Shareholders' equity is one of the most vital metrics financial experts gauge to analyze a company's viability and sustainability. This is because they use the shareholders' equity formula to calculate the total amount a company may give to its shareholders after converting its assets into cash and settling off its debts.

You may find three crucial elements if you open a company's financial statement or balance sheet. They are as follows:

- Assets - Assets are resources with an economic value. Assets are accumulated by countries, corporations, and individuals when they expect that the price or value of the concerned assets will increase in the future. Companies report assets on their balance sheets. Investors often evaluate a company's assets before investing in it. Assets are a vital component of the shareholders' equity formula

- Liabilities - Liabilities (a.k.a debt) refer to the total value of the expenses a company has to incur. Unlike assets, liabilities are mentioned on a balance sheet's right side. Liabilities include mortgages, bonds, deferred revenues, loans, warranties, accrued expenses, and accounts payable. Like assets, liabilities are also a vital component of the shareholders' equity formula

- Shareholders' Equity - Shareholders' Equity is the net value of the owner's assets after deducting the liabilities. Since it determines the owner's share of the company's assets, it is also referred to as the Share Capital, Equity Capital, Paid-In Capital, or Contributed Capital. The formula for determining the shareholders' equity is simple - deduct the total liabilities from the total assets

Before investing in a company, it is crucial to know the status of its assets, liabilities, and shareholders' equity since these components speak volumes about a company's sustainability and viability in the long run. Moreover, since shareholders' equity is compiled after factoring in the assets and liabilities, it is often considered an accurate indicator of a company's stability

This article explains the features, benefits, and the definition of shareholders' equity. It also elaborates on the shareholders' equity formula so that you can calculate it quickly and conveniently.

For an easier understanding, this article has been divided into the following sections:

- What is Shareholders' Equity?

- What Are The Key Elements of the Shareholders' Equity Formula?

- Retained Earnings

- Additional Paid-In Capital

- Other Comprehensive Income

- Treasury Stock

- What is the Difference Between Shareholders' Equity and the Market Equity Value?

- What is the Shareholders' Equity Formula?

- Shareholders' Equity Formula No. 1 - Example

- Shareholders' Equity Formula No. 2 - Example

- Is Shareholders' Equity Different From Book Value?

- Conclusion

- Key Takeaways

What is Shareholders' Equity?

Shareholders' equity refers to the actual value of any public or privately-owned company. In the field of accounting, shareholders' or stockholders' equity is also known as the book value of equity. Simply put, shareholders' equity is a company's net asset value after deducting its liabilities. The shareholders' equity formula helps determine the actual worth of a company in accounting terms.

You can find the shareholders' equity value at the end of the balance sheet of a company. It generally comes after the assets and the liabilities. Since, according to the shareholders' equity formula, all liabilities of a company must be deducted from assets, the shareholders' actual assets are the sum total of its shareholders' equity and liabilities. If a company is publicly traded, i.e., listed on a stock exchange, you can find the shareholders' equity data on the balance sheets they send to the Securities and Exchange Board of India every quarter and year.

Alternatively, you may download the balance sheet from the respective company's official website. To do so, you need to visit the 'Investors' section and download the appropriate report.

What Are The Key Elements of the Shareholders' Equity Formula?

Shareholders' equity is a key determinant of a company's financial health. If a company's shareholder equity is decent, it means the company possesses enough resources to clear off its liabilities. Conversely, if a company's liabilities are more than its assets, its financial standing is considered below par. Therefore, the shareholders' equity formula offers excellent insights into a company's financial condition and sustainability.

The shareholders' equity formula contains four key elements - retained earnings, additional paid-in capital, other comprehensive income, and treasury stock. Let's understand each in detail.

Retained Earnings

Retained Earnings, a.k.a., retained surplus or retention ratio, play a major role in the shareholders' equity formula.

