If you are setting up a business , or already have an active enterprise in Saudi Arabia, then you need to know about VAT - Value Added Tax. We have compiled this complete VAT guide to help you with just that.

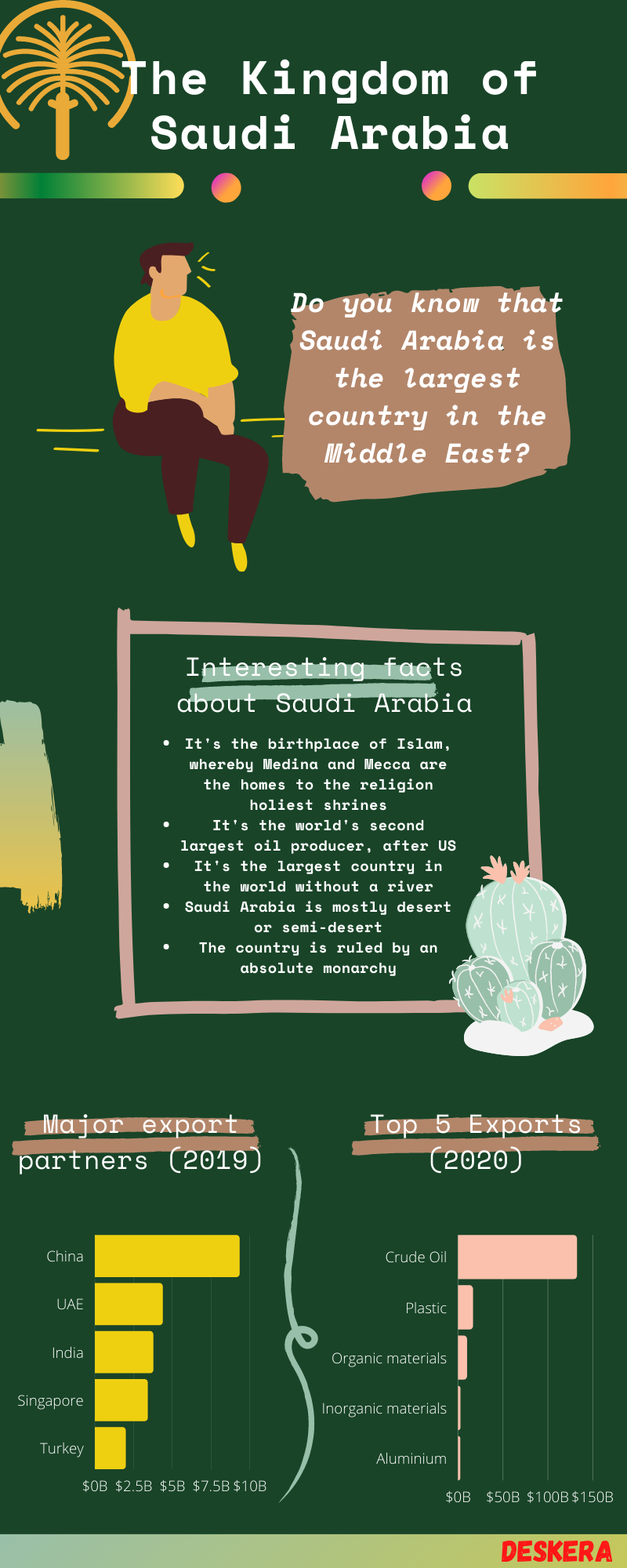

The Kingdom of Saudi Arabia is a wealthy nation with its vast land and precious resources such as petroleum, natural gas, iron ore, gold, and copper. The country has generated massive wealth with its natural resources leading to economic growth and success.

Some of the great cities that are built here include Riyadh, Jeddah, Medina, and Mecca.

Even though Saudi Arabia is an Islamic country, the country doesn't shy away from foreign investors or talent. It still welcomes foreign investors into the country, regardless of their race, creed, or religion.

Foreign investors can obtain licenses to kickstart their business without a local partner and also have 100% ownership of the company.

Sound incredible, right?

If you're interested in starting your business in Saudi Arabia, it's good to understand the VAT law and regulations to stay compliant and up-to-date at all times.

In this article, we have prepared the VAT guide in Saudi Arabia, so you have a clearer picture of the VAT system in this country.

Let's jump right in to find out more.

Read more on how to create your Saudi Arabia organization using Books.

https://www.deskera.com/care/how-to-get-started-with-saudi-arabia-compliance-in-deskera-books/

What is the VAT rate in Saudi Arabia?

