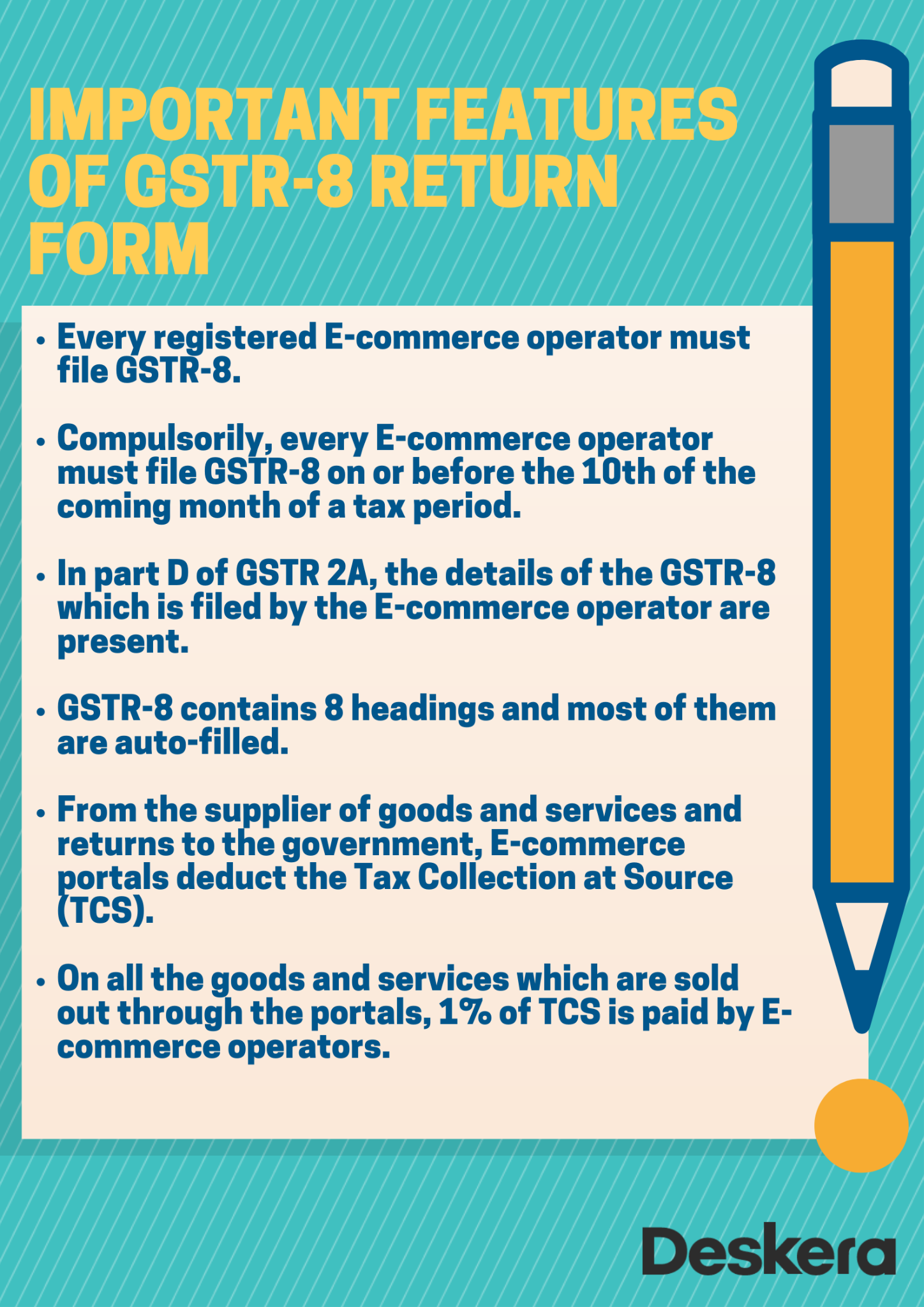

For every e-commerce operator, filing GSTR-8 is a must to accumulate TCS(Tax Collected at Source), for all taxable supplies made through it. The tax collected at source by thee-commerce dealer and the complete information for these supplies needs to be mentioned every month by visiting the GST portal, in the Form GSTR-8.

