Are you a business owner in Jharkhand who is bound to comply with the regulatory deadlines of the state? Do you want to ensure that you do not have to pay any heavy fines, decrease your productivity and lose your opportunities and revenue due to non-compliance? Then this article is for you.

The aim of sharing the compliance calendar for Jharkhand with you is to ensure that all the compliance officers of your business have a holistic view of compliance filing dates across various applicable laws. This will help you to improve your cash flow, increase your business’s net profit ratio and have healthier financial statements in general.

The topics covered in this article are:

- What is a Compliance Calendar?

- What to Include in a Compliance Calendar?

- Reasons to Use a Compliance Calendar and its Benefits

- Best Practices for Developing Your Organization’s Compliance Calendar

- Compliance Calendar for Jharkhand

- Glossary for all the Acts of Statues/Returns/Compliances

- Forms as Needed as per Compliance Calendar of Jharkhand

- How Can Deskera Assist you with the Compliance Calendar of your Business?

- Key Takeaways

- Related Articles

What is a Compliance Calendar?

A compliance calendar centralizes and tracks important dates and deadlines related to critical regulations, permits, accreditations, and reporting obligations. A compliance calendar can be used to track both internal and external events, as well as the requirements at the local, national or international level.

A compliance calendar will thus help in keeping track of all of your company’s required filings, their due dates, and related details so that you can prevent your company from incurring any fines or other penalties for late filings or missing information.

What to Include in a Compliance Calendar?

What you include in your compliance calendar depends heavily on your particular business and the type of compliance dates that it faces. Filing deadlines and timelines vary in each state as well as industry- because some are ongoing, monthly, or quarterly, like tax payments.

In addition to that, some of the business filing obligations also include many types of licenses and permit renewals, which occur annually. For such instances, it is a yearly compliance calendar that you would require in order to keep track of these types of annual filing deadlines.

A compliance calendar is also used for keeping track of other important dates and filings for corporate meeting minutes and schedules, annual report filing deadlines, and any special events related to compliance activities.

Hence, the compliance calendar of your company can include everything that is important for its smooth functioning. It is slightly like a marketing planner, but while a marketing planner is department-specific and does not have to worry about reporting obligations to the relevant government authorities and otherwise, a compliance calendar has a wider scope.

Reasons to Use a Compliance Calendar and its Benefits

There are multiple reasons for using a compliance calendar, especially due to the benefits that it brings with itself. For example, if yours is a small sole proprietorship business, then a compliance calendar will help you stay updated about all the paperwork you need to file and when. This will be equivalent to an entire job being done for you.

However, if yours is a Limited Liability Company, in that case, the compliance calendar would literally be able to make a difference up to the extent of you staying in or going out of the business. This is because problems tend to arise when you miss out on putting a detail, which will bring the state agencies regulating businesses to your door. A compliance calendar will help in ensuring that such mistakes do not happen.

Additionally, a compliance calendar is also a handy way of keeping all your employees and multiple owners on the same page in regards to the filing deadlines. In fact, if the need arises, a compliance calendar becomes that document having all the dates and information that you can present to the regulatory agencies.

Thus, the reasons and benefits of using compliance calendars are:

- Compliance calendars help secure organizational data in a secured manner, including your customer’s data.

- Compliance calendars ensure that your compliance information is spread throughout the organization, ensuring that all the deadlines are met and not forgotten. Compliance calendar will also serve the purpose of educating your entire organization on the applicable compliance measures, keeping each employee informed and up-to-date.

- Compliance calendar will facilitate you taking a proactive stance on the regulatory measures that are relevant and applicable to your business. They allow you to prepare and plan ahead, hence allowing you to gather data and allocate the resources needed to meet the obligation. They will also help in keeping track of the shifting compliance regulations.

- Compliance calendars increase transparency by offering an easy way of monitoring progress on compliance measures, hence increasing visibility across the organization. This would help in keeping the stakeholders, and board members informed while also removing any and all uncertainty in regard to compliance measures.

- Compliance calendars also facilitate global management by keeping track of all the compliance measures that need to be undertaken along with their deadlines and requirements.

- A compliance calendar will also help your organization in preparing for compliance audits and reports.

- Compliance calendars will also send automatic reminders and escalating email notifications when deadlines are missed, which will help in limiting the penalties, if not completely avoiding them.

Best Practices for Developing Your Organization’s Compliance Calendar

Some of the practices that you should follow while developing your organization’s compliance calendar are:

- Reviewing your company’s current compliance manual: All organizations should have a compliance manual in hand. This is because by referring to it, you would be able to plan your compliance calendar for each year better. While formulating your compliance calendar, you should also ensure that new regulations or initiatives are properly followed by your company’s policies. Also, double-check that the compliance processes on the ground accurately follow those outlined in the manual.

- Taking a critical look at your overall compliance program: This involves assessing the effectiveness of the ongoing measures, adding new elements as per the updated regulations, and removing those outdated programs that no longer serve their purpose or meet the needs of your business.

- Organizing the frequency of tasks based on the needs of your particular industry: Your compliance calendar may include tasks scheduled on an ongoing, monthly, quarterly, or annual basis based on the needs of your organization and industry.

- Exploring the advantages of automation: An automated compliance calendar software will help your company transition from using a calendar based on spreadsheets to a centralized database that will be easily and fully accessible to compliance officers and other appropriate users.

Compliance Calendar for Jharkhand

This section of the article will take you through all the deadlines and regulations that you should keep a tab on through your compliance calendar in order to stay on top of it.

January 2022, Compliance Calendar for Jharkhand

February 2022, Compliance Calendar for Jharkhand

March 2022, Compliance Calendar for Jharkhand

April 2022, Compliance Calendar for Jharkhand

May 2022, Compliance Calendar for Jharkhand

June 2022, Compliance Calendar for Jharkhand

July 2022, Compliance Calendar for Jharkhand

August 2022, Compliance Calendar for Jharkhand

September 2022, Compliance Calendar for Jharkhand

October 2022, Compliance Calendar for Jharkhand

November 2022, Compliance Calendar for Jharkhand

December 2022, Compliance Calendar for Jharkhand

Glossary for all the Acts of Statues/Returns/Compliances

- Jharkhand Factories Rules: Jharkhand Factories Rules, originally adopted in 1950, can be amended in accordance with the power conferred by section 12 of the Factories Act, 1948.

- Factories Act: The Factories Act 1948 is social legislation that has been enacted for occupational safety, health, and welfare of the workers in their workplaces. Thus, the main objective of this act was to regulate the conditions of work in manufacturing units that come under the term “factory” as defined in the act.

- The Employment Exchange (CNV) Act, 1959 and Rules: The Employment Exchanges (Compulsory Notification of Vacancies) Act was enacted in 1959, making it compulsory that the vacancies be reported to the Employment Exchanges and for the rendition of returns relating to Employment situation by the employers. This act came into force on 1st May 1960.

