Rita grows wild grapes, blackberries, and rhubarb in her garden and picks them when they are perfectly ripe. She collects milk from the dairy down the road and buys freshly harvested honey from her local beekeeper. These ingredients make their way into her kitchen, where Rita transforms them into exquisite chocolates.

Entrepreneurs like Rita have turned their passion into a full-time business. They have mastered their trade but are unsure of how to calculate net earnings.

If you are like Rita, read on to understand the following topics:

- Formula to Calculate Net Earnings

- Net Earnings: Important Terms Defined

- Difference Between Net Earnings and Gross Profit

- Importance of Net Earnings

- Net Earnings Ensure Continuity of Business

- Can Plough Back Net Earnings into the Business

- Healthy Net Earnings Helps a Business Avail Loans Easily

- Conclusion

- Key Takeaways

Formula to Calculate Net Earnings

Net Earnings can be calculated as follows:

- Total Revenue minus Cost of Goods Sold gives Gross Profit

- Gross Profit - Operating Expenses - Depreciation - Amortization - Interest - Tax = Net Earnings

Net Earnings: Important Terms Defined

Total Revenue: It is the amount of money a business generates by selling its goods and services at a certain price. It is the first item on a company's income statement which is used to calculate net earnings.

Total Revenue = Total amount of goods and services sold* Per unit price of the goods and services

Cost of Goods Sold

Cost of goods sold is the cost incurred by the company to produce the goods that are sold. This includes the cost of the materials, labor used to produce the goods, and the overhead costs for the production facility. This has to be subtracted from revenue while calculating net earnings.

Operating Expenses or Selling, General, and Administrative Expenses

These expenses include the cost of managing the company and the expense incurred as a result of delivering goods and services. These have to be subtracted from revenue while calculating net earnings. The following expenses come under the category of operating expenses:

- The salaries paid to the people working in the accounting, information technology, marketing, and human resources departments

- The cost of commission, advertising, and promotion

- The cost of rent, utilities, office equipment, and supplies that are not a part of the manufacturing cost

- Legal expenses

- Office overhead expenses which include salaries of administrative and other corporate staff

- Advertising and promotional materials

Depreciation

The cost of a tangible or a physical asset has to be written down over its useful life. This is referred to as depreciation. It tells us how much of an asset's value has been used up. The value of an asset on the balance sheet is its historical cost minus all the accumulated depreciation. The value of an asset after all depreciation has been accounted for is called its salvage value. Depreciation has to be subtracted from total revenue while calculating net earnings.

Amortization

The value of a loan or an intangible asset has to be written down over time. This is referred to as amortization. You have to subtract amortization from total revenue to calculate net earnings.

Interest

Interest is the amount charged for borrowing money and is generally expressed as a percentage. Inflation rate and the length of time the money is borrowed, liquidity, and risk of default affect interest rates. Interest has to be subtracted while calculating net earnings.

Taxes

The difference between the income of a business and its operating and capital expenses is considered their taxable business income. Taxes have to be subtracted from total revenue while calculating net earnings.

Difference Between Net Earnings and Gross Profit

- Revenue minus Cost of Goods Sold gives Gross Profit. It does not include selling, general and administrative expenses, depreciation, interest, and taxes. Net earnings on the other hand are calculated by subtracting operating expenses, depreciation, interest, and taxes from gross profit

- Gross profit assesses whether a company efficiently uses its labor and supplies to produce goods and services, while net earnings assess how much the revenue exceeds all the expenses of an organization

Importance of Net Earnings

Net earnings are also referred to as net income or net profit. Net earnings are important due to the following reasons:

Net Earnings Ensure Continuity of Business

If the business consistently has good net earnings, it can operate comfortably and can avoid financial problems. Without net earnings, a business has to essentially raise more funding or shut down operations.

