Do you ever wonder which sections of the contract labor Regulation and Abolition Act 1970 are relevant to the certificate principal by employer? Yes, we're talking about FORM – V, which refers to Form of Certificate by Principal Employer.

This article is intended to act as a review on Form-V. The following are the topics that we shall discuss:

- The Contract Labor (Regulation & Abolition) Karnataka Rules,1974

- FORM V- Form of Certificate by Principal Employer

- Major obligation of the Principal Employer / Contractor

- Key takeaways

The Contract Labor (Regulation & Abolition) Karnataka Rules,1974

This Act regulates contract labor in certain enterprises, provides for contract labor abolition in certain instances, and addresses other related issues. Rules are created at the federal and state levels to guarantee that the Act is properly administered and monitored.

Compliance

- Form V - Certificate by Principal Employer

- Form XII - Register of Contractors

- Form XIII - Register of Workmen Employed by Contractor

- Form XIV - Employment Card

- Form XV - Service Certificate

- Form XVI - Muster Roll

- Form XVII - Register of Wages

- Form XIX - Wages Slip

- Form XX - Register of Deductions for Damage or Loss

- Form XXI - Register of Fines

- Form XXII - Register of Advances

- Form XXIII - Register of Overtime

- Form XXIV - Return to be sent by the Contractor to Licensing Officer

- Form XXV- Annual Return of Principal Officer to be sent to the Registering Officer

Applicability

• It applies to every establishment or contractor in India that employs or employed 20 or more workers on any day in the last 12 months, as contract labor registration is required to use contract labor.

• The Contract Labor (Regulation & Abolition) Karnataka Rules, 1974 apply to the entire state of Karnataka, as well as all Karnataka units other than the Central Government.

FORM V- Form of Certificate by Principal Employer

Contractors must have a license to hire contract labor. A license application, along with the requisite fee and certificate, must be filed to the concerned Labor Commissioner.

The application must be submitted in three copies.

FORM – V

[See Rule 21(2)]

Form of Certificate by Principal Employer

Certified that I/We have engaged the applicant _______________________ as a ______________________________________________contractor in our establishment _________________________________________.

I/We undertake to be bound by all the provisions of the Contract Labor (Regulation and Abolition Act, 1970) and the Contract Labor (Regulation and Abolition) Karnataka Rules, 1974, in so far as the provisions are applicable to me in respect of the employment of contract labor by the applicant in my establishment.

Registration Certificate Number___________________

Registered Date_______________________________

Place : Signature of the Principal Employer

Date : Name and Address of Establishment

REGISTRATION AND LICENSING

Method of submitting a request for establishment registration.

(1) The application referred to in sub-section (1) of section 7 must be submitted in triplicate in Form I to the registering officer of the area in which the establishment seeks to be registered.

(2) The application referred to in sub-section (1) must be accompanied by a demand draft demonstrating payment of the registration fees.

(3) Every application referred to in sub-section (1) must be delivered to the registering officer in person or transmitted to him via registered mail.

(4) The registration officer shall give an acknowledgement to the applicant upon receipt of the application referred to in sub rule (1), after noting the date of receipt of the application by him.

Grant of certificate of registration.

(1) Form II is the certificate of registration issued under section 7's subsection (2).

(2) Every certificate of registration issued under sub-section (2) of section 7 must include the following information:

(a) the name and address of the establishment;

(b) the maximum number of contract laborers to be employed in the establishment;

(c) the type of business, trade, industry, manufacture, or occupation carried on in the establishment; and

(d) any other information relevant to the employment of contract labor in the establishment.

(3) The registering officer must keep a Form III register of the particulars of the establishments for which certificates of registration have been issued.

(4) If the particulars contained in the certificate of registration for an establishment change, the major employer of the establishment must notify the registering officer of the change within thirty days of the date of the change.

Circumstances in which a registration application may be denied

(1) If a registration application is incomplete in any way, the registering officer must require the major employer to revise the application to make it full in all ways.

