Did you know Piece rate pay, also known as piece work pay, is a complex compensation system that can be beneficial for businesses and their employees? Some employers have abused piece rate in the past, leading governments to tighten regulations on the practice.

Piece rate pay may not be practical in all fields, and some companies may not find it worthwhile to put in the extra effort required to calculate an employee's pay. A piece rate contract is a type of labour agreement in which wages are determined based on a worker's performance.

Table of contents

- What is Piece Rate Pay?

- Can we legally use a piece rate system?

- What's more preferable, an hourly wage or a piecework rate?

- What does it mean to be paid by the piece, and how does that work?

- How are Extra hours are calculated using piece rates?

- What are the Advantages of Piece Rate Pay?

- What are The drawbacks of piecework compensation?

- Difference between Salary based on hours worked vs. salary based on results

- What does the term hourly employee mean?

- What are the Benefits of being a time-based employee?

- What is an output-based employee?

- How to decide between time-based and results-based employment?

- Pay and benefits: Why Do They Matter?

- How much do people get paid and what other perks do they get at work?

- What is the Warr’s Vitamin Model?

- Why are compensation and benefits important?

- Methods for Ensuring Fair Compensation

- Key Takeaways

What is Piece Rate Pay?

Employers and workers sign a piece rate contract outlining the terms of their relationship. With this agreement in place, workers will be compensated based on their output or the number of hours they put in. Because the worker is paid based on their output, we can also refer to this as piece rate pay.

Can we legally use a piece rate system?

The use of piece rates is not only acceptable, but legal. However, businesses are still subject to the requirements of state and federal laws regarding record-keeping, overtime pay, and the minimum wage. Rest, recuperation, and other periods of inactivity should be paid for in California, Piece Rate Pay.

What's more preferable, an hourly wage or a piecework rate?

Those who are paid on a piece-by-piece basis may find that they are more motivated to work hard and increase output (or complete more projects). Gaining proficiency in work efficiency can increase a company's bottom line. This form of payment is most common in the manufacturing sector, but it is also common in agriculture and the home service industry.

Before we get started, let me just say that this article is not intended to serve as legal advice. However, professional legal counsel should still be sought whenever possible. If you have any doubts as to your understanding of the applicable labour laws, you should seek the advice of an attorney.

What does it mean to be paid by the piece, and how does that work?

Beginning in the late Middle Ages during the era of the Commercial Revolution, piece rate pay was first used to compensate artisans for work performed in the home. During the Industrial Revolution, factory workers were paid on a piece rate basis for the goods they produced, Piece Rate Pay.

Employees receiving piece work pay are compensated based on the quantity of goods or services they produce during the course of their shift. It's a replacement for an hourly wage in which the employer sets a flat rate for each unit of work. A worker's earnings are determined by multiplying their hourly rate by the total number of units they generate.

However, it's not quite as simple as that. Workers paid on a piece rate basis must be paid at least the minimum wage in order to meet FLSA requirements, Piece Rate Pay.

Employers are required to pay the higher of the federal, state, or local minimum wage requirements. Furthermore, workers who put in more than forty hours a week should be compensated at double time, Piece Rate Pay. Therefore, it is the responsibility of the employer to ensure that the piece rate compensated to the employee is equal to or greater than the minimum wage.

How are Extra hours are calculated using piece rates?

Overtime pay must still be given to workers who are paid on a piece-rate basis but who put in more than 40 hours a week. In other words, you have to pay your employees at least the minimum wage and any applicable overtime rates, Piece Rate Pay.

Those who are paid on a piece rate basis continue to receive double their regular rate for working overtime. Payment for overtime can be determined in two ways:

Just multiply the output by the fixed price. The employee's hourly rate can be calculated by dividing this figure by the total number of hours worked, Piece Rate Pay.

Extra pay for overtime must be calculated by first multiplying the regular hourly rate by 0.5 (the overtime rate), and then adding the resulting figure to the total number of overtime hours worked. In order to calculate weekly pay, this amount must be added to the piece rate payout. It will go something like this:

In order to determine the overtime premium: Multiplying the regular hourly wage of $22.40 by the overtime hourly wage of $0.50 times 10 overtime hours yields a total of $112.

However, there is a more straightforward approach to determining overtime piece rate compensation. Your worker must agree with you for this to happen. Although a written agreement is not required, it is recommended for the sake of your company's security, Piece Rate Pay. During overtime hours, the flat rate increases to 1.5 times the normal rate. Simply put in place a system to track and record output during overtime.

As can be seen, the result of the calculation is not always the same. And it's not always the case that the second choice results in a lower salary for the worker, Piece Rate Pay. One potential drawback of this method is that it may incentivize your employee to increase output at times when they are likely to be overtired. That may lead to output of lower quality, Piece Rate Pay.

