An accredited investor is someone who has gone through a rigorous process to demonstrate they have the financial resources and knowledge to invest in a business or financial product.

The process of becoming an accredited investor can be time-consuming and expensive, so it's usually reserved for those with a lot of money to spare.

Being an accredited investor doesn't mean you're guaranteed a lucrative return on your investment. In fact, many accredited investors aren't even allowed to trade their investments.

All it means is that you meet certain qualifications, which may include having a high income and invest in high-quality companies. If you're looking to invest in something other than common stocks and bonds, this is the type of designation for you.

- Accredited Investor: What is it?

- Accredited Investor in Detail

- What are the Requirements for Accredited Investor?

- What Sorts of Investments May Qualified Investors Make?

- Example of Accredited Investor

- How Do Companies Determine If You Are an Accredited Investor?

- Accredited Investor Definition Modifications by the SEC

- Advantages and Disadvantages of Becoming an Accredited Investor

- Frequently Asked Questions (FAQs) Associated with Accredited Investors

- Conclusion

- How Deskera Can Assist You?

Let’s get started!

Accredited Investor: What is it?

An accredited investor is a person or organization that has the legal right to invest in specific asset classes that are unavailable to the general public.

This designation is generally granted by the Securities and Exchange Commission (SEC) and is based on various criteria, such as income, net worth, and experience.

Accredited investors are generally regarded as high-net-worth individuals, banks, insurance companies, and other institutional investors. Accredited investors are also sometimes referred to as qualified purchasers, qualified institutional buyers, and qualified buyers.

Furthermore, accredited investors are typically allowed to invest in higher-risk, higher-reward investments. It includes private placements and hedge funds.

Accredited Investor in Detail

Securities not registered with regulatory bodies like the SEC may be legally purchased by accredited investors.

To this group of authorized investors, many corporations choose to aggressively market securities. Due to this decision's exemption from the requirement to register securities with the SEC, businesses can save a significant amount of money.

A private placement is the term used to describe this kind of share transaction. This could expose these certified investors to a great deal of risk. Therefore, authorities must ensure that they are knowledgeable about their risky endeavors, skilled, and financially stable.

The regulatory authorities' participation is confined to confirming or providing the appropriate rules for establishing benchmarks to establish who is an accredited investor when corporations elect to offer their shares to accredited investors. Regulatory agencies assist in determining if the applicant has the resources and expertise required to accept the risks associated with investing in unregistered securities.

Additionally, accredited investors enjoy preferential access to venture funding, hedge funds, angel investments, and transactions using sophisticated and more risky financial instruments.

What are the Requirements for Accredited Investor?

Every country has its own requirements for accredited investors, and these laws are typically set by a competent authority or a regional market regulator. A person who conforms with SEC Rule 501 of Regulation D in the United States is considered an accredited investor.

To be considered an accredited investor, an individual must have generated more than $200,000 ($300,000 for joint income) annually during the previous two years and anticipate earning that amount or more this year.

The individual must have earned more money alone or jointly with a spouse during the two years before than the thresholds. The first year of an individual's income and the subsequent two years of joint income with a spouse are insufficient to satisfy the income test.

An individual is considered to be an accredited investor if their net worth exceeds $1 million, whether they are investing alone or jointly with their spouse. This amount shall not be deemed to include a principal dwelling. A person is also regarded as an accredited investor by the SEC if they hold one of the following positions at the corporation that issued the unregistered securities: general partner, executive officer, or director.

If a company is a private business development company or has assets worth more than $5 million, it is recognized as an accredited investor. A business is also considered an accredited investor when all of its shareholders equity are accredited investors. However, a company cannot be founded with the only purpose of purchasing a specific stock.

What Sorts of Investments May Qualified Investors Make?

Accredited investors may invest in:

- Private equity funds.

- Hedge funds.

- Angel investments.

- Real estate investment funds.

- Venture capital.

- Specialty investment funds with an emphasis on cryptocurrencies, for example

These firms offer investors securities through private placements, often known as Regulation D (Reg D) offers. The SEC's Regulation D guidelines exempt some securities from SEC restrictions, in contrast to the Federal Reserve's Regulation D, which has ramifications for savings accounts.

When a business files a Reg D offering, basic information about the offering, the company's executives, and the location of the business must be disclosed. Any additional information provided to an investor is entirely up to the company making the private placement.

In contrast, a company that wants to issue shares that are publicly traded must go through a drawn-out application process with the SEC and undergo extensive due diligence to ensure that the company has been truthful and has provided all legally required disclosures.

