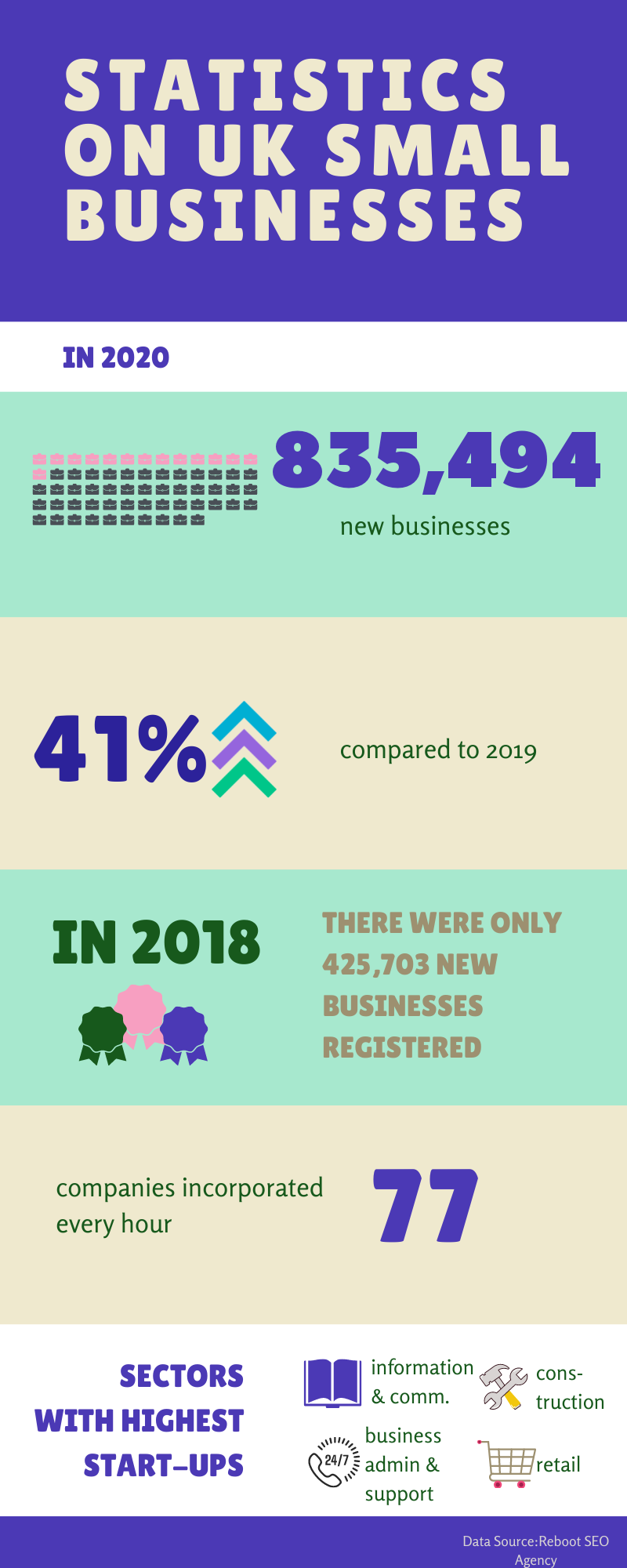

The United Kingdom is the birthplace of legendary icons such as The Beatles, William Shakespeare, Winston Churchill, Stephen Hawking, etc. UK's capital, London, is known as a bustling, lively, and busiest metropolitan city, surrounded by influential international finances, commerce, and cultural buildings.

So, what's not to love about starting or growing your business in the UK?

The UK is a country that is rich in history and culture, which might provide lots of inspiration and insight for your business growth and strategy. Although it might sound fun and exciting, in reality, it's not as straightforward as you think it is, especially with Brexit.

| Do you know that companies in the UK could reach more than 500 million consumers in Europe alone before Brexit?

If you're starting your new business in the UK, there are a few things you need to understand; the UK VAT rate, the VAT treatment with EU members, and how does Brexit impacts the supply of goods and services between the UK and EU members.

Read more below to find out more about the latest changes in the UK VAT post-Brexit.

What is the VAT rate in the UK?

The UK comprises of England, Scotland, Wales and Northern Ireland. Also, do note that Northern Ireland is not part of the Great Britain.

