Amortization and Depreciation are two ways to calculate the value of assets expended annually. The cost amount is used as a tax credit to reduce the company's tax obligations and to diversify the cost of an investment.

Table of Contents

- Similarities Between Amortization Vs. Depreciation

- Meaning of amortization

- Meaning of Depreciation

- Different Ways to Calculate Depreciation

- Amortization vs. depreciation – Key Differences

- Some More Points of Variations between Amortization vs. Depreciation are:

- Amortization vs. Depreciation examples

Introduction

The main difference between both methods is the type of asset perceived as an expense. When buying real estate, it is imperative to understand how amortization vs. depreciation work and the differences between them. Knowing these two terms will help you. It is essential to understand the meaning of both terms, especially before buying property or business-related assets, to save time, effort, and money and make better financial decisions.

Similarities Between Amortization Vs. Depreciation

Let us understand the similarities between the two:

- Both are Cashless - Both amortizations vs. depreciation are non-cash costs which mean there are no cash-related reductions in recognizing these costs

- Reporting of amortization vs. depreciation - These are treated as a reduction in fixed assets on the balance sheet and can also be summed for accounting purposes

- Impairment or writing off - Property, plant, equipment, and intangible assets are subject to impairment. Their book value may be depreciated. In this case, the remaining amortization vs. depreciation expenses will decrease because you need to offset the decrease in the balance.

Meaning of amortization

Amortization spreads the acquisition cost of intangible assets, which are not physical assets, over the useful life of this asset. Examples of intangible assets that are recognized as expenses by amortization include:

- Patents and trademarks

- Customer lists

- Trade names

- Franchise agreement

- Unique or proprietary processes such as copyrights

- Employee relations

- Bond issuance costs to raise capital

In contrast to amortization vs. depreciation, amortization is usually recorded as an expense in the straight-line method, which means the same amount is recorded as an expense for each period over the asset's useful life.

Another difference is that intangible assets that use amortization while incurring usually do not have salvage or resale values. Amortization refers to two types of situations - debt payments and long-term loans.

If you have a mortgage, student loan, or car loan, follow an amortization schedule that outlines the details of the principal and interest raised in monthly installments. Generally, most monthly payments count towards interest in the early stages of a loan. Another point is that amortization is the distribution of intangible assets over a period that is related to capital investment.

Amortization is usually calculated using the straight-line method used in both lending and accounting.

Meaning of Depreciation

Depreciation occurs as an expense for tangible assets (fixed assets) over its useful life. Depreciation takes place on a physical asset that you can touch. Examples are:

- Property, plant, and equipment

- Building Equipment or Office furniture

- Vehicles

- Machines

Depreciation is calculated by subtracting the residual or resale value of an asset from the cost, as tangible assets can have a specific value at the end of their useful life. The difference is evenly distributed over the expected useful life of the asset.

Depreciation is treated as a tax credit for the business until the asset reaches its useful life.

For example, a vehicle can be used for many years before it becomes obsolete and sold. The cost of the vehicle is distributed over its expected useful life, while some of the costs are recorded as costs for each fiscal year. Vehicles are usually depreciated at accelerated speeds. This means that most of the asset is spent in the first few years of the asset's useful life.

Different Ways to Calculate Depreciation

A tangible asset can be depreciated over time in various ways like:

- Straight-line or Linear method: This means when the depreciation amount of a tangible asset is evenly distributed over time

- Declining or aggressive balance: This is an accelerated accounting way that depicts how depreciation is reduced using fixed assets

- Double-declining balance: This is like the one mentioned above in which depreciation reduces the value of an asset twice as fast as the straight-line method

- Units of production: This depreciation method considers the number of units an asset produces, not the years of use

- Sum-of-years-digits: This method of calculating depreciation considers various factors of an asset like its residual value, cost, and useful life of the asset.

Amortization vs. depreciation – Key Differences

1. Definition of amortization vs. depreciation

Depreciation refers to the reduction in the cost of property, plant, and equipment over its useful life in proportion to the use of the asset for that particular year. Amortization refers to reducing costs over the useful life of an intangible asset.

