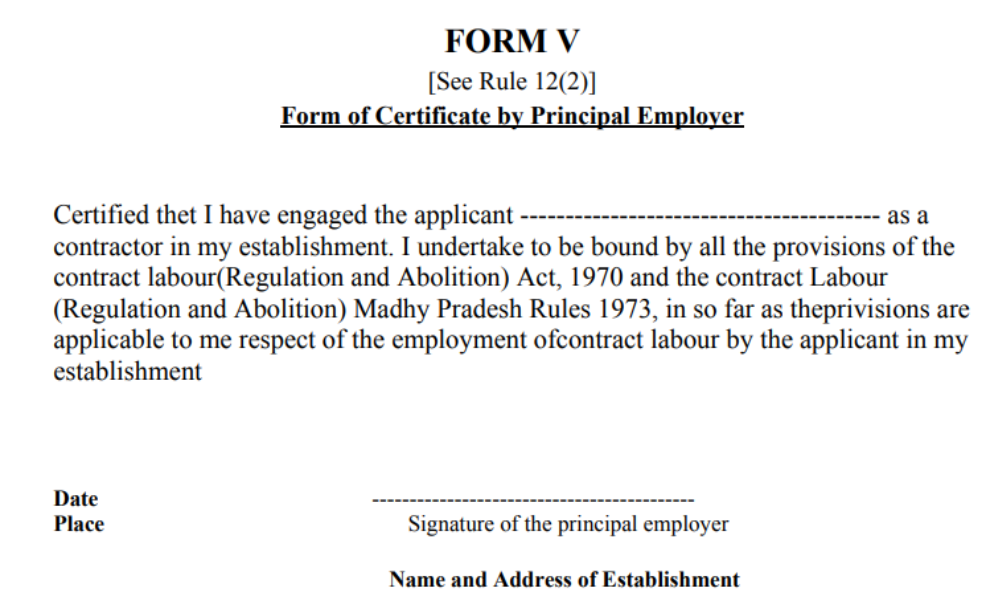

Form V is a certificate issued by the principal employer to a contractor in India under the Contract Labor (Regulation and Abolition) Act 1970. It certifies that the contractor has fulfilled all the obligations required under the Act, including the payment of wages and the provision of facilities like canteen, restrooms, and first aid, among others.

The form also indicates that the principal employer has paid the prescribed amount of contribution to the Labor Welfare Fund on behalf of the contract workers.

As per the laws governing labor in India, it is mandatory for the principal employer to issue a Form V certificate to the contractor. This certificate not only ensures compliance with legal requirements but also serves as proof of a mutually beneficial relationship between the two parties.

In this article, we will explore the importance of the Form V certificate and how it benefits both the principal employer and the contractor.

- History of Form V in India

- What is Form V?

- What is The Contract Labor (Regulation & Abolition) Act 1970?

- Eligibility Requirements

- Benefits of Form V

- Processing Time for Form V

- Common Mistakes to Avoid When Applying for Form V

- Conclusion

- How can Deskera Help You?

- Key Takeaways

- Related Articles

History of Form V in India

The history of Form V: Form of Certificate by Principal Employer to Contractor in India dates back to the early 20th century when it was introduced as part of the Contract Labor (Regulation and Abolition) Act, 1970. This form is used to provide the certificate of payment of wages to the contractor and is generally issued by the principal employer at the end of the contract.

We know that all employment letters contain details such as the contractor's name, the period of the contract, the number of workers employed, the rate of wages, the number of wages paid, and other particulars. It also contains a declaration by the principal employer that the wages have been paid in full.

The Form V is used to confirm that any welfare measures or benefits provided to the workers have been complied with. This form is important for contractors to demonstrate that they have fulfilled their contractual obligations to the principal employer.

What is Form V?

Form V is a form of a certificate provided by the Principal Employer to the Contractor in India. It is used to certify that the contractor has fulfilled all the requirements as specified in the contract. The form is an important document in the process of obtaining payment from the contractor.

Fundamentally, it is a certification from the employer that the individual is a part of his establishment and works as a contractor.

The form also states that the employer is bound by and will abide by all the provisions of the contract labor Act. This Act is also known as the Regulation and Abolition Act, 1970.

The employer is also bound by the provisions of the Labor Regulation and Abolition Madhya Pradesh Rules, 1973.

