An undeniable fact of running a small business is that at some point the company will have to take out a loan to advance its operations.

After all, unless the owner is managing the business just for fun, they want to expand operations in the hopes of earning more money.

Now, taking out a loan usually comes with an associated cost known in accounting as the interest expense. Interest expense is an extra percentage you have to pay to your creditor as compensation for borrowing cash from them.

Leveraging ERP.AI can simplify managing and tracking interest expenses by automating calculations, ensuring accuracy, and providing real-time financial insights, helping business owners make informed decisions effortlessly.

In this guide, we will go through the different types of interest expenses, and the appropriate steps for calculating and recording them.

What Is Interest Expense?

Any time you borrow money, whether from an individual, another business, or a bank, you’ll have to repay it with interest. The interest part of your debt is recognized as an interest expense in your business’ income statement.

In most cases, you won’t have to calculate the interest due yourself - financial institutions will send you a breakdown of the cash owed. And if you’re using an online accounting system, the software can calculate this for you.

Interest expenses can be either short or long term.

Short-term debts are paid within 6 months to a year and include lines of credit, installment loans, or invoice financing. For these types of debts, the interest rate is usually fixed at an average of 8-13%.

Long-term debts, on the other hand, such as loans for mortgage or promissory notes, are paid off for periods longer than a year. Interest rates are typically lower for these types of loans.

Difference Between Interest Expense and Interest Payable

A term you might confuse with interest expense is interest payable.

Interest expense, as previously mentioned, is the money a business owes after taking out a loan. It’s recorded as an expense in the income statement.

Interest payable, on the other hand, is a current liability for the part of the loan that is currently due but not yet paid. Since it’s a liability, interest payable accounts are recorded on the balance sheet and are due by the end of the accounting year or operating cycle.

To learn more about payables and how to record them as journal entries, head over to our accounts payable guide.

What Is the Interest Coverage Ratio?

The interest coverage ratio measures the ability of a business to pay back its interest expense. It’s important to calculate this rate before taking out a loan of any sort to make sure the business can afford to repay its debt.

Creditors and inventors are also interested in this ratio when deciding whether or not they’ll lend to a company.

A low interest coverage ratio means that there’s a greater chance a business won’t be able to cover its debt. A high interest coverage ratio, on the other hand, indicates that there’s enough revenue to cover loans properly.

Interest coverage ratio is calculated by dividing (earnings before interest and taxes) by (total outstanding interest expenses).

How to Calculate Interest Expense

Calculating interest expense is very simple:

Interest Expense = Debt Balance × Interest Rate

Let’s check out a few examples to understand this formula better.

Example 1

Let’s say a company borrows $5,000 from the American National Bank, with an annual interest rate of 5%. To calculate the exact interest expense this company has to pay we apply the formula:

Interest Expense = $5,000 × 5% = $250

This means that at the end of the fiscal year the company has to pay $250 to cover their interest expense. If you want to calculate the monthly charge, just divide the interest expense by 12.

Example 2

A company has taken out a loan worth $90,000 at an annual rate of 10%. Now, the accountant of this company issues financial statements each fiscal quarter and wants to calculate the interest rate for the last three months.

Method 1

For the entire year the amount would be: Interest Expense = $90,000 × 10% = $9,000

For one month, we divide the balance by 12: $9,000/12 = $750

And lastly, to find out the interest expense for three months, it’s: $750 per month × 3 months = $2,250.

Method 2

Using just one formula, you can find out the interest expense by multiplying the principal amount by the interest rate and then multiply by .25 (as in, one quarter-year):

Interest Expense = $90,000 × 10% × 0.25 = $2,250.

Journal Entries for Interest Expense

Before diving into some business examples on how to make journal entries for interest expenses, let’s first go over some accounting basics you’ll need to know.

Interest expenses are recorded under the accrual basis of accounting. With the accrual basis of accounting, you record expenses as they occur, not when you pay.

So, you record the interest expense as a journal entry as soon as the loan is taken out, and not when you repay it at the end of the year or month.

This is helpful to business owners as it provides a clear overview of your cash flow, and that's what potential investors will want to see, too.

