Payroll taxes are levied by the federal, state, or local governments to fund public programs. These are paid by direct contributions from the employer and deductions from the employee's wages. Examples of payroll taxes are Medicare, which provides health insurance for adults aged 65 and over, and social security, which provides retirement income to adults aged 62 and over, certain disabled people, and survivors of certain taxpayers.

Kevin, who is an IT professional at Michigan, was confused about why he would be paying something that is similar to the payroll taxes as per Indiana payroll taxes. This is because it is a reciprocal state. You must learn about what Indiana payroll taxes is all about.

Table of Contents

- A step-by-step guide to payroll in Indiana

- Indiana Payroll Laws, Taxes, and Regulations

- Indiana State Payroll Taxes

- Unemployment insurance

- Unemployment Tax

- Workers' accident compensation insurance

- Indiana Minimum Wage Act

- Overtime policy

- Minimum payment frequency

- Wage Withdrawal Rule

- Salary or leave prepayment

- Final salary method

- Unpaid leave is considered deferred wages

- Indiana Family Leave Act

- Indiana Human Resources Development Act

- Indiana State W4 Form

- Conclusion

- Key Takeaways

Introduction

To pay salaries in Indiana, whether for full-time, part-time, temporary, or seasonal employment, you must comply with some state regulations in addition to federal payroll laws. Indiana has a state income tax rate of 3.23%, and the county also has its withholding taxes that need to be calculated. There are also five state reciprocal agreements.

This means that if you are in one of the alternative states, you will withhold taxes based on where your employees live and work. Other wages and staff laws are generally simple.

A step-by-step guide to payroll in Indiana

Step 1: Register as an employer

You need a Federal Employer Identification Number (FEIN) and an electronic Federal Taxation System ( EFTPS).

Some details are:

- Employee's Withholding Tax Exemption Certificate-WH-4

- Supplemental Rate-3.23%

- Indiana State Unemployment Insurance (SUI)

- Indiana Wage Base, $9,500 for 2021

- Indiana SUI Rates range from 0.50% to 9.4% for 2021

- Indiana new employer rate-2.50% to 2.96% for 2021

- Indiana's new construction employer rate-2.53% for 2021, unless certain conditions are met

Step 2: Register with Indiana

Register your business with INTIME, an information management engine for Indiana taxpayers. You will need the EIN, company name and address, and the names of company officers. Then create an account and submit taxes and other documents. You must also register as a new business on the Uplink Employer Self Service website to pay the state unemployment insurance tax.

Step 3: Set up the payroll process

You must register a payroll process and schedule at least a biweekly or once-a-month payday. Determine how you pay your employees, how long each payday covers them, and the process. Follow the instructions to collect employee forms and other payroll documents.

Step 4: Collect employee payslips

The form contains W4, I-9, and direct deposit information. For Indiana, you will need WH4 or WH4MIL, and for employees who live in a mutually beneficial state, you will need WH47.

Step 5: Collect, review and approve timesheets.

If you have an hourly or part-time employee, you need to track that time. Most employers create their timesheets or use time tracking software. You can use the free timesheet calculator to make sure the totals are correct. Be sure to schedule approvals so that you can pay your employees within 10 days of the end of the payment period. If the normal payment date is a holiday, schedule the payment the day before.

Indiana Reciprocal States

- Kentucky

- Pennsylvania

- Michigan

- Ohio

- Wisconsin

Step 6: Calculate salary and pay employees

You can use a payroll calculator by just entering your salary amount, W4, and Indiana state information and calculate the following:

- Indiana Salary Paycheck Calculator

- Indiana Hourly Paycheck Calculator

- Indiana Gross-Up Calculator

- Indiana Bonus Tax Percent Calculator

- Indiana Bonus Tax Aggregate Calculator

- Indiana 401k Calculator

- Indiana Dual Scenario Salary Paycheck Calculator

- Indiana Dual Scenario Hourly Paycheck Calculator

Step 7: Declare payroll taxes to the federal and state governments

Follow the IRS instructions for federal taxes, including unemployment.

Indiana Income Tax: Withholding must be submitted electronically on a schedule. If you have filed a tax withholding tax in the past, you will still need to withhold the tax even if you have not borrowed anything. The state reassesses tax withholding each year and tells you the schedule to follow. The new company will follow a schedule set based on the expected withholding tax.

