The Karnataka Shops and Establishment Act governs how businesses and retail enterprises operate. The Karnataka Shops and Establishment Act was introduced to control the working conditions for women and children, as well as other features of shops or other commercial establishments. We go into great detail about the Karnataka Shops and Establishment Act in this article.

- The Shops and Establishment Act

- Major Definitions Associated with Shops and Establishment Act

- Features of the Karnataka Shop and Commercial Establishment Act

- Intermediary

- Forms & Records

- Form P Notice Holiday

- Highlights of Karnataka Shops and Establishment Act

- Establishment Exempted from Karnataka Shops and Establishment Act

- How Deskera Can Assist You?

The Shops and Establishment Act

The Shops and Establishment Act has been enacted by various State Governments to regulate the conditions of work of employees in shops, commercial undertakings, restaurants, etc., All commercial establishments must abide by The Weekly Holiday Act, 1942 enacted by the Central Government which governs the grant of holidays.

However, there is no specific Central Government Act that comprehensively governs hours of work, payment of wages, and health and safety in commercial establishments.

To bridge this gap, state Governments have enacted a Shops and Establishment Act to help regulate the conduct of commercial establishments within their jurisdiction.

Major Definitions Associated with Shops and Establishment Act

The Karnataka Shops and Commercial Establishment Act extends to the whole state of Karnataka. All shops and commercial establishments except those exempted are required to comply with the Karnataka Shops and Commercial Establishment Act.

A shop is defined as follows by the Karnataka Shop and Establishment Act:

“A “shop” means any premises where any trade or business is carried on or where services are rendered to customers, and includes offices, storerooms, godowns, or warehouses, whether in the same premises or otherwise, used in connection with such trade or business, but does not include a commercial establishment or a shop attached to a factory where the persons employed in the shop fall within the scope of the Factories Act, 1948.”

A commercial establishment is what the Karnataka Shops and Establishment Act specifies as:

“The “commercial establishment” means a commercial or trading or banking or insurance establishment, an establishment or administrative service in which persons employed are mainly engaged in office work, a hotel, restaurant, boarding or eating house, a cafe or any other refreshment house, a theatre or any other place of public amusement or entertainment and includes such establishments as the State Government may by notification declared to be a commercial establishment for the purposes of this Act;”

Definition of Owner

Owner means the person having charge of or owning or having ultimate control over the affairs of an establishment and includes members of the family of an employer, a manager, agent, other person acting in the general management and control of an establishment.

Definition of Employee:

Employee means a person wholly or principally employed in or in connection with, any establishment whether working on permanent, periodical, contract or piece-rate wages or on a commission basis, even though he receives no reward for his labour and includes an apprentice.

Features of the Karnataka Shop and Commercial Establishment Act

- Issuing Registration Certificate

- Renewal of Registration Certificate

- Facilitating changes in Registration Certificate

- Issuing Duplicate Registration Certificate

- Annual Returns Filing

- Exemption or relief weekly holidays

- Exemption for Women working in Night Shifts

- Appeal submission

Intermediary

GSR 15.-In exercise of the powers conferred by sub-section (1) of Section 40 of the Karnataka Shops and Commercial Establishments Act, 1961 (Kamataka Act 8 of 1962), the Government of Kamataka hereby makes the following Rules, the draft of the same having been published as required by sub-section (4) of the said section in the Karnataka Gazette, dated the 16th May, 1963, in Notification No. PLM 82 L5C 61, dated the 10th May, 1963, namely:-

1. Title.

These rules may be called the Karnataka Shops and Commercial Establishments Rules, 1963.

2. Definitions.

In these rules, unless the context otherwise requires.-

(a) "Act" means the Karnataka Shops and Commercial Establishments Act, 1961;

(b) "Form" means a form appended to these rules;

(c )"Government" means the Government of Karnataka;

(d)"Schedule" means the schedule appended to these rules;

(e)"Section" means a section of the Act;

(f)Words and expressions used in the Act and not defined in these

Rules shall have the meanings assigned to them in the Act.

3. Registration of establishments, etc.

(1) Within the period specified in sub-section (3) of Section 4, the employer of every establishment shall send to the Inspector of the area concerned a statement in Form "A" together with the fees specified in Schedule 1.

Provided that a factory or an Industrial Establishment for the

Commercial Establishments] may use the combined application form as prescribed under the Karnataka Factories Rules, 1969 in lieu of Form 'A' under this rule.

