You are definitely dealing with a huge number of invoices if you're a small business owner, entrepreneur, or independent vendor. Managing funds coming in and out of your bank accounts on a continual basis is, without a doubt, a difficult undertaking. Moreover, when it comes to managing proper accounting, there is no room for errors.

So, the question arises what’s the perfect way to handle that?

‘Invoice Reconciliation’ — that’s your answer to this question. It is a crucial method that ensures that your accounting works accurately. Moreover, it's critical to cross-check the amounts on bank statements with the many incoming and departing invoices you have to help monitor this money.

In today’s article, we will discover invoice reconciliation and its related concepts. Let’s take a look at the table of content:

- What’s Invoice Reconciliation?

- Understanding Invoice Reconciliation

- Difference between Invoice and Reconciliation

- Significance of Invoice Reconciliation

- Different Types of Invoice Reconciliation

- Need of Invoice Reconciliation

- Advantages of Invoice Reconciliation

- Method to Reconcile your Invoice

- How you can Reconcile Invoice in Accounts?

- Tips for Effective Invoice Reconciliation

- Important Suggestions for Invoice Reconciliation

- Frequently Asked Questions (FAQs) on Invoice Reconciliation

Let’s begin!

What’s Invoice Reconciliation?

Invoice reconciliation is the procedure of sorting and matching bank statements to the receiving and outgoing invoices. It assists to trace each transaction so that account can be balanced.

Moreover, the account settlement procedure involves documenting two kinds of data: money leaving a bank account and invoices issued for it.

Understanding Invoice Reconciliation

The invoice reconciliation method involves verifying and comparing all of the information contained in invoices. Each invoice is sorted to line up with the appropriate bank statements. It further allows each account to be balanced.

Reconciliation, in terms of accounting, refers to the use of multiple records to ensure that all statistics are similar and comply with one another.

Nevertheless, it could also suggest that the company is attempting to validate each account payable and invoice within a certain time frame in order to achieve a balance. Additionally, Reconciliation fosters financial accounting and reporting because it promotes consistency and accuracy.

Difference Between Invoice and Reconciliation

An invoice is a financial document prepared by a seller or vendor after a project has been completed. The invoice contains an itemized array of items, along with their quantity and cost, as well as other important information. An invoice is delivered to the clients, requesting that they settle the payment by the due date.

Reconciliation is an accounting method that involves comparing two pairs of records. It further helps to confirm that the money leaving the bank account equals the invoices. Reconciliation assists in distinguishing authentic anomalies from indicators of fraud or error.

Moreover, irregularities occur in the amount leaving the bank account and money spent. In simple words, this procedure assesses if the irregularities are due to fraud or technological mistakes.

Significance of Invoice Reconciliation

Invoice reconciliation is an accounting procedure that helps to compare two sets of records when any discrepancies are identified.

Moreover, it is necessary to grasp the reconciliation procedure in order to comprehend the possible condition that mandates this restorative method.

The following scenarios may necessitate invoice reconciliation:

- Invoices that are missing or duplicated

- Bank deducts fees. For example; if any international transactions occurred

- Applied discounts on early payments

- The delivery of products may be delayed, causing payment to be delayed

- Payments and deposits may be made at times that fall out of the reconciliation period

- An invoice is not completely paid

Ultimately, the primary goal of invoice reconciliation is to detect and monitor fraudulent activity and timing concerns.

Invoice reconciliation examines fraud, which can be better regulated if the process is automated. This way, you can prevent fraud by setting well-defined permissions. Additionally, reconciling invoices also aid in determining the cause of the payment date discrepancy.

Different Types of Invoice Reconciliation

Below we have listed two types of invoice reconciliation. Let’s learn:

Manual:

It is obvious that earlier manual reconciling invoices were a challenging and time-consuming operation. It requires line-by-line, document-by-document cross-checking of details. Hence, it takes enormous time and effort. Moreover, there is a high risk of errors due to lengthy processes.

As a result, modern businesses have switched to automated processes to fulfill their objectives. This automated procedure performs time-consuming tasks, saves time and effort, and resolves challenges that organizations and users encounter.

