Book value per share is a market term that helps investors figure out the actual stock value of a company. This number depicts the value of each share with respect to the net asset value of a company, giving an idea of the actual prices per share.

Book value per share differs from the market value per share in that it displays the actual share value of a company, instead of the one on stock market indices. This is the primary reason why investors prefer to look at the book value per share to avoid investing in undervalued or overvalued stock.

Book value per share is a function of common equity and shares outstanding. It paints a more detailed picture of the standing of a company in the market. Book value per share is a number that can be actively increased through planning company assets better or through other methods depending on C-suite decisions and strategies.

Book value per share, in a way, can be looked at as the earning power of a company. Let’s understand this metric in depth by covering these points:

- What is Book Value Per Share?

- How to Calculate Book Value Per Share?

- Nuances of Book Value Per Share

- What Does Book Value Per Share Tell You?

- Limitations of Book Value Per Share

- Ways to Improve Book Value Per Share

What is Book Value Per Share?

Book value per share can be calculated by dividing the common equity of a company by its shares outstanding. It is a figure that tells you about the company’s book value on the basis of the price of each share issued. The formula for calculating book value per share of a company is as follows:

Book Value Per Share = (Stockholders’ Equity – Preferred Stock) / Average Shares Outstanding

Instead of using the absolute value of shares outstanding, the weighted average shares outstanding takes into account the fluctuations occurring due to new issuances and bulk buyouts over the specified period of time. It gives a more comprehensive, clearer picture of book value per share when used in the formula.

Comparing the book value per share of a company with its market value per share helps investors measure its true value. When the book value per share is higher than its market value, the stock is undervalued; the stock is overvalued when the book value per share is lesser than its market value.

To understand book value per share better, consider this: in the event that a company comes to be liquidated for some reason, all its liabilities squared off and physical/tangible assets sold, the sum/amount that its shareholders would receive is termed as book value per share.

How to Calculate Book Value per Share

Calculating the book value per share is a simple exercise. The formula to be used is:

Book Value Per Share = Common Equity / Shares Outstanding

Here, common equity represents the total amount that the common shareholders have invested in a company. It also accounts for the paid-in capital and the value of all the common shares. This figure represents the amount that is available after accounting for all the liabilities and assets of a company – the pay-out that the shareholders are entitled to receive. Applying logic, dividing the total pay-out with the total number of shareholders invested in the company gives the value of each share.

Shares outstanding represent the total issued stock that is held by the shareholders in the market. These shares are exclusive of treasury shares which still rest with the company or comprise all the buybacks that the company initiates. In simpler words, the total number of shares of a company that are currently circulating in the market are termed outstanding shares.

On the other hand, the weighted average shares outstanding is a different number that accounts for the changes in total shares outstanding. All the new issuances and buybacks that happen during a set term are accounted for in the weighted average shares outstanding when calculating book value per share, making it a more reliable, true number.

Let’s try understanding book value per share with a simple example. Say that company A has a total shareholders’ equity of $50,000,000. With a preferred stock value standing at $10,000,000 and the total shares outstanding at 5 million counts, the book value per share for this company can be calculated thus:

Book Value Per Share = Common Equity / Shares Outstanding

Book Value Per Share = ($50,000,000 - $10,000,000) / 5,000,000

Book Value Per Share for company A = $8 per share

One popular example is that of the famous denim brand, Levi Strauss, whose total shareholders’ equity stood at $1434 million in May 2021, and a weighted average shares outstanding was at 401,964,569 counts (402 million approximately) during the same period. Additionally, the company did not have any preferred stock listed. The book value per share would thus be,

Book Value Per Share = $1434 / 402 (all values in millions)

Book Value Per Share for Levi Strauss = $3.56

Book value per share tells you the true status of the shares of a company with respect to their price on the market.

Nuances of Book Value Per Share

Book value per share is an important number for investors to measure how underperforming or overvalued a stock is on the market when pitched in comparison with the corresponding market value per share. In fact, the two terms may sound similar – there are, however, certain differences between them.