Also known as the standard rate, the VAT rate in Saudi Arabia is currently at 15% on most goods and services. The new rate was implemented last year on 1 July 2020, replacing the old rate, which was charged at 5% earlier.

Any goods and services bought, sold, or imported to Saudi Arabia are subject to VAT unless stated as exempted.

Some of the common taxable goods and services are:

- Food and beverages - fast foods, dining out, basic groceries, etc

- Education services

- Private healthcare services

- Local transportation

- All types of insurance except life insurance

What are zero-rated supplies?

Zero-rated supplies are taxable supplies with a VAT charged at 0%.

Here are some examples of zero-rated supplies:

- Medication and medical devices specified by the Ministry of Health and Saudi Food and Drug Authority

- Any supply of gold, silver, and platinum (of 99% purity or higher) for investment purposes

- Any export to non-GCC residents or outside the Council Territory

- Any services supplied to non-GCC residents

- International transport services of goods or passengers

What are exempt supplies?

Exempt supplies are different as compared to zero-rated supplies. Exempt supplies are not subject to any VAT, whereas zero-rated supplies are subject to VAT.

If you are a business owner supplying exempt goods and services, you are not required to collect VAT in your sales transactions. At the same time, you cannot deduct or claim a refund for the input VAT paid to your suppliers.

Here are some examples of exempted supplies:

- Rental of residential real estate

- Some financial services; loans, mortgages, credit cards fees or interest, issuance or transfer of debt or equity security, issuance of life insurance policy, etc.

In short, you are not required to register for VAT even if your turnover is above 375,000 SAR (exceed the mandatory threshold) for exempt supplies.

What is excise rate?

The Excise Tax Law has become effective since 11 June 2017 as per the General Authority of Zakat and Tax (GAZT) in Saudi Arabia.

The excise rate is an additional rate imposed on specific products that harm consumers' health or the environment. The price of these products is generally higher as compared to other products' categories. And, the consumers will have to bear the cost if they want to consume it.

Some of the examples of goods with excise rates in Saudi Arabia are:

- sugar-sweetened beverages (SSB) - 50% Excise Tax

- electronic devices and equipment used for smoking - 100% Excise Tax

- the liquid used in electronic devices - 100% Excise Tax

- energy drinks - 100% Excise Tax

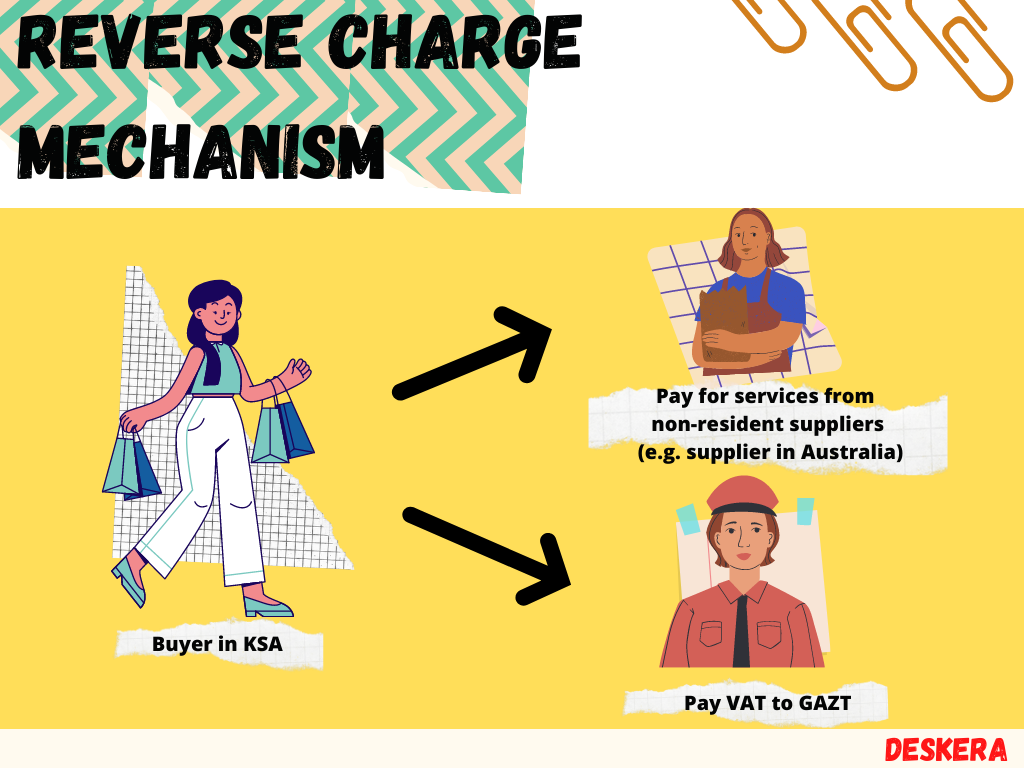

What is reverse charge mechanism?