(2) The fees payable under sub-rule (1) shall be paid into the

local Treasury under the Head of Account "XXI-Miscellaneous-b-Labour" and the receipt obtained, therefore, shall be sent along with Form "A".

Registration Karnataka Shops and Establishment Act

Karnataka Shops and Establishment Act registration is mandatory for all shops and commercial establishments in Karnataka, except those exempted.

New shops or commercial establishments in Bangalore or Karnataka are required to apply for Karnataka Shops and Establishment Act Registration within 30 days of commencing operations. The Shops and Establishment Act Registration must be submitted in the prescribed format to the Labour Inspector of the area concerned. The following information must be provided as a part of the Shop and Establishment Act Registration application:

- The name of the employer and manager, if any

- The postal address of the establishment;

- The name, if any, of the establishment; and

- Such other particulars as may be prescribed.

On submission of the application, the Inspect would verify and provide the Shops and Establishment Act Registration. All Karnataka Shops and Establishment Act registrations are valid for a period of 5 years and can be renewed.

3-A. Renewal of Registration Certificate

(1) The Registration

Certificate issued under sub-section (2) of Section 4, shall be renewed once in five years before the date of its expiry. The employer of every establishment shall send to the Inspector of the area concerned a statement in duplicate, in "[Form "A"] before ninety days from the date of expiry of such registration certificate.

(2) The fees for the renewal of the Registration Certificate shall be the same as the fees specified in Schedule 1].

4. Manner of registering establishments and the form of registration certificate

On receipt of the statement and the fees prescribed in "Rule 3 or Rule 3-AJ, the Inspector shall after being satisfied with the correctness of the statement, register the establishment in the register of establishments which shall be in Form "B" and shall issue a Registration Certificate to the employer in Form "C".

[4-A. Issue of Duplicate Certificate of Registration. Where a

certificate of registration granted or renewed under Rule 3 or 3-A, is lost, defaced, or accidentally destroyed a duplicate copy of the certificate of registration may be granted on payment of a fee of rupees fifty only.]

5. Changes how notified

The employer shall notify the Inspector concerned of any change in respect of any information contained in his statement under ¹[Rule 3 or Rule 3-A] in [Form "A"] within 15 days after the. 3/30 change has taken place.

6. Computation of cash equivalent of certain concessions

(1) The cash equivalent of the advantage accruing through the concessional sale of foodgrains and other articles payable to workers proceeding on leave or for the purpose of calculation overtime rate of wages shall be the difference between the value at the average rates in the nearest market prevailing during the month immediately preceding his leave and the value at the concessional rates allowed of foodgrains and other articles he is entitled to.

(2) For the purpose of cash equivalent monthly average market rate of foodgrains and other articles shall be as computed by the Department of Labour.

7. Enquiry for fixing, opening, and closing hours of

Establishments

(1) Before issuing a notification under sub-section (1) of Section 11, the Government shall make an inquiry under sub-section (2) of Section 11 in the manner specified in the following sub-rules.

(2) The Government shall give notice of its intention to pass such order. The notice shall be in Form "E" and shall, unless a copy of the order proposed to be passed is annexed to it, specify the area and the establishment or establishments or class or classes of establishments to which the order shall apply the hours of opening or the hours of closing or both, which are proposed to be fixed and the days in respect of which such hours are proposed to be fixed. The Notice shall also state that objections and suggestions with respect to such orders, if any, may be sent to the officer mentioned in the notice within one month from the date of such notice.

(3) The notice shall be published in the Official Gazette and the copies of the notice shall be affixed at such public places in the area to which the order is proposed to be applied as the State Government may deem fit. Copies of the notice shall be sent to the local authority in whose jurisdiction such area is situated and to such associations or organizations as the State Government may deem fit. The notice shall also be published in at least one newspaper having circulation in such an area.

(4) The State Government shall consider all objections and suggestions received by them before issuing the notification under sub-section (1) of Section 11.

8. Leave with wages register

(1) The employer shall maintain a leave with Wages Register in Form "F"

Provided that where the Inspector is of the opinion that any muster-roll or register maintained as part of the routine of the establishment or return made by the employer given in respect of any or all of the persons employed in the establishment the particulars for the enforcement of Chapter IV of the Act, he may, by order in writing direct that such muster-roll or register or return shall, to the corresponding extent, be maintained in place of and be treated as the register or return required under this rule for that establishment.

(2) The register maintained under sub-rule (1) shall be preserved for a period of three years after the last entry in it and shall be produced before the Inspector on demand.

