Optimizing finished goods costing is a crucial endeavor for executives seeking to maximize profitability and gain a competitive edge in today's dynamic business landscape. Effective cost management in the production and distribution of finished goods directly impacts the bottom line and overall business performance.

However, the complexity of costing methodologies, fluctuating market conditions, and evolving customer demands present significant challenges. To navigate these hurdles successfully, executives need a comprehensive guide that provides strategic insights and practical solutions.

This executive guide aims to equip decision-makers with the knowledge and tools necessary to optimize finished goods costing. It will delve into the fundamental concepts of finished goods costing, highlight common challenges faced by organizations, and present strategies to overcome them.

From implementing innovative costing methodologies to harnessing technology-driven solutions and fostering collaboration, this guide will explore various approaches that enable executives to enhance cost transparency, streamline operations, and ultimately drive profitability.

- Importance of Optimizing Finished Goods Costing for Executives

- Understanding Finished Goods Costing

- Challenges in Finished Goods Costing

- Strategies for Optimizing Finished Goods Costing

- Key Performance Indicators (KPIs) for Finished Goods Costing

- Why Should Businesses Implement Strategies for Cost Optimization?

- Conclusion

- How can Deskera Help You?

- Key Takeaways

- Related Articles

Importance of Optimizing Finished Goods Costing for Executives

In today's fast-paced business environment, executives face relentless pressure to maximize profitability and drive sustainable growth. One critical area that demands their attention is optimizing finished goods costing. Efficiently managing the costs associated with producing and delivering finished goods is essential for maintaining a competitive edge, improving profit margins, and meeting customer expectations.

Optimizing finished goods costing offers numerous benefits for executives and their organizations. First and foremost, it directly impacts the bottom line. By identifying and implementing cost-saving measures, executives can enhance profit margins and improve overall financial performance. This, in turn, strengthens the company's position in the market and provides the necessary resources for investments in innovation, expansion, and talent acquisition.

Moreover, optimizing finished goods costing enables executives to maintain competitive pricing strategies. In today's price-sensitive market, customers are increasingly demanding high-quality products at reasonable prices. By carefully managing production costs, executives can strike a delicate balance between cost efficiency and value creation, ensuring their products remain attractive to customers while still generating healthy profit margins.

Another crucial aspect is risk mitigation. By optimizing finished goods costing, executives can identify potential areas of waste, inefficiency, or excess spending. This proactive approach allows them to minimize financial risks and exposure, protecting the organization from unforeseen economic downturns or market fluctuations.

Furthermore, optimizing finished goods costing provides valuable insights into the overall efficiency of operations. By analyzing cost structures, executives can identify bottlenecks, inefficiencies, and areas for improvement within the production process. This enables them to streamline operations, eliminate waste, and enhance productivity, leading to increased operational efficiency and reduced costs in the long run.

Additionally, optimizing finished goods costing promotes transparency and accountability within the organization. By implementing robust costing systems and processes, executives can ensure accurate tracking of costs at each stage of production, from raw materials to the final product. This transparency facilitates effective decision-making, as executives can assess the financial implications of various choices and allocate resources accordingly.

In summary, optimizing finished goods costing is of paramount importance for executives. It directly impacts profitability, pricing strategies, risk mitigation, operational efficiency, and organizational transparency. By prioritizing and investing in cost optimization initiatives, executives can unlock significant value, enabling their organizations to thrive in today's fiercely competitive business landscape.

Understanding Finished Goods Costing

To effectively optimize finished goods costing, executives must first develop a deep understanding of this intricate process. From raw materials to the final product, every element contributes to the overall cost structure.

In this section, we delve into the fundamental aspects of finished goods costing, unraveling its complexities and shedding light on key components such as direct and indirect costs, cost allocation methods, and the impact of external factors. By grasping the intricacies of finished goods costing, executives can lay a solid foundation for informed decision-making and effective cost optimization strategies.

A. Definition and purpose of finished goods costing

Understanding the definition and purpose of finished goods costing is crucial for executives aiming to optimize their cost management strategies. Finished goods costing refers to the process of calculating and allocating the total cost associated with producing and delivering a finished product to the market.

The purpose of finished goods costing is multifaceted. Firstly, it provides executives with a comprehensive understanding of the expenses incurred at each stage of the production process, including direct costs (such as raw materials, labor, and manufacturing overhead) and indirect costs (such as administrative expenses and marketing costs). This breakdown enables executives to analyze and evaluate the profitability of their products, identify cost drivers, and make informed decisions to enhance efficiency and profitability.

Secondly, finished goods costing facilitates accurate pricing decisions. By determining the true cost of manufacturing and delivering a product, executives can set appropriate selling prices that not only cover the costs incurred but also generate a reasonable profit margin. This ensures that pricing strategies align with market demands, competition, and customer expectations, ultimately contributing to the organization's financial success.

Furthermore, finished goods costing plays a pivotal role in inventory management. It allows executives to assign costs to individual units of finished goods, enabling them to accurately calculate the value of inventory on hand and make informed decisions regarding inventory levels, reorder points, and production schedules. This helps minimize carrying costs, reduce excess inventory, and avoid stockouts, thereby optimizing cash flow and improving overall operational efficiency.

Lastly, finished goods costing provides a foundation for performance measurement and cost control. By comparing actual costs against predetermined standards or budgets, executives can identify variations and deviations, enabling them to take corrective actions promptly. It allows them to evaluate the efficiency of production processes, pinpoint areas of waste or inefficiency, and implement strategies to control and reduce costs, ultimately enhancing profitability and competitiveness.

B. Key components of finished goods costing

The key components of finished goods costing include direct costs, which are directly attributable to the production of a specific finished good, indirect costs (or overhead costs), which support the overall manufacturing process, and overhead costs, which encompass both indirect manufacturing and non-manufacturing expenses. Understanding and appropriately allocating these costs is essential for executives seeking to optimize their finished goods costing and make informed decisions about pricing, profitability, and cost control.