Every month, one can file the return in Form GSTR-8 by visiting the GST Portal. However, the GSTR-8 filing for a specific month needs to be done upon completing that particular month.

In this article we will find out more about GSTR 8 format, eligibility to file, due date, penalties, the return filing process.

Let’s get started!

What is GSTR-8 Return?

GSTR-8 is an exceptional GST Return that needs to be filed by e-commerce companies that deduct Tax Collected at Source(TCS) from their customers. The return consists of supplies that an e-commerce operator makes through their online platform and TCS collects on these supplies.

Every e-commerce company operating and making supplies in India needs to file GSTR-8 and be registered under GST. For GST, any person who makes supplies through an online platform is treated as an e-commerce operator.

For Example, Mr. A registered himself in www. amazon. In and sold laptops through amazon. Any sale made on amazon, the amount is received by amazon and later paid to Mr. A at the end of the month. Amazon will deduct his commission and also collect TCS from Mr. A. The rest amount will be paid to Mr. A. Then amazon needs to file GSTR 8 showing all supplies made through his platform.

The Purpose of GSTR-8 Form

The primary purpose of the GSTR 8 format is to maintain the right information regarding the TCS amount which e-commerce operators collect on supplies made through their platform.

It ensures that there is a seamless flow of input credit to the suppliers who have paid TCS to the e-commerce operator. In Part C of the GSTR-2A return form, the respected supplier can view the TCS details.

The collected TCS by the e-commerce operator goes directly to the government, which the concerned supplier can eventually recover through the Input credit mechanism.

Due Dates for Filing GSTR-8 Form

An E-commerce operator can file GSTR-8 after the month ends and the last date to file the details is the 10th of the following month of the tax period.

GSTR-8 Late fees & Penalty

For GSTR-8 late filing, both penalty and interest will be required to pay for registered taxpayers.

Late Fees

The registered taxpayers must pay a penalty of Rs 100 under SGST and Rs.100 under CGST. In simple words, a total of Rs.200 per day will be charged to the taxpayer. Rs. 5000 is the maximum amount calculated that is to be charged.

Interest

The interest rate of 18% per annum needs to be paid by the taxpayer. Then, based on the tax to be paid, the taxpayer calculates the interest.The interest will be applied from the next day of the due date to the date of actual payment.

Details Furnished in GSTR-8 Form

On the GSTIN Portal, the GSTR 8 form can be filed online by registering and signing in to your account. Following details will be included.

