If you are a bank or a financial institution that regularly lends money as a part of your business, then credit risk is a thing that persistently bothers you.

Without a 100% guarantee of getting your money back, your enterprise faces the risk of losses and a diminishing value of your portfolio.

The same is true if you have a small business and lend goods on credit. Can you be sure that the money your customers owe you shall come back in full to you? There must be a way you could recognize the risks associated with this model.

Here, the risk that we refer to is the Credit Risk, and the measure to combat it is termed Credit Risk Management. We shall learn more about the process and the elements related to it.

Here’s what the article takes you through:

- What is Credit Risk?

- What is Credit Risk Management?

- Why is Credit Risk Management Important?

- Credit Risk Management: Best Practices

- Credit Risk Management Techniques

- Pros and Cons of Credit Risk Management

What is Credit Risk?

Credit risk is defined as the probability of a loss owing to the borrower’s failure to repay the loan or borrowed sum. In other words, it is termed as the risk the lender faces in the case where the borrower is unable to pay back the principal and interest. This results in disturbing the cash flows and increases the costs for collection.

Consumer credit risks are measured by the five Cs, which are:

- Credit History

- Capital

- Capacity to repay

- Condition of the loan

- Associated Collateral

Credit risks are a commonly observed phenomenon in areas of finance that relate to mortgages, credit cards, and other kinds of loans. There is always a probability that the borrower may not get back with the amount.

The same can happen in the case of customers who purchase goods or products on credit and then do not pay their invoices. Credit risk also applies to the issuer of a bond does not make the payment or when an insurance company fails to pay the claims made against the policy.

What is Credit Risk Management?

When a borrower applies for a loan, the lender or the issuer must establish and examine the borrower’s ability to repay the loan. Apart from the current financial condition, the issuer must also check the borrower’s previous lending and repayment records. This is also known as the creditworthiness of the borrower.

Creditworthiness is important as it lets the lender know about the previous financial behavior of the borrower. A detailed look at this aspect will provide the lender with knowledge about the past debts, their repayment, length of the commitment, and so on.

When the individual requests a loan, all the financial details come into play and help the lender analyze the risk of the loan requested. Banks and companies that lend money take into account all these factors which assess the individual’s loan repayment abilities. These are the practices that are generally followed and are collectively termed credit risk management.

Having stated that, we must also note that despite the detailed financial evaluation, there are still some factors that may not be seen upfront and may cause disruption in the risk management process.

Why is Credit Risk Management Important?

Credit risk management is inevitable to all the businesses and banks that lend money. While they are constantly striving to combat the factors that heighten the risks, such as cybersecurity threats and scams, they also need to guard against irresponsible or untrusted borrowers.

Credit risk management becomes relevant because even with a single missed repayment, the lending party incurs losses. The collateral also becomes ineffective as the lender will still be left with a negative return. Worse could be a complete failure to repay the remaining loan amount.

All these could seriously hamper the financial stability of the lending institution. Therefore, it becomes extremely important to consider the borrower’s creditworthiness and have a credit risk management process in place.

Credit Risk Management Techniques

The risk management techniques benefit all the lenders alike.

KYC- Know Your Customer

KYC is a very commonly applied process by banks and financial service providers. It is implemented to eliminate terrorist funding and money laundering. KYC is a comprehensive document that comprises complete information about the customer. It also serves as an efficient tool to update the credit rating.

Assessment of Creditworthiness

Balance sheet analysis can effectively drive the estimation of creditworthiness. Annual financial statements along with the reports generated quarterly can provide a lot of consequential information about a company’s financial position. However, acquiring the data could be cumbersome.

AI or automation could come to the rescue, through which reading and presenting the balance sheet become easy. An automated accounting tool like Deskera can capture the inputs from the financial statements and add them under appropriate categories.

Risk Quantification

The process of risk quantification calls for the determination of the probability of default or the PD. It also examines LGD or the loss given default and RAROC - risk-adjusted return on capital. These are important as they lay the foundation for pricing and other terms related to credit.

Credit Decision

Although the final credit decision lies with the banks, the process of arriving at a decision is lengthy and time-consuming. Most of the time, borrowers are in a rush to acquire loans and leave very little time for the banks to issue approvals. This has to be countered with an effective mechanism that ensures the right decisions and in a rapid manner.