(2) If the principal employer fails to alter his application for registration after being asked by the registering officer to do so, the registering officer will reject the application.

Amendment of certificate of registration

(1) If the registering officer is satisfied that an amount higher than the amount paid by the principal employer as fees for the registration of the establishment is payable after receiving the intimation under sub-rule (4) of rule 18, he shall require such principal employer to pay a sum equal to such higher amount of fees payable for the registration of the establishment, together with the amount already paid by such principal employer.

(2) When the registration officer receives the notice referred to in sub-rule (4) of rule 18, he is satisfied that there has been a change in the particulars of the establishment as entered in the Form III register, he shall modify the said register and record the change: Provided that no such amendment shall affect anything done or any action taken or any right, obligation or liability acquired or incurred before such amendment: Furthermore, until the relevant fees have been deposited by the major employer, the registering officer may not make any changes to the Form III register.

Application for a license

(1) A contractor's application for a license must be submitted in triplicate in Form IV to the licensing officer in the area where the establishment for which he is the contractor is located.

(2) Every application for a license must be accompanied by a certificate in Form V from the principal employer stating that the applicant has been employed by him as a contractor in relation to his establishment and that he agrees to be bound by all provisions of the Act and the rules made thereunder in so far as they apply to him as the principal employer in respect of the applicant's employment of contract labor.

(3) Any such application must be delivered to the licensing officer in person or addressed to him via registered mail.

(4) The licensing officer shall give an acknowledgment to the applicant upon receipt of the application referred to in sub-rule (1), after noting the date of receipt of the application.

(5) Every application described in sub-rule (1) must be accompanied by a demand draft demonstrating the deposit of the security at the rates provided in rule 24, and (ii) the payment of the fees at the rates stipulated in rule 26.

Matters to be taken into account in granting or refusing a license

The licensing officer must consider the following factors when granting or refusing a license: (a) whether the applicant is a minor, or (ii) is of unsound mind and has been declared so by a competent court; or (iii) is an un-discharged insolvent, or (iv) has been convicted (at any time during the five years immediately preceding the date of application) of an offence involving moral turpitude in the opinion of the Central Government.

(b) whether there is an order of the appropriate Government, or an award or settlement, for the abolition of contract labor in the establishment for which the applicant is a contractor;

(c) whether any order has been made in respect of the applicant under sub-section (1) of section 14, and, if so, whether a period of three years has elapsed since the date of that order;

(d) whether the application fees have been deposited; at the rate specified in rule 26; and

(e) whether security has been deposited by the applicant at the rates specified in rule 24.

Refusal to grant license

(1) As soon as possible after receiving the contractor's application, the licensing officer shall investigate or cause an investigation to be conducted to satisfy himself about the accuracy of the facts and particulars provided in the application, as well as the applicant's eligibility for a license.

(2) (i) If the licensing officer believes the license should not be granted, he shall make an order denying the application after giving the applicant a sufficient opportunity to be heard. (ii) The order must include the reasons for the rejection and be sent to the applicant.

Security

(1) Before a license is issued, the contractor must deposit an amount calculated at the rate of Rs. 1 [90] for each of the workmen to be employed as contract labor, in respect of which the application for license has been made, in order to ensure that the conditions of the license are met and that the Act or its rules are followed:

Provided, however, that when the contractor is a co-operative society, the sum placed as security shall be at the rate of [Rs. 15] for each of the contract laborers to be hired.

If the licensing officer believes that any amount from the security deposited in respect of that license should be directed to be refunded to the applicant under rule 31, the licensing officer may adjust the amount so refunded towards the security required to be deposited in respect of the application for the new license and the applicant need deposit on an application made for that purpose in Form VA by the applicant.

(2) The amount of security, or the balance amount, required to be deposited under sub-rule (1) or, as the case may be, under sub-rule (1A)] shall be paid in the local treasury under the Head of Account "Section T—Deposits & Advances— Part II Deposits bearing interest—(c) Other Deposit Accounts— Departmental and Judicial Deposits—Civil Deposits—Deposits, under the Contract Labor (Regulation and Abolition) Act, 1970 (Central).”