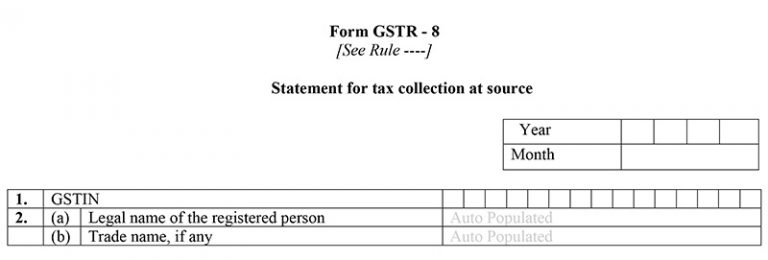

1 & 2. Details of Taxpayer

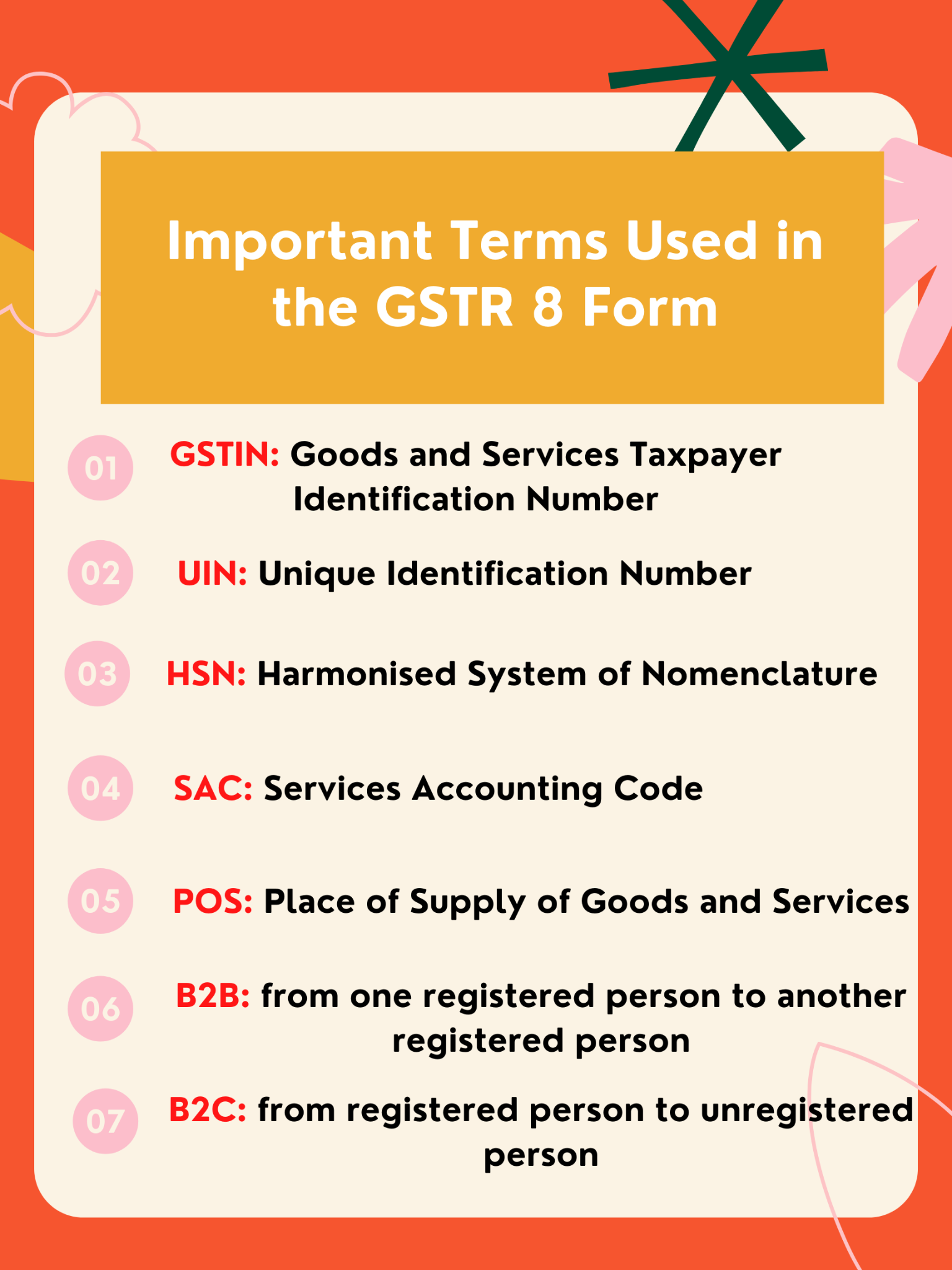

a. GSTIN: At the registration time, the 15-digit Identification Number is assigned to you.

b. Legal name of the GST registered person: Based on the GSTIN, the name of the registered taxpayer will auto-populate.

c. Year & Month of the tax period.

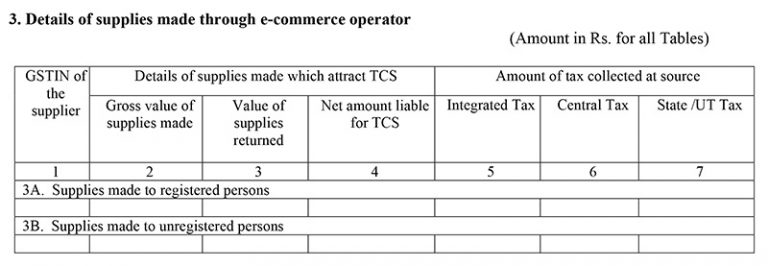

3. Details of supplies made through e-commerce platform

This section will include the supplies' gross value made through your e-commerce platform to registered and unregistered persons and the value of supplies these recipients returned. The TCS net amount liable would be the difference between the total supplies made and returned.