What is The Contract Labor (Regulation & Abolition) Act, 1970?

This Act governs the employment of contract labor in certain establishments, provides for the abolition of contract labor in certain circumstances, and addresses other related issues. Central and state rules are developed to ensure that the Act is effectively administered and monitored.

It applies throughout India to any establishment or contractor who employs or employed 20 or more workers on any day in the preceding 12 months, as contract labor registration is required to employ contract labor.

Gist of The Contract Labor (Regulation & Abolition) Act, 1970

The Contract Labor (Regulation & Abolition) Act of 1970 is an Act of the Parliament of India that regulates the conditions of work of contract labor in India. It was enacted to provide for the regulation of the employment of contract labor and to prohibit its employment in certain circumstances.

- The Act provides for the registration of contractors, licensing of contractors, and conditions of service of contract labor.

- It also provides for the abolition of contract labor and the payment of compensation for the loss of employment.

- The Act lays down the rights and obligations of the contractors, employees, and the principal employer.

- It also provides for the establishment of Advisory Boards at the central and state level to advise the government on the implementation of the Act.

Eligibility Requirements

Here are the requirements for the contractor and the principal employer.

- The contractor must be registered with the Contract Labor (Regulation & Abolition) Act of 1970.

- The contractor must have a valid registration under the Shops and Establishments Act and the Employees' State Insurance Act of 1948.

- The contractor must have a valid license or certificate of registration issued by the appropriate authority.

- The contractor should provide proof of having paid the minimum wages and other statutory dues to its employees.

- The contractor must have a valid and updated registration with Goods and Services Tax (GST).

- The contractor should provide evidence of having maintained adequate records of employee attendance, wages, deductions, and other payments.

- Form V should be obtained by the contractor before the commencement of the work.

- The contractor should have the necessary manpower, machinery, equipment, and other resources to carry out the work as required by the principal employer.

Benefits of Form V

The following points summarize the benefits of Form V:

- Provides proof of the agreement between the contractor and the principal employer: Form V serves as a legal document that establishes the agreement between the contractor and the principal employer. This helps both parties to avoid any potential disputes in the future.

- Facilitates payment of wages: Form V also serves as proof that the wages of the contractor have been paid by the principal employer. This helps to ensure that the contractor receives the correct amount of wages for the work they have done.

- Protects the rights of the contractor: Form V ensures that the rights of the contractor are protected. This includes their right to receive the agreed wages, to receive payment on time, and to receive any other benefits that have been agreed upon by both parties.

- Helps to prevent disputes: Form V helps to prevent any disputes between the contractor and the principal employer as it establishes the terms and conditions of the agreement. This helps to avoid any misunderstandings or disputes between the two parties.

Processing Time for Form V

The processing time for Form V: Form of Certificate by Principal Employer to Contractor varies depending on the type of contractor and the complexity of the project. Generally, it can take anywhere from a few days to several weeks to process the form.

It is important to note that the processing time may be affected by the number of contractors involved in the project and the complexity of the project. Additionally, the processing time may also be affected by the availability of resources, such as time and personnel, to process the form.

Common Mistakes to Avoid When Applying for Form V

All government forms need to be filled in with special care. There are a host of factors that must be taken care of. The same goes for Form V. The following points help us get information about the common mistakes to be avoided when applying for Form V.

- Not providing all the required information: Make sure to fill out the form completely and accurately. Provide all the necessary information required, such as the name of the contractor, contact information, and other relevant details.

- Not getting the signature of the employer: Make sure to get the signature of the employer on the form. Without this, the form isn’t valid, and the contractor won’t be able to take advantage of the benefits of the form.

- Not filing the form on time: Make sure to file the form within the specified time frame. Filing it too early or too late may delay the process and result in the form not being accepted.

- Not attaching supporting documents: Make sure to attach all the necessary documents along with the form, such as the contract of employment, payslips, and other relevant documents. These documents help to prove the information provided in the form.

- Not keeping a copy of the form: Make sure to keep a copy of the form with you once you’ve submitted it. This will help you in case you need to refer to the form in the future.

Conclusion

In conclusion, Form V is a crucial document that serves as a certificate from the principal employer to the contractor in India. The purpose of this form is to ensure that the contractor is adhering to all the applicable labor laws and regulations, including minimum wage and social security obligations. The form also serves as evidence of the contractual relationship between the principal employer and the contractor.