Example of Accredited Investor

A person should make a personal balance sheet like the one below by deducting all of their debts from all of their assets to see if they are an authorized investor.

Accredited Investor:

The individual has net worth of $6,500,000, which is above the US Securities and Exchange Commission (SEC) accredited investor net worth requirement of $1,000,000. The person is therefore regarded as an accredited investor.

Non-Accredited Investor:

The person's net worth is $100,000, which is less than the minimum requirement of $1 million set by the US Securities and Exchange Commission (SEC) for authorized investors. Therefore, they would not qualify as an accredited investor.

How Do Companies Determine If You Are an Accredited Investor?

The most common way for companies to verify that an individual is an accredited investor is to ask the prospective investor to provide documentation, such as a bank statement, tax form, or other financial statement, that demonstrates their status as an accredited investor.

The investor must then provide proof of net worth, income, or other financial information that meets the criteria of an accredited investor as defined by the US Securities and Exchange Commission (SEC).

The SEC requires that investors provide documentation that shows their net worth, income, and other financial information that meets the requirements for accredited investors, and that their financial condition has not changed substantially since the documentation was provided. Companies may also require investors to sign a document that confirms their status as an accredited investor.

The company may also request additional documentation, such as a sworn affidavit from a financial advisor or other qualified individual, to verify that an individual meets the criteria for an accredited investor.

Companies may also ask for references from a financial advisor, legal counsel, or other qualified individual who can attest to the investor’s financial sophistication.

Finally, companies may use third-party verification services to confirm an individual’s status as an accredited investor. These services can provide companies with the necessary information to verify that an individual meets the requirements set forth by the SEC.

Additionally, these services can provide companies with an additional layer of security, as they can track the individual’s financial history and ensure that the individual is not engaging in any fraudulent activity.

To assist businesses in determining whether a person is an accredited investor, the SEC has established regulations. Undoubtedly, a company will ask you to complete a survey about your status. They can even ask for a review of your

- Bank records and other financial documentation

- Tax filings

- W-2s, other earnings statements, or credit reports

- Credentials from the Financial Industry Regulatory Authority (FINRA), if relevant.

These can help a business determine your financial capability and investing knowledge, both of which may influence whether you are regarded as an accredited investor.

Accredited Investor Definition Modifications by the SEC

On August 26, 2020, the Securities and Exchange Commission (SEC) of the United States modified its definition of an accredited investor.

In accordance with an SEC news release, "The amendments now permit people to become accredited investors based on particular measures of professional expertise, experience, or certifications in addition to the present requirements for income or net worth.

The modifications, among other things, allow any organization that meets an investment criterion to become an accredited investor, expanding the pool of organizations that are eligible to do so."

The SEC currently includes the following groups among others when defining accredited investors:

- Those who hold specific professional titles, certificates, or credentials.

- Those who serve as "knowledgeable personnel" for a private fund.

- investment advisors registered with the SEC and the states.

People who possess a Series 7, Series 65, or Series 82 license are now considered accredited investors. While encouraging the public to offer new credentials, designations, or certificates for consideration, the SEC can keep including certifications and designations.

Employees who are deemed as "knowledgeable employees" in connection to a private fund are now regarded as accredited investors.

Additionally, the SEC has expanded the definition to cover a wide range of organizations, including "Indian tribes, governmental bodies, funds, and entities organized under the laws of foreign countries that "own" investments as defined in Rule 2a51-1(b) under the Investment Company Act, which are in excess of $5 million and that were not formed with the express purpose of investing in the securities offered."

Limited liability companies with assets of $5 million or more, exempt reporting advisers, investment advisers registered with the SEC and/or a state, and rural business investment firms are other entities that may be eligible.

Advantages and Disadvantages of Becoming an Accredited Investor

Following, we've discussed the advantages and disadvantages of becoming an accredited investor. Check them out:

Pros of Becoming Accredited Investor

Check the following pros of becoming an accredited investor:

1. Access to Investment Possibilities: Investors that are accredited have greater access to investment opportunities that are not open to the general public. These opportunities may include hedge funds, private equity, venture capital, and other alternative investments.

2. Lower Risk: Accredited investors are typically able to invest in higher-risk investments with potentially higher rewards than those available to the general public.

3. Higher Potential Returns: Because accredited investors now have more access to better-risk assets, they may be able to earn a higher return on their investments.