- PF Act: Also known as the Employees’ Provident Fund and Miscellaneous Provisions Act, 1952 was adopted to provide for the institution of provident funds, pension funds, and deposit-linked insurance funds for employees. Employees’ Provident Fund Organization (EPFO) is one of the largest security organizations in India in terms of the number of covered beneficiaries and the volume of financial transactions undertaken.

- The Maternity Benefit Act, 1961: This act was adopted in order to regulate the employment of women in certain establishments for a certain period before and after childbirth. Through this act, it is ensured that these women get maternity benefits and certain other benefits.

- ESI Act: Also known as the Employees’ State Insurance Act, 1948, it is an integrated measure of Social Insurance embodied in the Employees’ State Insurance Act. The main aim of this act is to protect “employees” as defined in the Employees’ State Insurance Act, 1948, against the impact of incidences of sickness, maternity, disablement, and death due to employment injury. It also involves providing medical care to the insured persons and their families.

- The Jharkhand Shops and Establishments Rules: While the government here is in reference to the Jharkhand government, the act means the Bihar Shops and Establishments Act, 1953.The main objective of this act is for the employers to get their establishment registered and receive a certificate of registration, on approval of the inspecting officer for the same. Each establishment will be issued a registration mark and a number that would be distinctly noted on the Certificate of Registration.

- The Contract Labor (R&A) Act, 1970 and Rules: Here, R stands for regulation and A stands for abolition. This is an act that was adopted to regulate the employment of contract labor in certain establishments and to provide for its abolition in certain circumstances and for matters connected therewith.

- Jharkhand Minimum Wages Rules, 1951: The Minimum Wages Act, 1948, provides for fixing minimum rates of wages in certain employment that are included in the schedule.The Jharkhand Government has enacted this act with its 2015 Amendment Rules in order to ensure the effective administration and monitoring of the Minimum Wages Act, 1948.

- Jharkhand Payment of Wages Rules, 1937: This follows the Payment of Wages Act (IV of 1936), according to which the employer or the person responsible for making the payment of wages must pay in currency coins or currency notes or in both and that he cannot pay in kind. The employer can also pay the wages via a cheque or a direct deposit to the bank account of the employee after taking a written authorization from him.

- Inter-State Migrant Workman: Any establishment that is proposing to employ inter-state migrant workmen will be required to be registered with the registering officers appointed under the Central Government or the State Government, depending on whether the establishment falls under the Central sphere or under the State sphere.

- The POSH Act: Also known as the Sexual Harassment of Women at Workplace (Prevention, Prohibition and Redressal) Act, 2013, has been enacted in order to provide protection to women at their workplace against sexual harassment. It also involves prevention and redressal of complaints and for matters connected or incidental thereto. The PoSH Act lays down steps for employers to follow in order to ensure that their women employees are protected against sexual harassment at all workplaces, be it public or private. It also lists down circumstances which if it takes place, will amount to sexual harassment.

- The Payment of Bonus Act: This act applies to all the factories and every other establishment that has employed 20 or more workmen. The Payment of Bonus Act, 1965 provides for a minimum bonus of 8.33 percent of wages. The payment is subject to the stipulation that the bonus is payable to employees drawing wages or salary not exceeding Rs. 10,000 per month would be calculated as if their salary or wages is Rs. 3,500 per month. Here, the Central Government is the appropriate authority in respect of the industries/establishments for which it is the appropriate Government under the Industrial Disputes Act, 1947. The bonus amount payable to an employee under this act shall be paid in cash by his/her employer within a period of 8 months from the close of the accounting year.

- The Jharkhand Tax On Profession, Trades, Callings and Employments Act: This act is about the taxes that every person or employee is liable to pay to the state government because they are engaged actively or otherwise in any profession, trade, calling or employment and falling under one or the other classes as mentioned in this act. This liable tax is to be deducted by his or her employer from the monthly salary or wage payable to such person or employee before it is paid to that individual.

Forms as Needed as per Compliance Calendar of Jharkhand

Form 29

Form 29

Prescribed under Rule 125

ANNUAL RETURN

For the year ending 31stDecember, 20..........

1. Registration number of factory :

2. Name of factory :

3. Name of occupier :

4. Name of the manager :

5. District :

6. Full postal address of factory :

7. Nature of industry :

Number of workers and particulars of employment

8. No. of days worked in the year :

9. No. of man-days worked during the year

(a) Men :

(b) Women :

(c) Children :

10. Average number of workers employed daily

(a) Adults

(i) Men :

(ii) Women :

(b) Adolescents

(i) Male :

(ii) Female :

(c) Children

(i) Male :

(ii) Female :

11. Total no. of man-hours worked including overtime.

(a) Men :

(b) Women :

(c) Children :

12.Average number of hours worked per week (See explanatory note)

(a) Men :

(b) Women :

(c) Children :

13. (a) Does the factory carry out any process or operations declared as dangerous under Section 87 (See Rule 116):

(b) If so, give the following information

-----------------------------------------------------------------------------------------------------------------

Name of the dangerous process Average no. of persons employed daily in each

Or operations carried on of the processes or operations given in Col.1

1 2

-----------------------------------------------------------------------------------------------------------------i)

ii)

iii) etc.

-----------------------------------------------------------------------------------------------------------------

Leave with Wages

14. Total number of workers employed during the Year :

(a) Men :

(b) Women :

(c) Children :

15. Number of workers who were entitled to annual leave wit wages during the year

(a) Men :

(b) Women :

(c) Children :

16. Number of workers who were granted leave during the year

(a) Men :

(b) Women :

(c) Children :

17. (a) Number of workers who were discharged, or dismissed from the service, or quit employment, or were superannuated, or died while in service during the year :

(b) Number of such workers in respect of when wages in lieu of leave were paid :

18. (a) Number of Safety Officers required to be appointed as per notification under Section 40-B :

(b) Number of Safety Officers appointed :

Ambulance room

19. Is there an ambulance room provided in the factory as required under Section 45 ? :

Canteen

20. (a) Is there a canteen provided the factory as required under Section 46? :

(b) Is the canteen provided managed

i) departmentally, or :

Ii) through a contractor? :

Shelters or Rest Rooms and Lunch Rooms

21. (a) Are there adequate and suitable shelters or rest rooms provided in the factory as required under Section 47? :

(b) Are there adequate and suitable lunch rooms provided in the factory as required under Section 47? :

Creches

22. Is there a Creche provided in the factory as required under Section 48 ? :

23. (a) Number of Welfare Officers to be appointed as required under Section 49 :

(b) Number of Welfare Officers appointed :

Accidents

24.(a) Total number of accidents

i) Fatal :

ii) Non-Fatal :

(b) Accidents in which workers returned to work during the year to which this return relates :

i) Accidents (workers injured) occurring during the year in which injured workers returned to work during the same year

(aa) Number of accidents :

(bb) Man-days lost due to accidents :

ii) Accidents (workers injured) occurring in the previous year in which injured workers returned to work during the year to which this return relates

(aa) Number of accidents :

(bb) Man-days lost due to accidents :

(c) Accidents (workers injured) occurring during the year in which injured workers did not return to work during the year to which this return relates

i) Number of accidents :

ii) Man-days lost due to accidents :

Certified that the information furnished above is to the best of my knowledge and belief, correct.

