The retail market size in India was expected to amount to 1.7 trillion U.S. dollars by 2026, up from 883 billion dollars in 2020. While an overall increase was noted up to 2019, 2020 marked a decrease due to the coronavirus pandemic. Nevertheless, the market is estimated to recover in 2021.

Form G for change of information pertains to the Punjab Shops And Commercial Establishments Act of 1958. This is the form that eligible or registered institutions fill out whenever there is a change in the information related to:

- Personnel employed

- Working hours

- Address of the business/shop/commercial establishment

- Authorised signatory

- Any other information pertaining to the work of employees within the institution

Form G is required to be filled out, for example, when you change the working hours at your factory from 8 am to 4 pm, to 9 am to 5 pm. Such changes need to be notified to the government under the Punjab Shops and Commercial Establishment Act (1958). Since it is a matter of compliance with regulations, it is important to understand what this act is all about. Through discussing the following topics, let’s try to understand the Punjab Shops and Commercial Establishment Act (1958) and Form G better:

- What is Punjab Shops and Commercial Establishment Act (1958)?

- Which Forms are Related to This Act?

- What is The Need of Form G and Punjab Shops and Commercial Establishment Act (1958)?

- What are The Highlights of Punjab Shops and Commercial Establishment Act (1958)?

- What is The Procedure to Register Under Punjab Shops and Commercial Establishment Act (1958)?

What is the Punjab Shops And Commercial Establishments Act, 1958?

The Punjab Shops And Commercial Establishments Act, 1958 was put in place in 1958 in the welfare of the workers employed in shops and commercial establishments. In order to create humane and justified working conditions for the hands employed on shop floors, this Act lays down certain guidelines that eligible shops and commercial establishments must comply with.

Random surprise inspections are sometimes conducted to ensure that eligible establishments are compliant with the rules laid out in this Act. Some of the salient points that this act covers are as follows:

- Employment conditions for young persons in such establishments

- Hours of employment

- Break time for meals and tea

- Opening and closing hours at shops

- Off days

- Holidays

- Leaves

- Wages, deductions and compensations

- Registration of eligible institutions

- Record-keeping

- Inspections

Many more clauses are included in the act that cover penalties and consequences of non-compliance. While registering under this Act, commercial establishments furnish information pertaining to the shop – address, authorised personnel, workers and related information, etc. Licence to run the business is granted upon approval. However, in case there is a change in any of the aspects mentioned above, the owner is required to notify the government by filling out Form G.

Form G helps such institutions stay compliant with this Act even if the information furnished for the initial registration changes later on.

Forms Related to the Punjab Shops And Commercial Establishments Act, 1958

This Act requires commercial establishments to fill out quite a few forms, out of which Form G is also one. Mentioned below is the list of related compliances that shops must follow, along with a short description of what they are needed for:

- Form A, for notifying the working hours and intervals

- Form B, for display of notices

- Form C is a register of employees working at the shop

- Form D is the register of employee wages

- Form E is the deductions register

- Form F is the Statement for Registration of Establishments

- Form G is for the intimation of change in information

- Form H is the Registration of Establishment

Form G

Form G for the Punjab Shops and Commercial Establishment Act of 1958 is meant for shop owners to intimate the authorities regarding any changes in the necessary information of the commercial establishment, such as an address, working hours, wages, etc. In essence, this is what a Form-G looks like:

FORM-G

FORM OF CHANGE IN RESPECT OF INFORMATION CONTAINED IN STATEMENT REQUIRED BY SUB-SECTION 13 OF THE PUNJAB SHOPS AND COMMERCIAL ESTABLISHMENTS ACT, 1958

To

The Inspector of Shops and Commercial Establishment Circle

I hereby notify that the following change has with effect from ___ (date) taken place in respect of the information relating to the establishment as supplied by me in my statement dated ___. My registration certificate number is ___.

Date ___.

(Here mention the change)

_______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Dated ___.

(Signature of the employer)

Note. -- The change is required under sub-section (4) of Section 13 of the Punjab Shops and Commercial Establishments Act, 1958, to be notified by the employer within seven days after the change has taken place.