4. Greater Access to Higher-Risk Assets and Potentially Higher Returns: Due to the expanded access to higher-risk investments, accredited investors may be able to generate greater returns on their investments.

5. Greater Access to Investments: Accredited investors may have access to investments that are not available to the general public. This can include private equity deals, venture capital funds, and other alternative investments.

Cons of Accredited Investor

Check the following cons of becoming an accredited investor:

1. The process of becoming an accredited investor can be costly and time consuming.

2. Higher Potential Returns: Because accredited investors now have more access to better-risk assets, they may be able to generate higher returns on their investments.

3. Accredited investors are subject to more stringent regulations than non-accredited investors, which can limit their ability to make investments.

4. Accredited investors may be more likely to face fraud or other losses due to the higher level of risk associated with investments.

5. Due to their status as accredited investors, investors may only have limited access to some investments. These investments may include private placements, hedge funds, and venture capital funds. Additionally, they may be subject to certain restrictions regarding the amount of their investments and may need to meet certain income or net worth requirements to qualify.

Frequently Asked Questions (FAQs) Associated with Accredited Investors

Following, we’ve discussed some crucial frequently asked questions (FAQs) associated with accredited investors. Let’s learn:

Que 1: How Can You Tell If You Are Accredited?

If a person's income over the previous two years was $200,000 or more, or $300,000 if their income is coupled with their spouse's, they automatically qualify as an accredited investor.

After taking into account the cost of a principal residence, a person can still have a net worth of $1 million or more.

Only when an investor has an underwater mortgage or a balance on a home equity line of credit does the principal residence affect net worth.

Que 2: Accredited Investors in Other Countries

Other countries have categories for accredited investors as well, and they have similar rules. While other countries have varying rules, some, like Singapore, Australia, and Canada, have accreditation requirements that are comparable to those in the United States in terms of net worth and income.

For example, in the EU and Norway, there are three requirements to meet in order to be considered an accredited investor. A candidate's knowledge, experience, and skills are assessed in the first qualitative test to see if they are qualified to make their own investment decisions. The second is a quantitative test in which the candidate must meet two of the following conditions:

- has, over the preceding four quarters, averaged ten large-scale transactions on the relevant market every quarter.

- possesses a financial portfolio worth more than EUR 500,000 and

- has at least one year of experience working in the financial industry.

Last but not least, the customer must explicitly state in writing that they want to be treated professionally, and the business they choose to work with must notify them of the protections they may forego.

Other countries, such as Switzerland and India, might not specify their criteria blatantly, but they do insist that one first seek legal advice locally to determine whether they are an authorized investor.

Que 3: How Might You Fund Startups?

Joining a startup at first may sound intriguing. Unfortunately, most people cannot invest in pre-IPO companies other than through employee stock options. (We'll discuss how crowdfunding for startups is slightly changing this below.)

Accredited investors, however, have a number of options for investing in businesses. Typically, accredited investors find private placement transactions online or through a venture capital (VC) firm.

A company invests in a variety of enterprises using the money from the fund. Accredited investors join VC funds through venture capital firms. You probably won't be able to seek a withdrawal at any time because VC funds often have limited liquidity.

Accredited investors need to be continually aware of the dangers involved and knowledgeable about a VC firm's investment horizon.

Online markets like Peerstreet, Cadence, and Yieldstreet connect accredited investors with investment possibilities. Due diligence must be done before choosing any investments because platform-specific liquidity differs.

Even if you are not an accredited investor, you can invest in startups using crowdfunding platforms, and that are relatively new.

Through StartEngine, WeFunder, and NextSeed, investors of every income level are welcome to take part as equity investors in emerging businesses.

Just keep in mind that these investments are substantially riskier and less liquid than shares of publicly traded companies.

Que 4: Do I Have to be an Accredited Investor to Obtain Good Returns?

People with significant net worth have access to a variety of investing possibilities. However, you do not need to be an accredited investor to receive a fair rate of return on your investment.

The S&P 500 has produced returns of 10% annually on average since its inception. In bull markets, hedge funds find it difficult to achieve that number, but they succeed in bear markets.

A well-chosen selection of individual stocks, or even a diverse selection of mutual funds and ETFs, can help most investors generate the profits necessary to pay their retirement and leave something behind.

Whatever your net worth, keep an eye out for investing opportunities. When faced with making a sizeable or risky investment, conduct your own due diligence, understand how liquid your investment will be, and ask the difficult questions. Are you able to wait it out and possibly lose that cash?

