Have you ever wondered how businesses decide whether to invest in a new factory, launch a product, or upgrade their technology? The answer lies in a strategic financial tool known as capital budgeting. This process helps companies evaluate the profitability and risks of long-term investments, ensuring that resources are directed toward projects that maximize value.

At its core, capital budgeting is the foundation of sound financial planning. It is not about day-to-day expenses, but rather about high-stakes decisions that shape the future growth of a business. From infrastructure expansion to mergers and acquisitions, these investment choices can determine whether a company thrives or struggles in a competitive market.

The importance of capital budgeting goes beyond just crunching numbers—it provides a structured way to assess costs, revenues, risks, and long-term returns. Businesses use specific methods and formulas, such as Net Present Value (NPV) or Internal Rate of Return (IRR), to evaluate each option objectively. By following a defined process, companies can minimize uncertainty and make decisions that align with both short-term goals and long-term strategy.

Integrating AI-powered tools like ERP.AI into the capital budgeting process can enhance decision-making by analyzing vast financial data, forecasting potential returns, and optimizing resource allocation, enabling businesses to pursue growth opportunities more confidently and efficiently.

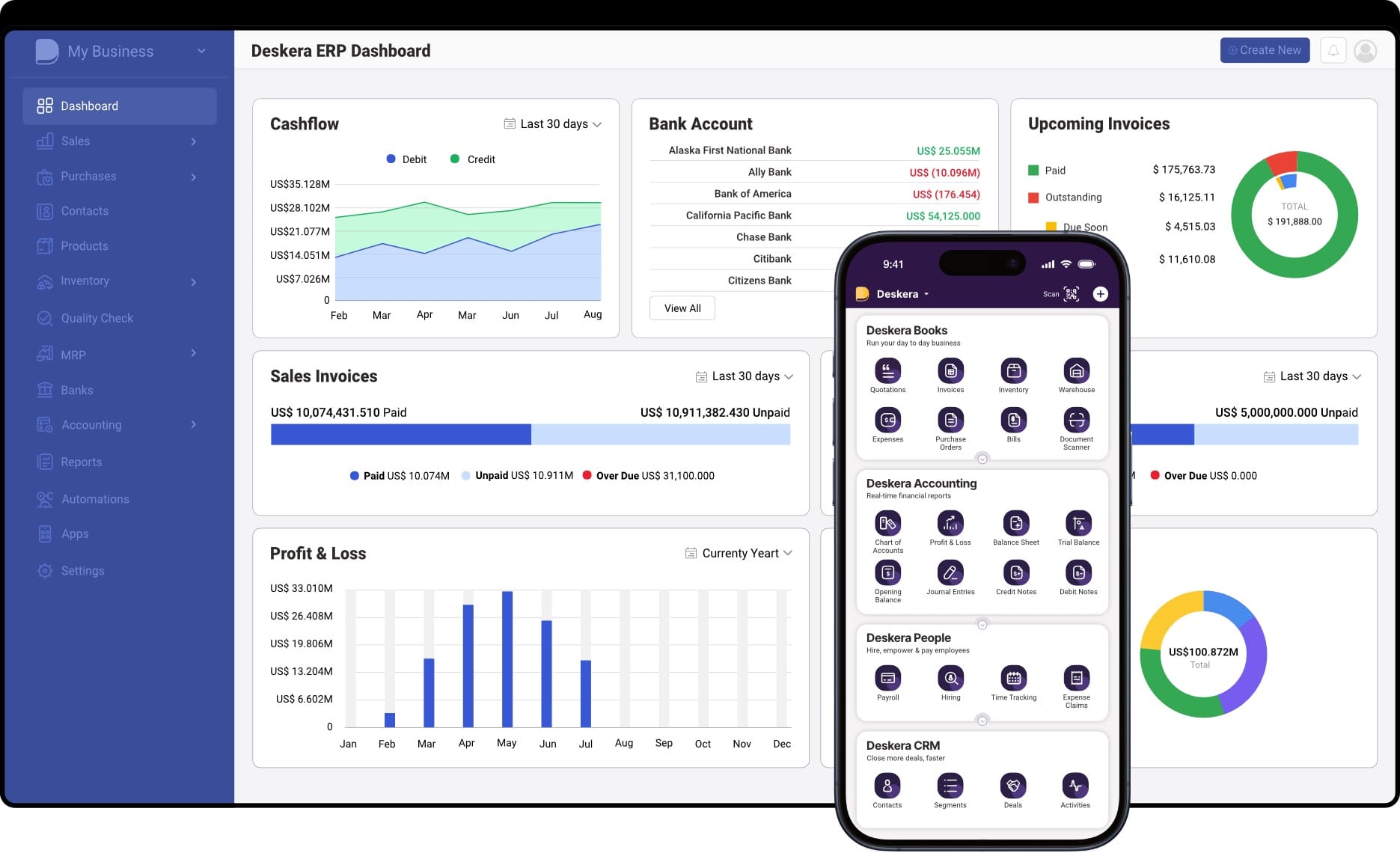

This is where technology like Deskera ERP becomes invaluable. With its automated financial forecasting, real-time cash flow insights, and advanced reporting tools, Deskera ERP enables businesses to analyze investment opportunities with precision. It simplifies the complex calculations of capital budgeting while offering a clear view of potential returns, making decision-making faster and more reliable.

What is Capital Budgeting?

Capital budgeting is the process of evaluating and selecting long-term investment projects or capital expenditures. Unlike day-to-day expenses, these are large financial commitments—such as building a new factory, purchasing advanced machinery, or expanding into a new market—that directly influence a company’s growth and profitability. The goal is to analyze whether the potential returns from a project are worth the initial investment, helping businesses allocate resources more efficiently.