Under the reverse charge mechanism, remitting VAT falls on the recipients of goods and services instead of the vendors. The customers that purchased the goods and services will have to pay VAT to GAZT directly.

So, when do you need to apply the reverse charge mechanism?

The Reverse Charge Mechanism applies to a few scenarios such as:

- A VAT-registered business imports taxable services (i.e., online services such as software) into Saudi Arabia

- A taxable person receives services from overseas business

- Trade between the GCC territories

For import of goods (material assets) into the Kingdom of Saudi Arabia, the importers will bear the VAT, paid at Customs, together with additional duties and other charges to clear customs.

What is place of supply?

When deciding your transactions's tax rate, it's crucial to understand the place of supply of the goods and services, and the transportation type involved.

The place of supply simply refers to the location where the final consumption of goods or services occurs, which is different from the place where the goods are manufactured.

However, the rules of place of supply differs for goods and services, as well as for domestic or international supplies.

Place of supply of goods

Place of supply of services

The place of supply for services is the supplier's place of residence, by default.

However, some exceptions override the rules specified above.

According to the unified VAT Agreement, special rules apply to specific categories such as:

- Supply of goods and passenger transportation; the supply for these services is in the country providing the transportation services.

- Supply of services link to real estate; the place of supply is in the country where the real estate, land, or estate is located.

- Telecommunications services and electronic suppliers; the place of supply is where the users enjoy the services.

- Restaurant, hotel, and catering services; the place of supply is the place of actual performance.

- Cultural, artistic, sport, educational, and recreational services; the place of supply is the actual performance's location where the recipients are charged for an event's admission.

Do I need to register for VAT?

Not all businesses that are operating in Saudi Arabia are required to register for VAT.

Only companies that have a value of taxable supplies exceeding SAR 375,000 in the preceding 12 months or the next 12 months must register for Saudi VAT compulsorily.

Those who are not a resident in the KSA but still supply goods and services in the state of KSA will have to register for VAT, regardless of the stated threshold.

As a non-resident, you should appoint a tax representative in Saudi Arabia approved by GAZT to assist you with your VAT payment due.

Can I register for VAT voluntarily?

You can register for VAT voluntarily if your annual taxable supplies fall between SAR 187,500 to SAR 375,000 in the last 12 months or are projected to reach within the specified range in the subsequent 12 months.

Once you have voluntarily registered for VAT, you are responsible for collecting, recording, and paying VAT to the GAZT in Saudi Arabia.

How do I register for VAT in Saudi Arabia?

To register for VAT, business owners are required to submit a VAT application form to GAZT.

Follow the 4-step process to register for VAT in Saudi Arabia;

Obtain your Tax Identification Number (TIN)

Submit the required information to the tax authority (GAZT) online to obtain your TIN.

The following details are:

- Your name

- The physical address or place of your business

- Your email address

- Existing electronic identification number issued by the GAZT (if any)

- Commercial Registration (CR) number

- Value of annual supplies or annual expenses

- The effective date of registration, or alternative date as requested

Once the GAZT officials approve your application, you will receive a certificate of registration, which contains your TIN (Tax Identification Number) and the registration date.