2. Formula to calculate amortization vs. depreciation

Annual Depreciation = (Cost of Tangible Asset-Salvage Value)/Useful Life

Annual Amortization= (Cost of Intangible Asset)/Useful Life

3. The materiality of amortization vs. depreciation

Both amortizations vs. depreciation are means of diversifying the costs of intangible assets/property, plant, and equipment / over their useful lives and recording them as expenses in the income statement/ Profit and Loss Statement

4. Applicability of amortization vs. depreciation

Depreciation applies only to tangible assets such as plants, machinery, equipment, and buildings. Amortization applies only to intangible assets like leases, patents, brands, concessions, and brand values

5. The implementation method of amortization vs. depreciation

You can use either the straight-line method (SLM) or accelerated depreciation for property, plant, and equipment. In contrast, amortization is used primarily to amortize intangible assets using the straight-line method.

6. Residual or Salvage value of amortization vs. depreciation

Tangible assets have a residual value after their useful life (value based on their useful life), used to calculate annual depreciation. Intangible assets have no residual value

7. Amortization vs. depreciation - Recognized as an expense

Depreciation is recognized as an expense in the company's income statement and is used for tax purposes. It can be more beneficial for tax purposes because companies can use accelerated depreciation to record higher initial costs.

Amortization is also recognized as an expense in the company's income statement and may also be used for tax purposes

8. Journal Entry for amortization vs. depreciation

- Depreciation Expense - Debit

- Accumulated Depreciation - Credit

- Amortization Expense - Debit

- Accumulated Amortization - Credit

Some More Points of Variations between Amortization vs. depreciation are:

The main differences between Amortization vs. Depreciation are:

- The primary purpose of depreciation is to spread the cost of an asset over its expected useful life. This contrasts with amortization, which is the capitalization of the cost of an asset over the useful life of the asset.

- Depreciation is calculated for linear, depreciated balances, annuities, etc. whereas, the calculation method of amortization is linear, reduced balance, pension, bullet point, etc.

- Because accelerated depreciation can be used for assets, plants, and equipment, the tax benefits are greater with depreciation than with amortization.

Amortization vs. Depreciation Examples

Example 1: Calculation of depreciation using Straight-line method

ABC company purchased a vehicle for official purposes. The approximate helpful life of the vehicle is, as stated earlier, 5 years. The residual value is 10% of the purchase price.

Here is how you can calculate depreciation using the straight-line method:

Vehicle costs: $ 100,000

Residual/ salvage value: $ 100,000 x 10% = $ 10,000

Depreciation: Remaining vehicle cost or $ 100,000 $ 10,000 = $ 90,000

Vehicle life: 5 years

Amortization example

XYZ Company is involved in the construction of roads and highways has been granted $ 800 million in right of way by the Highway Authority, which will be recovered in 20 years.

The amortization costs that the company can charge using the straight-line method are follows.

Annual amortization = (Value of Toll-Residual/Salvage Value)/Useful Life

Annual amortization = (800-0) / 20 years

Annual amortization cost = $ 40 million

Conclusion - Amortization vs. depreciation

Amortization and depreciation are used to spread the cost of an asset (tangible or intangible) over its useful life. More precisely, depreciation of property, plant and equipment and depreciation of intangible assets are performed. Amortization and depreciation are recorded as expenses in the company's income statement and are used for tax purposes.

Amortization vs. depreciation is usually the same conditions, with the only difference being that depreciation applies to tangible assets, while amortization applies to intangible assets. Since both are capital investments, they appear as a reduction on the asset side of the balance sheet. Amortization vs. depreciation is subject to different accounting standards.