It is important for both the principal employer and the contractor to understand the significance of Form V and ensure that all the necessary details are accurately filled in. Any discrepancies or errors in the form can lead to legal implications, fines, and penalties.

In addition, it is essential for the principal employer to monitor the contractor's compliance with all labor laws and regulations throughout the duration of the contract. This will help to prevent any potential disputes and ensure that the work is completed within the legal framework.

Overall, Form V plays a critical role in maintaining transparency and accountability in the employer-contractor relationship, and it is important for both parties to understand its significance and comply with all the relevant laws and regulations.

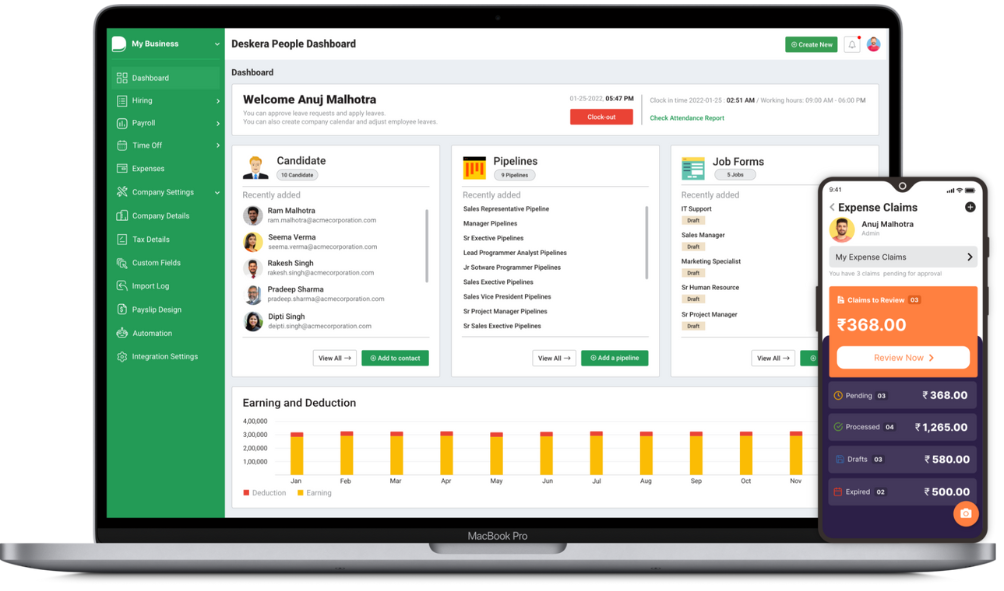

How can Deskera Help You?

Deskera People is a human resources software solution that assists businesses in managing employee data and tracking performance. It assists organizations in managing employee attendance, payroll, benefits, recruitment, and other HR functions. It also provides analytics and reporting to help you make better decisions.

It is cloud-based, safe, and simple to use. It assists businesses in streamlining and automating their processes, resulting in greater efficiency and cost-effectiveness.

Deskera Books for assisting with automated accounting, and invoice creation.

Deskera CRM for extraordinary customer relationship management.

Deskera ERP for unparalleled and cost-effective enterprise resource planning.

Deskera MRP for helping manufacturers in optimizing their administrative jobs and much more!

Deskera's various modules are appropriate for businesses of all sizes, from startups to established corporations. It offers a simple, unified platform for businesses to manage their operations more effectively and efficiently.

Key Takeaways

- Form V is a certificate issued by the principal employer to a contractor in India under the Contract Labor (Regulation and Abolition) Act of 1970.

- It certifies that the contractor has fulfilled all the obligations required under the Act, including the payment of wages and the provision of facilities like canteen, restrooms, and first aid, among others.

- The form also indicates that the principal employer has paid the prescribed amount of contribution to the Labor Welfare Fund on behalf of the contract workers.

- The history of Form V: Form of Certificate by Principal Employer to Contractor in India dates back to the early 20th century when it was introduced as part of the Contract Labor (Regulation and Abolition) Act, 1970.

- The form contains details such as the contractor's name, the period of the contract, the number of workers employed, the rate of wages, the number of wages paid, and other particulars.

Related Articles