9. Leave with wages book of the persons employed

(1) The employer shall provide each employee with a book called the "Leave with wages book" in Form "H". The book shall be the property of the employee and entries of the dates of holidays or interruptions in service shall be made therein by the employer from time to time. The employer shall not keep it for more than 10 days at a time to make the entries.

(2) The employer shall on being satisfied that the employee has lost his leave with wages book provide him with a duplicate thereof on payment of 25 paise.

10. Production of Medical Certificate by employee

If so required by the employer in writing the employee shall submit a Medical Certificate signed by a registered or recognized Medical Practitioner. Vaidya or Hakim stated the cause of the absence and the period for which the employee is, in his opinion, unable to attend to his work.

[11. Notice by employee for not availing himself of leave with wages due to him in a year.

12. Programme of leave with wages to be prepared by the employer.

13. Members of one family to be allowed to leave on the same date.

14. Notice by employer of alteration of dates fixed for leave.

15. Exchange of leave between employees.

16. Cleanliness of an establishment]

17. Establishment to be sufficiently lighted

The latrines, passages, stairs, hoists, establishment grounds, in so far as the entrance of the said places is not closed, shall during working hours be provided with such lighting as will ensure safety of movement or passage through them.

18. Building of more than one storey to be provided with two

Stairs

Every building of more than one storey shall be provided with at least two sets of stairs or steps permanently fixed either inside or outside the building, so as to afford direct and unimpeded access from every part of the establishment to the ground level. Such stairs shall be provided with a suitable and sufficient handrail or other convenient support. In establishments employing less than 40 persons, the Inspector may accept in lieu of a second set of stairs or steps such other means of escape in case of fire as can reasonably be required in the circumstances of each case.

19. Exits to external stairs to open from inside

Every window or door giving access to an external staircase shall be so arranged as to open immediately from inside.

20. Precaution against fire

No person shall smoke or use a naked light or cause or permit any such light to be used, in the immediate vicinity of any inflammable material in any establishment.

21. Duties of Inspectors

(1) The Inspector shall make such examination as may appear to him to be necessary for the purpose of satisfying himself that the provisions of the Act and of these rules and any order passed by the Government under the Act are duly observed.

In particular, he shall satisfy himself-

(i) that the establishment is duly registered under the Act;

(ii)that the registers, records, and notices required to be maintained

or displayed under the Act or these rules are properly

maintained or displayed;

(iii) that the intervals of rest and holidays required to be granted or observed under the Act are granted and observed and the limits of hours of work and spread-over laid down under the Act are granted and observed and the limits of hours of work and spread-over laid down under the Act are not exceeded;

(iv) that the provisions of the Act and any notification issued by the Government regarding the opening and closing hours are duly observed;

(v) that the provisions of the Act and the rules regarding leave are properly observed:

(vi)that the provisions of these rules relating to cleanliness, lighting and precaution against fire are properly observed;

(vii) that the provisions of the Act relating to the payment for

overtime work are duly observed:

(viii) that no child is allowed to work in any establishment.

(2) For carrying out such examination, the Inspector may interrogate such persons on the premises as he may deem necessary provided that no such person shall be required under this rule, to answer any question, the answer to which might tend to incriminate him.

21-A. Procedure for Prosecution

-An Inspector shall obtain the prior approval of the Chief Inspector for any other officer not below the rank of an Assistant Labour Commissioner specially authorized by him on this behalf] before making a complaint in respect of an offense punishable under the Act. rules or orders made thereunder.

22. Ascertainment of age by the Inspector

An Inspector may require an employer to produce a certificate of age from a registered medical practitioner in respect of any employee, such certificate shall be in Form "J".

23. Submission of a diary by Inspectors

The Inspectors shall keep a file of the records of his inspection arranged in monthly bundles and shall submit to the officer to whom he is subordinate on the 15th day of each month a diary in Form "K",

24. Maintenance of registers and records and display of notices

Every employer shall exhibit in his establishment a notice in Form "P" specifying the day or days of the week on which the persons employed by him shall be given a holiday. The notice shall be exhibited before the persons to whom it relates cease work on Saturday immediately preceding the first week during which it is to have an effect.

5) Every employer shall exhibit in his establishment a notice containing such extracts of the Act and these rules in Kannada] and in the language of the majority of the employees.

(6) Any notice required to be exhibited under these Rules shall be exhibited in such manner that it can be readily seen and read by any person whom it affects and shall be renewed whenever it becomes defaced or otherwise ceased to be clearly legible.