Companies are of two types. While the first type issues dividends to stockholders when they make extra profits, other companies do not distribute dividends but invest the extra income in clearing off their debt or sponsoring business expansion. When a company decides to keep the income and not distribute dividends, the income gets added to the company's retained earnings account.

'Retained Earnings' is generally the biggest line item in the shareholders' equity formula. To check a company's retained earnings, you need to open its balance sheet or find it in a statement exclusively published for the purpose.

Additional Paid-In Capital

Additional Paid-In Capital or APIC is an essential component of the shareholders' equity formula. It refers to the money paid to purchase shares of companies beyond the declared par value of such shares. In essence, APIC is the difference between the common stock's par value and the preferred stock's par value and the actual price of selling such stocks. It also includes the shares recently sold.

Although APIC is an important element of the shareholders' equity formula, it is not universal. APIC happens only when investors purchase shares by directly approaching the company issuing such shares. When an investor pays more than the stock's face value during an IPO or Initial Public Offering, it is classified as APIC. APIC details can be found in the balance sheet of a company. If you cannot find it on the first page, check the 'equity' section.

Other Comprehensive Income

Other Comprehensive Income (OCI) is also a crucial parameter in the shareholders' equity formula. OCI is the income, revenue, expenses, or loss that a company hasn't realized when preparing the audited financial statement in an accounting period. Since the OCI refers to the unrealized income or expense, it is not included in the net income of a company in the balance sheet.

You can find information about OCI in the section following 'Net Income' in the balance sheet of a company. Unlike Assets, OCI is listed on the right side of the balance sheet.

Treasury Stock

The last item in the shareholders' equity formula is treasury stock, a.k.a reacquired stocks or treasury shares. Treasury stock refers to the total number of shares a company repurchases from investors. A company may keep its stocks in the treasury for using them in the future. They may also sell the stocks at a premium to get money for running the business. Alternatively, some companies use treasury stock to thwart a hostile takeover attempt.

Treasury stock is actually negative since it decreases the effective shareholders' equity on the balance sheet of a company. You can find information about treasury stock in the equity section of a company's balance sheet.

The four components mentioned above form a vital part of shareholders' equity. Investors often use the shareholders' equity formula to check whether a company's assets are enough to cover its liabilities or not. It speaks volumes about a company's financial management style. Investors analyze the shareholders' equity before categorizing an investment as safe or risky.

However, although the shareholders' equity formula is an important metric to evaluate a company's financial health, experts suggest that it must be used in conjunction with other parameters like liquidity, profitability, operating efficiency, and solvency of the company.

What is the Difference Between Shareholders' Equity and the Market Equity Value?

When you open a company's balance sheet, you can get information about its book value of equity or shareholders' equity. You can also find the shareholders' equity by applying the appropriate formula. But, the market value of equity is completely different from shareholders' equity. An investor must know both to make sensible investment decisions.

The book value of equity is a key accrual accounting metric that is calculated by factoring in historical data. However, the market value of equity refers to a company's share price on the latest market closing date.

Since the market value of equity depends on the total number of outstanding shares and the current share price, it is typically higher than the book value of equity.

What is the Shareholders' Equity Formula?

You may calculate the shareholders' equity by using the shareholders' equity formula in two broad ways. They are as follows:

- Deduct the total liabilities of the company from its total assets to find the shareholders' equity

- Add the retained earnings, additional paid-in capital, and other comprehensive income. Deduct the treasury stock value from the resulting figure obtained in the previous statement

Let us understand each shareholder's equity formula with an example.

Shareholders' Equity Formula No. 1 - Example

Suppose you have to find the shareholders' equity of ANC Ltd. by gathering details from its balance sheet. After scanning the balance sheet, you found that the company's total assets are INR 10 crore. Also, its liabilities are INR 8 crore. So, to calculate the shareholders' equity, you must deduct INR 8 crore from INR 10 crore. Hence, the shareholders' equity of ANC Ltd. is INR 2 crore.

