One of the most useful indicators for assessing a company's financial strength and stock price is the profit per share, which is called the Earning Per Share Ratio (EPS). This is a crucial parameter to define profit per share, and you will see how it is calculated and how it can help improve your investment decisions.

In this blog, we'll be going over the following things:

- What is the EPS - Earnings Per Share Ratio?

- Earnings per share ratio formula

- Interpretation of Earnings per share ratio:

- Types of earnings per share ratio:

- How do earnings per share ratios affect stock valuation?

- Why are the earnings per share ratio important?

- What earnings per share ratio doesn't tell you?

- How are the earnings per share ratio used?

- What are the ideal earnings per share ratio?

- What are the earnings per share ratio limitations?

- Types of earnings per share ratio variation

What is the EPS - Earnings Per Share Ratio?

The earnings per share ratio (EPS) is the percentage of a company's net income per share if all profits are distributed to shareholders. The earnings per share ratio tell a lot about the current and future profitability of a company and can be easily calculated from the basic financial information of an organization that is easily available online.

Earnings per share ratio (EPS) is a financial ratio calculated by dividing net income by the total number of issued common shares. Investors use EPS to assess a company's performance and profitability before investing. The higher the EPS, the better the financial condition, the higher the value, and the more profits to distribute to shareholders.

Companies typically issue earnings per share ratio tailored to exceptional items and potential stock dilution. The company's earnings per share ratio shows how much money the company has made per common stock. The earnings per share ratio are usually calculated quarterly or yearly.

You don’t want to judge a company’s stability by analyzing single earnings per share ratio; instead, you should be making a comparison of various changes in earnings per share ratio over time, compare it to other companies, and then finally judge the financial health of the company.

Earnings Per Share Ratio Formula

You can calculate the earnings per share ratio using the following formula-

Earnings Per Share Ratio Formula = (Net Income – Preferred Dividends)/Weighted Average Number of Shares Outstanding

Earnings per share ratio are the net income that is available for the shareholders after deducting preferred dividends (does not include the common stock dividends)

The number of issued common shares can fluctuate throughout the year, so a weighted average is used to calculate the earnings per share ratio.

The weighted average number of common shares is the number of outstanding shares weighted by the total time of the year in which they were outstanding.

You Must follow 3 steps to calculate the weighted average number of outstanding common shares:

- Determine the company's net profit from the previous year

- Determine the number of outstanding shares

- Divide the net income by the total number of shares outstanding

Procedure for calculating weighted earnings per share ratio

Let us look at the steps to be followed below:

1. Determine the net profit of the company of the previous year

The easiest way to find earnings per share ratio is to use your company's net earnings or net income that can usually be found on their website or financial website. Don’t confuse quarterly net income with annual net income.

2. Determine the number of issued/outstanding shares

The number of shares in circulation is the number of shares held by the company on the stock exchange. Financial websites publish this information.

3. Divide net income by the number of issued shares to find the basic profit per share

You simply divide last year's net income by the total number of issued shares to calculate the earnings per share ratio.

Earnings per share ratio Example - 1

Mr. Grand runs a company under the name of Melco Enterprises, and here are some of its financial details:

Net income at the end of 2020 = 450,000 dollars

The preferred dividends paid in 2020 = 30,000 dollars

The company issued 50000 and 40000 common shares at the beginning and the middle of the financial year 2020, respectively.

Now to find the Earnings Per Share Ratio using the above example, we have key information like the net income and the preferred dividends, but to calculate the weighted average of common shares outstanding, you would need to follow some calculations

50000 shares will be considered for the entire year (50,000 * 1), and since 40000 shares were issued in the second half, so they will be considered for only half the year (40,000 * 0.5).

So, the Weighted average number of common shares becomes (50,000 * 1) + (40,000 * 0.5) = 50,000 + 20,000 = 70,000 shares.

Now to find the ratio, you must apply the formula:

Earnings per share ratio formula = (Net Income – Preferred Dividends) / Weighted Average Number of Common Shares

Earnings per share ratio formula = ($450,000 – $30,000) / 70,000

Earnings per share ratio = $420,000 / 70,000 = $6 per share.