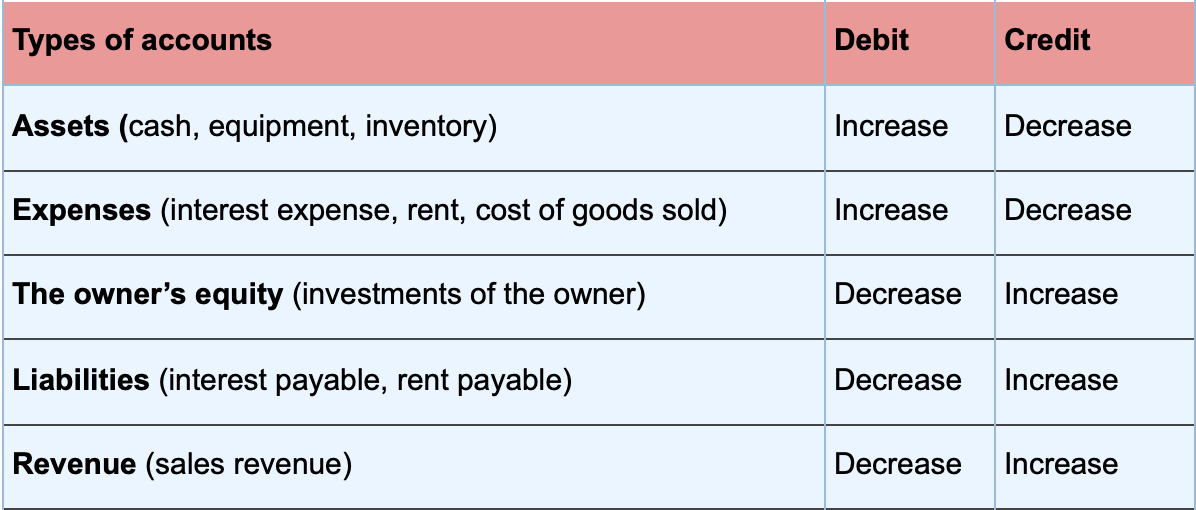

Next, to make a journal entry means to debit one account and credit another.

The interest expense account is always debited.

And since usually we don’t pay for interest expenses right away, the other account part of the journal entry is interest payable, which is a liability account representing the debt. Interest payable is therefore credited.

Here’s a chart of accounts with their corresponding debits and credits to understand the concept better:

Now that we covered all of the basics, let’s check out some examples.

Example 1

An advertising agency signs a $6,000, 3-month note payable (a type of loan) with an annual rate of 10% on October 1st.

Now, since the business works under the accrual basis of accounting, the interest expense will be recorded at the end of the month, for the next 3 months.

So, the recording of the interest expense will be on October 31st, for just one month of the year.

Step 1: Determine the interest expense amount, using the interest expense formula:

$6,000 (principal amount) × 10% (annual interest rate) × 1/12 (time in terms of the year) = $50 per month

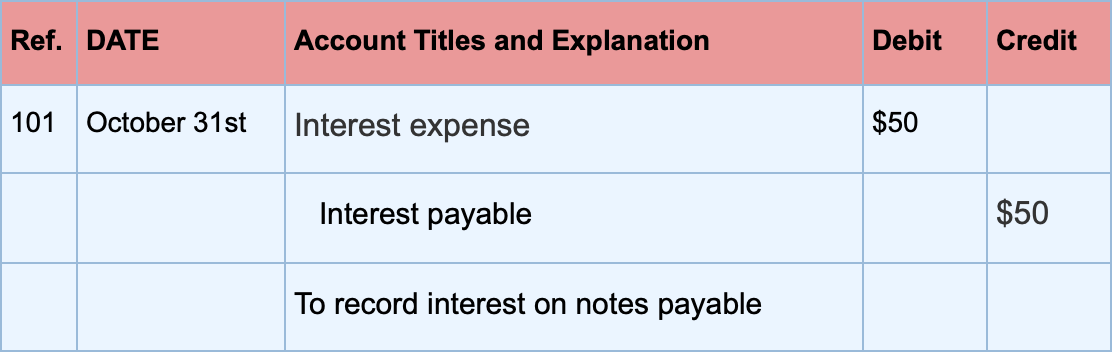

Step 2: Make a journal entry for the end of the month, October 31st.

This step is repeated for the month of November and December. In the end, journal entries will total $150 worth of interest expense and interest payable.