For instance, if a small business consistently generates around $300,000 in annual revenue and $250,000 in expenses, it produces net earnings of $50,000. On the other hand, if expenses were $350,000, there would be a shortfall of $50,000 each year which will have to be bridged with the help of additional funding from investors. Without net earnings, it would not be possible to continue business for very long.

Can Plough Back Net Earnings into the Business

You can funnel back net earnings into your business in order to grow the business. If you reinvest net earnings into your business, you are basically financing your business independently without relying on creditors. Since creditors charge interest on the money they provide, net earnings prove to be the better alternative to external funding.

Using net earnings to finance your business gives you a great deal of independence since you can finance your business without any additional costs or restrictions.

Healthy Net Earnings Helps a Business Avail Loans Easily

Although companies that have healthy net earnings typically don't need external financing, they may require loans once in a while for expansion. Creditors offer loans at a lower rate of interest to businesses that have healthy net earnings since they believe that the business can pay back the loans on time.

Moreover, they impose fewer restrictions on companies with healthy net earnings since they believe that the companies can generate enough cash to meet their obligations.

Conclusion

Even though net earnings are important, Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) is also a reliable way to measure a company’s performance. A positive EBITDA indicates that the company is profitable at the operating level since it sells its products and services at a price that is higher than what it takes to produce the product or render the service.

If we compare the EBITDA to the capital invested, we can quickly diagnose the financial health of the company.

How can Deskera Help You?

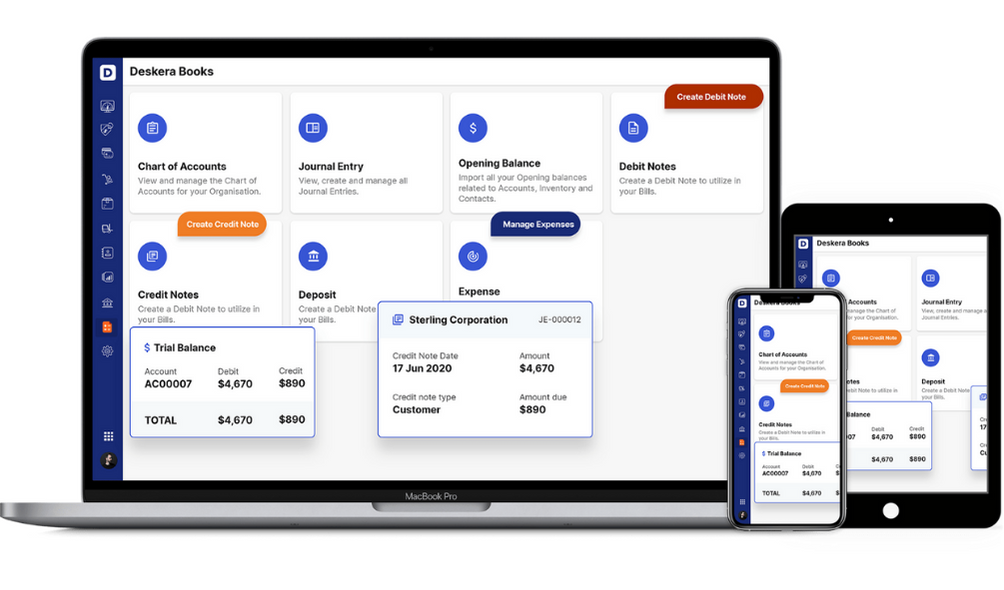

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs, from creating invoices and tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

- Net earnings are the same as net profit and net income

- Net earnings are calculated by subtracting total expenses from total revenue

- For calculating net earnings, cost of goods sold, selling, general and administrative expenses, depreciation, interest, and taxes are deducted from total revenue

- Total Revenue minus Cost of Goods Sold gives Gross Profit

- By subtracting selling, general and administrative expenses, depreciation, interest, and taxes from the gross profit, we get net earnings

- Healthy net earnings ensure continuity of business, help to funnel back profits into the business, and help a business avail loans easily

Related Articles