Signature of the manager :

Date:

ER-1

FORM ER-I

Quarterly return to be submitted to the local Employment Exchange

For the quarter ended……………………..

[ Vide the Employment Exchanges (Compulsory Notification of Vacancies) Rules, 1960] The following information is required under the Employment Exchanges(Compulsory Notification of Vacancies) Rules, 1960 to assist in evaluating trends in employment and for action to correct imbalances labour supply and demand

Name and address of the employer……………………………………………………..

………………………………………………………………………………………………

………………..

Whether it is: [ ] Head Office [ ] Branch Office

I. (a) EMPLOYMENT

Total number of persons including working proprietors/partners/commission agents/ contingent paid And contractual workers, on the pay rolls of the establishments excluding part-time workers and apprentices .

( The figures should include every person whose wage or salary is paid by the establishment).

On the last working day of On the last working day of

the previous quarter. the quarter under report.

Men :

Women:

Total:

(b) Please indicate the main reason s for any increase or decrease in employment if the increase or decrease is more than 5% during the quarter………………………………………………………………………………

NOTE:- Establishment are remind of their obligation under the Employment Exchanges(Compulsory Notification of Vacancies) Act for notifying to Employment Exchanges details of vacancies specified under the act before they are filled.

2. VACANCIES : Vacancies carrying emoluments of Rs 60 or over per month and of over 3 months duration

2.(a) Numbers of vacancies occurred and notified during the quarter and the numbers filled during the quarter.

|

Number of vacancies which come within the purview of the Act |

||||

|

Occurred |

Notified |

Filled |

Source (describe the source form which filled) |

|

|

Local Employment Exchange |

Central Employment Exchange |

|||

|

(1) |

(2) |

(3) |

(4) |

(5) |

|

|

|

|

|

|

(b) Reasons for not notifying all vacancies occurred during the quarter under report vide 2 (a) above:

3. MANPOWER SHORTAGES

Vacancies /posts unfilled because of shortage of suitable application s.

|

Name the occupation or designation of the post. |

Numbers of unfilled

vacancies /posts |

||

|

Essential qualification prescribed |

Essential experience |

Experience not necessary |

|

|

1 |

2 |

3 |

4 |

|

|

|

|

|

Please list any other occupation for which this establishment had recently any difficulty in obtaining suitable applications.

Signature of employer __________________

To

The Employment Exchange,

Maternity Benefit Act Forms: LMNO Rule 16 (1)

Form L

[See Rule 16]

Annual Return for the Year ending on the 31st December, 20....

- Name of the [mine or circus]

- Situation of the [mine or circus]

Mauza:

District:

State:

Nearest Railway Station:

3. Date of opening the [mine or circus]

4. Date of closing, if closed.

5. Postal address of the [mine or circus]

6. Name of the employer. Postal address of the employer.

7. Name of managing agent, if any. Postal address of managing agent.

8. Name of Agent or Representative of the Employer. Postal address of the representative of the employer.

9. Name of the Manager. Postal address of the manager.

10.

(a) Name of medical officer, attached to the [mine or circus]

(b) Qualification of the medical officer, attached to the [mine or circus]

(c) Is she a resident at the [mine or circus]?

(d) If she is a part-time employee, how often does he pay visits to the [mine or circus]?

11.

(a) Is there any hospital at the [mine or circus]?

(b) If so, how many beds are provided for women employees?

(c) Is there a lady doctor?

(d) If so, what are her qualifications?

(e) Is there a qualified midwife?

(f) Has any creche been provided?

Signature of the Employer ___________

Date: __________

Form M

[See rule 16]

EMPLOYMENT, DISMISSAL, PAYMENT OF BONUS, ETC. OF WOMEN FOR THE YEAR ENDING ON 31ST DECEMBER, 20.....

- [Mine or circus]

- Aggregate number of women permanently or temporarily employed during the year.

- Number of women who worked for a period of not less than 80 days in the twelve months immediately preceding the date of delivery.

- Number of women who gave notice under section 6.

- Number of women who were granted permission to remain absent on receipt of notice of confinement.

- Number of claims for maternity benefit paid.

- Number of claims for maternity benefit rejected.

- Number of cases where pre-natal, confinement, and post-natal care was provided by the management free of charge (section 8).

- Number of claims for medical bonus paid (section 8).

- Number of claims for medical bonus rejected.

- Number of cases in which leave for miscarriage/ MTP was granted.

- Number of cases in which leave for miscarriage/MTP was applied for but was rejected.

12a. Number of cases in which leave for tubectomy operation under section 9A was granted.

12b. Number of cases in which leave for tubectomy operation was applied for but was rejected.

13. Number of cases in which additional leave for illness under section 10 was granted.

14. Number of cases in which additional leave for illness under section 10 was applied for but was rejected.

15. Number of women who died

(a) Before delivery

(b) After delivery

16. Number of cases in which payment was made to persons other than the woman concerned.

17. Number of women discharged or dismissed while working.

18. Number of women deprived of maternity benefit and/or medical bonus under proviso to sub-section (2) of section 12.

19. Number of cases in which payment was made on the order of the Competent Authority or Inspector.

20. Remarks.

Note: Full particulars of each case and reasons for the action taken under serials 7,10,12,14,17, and 18 should be given in the Appendix below:

Signature of the Employer _________

Date: __________

Form N

[See rule 16]

DETAILS OF PAYMENT MADE DURING THE YEAR ENDING 21ST DECEMBER, 20.....

Name of person to whom paid _______

Amount Paid _______

- Date of payment.

- Woman employee.

- Nominee of the woman.

- Legal representative of the woman.

- Amount for the period preceding date of expected delivery.

- Amount for the subsequent period.

- Under section 8 of the Act.

- Under section 9 of the Act.

8a. Under section 9A of the Act.