Forms and terms and conditions of license

(1) Form VI is required for all licenses issued under section 12's subsection (1).

(2) Every license granted under sub-rule (1) or renewed under rule 29 is subject to the following conditions:

(i) the license is non-transferable;

(ii) the number of contract workers employed in the establishment on any given day does not exceed the maximum number specified in the license;

(iii) the fees paid for the grant, or as the case may be, for renewal of the license, are non-refundable, except as provided in these rules;

(iv) the contractor's wage rates for workmen shall not be less than the rates prescribed for such employment under the Minimum Wages Act, 1948 (11 of 1948), where applicable, and where the rates have been fixed by agreement, settlement, or award, not less than the rates so fixed;

(v) (a) In cases where the contractor's workmen perform the same or similar work as workmen directly employed by the establishment's principal employer, the contractor's workmen's wage rates, holidays, hours of work, and other conditions of service shall be the same as those applicable to workmen directly employed by the establishment's principal employer on the same or similar kind of work:

Provided, however, that in the event of a disagreement about the type of labor, [the Deputy Chief Labor Commissioner (Central)] will determine.

(b) In all other situations, the contractor's workmen's salary rates, vacations, hours of work, and conditions of service shall be as determined by [the Deputy Chief Labor Commissioner (Central)]; Explanation.— Deputy Chief Labor Commissioner (Central) shall give appropriate respect for wage rates, holidays, hours of work, and other conditions of service prevailing in similar employments when determining wage rates, holidays, hours of work, and other conditions of service under (b) above.

(vi) (a) In every establishment where twenty or more women are normally employed as contract labor, two rooms of reasonable dimensions shall be provided for the use of their children under the age of six years,

(b) one of such rooms shall be used as a play room for the children and the other as a bed room for the children,

(c) the contractor shall supply an adequate number of toys and games in the play room and an adequate number of cots and bedding in the sleeping room,

(d) the standard of construction and maintenance of the creches shall be as specified by the Chief Labor Commissioner (Central);

(vii) the licensee shall notify the licensing officer of any change in the number of workmen or the conditions of work;

(viii) the licensee shall submit a return to the Inspector appointed under section 28 of the Act within fifteen days of the commencement and completion of each contract work informing the actuarial value; as the case may be, completion of such contract work in Form VIA);

(ix) a copy of the license shall be prominently displayed at the location where the contract work is being performed;

(x) no female contract labor shall be employed by any contractor before 6.00 a.m. or after 7.00 p.m.: Provided, however, that this clause shall not apply to the employment of women in pithead baths, creches, and canteens, as well as midwives and nurses in hospitals and dispensaries.

Required Documents

- Application form

- A copy of the Trade license issued by the local authorities.

- Address Proof (Aadhaar/voter ID/Driving license)

- Proof of date of Birth.

- A copy of the Registered Partnership Deed (if the firm/establishment is a partnership).

- Original copies of the Treasury Challan, with the required amount of fees as security and license fees deposited in the specified Head of Account in the Government Treasury, or through "e-Payment" when it is informed and functioning according to the rules.

- Form V (certificate from the major employer)

- Certificate of no objection from the police department/Police Report

- A copy of the contract signed by the Principal Employer and the Contractor.

- Self-Affidavit as advised

- PAN Card

- Aadhaar card

Fees

(1) The following fees must be paid in order to obtain a certificate of registration under section 7. — If the following number of workers are suggested to be hired on a contract basis on any given day:

(2) The following are the fees that must be paid in order to obtain a license under section 12:

If the contractor employs a certain number of workers on any given day

License validity

Every license issued under rule 25 or renewed under rule 29 is valid for a period of twelve months from the date of issuance or renewal.

Amendments to the license

(1) The Licensing Officer may change a license issued under rule 25 or renewed under rule 29 for good and adequate grounds.