Direct Costs: Direct costs are expenses that can be easily traced and directly attributed to the production of a specific finished good. These costs directly contribute to the creation of the product and are incurred in the manufacturing process.

Examples of direct costs include the cost of raw materials, direct labor (wages and benefits for employees directly involved in production), and any other costs directly associated with manufacturing the finished goods. Direct costs are typically variable, meaning they fluctuate with changes in production levels or the quantity of finished goods being produced.

Indirect Costs: Indirect costs, also known as overhead costs, are expenses that are not directly attributable to a specific finished good but are necessary for the overall production process. These costs are incurred to support the manufacturing operations as a whole, rather than being directly tied to a particular product or unit.

Indirect costs include items such as rent, utilities, depreciation of production equipment, factory supervision, quality control expenses, and maintenance costs. Unlike direct costs, indirect costs are often fixed or semi-variable, meaning they remain relatively stable regardless of production levels.

Overhead Costs: Overhead costs are a specific subset of indirect costs that encompass the expenses associated with running a production facility or operation. These costs include both indirect manufacturing costs (e.g., rent, utilities, equipment depreciation) and indirect non-manufacturing costs (e.g., administrative expenses, marketing costs, research and development expenses).

Overhead costs are necessary for the overall functioning of the organization and are allocated to the cost of producing each unit of finished goods using predetermined cost allocation methods, such as allocating based on labor hours, machine hours, or material usage.

Effectively tracking and allocating overhead costs is crucial in finished goods costing as it ensures that the costs are distributed fairly across different products or units. It allows for a more accurate assessment of the true cost of production and helps executives make informed decisions regarding pricing, inventory management, and cost control.

Challenges in Finished Goods Costing

Navigating the realm of finished goods costing is not without its challenges. Executives striving to optimize costing processes must confront various hurdles that can impede accurate cost calculations, hinder decision-making, and impact overall profitability.

In this section, we delve into the key challenges faced in finished goods costing, ranging from complexities in cost allocation and tracking to the impact of market fluctuations and evolving industry dynamics. By gaining a comprehensive understanding of these challenges, executives can proactively address them, develop robust strategies, and overcome obstacles to achieve effective cost optimization and sustainable success.

A. Variability in cost components

One of the significant challenges in finished goods costing is the inherent variability in cost components. Cost variability arises due to several factors, including fluctuations in input prices, labor rates, and overhead expenses. These variations can pose difficulties for executives in accurately determining the true cost of producing finished goods and making informed decisions based on reliable cost data.

Fluctuating input prices, such as raw materials or components, can significantly impact the overall cost of production. Price volatility in commodities or market-driven fluctuations can make it challenging to estimate and allocate costs accurately. Executives must stay updated on market trends, establish effective supplier relationships, and employ robust cost tracking systems to mitigate the impact of input cost variability.

Labor costs also introduce variability in finished goods costing. Factors such as wage rates, overtime, shifts in labor availability, or changes in workforce composition can affect the cost of direct labor. Executives need to monitor and analyze labor-related expenses carefully, adjusting cost calculations to reflect the actual labor inputs required for each finished good.

Overhead costs, including rent, utilities, and maintenance, may also fluctuate due to factors such as inflation, changes in production volume, or unexpected expenses. Managing these variable costs poses a challenge, as they need to be allocated accurately across different finished goods to reflect their specific resource usage. Executives must establish consistent cost allocation methods and periodically reassess the allocation basis to account for changes in overhead cost variability.

To address the challenge of variability in cost components, executives can implement strategies such as regular cost reviews and updates, leveraging historical data and trends to predict and manage fluctuations. They can also explore hedging strategies or long-term agreements with suppliers to mitigate input price volatility.

Furthermore, implementing cost-tracking systems that capture real-time data and allow for flexible cost allocation methods can enhance accuracy and enable better decision-making in the face of cost variability.

B. Inaccurate cost allocation methods

Inaccurate cost allocation methods represent a critical challenge in the realm of finished goods costing. Cost allocation involves assigning various costs, both direct and indirect, to specific products or units based on predetermined allocation bases or drivers.

When cost allocation methods are flawed or inaccurate, executives face difficulties in obtaining a true representation of the cost of producing each finished good, leading to suboptimal decision-making and potential financial repercussions.

One common issue with cost allocation is using outdated or simplistic allocation bases that fail to capture the true drivers of cost. For instance, allocating overhead costs solely based on direct labor hours or machine hours may not accurately reflect the actual resource consumption by different products.

This can result in misallocations, where certain products bear a disproportionate share of overhead costs, while others are underrepresented. Inaccurate cost allocation can lead to distorted cost information, skewed profitability analysis, and inefficient resource allocation.

Another challenge arises when executives rely on arbitrary or subjective allocation methods. Subjective judgments in cost allocation can introduce biases and inconsistencies, undermining the integrity and reliability of the costing process. Executives must strive for objectivity and transparency in selecting and implementing cost allocation methods to ensure fairness and accuracy.

Moreover, incorporating complex production processes or multiple product lines can complicate cost allocation. Executives may struggle to determine the appropriate allocation basis for shared resources or overhead costs across different products. Failure to account for these complexities can result in distorted cost figures and hinder the ability to make informed decisions.

To address the challenge of inaccurate cost allocation methods, executives can implement several strategies. First, they should assess and refine their allocation bases regularly, ensuring they align with the actual drivers of cost. This may involve analyzing historical data, conducting time-motion studies, or seeking input from relevant departments and stakeholders.

Implementing advanced costing systems or software can also enhance accuracy in cost allocation. These systems can automate calculations, incorporate complex allocation scenarios, and provide real-time data, improving the reliability and efficiency of the costing process.

Additionally, executives should prioritize transparency and consistency in cost allocation practices. Clear documentation of the chosen allocation methods, rationale, and any assumptions made can foster trust among stakeholders and facilitate accurate cost analysis.

In summary, inaccurate cost allocation methods pose a significant challenge in finished goods costing. Executives must address issues related to outdated allocation bases, subjective judgments, and complexities in production processes.

