Commuting is a daily habit for most Americans, with the typical journey lasting around 26.6 minutes. There is, thankfully, a method for you to make your employees' morning and afternoon commutes a bit more tolerable. So say welcome to commuter benefits.

Simply put, commuter benefits are incentives that you provide to your employees to assist them in saving money on transportation costs to and from work. They may also help you and your staff in lowering your tax liabilities.

They are so good that a few localities in the United States mandate certain businesses to supply them to their employees.

Table of Content:

- What are commuter benefits?

- How do commuter benefits help me and my employees save on taxes?

- Commutes that are Covered

- What can not be used as a Commuter Benefit?

- How do I set up commuter benefits?

- How much money can my employees and I contribute?

Let's Start!

What Are Commuter Benefits?

As the name implies, commuter benefits reimburse employees for the expenses and inconveniences of commuting to work.

There are several reasons firms may desire to provide commuting perks to their employees. First, these sorts of perks can help employees balance their commuting expenses to a central location and make it simpler for them to afford the expenditures of commuting to a central location.

It can also show that the business understands many employees' desire not to have to commute and serve as compensation when remote work is not a possibility. In addition, many commuting perks can take the form of a pre-tax, lowering both the employee and company tax burden.

Additionally, encouraging employees to use public transit might cause less traffic congestion and pollution, which benefits everyone. Some regions need commuter benefit offers, so check your local regulations to determine if this pertains to any of your company's locations.

How do Commuter Benefits Help Me and My Employees Save On Taxes?

A commuter benefits scheme is a qualifying fringe benefit. The program is often in the guise of an employer-funded pool. The pool contains funds that are non-taxable if employees use them to pay for eligible transportation to and from work.

Pre-tax payroll deductions reduce your workers' taxable income since the amount they contribute is exempt from income and FICA taxes. Employee pre-tax contributions minimize your part of FICA taxes as well.

Savings are likely to be significant. For example, assume your employee pays $150 per month for their train pass. If they pay taxes at 30%, they could save up to $540 per year, while you could save up to $120 per year on FICA tax payments.

However, if your employees are low-income, the benefits may reduce the amount of money they get back through the Earned Income Tax Credit (EITC). Before enrolling in commuter benefits, have your workers consult with an auditor or tax specialist.

Commutes that are Covered.

Various benefit options assure that no matter how a worker travels, they can take advantage of the benefits with ease.

Besides the perks mentioned above, now there are riding benefits as well. While there are no tax incentives for firms that provide bicycles, it is a nice bonus for workers who ride their bikes to work. In addition, commuters can use the bike benefit to pay up to $20 per month on gear and maintenance.

What can not be Used as a Commuter Benefit?

Here's what you can't do with those benefits:

- Gasoline and mileage.

- Automobile insurance

- Your vehicle's wear and tear.

- Tolls on highways and bridges

- Taxis, as well as full-priced Ubers and Lyfts.

- Parking that is not close to your workplace or where you park to use public transportation.

Remember that only employees, not their families or dependents, are eligible for a commuter benefit.

How do I set up commuter benefits?

Begin by considering whether you want to do it yourself or go via a benefits provider. The benefit of having another firm handle commuter benefits would be that it assists you in deducting the proper amount from payroll while also helping your business adhere to the plethora of laws.

If you decide to handle it yourself, consult with an auditor or tax specialist to ensure that you consider all these factors.

There are several options for establishing a commuter benefits program:

- Employee-paid benefit: The most common technique is pre-tax assistance, which saves taxes for both you and your employees. This solution also comes at a low cost.

- Employer-sponsored benefit: The second most prevalent way is to offer employees funds to assist them in paying for transportation or parking. You can pay for the whole benefit or make a monetary contribution. Because of the tax savings, this results in more cash for your employees than a similar-sized incentive.

- Purchase your transportation: The less common alternative, which is generally only viable if you are a larger organization, is to offer some shuttle service.

How much money can my employees and I contribute?

Employers and workers can both contribute to commuter benefit accounts.

In 2020, you and your employee can pool your pre-tax income to donate up to $270 per month for parking and another $270 toward transit. You may even combine both bonuses up to their respective limits!

Your maximum monthly contribution is determined by what your team contributes. Contributions made over the pre-tax limitations are taxable as an unqualified side benefit.

It is entirely up to you how much you subsidize.

Other firms pay more for parking than transit if they are in a high-priced metropolitan area, some pay less for parking if they wish to encourage employees to use public transportation, and some pay the same for both modes.

How Can Deskera Assist You?

