Small merchandising businesses can track their inventory with an inventory management approach known as the periodic inventory system.

Under a periodic inventory system, any change in inventory is recorded periodically, typically at the end of the month or year.

So, instead of keeping track of the decrease or increase in merchandise every time a financial transaction occurs, businesses using periodic inventory do it at different time intervals.

In this guide, we will be explaining the operational activities related to the periodic inventory system, its pros and cons, and whether or not this inventory management system is the right decision for your small business accounting.

Read along to learn about:

- What Is a Periodic Inventory System?

- How Does a Periodic Inventory System Work?

- Who Uses a Periodic Inventory System?

- Pros of a Periodic Inventory System

- Cons of a Periodic Inventory System

- 5 Journal Entries for Periodic Inventory

- Inventory Management with Deskera

What Is a Periodic Inventory System?

A periodic inventory system is an approach businesses can use to evaluate their merchandise inventory and the cost of goods sold.

More specifically, under a periodic inventory, the physical count of inventory and calculation of the inventory costs is done periodically, at regularly occurring intervals.

This interval usually corresponds to a full year (at the end of the year), however, a business can count its inventory every month, quarterly, every six months, or at any other interval that best suits the business’ financial agenda.

Since some companies carry hundreds, and even thousands of merchandise, performing a physical count can be a tiring and time-consuming process.

That’s why a periodic inventory system is only mainly used by small businesses with limited inventory and few financial transactions.

Perpetual vs Periodic Inventory System

Merchandising businesses that deal with hundreds of transactions a day, such as grocery stores or pharmacies, can’t possibly maintain their inventory through a periodic inventory system.

That’s why businesses with high sales volume and multiple sales channels use a perpetual inventory system, instead.

A perpetual inventory system is a method that records each sale or purchase of inventory in real-time, through automated software.

So, every time a product is purchased or sold, the perpetual system uses a barcode scanner to update the inventory count, and recalculate the corresponding cost of goods sold. Then, whenever inventory levels hit a reorder point, the software automatically generates the purchase orders necessary for restocking.

Through a perpetual system, businesses are also able to access inventory reports at all times, and reduce human error through automation.

On the other hand, in a periodic inventory system, inventory reports and the cost of goods sold aren’t kept daily, but periodically, usually at the end of the year. A periodic inventory system also requires manual data entry and physical inventory counting.

That’s why, by comparison, the periodic inventory system is way more tiresome, time-consuming, and prone to error than the perpetual inventory, as everything is done manually.

For this reason, most businesses that are looking to expand, and want more control over their merchandise, use a perpetual inventory system to save time, minimize human error, and ultimately save a boatload of money.

How Does a Periodic Inventory System Work?

A periodic inventory system works as follows.

When merchandise is purchased, the cost is not debited to the Inventory account, but rather to another account called Purchases.

When merchandise is sold, an entry is made to record the sales revenue, but none to record the cost of goods sold, or to reduce the inventory.

At the end of the year, or at the end of any other timing interval businesses choose, a physical inventory count is done, to recognize the amount of remaining inventory.

Then, after this counting is done, the Cost of Goods Sold (COGS) is found through two short computations.

How Do You Calculate Cost of Goods Sold Using the Periodic Inventory System?

First, you add the inventory amount at the beginning of the year to the amount reflected on the Purchases account, to figure out the total cost of goods available for sale. If your business doesn’t have a clearly defined beginning inventory amount, you can use the remaining stock number from the end of the previous period.

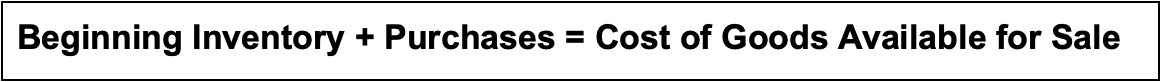

As a formula, this calculation looks like this:

Then, you subtract the previously counted ending inventory from the total cost of goods available for sale, to compute the costs of goods sold.

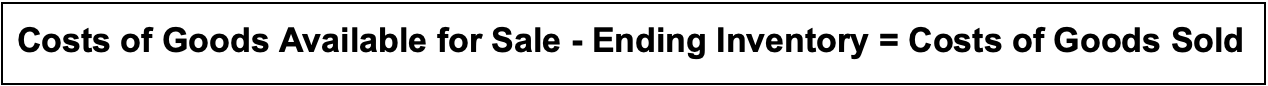

So, the second formula for computing the cost of goods sold would be:

We know this all might sound a bit confusing, so let’s take an example, to better understand this concept and put these computations to practice.

