Do you know how Contractors maintain a record of all workers reporting to work? How does he manage their absenteeism, leave status, and presence in the organization?

Every contractor must maintain a record of Central Muster Roll Form XVI, also called the labour muster roll format. It is a format that includes the contractor's name and address, the type and location of work, the worker's name and details, and the working day.

Besides maintaining details of the employees, it is also mandatory to note down the details of the contractor, how diligently he is monitoring the employees and if he is present on-site every day to keep a check on the work done.

This labour muster roll format list must be maintained by Rule 78(a)(i) of Contract Labour (Regulation & Abolition) Central Rules, 1971. It is created monthly and updated regularly daily and is a crucial document to prove that the contractor is in the field that day.

Table of Content

- Features Of The Labour Muster Roll Format

- Sample Of The Labour Muster Roll Format

- The Contract Labour (Regulation & Abolition) Act, 1970 Stipulates The Labour Muster Roll Format

- Applicability Of The Law

- Other Compliances Of The Law

- Form I - Application For Registration Of Establishments That Employ Contract Workers

- Form V – Certificate From Primary Employer To Contractor

- Form XII – Register Of Contractors

- Form XIII - Labor-Employer Registration By Contractor

- Form XIV - Employee Employment Card

- Form XV – Service Certificate To The Employee (Employment Record)

- Form XVII – Register Of Wages

- Form XVIII - Payroll Registration With Labour Muster Roll Format

- Form XIX - Payslip

- Form XX - Damage Or Loss Deduction Schedule

- Form XXI - Penalty Register

- Form XXII – Register Of Advances

- Form XXIII - Overtime Record

- Form XXIV – Return By The Contractor To The Licensing Officer

- Form XXV - Return By Principal Employer To Registering Officer

- Registers And Other Records That Must Be Kept

- The Effect Of Laws And Agreements Contrary To This Law

- Special Case Exemption Authority

- Protection Of Measures Under This Law

- Authority To Give Instructions

- The Power To Remove Difficulties

- The Power To Make Rules

- Conclusion

- Key Takeaways

Features Of The Labour Muster Roll Format

As specified by the Central government, Section 78 in the Contract Labour (Regulation and Abolition) Central Rules, 1971 ensures that every contractor maintains the labour muster roll format, sample cash register, wage register, deduction register, and overtime register.

Here are some important details:

1. Each contractor shall, concerning all work using contract labor-

- maintain model lists and payroll ledgers on Form XVI and Form XVII (labour muster roll format) respectively; however, if the payroll period is two weeks or less, the combined Wage cum Model role ledger on Form XVIII will be maintained by the contractor

- keep records of damages or loss deductions, fines, and down payments for Form XX, Form XXI, and Form XXII, respectively

- keep an overtime record on Form XXIII and detail the number of overtime hours and, if applicable, the wages paid for it

2. Each Contractor shall provide the Worker with a Form XIX pay slip at least one day before payment of wages if the payment period is one week or longer

3. Each Contractor or his authorized representative shall obtain the signature or fingerprint of the employee concerned for an entry in his associated wage ledger or labour muster roll format

4. It shall be verified and signed using the initials of the principal employer or his official representative along with the date as provided in Rule 73 in the labour muster roll format

5. Concerning establishments subject to the Payment of Wages Act, 1936 (4 of 1936) and the rules enacted under it, or the Minimum Wages Act, 1948 (11 of 1948) or the rules enacted under it, the following registries and records should be held by the contractor by these rules:

- Muster roll or labour muster roll format

- Wage ledger

- Registration of deductions

- Overtime record

- Fine registration

- Pre-registration

- Salary

To avoid duplication of work, the contractors can opt for a mechanized payroll accounting introduced for compliance with the rules contained, or for better management, with the prior consent of the Regional Labour Commissioner (Central).

The contractor must maintain the labour muster roll format according to the specified, contractual, major employer, and operational format. This includes branch and key employer information, job type, place of work, employee information such as name and gender, dates when employees worked, and comments.

Sample Of The Labour Muster Roll Format

The Contract Labour (Regulation & Abolition) Act, 1970 Stipulates The Labour Muster Roll Format

This law aims to regulate the employment of contract labor in certain facilities and to provide for the abolition of contract labor in certain circumstances and other related matters. Central and state regulations are implied and implemented to ensure effective control and to make sure that the law is followed diligently.

These regulations have been enacted to ensure effective control and supervision of the law. The labour muster roll format comes under this law.

Applicability Of The Law

This is widespread throughout India, and because contract worker employment requires contract worker registration, any business that employs or employs more than 20 workers on any day of the last 12 months needs to follow the law.

This means that the labour muster roll format will be followed by all the conditions mentioned herewith.

Other Compliances Of The Law

Besides the labour muster roll format, this law applies to the following compliances as well:

Form I - Application For Registration Of Establishments That Employ Contract Workers

Employment of temporary workers requires company registration. The primary employer submits three applications in the designated format to the registration officer in the area where the entity to be registered is located.