Particulars for Businesses in California

The Golden State takes a unique approach to a number of regulatory areas. Employers in that jurisdiction are required to compensate workers for time spent sleeping, recovering, or otherwise not actively contributing to the business. Piecework rates are paid separately, Piece Rate Pay.

Assembly Bill 1513 was enacted in 2015 to safeguard employees from overwork and underpayment. A large number of agricultural workers in the state, many of whom are paid on a piece rate basis, necessitate the implementation of such safeguards, Piece Rate Pay.

The California Department of Industrial Relations specifies the following types of supplemental compensation:

Piece-rate workers are entitled to ten minutes of paid rest for every four hours worked. An extra period of rest is needed, and that needs to be accounted for as well, Piece Rate Pay.

Minimum wage or higher must be paid for unproductive time

Piece rate overtime compensation earned for working holidays, overnights, weekends, or extra-long shifts must be calculated if double overtime is offered (or required to be paid).

Paying employees on a piecework basis is still a viable option for California businesses. There are more moving parts to keep track of, but the effort may be worthwhile, Piece Rate Pay. Employee output, quality, and satisfaction can all benefit from managers' efforts to ensure their workers get enough rest, are treated fairly, and are fairly compensated, Piece Rate Pay. In most cases, this results in a decreased need to recruit, screen, hire, onboard, and train new staff members.

What are the Advantages of Piece Rate Pay?

An employee should weigh the benefits of piece rate pay against those of other payment options before agreeing to it. Businesses can weigh the pros and cons of the payment system to decide if it's a good fit for their operations, Piece Rate Pay.

Piecework compensation has the following benefits: Efficiency and output have improved dramatically. Workers are more productive under the piece rate system because they are constantly motivated to meet their production goals, Piece Rate Pay. Staff members know that they stand to earn a bonus if they can complete their tasks in a shorter amount of time, so they exert themselves more, Piece Rate Pay.

There is a reduced need for close oversight of workers when using the piece rate system. Workers under a piece rate system have an incentive to work quickly and efficiently in order to maximise their earnings, Piece Rate Pay.

Since the employer has committed to paying a set amount per completed unit, wage calculations are simple. A project's final payment is calculated by multiplying the number of units by the unit price.

Regular employees get paid whether or not they put in full time, while those paid by the piece do not receive compensation for time spent not actively producing results. If they aren't producing, they aren't earning. Piece-rate workers can't afford to take breaks because doing so would result in a financial loss, Piece Rate Pay.

Increased output occurs when workers are efficient with their time and consistently push themselves to meet or exceed their goals. Many employees would rather set their own rates of productivity and pay in order to maximise their income. Piece Rate Pay. Because their pay is directly tied to their level of productivity, piece rate employment encourages even the least productive workers to work harder.

When an employer pays their employees on a piece rate basis, they do not factor the time it takes to complete a task into the total amount they owe them, Piece Rate Pay. They don't take anything into account beyond the final status of a task's completion or the achievement of a major milestone, Piece Rate Pay. These kinds of systems can motivate workers to put in extra effort and help them maximise their compensation for the work they do, Piece Rate Pay.

Workers using the piece-rate system often evaluate their own performance and strive to improve it. Without interference from management, employees are free to self-evaluate and adjust their goals accordingly, Piece Rate Pay.

Effective utilisation of machinery and tools results from employees' concentrated efforts to maximise the effectiveness of these resources. They make good use of the equipment because they realise that any downtime will cut into their earnings.

Efficient management of expenses

As output rises, it becomes possible to cut costs per unit. As a result of the reduction in per-unit costs of production when fixed overheads are in place, the company is able to lower the price at which its products are sold. Price cuts are a competitive strategy that draws in more buyers and benefits everyone, Piece Rate Pay.

Calculating the labour cost for each production unit is a simple task for both employers and managers. It's useful for cost estimates and planning production ahead of time, Piece Rate Pay.

The business owner or manager can easily plan for production by setting goals and monitor progress toward those goals. Once an employee's abilities have been assessed, it's simple for them to establish and meet daily, weekly, or monthly production goals, Piece Rate Pay. Because it is simple to revisit the predetermined goals on a regular basis, more command is exerted.

What are The drawbacks of piecework compensation?

It is important to be aware of the drawbacks of the piece rate payment system before agreeing to work under its conditions, Piece Rate Pay.

Reduced quality

When workers are under pressure to produce a large quantity of units quickly, they may sacrifice quality in the pursuit of quantity. The end result could be low-quality goods. This could result in financial losses for the company or in lost wages for the workers who are forced to redo their previous efforts, Piece Rate Pay.

Setting a consistent price per unit is problematic. Agreeing on a figure that is favourable for both parties can be time-consuming and it involves a lot of discussions and negotiations. However, once a price per unit is settled upon, determining how much money is owed is simple, Piece Rate Pay.