- If your monthly withheld average tax is $83.33 or less, you must file it every year and it should be paid 30 days after the end of the month

- If your monthly withheld average tax is $83.33 or less, you must file it every year and it should be paid 30 days after the end of the month

- If your monthly withheld average tax is Over $1,000, you must file it early and it should be paid 20 days after the end of the month

State Unemployment Tax (SUTA)

You must pay SUTA by entering the information manually or in a CSV file. If you have more than 50 employees, you need a CSV or ICESA file.

Step 8. Document and save your payslip

In Indiana, employee records must be retained for a minimum of 3 years. The information should consist of all the relevant details required by the federal Labor Standards Act like your personal details, contact number, etc.

Step 9. Create a year-end payroll taxes report

You must submit Federal Form W2 (for employees) and 1099 (for contractors). You will also need to submit the Indiana WH 3rd Annual Withholding slip. If you file more than 25 withholding tax returns in a calendar year, this must be done electronically.

Indiana Payroll Laws, Taxes, and Regulations

- In any state, you must comply with federal income tax, social security, Medicare, and federal unemployment insurance (FUTA) laws. You should withhold 6.2% of each employee's social security check and 1.45% of social security

- Medicare tax; you also have to pay the corresponding amount from your bank account. FUTA earns up to $ 7,000 and is 6%.

- Indiana Taxes range from 3.23% and county taxes range from 0.5% to 2.864%. There are reciprocal agreements for the five states you need to know

- SUTA runs from 0.5% and 7.4%. State Income Tax Indiana has a flat rate of 3.23%. However, each county collects taxes at tax rates ranging from 0.5% to 2.864%

- Withholding tax is based on the employee's county of residence in Indiana as of January 1 of the tax year. If you live outside the state, use the county you live in

- Visit the Indiana Treasury website for deduction tables, county codes, and rates. There are two tables. One is for personal deductions and the other is for dependent deductions. The exemption is stated on Form WH4

- Reciprocal Tariffs Indiana has reciprocal tariffs with Kentucky, Michigan, Ohio, Pennsylvania, and Wisconsin. All salaries, wages, tips, and commissions earned by Indiana residents residing in these states must be reported as if they were earned in Indiana

- Similarly, residents of these states who earn income in Indiana must report and tax their income in the state in which they live

- Out-of-state employees are required to fill out an IT40RNR form when earning wages, salaries, tips, or commissions

Indiana State Payroll Taxes

- Indiana has a payroll taxes rate of 3.23%.

- Indiana County Payroll Taxes is applicable for 92 counties in Indiana and applies to employees who are residents of the county.

Unemployment insurance

Unemployment is if you have an insured person's accident compensation of $ 1 or more, have acquired some or all of the business that pays the state's unemployment tax (SUTA), are responsible for another state, and have employees in Indiana.

Seasonal work: Seasonal workers only lose their jobs if they lose their jobs during the business season. So if you are for a seasonal job, hiring a tourist attraction and doing a seasonally categorized job will help lower your SUTA. These jobs need to be significantly different from year-round jobs to qualify.

Unemployment Tax

Indiana's unemployment tax is levied on the first $ 9,500 of employee income, ranging from 0.5% to 7.4%, with a new employee tax rate of 2.5%. Prices are based on experience credits as of June 30 and payslips for the last 36 months.

In addition, if you do not pay the premium within 10 days from the date requested in the Merit Rate Overdue Notice, you will be charged a 2% penalty. You should receive a notification with the applied rate, but you can find out how to calculate the rate and experience credits on the Indiana website.

If you pay SUTA, you may be eligible for a refund of up to 5.4% of federal unemployment insurance tax.

Workers' accident compensation insurance

If you have more than one employee, you will need to take out Workers' Accident Compensation Insurance. Fortunately, Indiana is one of the most cost-effective states to buy workers' accident compensation insurance. Several insurance companies offer insurance. You don't need to include company leaders in your coverage unless you need to.

Other exempt workers include temporary workers, agricultural workers, domestic workers, and independent contractors. You can take out self-insurance, but you must show that you can afford to cover the injured employee. Also, you or your parent company must be open for at least 5 years without interruption. Self-insurance requires a guarantee of at least $ 500,000 and you pay a state annual fee to maintain your certificate.