To do this, you need to attach a draft application that shows the payment of the branch registration fee. If there is a change in the information on the registration certificate in connection with the facility, the facility's primary employer shall be responsible for the date, location, details, and reason for such change.

After this registration procedure, the names of employees will be registered in the labour muster roll format.

Form V – Certificate From Primary Employer To Contractor

The contractor requires a license to hire a contract worker. The license application will be submitted to the relevant Labor Relations Commission, along with the required fees and certificates.

The application must be submitted three times.

Form XII – Register Of Contractors

The primary employer must maintain a register of contractors with which the employer has contracted, and the contracted worker has provided services.

This includes the contractor's name and address, the type of contract work, the place of work, the hours worked, and the maximum number of workers employed by the contractor.

Form XIII - Labor-Employer Registration By Contractor

This includes employee data such as branch and primary employer details, job type, workplace, name, gender, job title, start and end dates of the job, and why (if finished). The main employer must keep the register following the prescribed format.

The same will be filled in the labour muster roll format.

Form XIV - Employee Employment Card

This includes contractors, major employers, job details, and types and locations of work. It also includes employee details such as name, employee number on register, job title/employment type, wage rate, and duration of employment.

The contractor shall maintain an employment card for each employee following the specified format. Based on this card, the employee can be eligible for wages, work, and enrollment in the labor muster roll format.

Form XV – Service Certificate To The Employee (Employment Record)

The contractor must issue this certificate to individual employees after the contract period. This includes information about employees, job types, years of service, and wage rates.

Form XVII – Register Of Wages

This includes employee information, working days, wage rate, basic salary, overtime pay, overtime pay, other cash payments, total income and deductions, net amount, and time, date, and location of payment.

The contractor shall retain the wage period, contractual, primary employer, and business register following the format specified. This mainly depends on the labour muster roll format, as it is only based on the attendance that the wages will be calculated.

Form XVIII - Payroll Registration With Labour Muster Roll Format

This includes employee details, working days, wage rates, basic wages, living allowances, overtime, other cash payments, total income and deductions, net amount, and time, date, and location of payment.

The contractor retains the registration according to the prescribed format of wage period, contract-related, main employer-related, and company-related.

Form XIX - Payslip

This includes payroll cycles (weekly, biweekly, monthly), job types, locations, employee details, wage rates, overtime details, total wages, deductions, branches regarding actually paid salaries, and contains key employer information.

The contractor issues pay slips to all employees in the specified format.

Form XX - Damage Or Loss Deduction Schedule

This includes business and primary employer details, job type, workplace, employee details, damage/loss details, damage dates, opportunity to explain the cause, deductions given, number of installments, recovery details, and final rate.

According to the specified format, the contractor retains the registration for all contractors, primary employers, and all kinds of operations.

Form XXI - Penalty Register

This allows you to provide details of the branch and primary employer, type of work, place of work, employee details, fined action/omission, date of violation, and reason. It also notes down details of penalties that have been paid out, salary period included, salary paid, number of fines imposed, and timing of recovery.

According to the specified format, the contractor retains the registration for all contractors, primary employers, and all kinds of operations. If the labour muster roll format is not filled duly, the contractor will apply a penalty.

Form XXII – Register Of Advances

This includes branch and primary employer information, job category, place of work, employee information, payment period, prepayment amount and payment date, number of installments, date and amount of each installment, date of the last installment, and comments.

According to the specified format, the contractor retains the registration for all contractors, primary employers, and all kinds of operations.

Form XXIII - Overtime Record

This includes office and primary employee information, job type, location, employee information, overtime days, and payment information.

Form XXIV – Return By The Contractor To The Licensing Officer

Each contracting party must submit duplicate semi-annual reports in the specified format to the relevant licensee within 30 days of the end of the semi-annual. Half a year in the sense of this rule means six months from January 1st to July 1st each year.

This form includes contractor, primary employer, and facility details, contract period, number of days the primary employer/contractor worked for half a year, the maximum number of contract workers per day, weekly vacation time, and includes details such as wages and deductions, and the benefits granted.

Form XXV - Return By Principal Employer To Registering Officer

In the format provided, the primary employer must give the appropriate registration officer an annual return for the year ended December 31st. This includes branch and primary employer details, job type, place of work, employee details, overtime dates, and payment details.