The Need for Punjab Shops and Commercial Establishments Act, 1958

The labour employed with workshops and other commercial establishments also require humane conditions for work, decent wages and fair treatment for their mental and physical wellbeing. The Punjab Shops and Commercial Establishments Act of 1958 ensures that the commercial establishments falling under the ambit of the State’s jurisdiction are treating their labour force right.

The main purpose behind enacting the Punjab Shops and Commercial Establishments Act, 1958 was so that the rights of labourers employed with such institutions could be protected, and deserved compensation could be assured to them. This act helps the labourers get access to better conditions of work, fair payment, leaves, off days, and other such benefits that come with employment.

Even the working hours that young employees go through each week are stipulated in this act, and it is mandatory for employers to observe these regulations. For example, the Punjab Shops and Commercial Establishments Act, 1958 mentions that young employees should not be made to work more than thirty hours each week – and it is counted as compliance. Even the meal breaks and tea times that the workers are entitled to are mentioned in the Act.

This Act helps the employees of a commercial establishment work in better environments and be assured of their wages and workers’ rights.

Highlights of the Punjab Shops and Commercial Establishments Act, 1958 and Form G

The Punjab Shops and Commercial Establishments Act of 1958 highlights in great detail the optimum working conditions of workers in shops and commercial establishments. After registration, such establishments are given a license under which they conduct business. Should any of their essential information change, they are required to fill out Form-G to update the government of any changes that have occurred.

Highlights of the Punjab Shops Act, 1958

The following points from the act display how exhaustive the Act is in ensuring that working conditions for the workers stay humane:

- Young persons are given a break of half an hour for every three hours of continuous work. Additionally, they cannot be made to work for more than five hours a day

- The total number of hours any worker is made to work on a business should not exceed 48 hours in a week and nine hours a day

- All such establishments are required to stay closed on Sundays

- Workers cannot be made to work at any establishment before opening and after closing hours, on off days; workers are entitled to one off-day each week

- Workers are entitled to paid holidays on all notified government holidays

- Workers are entitled to one leave for every twenty workdays completed

- Wage period for any worker cannot exceed a period of one month

- Worker wages are not liable for any deductions other than those mentioned under Payment of Wages Act

Many more such provisions are included in this act that makes the welfare of the workers their primary focus and priority.

Procedure to File for Registration Under Punjab Shops and Commercial Establishments Act, 1958 and Form G

Every employer of a shop or commercial establishment is mandatorily required to register their establishment online through the government’s registration system. They are also required to submit a Form G later if any change in information happens. The forms that the employer needs to fill out are:

- Form F

- Form B

Let’s now understand the process.

Documents Required for Online Registration

- Details of the commercial establishment according to aforementioned Form F and B

- Scaned Proof of Establishment. These could be Registration Deed or Rent Deed – anything that proves possession

- Photograph of shop façade that also includes its surroundings

- Payment mode requisites, like card details, Treasury Challan details, etc.

Procedure for Online Registration

- Create a login ID and password at the government portal

- Create a profile and add the details that are asked in the Basic Information Proforma (BIP)

- Submit the documents as collected for online registration

- Pay the fee, whether online or through challan

- Submit your application, and track approval progress on the portal

- Generate certificate after the application has been approved

- Get your license verified from a 3rd party

How Deskera Can Assist You?