Automated:

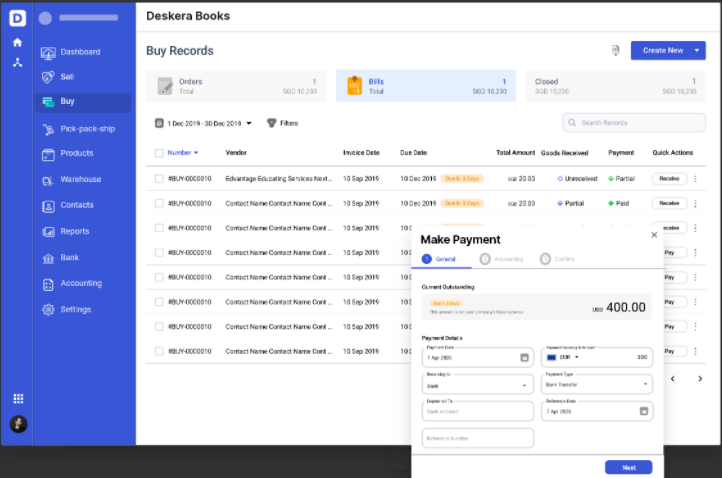

Integrated procurement system software and web technologies are employed for automatic invoice reconciliation such as Deskera.

The technology detects errors and mistakes automatically. For instance, the procurement software, platform, or tool will show all linked transactions for the item, such as whether the supplier has paid in full, partially paid, or is still owing money.

This will allow accountants to spend less time on unrelated activities and issues. It also enables them to take immediate action.

The procurement system optimizes the perfect match of purchase orders by reconciling bills depending on the invoices generated, allowing you to identify any anomalies at the time of delivery.

Furthermore, the advanced edition of the web platform also includes certain additional tools and capabilities to help with reconciling statements and making modifications as needed.

The software will also display warning signs for account-related concerns that require the accountant or approver's consideration and manual account reconciliation checks.

Moreover, if the system detects any cost discrepancies, you should immediately reconcile and examine the statement. This is perfect for avoiding human errors and rapidly locating overdue invoices.

Today's businesses rely on a variety of technologies to assist them with their accounting requirements. Many business owners still believe in the use of manual labor.

In their own way, both strategies are suitable. However, the optimal strategy for your organization will be determined by your needs. You must select the one that allows you to save time and effort for your team.

Ultimately, this minimizes the amount of effort required and makes it very easy to spot inconsistencies. Moreover, it ensures efficiency and reliable information.

Need of Invoice Reconciliation

Businesses must reconcile their invoices on a constant schedule. Moreover, accountants should use this technique to examine certain accounting documents and bank statements.

Additionally, they must monitor and update the status of transitions and invoice payments for that specific time based on their findings.

Furthermore, the reconciliation technique will maintain your bank statement and account activities up to date, allowing you to keep monitor and track each transaction on a constant schedule.

Advantages of Invoice Reconciliation

Invoice reconciliation aids in the resolution of inconsistencies. As previously discussed, invoice reconciliation is carried out either manually or with the help of an automated system.

Moreover, financial errors made by a bank or a commercial entity are usually the cause of the discrepancy. As a result, the settlement procedure is extremely beneficial to the firm.

Following we have discussed some major benefits associated with invoice reconciliation:

Identify frauds: Fraud detection is critical to the success of any firm. A thorough reconciliation process aids in the detection of fraud.

Track Payments: A frequent invoice reconciliation process can assist you to uncover clients who owe you money but haven't paid you yet. For pending dues, it is possible to contact such people in a timely manner.

Handle Accounting Records: The reconciliation technique aids in the maintenance of up-to-date accounting records with bank statements, allowing the company to keep track of each transaction activity on a daily basis.

Method to Reconcile your Invoice

Invoice reconciliation is critical for business accounting. It assists to maintain accuracy in your accounting records and preventing fraud.

Furthermore, integrating information from bank statements to invoices flowing out or in enables you keep a record of who has paid you and who hasn't, as well as whose payments are still outstanding.

Here are some helpful hints for reconciling your bills:

Select the Right Process

Invoice reconciliation can be made considerably easier with the use of the software. It will also benefit the management of your company. To start, sort your vendor invoices by month so you can generate reports to see which ones are past due. The reconciliation process will run more smoothly as a result of this.