When workers are paid on a piece-rate basis, they have an incentive to work harder to meet their goals, which can lead to burnout in some cases. Some employees are unable to handle the stress of working long hours without breaks, Piece Rate Pay.

Concern: Some workers may be unhappy with their working conditions (for instance, the slower workers who cannot earn reasonable wages). The best employees, who consistently deliver high-quality goods and services, may become dissatisfied if they are not compensated fairly for their expertise.

Some piece-rate workers worry that their employers will suffer financially if they miss work. There is no sick pay or other compensation for employees who call out sick or don't show up to work for any other reason, Piece Rate Pay.

Employees may receive either a salary based on their actual work done or a salary based on their actual hours worked. When making a career choice, it's important to weigh the pros and cons of both salary structures, Piece Rate Pay.

Gaining an understanding of the differences between salary structures based on time and those based on results will allow you to make an informed decision about which structure best suits your needs and objectives. This article will discuss the differences between a time-based salary role and an output-based salary role, as well as the pros and cons of each and how to decide between them.

Difference between Salary based on hours worked vs. salary based on results

If you're trying to decide whether or not to pursue a particular career path, knowing the difference between a job that pays you by the hour and one that pays you based on the results you produce is crucial, Piece Rate Pay.

There are professionals who would rather be paid an hourly wage, while others would rather be paid a set salary regardless of how long it takes them to complete their work. Each successful expert has their own unique set of concerns, objectives, and inclinations. Both salary schemes are important in the workplace because they suit different professionals in many industries.

What does the term hourly employee mean?

Time-based employees are professionals who are paid a predetermined amount for each hour they put in. When they accept the position, they negotiate an hourly wage with their employer, and they are compensated for the hours they work during each pay period, Piece Rate Pay.

Although most full-time workers do not receive an hourly wage, some do because their hours are less predictable than those of part-time workers. Paychecks for hourly workers are typically issued every week, biweekly, or monthly, and the amounts they receive each time can vary, Piece Rate Pay.

What are the Benefits of being a time-based employee?

Some skilled workers prefer time-based jobs to output-based ones because of the advantages they bring. If you're on the fence about accepting a job that pays you hourly, here are some perks to think about, Piece Rate Pay.

Ability to take time off or switch shifts with coworkers is facilitated by time-based jobs. You could potentially work irregular hours, permitting you to attend appointments during typical business hours, Piece Rate Pay.

For those who are paid by the hour, overtime pay may be available if they work more than 40 hours in a workweek. Workers who are required to come in on holidays may also receive premium pay.

The flexibility of part-time work schedules allows many hourly workers to pursue interests outside of their careers. Even full-time workers can benefit from a time-based employment contract because it allows them to better plan their personal lives around work, Piece Rate Pay.

Time-based workers face unique challenges

Time-based employment professionals may face some difficulties, despite the many advantages. If you're considering a role that requires you to be available at specific times, familiarising yourself with these potential obstacles can help you decide whether or not they're worth overcoming. Some potential drawbacks of time-based compensation include the following:

The salaries of time-based employees are not guaranteed and fluctuate according to the number of hours worked. Time-based workers can make better use of their income by creating a monthly, weekly, and daily budget, Piece Rate Pay.

Time-based workers often have erratic schedules that require them to be on-call at all hours of the day or night, as well as on the weekend. Time-sensitive workers may find success by approaching upper management to request a more stable work schedule, Piece Rate Pay.

Not all employers will provide benefits to hourly workers, even if they offer them. This is because workers whose pay is determined by the number of hours they put in may have greater flexibility in how they choose to spend their time at work and may be eligible for additional compensation in the form of paid time off or overtime, Piece Rate Pay.

What is an output-based employee?

A professional who receives a salary rather than an hourly wage based on their output is said to be paid on an output basis. Each pay period, regardless of the number of hours worked, they receive their full salary. Depending on the nature of their position, they may be eligible for bonuses or commission in addition to their guaranteed base salary. Employees paid on the basis of their output are typically paid every two weeks or once a month.

Gains associated with taking a results-oriented approach to work

There are many advantages to being an output-based worker. If you're trying to decide whether or not to take a job that pays you by the hour or for your output, here are some pros and cons to think about, Piece Rate Pay.

Many employees who are compensated based on their output receive benefits from their employers. It's possible that if you work in an output-based role, you'll be eligible for certain perks like paid vacation and maternity leave, Piece Rate Pay.

Professionals who are paid based on their output are in high demand because they can take on challenging roles and devote their full attention to significant projects. They may feel more secure in their jobs than they would in a time-based role because they know they can put in extra time on these projects as needed without incurring any additional costs to the company, Piece Rate Pay.

High-level professionals, such as those in management and executive roles, typically receive compensation based on their productivity for their employer. As a result, you may be able to increase your credibility as a professional and move up in your chosen field, Piece Rate Pay.