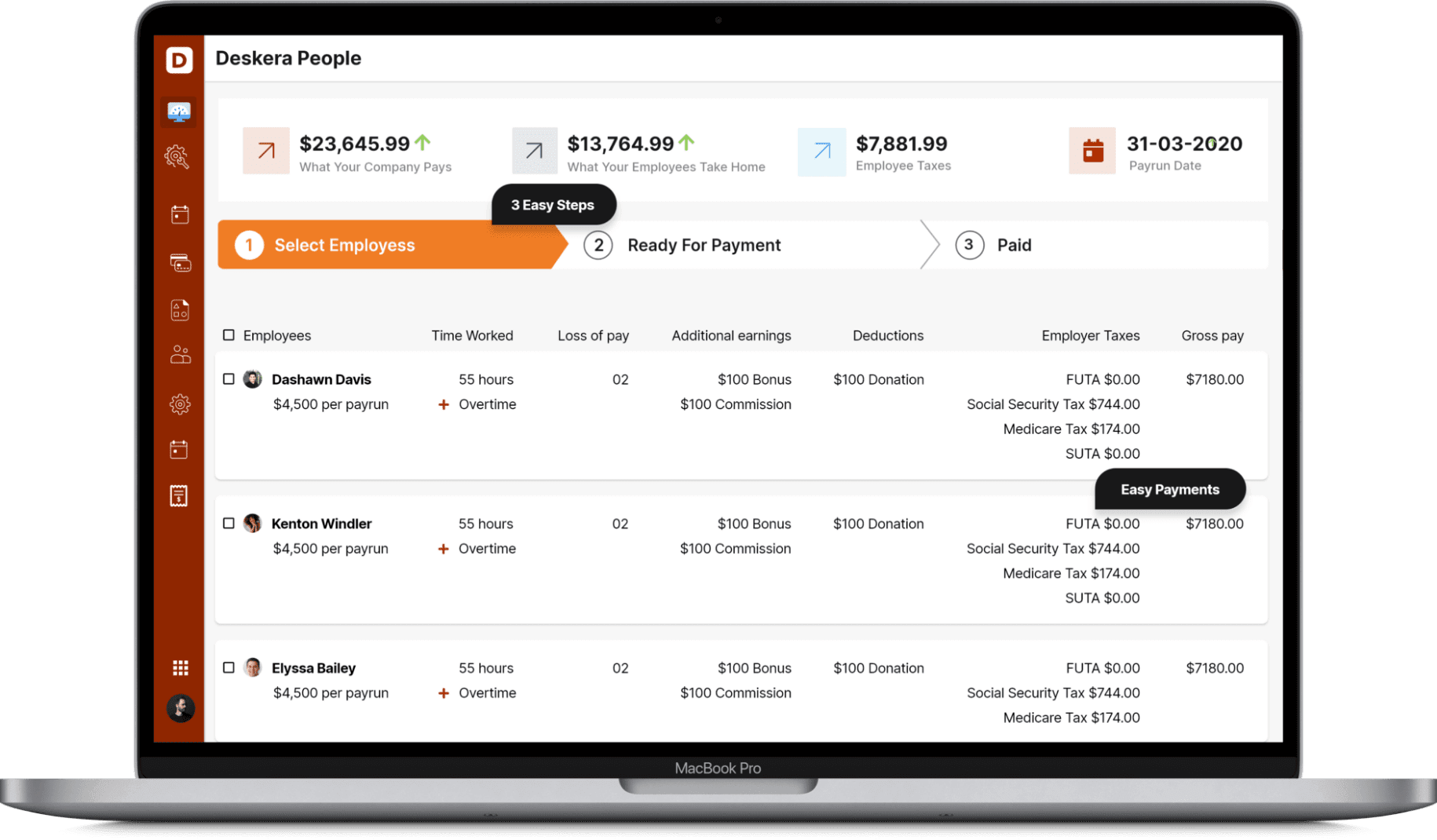

Deskera People helps digitize and automate HR processes like hiring, payroll,leave, attendance, expenses, and more.

Simplify payroll management and generate payslips in minutes for your employees.

In addition to a powerful HRMS, Deskera offers integrated Accounting and CRM Software for driving business growth.

Conclusion

Form G is basically an application for modification of details of shops or commercial establishments that are submitted in case there has been a change in shop information when it was registered. It is necessary that the government be notified of these changes, which is why Form G is required.

Key Takeaways

- The Punjab Shops and Commercial Establishments Act of 1958 was enacted to protect the welfare of shop workers and provide them with good working conditions and the environment

- It stipulates safe and humane working conditions for labourers and requires that all shops and commercial establishments comply with it

- In case the shops make a change in working hours or wages or number of employees, etc., they are required to fill out a Form G to notify the government of such changes

Related Articles