Therefore, automation can help expedite the process while still maintaining the accuracy of the credit decision.

Price Calculation

Here, too, machine learning can be used more extensively in the lending industry for the purpose of price calculation. It helps the financial service providers to calculate the borrower's individual risk of default and overall repayment performance with great accuracy.

Monitoring after Payout

Even if the borrower has been paying the installments on time, it is important to keep assessing their financial growth over time. After all, it may be too late by the time they start defaulting on their repayments. Gauging the borrowers’ financial development gives enough time to the banks to react before it gets late.

Credit Risk Management: Best Practices

The very first step the financial institutions can take to mitigate the risks is to have complete knowledge about the borrower’s economic wellbeing. The five Cs, as discussed earlier, are the common elements that give an insight into the profile and the risks. This assessment could provide enough data on the future actions and behavior of the borrower.

When we talk about risk management, we aim to reduce the risks and drive profits for the organizations. This brings us to follow the best practices under the credit risk management process. Let’s learn about them here:

Assess your data sources continuously

Keep an eye out for new data sources that can add value to your portfolio.

Consistently test your scorecard model. You can hire a third-party auditor who will be better positioned to make your credit rules more effective.

Protect yourself against financial fraud

The advent of technology has also given rise to more crimes. Consistently lookout for innovative ways to combat financial frauds and scams using advanced technologies.

Maintain a proactive monitoring program

As markets change, scorecard models are subject to degradation. Monitor your program to measure the levels of degradation of the scorecard model. This, too, can be accomplished with the help of third-party resources.

Automate the process

You can now compare traditional scorecard models with those developed using newer technologies and automate the process. This will be beneficial in cutting down peripheral tasks and focusing on the main issue.

Take advantage of dynamic data

Why look at old credit scores when you can access the latest and current bank transaction information! This will aid in recognizing any spaces for issues with prepayment.

Invest in the leading software

Deskera offers you software that helps you manage all your accounts receivables and manage your outstanding incredibly well. Experience remarkable credit risk management by making timely payments to your suppliers and also avoiding bad debts.

Pros and Cons of Credit Risk Management

So far in the article, we have learned that credit risk can hugely affect the profits and business operations in general for a company. This fear of incurring losses triggers the process of credit risk management. Let’s view the advantages and disadvantages the process entails:

Advantages

Mitigating risks: This is the primary benefit of having a credit risk management process. Lenders accessing and analyzing borrowers’ financial dynamic data reduces risks. This, in turn, lowers the chances of losses to the financial institutions.

Reducing Occurrences of fraud: This is another benefit of the process. Now that the companies are deploying exclusive and latest technologies to tighten the security pertaining to their cyberspace, the occurrences of fraud are considerably lowered.

Disadvantages

Inefficiency in utilizing data: There may be cases where the companies are not able to use dynamic data or when they do not have appropriate data storage solutions. Such instances could lead to inefficient data management.

Improper reporting: Even if the data is collected, not reporting it congruously could raise the risks. There has to be a clear representation of the factors that help identify risks.

How can Deskera Help You?