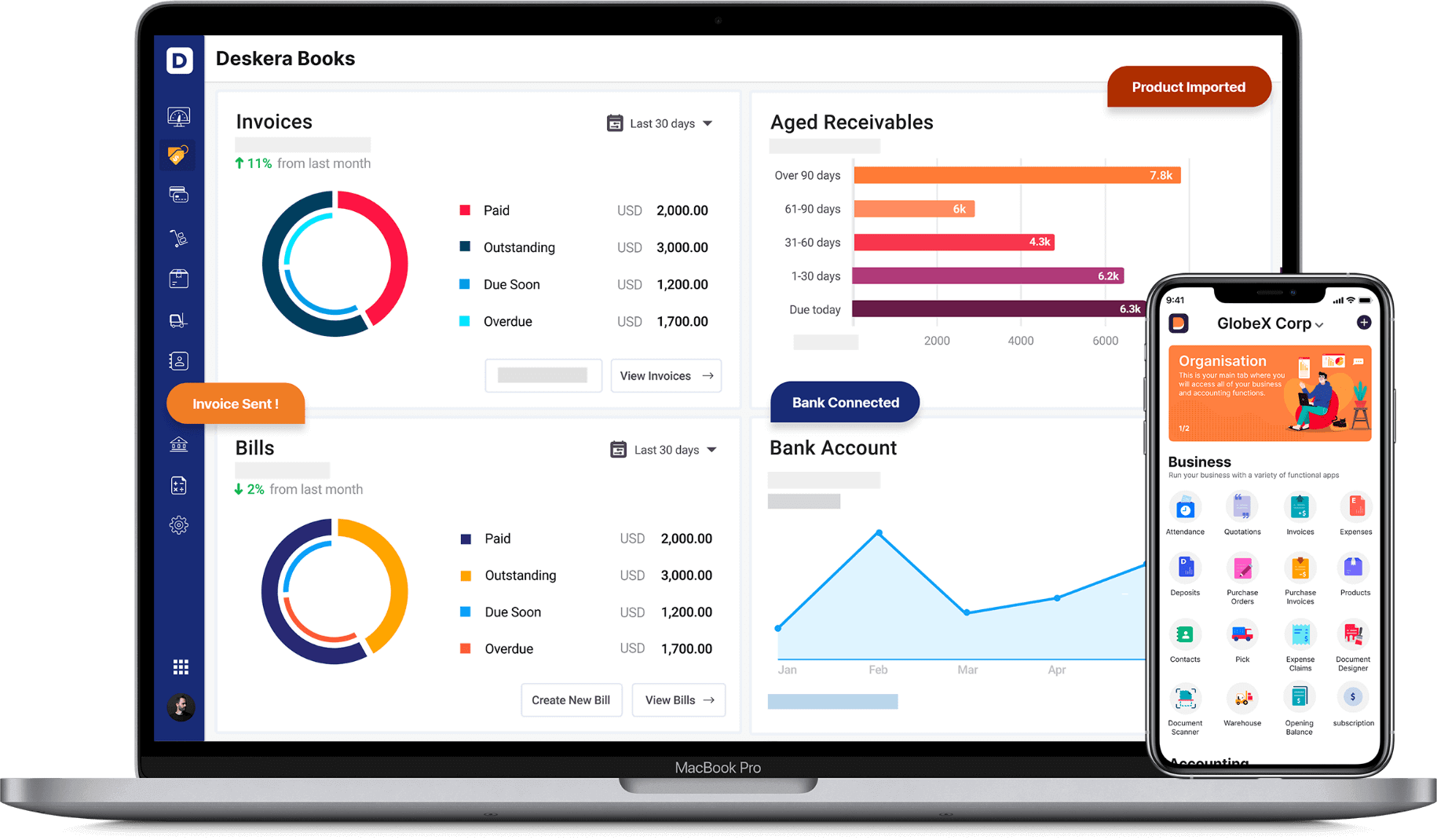

How can Deskera Help You?

Managing finances and calculating the deductions is a tough task and requires you to keep all your documents handy. Let an automated accounting system take care of it.

Deskera Books is comprehensive accounting software that can help you manage your finances.

It helps you manage your profit loss statement, work on invoicing, general ledger, balance sheets. It also helps you automate your financial records and keep track of them online.

Learn about the exceptional and all-in-one software here:

Key Takeaways

- Amortization vs. depreciation are two ways to calculate the value of a business asset over time

- Companies calculate these costs and use them as tax credits to reduce their tax obligations.

- Amortization spreads the acquisition cost of an intangible asset over the useful life of this asset. Depreciation is depreciation over the useful life of a fixed asset

- The third way - an accrual accounting method used by companies, to record business assets is the depletion method which is used when companies extract natural resources such as wood, oil, and minerals from the earth

- Depreciation is a method of calculating an asset over a period

- Depreciation is the value of an asset that is lost over time

- Amortization is a way to reduce the cost of an asset over a period, and it usually uses the straight-line method to calculate payments

Related Articles