Form 4562 typically applies to your business when you have bought a piece of equipment or a vehicle or any asset that will be utilized for business purposes. When filing your taxes, this form will require you to add in all the details pertaining to the depreciation and amortization of the asset you have recently purchased.

A complete understanding of the form will alleviate most of your tax problems.

We shall learn how the form plays out in this scenario in this article. The article decodes the instructions for filling out the form. We have also included some of the most relevant terms around form 4562. Here they are:

- What are Depreciation and Amortization?

- What Is Form 4562?

- When should you file Form 4562?

- What do you need to fill out in Form 4562?

- Who Can File Form 4562: Depreciation and Amortization?

- How to File: Form 4562 Specific Instructions

- Conclusion

- How can Deskera Help You?

- Key Takeaways

What are Depreciation and Amortization?

According to IRS rules, you may not be able to write off the entire value of a big purchase in one year. This is why you spread the cost out over several years.

What is Depreciation?

Depreciation is an accounting practice for writing off tangible assets over several tax years. Depending on your business structure, your depreciation deduction is reported each year on Form 1040 (Schedule C), Form 1120/1120S, or Form 1065.

What is a Tangible Asset?

A tangible asset is defined as assets that have a physical presence and can be seen and touched. Examples of tangible assets are cash, buildings, vehicles, inventory, equipment.

What is Amortization?

Amortization is a concept very similar to depreciation with the only difference being that it applies to an intangible asset. So, when the value of an intangible asset is depreciated across the years, it is termed amortization.

What is an Intangible Asset?

An intangible asset can be termed an asset that does not have a physical presence and cannot be touched. Some examples of intangible assets can be patents, trademarks, goodwill, licenses, list of clients.

Choosing the right amortization strategy depends on how much income you generate for your business and for how many years you are claiming the deduction.

Once you have understood depreciation clearly, it would position you much better to get a grip over the form 4562. For someone who plans to amortize an asset, consulting a CPA is a good idea.

What Is Form 4562?

Form 4562 must be filed only if you are deducting depreciable assets on your tax return. As learned from the previous section, if you plan to use an asset for more than one financial year, it is considered a depreciable asset.

All the huge assets you utilize for your business are those whose depreciation will be counted for in the form 4562. This implies that you would be filing Form 4562 every year till your assets continue to depreciate. Form 4562 also enables you to file a bonus depreciation claim.

When should you file Form 4562?

Your annual tax return should include Form 4562. You must note that depreciation and amortization taxes should be filed the same year you purchased the property.

What do you need to fill out in Form 4562?

Like any other form, you will need to keep all your financial data ready when you decide to file your Form 4562. Here is what else you will require:

- The cost or value of the asset which is being depreciated

- The receipt of the asset being depreciated

- The date on which the asset was put to use first or when you started using it for your business

- Amount of income your business earned in that year

Some businesses may utilize assets for purposes other than work. The vehicle or the office car may be used for personal reasons. An important point to remember here is that if the asset in question is also being used for personal purposes along with business, you will also need to add the following:

- A percentage-wise description or breakdown of how often the asset is used for work and for other purposes

- Any other essential documents or evidence or logs such as mileage of the vehicle

Who Can File Form 4562: Depreciation and Amortization?

Form 4562 needs to be filed only if you plan to deduct a depreciable asset from your tax return. Anyone who wants to achieve this must include the following:

- Depreciation for the tax year of the asset in service

- The depreciation of any listed vehicle or property, irrespective of when it was placed into service

- Section 179 deductions which may include carryovers from previous years

- Any depreciation claimed on a corporate income tax return other than Form 1120-S: Income Tax Return for an S-Corporation

- Deductions for vehicles reported on forms other than Schedule C: Profit or Loss From Business