This process, often referred to as investment appraisal, focuses on cash inflows and outflows over a project’s life cycle. For instance, managers assess how much cash a project will generate versus how much it will cost, and whether it will meet the company’s financial benchmarks. By doing so, capital budgeting provides a structured way to decide which projects are worth pursuing and which should be rejected.

In practice, businesses use capital budgeting to answer critical strategic questions. Should a car manufacturer build its own electric vehicle plant or acquire a specialized EV company? Should a retailer invest in automated inventory software to streamline operations? Should a small restaurant owner purchase an extra oven to meet rising demand? Each of these decisions requires weighing future benefits against the costs and risks involved.

At the heart of capital budgeting are two key financial concepts: opportunity cost and the time value of money. Opportunity cost highlights the benefits a business sacrifices by choosing one investment over another, while the time value of money emphasizes that a dollar today is more valuable than a dollar in the future. Together, these principles ensure that managers make investment decisions not only based on profitability but also on timing, alternatives, and long-term value creation.

Example of Capital Budgeting in Action

Imagine a company is considering buying a new machine for $100,000. The machine is expected to generate additional cash inflows of $30,000 per year for the next 5 years.

- Total inflows = $30,000 × 5 = $150,000

- Initial investment = $100,000

- Net gain = $150,000 – $100,000 = $50,000

Since the project generates more cash inflows than the initial investment, it would likely be considered a profitable decision. Of course, in real-world scenarios, managers would also factor in the time value of money (discounting future cash flows), risks, and opportunity costs before making the final call.

Objectives of Capital Budgeting

Capital budgeting involves significant long-term investments, and each decision can have a lasting impact on a company’s growth and profitability. Therefore, businesses need to approach capital budgeting with clear objectives to ensure the most effective use of their resources. Some of the key objectives include:

1. Selecting Profitable Projects

Organizations often encounter multiple potential investment opportunities. However, due to limited capital, it is essential to select the projects that are most likely to increase shareholders’ wealth. The focus is on choosing investments that offer the highest returns relative to their risks, ensuring long-term financial growth.

2. Controlling Capital Expenditures

While profitability is crucial, managing costs is equally important. Capital budgeting aims to control capital expenditures by forecasting requirements, planning budgets, and monitoring actual spending. This ensures that investments are made efficiently and no opportunities are wasted due to budgetary mismanagement.

3. Finding the Right Sources of Funds

Capital budgeting also involves determining how to finance investments. Businesses must identify the optimal sources of funds, balancing the cost of borrowing against expected returns. This helps ensure that the financing structure maximizes profitability while maintaining financial stability.

4. Minimizing Risk

Capital budgeting helps organizations evaluate potential risks associated with long-term investments. By analyzing cash flows, market conditions, and economic factors, companies can make informed decisions that reduce the likelihood of financial losses.

5. Ensuring Strategic Alignment

Another objective is to ensure that investment decisions align with the company’s long-term goals and strategic priorities. Projects selected through capital budgeting should support overall business growth, operational efficiency, and competitive advantage.

Features of Capital Budgeting

Capital budgeting is a fundamental financial management tool that helps businesses evaluate and prioritize long-term investments. Its features reflect both the strategic importance and the careful analysis required to make high-stakes financial decisions.

1. Long-Term Focus

Capital budgeting is concerned with investments that will have an impact over multiple years. Unlike routine operational expenses, these projects—such as constructing a new manufacturing plant, launching a new product line, or upgrading technology—extend far into the future. This long-term perspective requires businesses to forecast revenues, costs, and potential risks over the life of the project.

2. Large Capital Outlay

Projects evaluated under capital budgeting typically require substantial amounts of money. These are not minor expenses but significant investments that can affect the company’s overall financial position. Because of the large financial commitment involved, careful planning, evaluation, and prioritization are crucial to ensure that funds are allocated effectively.

3. Risk and Uncertainty

Capital budgeting decisions involve future-oriented projections, which are always subject to risk and uncertainty. Market fluctuations, economic conditions, technological changes, and unforeseen events can affect the expected cash inflows and outflows. Businesses must therefore perform a comprehensive analysis, including sensitivity analysis and scenario planning, to minimize potential losses.

4. Irreversibility of Decisions

Once a capital investment is made—such as purchasing heavy machinery or building a factory—it is often difficult or costly to reverse. This makes every decision high-stakes, requiring careful consideration of alternatives, expected returns, and alignment with strategic objectives. Poor decisions can lead to sunk costs and missed opportunities.

5. Focus on Cash Flows

Capital budgeting emphasizes cash inflows and outflows rather than accounting profits. Since profits can be influenced by non-cash factors like depreciation or accrual accounting, focusing on actual cash flows ensures that the investment’s true financial impact is understood. Cash flow analysis also helps in assessing liquidity and the project’s ability to generate returns over time.

6. Strategic Importance

Decisions taken through capital budgeting are strategically critical, as they affect the company’s long-term growth, competitive position, and overall sustainability. Projects are not just assessed on immediate profitability but also on how they contribute to broader business goals, such as market expansion, operational efficiency, and shareholder value.

7. Incorporates Key Financial Concepts

Capital budgeting relies heavily on financial principles like the time value of money and opportunity cost. The time value of money ensures that future cash flows are discounted to reflect their present value, while opportunity cost highlights the potential benefits forgone by choosing one project over another. These concepts allow businesses to make rational, data-driven investment decisions.