By refining allocation methods, leveraging advanced costing systems, and promoting transparency, executives can overcome this challenge and ensure accurate cost allocation, leading to more informed decision-making and optimized finished goods costing.

C. Lack of real-time data and visibility

The lack of real-time data and visibility presents a significant challenge in the realm of finished goods costing. Executives require up-to-date and accurate information to make informed decisions, monitor costs, and identify areas for optimization.

When there is a lack of real-time data and visibility, executives face hurdles in obtaining timely cost information, which can hinder their ability to respond quickly to cost fluctuations, market dynamics, and operational changes.

One aspect of this challenge is the availability and accessibility of data. Traditional costing systems often rely on manual data entry and batch processing, resulting in delays in data compilation and reporting. This lag in data availability limits executives' ability to have a real-time understanding of costs and may lead to outdated or incomplete information when making critical decisions.

Furthermore, limited visibility into the cost drivers and their impacts can hamper executives' ability to identify areas for improvement. Without granular and real-time data, it becomes difficult to pinpoint specific cost drivers, assess their effectiveness, and take appropriate actions to optimize costs. Lack of visibility can obscure inefficiencies, prevent accurate performance measurement, and impede the identification of cost-saving opportunities.

Another challenge is the integration of data from various sources and systems. In many organizations, cost data may reside in disparate systems or departments, making it challenging to consolidate and analyze the information effectively. This lack of integration can result in fragmented views of costs, hindering executives' ability to have a comprehensive understanding of the cost structure and its implications.

To address the challenge of a lack of real-time data and visibility, executives can implement strategies that enhance data collection, analysis, and reporting processes. Investing in technology solutions that automate data capture, integrate systems, and provide real-time reporting capabilities can significantly improve the availability and accessibility of cost data.

Implementing data analytics tools and dashboards can also provide executives with real-time visibility into cost drivers, trends, and performance indicators. These tools enable executives to track costs, identify patterns, and make informed decisions based on accurate and timely information.

Furthermore, fostering a culture of data-driven decision-making and encouraging cross-functional collaboration can enhance the flow of information and promote transparency. By breaking down silos and facilitating the exchange of data and insights, executives can improve visibility and gain a comprehensive understanding of costs across the organization.

In summary, the lack of real-time data and visibility poses a significant challenge in finished goods costing. Executives must address issues related to data availability, integration, and accessibility. By leveraging technology solutions, implementing data analytics tools, and fostering a data-driven culture, executives can overcome this challenge, gain real-time visibility into costs, and make informed decisions for optimized finished goods costing.

D. Impact of external factors on costing

The impact of external factors on costing presents a complex challenge for executives involved in finished goods costing. Numerous external factors can influence costs, making it difficult to accurately predict and control expenses. Understanding and effectively managing these external factors are crucial for executives to optimize costing processes and make informed decisions.

One significant external factor is the volatility of input prices. Fluctuations in the cost of raw materials, energy, and other inputs can significantly impact the overall cost of production. Factors such as global supply and demand, geopolitical events, natural disasters, and currency fluctuations can lead to price volatility.

Executives must closely monitor these external factors, establish strong supplier relationships, and explore strategies like hedging or long-term contracts to mitigate the impact of price fluctuations.

Market dynamics and competition also play a vital role in costing. Changes in market demand, shifts in consumer preferences, and evolving industry trends can affect the pricing of finished goods and the cost structure. Executives need to consider these factors when determining product pricing and aligning costs with market realities. Failure to adapt to changing market conditions can lead to price erosion, reduced profitability, and loss of competitive advantage.

Government regulations and policies can significantly impact costing as well. Changes in taxation, import/export duties, environmental regulations, labor laws, and other regulatory requirements can directly influence production costs. Executives must stay updated on regulatory changes and factor them into their costing calculations and decision-making processes.

Macroeconomic factors, such as inflation rates, interest rates, and exchange rates, can also impact costing. Fluctuations in these factors can influence the cost of financing, borrowing, and currency conversions, ultimately affecting the overall cost structure. Executives must consider the macroeconomic environment when evaluating costs, conducting sensitivity analyses, and making strategic decisions.

To address the challenge of external factors on costing, executives can adopt several strategies. They should invest in market research and analysis to understand customer needs, monitor industry trends, and anticipate changes in demand and competition. Additionally, executives should establish effective risk management strategies, such as diversifying suppliers, developing contingency plans, and conducting scenario analyses to assess the impact of external factors on costs.

Collaboration with relevant stakeholders, such as suppliers, industry associations, and regulatory bodies, can provide valuable insights into external factors and help executives adapt their costing strategies accordingly. Regular monitoring of external factors, data-driven analysis, and continuous improvement initiatives can enhance executives' ability to manage the impact of external factors on costing effectively.

Strategies for Optimizing Finished Goods Costing

In the quest for enhanced profitability and sustainable growth, executives must proactively employ effective strategies to optimize finished goods costing. This section explores a range of strategies that empower executives to streamline costing processes, identify cost-saving opportunities, and make informed decisions that drive financial performance.

From implementing advanced costing methodologies to embracing technology-driven solutions and fostering a culture of continuous improvement, these strategies offer valuable insights and practical approaches to unlock the full potential of finished goods costing.

By leveraging these strategies, executives can navigate the complexities of cost optimization and position their organizations for success in today's competitive business landscape.

A. Implementing Activity-Based Costing (ABC) approach

Implementing the Activity-Based Costing (ABC) approach offers several benefits in capturing cost drivers accurately and gaining a deeper understanding of the cost structure in finished goods costing. Some key benefits include:

a. Enhanced Cost Accuracy: ABC enables executives to allocate costs more accurately by tracing expenses to specific activities and cost drivers. This approach provides a more detailed and comprehensive view of how different activities contribute to the overall costs of producing finished goods.

b. Identification of Cost Drivers: ABC helps identify the specific activities that drive costs within the production process. By linking costs to activities, executives can determine the factors that have the most significant impact on the cost of producing finished goods. This information allows for targeted cost reduction efforts and better resource allocation.

c. Improved Decision-Making: With a better understanding of cost drivers, executives can make more informed decisions. They can identify non-value-added activities, prioritize cost-saving initiatives, and optimize resource allocation to achieve cost efficiency while maintaining or improving product quality.

d. Enhanced Pricing Strategies: ABC provides insights into the true cost of producing each finished good, allowing for more accurate pricing decisions. By understanding the costs associated with specific activities, executives can determine the pricing that ensures profitability while remaining competitive in the market.

e. Transparency and Accountability: ABC promotes transparency and accountability by linking costs to specific activities and cost centers. It allows executives to communicate the rationale behind cost allocation and facilitates better cost control and performance evaluation.