Suppliers will almost certainly label and structure their invoices in their own unique style. Ensure you know where to look for important information such as deadlines, reference numbers, and other essential details.

Generate Checklist

Prepare a accounting checklist to help you go through cases where you can't reconcile the figures as part of your invoice reconciliation procedure.

Following we have listed items on the checklist that you should include:

- Was a bank or other financial intermediary charging a transfer or currency fee?

- Is the balance due to be paid at a later date?

- Did you offer a discount for paying in advance?

- Is the provider charging you too much or too little?

- Has a portion of a previous balance been rolled over?

Make the use of Software

Inputting the data you require for reconciliation shouldn't be difficult or time-consuming. Not every business owner has the time, inclination, or expertise to maintain numbers in a spreadsheet.

The simplest way to simplify this process is to use an online accounting software tool to compare your bank statement payments to your outstanding invoices.

How you can Reconcile Invoice in Accounts?

Following we have discussed how you can reconcile invoices in accounts. Let’s check:

Manage all invoices: Organize all invoices in a structured manner and sort them by date. This will assist you to figure out why a particular invoice is overdue. Begin by comparing the client statement to the invoice to ensure that the amount received corresponds to the invoice amount.

Track discrepancies: Keep track of any discrepancies as you compare the customer statement against individual bills. Check all of the details, including the invoice number, invoice amount, taxes, and so forth.

Reach to Customer: It is necessary to contact the client in order to resolve the discrepancy. If disagreements cannot be resolved, the business owner/authorized individual has the authority to decide whether or not to write off past-due debts.

How You Can Improve Invoice Reconciliation?

Invoice reconciliation is without a doubt one of the most crucial procedures in keeping track of revenue and expenses. As a result, the Small Business Administration recommends that all business owners keep reliable records.

Following we have discussed some of the crucial ways that will help you to improve invoice reconciliation:

Switch to Accounting Software

You must determine the best strategy for improving your reconciliation process in order to make it more efficient.

For example, invoice reconciliation is frequently included in automated processes found in commercial accounting software. Moreover, this eliminates the need for spreadsheets and line-by-line evaluation.

Improve Your Spreadsheet Proficiency

Are you a purist who prefers to do everything manually? Taking courses online to develop different spreadsheet abilities is a simple approach to improve your DIY accounting. Reconciliation accuracy can be improved by memorizing keyboard shortcuts and Microsoft Excel algorithms.

Invest in an Accountant

It may be advisable to outsource your reconciliation activities if you're overloaded with a grueling schedule and clients.

For example, a certified public accountant (CPA) can provide specialized financial services. Although a bookkeeper can help with many day-to-day tasks at a cheaper cost. Therefore, find a few accountants and check to see whether they provide invoice reconciliation.

You should be consistently analyzing financial papers regardless of your invoice reconciliation method. This increases the effectiveness and alerts you to any potential problems. Prepare a checklist containing known bank fees, recurring charges, and rollovers to assist speed up the process and making statement reviews quicker.

How Invoice Reconciliation assists Businesses?

Invoice reconciliation is highly required to avoid any kind of inconsistencies. As previously said, it can be done both manually and using automated methods.

Financial errors are made by either the organization or the bank when the entries do not match. As a result, the account settling process is extremely beneficial to the company.

Let's take a closer look at the advantages of invoice reconciliation.

1.To detect and manage fraudulent activities. Fraudulent acts in the workplace, whether perpetrated by outside parties or internal personnel, are a typical occurrence.

Vendor fraud can be facilitated by disorganized systems. By tracking POs, invoices, and other records, invoice reconciliation software can aid in the detection of fraud through a three-way check.

Performing invoice reconciliation can help uncover fraudsters at the source and manage their activities, whether it's supplier fraud or fraud during check payment.

2. To keep track of payments coming in from various sources. Reconciling accounts would be advantageous for you if you are aware when making economically sensible judgments.

For example, a deposit made two days ago may not appear on a bank statement, or a check written weeks ago may not have been cashed yet. In such circumstances, account reconciliation can assist you in determining the reasons for the problem and balancing your financial statement.

Tips for Effective Invoice Reconciliation

The following are some helpful hints for good invoice reconciliation:

- Deposit time and date invoices should be filed, and entries should be recorded as soon as cash is received.