(7) In any register or record that an employer is required to maintain under these rules the entries relating to any day shall be made on such day.

(8) Save as otherwise provided in these Rules, the registers, records, and notices relating to any calendar year shall be preserved till the end of the next calendar year.

(9) If on any application made by an employer in writing, the Government is satisfied that any muster-roll, register or record maintained by such employer gives in respect of all or any of the persons employed in his establishment the particulars required to be shown in any register, record or notice prescribed under this rule the State Government, may, by order in writing direct that such muster-roll, register or record shall, to the corresponding extent, be maintained in place of such register, record or notice, as the case may be.

[(9-A) The appointment order issued by the employer under Section 6-A shall be in Form 'Q']

[(9-B) Every employer shall maintain a combined Muster Roll-cum-Register of Wages in Form T in respect of the employees employed in the establishment:

Provided that where an employer has maintained Form "T", he need not be required to maintain another Muster Roll or Register of Wages separately which contains the same information already available in Form T."

(9-C) Every employer shall send a combined Annual Return in Form 'U' to the concerned Inspector on or before 31st January of every year.

Provided that where an employer furnishes annual returns in Form "U", he need not furnish any other annual return containing the same information.

(10) Save as otherwise provided in sub-rule (5), all registers, records, muster-rolls and notices required to be maintained, exhibited or given under these Rules shall be either in English or in Kannada.

(11) Every employer shall maintain a Visit Book in which an Inspector visiting the establishment may record his remarks regarding any defects that may come to light at the time of his inspection and shall produce it whenever required to do so by an Inspector.

Where an office, storeroom, godown, warehouse, or workplace used in connection with the trade and business of an establishment is situated at premises other than the premises of the establishment, all registers, records, muster rolls, visit book, and notices required to be maintained, exhibited or given under the Act, and these rules shall be separated so maintained, exhibited, or given in respect of and at such office, storeroom, godown, warehouse or workplace.

[24-A. Exhibition of name Board.

The name Board of every establishment shall be in Kannada and wherever other languages are also used, the versions in such other languages shall be below the Kannada version. The name Board in the Kannada version shall be written more predominantly by providing more space than for other languages if any.]

[24-B. Exemption under Section 25.-

(1) Where power to exempt establishments of Information Technology or Information Technology enabled services under the proviso to Section 25 is delegated by the State Government under Section 37 to the Commissioner for Labour, Bangalore or the Deputy Labour Commissioner having jurisdiction, every employer who intends to seek exemption under Section 25 to engage women employees during the night shift, shall make an application in Form K to the Commissioner for Labour or the Deputy Labour Commissioner having jurisdiction, with the list of women employees willing to work in night shifts. There shall be at least five women employees in one night shift.

(2) On receipt of the application under sub-rule (1), the Commissioner for Labour or the Deputy Labour Commissioner concerned may grant exemption in Form 5.]

25. Appeals under Section 39

(1) The Assistant Commissioners of Labour shall, within the areas of their respective jurisdiction be the officers to whom appeals in respect of orders under sub-section (1) of Section 39 shall lie.

(2) Every such appeal shall be presented within 30 days from the date on which the order of removal or dismissal was communicated to the employee:

Provided that an appeal may be admitted after the said period of 30 days if the appellant shows sufficient to cause that the appeal could not be presented in time.

(3) Every appeal shall be in the form of a memorandum setting forth concisely the grounds of objection to the order and shall be accompanied by a copy of the order appealed against.]

26. Penalty for contravention

Whoever contravenes Rules 8, 9, 9-A, 9-B,9-C, 17, 18, 19, 20, 22, 24 and 24-B shall on conviction, be punishable with a fine which shall not be less than five hundred rupees but which may extend to one thousand rupees and whoever contravenes Rule 24-A shall on conviction, be punishable with fine of ten thousand rupees and for each continued offence be punishable with fine which shall not be less than ten thousand rupees.]

Forms & Records

Form A:

Registration, Renewal and Report Change of information of establishment.

Form P:

Fixing different days for weekly holidays.

Form F & Form H:

Maintaining employee leave a record (Form F) and share a copy to the employee (Form H)

Form T:

Employee daily attendance.

Form R:

Permission to allow women to work after 8 PM.

Form U:

Annual Report for the year ending with 31st December shall be submitted before 31st January of next year.

The act will be implemented under the supervision of labour commissioner – Chief Inspector.

Inspector and Senior Inspector – Inspector and department level authorities are called as Additional Inspector.