Steps to implement ABC in finished goods costing: Implementing the ABC approach in finished goods costing involves several key steps:

a. Identify Activities: Identify and define the activities involved in the production process of finished goods. These activities should capture the various tasks, processes, and resources utilized in manufacturing the products.

b. Determine Cost Drivers: Identify the factors or drivers that significantly impact the costs of each activity. Cost drivers could include machine hours, labor hours, number of setups, or any other factors that have a direct influence on resource consumption and costs.

c. Allocate Costs: Assign costs to each activity based on their consumption of resources and the identified cost drivers. This step involves quantifying the resources used by each activity and calculating the cost associated with each resource.

d. Calculate Activity Rates: Calculate the activity rates by dividing the total cost of each activity by the total quantity of the associated cost driver. This step determines the cost per unit of the cost driver and provides the basis for allocating costs to specific finished goods.

e. Assign Costs to Finished Goods: Allocate the costs of each activity to specific finished goods based on their usage of the identified cost drivers. This step involves multiplying the activity rates by the quantity of the relevant cost driver used by each finished good.

f. Analyze and Evaluate: Analyze the results obtained from the ABC calculations to gain insights into the cost structure of finished goods. Compare costs across different products, identify areas of cost inefficiency, and assess the impact of cost drivers on overall costs.

g. Continuous Improvement: Implement a system for ongoing monitoring and refinement of the ABC approach. Regularly review and update activity costs and cost drivers based on changing production processes, market dynamics, and internal factors.

By following these steps, executives can successfully implement the ABC approach in finished goods costing, enabling them to capture cost drivers accurately, make informed decisions, and optimize cost efficiency throughout the production process.

B. Utilizing technology solutions for cost analysis

Utilizing technology solutions for cost analysis, such as data analytics and machine learning, as well as implementing cost management software, can significantly enhance cost analysis capabilities. Let's explore each aspect:

Leveraging data analytics and machine learning: Data analytics and machine learning can revolutionize cost analysis by enabling organizations to process and analyze vast amounts of data to gain valuable insights and make data-driven decisions. Here's how these technologies can be utilized:

a. Data Processing and Analysis: Data analytics tools can aggregate and process data from various sources, such as ERP systems, financial databases, and production records. Machine learning algorithms can then analyze this data to uncover patterns, identify cost drivers, and reveal hidden correlations that may not be apparent through traditional analysis methods. By leveraging these technologies, executives can gain a deeper understanding of costs and make informed decisions based on accurate and timely insights.

b. Predictive Analytics: Machine learning algorithms can leverage historical cost data, combined with other relevant variables, to predict future costs and trends. This enables executives to anticipate cost fluctuations, identify potential cost-saving opportunities, and make proactive decisions to optimize costs. Predictive analytics also helps in forecasting cost impacts under different scenarios, supporting better resource allocation and planning.

c. Cost Optimization Modeling: Data analytics and machine learning can assist in developing cost optimization models. These models analyze different cost drivers, constraints, and variables to identify the optimal cost structure. By simulating various cost scenarios and conducting what-if analyses, executives can explore the impact of potential cost-saving initiatives and make informed decisions to achieve cost optimization goals.

d. Real-time Cost Monitoring: Data analytics and machine learning technologies enable real-time cost monitoring by integrating data from multiple sources and providing timely insights. Executives can access dashboards and reports that provide a holistic view of costs, allowing them to monitor costs continuously, identify cost anomalies, and take immediate action to address any cost overruns or inefficiencies.

Implementing cost management software: Cost management software provides a dedicated platform for effectively managing and analyzing costs across the organization. Here are the key advantages of implementing such software:

a. Automated Cost Calculation: Cost management software automates the process of calculating costs, reducing manual effort and potential errors. It streamlines cost allocation, tracking, and reporting, ensuring accuracy and consistency in cost calculations across different products, projects, or cost centers.

b. Data Integration and Visualization: Cost management software integrates data from various systems and databases, providing a centralized repository for cost-related information. This integration allows executives to access and visualize cost data through interactive dashboards and reports, facilitating better decision-making and providing a comprehensive view of costs.

c. Cost Allocation and Tracking: Cost management software simplifies and streamlines cost allocation processes. It offers predefined cost allocation methods and allows customization based on specific requirements. Executives can track costs at various levels, such as product, project, or cost center, ensuring transparency and accountability in cost management.

d. Reporting and Analysis: Cost management software provides robust reporting and analysis capabilities. Executives can generate detailed cost reports, conduct variance analysis, perform profitability analysis, and gain insights into cost trends and patterns. These features enable better visibility into costs, facilitating data-driven decision-making and identifying areas for cost optimization.

e. Collaboration and Workflow Management: Cost management software often includes collaboration features, enabling teams to collaborate on cost analysis, cost reduction initiatives, and cost control measures. Workflow management capabilities streamline the review and approval processes, ensuring efficient and timely decision-making.

In summary, utilizing data analytics and machine learning technologies, as well as implementing cost management software, empowers organizations to enhance cost analysis capabilities. By leveraging these technology solutions, executives can gain deeper insights, optimize costs, make informed decisions, and drive financial performance.

C. Enhancing cost transparency and collaboration

Enhancing cost transparency and collaboration plays a crucial role in optimizing costs in the context of cross-functional teams for cost optimization and supplier collaboration and negotiation.