Even though all investments involve risk, qualified investors must exercise extreme caution because the opportunities that become available to them have less regulatory control and demand a greater initial financial commitment.

Contact a financial advisor to begin a discussion if you want to learn more about the possibilities that are open to authorized investors like yourself.

Que 5: How Do Hedge Fund Investments Work?

Investments in hedge funds fall under the category of alternative investments, which differ from more conventional investment types including bonds, stocks, and mutual funds. Leverage, short selling, arbitrage, and derivatives are just a few of the methods employed by hedge funds to increase returns.

Hedge funds are typically managed by professional investment managers who are responsible for making investment decisions on behalf of their investors.

Hedge fund investments are illiquid, meaning they cannot be easily converted into cash, and can be risky since they are not diversified and may involve a high degree of leverage.

In order to invest in a hedge fund, an investor must meet certain financial requirements and be accredited, meaning they have a net worth of over $1 million, or income of over $200,000 a year.

Typically, hedge funds have high minimum investments, often in the millions of dollars. Investors in a hedge fund typically pay an annual management fee, usually 2%, and usually a performance fee of 20%, which is taken from the profits generated by the fund.

For investors who wish to diversify their portfolios and have a high risk tolerance, hedge fund investments can be a suitable choice. They are not suitable for all investors, however, and it is important to understand the risks associated with investing in hedge funds before allocating any capital.

Hedge funds are typically more volatile, and often less liquid, than traditional investments such as stocks, bonds, and mutual funds. Investing in hedge funds also requires a significant minimum investment and often comes with higher fees.

Que 6: Which Perks Are Available to Accredited Investors That Are Not Available to Others?

Federal securities laws limit participation in some securities offerings to accredited investors only. Securities from private placements, structured products, private equity, and hedge funds are a few examples of them.

Que 7: Do any other ways to become an accredited investor exist?

Under some circumstances, the title of accredited investor may be given to directors, executive officers, or general partners of the business that issuing the securities being offered or sold.

An individual who holds a Series 7, 62, or 65 license from the Financial Industry Regulatory Authority (FINRA) may on occasion also act as an accredited investor. Other approaches, including having someone in charge of a trust with more than $5 million in assets, are less useful.

Conclusion

The conclusion for an accredited investor is that they are a valuable asset to the financial world. Accredited investors are individuals or organizations who are authorized to invest in certain transactions due to their financial sophistication, experience, and ability to bear risk.

They must meet certain financial requirements set forth by the SEC in order to become an accredited investor. Accredited investors can provide capital to startups and other high-risk investments, which can help to fuel economic growth.

Additionally, accredited investors often receive preferential treatment in certain investments, such as private placements, and may also receive more favorable terms and rates than non-accredited investors.

Accredited investors are invaluable to the financial system as they provide capital to businesses, create jobs, and help to stimulate the economy.

How Deskera Can Assist You?