8. Helps Prioritize Investments

A subtle but important feature of capital budgeting is that it helps companies rank and prioritize multiple investment opportunities. Since resources are limited, managers can evaluate which projects offer the best combination of profitability, risk, and strategic alignment, ensuring the most effective use of capital.

Capital budgeting is the bridge between strategic vision and financial execution, ensuring that every big investment decision is future-focused and value-driven

How Capital Budgeting Works

Capital budgeting works like a roadmap — guiding businesses from opportunity identification to strategic decision-making through numbers, risks, and foresight.

Capital budgeting is a structured process that helps businesses make informed decisions about long-term investments. Understanding how it works in practice can help managers allocate resources efficiently and minimize financial risks.

1. Step-by-Step Functioning in Real Business Scenarios

The capital budgeting process typically follows a series of steps. First, managers identify potential investment opportunities, such as launching a new product, expanding operations, or upgrading machinery.

Next, they collect relevant data, including estimated costs, expected revenues, and potential risks associated with each project. This is followed by a detailed evaluation using financial models like Net Present Value (NPV), Internal Rate of Return (IRR), or Payback Period.

Finally, the organization selects the most profitable and strategically aligned projects and monitors them throughout implementation to ensure objectives are met.

For example, a manufacturing firm considering a new production line would start by estimating how much the equipment costs, the expected increase in production, and the potential market demand. By analyzing these factors, managers can determine whether the investment will generate sufficient returns.

2. Estimating Costs, Revenues, and Risks

Managers use financial projections to estimate the costs of the project, including initial capital outlay, operating expenses, and maintenance. Expected revenues are forecasted based on market research, historical performance, and potential growth.

At the same time, risks—such as fluctuating raw material prices, economic uncertainty, or competitive pressures—are assessed to understand how they may affect the project’s success. This thorough evaluation ensures that decisions are not based on assumptions alone but on realistic and data-driven insights.

3. The Role of Discounting and Cash Flow Analysis

One of the key aspects of capital budgeting is the time value of money. Future cash inflows and outflows are discounted to their present value to accurately assess the project’s worth.

This ensures that projects are evaluated based on the actual economic benefit today, rather than just future nominal returns.

Cash flow analysis also helps managers determine the timing of inflows and outflows, allowing for better liquidity planning and risk management.

4. Decision-Making Based on Profitability and Strategic Alignment

Once the analysis is complete, managers make investment decisions by considering both financial profitability and strategic fit. A project may be financially attractive but might not align with long-term business objectives, such as entering a new market or improving operational efficiency.

Capital budgeting ensures that only projects that meet both financial and strategic criteria are approved, thereby maximizing shareholder value and supporting sustainable business growth.

By following this structured approach, companies can make well-informed investment decisions, reduce the risk of financial losses, and prioritize projects that contribute meaningfully to their long-term goals.

Factors Affecting Capital Budgeting

Capital budgeting decisions are influenced by a variety of internal and external factors that can affect project evaluation, selection, and implementation. Understanding these factors helps businesses make more informed and strategic investment decisions.

- Size of the Investment: Large-scale investments typically require more rigorous analysis, detailed planning, and executive approval, whereas smaller investments may undergo a simpler review process. The magnitude of investment often determines the depth of feasibility studies and the level of risk scrutiny.

- Expected Returns: Projects with higher anticipated returns are generally prioritized, as they contribute more to profitability and shareholder value. Calculating projected cash inflows and evaluating potential revenue streams are essential to assess whether a project meets financial expectations.

- Risk and Uncertainty: Investment projects come with varying degrees of risk. Factors like market volatility, operational challenges, or supply chain uncertainties can influence decisions. Higher-risk projects may require contingency planning, sensitivity analysis, or risk mitigation strategies before approval.

- Cost of Capital: The cost of capital, which represents the required return by investors, is a critical benchmark. Projects must generate returns exceeding this rate to be considered financially viable. A lower-than-required return can render a project infeasible.

- Strategic Fit: Projects must align with the company’s long-term goals and overall strategy. Investments that support expansion, innovation, or competitive advantage are more likely to be approved, while those that diverge from strategic priorities may be rejected.

- Regulatory Environment: Compliance with laws, industry regulations, and environmental standards affects project feasibility. Changes in regulations or tax policies can impact cash flow projections, project costs, or even the legal viability of the investment.

- Market Conditions: Economic trends, consumer demand, industry growth, and competitive dynamics influence project success. Favorable market conditions enhance the likelihood of positive returns, while adverse conditions may necessitate postponing or modifying projects.

- Technological Changes: Rapid technological advancements may make existing processes obsolete or present new investment opportunities. Companies need to consider the potential for technology upgrades and ensure projects remain relevant over time.

- Social and Environmental Factors: Increasingly, companies evaluate projects based on social responsibility and sustainability. Investments that promote environmental stewardship, community welfare, or ethical practices can enhance brand reputation and long-term viability.

- Internal Factors: The company’s financial health, available resources, human capital, and operational capacity play a key role. Assessing internal strengths and limitations ensures that projects can be executed efficiently without overextending resources.

By carefully considering these factors, businesses can prioritize investments that offer the best combination of profitability, strategic alignment, and risk management.

Importance of Capital Budgeting in Business

Capital budgeting isn’t just about numbers — it’s about aligning today’s investment with tomorrow’s vision.

Capital budgeting is not just a financial tool; it is a strategic process that enables businesses to make informed, long-term investment decisions. By carefully evaluating and comparing opportunities, companies can decide where to allocate their limited capital resources to maximize benefits and drive sustainable growth.