Form P Notice Holiday

Highlights of Karnataka Shops and Establishment Act

The following are some of the major aspects of the Karnataka Shops and Establishment Act:

Employment of Child, Young Persons and Women

The Karnataka Shops and Establishment Act prohibits the employment of a child at any establishment. A child is any person who has not completed fourteen years of age.

Also, young person and woman cannot be required or allowed to work whether as an employee or otherwise in any establishment during night. A young person is anyone who has completed the age of fourteen, but not eighteen.

Hours of Work

As per the Karnataka Shops and Establishment Act, employees can only work for nine hours on any day and forty-eight hours in any week. If the employee works more hours, then wages need to be provided for overtime. Further, the period of work of an employee in an establishment should be fixed so that, no period or work exceeds five hours without an interval.

Weekly Holiday

All establishments in Karnataka are required to remain close for one day of the week and every employee in an establishment must be given at least one whole day in a week as a holiday for rest. However, if the establishment has sufficient additional staff, then it can remain open throughout the week.

Annual Leave with Wages

Employees working in an establishment in Karnataka has a permit to avail of leave with wages at the rate of one day for every twenty days of work done. In the case, of young persons, the employee should be allowed to avail a leave with wages at the rate of one day for every fifteen days of work performed.

Establishment Exempted from Karnataka Shops and Establishment Act

The Karnataka Shops and Establishment Act does not apply for the following types of establishments:

- Offices of or under the Central or State Governments or Local Authorities, except commercial undertakings;

- Any railway service, water transport service, postal, telegraph or telephone service, any system of public conservancy or sanitation or any industry, business or undertaking which supplies power, light or water to the public;

- Railway dining cars;

- Establishments for the treatment or care of the sick, infirm, or the mentally unfit;

- Establishments of the Food Corporate of India;

- Offices of legal practitioners and medical practitioners in which not more than three persons are employed;

- Offices of a banking company;

- Any person employed in any business from point 1 – 7 above;

- Persons occupying positions of management in any establishment;

- Persons whose work is inherently intermittent such as drivers, care-takers, watch and ward staff, or canvassers;

- Persons directly engaged in preparatory or complementary work, such as clearing and forwarding clerks responsible for the despatch of goods.

Further, sections relating to opening and closing hours, and weekly holidays in the Karnataka Shops and Establishment Act does not apply to:

- Shops dealing mainly in medicines or medical or surgical requisites or appliances;

- Clubs, residential hotels, boarding houses, hostels attached to schools or colleges, and establishments maintained in boarding schools in connection with the boarding and lodging of pupils and resident-masters;

- Stalls and refreshment rooms at railway stations, bus stands, ports or aerodromes;

- Shops of barbers and hairdressers;

- Shops dealing mainly in meat, fish, poultry, eggs, dairy produce, bread, confectionery, sweets, chocolates, ice, ice-cream, cooked food, fruits, flowers, vegetables or green fodder;

- Shops dealing in articles required for funerals, burials or cremations;

- Shops dealing in the pan, pan with beedies or cigarettes, or liquid refreshments sold retail for consumption on the premises;

- Shops dealing in newspapers or periodicals, editing sections of newspaper offices and offices of news agencies;

- Cinemas, theatres and other places of public entertainment and stalls and refreshment rooms attached to such cinemas, theatres and places of public entertainment;

- Establishments for the retail sale of petrol’

- Shops in regimental institutes, garrison shops and troop canteens in cantonments;

- Tanneries;

- Retail trade carried on at an exhibition or show if such retail trade is subsidiary or ancillary only to the main purpose of the exhibition or show;

- Oil-mills and flour-mils not registered under the Factories Act, 1948;

- Brick and lime kilns;

- Commercial establishments engaged in the manufacture of bronze and brass utensils so far as it is confined to the process of melting in furnaces;

- Information technology establishments;

- Bio-technology and research centers or establishments of the epidemic and other diseases;

How Deskera Can Assist You?

