Starting a business can be an exciting and challenging experience. Among the many decisions entrepreneurs must make, one of the most critical is the type of business structure. The C corporation (C-corp) is the preferred legal structure for many companies due to its flexibility, liability protection, and tax advantages.

In this article, we will dive into the C-corporations world and explore what they are, how they work, and why they might be the right choice for your business.

- What is a C-Corp?

- Characteristics of a C-Corp

- Advantages of a C-Corp

- Disadvantages of a C-Corp

- Differences between C-Corps and Other Business Structures

- How to Form a C-Corp?

- How can Deskera Help You

- Key Takeaways

- Related Articles

What is a C-Corp?

A C-Corporation, commonly called a C-Corp, is a type of business structure recognized as a separate legal entity from its owners. This means that the corporation can enter into contracts, own assets, and incur debts in its own name rather than the name of its shareholders.

C-Corps are the most common type of corporation in the United States and are subject to specific tax rules outlined by the Internal Revenue Service (IRS). This type of corporation is owned by shareholders, who elect a board of directors to oversee the corporation's management and operations.

Characteristics of a C-Corp

The following are some of the key characteristics of a C-Corp:

- Limited liability protection: The shareholders of a C-Corp are not personally liable for the debts and obligations of the corporation. Their liability is limited to the amount of their investment in the corporation.

- Board of Directors: A C-Corp is managed by a board of directors who the shareholders elect. The board of directors is responsible for overseeing the management and operations of the corporation.

- Ownership and management separation: The owners of a C-Corp are separate from their managers. Shareholders have no direct control over the day-to-day operations of the corporation.

- Incessant existence: A C-Corp can exist indefinitely, regardless of changes in ownership or management.

- Double taxation: C-Corps are subject to double taxation, where both the corporation and its shareholders are taxed on the corporation's profits. This can result in a higher tax burden for C-Corps compared to other business structures.

- Ability to raise capital: C-Corps have the ability to raise capital through the sale of stock. This can provide a significant advantage compared to other business structures, such as sole proprietorships or partnerships, which are limited in raising capital.

- Formal requirements: C-Corps are subject to formal requirements, such as holding regular meetings of the board of directors and keeping detailed records of corporate activities.

Advantages of a C-Corp

Here are some of the advantages of a C-Corp:

Limited Liability Protection

One of the primary advantages of a C-Corp is that it provides limited liability protection for its shareholders. This means that the shareholders' personal assets are not at risk if the corporation incurs debts or is sued. Only the assets of the corporation are at risk.

Ability to Raise Capital

C-Corps have the ability to raise capital through the sale of stock. This can provide a significant advantage compared to other business structures, such as sole proprietorships or partnerships, which are limited in raising capital.

Perpetual Existence

A C-Corp can exist indefinitely, regardless of changes in ownership or management. This means the corporation can continue operating even if one or more shareholders leave the company.

Tax Deductions

C-Corps are able to deduct many business expenses, including salaries, bonuses, and employee benefits, which can result in lower taxable income for the corporation.

Flexibility in Ownership

C-Corps offer flexibility in ownership, as they can have unlimited shareholders, and shareholders can be individuals, other corporations, or foreign entities.

Enhanced Credibility

A C-Corp may be viewed as more credible and trustworthy by customers, suppliers, and investors due to the formal structure and oversight provided by a board of directors.

Disadvantages of a C-Corp

It's important to note that while there are many advantages to operating as a C-corporation, some disadvantages exist, such as double taxation and increased regulatory requirements. It's important to weigh the pros and cons before deciding if a C-corporation is the right legal structure for your business.

Double Taxation

One of the most significant disadvantages of a C-Corp is that it is subject to double taxation. This means that the corporation's profits are taxed at the corporate level, and then again when they are distributed to shareholders as dividends. This can result in a higher overall tax burden for the corporation and its shareholders.

Increased Complexity

C-Corps are subject to more complex tax and legal requirements than other business structures. This can result in higher administrative costs, more paperwork, and the need to hire professional advisors to help manage the corporation's compliance obligations.

Formal Requirements

C-Corps are subject to formal requirements, such as holding regular meetings of the board of directors and keeping detailed records of corporate activities. Failure to meet these requirements can result in penalties and legal liability.

Limited Flexibility

C-Corps are subject to more rigid ownership and management structures than other business structures. Shareholders have limited control over the day-to-day operations of the corporation, and changes to the ownership or management structure require formal approval processes.

Higher Startup Costs

Forming and maintaining a C-Corp can be more expensive than other business structures, due to the need to comply with more complex legal and tax requirements.

Differences between C-Corps and Other Business Structures

There are several key differences between C-corporations and other business structures, including:

- Limited liability protection: C-corporations, S-corporations, and LLCs offer their owners limited liability protection. However, sole proprietorships and partnerships do not offer this protection.

- Taxation: C-corporations are subject to double taxation, meaning that both the corporation's profits and the shareholders' dividends are taxed. On the other hand, S-corporations and LLCs are pass-through entities and are only taxed once at the individual shareholder level. Sole proprietorships and partnerships are also taxed at the individual level.

- Ownership and management: C-corporations can have an unlimited number of shareholders and can issue different classes of stock with varying voting rights. S-corporations are limited to 100 shareholders and can only issue one class of stock. LLCs can have any number of members and have more flexibility in ownership and management structure than corporations.