Shareholders' Equity Formula No. 2 - Example

Suppose you have to find the shareholders' equity of ANC Ltd. by gathering details from its balance sheet. But, instead of applying the shareholders' equity formula on the assets and liabilities, you want to find it using the retained earnings, APIC, OCI, and treasury stock. The formula to find the shareholders' equity is mentioned below:

Shareholders’ Equity = Retained Earnings + APIC + OCI - Treasury Stock

So, if the Retained Earnings of ANC Ltd. is INR 10 crore, APIC is INR 10 crore, OCI is INR 10 crore, and Treasury Stock is INR 5 crore, the shareholders' equity will be 10 + 10 + 10 - 5 = INR 25 crore.

Is Shareholders' Equity Different From Book Value?

In essence, shareholders' equity and book value of equity is the same. However, investors may use them in different contexts. For example, some investors consider the shareholders' equity formula as equivalent to the book value while others evaluate the components, such as APIC, Treasury Stock, Retained Earnings, etc., to gauge the company's value.

Conclusion

It is important for an investor to analyze and evaluate the stockholders' equity formula to gauge the company's financial condition. It also represents the actual value of their investments in a company. You can check the shareholders' equity figure by scanning the balance sheet of the concerned company.

The shareholders' equity, coupled with other metrics like liquidity, earnings, market capitalization, EPS, debt, etc., can give accurate indications about a company's business prospects. For instance, if a company's shareholders' equity is constantly declining while the unrealized losses are negative, the company is believed to be nearing insolvency.

How can Deskera Help You?

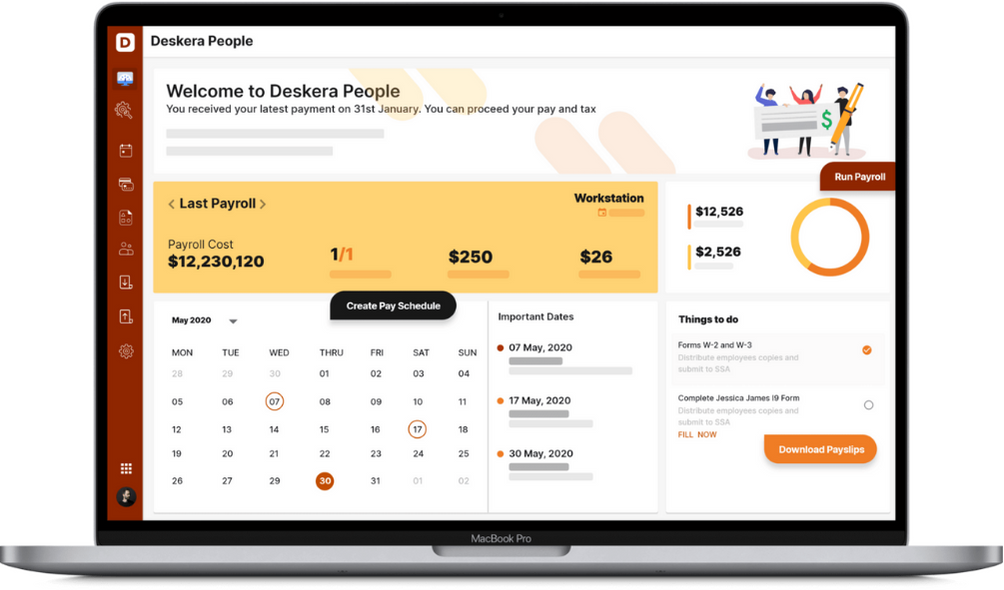

Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating pay slips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Shareholders' equity is one of the most vital metrics financial experts gauge to analyze a company's viability and sustainability

- The shareholders' equity formula helps determine the total amount a company may give to its shareholders after converting its assets into cash and settling off its debts

- The formula for determining the shareholders' equity is simple - deduct the total liabilities from the total assets

- The shareholders' equity formula helps determine the actual worth of a company in accounting terms

Related Articles