Beyond financial considerations, capital budgeting helps businesses improve efficiency, expand capacity, introduce innovative capabilities, and even gain a competitive edge in their industry. These strategic advantages ultimately enhance company value and increase shareholder wealth.

1. Ensures Optimal Allocation of Financial Resources

One of the primary benefits of capital budgeting is that it helps organizations prioritize investments that offer the best returns relative to cost.

By analyzing the potential profitability of various projects, businesses can allocate resources to initiatives that align with long-term objectives and deliver maximum value.

This systematic approach prevents wasteful spending on less impactful projects and ensures that every dollar invested contributes meaningfully to the company’s growth.

2. Reduces Risks by Evaluating Profitability and Feasibility

Capital budgeting incorporates rigorous risk assessment and feasibility analysis into the investment decision-making process.

By examining potential returns, costs, and uncertainties associated with each project, managers can identify risks early and develop strategies to mitigate them.

This reduces the likelihood of financial losses and helps ensure that only projects with strong potential and realistic assumptions are undertaken.

3. Helps in Long-Term Strategic Planning

More than just a financial exercise, capital budgeting is central to strategic planning. It aligns investment decisions with organizational goals, navigates uncertainty, and ensures that resources are used to support long-term objectives.

Companies can plan for growth, capacity expansion, and innovation while maintaining a clear roadmap for operational and financial priorities. Through this alignment, capital budgeting ensures that every investment contributes to the overall vision and sustainability of the business.

4. Improves Shareholder Value

By focusing on projects that generate higher returns and strategic benefits, capital budgeting directly enhances shareholder wealth. Smart investment decisions increase efficiency, boost profitability, and strengthen the company’s market position, all of which contribute to a higher overall company valuation. Shareholders benefit from both capital appreciation and consistent, long-term returns on their investments.

5. Maximizes Return on Investment

Capital budgeting allows businesses to assess and prioritize long-term projects based on their expected returns relative to required investments. This ensures that capital is directed toward projects that create long-term value and support the company’s strategic goals, ultimately driving sustainable financial growth.

6. Strengthens Resource Management

Capital budgeting takes a holistic view of resources, considering financial, human, and technological assets. It helps managers balance these resources across the organization, prioritizing high-value projects while avoiding overcommitment to less profitable initiatives. This approach enhances operational efficiency, maintains liquidity, and optimizes working capital.

7. Assesses Cash Flow

A core focus of capital budgeting is analyzing the timing and magnitude of cash flows associated with investment projects. This helps companies forecast liquidity accurately, ensuring they can meet current obligations while pursuing long-term growth opportunities. Understanding cash flow dynamics also supports better planning for debt servicing, reinvestment, and operational needs.

8. Evaluates Risks

Capital budgeting techniques incorporate risk assessment, allowing businesses to consider uncertainties such as market volatility, economic changes, or technological disruptions. By evaluating these risks, companies can avoid or mitigate investments that may threaten financial stability and make smarter, more resilient investment choices.

Capital Budgeting Process

The capital budgeting process is a structured approach that businesses use to evaluate, select, and manage long-term investment projects. How a company manages this process depends on its size and organizational structure.

Large organizations often have a capital budgeting committee overseeing all projects, while small and midsize businesses may rely on the owner or a small group of executives supported by accountants and financial analysts.

Regardless of the structure, it is essential to align every investment decision with the company’s strategic goals before moving into the procedural steps.

1. Identifying Investment Opportunities

The first step involves gathering ideas and proposals for potential investments. These proposals can come from any department, such as operations, sales, or R&D.

Organizations typically use standardized submission procedures and bid management tools, requiring details like estimated cash flows, projected costs, and anticipated benefits. Growing businesses often face many competing proposals, making it critical to have a structured way to collect, organize, and prioritize these opportunities.

2. Evaluating Feasibility & Cash Flow Projections

Once potential projects are identified, the next step is to assess feasibility. This involves verifying that proposals contain the necessary information and have been properly researched. Managers typically obtain endorsements from accounting, operations, and sales departments to ensure all perspectives are considered.

Key criteria, such as acceptable risk levels, hurdle rates, and spending thresholds, are established at this stage to ensure that selected projects will add value to the company. Cash flow projections are analyzed to determine whether the investment can generate sufficient returns relative to its costs and risks.

3. Estimating Costs and Returns

In this stage, managers calculate the total costs of the project, including initial outlay, operating expenses, and ongoing maintenance. At the same time, expected revenues and cash inflows are estimated.

This step often includes sensitivity analysis to account for market fluctuations and other uncertainties. By comparing costs and potential returns, the organization can determine whether the project is financially viable and meets internal benchmarks for profitability.

4. Applying Capital Budgeting Methods

After estimating costs and returns, managers apply specific capital budgeting techniques to evaluate the project quantitatively. Common methods include Net Present Value (NPV), Internal Rate of Return (IRR), Payback Period, Profitability Index, and Accounting Rate of Return (ARR). These techniques provide a structured way to compare projects and assess which ones are likely to generate the highest value relative to their risk.

5. Choosing the Best Investment Option

Once all analyses are complete, the company selects the projects that meet evaluation criteria and align with strategic priorities. Timing and resource availability often influence this step, especially when multiple projects compete for the same funds. Only proposals that offer strong financial returns and fit the organization’s long-term objectives are given the green light for implementation.

6. Implementation & Monitoring

The final step involves developing an implementation plan and closely monitoring the project. This plan outlines funding methods, key personnel, authority levels, project milestones, and procedures for managing exceptions such as delays or cost overruns.