Table 3A contains the supplies details made B2B, or to the registered business/person. It will also include their GSTIN, the total supplies gross value, the returned supplies value, net supply value, etc.

Table 3B contains the information of supplies made B2C or to unregistered persons.

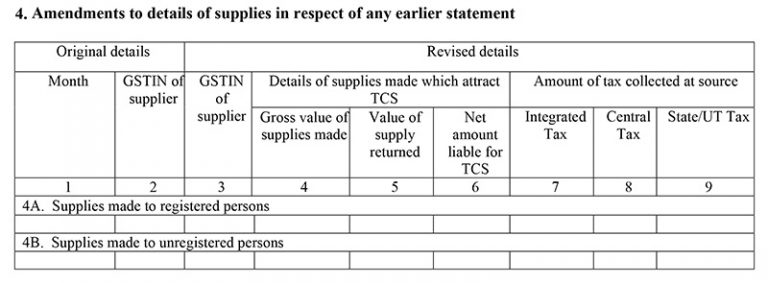

4. Amendments to supply details in respect of any earlier statement

If you need to make any changes in any previous return/statement, the details of supplies filed can be done in this head.

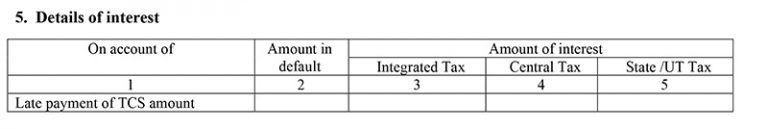

5. Details of Interest

In case of late filing of the return, this field contains the interest details (CGST, IGST, and SGST), in addition to the exact TCS amount. From the above table, these details are auto-populated.

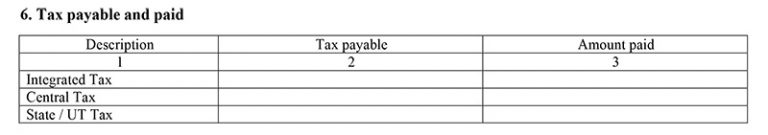

6. Tax Payable and paid

Based on the information above, the net amount of the TCS applicable for a particular tax period will be auto-popular in this table.

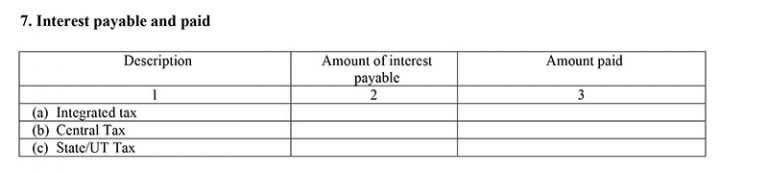

7. Interest payable and paid

It will contain the net amount of interest payable at 18% and paid on the TCS late payment.

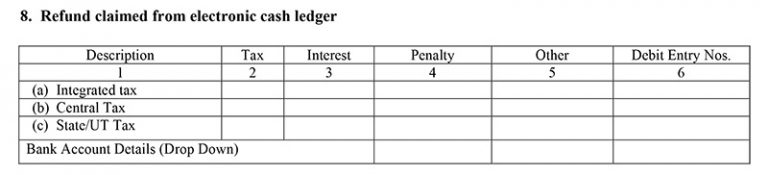

8. Refund claimed from electronic cash ledger

The refund can be claimed and information can be furnished here, after all the previous TCS liability has been paid.

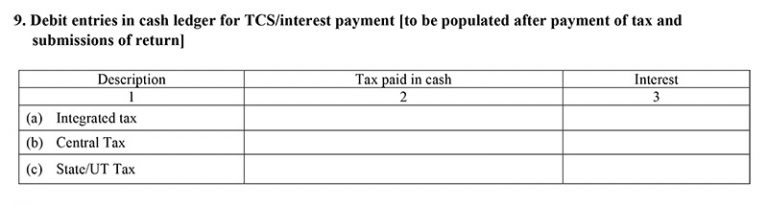

9. Debit entries in cash ledger for TCS/interest payment [to be populated after payment of tax and submissions of return]

The TCS details will auto-populate in Part C of GSTR-2A of the respective supplier after the tax is paid and the return is submitted.