Difference Between Book Value Per Share and Market Value Per Share

Market value per share is a metric that captures the future status of a company’s stock, while the book value per share is calculated on historical data. Say, for example, that a company invests money in an aggressive marketing campaign, which ends up increasing costs.

This takes away from the common equity, reducing the value of book value per share. With that said, if the marketing efforts boost the company’s sales and it makes unprecedented profits thereafter, the consequent market value per share would increase.

Also, the market value per share keeps fluctuating with market sensitivities. This is not the case with book value per share, which is largely stable.

Significance of Book Value Per Share

Since book value per share takes into account the shareholders’ equity divided among the total number of shareholders, it denotes the amount that each shareholder is entitled to receive. If the company is liquidated and all its tangible assets sold and debts settled, what is left is available to the shareholders. In short, this is the minimum amount that shareholders will receive for investing in the company.

Book value per share also tells you about whether or not the stock you are purchasing is undervalued. This may happen due to countless reasons, such as market dips or crashes, investors losing confidence in a company, deterioration in a company’s financial health or simply because of the media being harsh on a company.

Limitations of Book Value Per Share

While this figure is an indicator of the intrinsic value of the shares of a company, there are certain drawbacks to relying too much on this number. The first factor is that it doesn’t account for the intangible assets that the company deals in. If there is a certain sum from equity invested in the market by a company and a loss is incurred, the book value per share may not reflect it effectively.

Another drawback is that in industries where tangible assets are few, errors may creep into the valuation of its stocks on the book value. This happens because book value per share is based on the sum entitled to shareholders in case the company is liquidated.

How to Improve Book Value Per Share?

Increasing book value per share can be done in two ways; however, sound strategies are required for both in order to avoid a financial fallout. Let’s see what these techniques are.

Buying Stock Back From Common Stockholders

If you observe the formula for book value per share, you will notice that the denominator governs the value of the resultant. The higher the shares outstanding, the lower your book value per share will be. Buying stocks back from your shareholders will help you bring your book value per share up; however, the expense involved in doing this needs to be thoroughly investigated against potential benefits before going through with the decision.

Managing Assets and Liabilities

Liabilities are never good for business. The higher the liabilities, the lower the common equity, and thus, the lower the book value per share. In order to improve the book value per share of your company, put away a portion of your profits into either acquiring more assets or into squaring away liabilities quickly. This ought to bring the book value per share up, while keeping the number of shares outstanding at the same number for the said period.

Book Value Per Share is a Market Essential (Conclusion)

When deciding to invest in the market, it is important to know the actual share value of a company and compare it with market value and trends. This helps you better create a picture of the investment and how lucrative it will be for you in the long run.

How can Deskera Help You?