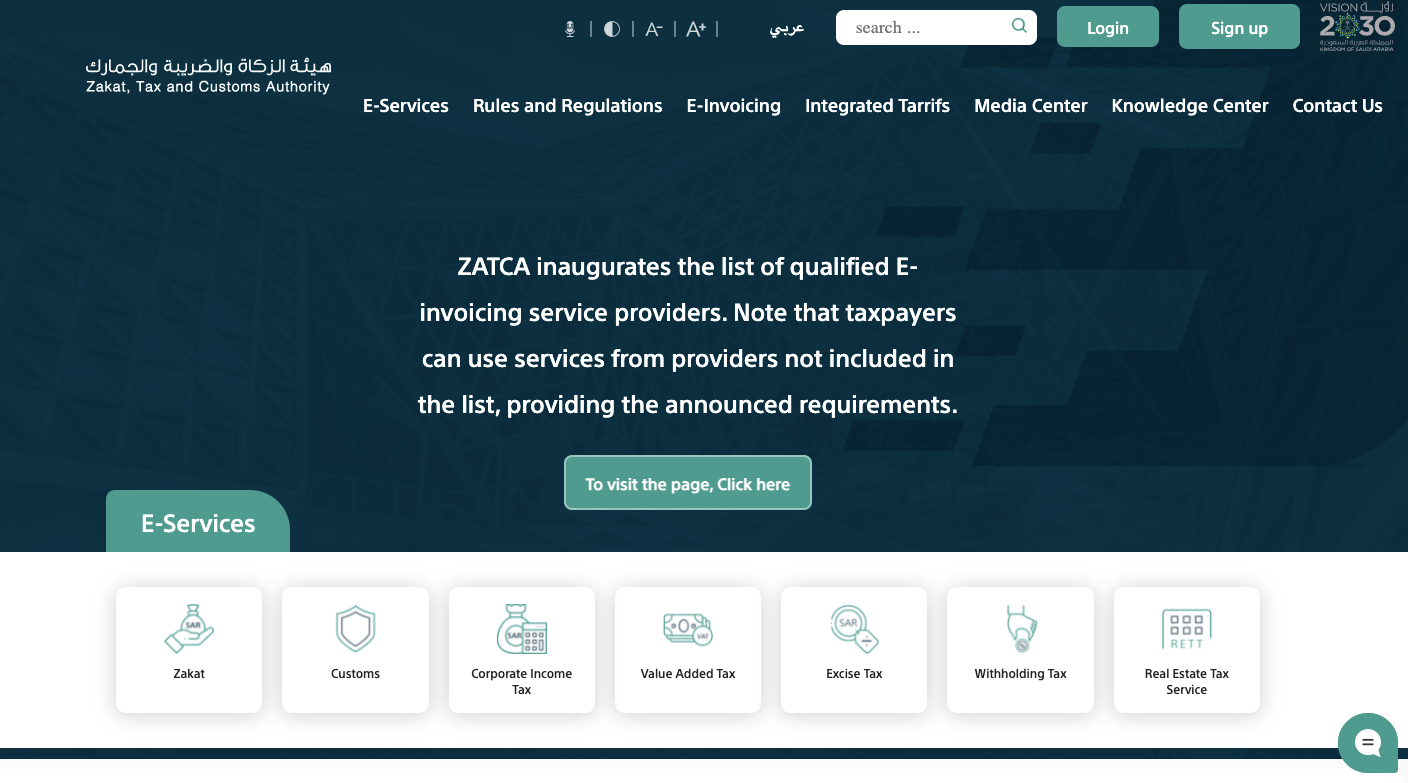

Login to GAZT website

Once you have your TIN on hand, login to your account via the GAZT portal to complete the VAT registration process