(2) The contractor who wishes to have the license altered must make an application to the licensing officer indicating the nature of the amendment and the reasons for it.

(3) (i) If the licensing officer approves the application, the applicant must submit a demand draft for the amount by which the payments that would have been payable if the license had been issued in the altered form would have been higher than the fees paid for the license originally. (ii) The license will be changed in accordance with the licensing officer's orders once the applicant submits the required demand draft.

(4) If the application for amendment is denied, the licensing officer must document and explain the reasons for the denial to the applicant.

Renewal of license

(1) Every contractor must apply for a license renewal with the licensing officer.

(2) Any such application must be made in triplicate in Form VII not less than thirty days before the license expires, and if it is, the license will be deemed renewed until the renewed license is issued.

(3) The fees charged for renewing a license are the same as those charged for obtaining one:

Provided, however, that if the application for renewal is not received within the time stipulated in sub-rule (2), a cost of 25% more than the normal fee for the license must be due for such renewal: Furthermore, if the licensing officer determines that the delay in submitting the application is due to unavoidable circumstances beyond the contractor's control, he may reduce or remit the payment of the excess fee as he sees fit.

Obtaining a duplicate registration or license certificate

If a certificate of registration or a license issued or renewed under the preceding rules is lost, defaced, or destroyed accidentally, a duplicate may be issued for a price of rupees five.

Refund of the security deposit

(1) (i) If the contractor does not intend to have his license renewed after the expiration of the period of licence, he may apply to the licensing officer for a return of the security deposited under rule 24.

(ii) The Licensing Officer shall direct the repayment of the security to the applicant if the Licensing Officer is satisfied that there has been no infringement of the conditions of license or that no order under section 14 for the forfeiture of the security or any portion thereof.

(2) If an order directs the forfeiture of any portion of the security, the amount to be forfeited will be removed from the security deposit, with any remaining funds reimbursed to the applicant.

(3) Any reimbursement application must be processed within 60 days after receipt, if at all possible.

Grant of temporary certificate of registration and license

(1) When circumstances arise in an establishment that necessitate the immediate employment of contract labor for a period of not more than fifteen days, the establishment's Principal Employer or the contractor, as the case may be, may apply to the Registering Officer or the Licensing Officer with jurisdiction over the area in which the establishment is located for a temporary certificate of registration or license.

(2) The application for such temporary certificate of registration or license shall be made in triplicate in Forms VIII and X, and shall be accompanied by a demand draft drawn in favor of the Pay and Accounts Officer, Office of the Chief Labor Commissioner (Central) New Delhi] showing payment of the appropriate fees and, in the case of a license, the appropriate amount of security as well.

(3) The Registering Officer or the Licensing Officer, as the case may be, shall grant a certificate of registration in Form IX or a license in Form XI, as the case may be, upon receipt of the application, complete in all respects, and on being satisfied, either by affidavit by the applicant or otherwise, that the work in respect of which the application has been made would be completed in a period of fifteen days and was of a nature which could not but be carried out immediately.

(4) The reasons for denying a certificate of registration or a license shall be recorded by the Registering Officer or the Licensing Officer, as the case may be.

(5) When the registration certificate's validity expires, the establishment must stop employing contract labor in the establishment for which the certificate was issued.

(6) The following payments must be paid for the grant of the certificate of registration under sub-rule (3): If the number of contract workers scheduled to be hired on any given day—

(7) The following are the fees to be paid for the grant of a license under sub-rule (3): If the contractor employs a certain number of workers on any given day—

(8) The provisions of rules 23 and 24 apply to refusals to issue licenses and licenses granted under sub-rules (4) and (3), respectively.

Payment of Fees

(1) All money due on account of security deposit, registration fees, license fees, appeals, supply of duplicate registration certificates, and other provisions of the Act and rules shall be paid by a crossed demand draft drawn in favor of the officers listed in Annexure 'A' and payable at the Union Bank of India branch at the officers' headquarters listed in column (3) of the said Annexure. All such demand drafts must be accompanied by a challan in form No. TR-6 (in triplicate) detailing the payment details, among other things.