Throughout execution, actual performance is compared with initial projections to ensure the project stays on track. Reviewing results at predetermined milestones and after completion provides valuable insights that can inform future capital budgeting decisions.

Capital Budgeting Methods

Capital budgeting methods help businesses evaluate, compare, and select investment projects based on financial viability, risk, and strategic alignment. Companies often use multiple methods to ensure the best decision. Below is a comprehensive list of the most common methods:

1. Payback Period

The payback period measures the time it takes for a project to recover its initial investment through cash inflows. It is widely used because of its simplicity and ease of calculation, especially for companies concerned about liquidity.

However, it does not account for the time value of money or cash flows beyond the payback point, which limits its accuracy in long-term projects.

Formula: Payback Period = Initial Investment ÷ Annual Cash Inflow

Example: A $400,000 investment generating $100,000/year → Payback Period = 4 years. Projects with shorter paybacks are preferred.

2. Discounted Payback Period

The discounted payback period is similar to the payback period but incorporates the time value of money, discounting future cash inflows before calculating recovery time.

This method provides a more accurate measure of liquidity risk and ensures that later cash flows are properly valued, which is especially important for long-term projects with varying inflows.

Formula: Discounted Payback Period = Time when Σ (Cash Inflow_t ÷ (1+r)^t) = Initial Investment

Example: $50,000 investment, $15,000/year inflows, discount rate 10% → Discounted payback slightly longer than 3.8 years.

3. Net Present Value (NPV)

NPV calculates the present value of expected cash inflows minus outflows, considering the time value of money. A positive NPV indicates a project will generate value exceeding its cost, while a negative NPV suggests it should be rejected. NPV helps companies compare projects of different sizes and durations on a consistent basis and is a key measure of a project’s financial viability.

Formula: NPV = Σ (Cash Inflow_t ÷ (1+r)^t) − Initial Investment

Example: $50,000 investment, $15,000/year inflows for 4 years at 10% → NPV ≈ $5,740 → Acceptable.

4. Internal Rate of Return (IRR)

IRR is the discount rate at which the NPV of a project equals zero. It represents the expected rate of return and allows comparison with the company’s required return. Projects with IRR higher than the required rate are accepted. IRR is useful for ranking projects, especially when multiple investments compete for the same funds. However, it may give multiple values for unconventional cash flows.

Formula: 0 = Σ (Cash Inflow_t ÷ (1+IRR)^t) − Initial Investment

Example: $100,000 investment, $30,000/year for 5 years → IRR ≈ 12%. Required rate = 10%, so project is acceptable.

5. Modified Internal Rate of Return (MIRR)

MIRR refines IRR by considering reinvestment at a realistic rate instead of assuming cash inflows are reinvested at the IRR. This provides a more accurate picture of project profitability. It is especially useful for long-term projects or when cash inflows vary widely, offering managers a better estimate for decision-making.

Formula: MIRR = (Terminal Value of Cash Inflows ÷ Present Value of Cash Outflows)^(1/n) − 1

Example: $50,000 investment, $15,000/year inflows reinvested at 8% → MIRR ≈ 11%.

6. Profitability Index (PI)

PI measures the ratio of present value of future cash flows to the initial investment. A PI greater than 1 indicates a financially viable project. This method helps in ranking projects when capital is limited and ensures optimal allocation of scarce resources. It also considers the time value of money, making it superior to payback period alone.

Formula: PI = Present Value of Future Cash Flows ÷ Initial Investment

Example: $60,000 investment, PV of inflows $75,000 → PI = 1.25 → Acceptable.

7. Discounted Cash Flow (DCF) Analysis

DCF calculates the present value of all expected cash inflows and outflows of a project. It considers the time value of money, allowing managers to compare projects of varying size, duration, and risk. DCF forms the foundation for NPV and other methods, making it critical for financial planning and investment decisions. Accurate cash flow forecasts and discount rates are crucial for reliable results.

Formula: DCF = Σ (Cash Inflow_t ÷ (1+r)^t) − Σ (Cash Outflow_t ÷ (1+r)^t)

Example: $100,000 investment, $30,000/year inflows for 5 years at 10% → NPV = $16,000.

8. Equivalent Annuity Method

The equivalent annuity method converts NPV into equal annual cash flows, enabling comparison of projects with different lifespans. Ideal for mutually exclusive projects or when evaluating options with unequal durations. This method ensures a fair assessment of long-term projects on an annualized basis.

Formula: EAA = (NPV × r) ÷ (1 − (1+r)^−n)

Example: Project A: NPV = $50,000, n = 5 years, r = 10% → EAA ≈ $13,230/year.

9. Throughput Analysis

Throughput analysis evaluates projects based on system-wide output increase rather than individual cost savings. Projects that relieve bottlenecks or improve overall flow are prioritized, especially in manufacturing. This method ensures capital is invested where it maximizes the company’s operational efficiency and profit across the entire process.

Example: A factory line bottleneck can be resolved by investing in faster machinery → Overall throughput increases, boosting profitability more than investing in unconstrained areas.

10. Constraint Analysis

Constraint analysis identifies operational or market limitations and selects projects that truly improve performance. It avoids investments in areas where resources are already limited, ensuring capital is allocated efficiently to projects that remove real constraints.

Example: A restaurant with limited seating may expand dining space rather than adding more kitchen equipment, as seating is the bottleneck.

11. Cost Avoidance Analysis

This method evaluates projects based on future costs that can be eliminated. Projects that prevent greater expenses or inefficiencies are prioritized. It incorporates opportunity costs and is useful for long-term financial planning, although the benefits are sometimes theoretical until realized.