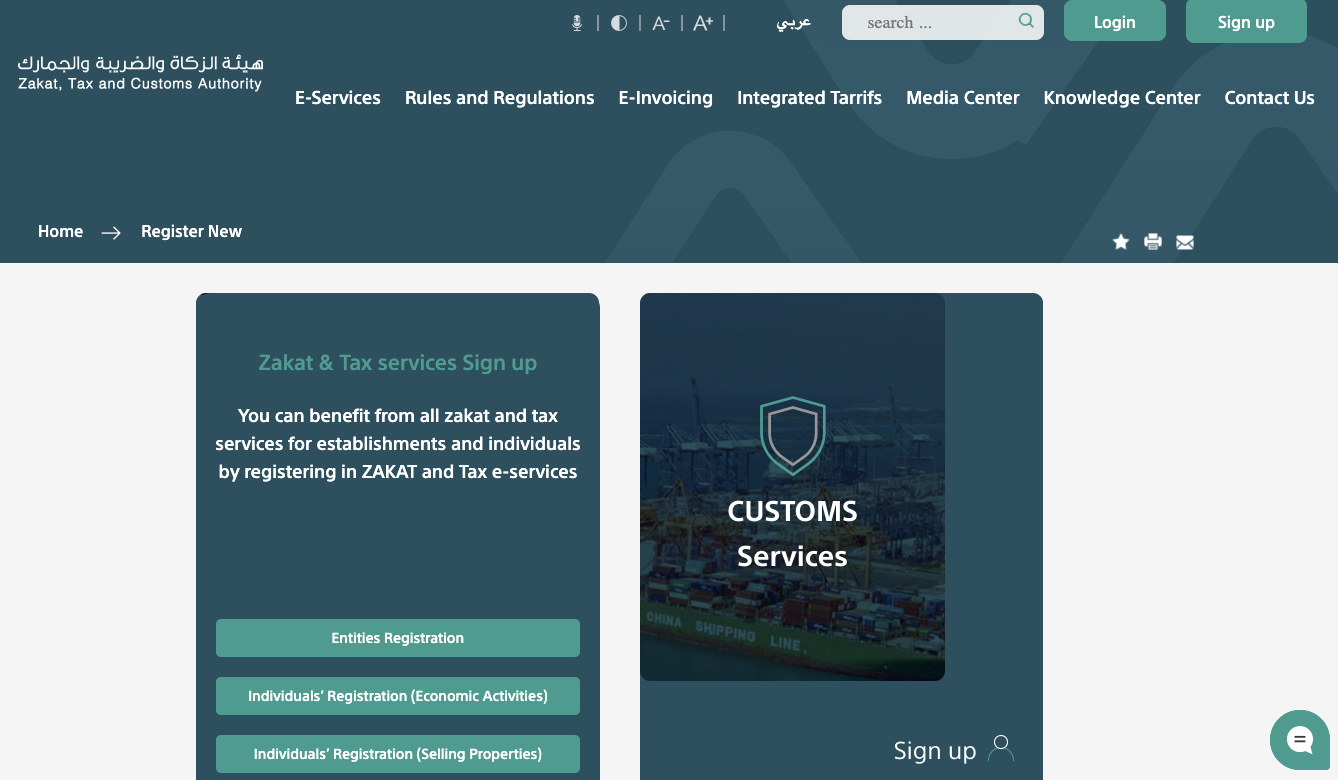

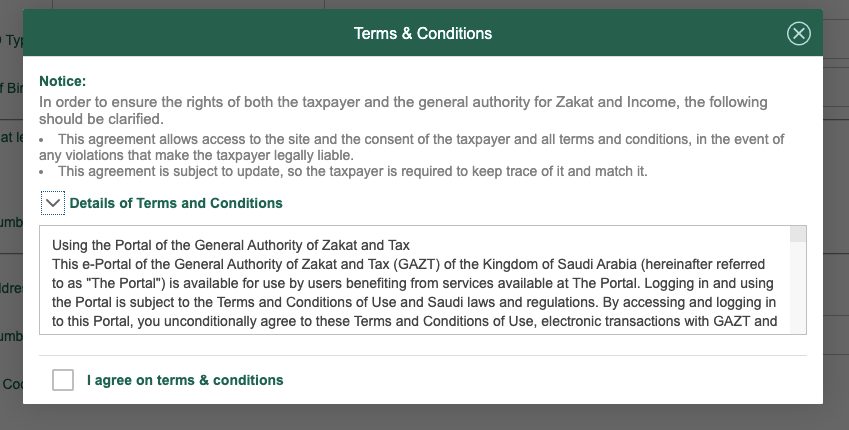

Sign-up for an account.

Next, under the Zakat and Tax services card, click on entities registration.

A pop-up will appear.

Read through the terms and conditions stated and enable the checkbox to continue.