Registers And Other Records That Must Be Kept

- All primary employers and contractors provide details of the contracted workers employed, the nature of the work done by the contracted workers, the percentage of wages paid to the contracted workers, and other details; it shall retain records in the prescribed form, and the labour muster roll format comes under this

- All primary employers and all contractors shall maintain employee records in the prescribed form on the premises of the company in which the contract worker is employed; for example, the labour muster roll format states working hours, types of work, and other prescribed information

The Effect Of Laws And Agreements Contrary To This Law

- The provisions of this Act apply before or after the start, even if there are conflicts that may be contained in other laws, terms of contract or service contracts, or rules of procedure applicable to the branch

- Contract workers employed by the branch have the right to benefit from such contracts, permanent service contracts, in favor of matters over which they are entitled under this contract

- Workers continue to have the right to receive more favorable benefits in respect of other matters under this Act, even though they have received benefits related to matters

Special Case Exemption Authority

In case of emergency, the relevant government may place an order according to such conditions and restrictions by notifying in the official bulletin. The deadline specified in the notice, all or part of the clause of this Act, or the rules created under it, shall not apply to the facility or facility class or contractor class.

Protection Of Measures Under This Law

In some cases, proceedings, prosecutions, or other judicial proceedings will not be conducted against registrars, license officers, other government officials, or members of the Board of Directors or the State Board of Directors where processes were done or intended in good faith.

Authority To Give Instructions

The central government may give instructions to the governments of any state regarding implementing the provisions of this law in the states.

The Power To Remove Difficulties

In the event of difficulty in implementing the provisions of this Act, if the central government determines by a resolution published in the official bulletin that it is necessary or appropriate to eliminate the difficulties, such provisions shall be made in this Act.

The Power To Make Rules

The competent government may issue rules regarding the implementation of the purposes of this Act, subject to prior publication.

In particular, without compromising the generality of the aforementioned authority, such rules may provide for the board and state committees, terms of office and other duties, procedures to be followed in performing duties, and how to fill vacancies.

Conclusion

The labour muster roll format is specified as a mandatory record that should be maintained by the contractor under Section 78 in the Contract Labour (Regulation and Abolition) Central Rules, 1971. The labour muster roll format is an attendance record or employment record that contains details of the attendance of a particular site, contractor, and employee for a particular period.

This labour muster roll format also keeps supervision of the attendance and work down by the contractor, as it is specified for him to visit the site every day. It serves as confirmation and evidence for salary and wage payments.

It is created and maintained by the contractor and includes other information such as hire dates, leaves taken, number of working hours, other service information, etc.

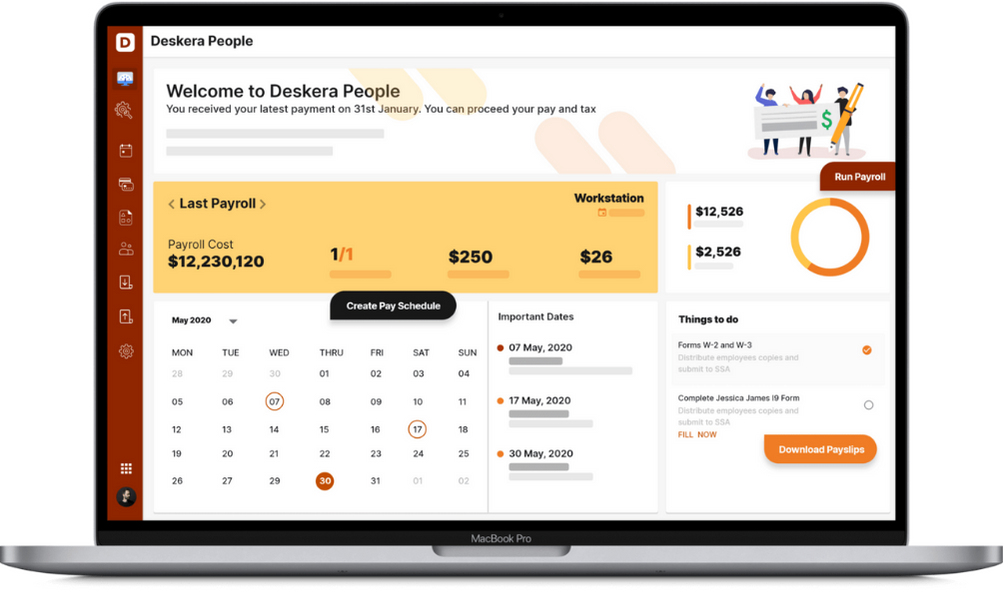

How Deskera Can Assist You?

Deskera People has the tools to help you manage your payroll, leaves, employee onboarding process, and managing employee expenses, all in a single system. Features like a flexible payment schedule, custom payroll components, detailed reports, customizable pay slips, scanning and uploading expenses, and creating new leave types make your work simple.

Key Takeaways

- A labour muster roll format is created by the contractor and filled with information by checking how many days the employees have worked, how many hours a day the contractor spent on the site, and how are the wages due and paid

- The labour muster roll format is an important register that will help inspectors, employers, and contractors to verify this information by collating it with the employee's time card or by asking a question

- The labour muster roll format controls, in addition to employees, the contractor visits too

- The labour muster roll format contains information such as the name and personal details of the employee, gender, father's name, working hours, etc

- All payments will be made according to the labour muster roll format as maintained by the contractor

Related Articles