Let's explore each aspect:

Cross-functional teams for cost optimization: Establishing cross-functional teams brings together individuals from various departments and functions within an organization to collectively focus on cost optimization initiatives.

By fostering collaboration among these teams, cost transparency can be enhanced in the following ways:

a. Sharing Information: Cross-functional teams enable the sharing of information and knowledge from different areas of expertise. This facilitates a comprehensive understanding of cost drivers, cost-saving opportunities, and potential areas for improvement. Through open communication and knowledge exchange, teams can gain insights into the cost implications of different decisions and work together towards optimizing costs.

b. Identifying Cost Drivers: With representatives from different functions, cross-functional teams can identify and analyze cost drivers across the entire value chain. By pooling their expertise, they can explore the factors that impact costs in each function and identify opportunities to optimize costs collectively. This collaborative approach helps in identifying the root causes of costs and designing effective cost reduction strategies.

c. Collaborative Decision-Making: Cross-functional teams enable collaborative decision-making processes by bringing together diverse perspectives. By involving stakeholders from various functions, decisions related to cost optimization can be evaluated from multiple angles. This leads to more well-rounded decisions that consider the broader impact on operations, quality, and customer satisfaction.

d. Continuous Improvement: Cross-functional teams can foster a culture of continuous improvement by regularly reviewing cost performance, sharing best practices, and implementing cost-saving initiatives. By working together to identify inefficiencies, eliminate waste, and streamline processes, these teams can drive ongoing cost optimization efforts.

Supplier Collaboration and Negotiation: Collaborating with suppliers and engaging in effective negotiation can significantly impact costs and enhance transparency in the supply chain. Here's how:

a. Transparent Supplier Relationships: Building transparent and collaborative relationships with suppliers involves open communication and sharing of relevant cost information. By working closely with suppliers, executives can gain insights into their cost structures, production processes, and pricing models. This transparency allows for a better understanding of supplier costs, enabling executives to identify opportunities for cost optimization and negotiate more effectively.

b. Value Analysis: Collaboration with suppliers can involve jointly conducting value analysis exercises to identify opportunities for cost reduction. By working together to examine product design, specifications, and materials, executives and suppliers can explore alternatives that achieve the desired quality and functionality at lower costs. This collaborative approach helps uncover cost-saving possibilities throughout the supply chain.

c. Strategic Sourcing: Effective negotiation with suppliers can result in favorable terms, such as lower pricing, volume discounts, or improved payment terms. By leveraging their collective purchasing power and engaging in strategic sourcing practices, executives can optimize costs by securing the best possible deals with suppliers. Regular supplier evaluation and performance monitoring ensure that cost and quality expectations are met consistently.

d. Long-Term Partnerships: Establishing long-term partnerships with key suppliers encourages mutual trust and collaboration. By fostering strong relationships, executives can gain insights into supplier cost structures, cost drivers, and potential areas for cost optimization. This collaborative approach allows for joint problem-solving and the implementation of innovative cost-saving initiatives.

In summary, enhancing cost transparency and collaboration through cross-functional teams and supplier collaboration and negotiation facilitates better cost understanding, identification of cost drivers, collaborative decision-making, and continuous improvement. By leveraging these collaborative approaches, executives can optimize costs throughout the organization and supply chain, ultimately driving financial performance and achieving cost optimization goals.

D. Continuous improvement and cost reduction initiatives

Continuous improvement and cost reduction initiatives are essential in achieving cost optimization in the context of lean manufacturing principles and value engineering/product redesign. Let's explore each aspect:

Lean manufacturing principles: Lean manufacturing principles focus on eliminating waste and improving efficiency throughout the production process. Continuous improvement and cost reduction initiatives are inherent to lean manufacturing. Here's how they work together:

a. Waste Identification and Elimination: Continuous improvement efforts in lean manufacturing involve identifying and eliminating various types of waste, such as overproduction, defects, inventory, unnecessary motion, waiting time, and excessive processing. By reducing waste, organizations can streamline processes, optimize resource utilization, and lower costs.

b. Kaizen and Continuous Improvement: Lean manufacturing emphasizes a culture of continuous improvement, where employees at all levels actively contribute to identifying process inefficiencies and suggesting improvements. Through regular kaizen events, organizations can engage employees in finding cost-saving opportunities, implementing process improvements, and achieving incremental cost reductions over time.

c. Value Stream Mapping: Value stream mapping is a lean technique that helps visualize and analyze the flow of materials, information, and activities throughout the production process. By mapping the value stream, organizations can identify areas of waste, bottlenecks, and non-value-added activities. This enables targeted cost reduction initiatives, such as optimizing material flow, reducing lead times, and improving overall process efficiency.

d. Standardized Work and Error Proofing: Implementing standardized work processes and error-proofing techniques, such as poka-yoke, ensures consistent quality, minimizes defects, and reduces rework or scrap costs. These initiatives contribute to cost reduction by eliminating unnecessary expenses associated with defects and quality issues.

Value Engineering and Product Redesign: Value engineering involves systematically examining the function and cost of a product or process to identify opportunities for cost reduction while maintaining or improving value. Product redesign focuses on optimizing product features and specifications to achieve cost savings. Here's how continuous improvement and cost reduction initiatives apply to value engineering and product redesign:

a. Cost Analysis and Optimization: Continuous improvement efforts involve analyzing the cost structure of products, identifying cost drivers, and optimizing costs through value engineering and product redesign. By carefully examining design elements, materials, manufacturing processes, and associated costs, organizations can identify cost-saving opportunities without compromising product quality or performance.

b. Design for Manufacturability: Designing products for ease of manufacturing and assembly helps eliminate unnecessary complexity, reduce production time, and minimize costs. Continuous improvement efforts focus on collaborating with design teams to optimize product designs for efficient manufacturing, ensuring that cost considerations are integrated into the design process.

c. Supplier Collaboration and Negotiation: Continuous improvement initiatives involve collaborating closely with suppliers to identify cost-saving opportunities and negotiate favorable pricing. By working collaboratively with suppliers, organizations can explore alternatives, leverage supplier expertise, and achieve mutually beneficial cost reductions through improved sourcing strategies and supplier relationships.

d. Lifecycle Cost Analysis: Continuous improvement efforts in value engineering and product redesign include conducting lifecycle cost analyses to assess the long-term cost implications of design choices. By considering factors such as product durability, maintenance requirements, and end-of-life disposal, organizations can optimize costs throughout the product's lifecycle, including the initial purchase, usage, and eventual disposal or replacement.