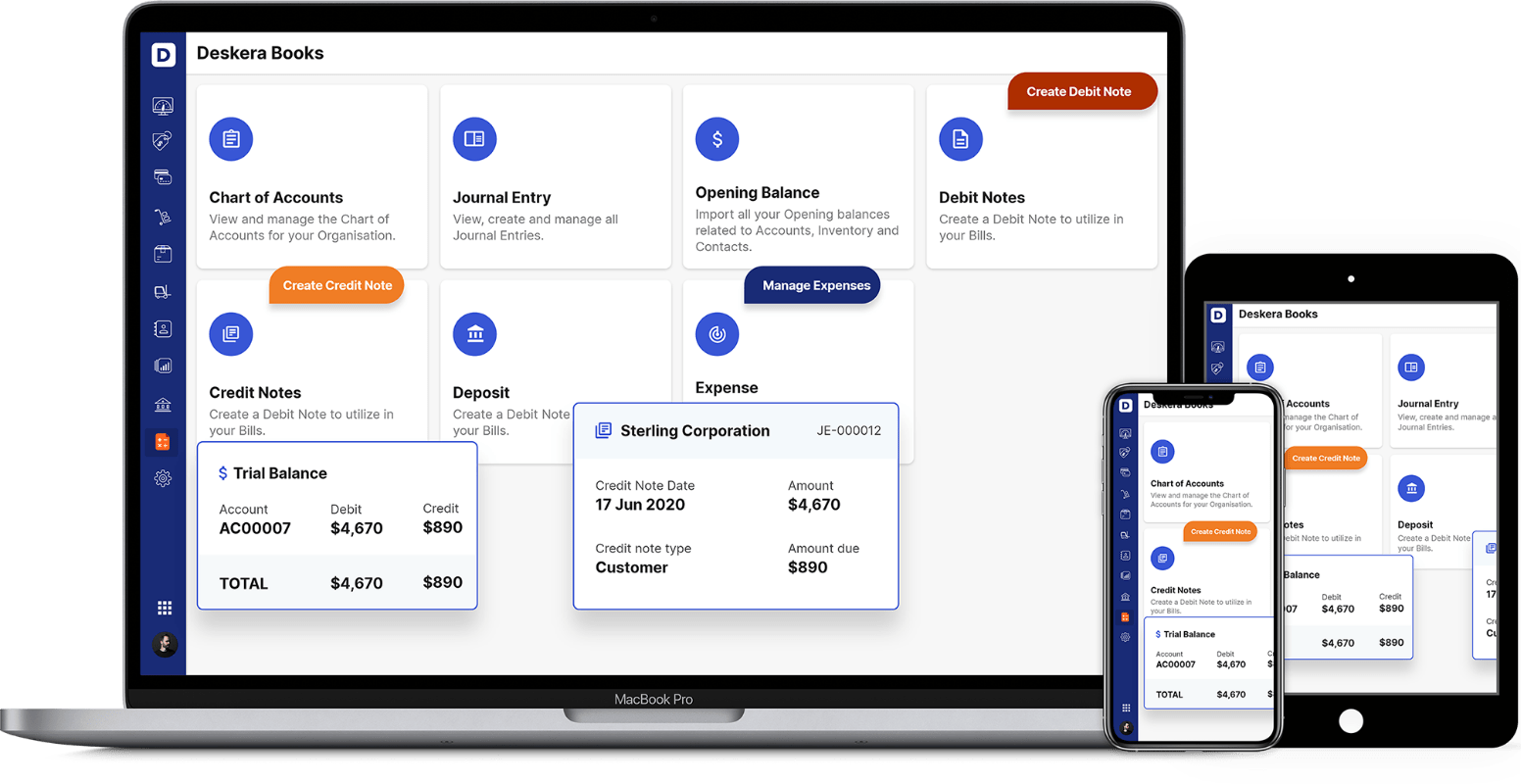

An online accounting and invoicing application, Deskera Books is designed to make your life easier. This all-in-one solution allows you to track invoices, expenses, and view all your financial documents from one central location.

The platform works exceptionally well for small businesses that are just getting started and have to figure out many things. As a result of this software, they are able to remain on top of their client's requirements by monitoring a timely delivery.

Thanks to our well-designed and well-thought-out templates, you can now anticipate that your work will become simpler. A template can be used for multiple actions, including invoices, quotes, purchase orders, back orders, bills, and payment receipts.

Take a small tour of the demo here to get more clarity:

Lastly, you would be able to assess all the reports- be it income statement, profit and loss statement, cash flow statement, balance sheet, trial balance, or any other relevant report from your laptop and your mobile phone.

Deskera Books hence is the perfect solution for all your accounting needs, and therefore a perfect assistant to you and your bookkeeping and accounting duties and responsibilities.

Key Takeaways

- The book value per share is based on the historical equities and shares outstanding data of a company

- It tells you about the intrinsic value of the shares of a company

- It can be greater than or lower than the corresponding market value per share for the company

- You can calculate book value per share using the formula: Book Value Per Share = (Stockholders’ Equity – Preferred Stock) / Average Shares Outstanding

- Market value per share is susceptible to market volatility and is a dynamic value; however, you can expect the Book Value Per Share to remain more or less stable.

- There are ways to improve the book value per share: 1. Stock buybacks 2. Liability reduction/asset augmentation

- Book Value Per Share is an important metric that helps investors figure out how undervalued or overvalued a stock actually is

Related Articles