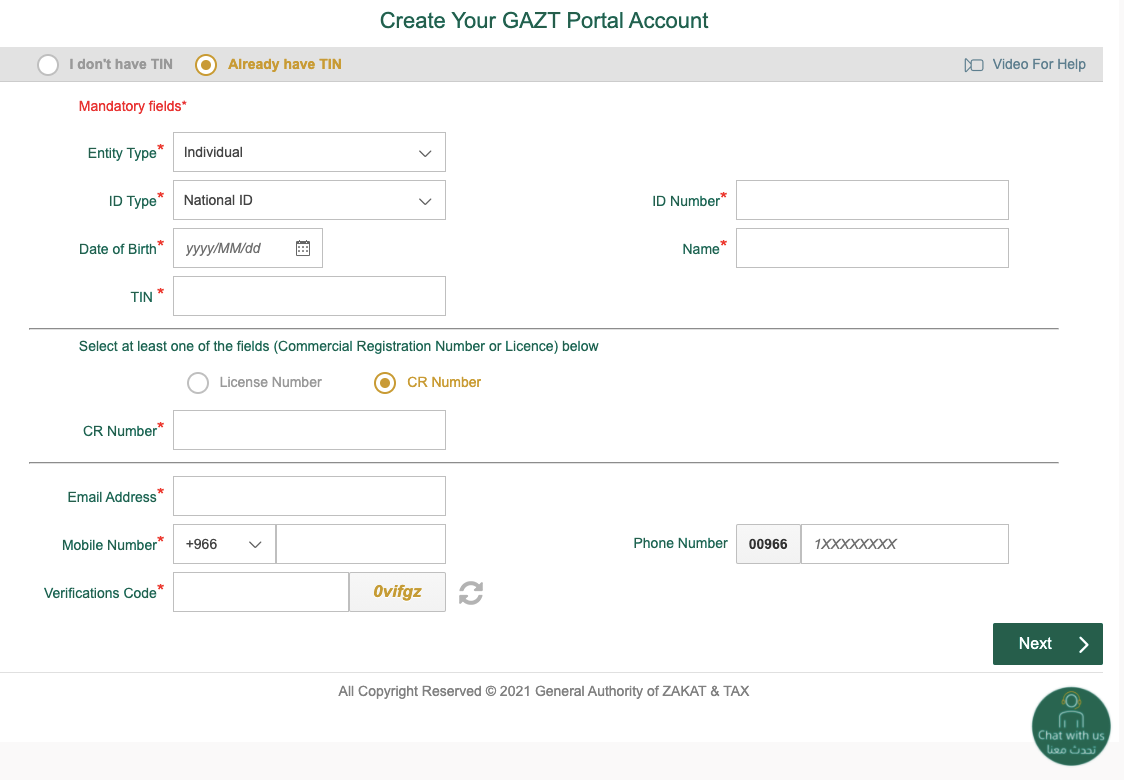

Check the "already have TIN" checkbox on the following page if you already have your TIN.

Fill in the required details on this page, such as your entity type, ID type, date of birther, TIN, ID number, CR number, email address, mobile number, and enter the verification code sent to your phone.

Once done, proceed to the next step.

Furnish business details and supporting documents

You have to furnish your business' details and provide supporting documents required by GAZT.

In this step, you are required to provide your business financial details such as:

- Taxpayer details - Enter TIN, company registration number (CR), and your business address. Here, you need to indicate whether your business involves exporting or importing goods and services, the IBAN, and enter the date your business is eligible for VAT.

- Financial details - Declare your business financial standings, the actual value of taxable sales and expenses last year, and the projected taxable sales and expenses for the following year. You are required to attach supporting documents such as income statements, balance sheets, custom reports as proof.

- A financial representative for non-resident - Residents in KSA can skip this step. This section is for non-resident in the KSA. A non-resident will need to provide information about their designated tax representative in Saudi Arabia. Each non-KSA business will need to provide the following details of their tax representatives such as their TIN (if they have one), ID number (such as a Saudi, Iqama, or GCC ID), contact number, and email address.

Declarations

After furnishing the business information, business owners must verify and ensure all the provided information and documents are accurate.

After confirming the details are accurate, enter your name, ID number, and your title within the company.

Click on the submit button.

You will receive an application number with an acknowledgment letter that you can download.

Finally, you have successfully registered for VAT for your business! Congratulations on completing this process.

Can I de-register VAT?

You can deregister your VAT account for the following situations:

- Mandatory de-registration; if your business has ceased its operations.

- Voluntary de-registration; if the value of your taxable sales in the past or projected 12 months is between SAR 187,500 and SAR 375,000

A non-resident must apply to deregister if they have not made any taxable supplies in Saudi Arabia in the last 12 months.

What is my filing frequency in Saudi Arabia?

The VAT Return in Saudi Arabia is a document that contains your business' tax liability for the reporting period.

Submit your VAT Return using the GAZT portal online.