In summary, continuous improvement and cost reduction initiatives play a crucial role in both lean manufacturing principles and value engineering/product redesign. By implementing these initiatives, organizations can streamline processes, eliminate waste, optimize costs, and achieve sustainable cost reductions while enhancing product quality and value.

Key Performance Indicators (KPIs) for Finished Goods Costing

In the realm of finished goods costing, tracking and evaluating key performance indicators (KPIs) is vital for executives seeking to optimize costs and drive financial performance. This section focuses on exploring the key performance indicators that provide insights into the cost structure, profitability, and efficiency of producing finished goods.

By measuring and monitoring these KPIs, executives can gain a comprehensive understanding of their organization's costing performance, identify areas for improvement, and make informed decisions to achieve cost optimization and maximize profitability.

A. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) is a fundamental key performance indicator in finished goods costing. It represents the direct and indirect costs incurred in the production of goods that are sold during a specific period. COGS serves as a measure of the expenses directly associated with the production process, providing insights into the overall cost efficiency and profitability of producing finished goods.

Tracking COGS helps executives evaluate the direct costs, including raw materials, direct labor, and manufacturing overhead, that are directly attributable to the production of each unit of finished goods. By monitoring COGS, executives can assess the effectiveness of cost control measures, identify cost-saving opportunities, and make informed decisions regarding pricing strategies, product profitability, and overall cost optimization.

COGS is typically calculated using the following formula:

COGS = Opening Inventory + Purchases - Closing Inventory

The opening inventory represents the value of finished goods at the beginning of the accounting period, while purchases account for the cost of materials and supplies acquired during the period. The closing inventory represents the value of finished goods remaining at the end of the period. The difference between opening inventory, purchases, and closing inventory provides the COGS for the specific period.

Monitoring COGS enables executives to analyze trends over time, compare costs across different products or periods, and benchmark against industry standards. It helps in identifying cost variances, cost drivers, and areas for improvement in the production process. By effectively managing and reducing COGS, executives can optimize costs, improve profitability, and gain a competitive edge in the market.

In summary, tracking the Cost of Goods Sold (COGS) is a critical key performance indicator in finished goods costing. It provides insights into the direct and indirect costs associated with the production of goods, allowing executives to assess cost efficiency, profitability, and make informed decisions to achieve cost optimization and maximize financial performance.

B. Gross profit margin

Gross profit margin is a key performance indicator in finished goods costing that provides insights into the profitability of producing and selling finished goods. It measures the percentage of revenue that remains after deducting the direct costs associated with producing those goods. Gross profit margin is a critical metric for executives to evaluate the efficiency of their cost management and pricing strategies.

The calculation of gross profit margin is as follows:

Gross Profit Margin = (Revenue - Cost of Goods Sold) / Revenue * 100

By subtracting the cost of goods sold (COGS) from revenue and dividing it by revenue, executives can determine the percentage of each dollar of revenue that contributes to gross profit. A higher gross profit margin indicates greater profitability and cost efficiency in producing and selling finished goods.

Monitoring gross profit margin enables executives to assess the effectiveness of their pricing strategies, cost control measures, and overall profitability. It provides a clear picture of the direct profitability of producing and selling finished goods before considering other expenses such as overhead and operating costs.

A high gross profit margin indicates that the company can cover its direct production costs and still generate a healthy profit. On the other hand, a low gross profit margin may indicate inefficiencies in production processes, high production costs, or pricing strategies that need to be reconsidered.

Executives can analyze gross profit margin in various ways, such as comparing it to industry benchmarks, monitoring trends over time, or evaluating it across different product lines. This analysis helps identify areas for cost optimization, pricing adjustments, and product mix strategies to improve overall profitability.

By striving to increase gross profit margin, executives can optimize costs, improve operational efficiency, and make informed decisions regarding pricing, product mix, and cost reduction initiatives. A higher gross profit margin allows companies to allocate resources strategically, invest in growth opportunities, and enhance their financial performance.

In summary, gross profit margin is a vital key performance indicator in finished goods costing that measures the profitability of producing and selling finished goods. By monitoring and analyzing gross profit margin, executives can evaluate cost efficiency, pricing strategies, and overall profitability, enabling them to make informed decisions to optimize costs and maximize financial performance.

C. Cost variance analysis

Cost variance analysis is a key performance indicator in finished goods costing that helps executives evaluate and understand the variances between actual costs and expected or budgeted costs. It provides valuable insights into the effectiveness of cost management strategies, identifies areas of cost overruns or savings, and enables informed decision-making to optimize costs.

Cost variance analysis involves comparing actual costs incurred during the production of finished goods with the predetermined budgeted costs or standard costs. The variance is calculated by subtracting the budgeted or standard costs from the actual costs. Positive variances indicate that actual costs are higher than expected, while negative variances indicate that actual costs are lower than expected.

Executives can analyze cost variances at various levels, such as overall production costs, specific cost categories (e.g., raw materials, direct labor, overhead), or individual products or projects. This allows for a granular understanding of cost discrepancies and facilitates targeted cost optimization efforts.

Key reasons for cost variances may include changes in input prices, fluctuations in production volumes, variations in labor efficiency, unexpected expenses, or deviations from planned production processes. By identifying the root causes of cost variances, executives can take appropriate actions to address them and improve cost control.

Cost variance analysis provides several benefits for executives:

Performance Evaluation: By comparing actual costs with budgeted or standard costs, executives can evaluate the performance of different cost centers, departments, or product lines. It helps in identifying areas of excellence or inefficiency, enabling targeted improvement efforts.