(2) On receipt of the demand draft from the party, the Licensing Officer, the Registering Officer, or the Appellate Authority, as the case may be, shall arrange to deposit the amount in the appropriate account in the Bank with which he is in account as Regional Labor Commissioner/Assistant Labor Commissioner (Central) as Drawing and Disbursing Officer. The demand draft would be deposited in the Union Bank of India, Extension Counter, Shram Shakti Bhawan, Rafi Marg, New Delhi in the account of 'Pay and Accounts Officer' Chief Labor Commissioner, New Delhi by the Assistant Labor Commissioner (Central), Delhi.

(3) Payments received in the form of demand draft by the officers listed in the aforementioned Annexure must be placed in the following heads of accounts:

Fees for registration—"087—Labor and Employment—Fees under Contract Labor (Regulation and Abolition) Central Rules, 1971 (adjustable in the accounts of the Pay and Accounts Officer, (Chief Labor Commissioner), Ministry of Labor, New Delhi"

Fees under the Contract Labor (Regulation and Abolition) Central Rules, 1971 (adjustable in the books of the Pay and Accounts Officer, (Chief Labor Commissioner), Ministry of Labor, New Delhi"; "087—Labor Employment—Fees under the Contract Labor (Regulation and Abolition) Central Rules, 1971 (adjustable in the books of the Pay and Accounts Officer, (Chief Labor Commissioner), Ministry of Labor, New Delhi";

Security deposits—Deposits and Advance(—) deposits that do not pay interest are known as security deposits. 843—Civil Deposits under the Contract Labor (Regulation and Abolition) Act, 1970 (adjustable in the Pay and Accounts Officer Chief Labor Commissioner's records) Ministry of Labor, New Delhi." Copies of the Registration Certificates in duplicate. —"087—Labor and Employment Fee under the Central Rules for Contract Labor Appeals (Regulation and Abolition), 1971"].

Major obligation of the Principal Employer / Contractor

A.Towards the welfare and health of the Contract Laborer.

Rule 40 - Provision of Facilities

(1) The contractor shall provide the facilities required by Sections 18 and 19 of the Act, namely a sufficient supply of wholesome drinking water, a sufficient number of latrines and urinals, washing facilities, and first aid facilities, in the case of existing establishments within thirty days of the commencement of these rules, and in the case of new establishments within thirty days of the commencement of contract labor employment there.

(2) If the contractor fails to deliver any of the facilities indicated in sub-rule (1) within the time frame specified, the major employer must provide the same within seven days of the time frame specified in the said sub-rule.

(3) Any arrangement established by the contractor with the major employer to make available to the workmen employed by L toe contractor the canteen or canteens required to be maintained by the principal employer under the Factories Act, 1948' for the workers directly employed by him (1).

Rule 41 - Rest rooms

Rule 42 – Canteens

B.Obligations of the major employer/contractor in terms of wage payment.

Rule 63 - Wage Period Fixation The contractor will choose the salary periods for which wages will be paid. [Wage era - Rule 64] A salary period of more than one month is prohibited.

Rule 65 - Wage payment deadlines Wages for contract laborers employed in an establishment or by a contractor with less than 1,000 workers must be paid before the end of the seventh day, and in other situations before the end of the tenth day after the end of the wage period for which the wages are due.

Rule 66- Wages are paid when a job is terminated. Wages earned by any worker whose employment is terminated by or on behalf of the contractor must be paid by the end of the second working day after the day on which his employment is terminated.

Rule 67 - Wage payment location, time, and date All wage payments must be made on a working day at the workplace and during working hours, on a date that has been agreed upon in advance, and if the work is completed before the wage period ends, final payment must be given within 48 hours of the last working day.

Rule 68 - Wages to be paid directly to workers or other approved individuals Wages owed to each employee must be paid directly to him or to someone he has authorized to act on his behalf.