Say a merchandising company uses a periodic inventory system and evaluates their merchandise at the end of the year. This means that any changes in inventory from the sales or purchases the business makes that year are not recorded until December 31st.

Now, when December 31st comes around, the following information is available:

- The inventory at the beginning of the year amounts to $15,000

- Purchases of merchandise for the entire year total $65,000

- The counted, ending inventory costs $10,000

For this data, the calculation of the COGS would be:

$15,000 Beginning Inventory + $65,000 Purchases = $80,000 Cost of the Goods Available for Sale

$80,000 - $10,000 Ending Inventory = $70,000 Cost of Goods Sold

If you want to learn more about inventory and how to properly keep track of it, check out our complete guide on inventory and stock management.

Who Uses a Periodic Inventory System?

The periodic inventory approach is primarily used by small businesses that deal with very few transactions, or companies that only have a limited number of inventory.

Sales and expenses for these companies are easily manageable, so they tend to opt for a periodic inventory system, as it’s more cost-effective to implement.

Examples of these types of businesses include art galleries, car dealerships, small cafes, restaurants, and so on.

Pros of a Periodic Inventory System

A periodic inventory system requires less bookkeeping, as there is no need to have separate accounting for raw materials, work in progress, and finished inventory.

All that gets recognized are purchases, and inventory is only counted at the end of the year.

Hence, the system is easier to implement, requires little accounting knowledge, and records changes in inventory through very few simple calculations.

This simplicity in use also makes the system more cost-effective, as it can be managed manually, and businesses won’t need to hire a trained bookkeeper or invest in expensive accounting software.

As long as the business owner is willing to put in the time to count inventory and calculate the cost of goods sold, there’s no business expense to the periodic inventory system.

For many small businesses, this method is a perfect solution and makes a lot of sense.

Small inventory levels and limited stock won’t take more than a couple of hours to count, and the cost of goods sold can be estimated through very few simple calculations.

Cons of a Periodic Inventory System

Now, keep in mind that the previously mentioned advantages only benefit small businesses that deal with a couple of hundred sales a year.

As stock levels arise, and your company grows, the periodic inventory system becomes complex and difficult to manage. That’s why the approach isn’t suitable for every type of company, and the majority of businesses use perpetual inventory instead.

And that’s only one of the many disadvantages of the system.

Because there’s no constant inventory tracking, it can be difficult for a firm to be aware of which goods are running low on stock, or if there’s an excess supply for a type of inventory.

This lack of information can result in a loss of possible revenue and sales opportunities.

At the same time, it prevents a business from planning and forecasting future inventory levels. This in turn means there’s no data for the company to analyze and better understand customer buying patterns, best-selling products, growing segments, or any other indicator that allows businesses to forecast demand.

5 Journal Entries for Periodic Inventory

When dealing with a periodic inventory, you’ll likely find yourself journalizing transactions, especially at the end of the year.

Below, we’ve put together some of the most common journal entries you’ll need to know, in order to manually do accounting for your periodic inventory system:

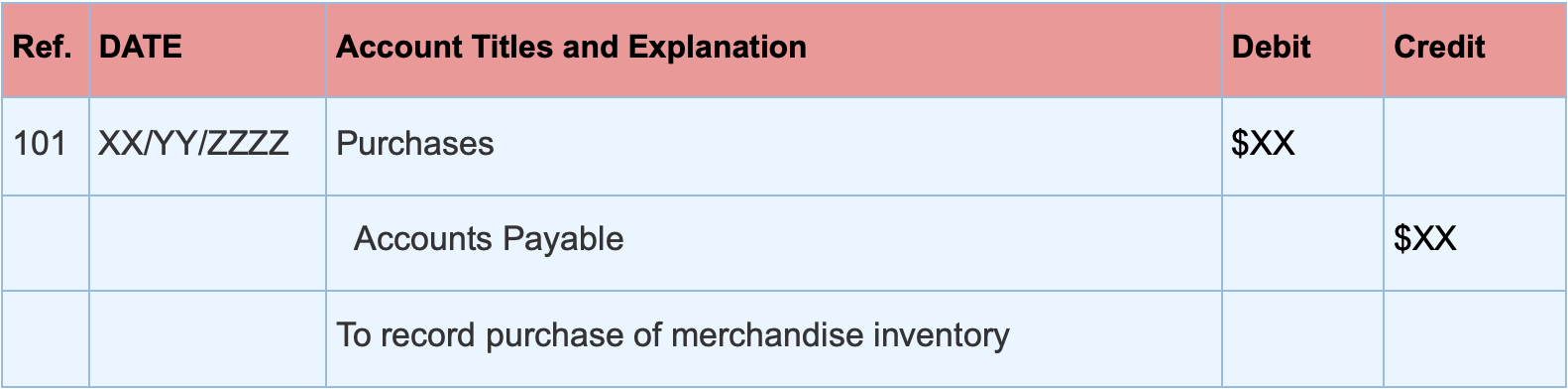

1. Purchase of Merchandise

To record the purchase of merchandise, the purchases account is debited and the accounts payable is credited, as shown below:

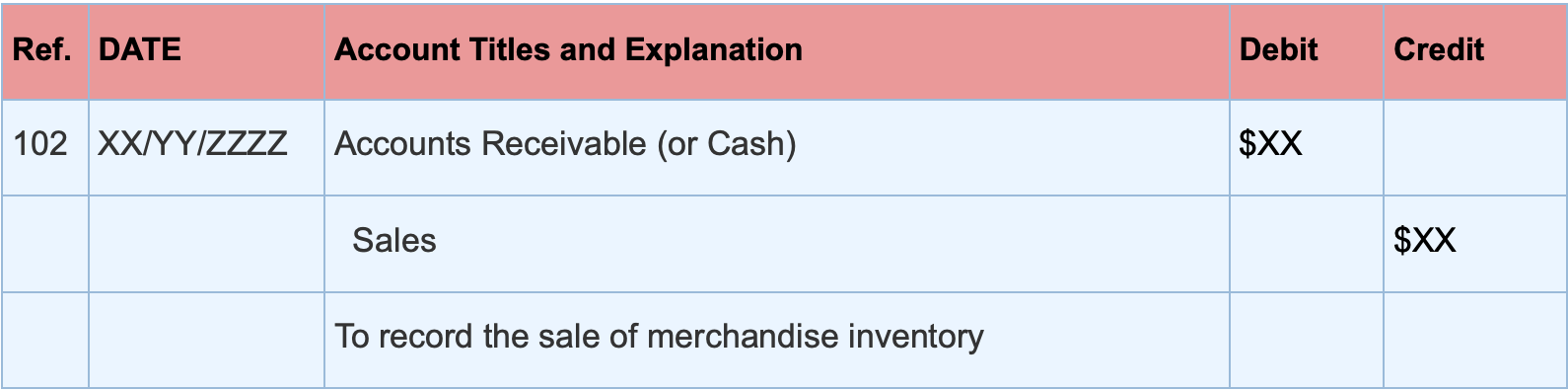

2. Sale of Merchandise

When a business sells merchandise, only one journal entry is made to recognize the sale. There’s no journal entry for the cost of goods sold.

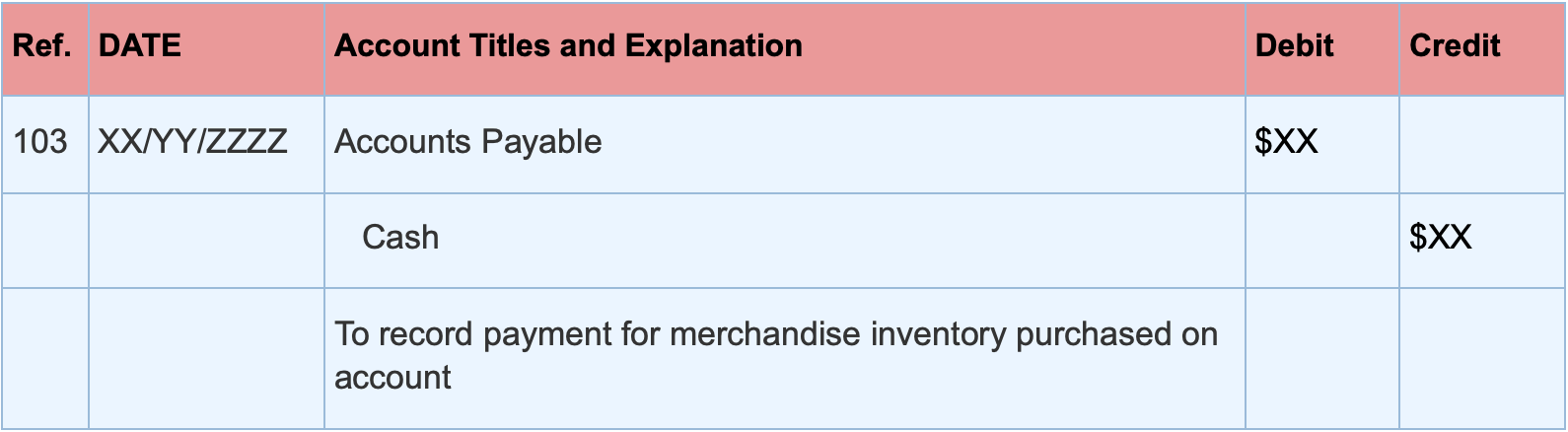

3. Settlement of Accounts Payable

The journal entry for making an invoice payment would look like this:

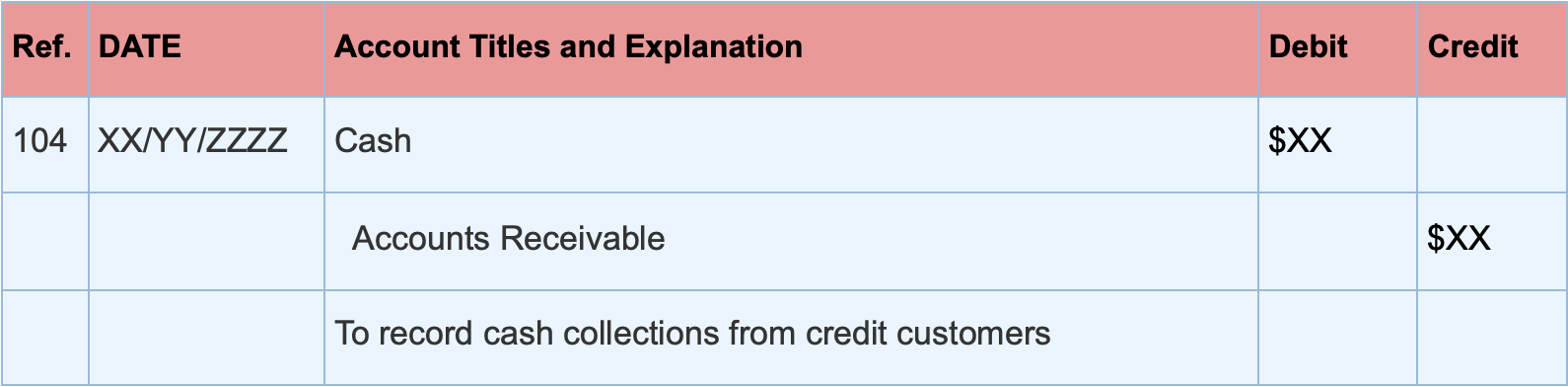

4. Collection of Credit

To recognize cash collection of accounts receivable, you’d make the following journal entry:

5. Year-End Balance for Inventory and COGS

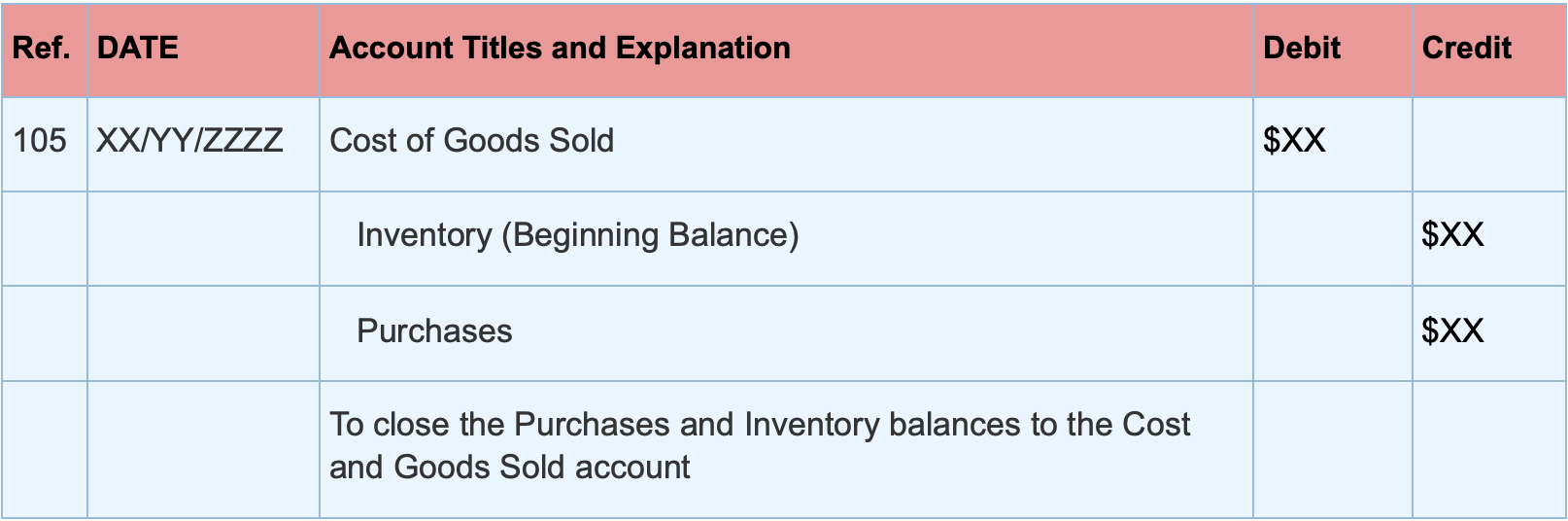

The accounts that contribute to the cost of goods sold include (1) the beginning of the year balance of inventory and (2) purchases made for the year.

These accounts are closed into a new account entitled Cost of Goods Sold, as shown in the entry below:

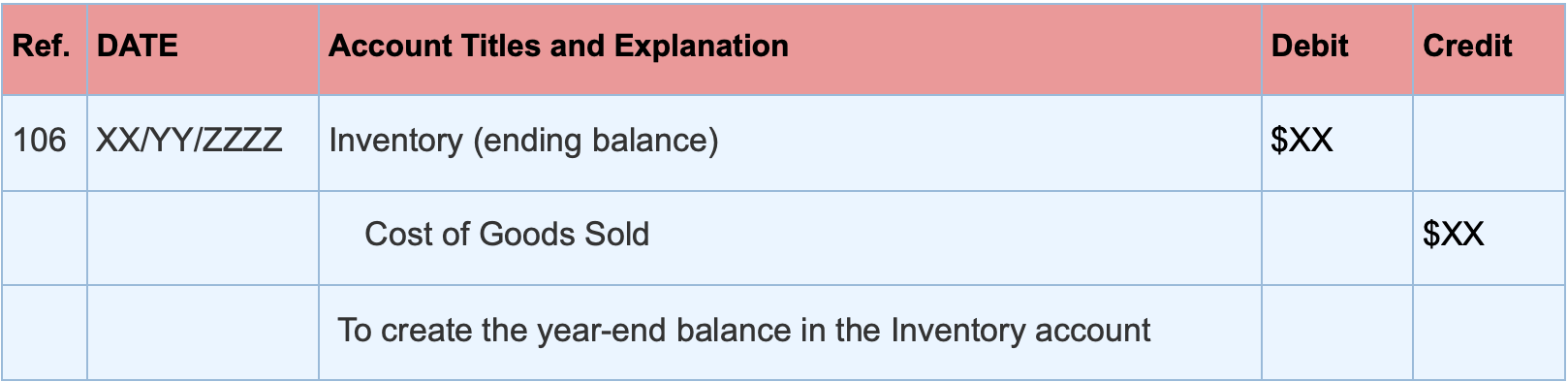

Then, a second closing entry is to reduce the balance of the COGS account, by the year-end inventory still on hand.

This entry brings the Inventory account up-to-date, and would look like:

Want to learn more about journal entries and how to record them for your small business? Head over to our guide on debit and credit entries, with practical examples.

Inventory Management with Deskera

The periodic inventory system is becoming an old-fashioned method of tracking inventory, and for a good reason. The growing use of cloud accounting software has made inventory tracking incredibly easy and cheap to implement.

So there’s no longer a need for businesses to manually count their merchandise, or write down journal entries by hand.

With inventory management software like Deskera, you can track your stock levels in real-time, fulfill orders, issue credit notes for returns, automate dropship, adjust and transfer stock, and so much more, for as little as $9 per month!

But don’t take our word for it.

You can try the software out yourself right away, by signing up for our free trial. No credit card details necessary!

Key Takeaways

And that’s a wrap! We hope our guide was helpful in understanding the basics of the periodic inventory system.

Before leaving, let’s go over some of the main points we’ve covered today:

- A periodic inventory system recognizes changes in inventory periodically, usually at the end of the year.

- The system is primarily used by small businesses that deal with a limited number of inventory, and financial transactions.

- The alternative to the periodic inventory is the perpetual inventory system, which is the most common and accurate inventory system for merchandising businesses. It records inventory-related transactions immediately as they occur, rather than at the end of the year.

- With cloud accounting software like Deskera, you can streamline your entire inventory management for no more than $9 per month.

Related Articles