9. Under section 10 of the Act.

10. Number of women workers who absconded after receiving the first installment of maternity benefit.

11. Cases where claims were contested in a court of law.

12. Results of such cases.

13. Remarks.

Signature of the Employer __________

Date: _________

Form O

[See rule 16]

PROSECUTION DURING THE YEAR ENDING 31ST DECEMBER, 20.......

|

Place of Employment of the Woman Employee |

Number of Cases Instituted |

Number of Cases Which Resulted in Conviction |

Remarks |

|

|

|

|

|

(For mines)

Reasons for prosecution should be given in full in the Appendix below:

Signature of the Employer___________

Date: ___________

PF Act (Forms 1,2,10,21, and 22)

Form 1

Form to be used by Head of Office for Final Payment/transfer of balances in the General/Contributory Provident Fund Account to Autonomous Bodies/Other Governments

The General Provident Fund/Contributory Provident Fund Account Number of Shri/Smt./Km… .……………………….., as certified from the statements furnished to him/her from year to year, is ……………………

2. He/She is due to retire from Government service/ has proceeded on leave preparatory to retirement for …………………. months/has been discharged/dismissed/has been permanently transferred to …………… /has resigned finally from Government service on………………………….

3. Certified that he/she had taken the following advances in respect of which…………….

installments of Rs….............................. each are outstanding.

Amount of Temporary advances Amount outstanding

1 ……………………………. ………………………

2. …………………………… ……………………….

3. …………………………… ……………………….

4. …………………………… ………………………..

4. Details of the withdrawals granted to him/her in the current financial year are also indicated below-

Amount of Final withdrawal Date of withdrawal

1 ……………………………. ………………………

2. …………………………… ……………………….

3. …………………………… ……………………….

4. …………………………… ………………………..

5. After adjusting the above withdrawals and advances, an amount of Rs……………

standing to the credit in his/her Provident Fund Account is appearing in the ledger account.

6. The final payment be made after verifying the records.

Signature of the Head of Office ______________

Forwarded to the Pay and Accounts Office........................................... for necessary action.

Form 2

NOMINATION AND DECLARATION FORM FOR UNEXEMPTED/EXEMPTED ESTABLISHMENTS

Declaration and Nomination Form under the Employees Provident Funds and Employees Pension Schemes

(Paragraph 33 and 61 (1) of the Employees Provident Fund Scheme 1952 and Paragraph 18 of the Employees Pension Scheme 1995)

1. Name (IN BLOCK LETTERS): Name Father’s / Husband’s Name Surname

2. Date of Birth : 3. Account No.

4. *Sex: MALE/FEMALE: 5. Marital Status

6. Address Permanent/ Temporary :

PART – A (EPF)

I hereby nominate the person(s)/cancel the nomination made by me previously and nominate the person(s) mentioned below to receive the amount standing to my credit in the Employees Provident Fund, in the event of my death.

|

Name of

the Nominee (s) |

Address |

Nominee’s

relationship with the member |

Date of

Birth |

Total

amount or share of accumulations in Provident Funds to be paid to each

nominee |

If the nominee is minor name and

address of the guardian who may receive

the amount during the minority of the nominee |

|

1 |

2 |

3 |

4 |

5 |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 *Certified that I have no family as defined in para 2 (g) of the Employees Provident Fund Scheme 1952 and should I acquire a family hereafter the above nomination should be deemed as cancelled.

2. * Certified that my father/mother is/are dependent upon me.

Strike out whichever is not applicable

Signature/or thumb impression of the subscriber_______________________

PART – (EPS)

Para 18

I hereby furnish below particulars of the members of my family who would be eligible to receive Widow/Children Pension in the event of my premature death in service.

|

Sr. No |

Name & Address of the Family Member |

Age |

Relationship with the member |

|

(1) |

(2) |

(3) |

(4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Certified that I have no family as defined in para 2 (vii) of the Employees’s Family Pension Scheme 1995 and should I acquire a family hereafter I shall furnish Particulars there on in the above form.

I hereby nominate the following person for receiving the monthly widow pension (admissible under para 16 2 (a) (i) & (ii) in the event of my death without leaving any eligible family member for receiving pension.

|

Name

and Address of the nominee |

Date of Birth |

Relationship with member |

|

|

|

|

Date

Signature or thumb impression of the subscriber

CERTIFICATE BY EMPLOYER

Certified that the above declaration and nomination has been signed / thumb impressed before me by Shri / Smt./ Miss employed in my establishment after he/she has read the entries / the entries have been read over to him/her by me and got confirmed by him/her.

Date :

Name & address of the Factory /Establishment

Signature of the employer or other authorized officer of the establishment_____________

Place : Date :

Form 10

Paragraph 36(2)(a) & (b) of the Employees’ Provident Funds Scheme, 1952

Return of Members leaving service during the month of

Name and address of the Factory/Est. Code No

|

Sl.

No |

Account

No. |

Name

of member (in block letters) |

Father’s

Name (or husband’s name in case of married woman) |

Date

of leaving service |

*Reasons

for leaving service |

Remarks |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

|

|

|

|

|

|

|

|

Signature of the employer or other authorized officer

Date : …………………….. Stamp of the Factory/Estt.

*Please state whether the member is (a) retiring according to Para 69 (1)(A) OR (B) of the scheme, (b) leaving India for permanent settlement abroad, (c) retrenchment, (cc) part of a total disablement due to employment injury, (d) ordinarily dismissed for serious and willful misconduct, (e) discharged, (f) resigning from or leaving service, (g) taking up employment elsewhere. (The name and address of the Employers should be stated) (h) Death, (I) attained the age of 58 years.

A request for deduction for the account of a member dismissed for serious and willful misconduct should be reported by the following certificate;

“Certified that the member mentioned at serial No. ……………… Shri…………… ……….. was dismissed for serious and willful misconduct. I recommend that the Employer’s contribution for ………………………. Should be forfeited from the account in the fund. A copy of the order of dismissal is enclosed.”

“Certified that the member mentioned at serial No. …………… Shri…………….. was paid/not paid retrenchment compensation of Rs. ……………. Under the Industrial Disputes Act, 1947.”

Signature of the Employer_________________

Form 21

[See rule 81(2)]

Form of letter sanctioning Family Pension to another member of family on death or ineligibility of a recipient of Family Pension No....................................................

Government of India Ministry of........................................

Department/Office.............................

Dated the..........................................

To

The Pay and Accounts Officer

...............................................

...............................................

Subject : Grant of Family Pension on death or ineligibility of a recipient of Family Pension.

Sir,

I am directed to say that Shri/Smt. .........................................................…………………..

(relationship) of late Shri/Smt......................................................................................................................... formerly

.................................... (designation) in this Ministry/Department/Office was authorised the payment of Family Pension of Rs ................................. with effect from ..................................... vide PPO No…………………………………

2. Intimation has been received in this Ministry/Department/Office that Shri/Smt./Km.…….........

............................................................. died/ceased to be eligible for family pension on account of

…………………..… on..................................... (date).