In the UK, there are three types of VAT rate such as the standard rate, the reduced rate, and the zero-rated supplies.

The Standard Rate

Most of the supply of goods and services is charged at VAT 20%.

The Reduced Rate

Some goods and supplies are charged at a reduced rate of 5%.

According to Budget 2021, from 1st October 2021 onwards, the reduced rate for supplies related to hospitality, hotel/holiday accommodation, and admission to certain attractions will increase from 5% to a new temporary rate at 12.5%.

Please note that the reduced rate for these items will still remain at 5%, such as:

- children’s car seats

- domestic fuel or power

- mobility equipment installed at home for older people over 60 years old

The Zero Rate

The zero-rated goods and services are charged at 0%.

The zero-rated supplies include:

- basic foods and water

- children’s clothes and footwear

- books and newspaper

- most goods you export from England, Wales, and Scotland (Great Britain) to a country outside the UK

- most goods you export from Northern Ireland to a country outside the EU and the UK

- goods you supply from Northern Ireland to a VAT registered EU business - you can check if your EU VAT number is still valid

What is exempt goods?

Exempted goods are VAT-free, which means no VAT is applicable for these items - they are not taxable.

The exempted goods and services in the UK are as follows:

- postage stamps

- financial and property transactions

- education and training

- fundraising events by charities

- subscriptions to membership organisations

If you buy exempt items, you cannot reclaim the VAT.

Learn more on how to create a new type of tax in Deskera Books.

Post Brexit: VAT Treatment for Export/Import between The Great Britain and the EU members

The United Kingdom has left the European Union on 31 December 2020. This simply means the UK is no longer part of the EU officially on 1 January 2021.

The exit also implies that the UK has completely left the EU Custom Unions and the EU VAT regime, which will significantly impact the trading processes between these two regions.

So, what is the next for UK businesses trading with firms from the EU regions? How will this impact the VAT treatment, or is there anything else that business owners need to note?

Refer to the table below to find out more about the VAT treatment for export and import between the Great Britain and the EU.

How does Brexit impact the export and import procedure between the Great Britain and the EU?

Pre-Brexit, UK consumers are free to purchase items from the EU without additional charges such as import duties or tariffs. However, this is not the same anymore after Brexit.

After Brexit, the import and export procedures between Great Britain and the EU have become more complicated and messy.

On top of the new custom declarations, businesses are also expecting delayed custom clearance, changes in logistics and transportation of goods, and a shift in import VAT obligations that changes the entire ecosystem of the UK-EU trade before Brexit.

We have prepared a checklist below so you can cross-check what needs to be done on your end.

Checklist for Importers and Exporters in the UK

As part of the preparation for businesses importing goods to the UK, or for businesses exporting goods to the EU, you can refer to the checklist below for smooth import and export operations.

- Determine who is the importer and exporter - Decide who is the person responsible for the import and export of goods. The person in charge will be responsible for the UK custom paperwork, export clearance, movement of goods from one place to another, and other issues arises the cross-border trade - also known as the Incoterms.

- Register for a UK Economic Operator Registration Identification (EORI)- The EORI is essential for businesses that supply goods within or outside the UK for business purposes. The EORI number will be required when making custom declarations, making either an entry or exit summary declarations, using custom systems such as the CHIEF system and the Import Control System Northern Ireland (ICS), etc. Hence, without an EORI number, it will be difficult for you to deliver your goods - which will result in loss of business.

- Examine whether you need an export license or certificate - There are special rules for certain goods. You may need to get licences or certificates if you are exporting any of the following goods; animal products, drugs/medicine, plant/plant products, medical devices, chemicals, etc.

- Complete your custom export/import declarations - You can either complete the custom export/import declarations by yourself using the UK National Export System (NES), or using approved custom intermediaries such as freight forwarders, custom agent/brokers, or fast parcel operators.

- Gather sufficient information for exit/entry declarations - Cross check the commodity code of your items, departure point and destination, consignee and consignor, nature, amount and packaging of the goods, transport method, any certificates and licences, an exporter statement of origin to allow your importer to qualify for zero tariffs. Once you have completed the custom export/import declarations to the NES, you will gate a unique consignment number.

- Move your goods - You can start exporting or importing the goods from or to Great Britain and clear customs easily.

What about the trade from the Great Britain with the Northern Ireland?