Rule 69 -Wages must be paid in current coin or currency notes. All wages must be paid in current coin, cash, or a combination of both.

Rule 70 - Reductions in wages that may be made Wages shall be paid without deductions of any type, unless the Government specifies otherwise by general or specific order or as permitted under the Payment of Wages Act, 1936. (4 of 1936).

Rule 71 - Display of a notice regarding wage payment. A notice stating the wage period as well as the location and time of wage disbursement must be posted at the place of work, with a duplicate submitted to the principal employer under acknowledgment.

Rule 72 - Payment of salaries is the responsibility of both the major employer and the contractor. The major employer must assure the presence of his authorized representation at the location and time of wage disbursement by the contractor to workmen, and it is the contractor's responsibility to ensure that wages are disbursed in the presence of such approved person.

Rule 73 - Recording of a Certificate of Wage Payment

C. Registers/Documentation to be maintained

Rule 74 - Contractors' Register. Every principal employer must keep a register of contractors on Form XII for each registered establishment.

Rule 75 - Employed Persons' Register Every contractor must keep a register in Form XIII for each registered establishment where he employs contract labour.

Rule 76 - Employment Card (i) Within three days of the worker's employment, the contractor must issue an employment card in Form XIV to the worker. (ii) The card must be kept up to date, and any changes to the information must be recorded.

Rule 77 - Certificate of Service When a worker's employment is ended for whatever reason, the contractor must issue a Service Certificate in Form XV to the worker whose services were terminated.

Rule 78 - Muster roll, wages registers, deductions register, and overtime register are all covered by Rule.

Rule 79 - Display of Act and Rules Abstract Every contractor must post an abstract of the Act and Rules in English and Kannada, as well as the language spoken by the majority of workers, in such form as the Commissioner of Labor may authorize.

Rule 80 - Registers and other records must be maintained and kept. (1) All registers and other records needed to be kept under the Act and Rules must be kept complete and up-to-date, and unless otherwise provided for, must be kept in an office or the nearest convenient building within the work premises or within a three-kilometer radius.

Rule 81 - The principal employer or contractor must post notices in English and Kannada on wage rates, hours of work, and other matters.

Rule 82 - (1) Every contractor shall transmit a half-yearly return in Form XXIV (in triplicate) to the Licensing Officer concerned not later than 30 days after the end of the half-year.

For the purposes of this rule, a half year is defined as "a period of six months beginning on January 1 and ending on July 1 of each year."

How Deskera Can help You?