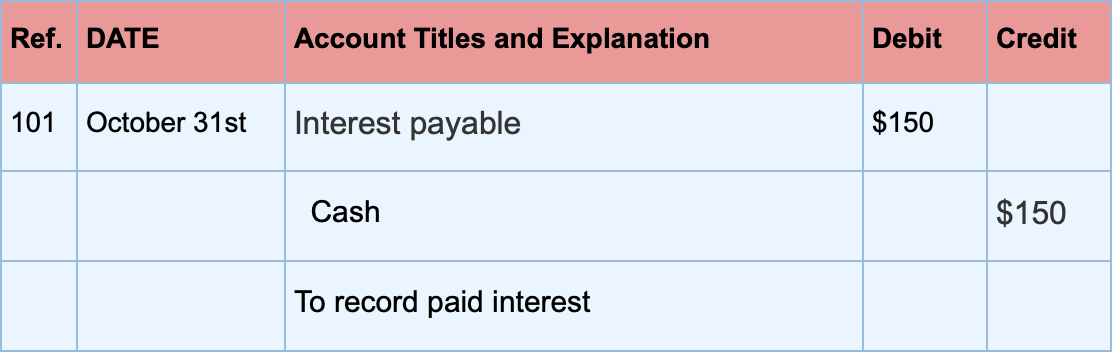

Now, when you pay your interest, the interest expense account doesn’t change.

The entry that is made is to interest payable, it recognizes the payment is made and decreases cash accordingly:

Example 2

A construction company takes out a 12-month bank loan of $60,000, with a rate of 8%.

Let’s figure out the monthly interest expense:

Monthly Interest Expense = $60,000 × 8% × 1/12 = $400

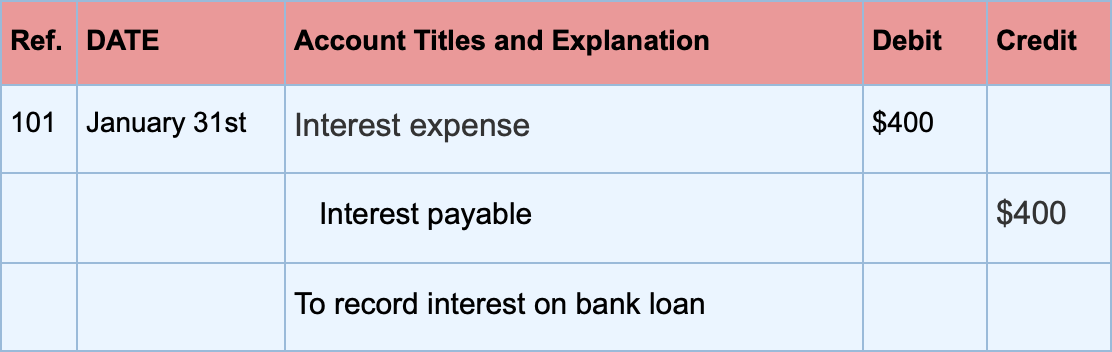

The journal entry for the end of the month (for every month of the year) would be:

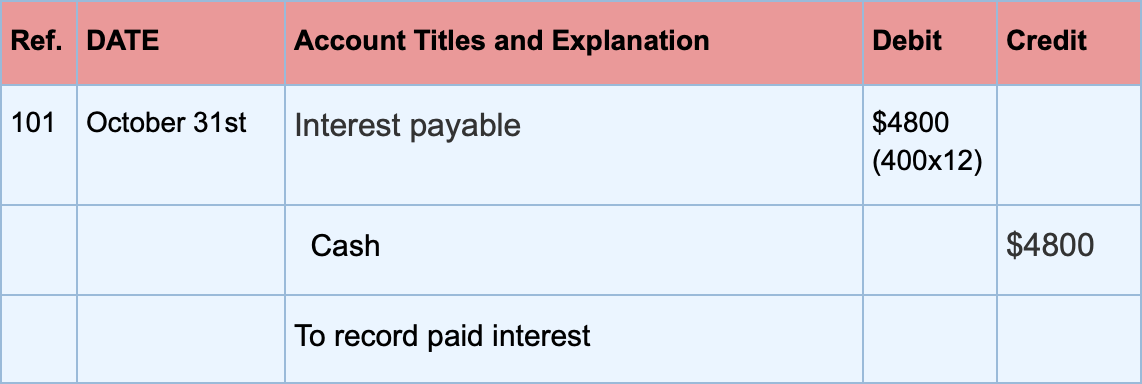

After the interest owed is paid back to the bank, the accounts are adjusted as follows:

How AI Is Optimizing Financial Management

In the realm of interest expense management, AI facilitates precise forecasting by analyzing historical data and market trends, enabling businesses to anticipate and plan for interest obligations effectively.