3. There are the following surviving members of family of the deceased Government servant/ pensioner:-

|

S. |

Name |

Date |

Address |

Relationship |

Whether suffering |

Marital |

|

No. |

|

of |

|

with |

from any disability |

status |

|

|

|

Birth |

|

deceased |

|

|

|

|

|

|

|

pensioner |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. In terms of rule 54 of the Central Civil Services (Pension) Rules, 1972, the amount of Family Pension has become payable to Shri/Kumari/Smt The Family

Pension will be payable on behalf of the minor/mentally disabled child to Shri/Smt. ...................

................................. who is the nominee/guardian.

5. Sanction for the grant of Family Pension of Rs.........................per month to Shri/Kumari/ Smt. …………….………………………. is hereby accorded. The Family Pension will take effect from.............................. and will be tenable as per the provisions of sub-rule (6) of rule 54 of the Central Civil Services (Pension) Rules, 1972.

6. The Family Pension is debitable to the Head.........................................

7. Your attention is invited to the enclosures forwarded herewith.

8. The receipt of this letter may be acknowledged and this Ministry/Department/Office informed that necessary instructions for the disbursement of family pension have been issued to the disbursing authority concerned, under intimation to family pensioner.

Yours faithfully,

Head of Office

List of enclosures—

1. Form 14 (along with check-list)

Form 22

FUNERAL EXPENSES CLAIM FORM EMPLOYEES' STATE INSURANCE CORPORATION

(Regulation 95-E)

Claim arising out of death on .................. of ................. s/w/d of .................. aged .....................

years, having Insurance No. .............. and last employed as ................. by M/s................................................................................................................................................................. Code

No. ....................

I ....................................... s/w/d of .......................................... aged.......................... years declare :

**(i) that I am the eldest surviving member of the family of the deceased Insured Person, whose particulars are furnished here-in-above, and that I actually incurred an expenditure of Rs. .................... (Rupees only) necessary for the funeral of

the said deceased person.

or

**(ii) that the deceased Insured Person, whose particulars are furnished there-in-above, did not have a family / was not living with his family at the time of his / her death and that I actually incurredan expenditure of Rs. .................... (Rupees.......................................................................................................................... only)

on the funeral of the deceased Insured Person.

Accordingly, I do hereby claim funeral expenses for the amount of Rs. ....................................

(Rupees.............................. only)

Date : Name in Block Letters ...................................................................................

Signature / Thumb-impression of the Claimant

ATTESATION

*** Certified that the declarations, as made here-in-above, are true to the best of my knowledge and belief.

Name in Block Letters and Rubber Stamp or Seal of the Attesting Authority

Signature ...................................

Designation ...............................

Date .............................................

*Delete either (i) or (ii), which may not be applicable in the case.

**This certificate is to given by (i) an officer of the Revenue, Judicial or Magisterial Department; or (ii) a Municipal Commissioner, or (iii) a Workmen's Compensation Commissioner; or (iv) the Head of Gram Panchayat under the official seal of the Panchayat, or M.L.A./M.P.; or (v) A Gazetted Officer of the Central/State Govt./Member of the Local Committee / Regional Board; or (vi) any other authority considered as appropriate by the Branch Manager concerned.

Important : Any person who makes a false statement or misrepresentation for the purpose of obtaining benefit, whether for himself or for some other person, commits an offence punishable with imprisonment for a term which may extend up to six months or with a fine up to Rs. 2,000/- or with both.]

Note : In the case of a minor, the guardian should sign the claim form on behalf of the minor and then add the following below his/her signature: —

........................................

(Name of the Minor) Through .....................

(Name of the Guardian) his/her ............................

(Relationship with the Minor)

Form XIX

( Rule 43 )

Quarterly report for the month of March/June/ September/December

1. Name of Establishment/ Employer—

2. Address Town District State

3. Type of the establishment

4. Number of days worked during the month

5. Normal working hours

6. Rest interval (Hours)

7. Employment and earning of hired workers

|

Serial No. |

No. of employment at the end of the quarter |

No. of man days worked during the

month |

Emolument paid in cash before deduction |

Money value of payment |

Ex-gratia

cash payment |

Contribution to social security

funds |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

Men

Women

Young

8. Number of unpaid helpers

N.B.—Ex-gratia cash payments including profit-sharing bonus may be paid annually, quarterly or over any other period and other ad hoc cash payments, if any.

Whether the establishment is a—

(i) Shop

(ii) Commercial establishment

(iii) Restaurant, eating house or hotel

(iv) Theatre or a place of public entertainment; or

(v) Other type should be mentioned here;

Form XXIV Rule 82 (1)

RETURN TO BE SENT BY THE CONTRACTOR TO THE LICENSING OFFICER

Half year ending___________

- Name and address of the Contractor

- Name and address of the Establishment

- Name and address of the Principal Employer

- Duration of the contract: From_________ To__________

- No. of days during the half year during which:

a. The establishment of the principal employer had worked_____

b. The contractor's establishment had worked_______

6. Maximum number of contract labor employed on any day during the half year:

Men____ Women______ Children_____ Total_______

7.

(i) Daily hours of work and spread over_______

(ii) (a) Whether weekly holidays observed and on what day______

(ii) (b) If so, whether it was paid for __________

(iii) Number of man hours of overtime worked_________

8. Number of man days worked by_____ Men____ Women_____ Children______ Total______

9. Amount of wages paid: Men_______ Women______ Children______ Total________

10. Amount of deductions from wages, if any: Men_______ Women_______ Children________ Total________

11. Whether the following have been provided:

(i) Canteen

(ii) Rest Rooms

(iii) Drinking water

(iv) Creches

(v) First Aid

(If the answer is "yes", state briefly standards provided)

Signature of Contractor___________

Place: ________

Date: _________

Form III

(Rule 17.)

REGISTER OF ADVANCES MADE TO EMPLOYED PERSONS.

...............................Factory...................................

|

Sr. No. |

Name |

Father’s name. |

Department. |

Date

and amount of advance made. |

Purpose

(s) for which advance made. |

No.

of instalments by which advance to be repaid. |

Postponements

granted. |

Dates

on which total amount repaid. |

Remarks. |

|

1 |

2 |

3 |

4 |

5 |

6 |

7 |

8 |

9 |

10 |

|

|

|

|

|

|

|

|

|

|

|

Form IV

RETURN FOR THE YEAR ENDING 31ST DECEMBER.................

Wages and deductions from Wages

1. (a) Name of the factory or establishment and postal address .

(b) Industry............................................

2. Number of days worked during the year.

3. (a) Average daily number of persons employed during the year -

Adults.

Children.

(b) Gross amount paid as remuneration to these persons including deductions section 7(2).................................

of which the amount due to bonus is......................................and that due to money value of concessions is............