To verify and confirm the details provided in the form, at the bottom, the taxpayer will provide an electronic signature.

How to File GSTR-8 on GST Portal?

Following is the step-by-step procedure to file GSTR-8 on the GST portal:

Step-1: Login to the GST portal.

Step-2: Next, click on Services>>Returns>>Returns Dashboard,

Step-3: Select the financial year and month for which the return needs to be filed,

Step-4: Then, click on “PREPARE ONLINE” button appearing below GSTR-8 in the dialogue box. Alternatively, you canalso file using the offline utility

Step-5: Enter details in each tile that appears on the dashboard. The next screen displays the following three tiles:

- Tile 3 – Here the details of TCS that isrelated to the current month needs to be disclosed.

- Tile 4 – This option can be used to amend the details relating to the earlier period. Since the GSTR-8 for the month of October 2018 is the first return, there would be no amendments in the first month.

- Tile 5 – To view the details of the interest payable for delay in payment of taxes collected to the government.

- In the tile 3 “Details of Supplies attracting TCS” enter the below details, & Click on ‘Save’.

- GSTIN of Supplier

- The gross value of supplies made

- Value of supplies returned

- Tax Collected under heads IGST/ CGST/ SGST.

2. Against erroneous entries uploaded for any of the previous months in Tile 4- “Amendment to details of Supplies attracting TCS”, enter the correct details.

For filing of amendments in the returns there are two instances which is required:

a. Uploaded by the e-commerce operator, correction can be made in supplier-wise details related to the particular month and financial year which has been incorrectly uploaded by the e-commerce operator in the earlier period.

When you click on the “Amend TCS Details” button, option for correcting vendor GSTIN, values mentioned against registered vendors and unregistered vendors and TCS deducted against such supplies can be amended.

After the details are filled in correctly, click on Save and return back to Amendment menu.

b. Rejected by supplier Under this option, the details of transactions rejected/modified by Supplier will appear.

You can edit the entry appearing on the screen based on such rejection/modification uploaded by supplier and fill in the corrected details. The screen will display the same options as in case of “Uploaded by E-Commerce Operator” with the values suggested by the Supplier.

After entering the corrected data, click on Save and return back to Amendment menu.

Step-6: Click on “Preview GSTR 8” once all the details have been uploaded. Then, verify the data uploaded and click on “Proceed to File”.

Step-7: Once the status of GSTR-8 is updated to “Ready to File”, this will enable tile 5 “Details of interest” and tile 6, 7 “Payment of Tax”.

Step-8: View the interest on the delay in payment of the TCS liability, the filing of the TCS return, etc., under “Details of Interest” tile, if any.

Step-9: After viewing the interest tile, click on the “Payment of Tax” tile to enter the details of taxes paid for that particular month;

Step-10: Finally, you can preview the draft GSTR-8 and acknowledge the declaration for filing the GSTR-8. Then, click on “File GSTR 8”. Use Digital Signature Certificate (DSC) of the authorised signatory or Electronic Verification Code (EVC).

Conclusion:

GSTR-8 is exclusively for e-commerce operators. Punctual monthly filing with payment of taxes can help them gain and maintain goodwill in the market. It will also help you make great profits in the business.

Related Articles:

- How to Register for India GST?

- How to Register for GST on the GST India Portal. A Step by Step Guide

- Complete guide to E-way Bills in India GST

- GST Calculator – Online Goods and Services Tax Calculator

- What is GSTIN?

- What is GSTN?

- Step-by-Step Guide for India GSTR Filing

- Understanding HSN Codes & SAC Codes Under India GST

- All about GST Compensation Cess

- What Is Input Credit (ITC) under GST ?

- Understanding Reverse Charge Mechanism (RCM) in India GST

- Special Economic Zone (SEZ) under GST

- What is TDS on Salary

- Making TDS Payments Online in India - The Complete Guide