Cost Optimization: Cost variances highlight areas where cost overruns occur, allowing executives to implement corrective actions to reduce expenses and optimize costs. It helps identify opportunities for process improvements, cost-saving initiatives, and efficiency enhancements.

Forecasting and Budgeting: Cost variance analysis provides insights into the accuracy of budgeted or standard costs. This information helps in refining future budgeting and forecasting processes, ensuring that future cost estimates are more accurate and aligned with actual cost trends.

Decision-Making: By understanding cost variances, executives can make informed decisions regarding pricing strategies, resource allocation, product mix, and cost reduction initiatives. It enables them to prioritize investments, allocate resources effectively, and take timely actions to optimize costs.

To conduct effective cost variance analysis, organizations need accurate and timely cost data, robust budgeting and cost tracking systems, and a clear understanding of the underlying cost drivers. Implementing a proactive cost variance analysis process allows executives to identify cost-saving opportunities, improve cost control, and enhance overall financial performance.

In summary, cost variance analysis is a valuable key performance indicator in finished goods costing. It enables executives to evaluate cost performance, identify areas of cost overruns or savings, and make informed decisions to optimize costs. By conducting regular cost variance analysis, executives can improve cost control, enhance operational efficiency, and drive financial performance.

D. Return on Investment (ROI)

Return on Investment (ROI) is a key performance indicator that measures the profitability and financial viability of an investment or project. While not directly linked to finished goods costing, ROI is an important metric for executives to assess the overall impact and value of their cost optimization initiatives. Let's explore its significance:

ROI is calculated by dividing the net profit generated by an investment by the initial investment cost and expressing it as a percentage. The formula for ROI is as follows:

ROI = (Net Profit / Initial Investment) * 100

ROI provides executives with insights into the efficiency and effectiveness of their investment decisions. It helps them evaluate the returns generated from various projects or initiatives and assess whether the investment has yielded a positive or negative outcome.

In the context of cost optimization, ROI can be used to assess the financial impact of cost reduction initiatives. By comparing the savings achieved through cost optimization efforts with the initial investment required to implement those initiatives, executives can determine the return on their investment.

Executives can use ROI in the following ways:

Cost Reduction Initiatives: When implementing cost reduction initiatives, executives can calculate the ROI to evaluate the financial impact of those efforts. By comparing the cost savings achieved through the initiatives with the costs associated with implementing them, executives can determine whether the initiatives have generated a positive ROI. This helps in prioritizing and allocating resources to the most effective cost reduction initiatives.

Investment Decision-Making: Executives can utilize ROI as a decision-making tool when considering new investments or projects. By estimating the potential returns and comparing them with the initial investment costs, executives can assess the financial feasibility and profitability of the proposed investments. This analysis ensures that resources are allocated to investments with the highest potential for generating a positive ROI.

Performance Evaluation: ROI can be used to evaluate the performance and profitability of different business units, projects, or product lines. By comparing the ROI of different segments, executives can identify areas that are generating higher returns and those that may require further analysis and improvement. This information helps in making informed decisions regarding resource allocation, investment prioritization, and overall business strategy.

It's important to note that ROI should be interpreted in conjunction with other financial metrics and factors. It should consider the time value of money, the duration of the investment, and the specific industry or market dynamics. ROI serves as a valuable indicator, but it should be evaluated in the context of the organization's overall financial goals and performance measures.

Why should Businesses Implement Strategies for Cost Optimization?

Implementing effective strategies for cost optimization is crucial for executives to enhance profitability, drive financial performance, and gain a competitive edge. By taking action and leveraging the following strategies, organizations can unlock significant cost-saving opportunities and achieve sustainable success:

Embrace Advanced Costing Methodologies: Implementing advanced costing methodologies, such as Activity-Based Costing (ABC), enables executives to gain a deeper understanding of cost drivers, accurately allocate costs, and make informed decisions. By adopting these methodologies, organizations can identify areas of inefficiency, optimize resource allocation, and improve overall cost control.

Leverage Technology Solutions: Utilize technology solutions, including data analytics, machine learning, and cost management software, to enhance cost analysis capabilities. These tools provide accurate insights, automate cost calculations, and enable real-time monitoring of costs. By leveraging technology, organizations can uncover cost-saving opportunities, improve decision-making, and drive operational efficiency.

Foster Cross-Functional Collaboration: Establish cross-functional teams to drive cost optimization initiatives. By bringing together individuals from different departments, organizations can leverage diverse expertise, identify cost-saving opportunities, and implement continuous improvement efforts. Collaboration fosters a culture of cost-consciousness and empowers employees to contribute to cost optimization.

Strengthen Supplier Collaboration and Negotiation: Collaborate closely with suppliers to optimize costs. Engage in value analysis exercises, foster transparent relationships, and negotiate favorable terms. By collaborating with suppliers, organizations can identify cost-saving opportunities, improve sourcing strategies, and achieve mutually beneficial cost reductions.

Continuously Monitor Key Performance Indicators (KPIs): Regularly track and evaluate KPIs related to finished goods costing, such as Cost of Goods Sold (COGS), Gross Profit Margin, Cost Variance Analysis, and Return on Investment (ROI). These KPIs provide insights into cost performance, profitability, and efficiency. Monitoring them enables organizations to identify areas for improvement, make data-driven decisions, and drive cost optimization efforts.

By taking action and implementing these strategies, organizations can embark on a journey of continuous cost optimization, leading to improved profitability, operational efficiency, and sustainable growth. It requires a proactive approach, collaboration across functions, and a commitment to leveraging technology and data-driven insights. Together, let's embrace these strategies, optimize costs, and secure a competitive advantage in today's dynamic business landscape.

Conclusion

In conclusion, optimizing finished goods costing is a critical endeavor for executives seeking to drive financial performance, maximize profitability, and gain a competitive advantage in the business landscape. Throughout this guide, we have explored various aspects and strategies that contribute to effective cost optimization.

We began by understanding the importance of optimizing finished goods costing for executives, recognizing the need to enhance cost transparency, collaboration, and decision-making. We delved into key components of finished goods costing, such as direct costs, indirect costs, and overhead costs, emphasizing their significance in accurate cost allocation and analysis.