- Amortization costs incurred during the tax year

How to File: Form 4562 Specific Instructions

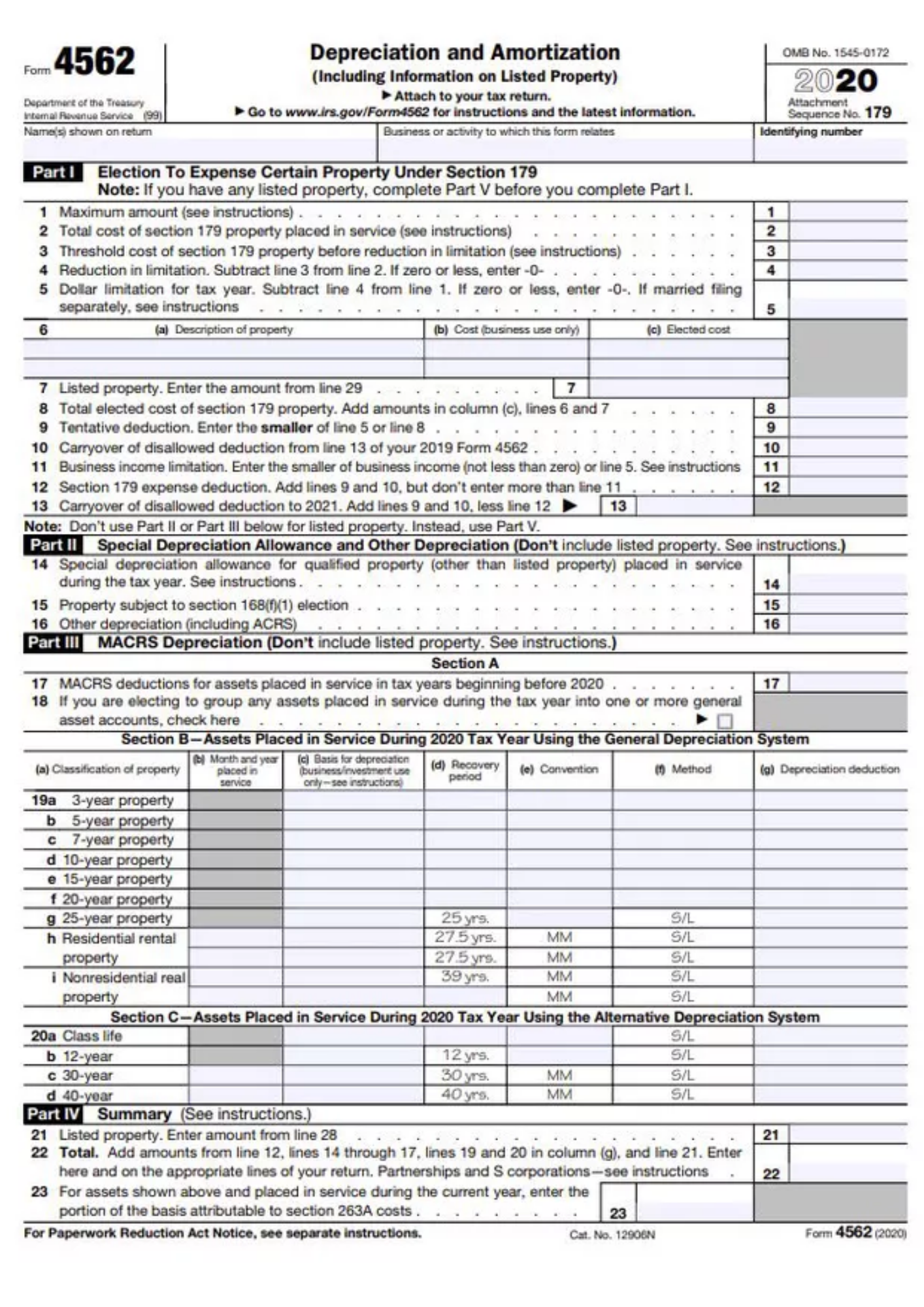

It is essential to get a clear understanding of the form before starting to fill it out. It is a form that comprises many parts and lines. This section will attempt to get a good grip over the various lines and what they mean.

Under Section 179, you are permitted to depreciate as much property as possible during the first year. You may depreciate the entire asset and if not, the overflow of depreciation is deferred over the upcoming years.

Although the instructions in the lines are straightforward and unproblematic, we have tried to put them across in a simple manner. For any doubts, visiting IRS instructions for Form 4562 can help. Let’s take a closer look at the instructions given in each line.

Part I: Section 179 deductions

Part II: Special depreciation allowance

Part III: MACRS depreciation

Understanding this section helps you if you are planning to depreciate your property over several years, rather than deducting everything with Section 179, and addressing the overflow later.

The Modified Accelerated Cost Recovery System divides fixed assets into classes that have fixed devaluation periods. The IRS has established guidelines in regards to assets that are eligible for depreciation under the MACRS. As a result, the depreciation of assets is faster in the early years of their use and slows down as time goes on.