Constraints of a results-oriented workforce

Even though output-based jobs are often highly rewarding, their professionals may face unique difficulties. By understanding these obstacles, you'll be better equipped to decide if an output-based role is right for you and your career. Here are some potential disadvantages of output-based jobs:

Concerning salaries, professionals who are paid based on their output do not gain anything from working more. In some weeks, they may work fewer hours for the same salary, so their take-home pay may seem low, Piece Rate Pay.

Output-based employees may put in extra time at the office during busy times or when rushing to meet a deadline. Most companies strike a balance by allowing employees to take longer vacations during slower periods.

Since their jobs are so time-consuming, many employees whose pay is contingent on their output have trouble striking a balance between their professional and personal lives. Disconnecting from work-related calls, texts, and chats can help people strike a better balance between their professional and personal lives, Piece Rate Pay.

How to decide between time-based and results-based employment?

Several factors should be taken into account when deciding between a job with a time-based salary scheme and one with an output-based salary scheme.

Both have their advantages and disadvantages, so it's important to weigh those against your personal and professional priorities before settling on one. Here are some things to consider when deciding whether to take on a role that is time-based or output-based:

Consider whether the role may help you advance in your career

Regardless of the job you end up taking, you should make sure it fits in with your long-term plans and allows you to grow professionally. Even though one job may pay more than another, you should consider whether or not the long-term benefits of taking the job outweigh the short-term benefits of the higher salary. If you choose a career path that could be beneficial to you in the long run, you may be able to advance your career and earn a higher salary.

Think about why you want to work in this field.

It's important to be enthusiastic about the work if you're going to accept a job that pays based on output rather than hours worked, Piece Rate Pay.

Time-based jobs, on the other hand, can help you explore different industries and find the kind of work you really love. Before accepting a job, regardless of how much money it pays, think about the tasks you'll be performing and whether you'd enjoy doing them on a daily basis.

Determine whether you're willing to work overtime

Since most output-based employees are paid the same rate regardless of how often they work, many businesses routinely ask and expect their staff to put in extra hours. Time-based workers may be eligible for overtime pay on occasion, and they are usually given the choice of whether to accept or decline overtime work, Piece Rate Pay. When deciding whether or not to accept a job offer, it is important to weigh the potential number of hours worked against the salary offered.

Set your own limits on how much work is too much

When you take on a position with a specific output, you agree to take on the entire responsibility for that output. The duties and hours of a time-based position, on the other hand, may be more manageable for you, Piece Rate Pay. An output-based position may be financially rewarding, but you should carefully consider whether you have the time and energy to devote to the position's responsibilities before accepting it.

Although both compensation and benefit are forms of remuneration paid by an employer to an employee, there are important distinctions between the two, Piece Rate Pay.

A worker is said to receive compensation if they are rewarded monetarily for the efforts they put forth on behalf of their employer. Employees are compensated for their time and effort in the form of salary, benefits (such as paid vacation and sick leave), bonuses, and other incentives. All of these things are considered part of an employee's compensation, which may or may not be monetary.

When we talk about benefits, however, we're talking about something other than money that's given to an employee as a thank you for their efforts. Employees appreciate perks like casual dress, working from home sometimes, free gym memberships, and catered lunches.

The ability to offer attractive benefits is a key factor in attracting and retaining top talent in any industry. Let's pretend a worker is being courted by two different companies. Financially, the offers are comparable, but the first one offers a better benefits package. In this situation, the worker is highly likely to accept the first job offer they receive, Piece Rate Pay.

Total Rewards Model

According to the Total Rewards Model, compensation isn't the only factor in an employee's satisfaction with their job. The monetary compensation isn't the only factor; other benefits, like a good work-life balance and being acknowledged for their efforts, are crucial as well.

This model was developed by World at Work, an international organisation for human resources professionals, and it states that an employee's total rewards include monetary pay, health and welfare benefits, opportunities for professional growth, and public acknowledgement of their efforts, Piece Rate Pay. Payment made to an employee in exchange for his or her time, effort, and talent is known as compensation, and it can be either a fixed amount or one that fluctuates with performance.

Well-being refers to a person's state as a whole, including their mental, physical, and social health. According to World at Work, an employee's benefits include financial support for things like healthcare, retirement, and vacation. Opportunities for enhancing one's skill set and climbing the corporate ladder are at the heart of development, Piece Rate Pay.

Alternatively, recognition is more concerned with showing an employee that they are valued for the contributions they have made to the company, whether that be formally or informally.

Peter Warr, a psychologist in the workplace, created a compensation model that likens different aspects of a job to different vitamins. Like a person needs a wide range of nutrients to thrive, Warr argued that employees required factors such as independence, financial reward, and job variety to thrive in the workplace, Piece Rate Pay.

Warr classified work-related factors into two categories. The first category, which he labelled Constant Effects, consists of factors whose abundance has no negative or positive impact on output, Piece Rate Pay.