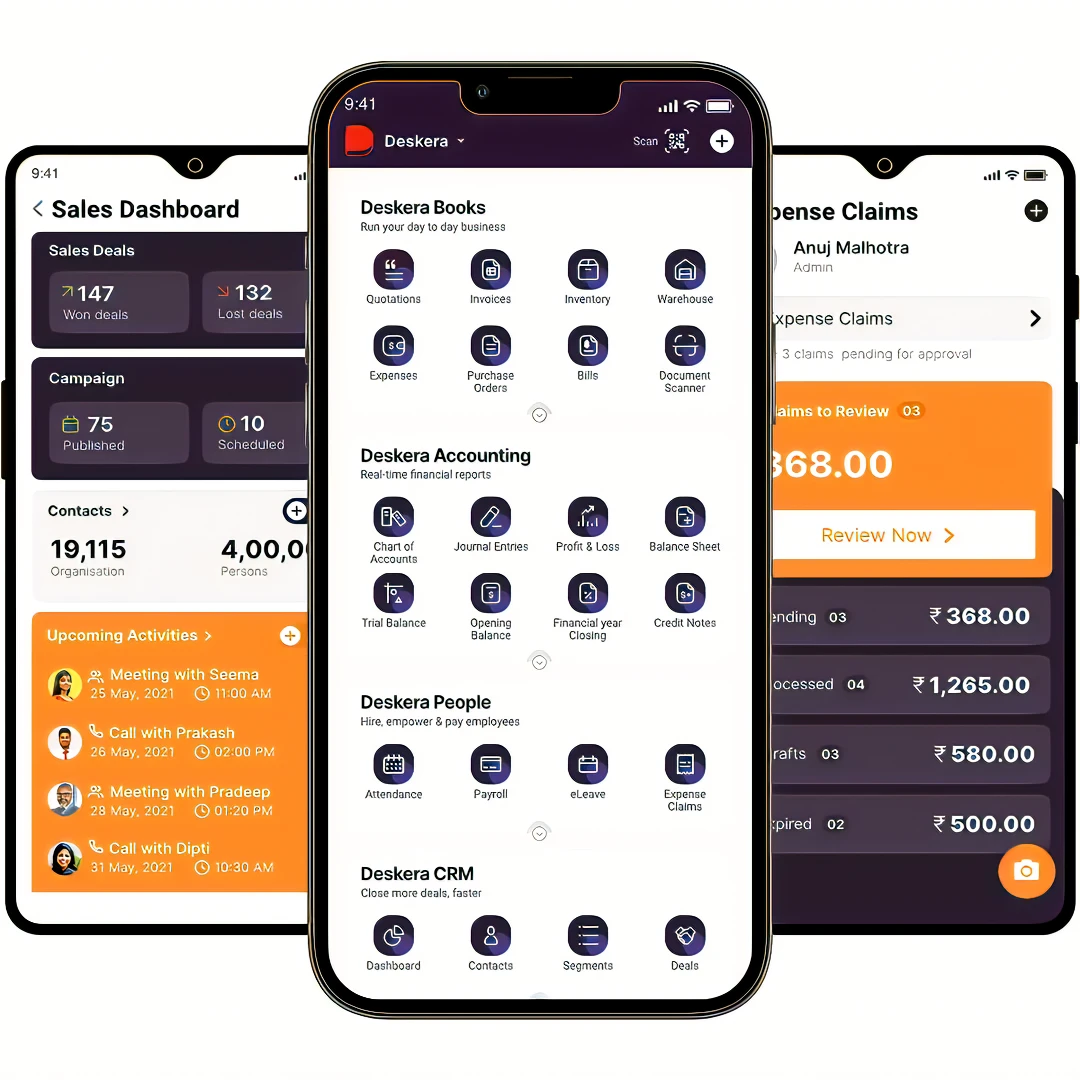

Deskera's integrated financial planning tools allow investors to better plan their investments and track their progress. It can help investors make decisions faster and more accurately.

Deskera Books enables you to manage your accounts and finances more effectively. Maintain sound accounting practices by automating accounting operations such as billing, invoicing, and payment processing.

Deskera CRM is a strong solution that manages your sales and assists you in closing agreements quickly. It not only allows you to do critical duties such as lead generation via email, but it also provides you with a comprehensive view of your sales funnel.

Deskera People is a simple tool for taking control of your human resource management functions. The technology not only speeds up payroll processing but also allows you to manage all other activities such as overtime, benefits, bonuses, training programs, and much more. This is your chance to grow your business, increase earnings, and improve the efficiency of the entire production process.

Final Takeaways

We've arrived at the last section of this guide. Let's have a look at some of the most important points to remember:

- Accredited investors are generally regarded as high-net-worth individuals, banks, insurance companies, and other institutional investors. Accredited investors are also sometimes referred to as qualified purchasers, qualified institutional buyers, and qualified buyers.

- A private placement is the term used to describe this kind of share transaction. This could expose these certified investors to a great deal of risk. Therefore, authorities must ensure that they are knowledgeable about their risky endeavours, skilled, and financially stable.

- To be considered an accredited investor, an individual must have generated more than $200,000 ($300,000 for joint income) annually during the previous two years and anticipate earning that amount or more this year.

- When a business files a Reg D offering, basic information about the offering, the company's executives, and the location of the business must be disclosed. Any additional information provided to an investor is entirely up to the company making the private placement.

- The individual has net worth of $6,500,000, which is above the US Securities and Exchange Commission (SEC) accredited investor net worth requirement of $1,000,000. The person is therefore regarded as an accredited investor.

- The SEC requires that investors provide documentation that shows their net worth, income, and other financial information that meets the requirements for accredited investors, and that their financial condition has not changed substantially since the documentation was provided. Companies may also require investors to sign a document that confirms their status as an accredited investor.

- Investments in hedge funds fall under the category of alternative investments, which differ from more conventional investment types including bonds, stocks, and mutual funds. Leverage, short selling, arbitrage, and derivatives are just a few of the methods employed by hedge funds to increase returns.

Related Articles