Additionally, AI-driven tools assist in identifying cost-saving opportunities by evaluating various financing options and their associated interest impacts. By integrating AI into financial operations, businesses can achieve greater transparency, optimize cash flow, and make informed decisions that enhance overall financial health.

Automate Expenses with Accounting Software

Manually writing down debit and credit entries can get tiring and time-consuming fast.

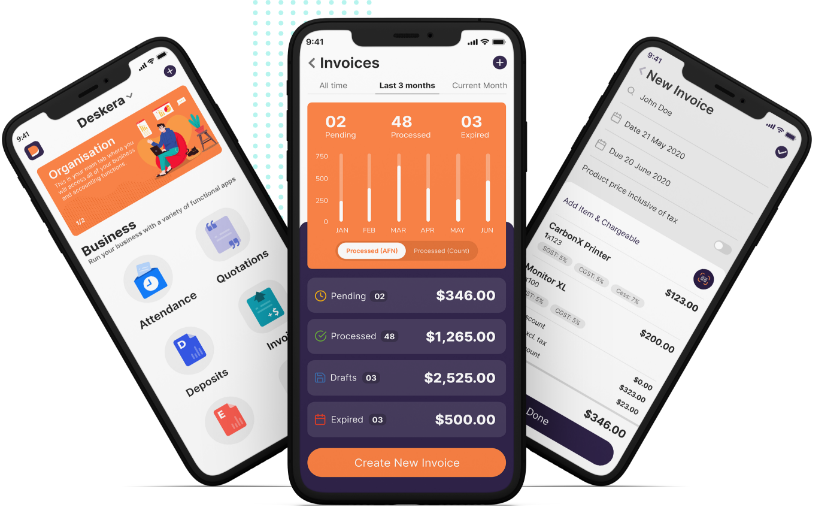

That’s why most businesses choose to manage their expenses with cloud accounting software like Deskera.

Deskera is an intuitive, user-friendly software you can use to automate not just expenses, but almost every part of your accounting process.