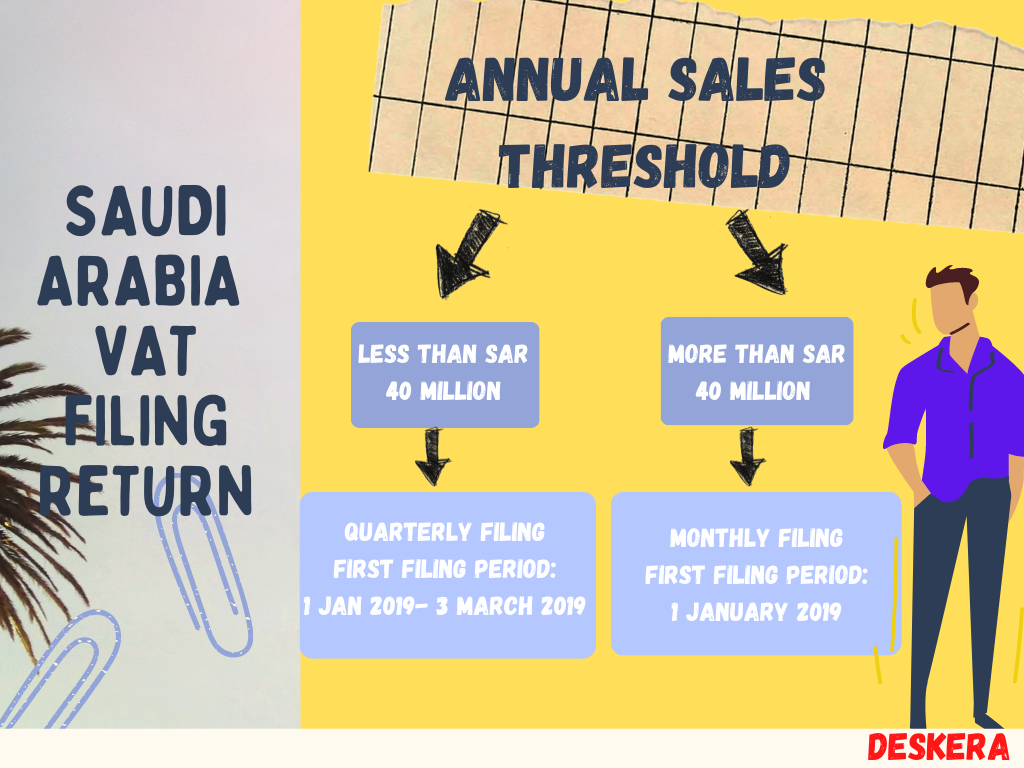

The tax period can be monthly or quarterly, depending on the business owner’s annual turnover.

Your annual taxable sales determine your VAT filing period. For example:

- less than SAR 40 million, your filing period is on each quarter

- more than SAR 40 million, your filing period will be every month

Your VAT filing due will falls on the last date of the subsequent reporting month. Once you have filed your VAT return, you have to make payment to clear your VAT liability at the same time.

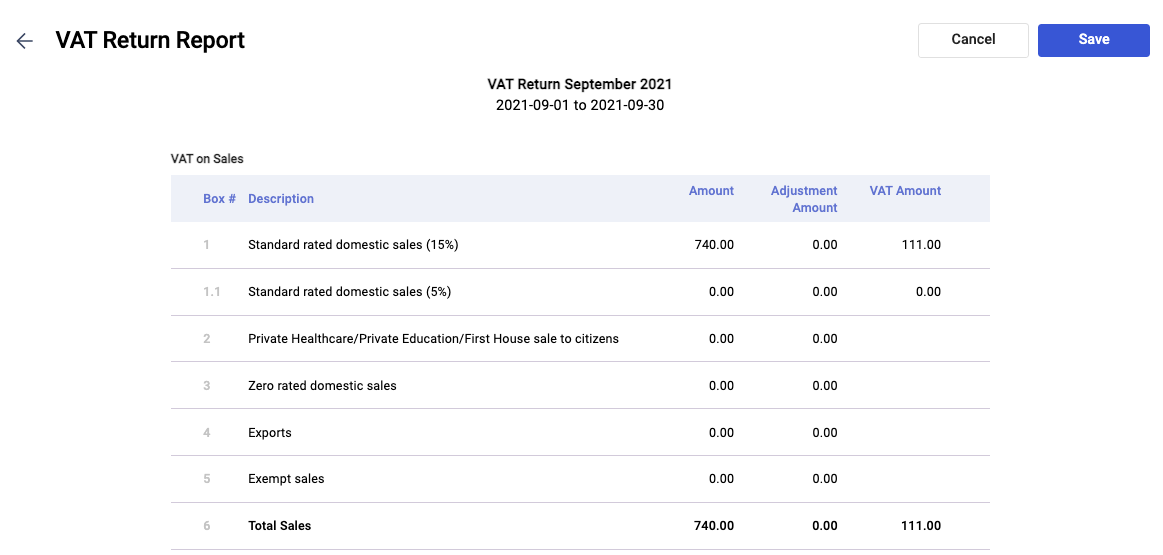

What is the VAT Return that I need to submit?

You must submit your VAT Return to GAZT electronically at the end of the following month after your reporting period.

For instance, you can log in to the GAZT portal to submit your return.