- Make sure to record invoices in a systematic manner when received.

- The procedure of reconciliation must be carried out on a regular basis.

- To make the reconciliation process effective and discover any fraud, it should be done by someone other than the individual who does the accounting.

- Organize all incoming invoices into a single folder, whether it's a physical or electronic file, depending on your preference.

- Put all of your incoming bills in one folder.

- Choose the reporting period you'd like to look at.

- Gather bank statements from that time period, which are normally available through your online bank login.

- Examine incoming invoices and cross-reference them with the things on your bank statement.

- Indicate if an invoice is "finished," "unpaid," or "partially paid."

- Analyze your incoming bills to ensure that you haven't overlooked any transactions.

- Confirm any past-due or partial payments, or schedule a reminder for the due date on your planner.

- Any discrepancies must get investigated.

- To collect overdue or partially paid clients' payments, follow up with them.

Important Suggestions for Invoice Reconciliation

Although, every business have their own procedures to deal with accounting and financial aspects. However, businesses should consistently learn new tools and techniques to minimize the workload and boost accounting efficiency.

When it comes to invoicing reconciliation, there are a lot of factors to bear in mind. The first step is to ensure that you are reporting your invoices using a deposit dates format and that you are making entries as soon as you get money.

Put all of the documents in sequential sequence to make it easy to maintain track of the information. You can then eliminate the lengthy stages while doing invoice reconciliation operations.

Many company owners forget to make entries after receiving payment for their goods or services, and they won't be able to locate the missing entries during the audit. As a result, it's critical to keep track of entries as soon as you received payment for the goods, services, or commodities you supplied to your customers.

Make it a routine to reconcile invoices as soon as shipments arrive and depart. This helps to ensure the effective management of invoices. These small ideas can assist you in keeping up-to-date transaction information between you and your clients, allowing you to cross-check the details.

Frequently Asked Questions (FAQs) on Invoice Reconciliation

Following we have discussed some major frequently asked questions on Invoice reconciliation. Let’s check:

Q1: What is the Definition of a Pro Forma Invoice?

A pro forma invoice, as defined by the International Trade Administration. Further, this invoice is delivered to a customer just before the purchase has been made.

This invoice works as an important factor when a client receives an import license, arranges delivery, or communicates with government agencies.

Q2: What's the Best Way to Make an Invoice?

An invoice is a document that keeps track of the items, quantities, and prices that a customer orders. Company information, client information, invoice number and date, goods per line item, tax, and total amount are all important items on an invoice. Moreover, there are numerous free internet programs for easily creating simple invoices.

Q3: How do you Generate a PayPal Invoice?

For businesses, PayPal provides a free option that allows them to produce and send invoices directly from the source site.

All you have to do is to log into your business account, go to the Tools section, choose Invoices, fill out the invoice with the required information, and send it.

How Deskera Can Assist You?

Deskera helps you to enhance automating purchasing and finance processes, and lowering financial risks.

Generate invoices, track spending, see your inventory in real-time, bookkeeping and access financial data whenever and wherever you need them.

Learn more about how Deskera may assist you in growing your business. Get in touch today and sign up for a free trial.

Final Takeaways

You have finally reached the end of this comprehensive guide. Below we have covered some of the crucial points for your reference. Let’s revise them:

- Invoice reconciliation is the procedure of sorting and matching bank statements to the receiving and outgoing invoices.

- The invoice reconciliation method involves verifying and comparing all of the information contained in invoices.

- Reconciliation fosters financial accounting and reporting because it promotes consistency and accuracy.

- Reconciliation assists in distinguishing authentic anomalies from indicators of fraud or error.

- The simplest way to simplify this process is to use an online accounting software tool to compare your bank statement payments to your outstanding invoices.

- Begin by comparing the client statement to the invoice to ensure that the amount received corresponds to the invoice amount.

- Reconciliation accuracy can be improved by memorizing keyboard shortcuts and Microsoft Excel algorithms.

- By tracking POs, invoices, and other records, invoice reconciliation software can aid in the detection of fraud through a three-way check.

- It's critical to keep track of entries as soon as is received payment for the goods, services, or commodities you supplied to your customers.

Related Articles