4. Total wages paid including deductions under section 7(2) of the following accounts –

(a)Basic wages including overtime.

(b) Dearness and other allowance in cash.

(c) Arrears of pay in respect of the previous years paid during the year.

5. Number of cases and amount realized as –

Number of cases. Amount.

(a) Fines.

(b) Deductions for damage or loss.

(c) Deductions for breach of contract.

Form XXIII

[Refer 45(1)]

Return to be sent by the Contractor to the Licensing Officer

Half-Year-Ending……………………………………..

1. | Name and address of the Contractor | .. |

| |||||||||||||||

2. | Name and address of the establish- |

|

| |||||||||||||||

| ment | .. |

| .. |

| .. |

| |||||||||||

3. | Name and address of the Principal |

|

| |||||||||||||||

| employer | .. |

| .. |

| ..

|

| |||||||||||

4. | Duration of Contract: From ……..to……. |

| ||||||||||||||||

|

|

| ||||||||||||||||

5. | No. of days during half year on which- |

| ||||||||||||||||

(a) | the establishment of the Principal | |||||||||||||||||

| employer had worked | |||||||||||||||||

(b) | the contractor's establishment had | |||||||||||||||||

| worked.. .. .. | |||||||||||||||||

6. | Maximum number of inter-state migrant workmen employed on any day during the half year: |

| ||||||||||||||||

| Men | Women |

| Children |

| Total

|

| |||||||||||

7. | (i) Daily hours of work and spread over- |

| ||||||||||||||||

| (ii) | (a) | whether weekly holiday |

| ||||||||||||||

|

|

| observed and on what day- |

| ||||||||||||||

|

| (b) | If so, whether it was paid for- |

| ||||||||||||||

| (iii) | No. of man-hours of overtime worked

|

| |||||||||||||||

8. | Number of man-days worked by- |

| ||||||||||||||||

| Men | Women |

| Children |

| Total

|

| |||||||||||

9. | Amount of wages paid- | * | ||||||||||||||||

| Men | Women |

| Children |

| Total

|

| |||||||||||

10. | Amount of deduction from wages, if any- |

| ||||||||||||||||

| Men | Women |

| Children |

| Total

|

| |||||||||||

11. | Amount of Displacement Allowance paid: |

| ||||||||||||||||

| Men | Women |

| Children |

| Total

|

| |||||||||||

12. | Amount of Outward Journey Allowance paid |

| ||||||||||||||||

| Men | Women |

| Children |

| Total

|

| |||||||||||

13. | Amount of wages for outward journey period paid: |

| ||||||||||||||||

| Men | Women |

| Children |

| Total

|

| |||||||||||

14. | Amount of Return Journey Allowance paid: |

| ||||||||||||||||

| Men | Women |

| Children |

| Total

|

| |||||||||||

15. | Amount of wages for return journey period paid: |

| ||||||||||||||||

| Men | Women |

| Children |

| Total

|

| |||||||||||

16. | Whether the following have been provided- |

| ||||||||||||||||

| (i) | Residential accommodation |

|

| ||||||||||||||

| (ii) | Protective clothing |

|

| ||||||||||||||

| (iii) | Canteen |

|

| ||||||||||||||

| (iv) | Rest-Room |

|

| ||||||||||||||

| (v) | Latrines and urinals |

|

| ||||||||||||||

| (vi) | Drinking water |

|

| ||||||||||||||

| (vii) | Creche |

|

| ||||||||||||||

| (viii) | Medical facilities |

|

| ||||||||||||||

| (ix) | First-Aid |

|

| ||||||||||||||

|

| (If the answer is 'yes' state briefly standards provided)

| ||||||||||||||||

|

* Wages shall not include wages for periods of outward and return journeys.

Place …………………… | |||||||||||||||||

| Signature of Contractor | |||||||||||||||||

| Date …………………….. | |||||||||||||||||

Form XXIV

[Refer Rule 56(2)]

Annual Return of Principal Employer to be sent to the Registering Officer

Year ending 31st December

1. Full name and address of the Principal Employer.

2. Name of Establishment:

(a) District

(b) Postal Address

(c) Nature of operation/industry/work carried on.

3. Full name of the manager or person responsible for supervision and control of the establishment.

4. Number of Contractors who worked in the establishment during the year (Give details in Annexure).

5. Nature of work/operation on which migrant workman was employed.

6. Total number of days during the year on which migrant workman was employed.

7. Total number of man-days worked by migrant workman during the year.

8. Maximum number of workmen employed directly on any day during the year.

9. Total number of days during the year on which direct labour was employed.

10. Total number of man-days worked by directly employed workmen.

11. Change, if any, in the management of the establishment, its location, or any other particulars furnished to the Registering Officer in the application for registration indicating also the dates.

Principal Employer

Place ……………………….

Date ………………………...

ANNEXURE TO FORM

Name and address of the Contractor | Period of contract

From-To | Nature of work | Maximum number of workers employed by each contractor | No. of days worked | No. of man-days worked |

1 | 2 | 3 | 4 | 5 | 6 |

|

|

|

|

|

|

Form D*

(See rule 5)

Annual Return - Bonus paid to employees for the accounting year ending on the.....

- Name of the establishment and its complete postal address:

- Name of the industry:

- Name of the employer:

- Total number of employees:

- Number of employees benefited by bonus payments:

(i) Total amount payable as bonus under section 10 0r 11 of the Payment of Bonus Act, 1965 as the case may be.............

(ii) Settlement, if any, reached under section 18(1) of 12(3) of the Industrial Disputes Act, 1947 with date.................

(iii) Percentage of bonus declared to be paid..............

(iv) Total amount of bonus actually paid.................

(v) Date on which payment was made.................

(vi) Whether bonus has been paid to all the employees, if not, reasons for non-payment......................

(vii) Remarks...................