Some examples of such features include a fair wage, secure employment, a pleasant work environment, and helpful management of employees' efforts. These features include, for instance, the frequency with which employees receive feedback, the level of challenge in their tasks, and the variety and intensity of the demands placed on them on a daily basis.

Pay and benefits: Why Do They Matter?

Human resources are the most important aspect of a company. Talented employees are directly correlated to increased productivity and profitability. A company's ability to provide competitive pay and benefits to its workers is a major factor in the level of satisfaction those workers feel toward their employer. The following are some additional justifications for salary and benefits:

It's important to keep your staff inspired

When workers are paid fairly, they are more excited to show up for work each day. Their spirits remain high, and they are increasingly satisfied with their work. Employees with high morale are more likely to put forth their best effort on a daily basis and are more invested in the success of the company as a whole, Piece Rate Pay.

Employees who are invested in their work and feel appreciated are less likely to look elsewhere for employment, another factor that contributes to their longer tenure with the same company.

Get the attention of the most qualified professionals in your field

Any employee worth their salt would be aware of their worth and work to increase it in order to receive the most favourable salary and benefits package possible, Piece Rate Pay.

Employees are more likely to leave if they believe they are being underpaid or if a competitor is offering the same salary but better benefits. In order to attract and retain the best employees, human resources departments should be aware of how their total compensation packages stack up against the market and, if possible, strive to match the offerings of their rivals.

When it comes to financial rewards, what are the most important factors?

Salary, paid time off, health insurance, and other benefits and policies aimed at improving employees' health and happiness are all part of compensation and benefits packages. However, compensation and benefits have three main components:

Fixed pay

The term fixed pay refers to the base salary an employee receives from their employer regardless of whether they work overtime or not. The worker is paid a set amount every month rather than by the hour. In determining this wage, considerations such as the state's minimum wage, the employee's position, the employee's location, the cost of living, the industry's standard of pay, etc, Piece Rate Pay.

Variable pay

A compensation from an employer that is based on both the general performance of the business and the individual performance of an employee is known as variable pay.

Equity pay

Stock options and other forms of equity compensation are sometimes offered to workers. These are non-cash in nature and represent an ownership of the company. Along with their salary and other benefits, employees can now also gain a portion of the company's overall profits, Piece Rate Pay.

These stocks form a part of an employee’s compensation package as equity pay. These stock options, however, typically do not become fully vested until after an employee has worked for the company for a certain number of years, Piece Rate Pay.

Health benefits

Healthcare coverage is a common and well-received perk for workers in the United States. Providing health insurance for your employees is a great perk, especially in light of the high cost of the best plans. Plans that go beyond the typical doctor's visit can help you stay ahead of the curve. It can also help establish your company culture as a people-first organisation, attracting and retaining top talent, Piece Rate Pay.

Pay and Benefits Package as an Example

The structure of each benefit and salary package will vary. In addition to the usual fare, this should also reflect the values and principles of your business. Think about what each package includes and how the law in your area might affect that. Also, think about the differences in benefits you'll provide for full-time, salaried employees versus contract or temporary ones.

The challenge of ensuring that everyone is paid fairly

Fair compensation means that all employees are paid a wage that takes into account their experience and what the market will bear, as well as any special circumstances they may bring to the table. If everything else were equal, a company would pay its employees who all held the same job title the same amount. But in the real world, not everything is level. Furthermore, the Harvard Business Review argues that "fair doesn't necessarily mean equal" when it comes to compensation.

It is not uncommon for one manager to oversee a group of 10 employees while another oversees 30. It's possible that one analyst is working with a client who requires in-depth familiarity with financial technology, while another analyst is handling a client who doesn't. They both perform the same functions, but the titles are different: manager and analyst. However, the tasks they must complete and the expertise needed to do so vary widely.

Equal pay for equal work should entail that these two workers receive the same salary. Nonetheless, if we want to create a company that pays its employees fairly, the manager with more team members and the analyst with specialised knowledge of financial technology should be paid more, Piece Rate Pay.

Fair compensation hinges on open lines of communication

While higher pay is one obvious way to keep employees engaged, a Payscale study found that workers were more dedicated if they believed they were being fairly compensated. So, when workers knew how their pay stacks up against both the norm in their field and their peers, they became more invested in their jobs.

As a result, it is incumbent upon an organisation to be forthright with its pay and benefits structures. Distributional fairness, or how employees feel their pay compares to that of their coworkers, is one way to promote open lines of communication, Piece Rate Pay.

Procedural fairness, or the extent to which workers believe their compensation was determined in an equitable manner, is another strategy for boosting worker involvement. Workers have a right to know how their salaries and those of their coworkers are calculated, Piece Rate Pay.

If workers believe their pay is inadequate relative to the value they bring to the company, this transparency can help to change their minds. An employee is less likely to object to a raise if they see that the company-wide criteria used to determine pay raises are consistent, fact-based, and ethical.