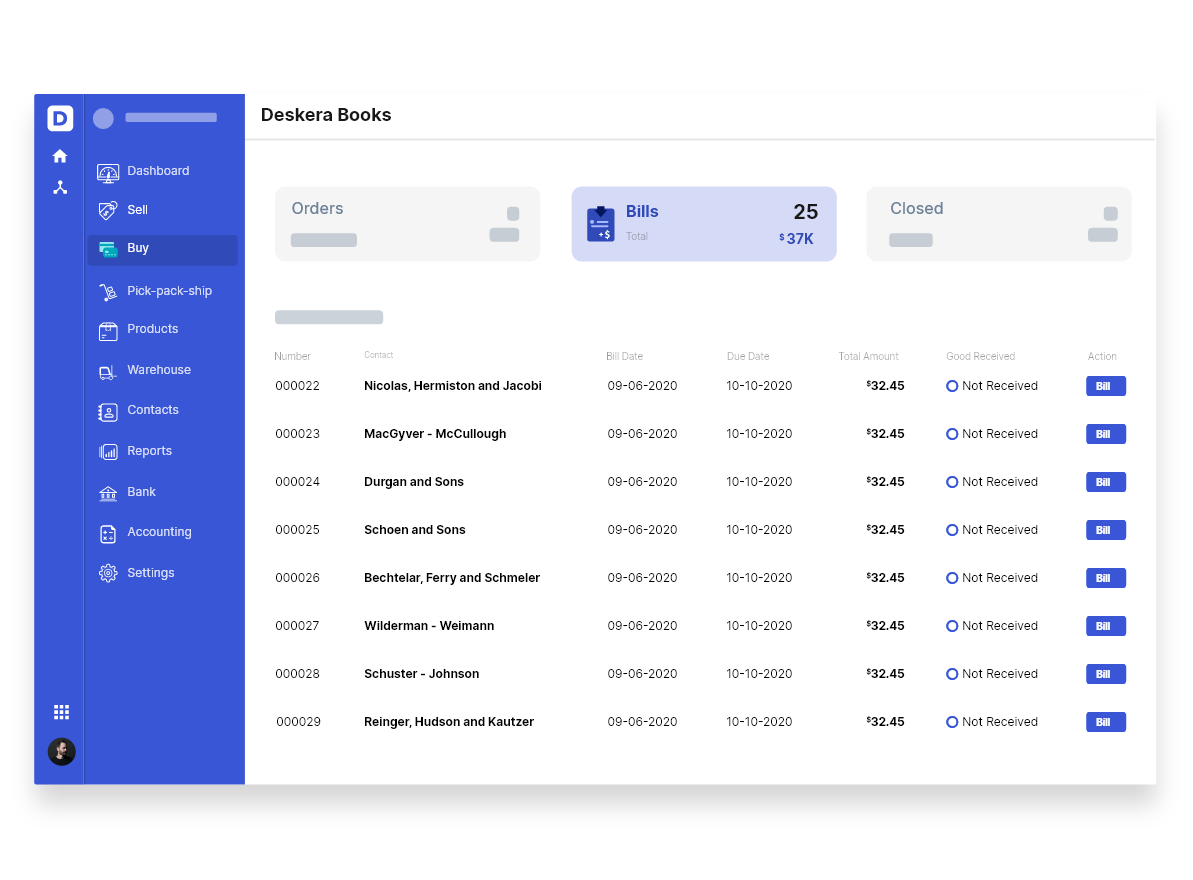

With Deskera’s Buy dashboard, you can make orders and send payments within seconds, and easily organize and review bills and invoices on the go.

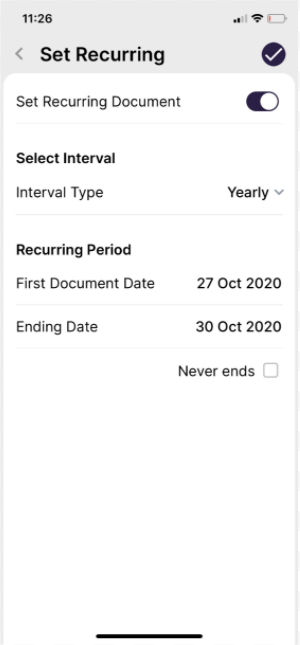

Don’t want to manually send the same interest expense to your bank every month? No problem!

Deskera allows you to automate your recurring invoice payments with just a few clicks.

Just fill in the recurring date and interval, and you’re good to go!

The best part? The software is accessible from anywhere, at any time! All you have to do is download the Deskera mobile app on your phone.

Start right away, by signing up for a free trial! No credit card details needed.

Interest Expense FAQ

#1. Why Is Interest Expense a Non-operating Expense?

Operating expenses include costs for maintenance, utilities, rent, employee payroll, etc, that have to do with the regular day-to-day activities of a business. An interest expense isn’t related to any of these core operations, which is why it’s considered a non-operating expense.

#2. What’s the Difference Between Interest Expense and Interest Income?

Interest expense and interest income are opposites.

If interest expense is the cost of borrowing money, interest income is the interest percentage you would receive if your business is the party lending the cash.

#3. Is Interest Expense a Debit or a Credit?

Interest expenses are debits because in double-entry bookkeeping debits increase expenses. Credits, in this case, are usually made for interest payable since that account is a liability, and credits increase liabilities.

#4. What’s the Difference Between Interest Expenses and Prepaid Expenses?

Prepaid expenses are payments made in advance for an expense that will be delivered in the future. Although the word expense is in their title, they are recorded as assets on the balance sheet.

While interest expense is an expense account in the income statement, that represents the total amount of the interest from borrowing cash.

Key Takeaways

And that’s a wrap on our interest expense guide!

Before leaving, let’s review some of the main points we’ve covered:

- The percentage you have to pay when borrowing money and taking out loans is called an interest expense.

- For short-term debts, interest rates are usually higher, while the opposite applies to long-term ones.

- Interest expense represents the total cost of the interest, whereas interest payable is the account that records the unpaid balance of interest.

- To measure the ability to pay back interest, businesses can use the interest coverage ratio.

- Calculating the interest expense can be done by multiplying the debt balance with the interest rate and time period.

- Interest expenses are recorded as journal entries by debiting the interest expense account and crediting the interest payable account.

Related Articles