Part IV: Form Summary

This section includes the summary of Form 4562.

Part V: Listed Property

You can use the listed property for both business and personal purposes. The information that goes in Part V is the depreciation on your listed property which includes claiming the standard mileage rate or actual vehicle expenses. You can do this regardless of when you purchased the property.

A point to note is that in case you file Form 2106, you must report this information on that form instead of Part V. Additionally, in case you are filing Schedule C (Form 1040) and you claim standard mileage or actual vehicle expenses (excluding depreciation), and you do not have to file Form 4562 for any other reason, then include vehicle information in Part IV of Schedule C instead of Form 4562.

Section B: If your company has employees who use company vehicles for work, you may skip this section move on to Section C.

Section C: Line 37 to Line 41

Part VI: Amortization

This section includes all information about the assets that you are amortizing.

Conclusion

Depreciation and Amortization are the two sides of the same coin. Yet, understanding amortization could be a slippery zone. This is so as it involves intangible assets which do not have a physical form. Imagine depreciating a patent or goodwill!

It is, therefore, recommended you take the help of a qualified CPA who understands the nuances of the terms and helps you file Form 4562.

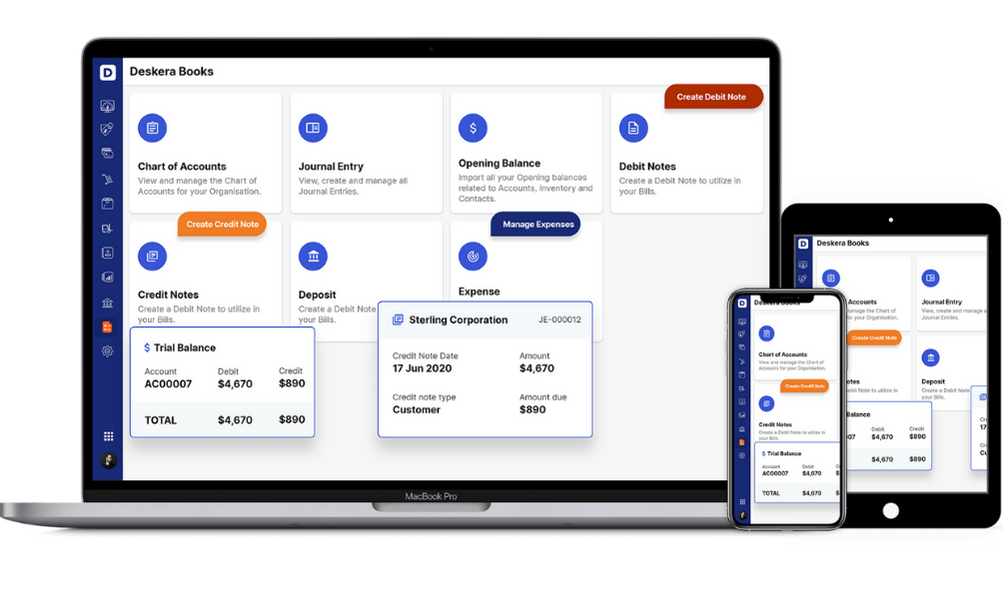

How can Deskera Help You?

Deskera Books is an online accounting, invoicing, and inventory management software that is designed to make your life easy. A one-stop solution, it caters to all your business needs from creating invoices, tracking expenses to viewing all your financial documents whenever you need them.

Key Takeaways

Let’s look at the key points from the article:

- Form 4562 typically applies to your business in instances where you have bought a piece of equipment or a vehicle or any asset that will be utilized for business purposes

- When you are filing your taxes, this form will require you to add in all the details pertaining to the depreciation and amortization of the asset you have recently purchased

- Depreciation is an accounting practice for writing off tangible assets over a number of tax years

- A tangible asset is defined as assets that have a physical presence and which can be seen and touched

- Amortization is a concept very similar to depreciation with the only difference being that it applies to an intangible asset. So, when the value of an intangible asset is depreciated across the years, it is termed amortization

- An intangible asset can be defined as an asset that does not have a physical presence and that cannot be touched

- All the huge assets that you utilize for your business are the ones whose depreciation will be counted for in the form 4562

- Your annual tax return should include Form 4562

- Depreciation and amortization taxes should be filed the same year you purchased the property

- Form 4562 comprises six parts which request a piece of comprehensive information about your assets

Related Articles