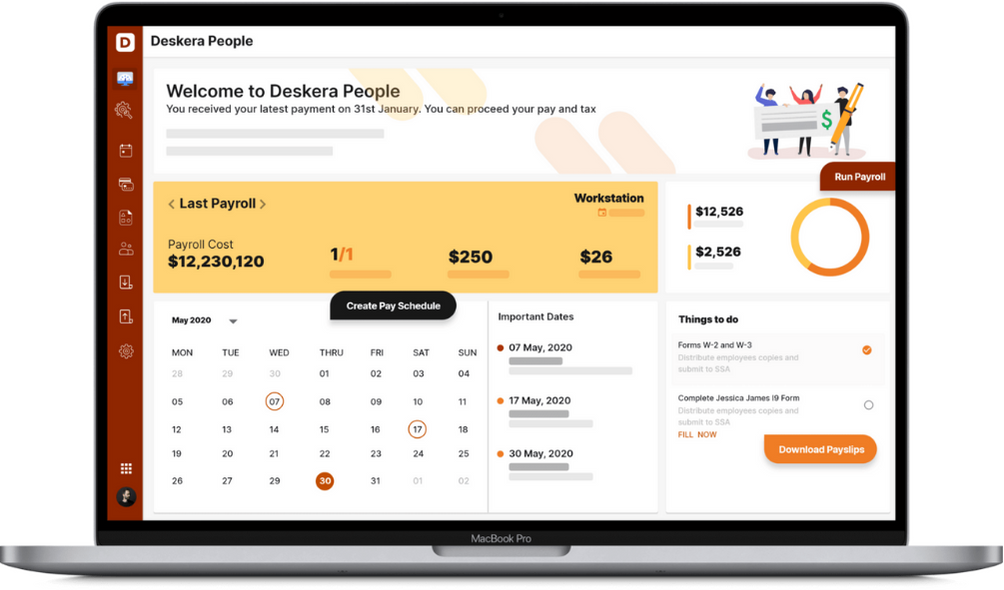

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Proforma invoices are sent to the buyer before shipping or shipping the goods or services

- Most proforma invoices provide buyers with accurate selling prices, description, quantity, quality, brand, and other details of the products/services as ordered by the buyer

- There are no guidelines that specify the exact display or format of the proforma invoice

- Proforma Invoices need only enough information to be able to determine the required obligations based on a general inspection of goods containing customs

Related Articles