Example: Investing in automated accounting software avoids hiring additional bookkeepers → Savings are considered a return on investment.

12. Real Options Analysis

Real options analysis evaluates managerial flexibility under uncertainty, allowing project delay, expansion, or abandonment. Extending NPV with probabilities and scenario planning, it is highly useful for dynamic industries with long-term investments. It accounts for changes that may affect cash flows, adding strategic value to decision-making.

Example: A tech company invests in a facility but can delay expansion if market conditions are unfavorable → Flexibility adds value beyond NPV.

No single method tells the full story — combining NPV, IRR, Payback Period, and other techniques provides the clearest picture of a project’s true potential.

Choosing the Right Capital Budgeting Method and Key Considerations

Selecting the appropriate capital budgeting method depends on several factors, including the nature of the project, available resources, and the company’s strategic objectives.

No single method fits all situations—some projects benefit from rigorous financial modeling, while others can be evaluated with simpler approaches. Often, companies use a combination of methods, such as NPV, IRR, and payback period, to cross-check results and ensure a well-rounded assessment.

Key Considerations for Choosing a Method

- Project Complexity and Size: Large-scale, long-term projects with high financial stakes often require sophisticated methods like Discounted Cash Flow (DCF) analysis or Real Options Analysis. Smaller, time-sensitive projects may be sufficiently evaluated using simpler methods, such as payback period.

- Availability of Data and Resources: Accurate cash flow projections and financial metrics are essential for methods like NPV or IRR. If reliable data is limited, simpler techniques may reduce the risk of misinterpretation.

- Strategic Alignment: The chosen method should reflect the organization’s strategic goals. For example, a company focused on growth may prioritize projects with higher IRR or throughput, while one prioritizing liquidity may emphasize shorter payback periods.

- Macroeconomic Trends: Broad economic factors, such as GDP growth, inflation, and interest rates, can influence project returns. Methods that incorporate the time value of money, like NPV and DCF, help account for these trends.

- Regulatory and Tax Implications: Capital budgeting decisions must consider current and anticipated regulations, tax credits, and depreciation rules, as these can materially affect cash flows and project feasibility.

- Competitive Landscape: Understanding competitors’ strategies and potential market entries is crucial. A project may have strong financial metrics but still fail to create long-term value if it does not improve competitive positioning.

- Technology and Innovation: Projects in rapidly evolving industries must account for technological changes that could impact efficiency, competitiveness, or relevance over time. Flexible methods like Real Options Analysis can help capture potential adjustments and opportunities.

- Capital Availability: The company’s ability to fund a project internally or through external financing can dictate which methods are feasible. Limited capital may necessitate prioritizing projects with the fastest payback or highest profitability index.

By considering these factors alongside the strengths and weaknesses of each capital budgeting method, businesses can make informed, strategic investment decisions that balance risk, return, and long-term value creation.

The best capital budgeting method depends on context — but the smartest companies often use a mix to balance speed, accuracy, and strategy.

Examples of Capital Budgeting in Action

From factory expansions to tech upgrades, capital budgeting transforms ambitious ideas into structured, profitable realities.

Capital budgeting isn’t just theory—it guides real-world investment decisions across industries. Businesses use it to compare alternatives, allocate scarce resources, and support growth. Below are some practical examples that show how companies apply capital budgeting techniques:

1. Manufacturing Expansion

A furniture manufacturer considers adding a new production line costing $1 million. Using NPV and IRR, the finance team estimates the project will generate $300,000 annually for 5 years. With a positive NPV of $250,000 and IRR above the company’s required return, the project is approved. This investment helps increase capacity and revenue while maintaining long-term profitability.

2. Technology Upgrade

A mid-sized retailer is debating whether to replace outdated point-of-sale systems with a modern cloud-based solution costing $250,000. A payback period analysis shows recovery within 3 years, while a DCF analysis confirms a positive return. Beyond cost savings, the system improves efficiency, customer experience, and real-time inventory tracking—delivering both financial and strategic benefits.

3. New Product Launch

A pharmaceutical company evaluates launching a new drug, requiring $2 million in R&D and marketing. Forecasted cash inflows vary, so managers apply Real Options Analysis to account for uncertainty. By modeling scenarios, they can decide whether to expand, delay, or abandon the project depending on regulatory outcomes and market conditions.

4. Cost-Saving Investment

A logistics company considers investing $500,000 in automated warehouse robots. A cost avoidance analysis shows the project could prevent the need to hire 20 additional employees over the next 5 years, saving $700,000 in labor costs. With a PI > 1, the project clearly adds value and enhances efficiency.

5. Service Industry Constraint Example

A restaurant wants to invest $100,000 in new kitchen equipment. However, a constraint analysis reveals that seating capacity, not kitchen speed, is the bottleneck. Instead, management reallocates funds toward expanding the dining area, which has a direct impact on sales and customer turnover, improving throughput.

Benefits of Capital Budgeting

“Smart capital budgeting unlocks efficiency, boosts investor confidence, and ensures business growth is both profitable and sustainable.”

Unlike its importance, which explains why capital budgeting matters, the benefits highlight what organizations gain when they apply it effectively. Here are the distinct advantages:

1. Better Cash Flow Management

Capital budgeting helps companies forecast and track cash inflows and outflows tied to major projects. This allows businesses to anticipate funding needs, avoid liquidity crunches, and plan financing strategies well in advance, ensuring smoother financial operations.

2. Data-Driven Decision Making

Instead of relying on intuition, managers can base investment decisions on structured analysis—such as NPV, IRR, or sensitivity tests. This reduces biases and provides a more objective foundation for approving or rejecting projects.