Since we have highlighted the export and import between the Great Britain and the EU above, next, find out more about the trade between the Northern Ireland and Great Britain

There will be no changes of trading from the Northern Ireland to the Great Britain (Wales, England, and Scotland). Any movement of goods from the Northern Ireland will still apply the UK VAT rate and is considered as domestic sales and purchases.

Hence, you can rest-assured that there are new or additional processes, restrictions, and paperworks required.

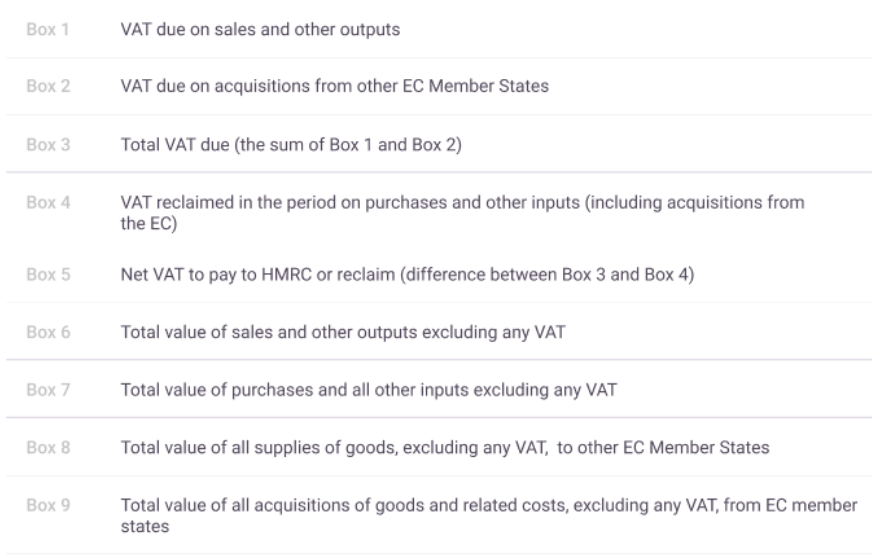

What is the standard VAT Return in the UK?

The UK VAT Return is a form that you have to submit to the HMRC, typically four times a year. It's a document that reflect the total VAT you are due to pay to the tax authority in the UK.

You are required to complete Box 1 until Box 9.

Refer to the table below to find out more about the requirement of each box.

**Note: Currently Deskera is not MTD compliant. You will need to file your VAT Return manually.

When do I have to register for a VAT account?

Once your business VAT taxable turnover exceeds or is expected to exceed $85,000 in the following 30-day period, you will have to register for a VAT account at the HMRC website.

Upon completing your registration, you should receive a VAT certificate with your VAT number, VAT due date, and VAT payment date in it.

You can opt to register for a VAT account voluntarily even though you didn't exceed the required VAT threshold as stated.

Note: You cannot apply for a VAT account if you supply only exempted goods and services.

How do I register for a VAT Identification Number?

You can register for a VAT account using a few methods.

Here's are some of the methods that you can use to apply for your VAT number:

- Register online - Most companies, including partnerships or groups of companies, can register online using the HMRC online services.

- Use an agent - You can also hire an accountant or agent to submit your VAT return on your behalf.

- Register using post for VAT1A, VAT1B, and VAT1C form - only use this option if you wish to apply for registration exception, joining the Agricultural Flat Rate Scheme, or registering the division or business units under a separate VAT scheme.

What is my filing frequency and when is the deadline to file my VAT Return?

In the UK, there are three types of VAT filing frequency. You can file your VAT on a monthly, quarterly, or yearly basis.

However, most businesses submit their VAT Return every quarter - which means they file their VAT Return four times a year.

If your business has an annual turnover VAT liability exceeding £2.3 million, you will have to file your VAT Return monthly (upon request by the HMRC).

The general rule of submitting and paying your VAT Return in the UK is usually on the 7th day of the second month, after your reporting period.

Note: If you're not sure about your VAT Return and payment deadlines, do login to your VAT online account to check.

How can I make payment?

You can log in to your VAT account online and proceed to make payment from the HMRC portal. The HMRC accepts payment from your credit card, debit card, BACS, CHAPS, or online telephone banking (Faster Payments).