Signature of the employer of his agent___________________

*Ins. by S.O. 251 dated 7th January, 1984, (w.e.f. 21.1.1984)

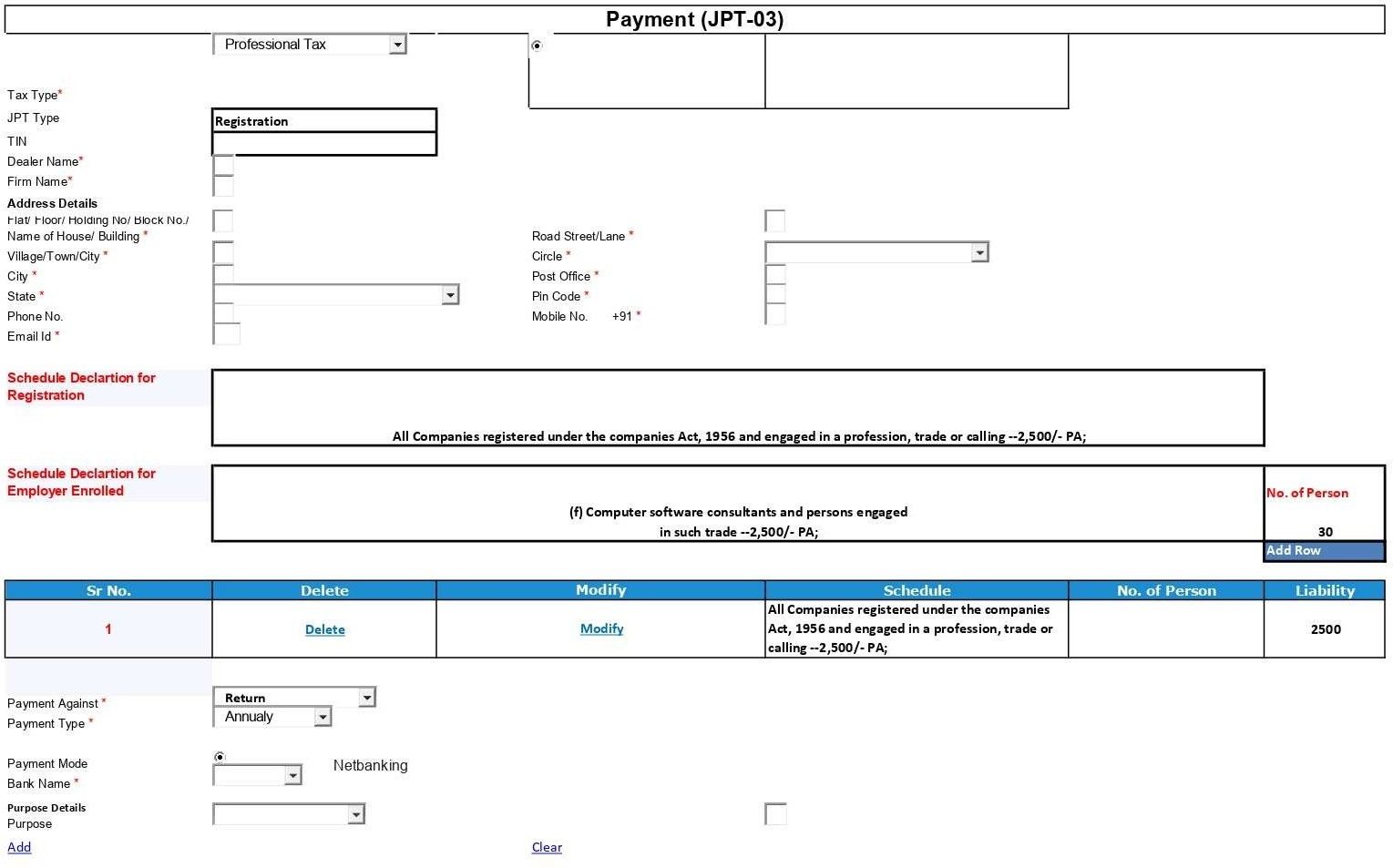

Form JPT-03

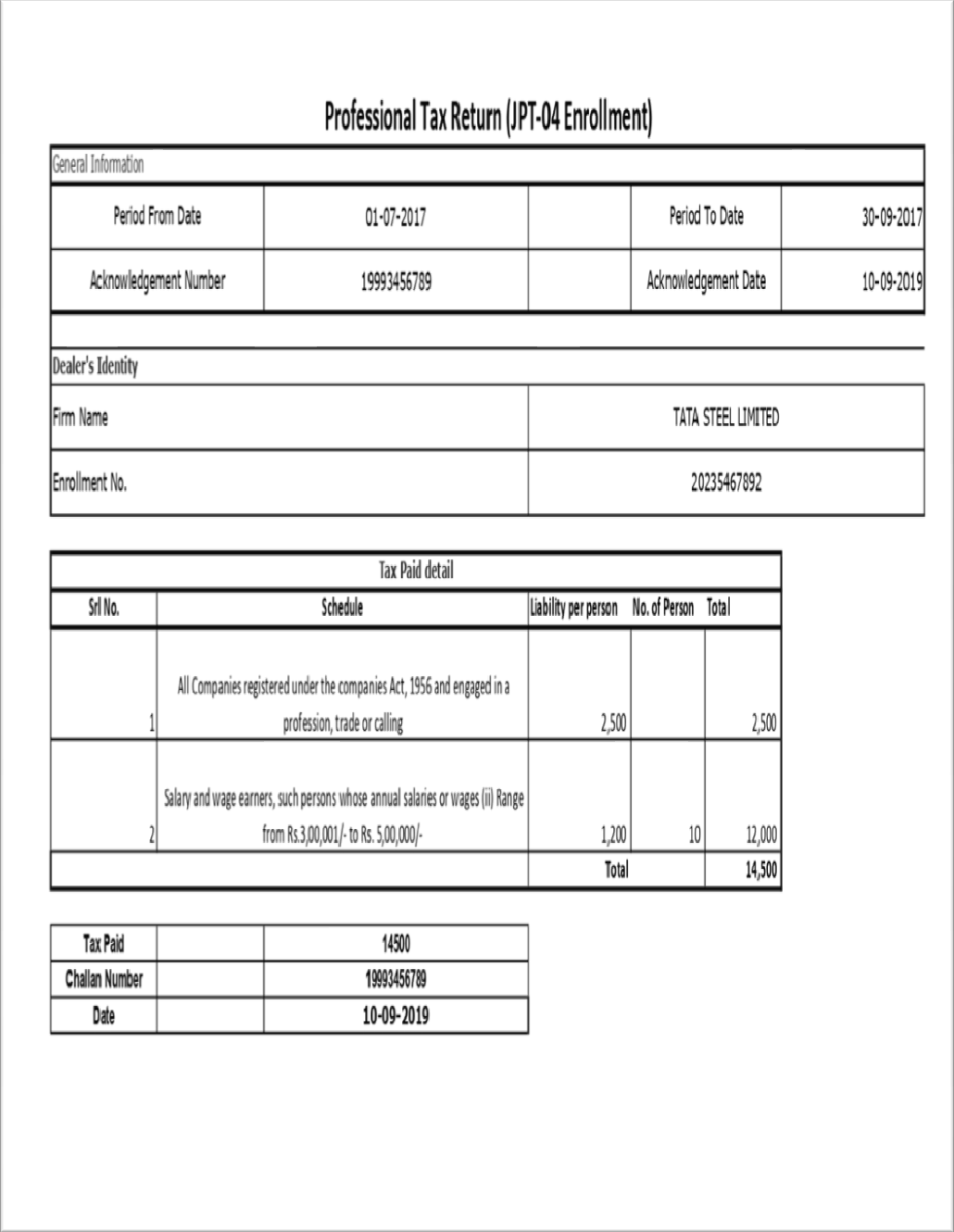

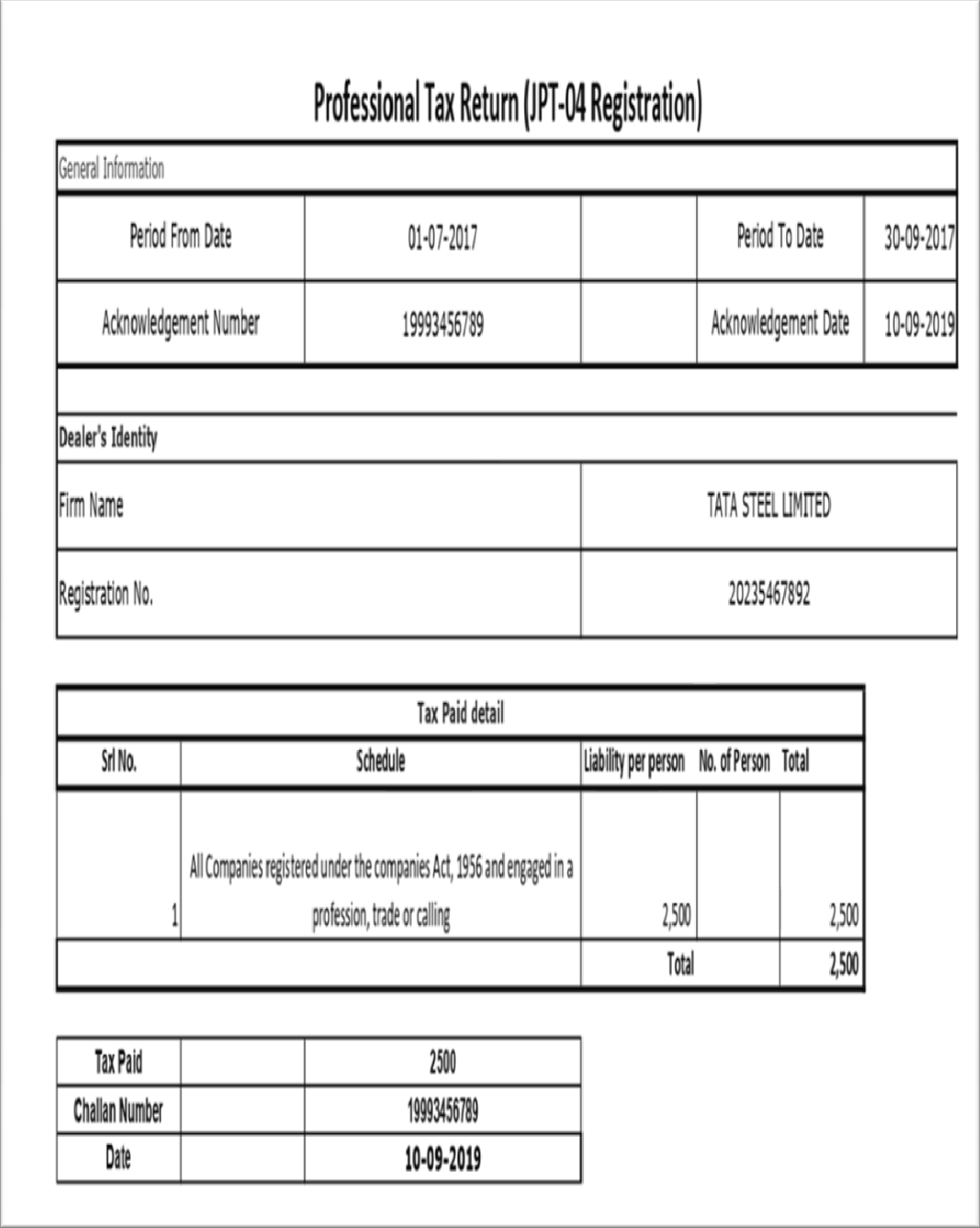

Form JPT-04

Form XXV

of Contract Labour (Regulation & Abolition) Central Rules

See Rule 82(2)

Annual Return of Principal Employer to be sent to the Registering Officer

Year ending 31st December, 19

1. Full name and address of the Principal Employer.

2. Name of Establishment:

(a) District

(b) Postal Address

(c) Nature of operation/industry/work carried on

3. Full name of the Manager or person responsible for supervision and control of the establishment.

4. Number of contractors who worked in the establishment during the year (Give details in Annexure).

5. Nature of work/operations on which contract labour was employed.

6. Total number of days during the year on which contract labour was employed.

7. Total number of man-days worked by contract labour during the year.

8. Maximum number of workmen employed directly on any day during the year.

9. Total number of days during the year on which direct labour was employed.

10. Total number of man-days worked by directly-employed workmen.

11. Change, if any, in the management of the establishment, its location, or any other particulars furnished to the Registering Officer in the application for Registration indicating also the dates.

Principal Employer:______________

Place:_________________

Date:_________________

Annexure to Form

|

Name and Address of the Contractor |

Period of contract |

Nature of work |

Maximum number of workers employed by each

contractor |

No. of days worked |

No. of |

|

|

From |

To |

|||||

|

1 |

2 |

3 |

4 |

5 |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

How Can Deskera Assist you with the Compliance Calendar of your Business?