3. Improved Transparency and Accountability

The capital budgeting process requires detailed proposals, cash flow projections, and evaluation criteria. This level of documentation increases transparency and makes managers accountable for their recommendations, which helps improve governance and investor trust.

4. Avoidance of Overinvestment or Underinvestment

By carefully analyzing potential returns, businesses can avoid the trap of overspending on unviable projects or underinvesting in profitable opportunities. This balance safeguards financial health and ensures that capital is deployed optimally.

5. Enhanced Competitive Advantage

When businesses allocate funds to projects with the highest potential—such as new technologies, market expansion, or product innovation—they gain a competitive edge. Strategic capital budgeting allows companies to stay ahead of rivals in fast-changing industries.

6. Measurable Post-Implementation Performance

One of the overlooked benefits of capital budgeting is its role in post-project evaluation. Comparing actual results with projections provides valuable feedback, helping companies refine their future budgeting models and strengthen decision-making accuracy over time.

7. Builds Investor and Stakeholder Confidence

When companies demonstrate a disciplined capital budgeting process, it signals financial prudence to stakeholders. This improves credibility, attracts investors, and reassures lenders that their capital is being managed responsibly.

Limitations of Capital Budgeting

While capital budgeting is a vital tool for making long-term investment decisions, it is not without its limitations. The process relies heavily on forecasts and assumptions, which can make the results less reliable in practice.

Below are some of the major challenges and constraints businesses may face when applying capital budgeting techniques:

1. Inaccurate Cash Flow Estimates

The accuracy of any capital budgeting decision depends on estimating future cash inflows and outflows. Overestimating revenues or underestimating costs can cause projects to look more profitable than they really are, leading to poor investment decisions. On the other hand, overly conservative estimates might cause viable projects to be rejected.

2. Uncertainty in Timing of Returns

Timing is just as important as the amount of cash flow. Delays in project execution, market adoption, or external conditions can significantly affect returns, especially in methods like Net Present Value (NPV). The longer the project timeline, the more difficult it becomes to forecast accurately.

3. Complexity in Choosing the Right Discount Rate

Determining the correct discount rate is a recurring challenge. If a company uses a rate that does not reflect its true cost of capital or risk profile, the results of methods such as NPV or Internal Rate of Return (IRR) may be misleading. Setting the right hurdle rate—the minimum acceptable return—also requires judgment and precision.

4. Dependence on Estimates and Assumptions

Capital budgeting models are built on assumptions about costs, revenues, risks, and market conditions. Factors like inflation, technological change, or unexpected competition can make these assumptions inaccurate over time, leading to decisions that may not align with real-world outcomes.

5. Time-Consuming and Complex Process

Capital budgeting often involves multiple stakeholders, detailed financial modeling, and scenario testing. For large organizations, committees may be required to review and approve projects, slowing down decision-making. For small businesses, the process may feel overly complex and resource-intensive, limiting agility.

6. Limited Scope for Qualitative Factors

Capital budgeting largely focuses on financial metrics, often overlooking qualitative aspects such as environmental impact, social responsibility, or long-term brand reputation. A project that looks profitable on paper might damage the company’s image or sustainability goals if non-financial factors are ignored.

7. Exposure to Risk and Uncertainty

No amount of forecasting can fully account for external risks such as economic downturns, regulatory changes, supply chain disruptions, or natural disasters. While tools like sensitivity analysis or Monte Carlo simulation can help, uncertainty will always remain a limitation.

8. Capital Rationing Constraints

Companies rarely have unlimited funds, and capital rationing often forces businesses to prioritize certain projects over others. This may result in rejecting worthwhile projects or concentrating too heavily on high-return ventures, which increases exposure to risk and reduces diversification.

9. Regulatory and Tax Challenges

Changes in regulations, safety codes, or tax structures can quickly alter the financial viability of a project. For instance, stricter environmental laws could add unexpected costs, while shifts in tax incentives may reduce expected returns.

10. Data and Integration Issues

If project data is scattered across siloed spreadsheets or disconnected systems, the capital budgeting process can suffer from inaccuracies and inefficiencies. Without integrated tools, companies risk making decisions based on incomplete or inconsistent data.

11. Misalignment with Strategic Planning

In some cases, capital budgeting decisions are made in isolation without proper integration into broader corporate strategy. This disconnect can result in funding projects that look profitable but don’t contribute meaningfully to long-term organizational goals.

In short, capital budgeting is essential but not foolproof. Its reliance on forecasts, assumptions, and complex calculations means businesses must remain cautious and flexible when making investment decisions.

Capital Budgeting Best Practices

Capital budgeting involves major investments that can shape the long-term success of an organization. To minimize risk and maximize returns, companies should adopt best practices that bring discipline, transparency, and accuracy to the process. The following practices help organizations refine their approach to capital budgeting:

1. Focus on Cash Flows, Not Net Income

Cash flows provide a clearer picture of a project’s viability than net income, which can be influenced by accounting treatments. Managers should include all cash movements—such as increases in receivables, changes in working capital, or repayment schedules—to reflect the project’s true financial impact.

2. Use Conservative Estimates

Overly optimistic projections can create unrealistic expectations and lead to poor investment decisions. A prudent approach involves using cautious assumptions about revenues and adopting a worst-case perspective when estimating costs. This reduces the likelihood of overcommitting capital to risky projects.

3. Carefully Project Timing of Cash Flows

Since capital budgeting relies heavily on the time value of money, accurately forecasting when cash inflows and outflows will occur is critical. Delays in revenue generation or unexpected costs can significantly affect NPV or IRR results, so precise timing helps ensure sound decision-making.