Earnings per share ratio - Example 2

Let us take Walmart as an example. Let us assume that the Net Income attributable to Common Shareholders in 2020 was $2,241 million, while the common shares outstanding is 930.8 million.

So, the ratio will be simply calculated as $2,241 / 930.8 = $2.41

Interpretation of Earnings per share ratio

- The earnings per share ratio signify the performance, profitability, and value, of a company, and here is how it can be interpreted:

- The higher the earnings per share ratio, the higher the payment

- Compare companies using earnings per share ratio and use its growth trends to predict future profitability. This can help you make smarter investments

- Use earnings per share ratio to determine the stock price. The earnings per share ratio provide the information needed to compare price- earnings per share ratio

- By dividing the stock price by the profit per share, you can determine whether the company is more expensive or fairly valued than its peers

- The higher the earnings per share ratio, the higher the payment. A high earnings per share ratio number means that the company is profitable and can provide a better payout to shareholders

- Consider other factors when making an investment decision, including stock price, number of dividends, market capitalization or the listing value of the company, and liquidity

Types of earnings per share ratio

There are three types of earnings per share ratio:

1. Trailing earnings per share ratio

Trailing earnings per share ratios are based on the previous year's figures. This calculation uses the results of the previous four quarters to calculate profit per share. Most stock market stocks use trailing earnings per share ratio because they use real numbers. However, investors may not pay much attention to it as they do not predict future earnings per share ratios.

2. Current earnings per share ratio

The current earnings per share ratio are based on the current year's figures, including forecasts. This calculation uses the four-quarter figures for the current fiscal year. Some quarters have already passed and show actual figures, but some quarters remain forecasted.

3. Forward earnings per share ratio

This is also called the futuristic earnings per share ratio, which is based on future forecasts. Analysts and the company use this ratio to make forecasts for investors, lenders, suppliers, and other stakeholders who want to know about the profitability of the company.

Many investors compare all three types of earnings per share ratios to make smarter investment decisions.

How does Earnings Per Share Ratio affect stock valuation?

The ratio represents the profitability of the company and is considered one of the most important indicators of the company's financial position. Results are published four times a year by listed companies, that research analysts and investors closely track.

This earnings per share ratio is a measure of a company's excellent performance and, in a sense, a measure of investor profits. The earnings per share ratio are available directly on the stock market.

The lower the multiple of PE compared to the industry average PE, the better the investment and valuation perspective. Because of the same relationship, stock prices react strongly to quarterly earnings.

Why is the Earnings Per Share Ratio important?

A company's ratio is significant when you think of buying, selling, or holding the stocks of that particular company. This ratio can be used for the following purposes:

- To understand the profitability of a company that can affect dividends and stock prices

- To calculate the company's price-earnings ratio which measures the stock price for earnings per share ratio

- To check if the company's profits are growing or declining over time It can also be compared to other companies’ actual ratios to meet the analysts' expectations

- There is no single number that represents an ideal EPS or a bad one as it's all relative

What Earnings Per Share Ratio doesn't tell you?

- The EPS or earnings per share ratio does not consider the current stock price. Perhaps the company is doing well, but the price is so high that it is currently overvalued, and the investment turns into a bad one

- The underlying ratio calculation also overlooks the impact of exceptional earnings events or expenses on the company's finances

- Looking at earnings per share ratio trends, you need to dig deeper to understand why the company’s EPS or earnings per share ratio is rising or falling

- Increasing R & D spending by companies can reduce the earnings per share ratio, but this is not necessarily a bad move in the long run

- Research-intensive tech and pharmaceutical companies can have negative profits per share, but they can offer good opportunities for growth stocks

- On the other hand, a high ratio can be the result of many changes, like increased sales, share repurchases, and lower costs

How is the Earnings Per Share Ratio used?

EPS or earnings per share ratio is one of many indicators that can be used to select stocks. If you are interested in trading or investing in stocks, the next step is to choose a broker that suits your investment style.

It may not make much sense for investors to compare earnings per share ratio on absolute terms, as ordinary shareholders do not have direct access to earnings. Instead, the investor compares the earnings per share ratio to the stock price to determine the value of the earnings and the investor's view of future growth.

What are the Ideal Earnings Per Share Ratio?