Deskera People is a cloud-based software designed to meet all your needs of HR and compliances. It comes with a fast and easy on-boarding process, letting you import all your data including your employees' data from other places on this one platform.

It will also let you set up a compliance calendar customized as per your business, which will be accessible by all those who have to look after your business compliances.

Deskera People also comes with an automatic alert system that will let you meet your deadlines and avoid penalties. Lastly, Deskera People can be used across various devices.

Key Takeaways

The key benefit of knowing and having your compliance calendar for Jharkhand in place will help you stay on top of your important deadlines, avoid penalties, and keep your business running smoothly. However, what needs to be noted here is that there is no general compliance calendar that is suitable for all companies across all industries of Jharkhand.

This is why it is important to have a system in place that will let you set up your customized compliance calendar according to your business and the industry that it is a part of. Such a compliance calendar will not only help in keeping track of your external compliances of different regulatory bodies but also of your internal compliances.

Softwares like Deskera People is what you should rely on for having a compliance calendar tailored especially for your business. It also has an automatic alert system to notify you when a deadline is close and when you have missed one.

Deskera People will thus let you be assured about meeting all your regulatory requirements and compliances while also being able to focus on tasks revolving around the development and growth of your business such that you are able to have healthier business metrics, financial KPIs, marketing KPIs, and improved customer retention and customer loyalty.

Related Articles