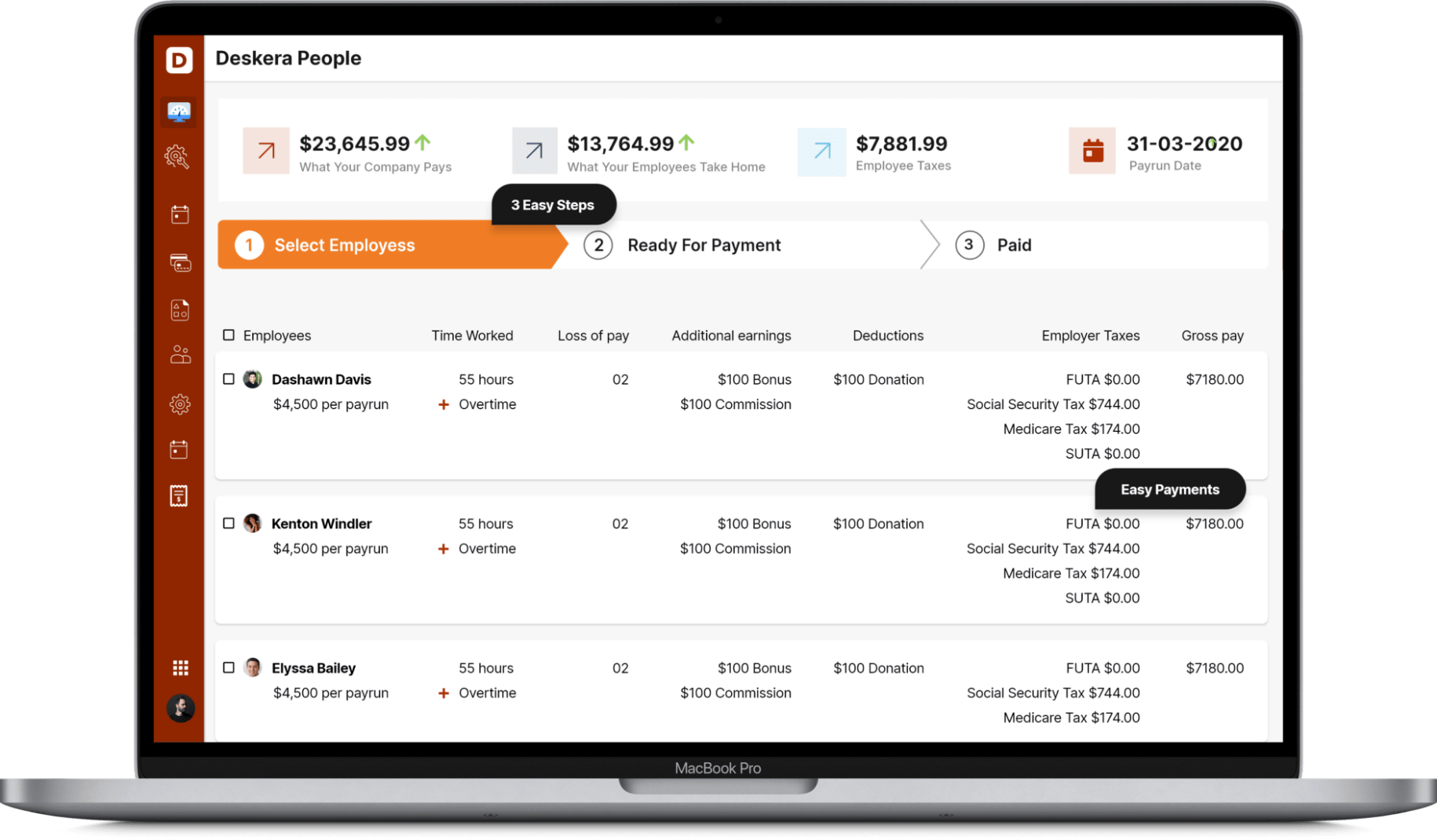

Deskera People make it simple to handle attendance, leave, payroll, and other processes so that you can focus on making the best decisions. For example, creating payslips for your employees is now simple since the platform also automates and digitizes HR tasks.

Frequently Asked Questions.

- Why Do We Provide Commuter Benefits?

Non-traditional benefits may help organizations differentiate themselves by providing unique incentives that are valuable to employees, positively influence company culture, and help attract and retain employees.

Commuting remains a crucial decision-making factor for employees, whether accepting a job offer or changing companies, as the time and costs to get to work continue to rise. Employee expectations are shifting when it comes to the overall benefits package. The perks you provide must meet their expectations.

2. Does the money from commuter benefits expire?

In a way, funds are carried over from month to month, and commuter benefit money does not expire while your organization employs employees. Employees who quit your organization, on the other hand, will be unable to access their funds.

3. Is there any local legislation I should be aware of?

It is determined by where you reside. Some cities have regulations governing when you must provide commuter benefits, so it's also good to verify local and state legislation to ensure you comply with any obligations.

How Can Deskera Assist You?

Deskera People make it simple to handle leave, attendance, payroll, and other processes so that you can focus on making the best decisions. For example, creating payslips for your employees is now simple since the platform also automates and digitizes HR tasks.

Deskera People provides all the employee's essential information at a glance with the employee grid. With sorting options embedded in each column of the grid, it is easier to get the information you want.

Key Takeaways

- Commuting is a daily habit for the majority of Americans, thankfully, there is a method for you to make your employees' morning and afternoon commutes a bit more tolerable.

- Commuter benefits are benefits provided to employees related to the expenses and inconvenience of commuting to work.

- The program works as an employer-funded pool. The pool contains not taxed funds if employees use them to pay for eligible transportation to and from work.

- Pre-tax payroll deductions reduce your workers' taxable income since the amount they contribute is exempt from income and FICA taxes. Employee pre-tax contributions minimize your part of FICA taxes as well.

- Consider whether you want to do it yourself or go via a benefits provider to set up commuter benefits. If you decide to handle it yourself, consult with an auditor or tax specialist to ensure that you consider all of these factors.

- There are several options for establishing a commuter benefits program:

- Employee-paid benefits.

- Employer-sponsored benefits.

- Purchase your transportation.

- Employers and workers can both contribute to commuter benefit accounts. Your maximum monthly contribution is determined by what your team contributes. Contributions made over the pre-tax limitations are taxable as an unqualified side benefit. It is entirely up to you how much you subsidize

Related Articles