For online telephone banking, you will need the following information;

- Sort code - 08 32 00

- Account number - 11963155

- Account number - HMRC VAT

Your payment must arrive in the HMRC bank account before the last working day if the deadline falls on weekends or bank holidays (unless you pay using the Faster Payments method).

Faster payment methods (online or telephone banking) will usually reach HMRC on the same day or the following day, regardless if it falls on weekends or bank holidays.

For overseas payment, you can use the information stated below:

- Account number (IBAN): GB36BARC20051773152391

- BIC Code: BARCGB22

- Account holder: HMRC VAT

- Bank address: Barclays Bank PLC; 1 Churchill Place; London; E14 5HP; United Kingdom

Note: You will incur different additional charges, depending on your payment method. If you'd like to check on the charges, you can contact your bank to find out about the processing fees.

What are the penalty for late filing and late payment?

If you failed to file your VAT Return and clear your VAT liability in time, you will have to bear additional surcharges and late penalties.

A surcharge is the percentage of the VAT outstanding on the due date that you defaulted for the respective accounting period. The surcharge amount will increase every time you default again in a surcharge period.

The table below shows how much you’ll be charged if you default within a surcharge period.

On top of the surcharges, the HMRC will also charge a penalty of up to 100% of any tax return that doesn't reflect an accurate amount, 30% if you didn't report to HMRC if they send a wrong assessment to you, £400 if you submit a paper VAT return.

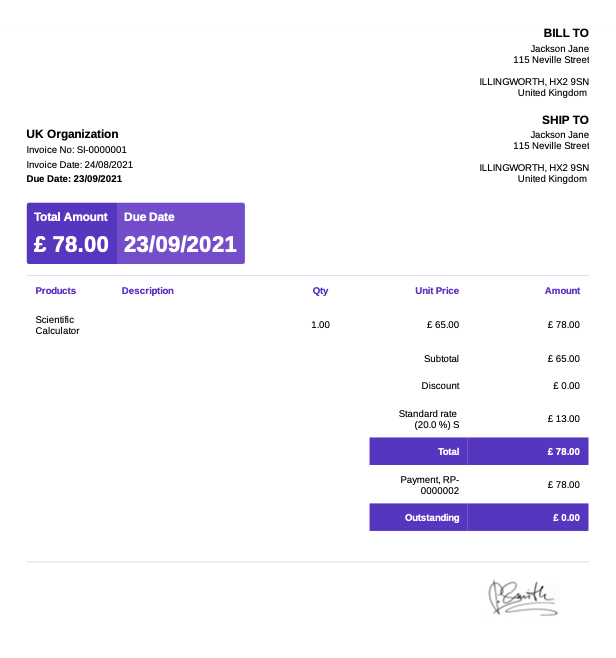

VAT, VAT Return and Invoicing for UK Small Companies With Deskera Books

The UK VAT and VAT return is simple and easy using Deskera software. You can setup your UK company in minutes and start creating and sending invoices immediately.

Refer to the simple guide below to create your company in Deskera Books.

You can specify your customers' location and charge the correct tax rate using the tax configuration in the system.

Here are the essential pieces of information that you can include in your invoice:

- Your company name and address

- The date when you issue the invoice

- Your business number (VAT Registration Number)

- The purchaser's name and address

- Term of Payment

- The name of the products or services purchased and their description

- Cost of each product and quantity purchased

- Total amount payable

- Tax component

With Deskera, you can easily apply the UK VAT rate against your sales invoice and send it directly to your customers using Deskera Books software.

You can rest assured as the software will do the work for your tax calculation. Instead of spending a tremendous amount of time on manual tasks, you can have more time for the things you love with Deskera.

Key Takeaways

And that is a wrap. From this article, you can take away the following points:

- What is the VAT rate in the UK?

- The Standard Rate

- The Reduced Rate

- The Zero Rate

- What is exempt goods?

- Post Brexit: VAT Treatment for Export/Import between The Great Britain and the EU members

- How does Brexit impact the export and import procedure between the Great Britain and the EU?

- Checklist for Importers and Exporters in the UK

- What about the trade from the Great Britain with the Northern Ireland?

- When do I have to register for a VAT account?

- How do I register for a VAT Identification Number?

- What is my filing frequency and the deadline to file my VAT Return?

- How can I make payment?

- What are the penalty for late filing and late payment?

Learn more about the invoicing feature using Deskera Books.