Studies have shown that a more engaged workforce results from a focus on procedural fairness rather than distributive fairness when determining an employee's compensation. Employees are more likely to stay committed to their jobs when they can see how their pay compares to both the market and their peers.

How much do people get paid and what other perks do they get at work?

While compensation and benefits may seem to be the same as remuneration from an employer to an employee, there are some key factors that make them different.

What is meant by the term compensation is the payment made to an employee in exchange for their services. Employees are compensated for their time and effort in the form of salary, benefits (such as paid vacation and sick leave), bonuses, and other opportunities to enhance their personal well-being and the well-being of the company. These benefits are all part of the employees' compensation, which may be monetary or in-kind.

In contrast, benefits are a form of non-monetary compensation given to an employee as an expression of gratitude for their efforts. The ability to work from home, free snacks and drinks, discounted gym memberships, catered lunches, and a laid-back dress policy are all perks that employees appreciate.

Benefits are essential to attracting and retaining top talent, even if they don't pay employees directly. Let's pretend a worker is being courted by two different companies. While the monetary value of both offers is comparable, the benefits package in the first offer is far more generous. In this situation, the worker is highly likely to accept the first job offer they receive.

Compensation Benefits

When referring to what an employer provides an employee in exchange for their time and effort, the term compensation is often used. Benefits form a subset of compensation.

Compensation is one method by which businesses can compete for top talent. Employees are pushed to do better work thanks to the incentives provided by their benefits packages.

Compensation can be monetary or non-monetary. Any advantages are not monetary in nature.

Employees receive compensation as a direct result of the work they do for their employer. Employees receive benefits as a form of remuneration for their efforts.

Depending on the circumstances, compensation may be fully or partially taxable. Depending on the circumstances, some or all of a benefit may be tax-free.

Models for elucidating pay and benefits

Many theories have been developed to describe the processes by which businesses and HR departments decide on pay and benefits for their employees.

Every aspect of an employee's life, from their mental and physical health to their relationships and their physical surroundings, contribute to their overall well-being. Benefits are defined by World at Work as monetary and non-monetary compensation provided to an employee, including medical care, retirement savings, and paid time off.

An employee's opportunities to learn new skills and advance in their career are the primary focus of development. Recognizing an employee's contributions to the success of the business can be done in a number of ways, both formally and informally.

What is the Warr’s Vitamin Model?

Peter Warr, a psychologist who specialises in the workplace, created a compensation model that likens certain aspects of a job to vitamins. Warr argued that, just as people require a wide range of nutrients to thrive, so too do workers benefit from factors like independence, financial compensation, and job variety.

The productivity and profitability of a business rise as the level of talent among its workforce rises. Two categories were created by Warr based on occupational characteristics. In the first category, which he labelled Constant Effects, we find traits whose overabundance has no negative or positive impact on output.

These features include the salary an employee receives, the presence of protective working conditions, the assurance of continued employment, and the availability of helpful management oversight. He likened these traits to vitamins C and E, saying that too much of either is neutral for the human body.

The second category, which Warr labelled Additional Decrement, consists of personality traits that, in excess, can be detrimental to an employee's success on the job.

These features include, for instance, the frequency with which employees receive feedback, the level of challenge in their tasks, and the variety and intensity of the demands placed on them on a daily basis. He likened them to vitamins A and D, saying that too much of either can cause toxic buildups and impair human health.

Why are compensation and benefits important?

Human resources, in this sense, are the most crucial part of any business. The productivity and profitability of a business rise as the level of talent among its workforce rises. In order to keep their employees happy, businesses should take care to provide competitive pay and benefits. Here are a few more arguments in favour of pay and benefits:

Don't let morale dip among your staff

Workers are more likely to show up for work when they are paid fairly. Their spirits are unabated, and they continue to take pride in their work. If morale is high, workers will be enthusiastic about coming to the office each day and giving their all to their tasks. Highly motivated and engaged workers are also less likely to look for other employment opportunities, which increases their length of service.

Create a magnet for the most qualified professionals in the field

Any competent worker would be aware of their worth and would aim to maximise it in order to receive the best possible salary and benefits package.

Employees are more likely to leave a company if they believe they are being underpaid or if a competitor is offering the same level of pay with a more attractive benefits package. In order to attract and retain the best employees, human resources departments should be aware of how their total compensation packages stack up against those of their competitors.

You need to know the fundamentals of salary and benefits

Salary, vacation time, health insurance, and other wellness policies are all examples of components of compensation and benefits. Still, there are three primary aspects of pay and perks:

Income Guaranteed

The term fixed pay refers to an employee's guaranteed minimum wage, regardless of whether or not they work overtime or receive any other form of compensation. Employees are paid a set amount each month rather than by the hour. Minimum wage, the employee's position, the cost of living, industry standard pay, etc. all play a role in determining this amount.