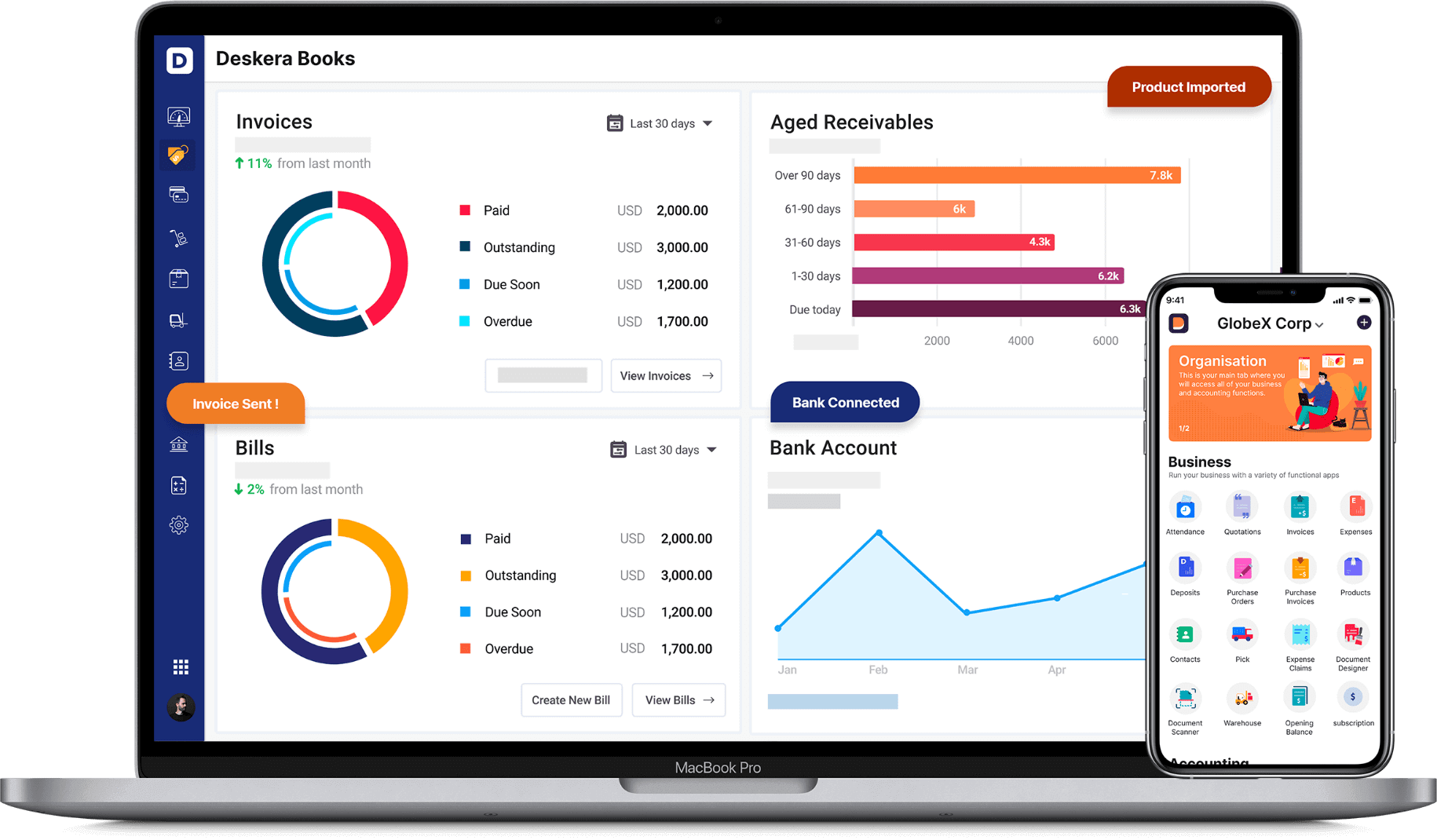

As a business owner, receiving timely payments is your top priority. The aging receivables reports in Deskera Books can present data in real-time. You can also access each of your invoices along with the due dates on your dashboard. Even better, you can send invoices online to your clients as a payment reminder and to receive payments on time.

Learn about the exceptional and all-in-one software here:

Key Takeaways

Business operations often take a back seat when they run into credit risks. Identifying them early on can ensure a smooth run for the enterprise.

Let’s go back to the highlights of the post:

- Credit risk is defined as the probability of a loss owing to the borrower’s failure to repay the loan or borrowed sum

- Credit risks are a commonly observed phenomenon in areas of finance that relate to mortgages, credit cards, and other kinds of loans. There is always a probability that the borrower may not get back with the amount

- When the individual requests a loan, all the financial details come into play and help the lender analyze the risk of the loan requested

- Creditworthiness is important as it lets the lender know about the previous financial behavior of the borrower

- Assessing data sources, protecting against fraud, having a proactive monitoring program, automating the process are some of the best practices that can be adopted for credit risk management

- KYC, assessing creditworthiness, risk quantification, credit decision, price calculation, and monitoring after payout are the six techniques for credit risk management

- Credit risk management mitigates risks and reduces chances of fraud

- On the other hand, the risk management process can be inefficient in utilizing data and could include improper or poor reporting as its shortcomings

Related Articles