Indiana Minimum Wage Act

The Indiana minimum wage remains at $ 7.25 per hour. Employees who receive the tip must be paid at least $ 2.13, and at least the minimum wage will be paid when the tip is added. If not, you need to make up for the difference.

Employees under the age of 20 are eligible to receive an apprenticeship wage of $ 4.25 per hour for the first 90 days of work. Students who work part-time up to 20 hours a week are exempt from the minimum wage to study. Under certain circumstances, if the minimum wage is exceeded, you may be required to pay the applicable wage.

Overtime policy

Overtime includes all the time you work more than 40 hours a week, which is 1.5 times the normal wage of an employee. You must pay this to qualified hourly or other non-exempt employees. Failure to comply will result in fines and fines. The exceptions are:

- Executives, clerks, and other professionals who earn at least $ 455 a week

- Housing housekeepers

- External salespeople

- Clerk artists

- Some transportation, agriculture, And agricultural workers

- Some computer workers (usually those who set their time)

- Certified Instructor

Use the free overtime calculator to avoid making mistakes that can lead to overestimation or underestimation of payroll taxes. Various Payment Methods for Employees In Indiana, employers must pay wages by check, draft, money order, or direct wire. However, you cannot force employees to accept deposits directly. Payroll cards are not treated, but workers must pay the full wage (that is, payroll cards cannot record a percentage), or they must pay that percentage for the wages they earn.

Salary method In Indiana, your payslip must include a list of working hours, wages paid, and deductions made.

Minimum payment frequency

Wages must be paid at least every 6 months or every 2 weeks, within 10 business days after the end of the wage period. Employees can request payment every other week and you have to commit.

Wage Withdrawal Rule

Indiana cannot deduct more than 25% of an employee's available weekly salary or an amount whose weekly wage exceeds 30 times the state's minimum hourly wage. Indiana grants the following deductions required by law or court and required by employees:

- Premiums

- Charitable Donations

- Purchase of Employer's Bonds, Stocks, or Shares

- Union Fees

- Products Sold to Employees by Employers

- Amount Loans from Employers are Provided to Employees

- Healthcare

Purchase uniforms or equipment, up to $ 2,500 per year ($ 48.08 per week) or 5% of the employee's weekly disposable income

Compensation for education or employee skill development

Salary or leave prepayment

Employer-provided products, unless education or employee skill development is provided through a federal, state, or local economic development incentive program.

Goods, or Food Benefits on employee's written request for use or consumption by the employee

Final salary method

If an employee retires permanently or temporarily, pay the final salary by the next normal payday. is needed. The final salary should include the incurred PTO or vacation salary. You don’t have to pay severance pay. If you choose to provide this, make sure it is included in your employment contract. Unpaid paid leave Indiana has no paid or vacation policies. Therefore, it is up to you to set guidelines when hiring. All agreements you make are legally binding.

Unpaid leave is considered deferred wages

Paid sick leave In Indiana, you don't have to take sick leave. However, if you agree to paid sick leave, you cannot refuse a benefit or reduction of benefits due to age, gender, country of origin, or religion.

Indiana Family Leave Act

Indiana is subject to federal law on family vacations. Federal FMG applies to employers who have employed at least 50 employees in the 20 weeks of the current year or the previous year. This allows employees to take up to 12 weeks of unpaid leave for any 12 months to deepen ties with new children, deal with serious health problems, and prepare for family emergencies during military service. You can deal with it.

Indiana Human Resources Development Act

Affecting Salaries Indiana law is usually based on federal law or treaties. However, the underage employment law was changed in July 2021 and is noteworthy. Report on Indiana New Employees You must report a new employee or re-employed employee who has returned to work after 60 days of notice, layoff, leave, turnover, or unpaid leave.

Do this on the new employee's website within 20 days of hiring or rehiring. The instructions there are guides to completing the report. At a minimum, you must provide the employee's name, address, social security number, date of employment, company name, address, and FEIN.

- Lunch and other break requirements In Indiana, you don't have to take a meal break for employees of all ages.

- Meal breaks are usually 30 minutes or more, but in some situations, they can be shorter.