Compensation that varies from week to week

Pay that varies depending on factors like the employee's own performance and the company's success is known as variable compensation.

Profit sharing

Stock options and other forms of equity compensation are sometimes offered to workers. These are not monetary in nature but still represent a stake in the business. Along with their salary and other benefits, employees can now also gain a portion of the company's overall profits.

Equity compensation such as these stocks are provided to employees as part of their overall compensation package. These stock options, however, typically do not become fully vested until after an employee has worked for the company for a certain number of years.

Therapeutic Value

Healthcare coverage is a common and well-received perk for workers in the United States. Providing health insurance for your employees is a great perk, especially in light of the high cost of the best plans. Plans that go beyond the typical doctor's visit can help you stay ahead of the curve. Establishing a culture that values its employees is another way to improve your company's ability to attract and keep the best people.

Pay and Benefits Package as an Example

The structure of each benefit and salary package will vary. In addition to the usual fare, this should also reflect the values and principles of your business. Think about what each package includes and how the law in your area might affect that. Also, think about the differences in benefits you'll provide for full-time, salaried employees versus contract or temporary ones.

The challenge of ensuring that everyone is paid fairly

Fair compensation means that all employees are paid a wage that takes into account their experience and what the market will bear, as well as any special circumstances they may bring to the table.

If everything else were equal, a company would pay its employees who all held the same job title the same amount. But in the real world, not everything is level. Furthermore, the Harvard Business Review argues that fair doesn't necessarily mean equal when it comes to compensation.

It is not uncommon for one manager to oversee a group of 10 employees while another oversees 30. It's possible that one analyst is working with a client who requires in-depth familiarity with financial technology, while another analyst is handling a client who doesn't. They both perform the same functions, but the titles are different: manager and analyst. However, the tasks they must complete and the expertise needed to do so vary widely.

Equal pay for equal work should entail that these two workers receive the same salary. Nonetheless, if we want to create a company that pays its employees fairly, the manager with more team members and the analyst with specialised knowledge of financial technology should be paid more.

Fair compensation hinges on open lines of communication

While higher pay is one obvious way to keep employees engaged, a Payscale study found that workers were more dedicated if they believed they were being fairly compensated. So, when workers knew how their pay stacks up against both the norm in their field and their peers, they became more invested in their jobs.

As a result, it is incumbent upon an organisation to be forthright with its pay and benefits structures. Distributional fairness, or how employees feel their pay compares to that of their coworkers, is one way to promote open lines of communication. In general, workers are more invested in their jobs when they can see how their pay stacks up against that of their colleagues.

Procedural fairness, or the extent to which workers believe their compensation was determined in an equitable manner, is another strategy for boosting worker involvement. Workers have a right to know how their salaries and those of their coworkers are calculated.

If workers believe their pay is inadequate relative to the value they bring to the company, this transparency can help to change their minds. An employee is less likely to object to a raise if they see that the company-wide criteria used to determine pay raises are consistent, fact-based, and ethical.

Studies have shown that a more engaged workforce results from a focus on procedural fairness rather than distributive fairness when determining an employee's compensation. Employees are more likely to stay committed to their jobs when they can see how their pay compares to both the market and their peers.

Methods for Ensuring Fair Compensation

Any HR professional worth their salt knows how important it is to ensure their employees feel they are being fairly compensated by providing them with clear and transparent communication about the levels of salaries the company offers and how those salaries and compensation are calculated. Employees' perceptions of compensation fairness are bolstered when they understand the methodology behind their pay.

Human resources professionals can do this in a number of ways, one of which is to draught example compensation and benefits packages for various positions within the company. A company, for instance, may hire entry-level analysts, senior analysts, and upper-level management, among others. Three sample compensation and benefits packages can be developed by HR for each position.

This can include not only their base salaries but also any bonuses they may be due, the total value of their health care package, their retirement savings plans, and any other plans that may incur annual costs to the company.

The Human Resources department can then post these example resumes and cover letters on their recruitment website. This data can be used for both internal and external recruitment purposes, including informing current employees of their compensation levels.

Human resource managers should also make a point of advertising any enticing benefits that set their company apart from the competition. This will help the company stand out from its rivals and make sure that its employees are aware of the ways in which it offers a superior benefits package.

Compensation and benefit cost estimation

Businesses typically pay their employees the going rate for their industry, while governments guarantee a minimum wage to anyone who chooses to work. Several options exist for accomplishing this:

Pay scale studies

If they want to attract the best and brightest, businesses in every sector must pay up to industry compensation standards. Companies can benefit from knowing the market rate of pay by participating in salary surveys.

Organizations frequently employ the services of a compensation expert to carry out salary surveys. This expert compiles information from various employers about the wages they offer their workers. The information is then de-identified and resold to the businesses in question so that they can better gauge what the going rate of pay is in the sector.