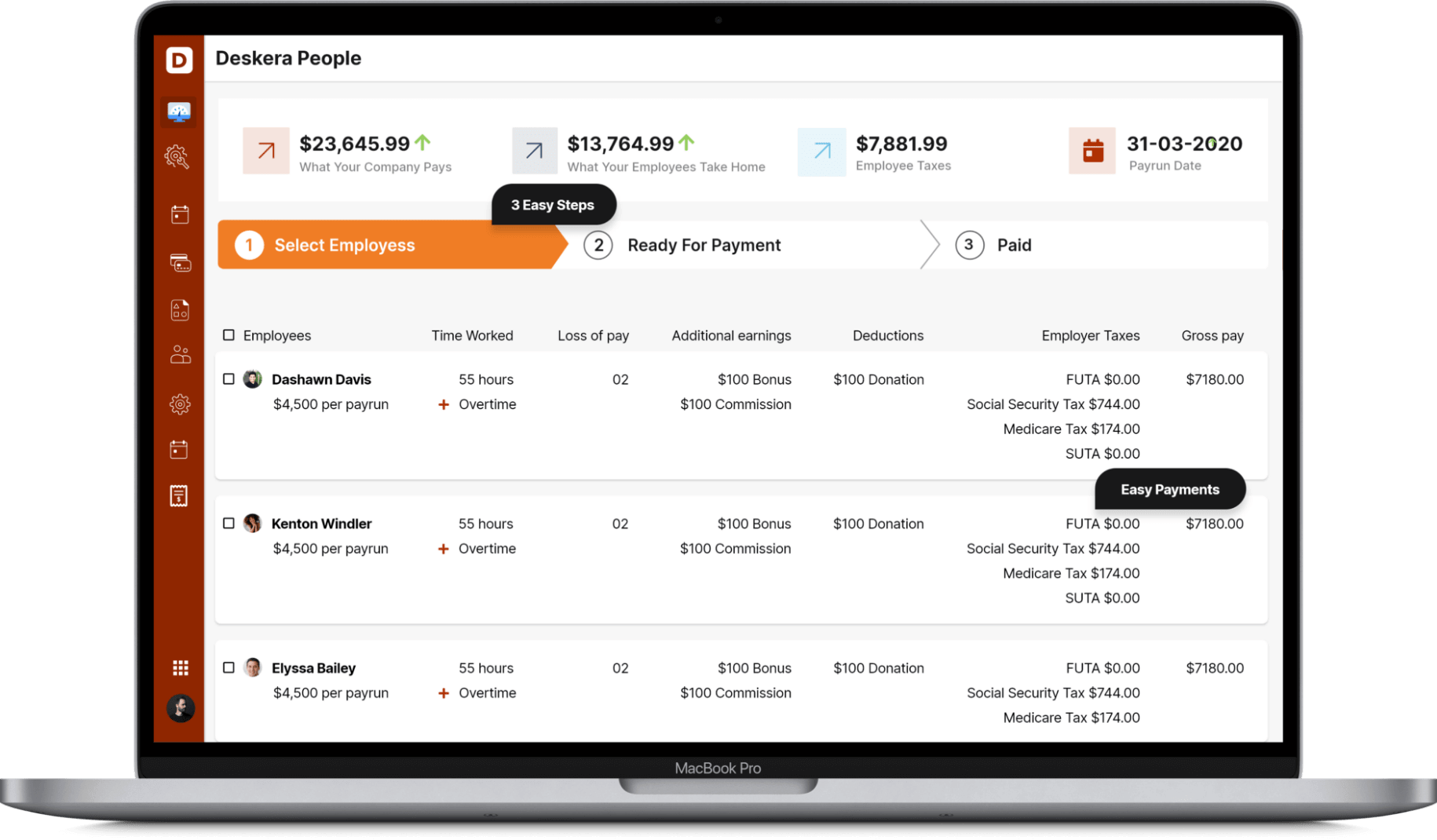

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

In addition to a powerful HRMS, Deskera offers integrated Accounting, CRM & HR Software for driving business growth.

To learn more about Deskera and how it works, take a look at this quick demo:

Key takeaways

- Every major employer of a registered establishment must submit an annual return in Form XXV (in duplicate) to the Registering Officer concerned by the 15th February following the end of the year in question: [An employer is not required to file an annual return if he files a common annual return in Form 20 of the Karnataka Factories Rules, 1969.]

- To every contractor who employed or engaged twenty or more workers on any day within the previous twelve months. Provided, however, that the competent Government may apply the requirements of this Act to any establishment or contractor employing fewer than twenty workers after giving not less than two months' notice of its intention to do so by notification in the Official Gazette.

- The fact that the contractor's work is performed away from the business does not exempt it from S. 2(1)(definition )'s of "work of any establishment"—Construction of a building for the major employer at a new location constitutes "work of that establishment." -The word "work of an establishment" used in the definition of "workmen" or "Contractor" is not the same as "other work in any business" in S. Workman does not have to be doing the same or related work as the major employer.

- Every principal employer shall submit a return to the Inspector, appointed under Section 28 of the Act, within fifteen days of the commencement or completion of each contract work under each contractor, informing the actual dates of the commencement or, as the case may be, completion of such contract work, in Form XXVI].

- The major employer may or may not own the work site or place, but it will not prevent the Act from being applied or a determination that a specific location or work site where industry, trade, business, manufacture, or employment is carried on is not an establishment.

Related articles