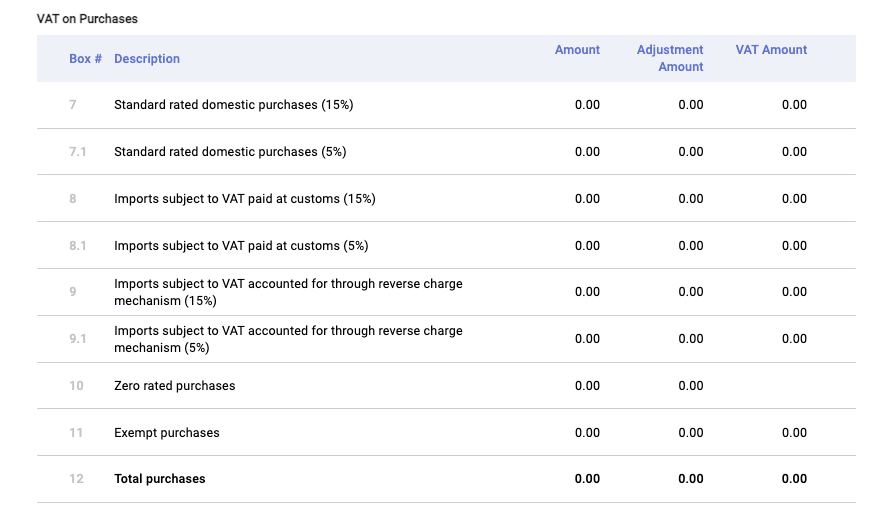

We have prepared a table below that explains the component of each box in the VAT Return.

.

Here's the table for your reference.

How can I make payment?

Payment must be made once you have submitted your VAT Return to the General Authority of Zakat and Tax (GAZT).

You can clear your VAT liability by using the bank's online services to transfer the funds. The bank transfer can be done via the SADAD payment system.

If you cannot pay VAT by the end of your due date, you can always request an extension.

You can contact GAZT requesting to defer your payment. Provide the following information:

- Your total VAT liability

- Your reporting tax period

- The reason for an extension

The GAZT officers will review your request and decide to either reject or approve your request to defer the VAT payment in 20 days.

What are the penalty for late payment?

You will be imposed a fine or penalty in Saudi Arabia if you forget to file your VAT Return or remit your payment on time.

Here are some circumstances that will incur fines or penalties:

- filing an incorrect tax return - 50% of the value of the difference between the calculated tax and tax due

- failure to make payment by the expected due date - 5% of the value of the unpaid tax for each month

- failure to file the tax return by the expected due date - a penalty from a range of 5% to 25% of the value of tax due

- a non-registered person issuing tax invoice - SAR 100,000 or less

- an eligible taxable person who has not registered for VAT within the specified period - SAR 10,000

VAT, VAT Return and Invoicing for Saudi Arabia using Deskera Books

Creating VAT, generating VAT Return and issuing an invoice is a piece of cake with Deskera. You can set up your Saudi Arabia company in minutes and start creating and sending invoices immediately.

With Deskera Books, you can generate beautiful invoice templates from the system without the need to design your template from scratch.

Additionally, the system supports the Arabic language that allows you to send invoices in Arabic, so you stay compliant at all times.

Also, you have the flexibility to configure the tax rate in the system and apply the individual tax rate to your products accordingly.

For instance, you can generate the invoice template from Deskera Books, as per the image below.

You can indicate essential information using the invoicing feature from Deskera Books, such as:

- The date the invoice was issued

- The date of supply

- Your invoice number

- Your customer's name, bill-to-address, and shipping address

- Your company's name, company's address, and tax identification number

- The products' line item, quantity, and description of the goods sold

- Enter the discounts or rebates, if needed

- Indicate if the price listed is inclusive of VAT

- The total tax amount payable by your customers in SAR

Before issuing an invoice, you must ensure that you have met all the VAT requirements in Saudi Arabia. Your invoice doesn't need to be stamped, but all tax invoices must be issued in the Arabic language.

If your business involves foreign transactions, make sure that you convert the VAT amount to SAR based on the conversion rate from Saudi Arabian Monetary Authority.

Learn more about the invoicing feature using Deskera Books.

https://www.deskera.com/care/document-generator-on-deskera-books/

Key Takeaways

And that is a wrap. From this article, you can take away the following points:

- What is the VAT rate in Saudi Arabia?

- What are zero-rated supplies?

- What are exempt supplies?

- What is excise rate?

- What is reverse charge mechanism?

- What is place of supply?

- Do I need to register for VAT?

- Can I register for VAT voluntarily?

- How do I register for VAT in Saudi Arabia?

- Can I de-register VAT?

- What is my filing frequency in Saudi Arabia?

- What is the VAT return that I need to submit?

- How can I make payment?

- What are the penalty for late payment?

- VAT, VAT Return and Invoicing for Saudi Arabia using Deskera Books

With Deskera, you can easily apply the Saudi Arabia tax rates to your transactions and generate a proper sales invoice.

You can rest assured as the software will do the work for your tax calculation. Instead of spending a tremendous amount of time on manual tasks, you can have more time for the things you love with Deskera.