- Regulatory requirements: C-corporations are subject to more regulatory requirements than S-corporations and LLCs, including annual meetings and formal record-keeping. Sole proprietorships and partnerships have fewer regulatory requirements than any other business structure.

- Transferability of ownership: C-corporation stock is generally more easily transferable than ownership interests in LLCs or partnerships. This can make it easier to raise capital or sell the business.

- Cost and complexity: Setting up and maintaining a C-corporation can be more costly and complex than other business structures due to the need for formalities such as shareholder meetings and issuing stock certificates.

It's important to consider each business structure's advantages and disadvantages and determine which is the best fit for your specific business needs.

How to Form a C-Corp?

Here are the general steps to form a C-corporation:

- Choose a name for your corporation: Your corporation's name must be unique and not already in use by another corporation in your state. You can check the availability of your chosen name through your state's Secretary of State website.

- File articles of incorporation: You'll need to file articles of incorporation with your state's Secretary of State office. This document includes basic information about your corporation, such as its name, purpose, location, and number of shares.

- Appoint a board of directors: Your corporation must have a board of directors who are responsible for managing the corporation. You'll need to appoint at least one director and specify their names and contact information in your articles of incorporation.

- Draft corporate bylaws: Your corporation's bylaws are the internal rules that govern how your corporation will be run. They should include information about the duties and responsibilities of the board of directors, how meetings will be conducted, and how decisions will be made.

- Issue stock certificates: Your corporation will need to issue stock certificates to its shareholders. These certificates represent ownership in the corporation.

- Obtain any necessary licenses and permits: Depending on your business and location, you may need to obtain additional licenses and permits before you can begin operating.

- Hold an organizational meeting: After your corporation is formed, you should hold an organizational meeting to adopt your bylaws, appoint officers, and handle any other necessary business.

The process for forming a C-corporation may vary slightly by state, so it's important to check with your state's Secretary of State office for specific requirements and instructions. Additionally, it's often helpful to work with an attorney or accountant who can guide you through the process and ensure that everything is done correctly.

How can Deskera Help You?

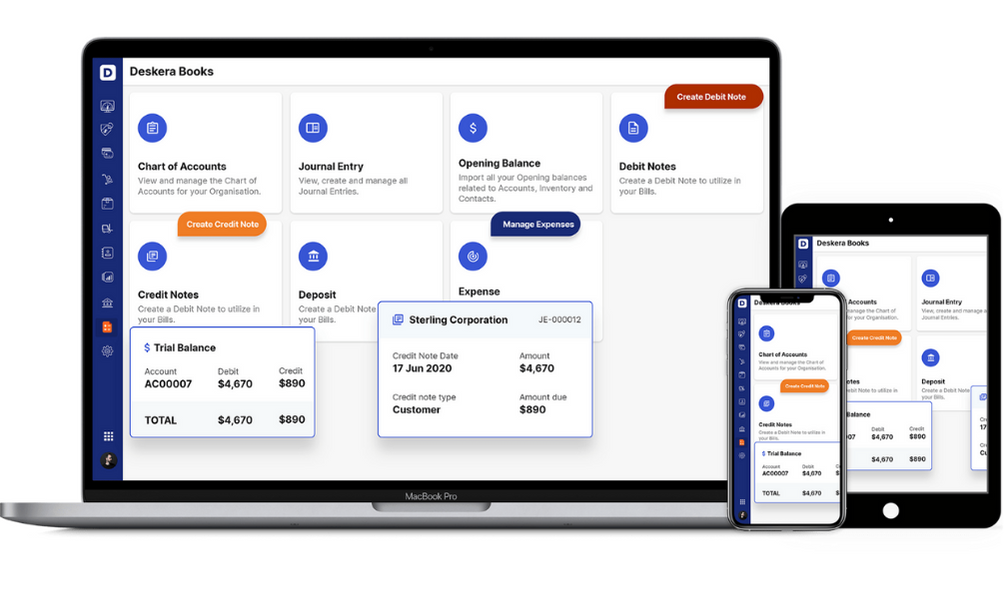

Deskera is a cloud-based software that provides an extensive suite of business tools, including accounting, CRM, inventory management, and payroll management. While Deskera is not specifically designed to manage trusts, it can help with certain aspects of trust management, such as record-keeping and financial reporting.

For example, Deskera Books can be used to track income and expenses related to the trust, while its reporting tools can generate financial statements for the trust.

Additionally, Deskera's CRM module can be used to manage communication with beneficiaries and other stakeholders, while its inventory management module can help track physical assets held in the trust.

Key Takeaways

- A C-corporation is a type of legal structure for a business that provides limited liability protection for its shareholders.

- C-corps can raise capital through the sale of stock, have perpetual existence, and are viewed as credible entities by customers, suppliers, and investors.

- However, C-corps are subject to double taxation, and increased regulatory requirements, and can be costly and complex to establish and maintain.

- Other business structures, such as S-corps, LLCs, sole proprietorships, and partnerships, offer different advantages and disadvantages and maybe a better fit for some businesses.

- To form a C-corporation, you'll need to choose a name, file articles of incorporation, appoint a board of directors, draft bylaws, issue stock certificates, obtain necessary licenses and permits, and hold an organizational meeting.

- It's important to consider all factors and consult with professionals before choosing a legal structure for your business.

Related Articles