Indiana has federal laws prohibiting minors from working in dangerous industries. She recently updated the list of banned professions for minors. Here are some examples, but for more information, including specific definitions, visit the youth recruitment site. The prohibited occupations for 16 and 17 years old are:

- Working near explosives or manufacturing explosives

- Extract coal

- Forest firefighting, forestry, logging

- Sawmill operation

- Working near radioactive materials

- Operate a bakery machine

- Operate circular saws and other power saws

- Canopy or Excavation

Indiana State W4 Form

You pay to withhold tax through Payroll INTIME, but other required payslips are available in PDF format and can be downloaded or filled out online.

- Indiana W4 Form The Indiana withholding tax exemption form is WH1.

- WH1U is for underpayment and WH3 is for year-end tax withholding.

- These are only sent via INTIME

- Other Indiana Salary and Tax Forms WH4:

- Non-resident military spouses must complete WH4MIL to be tax-exempt.

- WH47: Certificate of residence for non-Indiana residents of Reciprocity.

- Additional salary forms can be found on the Indiana Government website.

- Federal Salary Form -W4 Form

- Helps employers calculate taxes withholding from employee salaries

- W2 Form: Report total annual wages earned (one for each employee)

- W3 Form: Report total wages and taxes for all employees

- Form 940: Calculate reports and IRS unemployment taxes

- Form 941: Report of quarterly income and FICA tax withheld from salary

- Form 944: Report of annual income and FICA tax withholding from salary

- Form 1099: Non-employee to help the IRS assess taxes on contract work. It provides information about employee salaries.

Conclusion

Revenue Mutual recognition of county taxes and neighboring states complicates Indiana payroll taxes, but otherwise, it's very easy. Depending on the amount of withholding, you will have to pay the withholding monthly, quarterly, or yearly.

SUTA is calculated quarterly. Industry group insurance should also be considered, and there is some generosity in planning minors. But overall, the process is simple, and the Indiana Government website has guiding documentation.

How Can Deskera Assist You?

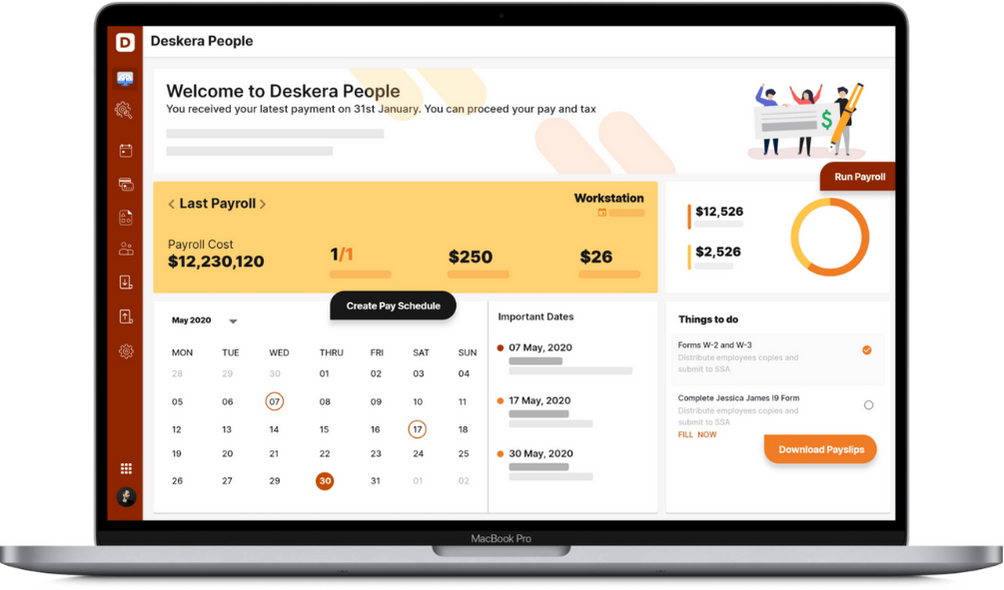

As a business, you must be diligent with employee leave management. Deskera People allows you to conveniently manage leave, attendance, payroll, and other expenses. Generating payslips for your employees is now easy as the platform also digitizes and automates HR processes.

Key Takeaways

- Indiana Payroll taxes are applied by the government for specific programs

- Payroll taxes are withheld from every employee's salary and submitted to the government

- In the U.S., different states have their specified payroll taxes which are used to provide benefits like medical facilities and Social Security

- Payroll taxes are a part of the government's general fund

Related Articles