An ideal ratio depends on factors like the performance of the company’s competitors, its recent performance, and the expectations of analysts who track the stocks. Companies may be able to report an increase in profit per share, but if analysts expect higher numbers, stock prices could fall.

As with the, lower earnings per share ratio values can still lead to higher prices if analysts expect even worse results. It is important to always measure profit per share about a company's stock price, such as the company's price-earnings per share ratio. or the company's rate of return.

What are the Earnings Per Share Ratio Limitations?

When considering the earnings per share ratio to make investment or transaction decisions, be aware of some potential drawbacks.

A company can manipulate its earnings per share ratio by repurchasing shares, reducing the number of issued shares, and increasing the number of earnings per share ratio at the same profit level.

It can change the accounting and valuation method of the earnings because of which the ratio may also change.

Let us look at the five major categories of Earnings Per Share Ratio

also does not consider stock prices, so there is little mention of whether a company's stock price is overvalued or undervalued.

1. Reported earnings per share ratio or GAAP EPS

Corporate profits can be distorted by GAAP. For example, in the case of one-time machinery, the sales may increase profit per share when treated as operating profit under GAAP. Even if a company chooses to treat large amounts of recurring expenses as extraordinary expenses, it will artificially increase the earnings per share ratio directly.

2. Ongoing EPS or Pro Forma earnings per share ratio

This variation helps determine the expected return from the core business, but it does not help predict the real record of earnings that highlights the company's actual return.

The word pro forma means that assumptions have been considered while calculating the earnings per share ratio for a specific company.

3. Retained earnings per share ratio

This indicates the amount that the company has decided to make a profit, rather than distributing it to shareholders as a dividend. Entrepreneurs can choose to use retained earnings to repay existing debt, for expansion purposes, or to reserve future requirements. As a general rule, profits that are not used within a certain period will be added to net income for the next accounting period. This income will appear on the balance sheet under the heading equity.

Net income per share is calculated by adding net income to the currently distributable income and subtracting the total dividends paid. Finally, divide the rest by the total number of issued shares. The formula is:

Retained earnings per share ratio = (Net earnings + current retained earnings) – divided paid/total number of outstanding shares

On the contrary, if the retained earnings per share ratio are negative, it is deducted from the net profit for the next accounting period.

4. Cash earnings per share ratio

It is one of the important earnings per share ratio variations as it helps understand the company`s financial standing. It gives the exact amount of cash earned. and unlike net income, it is difficult to play around with this variation of earnings per share ratio.

Cash earnings per share ratio = Operating Cash Flow/Diluted Shares Outstanding

5. Book Value earnings per share ratio

This ration variation calculates the average amount of company equity in each share. Also, it helps to estimate the worth of a company`s share in case of liquidation. It focuses primarily on the balance sheet, so it is considered to be a static representation of the performance of a company.

How can Deskera Help You?