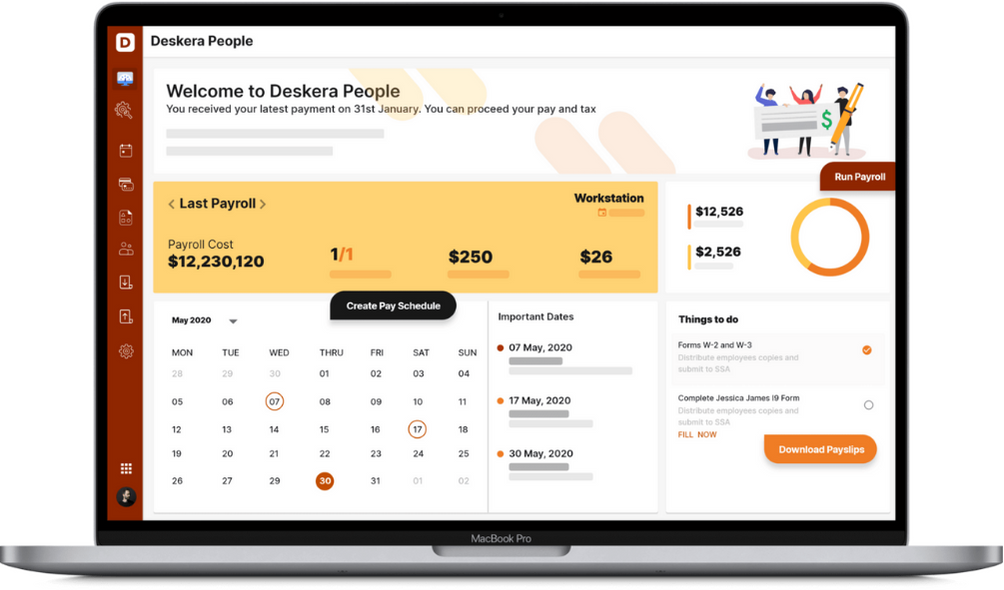

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. Easily generate pay slips for your employees and simplify your payroll management with Deskera People. It also digitizes and automates HR processes including hiring, expenses, payroll, leave, attendance, and more.

Final Takeaways

We've arrived at the last section of this guide. Let's have a look at some of the most important points to remember:

- The Karnataka Shops and Establishment Act governs how businesses and retail enterprises operate. The Karnataka Shops and Establishment Act was introduced to control the working conditions for women and children, as well as other features of shops or other commercial establishments.

- The Shops and Establishment Act has been enacted by various State Governments to regulate the conditions of work of employees in shops, commercial undertakings, restaurants, etc., All commercial establishments must abide by The Weekly Holiday Act, 1942 enacted by the Central Government which governs the grant of holidays.

- The Karnataka Shops and Commercial Establishment Act extends to the whole state of Karnataka. All shops and commercial establishments except those exempted are required to comply with the Karnataka Shops and Commercial Establishment Act.

- New shops or commercial establishments in Bangalore or Karnataka are required to apply for Karnataka Shops and Establishment Act Registration within 30 days of commencing operations. The Shops and Establishment Act Registration must be submitted in the prescribed format to the Labour Inspector of the area concerned.

- On submission of the application, the Inspect would verify and provide the Shops and Establishment Act Registration. All Karnataka Shops and Establishment Act registrations are valid for a period of 5 years and can be renewed.

- On receipt of the statement and the fees prescribed in "Rule 3 or Rule 3-AJ, the Inspector shall after being satisfied with the correctness of the statement, register the establishment in the register of establishments which shall be in Form "B" and shall issue a Registration Certificate to the employer in Form "C".

- For the purpose of cash equivalent monthly average market rate of foodgrains and other articles shall be as computed by the Department of Labour.The Government shall give notice of its intention to pass such order. The notice shall be in Form "E" and shall, unless a copy of the order proposed to be passed is annexed to it, specify the area and the establishment or establishments or class or classes of establishments to which the order shall apply the hours of opening or the hours of closing or both, which are proposed to be fixed and the days in respect of which such hours are proposed to be fixed.

- The employer shall provide each employee with a book called the "Leave with wages book" in Form "H". The book shall be the property of the employee and entries of the dates of holidays or interruptions in service shall be made therein by the employer from time to time. The employer shall not keep it for more than 10 days at a time to make the entries.

- Any notice required to be exhibited under these Rules shall be exhibited in such manner that it can be readily seen and read by any person whom it affects and shall be renewed whenever it becomes defaced or otherwise ceased to be clearly legible.

- The Inspectors shall keep a file of the records of his inspection arranged in monthly bundles and shall submit to the officer to whom he is subordinate on the 15th day of each month a diary in Form "K",

- Every employer shall maintain a Visit Book in which an Inspector visiting the establishment may record his remarks regarding any defects that may come to light at the time of his inspection and shall produce it whenever required to do so by an Inspector.

- As per the Karnataka Shops and Establishment Act, employees can only work for nine hours on any day and forty-eight hours in any week. If the employee works more hours, then wages need to be provided for overtime.

Related Articles