4. Exclude Non-Cash and Financing Costs

Items like depreciation, amortization, and financing costs should not be included in capital budgeting models. These are accounting entries or financing-related charges that don’t reflect the actual operational cash flows of a project. By excluding them, managers keep evaluations focused on a project’s true economic performance.

5. Establish a Strong Procedural Framework

Capital budgeting should follow a structured process with clear accountability. This means setting up approval hierarchies, defining roles, and creating procedures for monitoring project progress. A formal framework helps ensure discipline, reduces errors, and builds organizational confidence in investment decisions.

6. Incorporate Reviews and Feedback Loops

Learning from past projects is essential to improving future capital budgeting practices. Companies should conduct periodic reviews at different project milestones and document lessons learned. This continuous feedback loop not only improves forecasting accuracy but also sharpens evaluation criteria over time.

7. Use Scenario and Sensitivity Analysis

Since future outcomes are uncertain, companies should test multiple scenarios—optimistic, pessimistic, and most likely—and analyze how changes in variables like sales, costs, or discount rates affect results. Sensitivity analysis helps uncover potential risks and prepares managers for contingencies.

8. Align with Strategic Objectives

Every capital project should be evaluated not only on profitability but also on how well it aligns with the organization’s long-term goals—such as sustainability, innovation, or market expansion. This ensures capital is allocated to projects that build lasting value.

9. Leverage Technology and Integrated Tools

Relying on spreadsheets and siloed systems can lead to errors and inefficiencies. Adopting modern solutions like ERP systems (e.g., Deskera ERP) allows businesses to streamline data collection, track financials in real time, and integrate capital budgeting with broader financial planning.

By following these best practices, businesses can refine their capital budgeting process, reduce the risks of estimation errors, and ensure that investments support both profitability and strategic growth.

How AI Improves Capital Budgeting and Investment Decisions

AI analyzes historical and real-time financial data to generate more reliable projections of future cash flows and ROI. AI tools simulate multiple investment scenarios and calculate potential risks, helping decision-makers evaluate projects with greater confidence.

With automated AI-driven modeling tools complex calculations like NPV and IRR are streamlined. By leveraging AI, businesses gain speed, accuracy, and deeper insight in their capital investment strategies—leading to smarter and more profitable outcomes.

How Can Deskera ERP Help You with Capital Budgeting?

With tools for forecasting, risk analysis, and real-time insights, Deskera ERP empowers leaders to make capital budgeting decisions with confidence.

Capital budgeting involves analyzing long-term investments, estimating returns, and ensuring projects align with business strategy. Deskera ERP simplifies this complex process by offering integrated tools for financial planning, reporting, and decision-making.

1. Accurate Financial Forecasting

Deskera ERP enables businesses to create detailed financial projections, helping assess cash inflows and outflows for different projects. With real-time accounting and budgeting modules, you can evaluate whether an investment meets profitability thresholds.

2. Cost and Resource Tracking

Managing large investments requires visibility into costs and resource allocation. For growing teams, especially SMBs, this is where skilled administrative virtual assistants from trusted companies like Virtual Latinos can play a vital role - helping manage budgets, maintain project records, prepare reports, and streamline workflows across departments, even with limited in-house staff.Deskera ERP provides project-level tracking, ensuring businesses monitor expenses against budgets and avoid cost overruns.

3. Risk Assessment and Scenario Planning

Through advanced reporting and analytics, Deskera ERP helps simulate different financial scenarios. Businesses can evaluate how changes in market conditions, capital costs, or risks may impact project viability.

4. Seamless Integration with Strategic Goals

Deskera ERP aligns investment decisions with organizational objectives by centralizing financial data. Leaders can ensure projects selected for funding are strategically sound and contribute to growth.

5. Regulatory and Compliance Support

The system ensures compliance with tax rules, accounting standards, and reporting requirements. This minimizes risks associated with capital investments while ensuring adherence to regulatory frameworks.

6. Advanced Reporting and Insights

Deskera ERP provides customizable dashboards and automated reports that highlight ROI, payback periods, and capital allocation efficiency. These insights support faster and more confident decision-making.

Deskera ERP helps businesses streamline capital budgeting by combining accurate forecasting, cost control, compliance, and strategic alignment into one powerful platform.

Key Takeaways

- Capital budgeting is long-term, involves high risks, large funds, and strategic decision-making. Its features ensure investments are evaluated systematically to maximize shareholder value.

- Internal and external factors such as investment size, risks, cost of capital, market conditions, technology, and regulations strongly influence capital budgeting decisions.

- The process follows a structured approach — identifying opportunities, estimating cash flows, applying discounting methods, and aligning projects with business strategy for optimal returns.

- Each method (Payback Period, NPV, IRR, PI, ARR, and DCF) offers unique insights into project evaluation. Using multiple methods together provides a balanced view of financial viability.

- Real-world applications such as factory expansion, technology upgrades, or mergers show how capital budgeting guides businesses in making informed and profitable investment choices.

- It ensures resources are allocated wisely, projects are aligned with strategic goals, risks are mitigated, and long-term growth is achieved.

- Beyond financial evaluation, it enhances resource efficiency, builds investor confidence, improves corporate governance, and strengthens long-term sustainability.

- The right method depends on the project size, available funds, company objectives, and market conditions. Often, businesses use a combination for accuracy.

- Deskera ERP simplifies capital budgeting with accurate forecasting, risk analysis, cost tracking, compliance support, and real-time reporting — helping leaders make smarter investment decisions.

Related Articles