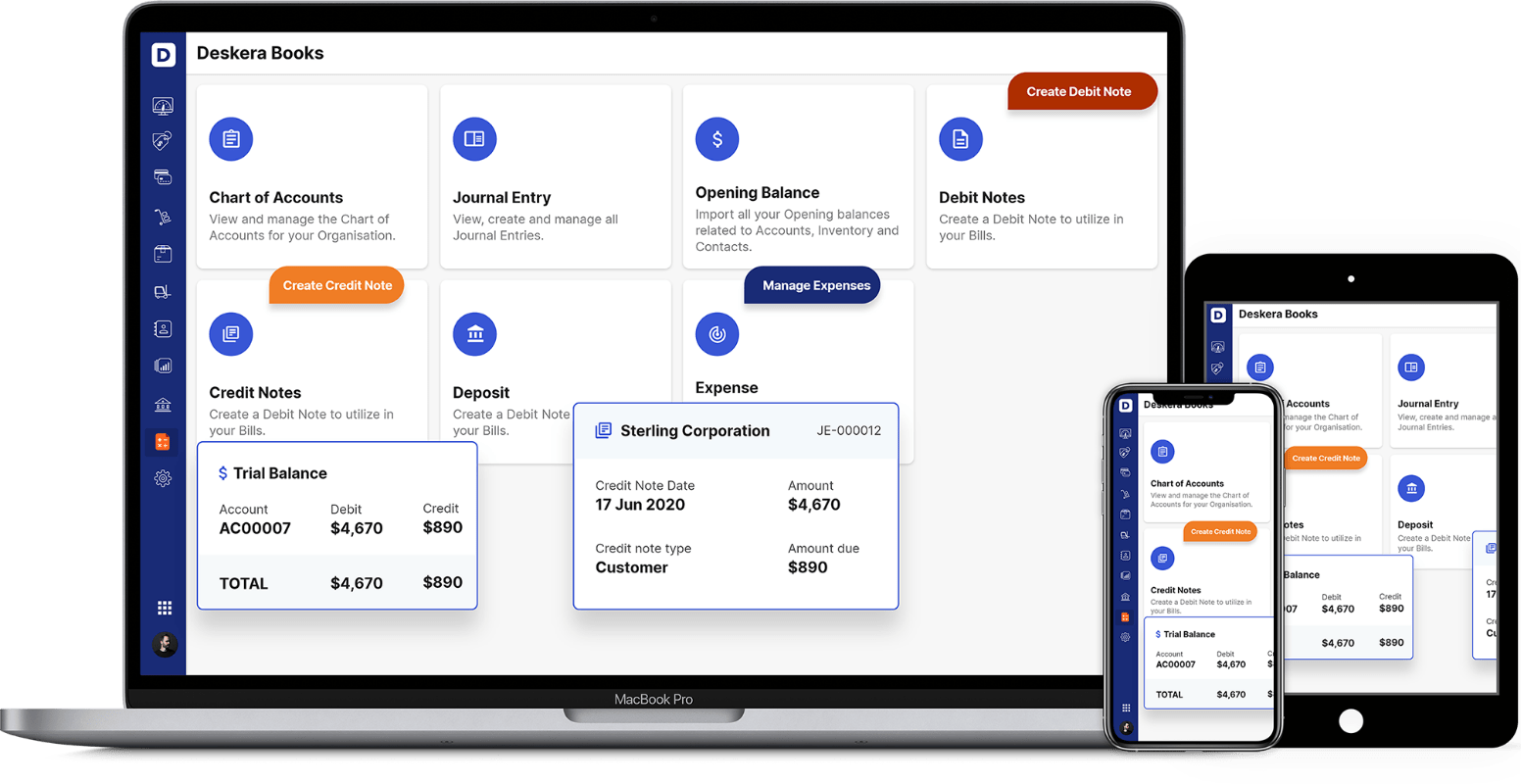

An online accounting and invoicing application, Deskera Books is designed to make your life easier. This all-in-one solution allows you to track invoices, expenses, and view all your financial documents from one central location.

The platform works exceptionally well for small businesses that are just getting started and have to figure out many things. As a result of this software, they are able to remain on top of their client's requirements by monitoring a timely delivery.

Thanks to our well-designed and well-thought-out templates, you can now anticipate that your work will become simpler. A template can be used for multiple actions, including invoices, quotes, purchase orders, back orders, bills, and payment receipts.

Take a small tour of the demo here to get more clarity:

Lastly, you would be able to assess all the reports- be it income statement, profit and loss statement, cash flow statement, balance sheet, trial balance, or any other relevant report from your laptop and your mobile phone.

Deskera Books hence is the perfect solution for all your accounting needs, and therefore a perfect assistant to you and your bookkeeping and accounting duties and responsibilities.

Conclusion

EPS or earnings per share ratio helps you understand whether your company's profits are increasing or decreasing over time. You must also consider various other factors before making potential investments, such as future inflation forecasts, interest rates, and market sentiment.

You cannot ignore the ratio as it helps to assess the company’s past performance and the capacity of its competitors. Instead, it should be used as one of the significant screening criteria to consider when making investment decisions.

Key Takeaways

- The earnings per share ratio or the EPS is the net company of the company divided by the number of common shares issued

- The earnings per share ratio is a widely used indicator of how much a company earns per share of its stock and is used to estimate its corporate value

- A high profit per share means that if an investor thinks that the company is making a high profit compared to the stock price, the investor pays more for the company's stock

- Earnings per share ratio can be determined in a variety of formats, for example, on a diluted basis, or by excluding exceptional items and discontinued operations

Related Articles