Next, we examined the challenges that organizations may encounter in finished goods costing, including variability in cost components, inaccurate cost allocation methods, the lack of real-time data and visibility, and the impact of external factors. Understanding these challenges is crucial in identifying areas for improvement and implementing effective cost optimization strategies.

To address these challenges, we explored strategies for optimizing finished goods costing, such as implementing the Activity-Based Costing (ABC) approach, leveraging technology solutions for cost analysis, and fostering cross-functional collaboration. These strategies empower executives to streamline costing processes, identify cost-saving opportunities, and make informed decisions that drive financial performance.

Furthermore, we discussed key performance indicators (KPIs) for finished goods costing, including Cost of Goods Sold (COGS), Gross Profit Margin, Cost Variance Analysis, and Return on Investment (ROI). Monitoring and evaluating these KPIs enable organizations to assess cost performance, profitability, and efficiency, facilitating data-driven decision-making and continuous improvement.

In conclusion, optimizing finished goods costing requires a comprehensive approach that encompasses accurate cost allocation, leveraging technology solutions, fostering collaboration, and monitoring performance through relevant KPIs. By implementing these strategies, organizations can unlock cost-saving opportunities, drive operational efficiency, and achieve sustainable growth.

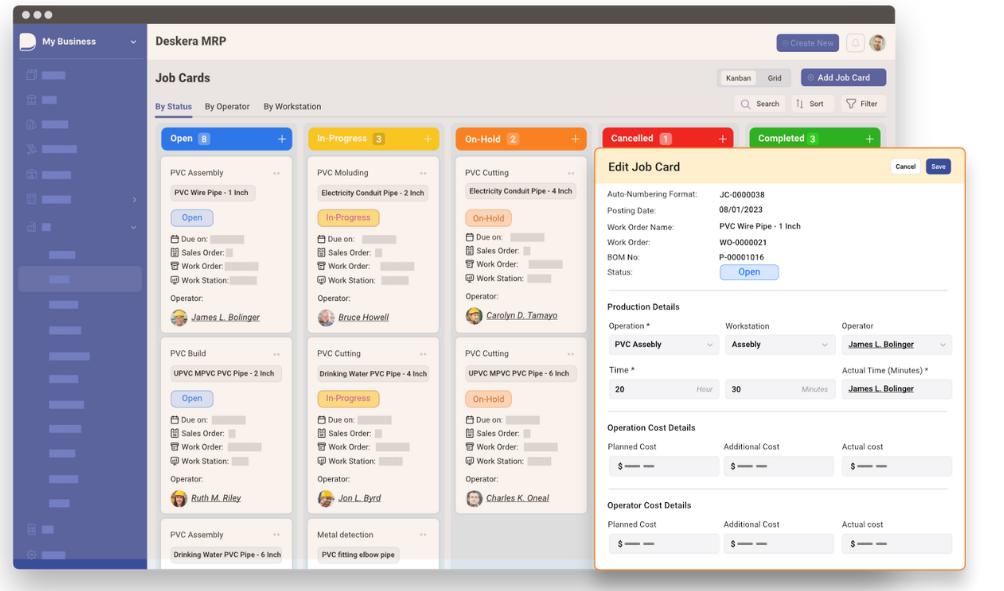

How can Deskera Help You?

Deskera ERP and MRP systems help you to keep your business units organized. The system's primary functions are as follows:

- Keep track of your raw materials and final items inventories

- Control production schedules and routings

- Keep a bill of materials

- Produce thorough reports

- Make your own dashboards

Deskera's integrated financial planning tools enable investors to better plan and track their investments. It can assist investors in making faster and more accurate decisions.

Deskera Books allows you to better manage your accounts and finances. Maintain good accounting practices by automating tasks like billing, invoicing, and payment processing.

Deskera CRM is a powerful solution that manages your sales and helps you close deals quickly. It not only enables you to perform critical tasks like lead generation via email, but it also gives you a comprehensive view of your sales funnel.

Deskera People is a straightforward tool for centralizing your human resource management functions.

Key Takeaways

- Optimizing finished goods costing is essential for executives to drive financial performance and maximize profitability in today's competitive business landscape.

- Understanding the key components of finished goods costing, including direct costs, indirect costs, and overhead costs, is crucial for accurate cost allocation and analysis.

- Challenges in finished goods costing, such as variability in cost components, inaccurate cost allocation methods, lack of real-time data and visibility, and the impact of external factors, need to be identified and addressed for effective cost optimization.

- Implementing the Activity-Based Costing (ABC) approach enables executives to allocate costs more accurately by tracing expenses to specific activities and cost drivers, providing insights into cost behavior and opportunities for cost reduction.

- Leveraging technology solutions, such as data analytics, machine learning, and cost management software, enhances cost analysis capabilities, enables real-time monitoring of costs, and provides accurate insights for informed decision-making.

- Fostering cross-functional collaboration and engaging in supplier collaboration and negotiation are crucial for identifying cost-saving opportunities, improving cost control, and optimizing resource allocation.

- Monitoring key performance indicators (KPIs) for finished goods costing, such as Cost of Goods Sold (COGS), Gross Profit Margin, Cost Variance Analysis, and Return on Investment (ROI), provides insights into cost performance, profitability, and efficiency, facilitating data-driven decision-making and continuous improvement.

- Cost variance analysis helps executives evaluate cost performance by comparing actual costs with budgeted or standard costs, identifying areas of cost overruns or savings, and enabling targeted cost optimization efforts.

- Return on Investment (ROI) serves as a valuable metric to assess the financial viability and profitability of investments and cost reduction initiatives, aiding in decision-making and resource allocation.

- Taking action and implementing strategies for cost optimization, including embracing advanced costing methodologies, leveraging technology solutions, fostering collaboration, and monitoring KPIs, is crucial for organizations to unlock cost-saving opportunities, drive operational efficiency, and achieve sustainable growth.

Related Articles