Experts in compensation more frequently establish a salary range than a specific wage for a position. This is because a manager at a Fortune 500 company would earn more than their counterpart at a smaller company. Companies of varying sizes can use the range to determine their own compensation packages while still remaining within the bounds of a common market norm.

Regression analysis

To determine an appropriate wage, human resources experts frequently resort to algorithmic methods that take a number of factors into account. Employees' current salaries, highest level of education, length of service, and evaluations of their work performance are all examples of such factors.

How can a company ensure its success through pay and benefits packages?

In a company, an employee's salary and benefits are determined by a number of factors. Establishing and communicating to current and prospective hires that one's company provides competitive compensation and benefits packages is a crucial function of any HR professional.

There are two main benefits for a company when it comes to establishing compensation and benefit policies. First, as we've already established, they're able to entice and keep the most talented people in their field.

The second advantage is that it shows businesses exactly how much money is being spent on salaries and benefits, so they can keep their income high enough to pay their workers a fair wage.

To manage your costs and expenses you can use many available online accounting software.

How Deskera Can help You?

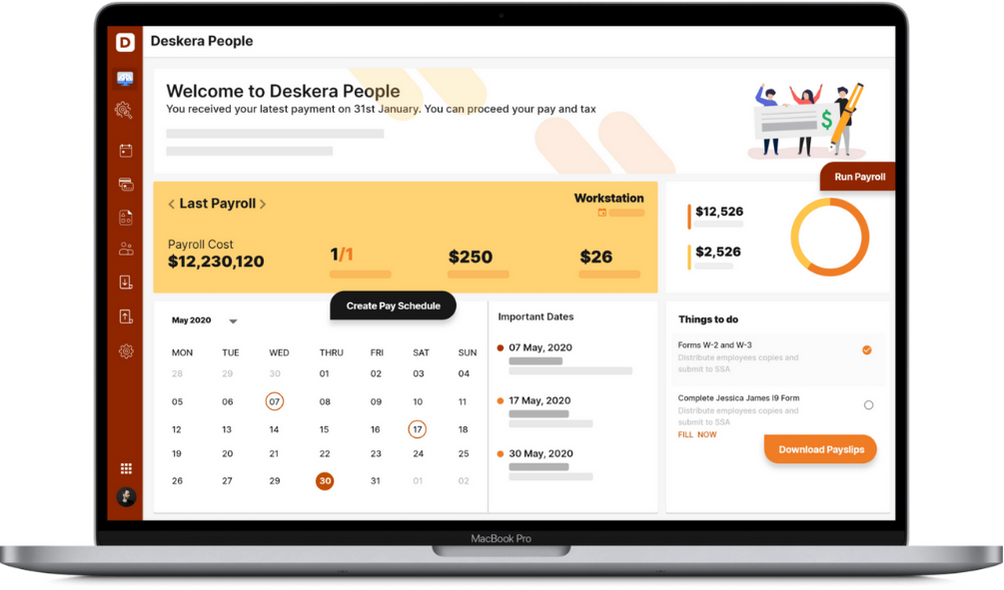

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key Takeaways

Employers and workers sign a piece rate contract outlining the terms of their relationship. With this agreement in place, workers will be compensated based on their output or the number of hours they put in. Because the worker is paid based on their output, we can also refer to this as piece rate pay.

The use of piece rates is not only acceptable, but legal. However, businesses are still subject to the requirements of state and federal laws regarding record-keeping, overtime pay, and the minimum wage. Rest, recuperation, and other periods of inactivity should be paid for in California.

Overtime pay must still be given to workers who are paid on a piece-rate basis but who put in more than 40 hours a week. In other words, you have to pay your employees at least the minimum wage and any applicable overtime rates.

Those who are paid on a piece rate basis continue to receive double their regular rate for working overtime. Payment for overtime can be determined in two ways: Just multiply the output by the fixed price. The employee's hourly rate can be calculated by dividing this figure by the total number of hours worked.

An employee should weigh the benefits of piece rate pay against those of other payment options before agreeing to it. Businesses can weigh the pros and cons of the payment system to decide if it's a good fit for their operations.

Piecework compensation has the following benefits: Efficiency and output have improved dramatically. Workers are more productive under the piece rate system because they are constantly motivated to meet their production goals. Staff members know that they stand to earn a bonus if they can complete their tasks in a shorter amount of time, so they exert themselves more.

When you take on a position with a specific output, you agree to take on the entire responsibility for that output. The duties and hours of a time-based position, on the other hand, may be more manageable for you. An output-based position may be financially rewarding, but you should carefully consider whether you have the time and energy to devote to the position's responsibilities before accepting it.

In a company, an employee's salary and benefits are determined by a number of factors. Establishing and communicating to current and prospective hires that one's company provides competitive compensation and benefits packages is a crucial function of any HR professional.

Related Articles